Working Paper Series

Caution: do not cross!

Capital buffers and lending

in Covid-19 times

Cyril Couaillier, Marco Lo Duca,

Alessio Reghezza, Costanza Rodriguez d’Acri

Disclaimer: This paper should not be reported as representing the views of the European Central Bank

(ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

No 2644 / February 2022

Abstract

While regulatory capital buffers are expected to be drawn to absorb losses and meet credit

demand during crises, this paper shows that banks were unwilling to do so during the

pandemic. To the contrary, banks engaged in forms of pro-cyclical behaviour to preserve

capital ratios. By employing granular data from the credit register of the European

System of Central Banks, we isolate credit supply effects and find that banks with little

headroom above regulatory buffers reduced their lending relative to other banks, also

when controlling for a broad range of pandemic support measures. Firms’ inability to

reallocate their credit needs to less constrained banks had real economic effects, as their

headcount went down, although state guarantee schemes acted as partial mitigants. These

findings point to some unintended effects of the capital framework which may create

incentives for pro-cyclical behaviour by banks during downturns. They also shed light

on the interactions between fiscal and prudential policies which took place during the

pandemic.

JEL classification: E61; G01; G18; G21

Keywords: Coronavirus; Macroprudential policy; MDA distance; Bank lending; Buffer

usability; Credit register

ECB Working Paper Series No 2644 / February 2022

1

Non-technical summary

The Basel III capital framework provides the foundations for the prudential supervision

of banks (BCBS, 2011). Its goal is to reduce the pro-cyclical effects of the banking system

on the economic cycle, namely to limit bank risk-taking and excessive credit growth in

good times and credit supply contractions during periods of economic distress. To this

aim, the framework envisages that bank capital is built up during economic upturns and

then employed to absorb losses and meet credit demand during economic downturns and

crises. The deep economic recession, the economic uncertainty, the prospect of serious

deterioration in bank asset quality and profitability caused by the Covid-19 pandemic

provided a first test of the capital framework. By analysing euro area banks’ behaviour

during the pandemic, this paper investigates banks’ willingness (or unwillingness) to make

use of capital buffers, as envisaged by Basel III.

Banks in the euro area entered the Covid-19 pandemic with relatively strong capital

ratios (Enria, 2020), however, most of this capital was held in the form of prudential

regulatory buffers. These buffers sit on top of minimum capital requirements and con-

stitute the combined buffer requirement (CBR). The CBR abets banks to absorb losses

while continuing to provide key financial services during distressed periods, thus mitigat-

ing negative externalities related to credit rationing and asset fire sales that could harm

the economy (Acharya et al. 2017). However, banks’ willingness or ability to draw down

the CBR may be limited by a several factors, including limitations to distributions (ac-

cording to the Maximum Distributable Amount – MDA – mechanism), market pressure

and stigma. Ultimately, impediments to the use of buffers can negatively affect lending

supply to the real economy when most needed, thereby causing pro-cyclical amplification.

In this paper, we investigate empirically whether banks closer to the MDA trigger take

adjustment actions curtailing their lending to NFCs during the pandemic in comparison

to banks further away from the MDA. This research question is of primary importance

for policy makers as it points to possible unintended distortions in the capital framework

and possible pro-cyclical effects during downturns (Behn et al., 2020).

ECB Working Paper Series No 2644 / February 2022

2

We employ loan-level data to exploit multiple bank relationships, thus controlling for

credit demand effects (Khwaja and Mian, 2008). We also match our datasets with bank-

and loan-level information on banks’ features including reliance on central bank funding,

payment moratoria and government guaranteed loans. In this way we isolate credit supply

effects triggered by the proximity to the MDA from other bank specific features and from

pandemic-related support measures which also have an impact on lending. We apply

sample matching strategies to convey robust results and ensure that results are not driven

by other possible explanations.

The results of our analysis show that proximity to the MDA trigger results in lower

lending to NFCs. Specifically, we find that proximity to the MDA reduces lending by

about 3.5% to NFCs during the pandemic. We also find that lower lending from banks

in proximity of the MDA trigger resulted in credit constraints to firms exposed to these

banks as lost loans were not fully replaced. In particular, firms that prior to the pandemic

received most of their borrowing from banks closer to the MDA trigger experienced about

2.5% lower borrowing during the pandemic in comparison to firms that borrowed mostly

from other banks. We document that this lack of perfect credit substitution led to firms

cutting down their headcounts by close to 1% in comparison to other firms. Finally, we

show that government guarantees ameliorated the negative effect caused by proximity to

the MDA trigger as firms receiving loans covered by government schemes counter off the

lending impairments caused by banks in proximity of the MDA trigger.

Beyond contributing to different strands of the academic literature on banking, these

findings inform the current debate on the appropriateness of the capital buffer framework

and support discussions on how to improve its design. They also shed some light on the

fiscal and prudential policies’ interactions which took place during the pandemic.

ECB Working Paper Series No 2644 / February 2022

3

1 Introduction

The Basel III capital framework provides the foundations for the prudential supervision

of banks (BCBS, 2011). Its goal is to reduce the pro-cyclical effects of the banking system

on the economic cycle, namely to limit bank risk-taking and excessive credit growth in

good times and credit supply contractions during periods of economic distress. To this

aim, the framework envisages that bank capital is built up during economic upturns and

then employed (i.e. by allowing temporary declines in capital ratios) to absorb losses and

meet credit demand during economic downturns and crises. The deep economic recession

and the economic uncertainty caused by the Covid-19 pandemic provided a first test of

the Basel III capital framework. By analysing euro area banks’ behaviour during the

pandemic, this paper investigates banks’ willingness (or unwillingness) to make use of

capital buffers, as envisaged by Basel III.

The rapid spread of Covid-19 worldwide confronted policymakers not only with a

major public health problem but also with the prospect of a serious economic and financial

crisis. While prompt and forceful policy actions assuaged the worst economic effects of

the pandemic,

2

restrictions on personal mobility and nonessential business operations

strongly affected business profits, causing a surge in liquidity needs. At the same time,

those containment measures caused a major global economic contraction. As such, banks

faced simultaneously a surge in credit demand and the prospect of serious deterioration in

asset quality and profitability. Therefore, in this paper we exploit the exogenous economic

shock caused the Covid-19 pandemic to assess banks’ behaviour and their willingness to

use regulatory capital in periods of severe economic distress.

Banks in the euro area entered the Covid-19 pandemic with on average strong capital

ratios (Enria, 2020). Most of this capital was raised to meet capital requirements (Figure

1): the minimum requirements that banks must meet at all times and the combined

2

Monetary policy ensured accommodative financing conditions overall and for banks. Fiscal policy

provided support to household and firms via tax credit, direct transfers, job support schemes, debt

moratoria and loan guarantees (ECB, 2020). Prudential authorities also adopted a number of measures

to allow banks to operate with more flexibility during the pandemic (SSM, March 2020).

ECB Working Paper Series No 2644 / February 2022

4

buffer requirements (thereafter CBR). The latter capital buffers sit on top of minimum

capital requirements and, in the European framework, consist of the capital conservation

buffer (CCoB), counter cyclical buffer (CCyB), systemic risk buffer (SyRB) and buffers for

systemically important banks (Figure 2).

3

The CBR abets banks to absorb losses while

continuing to provide key financial services during distressed periods, thus mitigating

negative externalities related to credit rationing and asset fire sales that could harm the

economy (Acharya et al. 2017). Indeed, whereas minimum capital requirements must be

met on an ongoing basis, the CBR can, in principle, be drawn down when needed during

severe downturns or financial crises. Consequently, capital ratios may dip into the CBR in

order to: (i) cushion the materialisation of losses (i.e. the numerator of the capital ratio)

and; (ii) allow for increases in risk-weighted assets (i.e. the denominator of the capital

ratio).

[Insert Figure 1 Here]

[Insert Figure 2 Here]

While prudential authorities made clear at the beginning of the pandemic that banks

were expected to use the CBR in case of need (Enria, 2020; BIS, 2020; FSB, 2020), banks’

willingness or ability to draw down buffers may be limited by a number of factors. First,

dipping into the CBR triggers restrictions on dividend distributions, bonuses and coupon

payments according to the Maximum Distributable Amount (MDA) mechanism (Svoronos

and Vrbaski, 2020). Although European supervisors encouraged the suspension of divi-

dend payouts during the Covid-19 pandemic, banks may still want to avoid breaching the

MDA trigger in order to distribute dividends as soon as the ban is lifted. Second, dipping

into the CBR could provide a negative signal to the market in respect to bank’s solvency

(Drehmann et al., 2020; Baker and Wurgler, 2015). This can lead to higher funding costs

and/or have negative implications for bank credit ratings (Claessens et al., 2018). Third,

banks’ willingness to draw down buffers depends on the expected reaction of supervisory

3

These are buffers for Other Systemically Important Intermediaries (O-SIIs), which are systemic do-

mestic banks, and for Globally Systemically Important Banks (G-SIBs)

ECB Working Paper Series No 2644 / February 2022

5

authorities (Borio et al., 2020). If banks expect heightened scrutiny because of a breach

of the CBR (EBA, 2021), it is unlikely that banks will make use of it.

4

Additionally,

banks might be uncertain about the time they will be given to replenish capital buffers.

Such concerns may be more relevant when profitability is low or access to capital markets

is constrained. Finally, other regulatory requirements such as the leverage ratio or the

Minimum Requirement for own funds and Eligible Liabilities (MREL) constrain the us-

ability of buffers if they are more binding than risk-based requirements (BoP, 2020). For

the above reasons, banks tend to keep capital targets above the CBR (Couaillier, 2020;

Behn et al., 2020) by holding excess capital (or management buffers).

5

Bank unwillingness to draw down buffers can negatively affect lending supply to the

real economy when most needed. In this paper, we investigate empirically whether banks

closer to the MDA trigger take adjustment actions to preserve capital ratios, curtailing

their lending to non-financial corporations (NFCs) during the pandemic in comparison to

banks further away from the MDA trigger. This research question is of primary impor-

tance for policy makers as it points to possible unintended effects of the capital framework

and possible pro-cyclical behaviour of banks during downturns (Behn et al., 2020).

Our analysis offers a comprehensive assessment of the effect of proximity to the MDA

trigger on bank credit supply adjustments following the pandemic outbreak. Specifically,

we answer the following questions: Did banks closer to the MDA trigger curtail their lend-

ing in comparison to banks further away from it? Did firms most exposed to these banks

experience a contraction in credit? Did government guaranteed schemes ameliorated the

negative effect coming from banks’ proximity to the MDA trigger? We rely on granular

loan-level data to address these questions.

Several empirical challenges must be overcome to estimate the effect of proximity to

4

When approaching the MDA trigger, a bank must inform the supervisor of a Capital Conservation

Plan describing how it intends to replenish its buffer. Should the supervisor disagree with the plan, it

can require the institution to increase capital in a specified period and lower the MDA (Article 142 of

CRD IV).

5

Bank management buffers (or excess capital) support banks’ credit ratings and business model strate-

gies, but, more importantly for this paper, they insulate banks from the supervisory interventions which

are triggered when regulatory capital requirements are breached.

ECB Working Paper Series No 2644 / February 2022

6

the MDA trigger on lending behaviour during the Covid-19 pandemic. First, it requires

accounting for the large surge in credit demand from firms for emergency liquidity needs

during the pandemic. In this respect, we rely on granular loan-level data taken from the

analytical credit register (AnaCredit) of the European System of Central Banks. In partic-

ular, we exploit a difference-in-differences (DiD) framework with multiple bank relation-

ships and firm fixed effects (Khwaja and Mian, 2008) as well as single-bank relationship

via the inclusion of industry-location-size fixed effects to control for the heterogeneity

in credit demand across firms (Degryse et al., 2019). Second, it necessitates isolating

bank credit supply from pandemic-related measures: most notably, government guaran-

tee and moratoria schemes. Government guarantees on new loans helped firms obtaining

bank loans to roll over liquidity and working capital needs while debt service morato-

ria have also been widely introduced to mitigate the liquidity concerns of households

and firms. To control for the confounding effect of these measures on bank lending, we

match AnaCredit with bank-firm level information on payment moratoria and govern-

ment guarantees. Third, we account for monetary and prudential measures by including

unconventional monetary policy (TLTRO III) and the ECB recommendation on dividend

distribution in our empirical strategy. Altavilla et al. (2020) show that in the absence

of TLTRO III lending to firms would have been 3 percentage points lower. Additionally,

Martinez-Miera and Vegas (2021) find that banks extended significantly more credit to

non-financial corporations after the entry into force of the recommendation. We also use

propensity score matching (PSM) estimations to select banks that share similar charac-

teristics but differing in terms of their proximity to the MDA trigger, thereby ensuring

that results are not endogenous, i.e. driven by weaker balance sheets for banks closer to

the MDA trigger point.

To preview our findings, proximity to the MDA trigger results in lower lending to

NFCs. Specifically, we find that proximity to the MDA reduces lending by about 3.5%

to NFCs during the pandemic. We also find that lower lending from banks in proximity

of the MDA trigger resulted in credit constraints for firms exposed to these banks as lost

loans were not fully replaced. In particular, firms that prior to the pandemic received

ECB Working Paper Series No 2644 / February 2022

7

most of their borrowing from banks closer to the MDA trigger experienced about 2.5%

lower borrowing during the pandemic in comparison to firms that borrowed mostly from

other banks. We document that this lack of perfect credit substitution led to firms cutting

down their headcounts by close to 1% in comparison to other firms. Finally, we show that

government guarantees ameliorated the negative effect caused by the proximity to the

MDA trigger. In particular, firms receiving loans covered by government schemes counter

off the lending impairments caused by banks in proximity of the MDA trigger.

Our paper provides a solid contribution to the extant literature in several respects.

First, we add to the long-standing empirical literature on bank capitalisation and lending

(Bernanke and Lown, 1991; Berger and Udell, 1995; Peek and Rosengren, 1997; Gamba-

corta and Mistrulli, 2004; Berrospide and Edge, 2010).

6

While these papers investigate

the absolute level of capital ratios, we investigate the impact of the closeness to regulatory

buffers.

Our paper also contributes to a growing literature studying the effect of capital re-

quirements on bank lending. Various papers look at the effect of bank-specific capital

surcharges (Berrospide and Edge, 2019; Gropp et al., 2019; De Jonghe et al., 2020),

structural buffers (Reghezza et al., 2020; Behn and Schramm, 2020; Degryse et al., 2020)

and dynamic capital requirements (Aiyar et al., 2014; Auer and Ongena, 2016; Jimenez

et al., 2017; Basten, 2019) on bank lending. While this literature largely focuses on the

impact of changes in capital requirements, we contribute by investigate the usability of

buffers in crisis time, i.e. a key feature of the Basel III regulatory framework. Should

banks not consider these buffers as usable, achieving the countercyclical objective of the

framework would be very difficult.

We also differ from the previous literature in terms of data granularity. Earlier studies

apply aggregate (Hancock et al., 1995; Lown and Morgan, 2006) or bank-level data (Peek

and Rosengren, 2000). However, bank-level data may be prone to endogeneity issues due

6

For the theoretical literature we refer to Diamond and Rajan (2000), Bolton and Freixas (2006), Van

de Heuvel (2008), Gersbach and Rochet (2017) among others.

ECB Working Paper Series No 2644 / February 2022

8

to the omission of firm-level variables. Addressing this problem requires perforce bank

lending and firm borrowing to be considered jointly. This allows to control for firm credit

demand. Undeniably, a perennial challenge when examining the effect of bank capital

requirements on lending is to disentangle supply from demand. Similarly to more recent

studies (Puri et al., 2011; Behn et al., 2016; Fraisse et al., 2020) we combine loan-level

and firm-level analyses. However, while papers using loan-level analysis are mostly based

on single country setting as they rely on national central bank credit registers (among

the few exceptions, Altavilla et al., 2020), we add to the relevant literature by resorting

to AnaCredit, the analytical credit register of the European System of Central Banks

which allows us to exploit million of loans in a multi-country setting. Furthermore, we

overcome an additional econometric identification challenge that emerges when analysing

the impact of Covid-19 on bank lending behaviour. This arises from the necessity to

disentangle the effect of a bank’s distance to the MDA trigger on lending from the ef-

fect of the post-pandemic fiscal support packages (notably payment moratoria and loan

guarantees). In this paper, by collecting unique data on loan protections we are able to

control for pandemic-related fiscal support measures, further mitigating omitted variable

bias concerns.

Finally, we contribute to the policy-oriented debate on the effectiveness of the buffer

framework (FSB, 2020; BIS, 2021; IMF, 2021) by providing empirical evidence of how

banks in proximity of the MDA trigger point fared at the onset of the pandemic.

The rest of the paper is organised as follow. Section 2 describes the econometric

identification. Section 3 introduces our data and descriptive statistics. Section 4 presents

the results. Section 5 presents a number of robustness checks and Section 6 concludes.

2 Econometric Identification

This paper exploits differences in the distance to the MDA trigger prior to the pandemic

to investigate whether and to what extent banks adjust their balance sheets after its

outbreak. We employ loan-level data, thus controlling for heterogeneity in credit demand,

ECB Working Paper Series No 2644 / February 2022

9

to investigate whether bank lending is affected by a smaller capital headroom above the

CBR. The strict exogeneity of the Covid-19 shock naturally lends itself to a DiD research

design.

2.1 Bank-firm level analysis

To shed light on bank lending behaviour in response to the pandemic, we start by

examining whether and how banks, whose capital ratios prior to the health emergency

were in proximity of the MDA trigger, adjust their balance sheet after the shock. We use

loan-level data as they allow to disentangle credit supply from credit demand.

For identification purposes, we follow two distinct approaches. First and in the spirit

of Khwaja and Mian (2008) we exploit multiple bank-firm relationships to control for firm

credit demand, hence firms that borrow from multiple banks and within-firm comparisons

across banks at different distance to the MDA trigger. However, one shortcoming of the

Khwaja and Mian (2008) econometric identification strategy is the exclusion of single-bank

lending relationships which are absorbed by firm fixed effects. Since the majority of single-

bank relationships involve small and medium enterprises (SMEs) which are predominant

in most European countries, we follow the approach by Popov and Van Horen (2015),

Acharya et al. (2019), Degryse et al. (2019) and construct firm industry-location-size

(ILS) fixed effects. To classify the industrial sectors, we follow the Statistical Classification

of Economic Activities in the European Community (NACE Rev.2) code.

7

The industry

clusters are based on 2-digit NACE codes. The location clusters are based on 5-digit postal

code for the largest countries in the sample while for the smallest (Cyprus, Estonia, Lativa,

Lithuania, Luxembourg, Malta, Slovakia and Slovenia) on the firm’s country headquarter.

For size, we take the definition given in AnaCredit which distinguishes between large,

medium, small and micro enterprises.

8

The inclusion of ILS fixed effects allows us to

7

NACE Rev. 2 classification is based on a hierarchical structure, which consists of first level sections

(alphabetical code), second level divisions (2-digit numerical code), third level groups (3-digit numerical

code and fourth level classes (4-digit numerical code). Refer to https://ec.europa.eu/eurostat/documents/

3859598/5902521/KS-RA-07-015-EN.PDF

8

The classification of firm size in AnaCredit is based on the EU Commission standard whereby a large

firm employs more than 250 employees; has an annual turnover greater than EUR 50 million; and annual

ECB Working Paper Series No 2644 / February 2022

10

retain more than 1.3 million additional single bank-firm relationships in our estimation.

Our econometric identification relies on the following DiD specification:

∆Log(loans)

i,k

= α

k

+ βLow.D2M DA

i

+ τ X

0

i

+ δZ

i

+ γ

j

+

i,k

(1)

where the dependent variable is the change in the logarithm of loans from bank i to firm

k around the pandemic. Following, Betrand et al. (2004) we collapse the quarterly data

into pre (2019Q3-Q4)- and post (2020Q3-Q4)-event (Covid-19) averages to avoid issues

of serial correlation, hence we consider one observation per firm-bank relationship.

9

In

equation (1), Low.D2MDA is our dummy variable of interest which is equal to 1 if a

bank, prior to the pandemic (2019Q3-Q4), has an average distance to the MDA trigger

below the first quartile of the distribution, 0 otherwise.

10

β is our coefficient of interest

as it indicates whether a given bank in proximity of the MDA trigger lends less follow-

ing the shock in comparison to banks with more sizeable MDA headroom. To control

for possible heterogeneity among banks, we specify a vector X that includes averaged

lagged bank control variables, thus taking into account bank-specific factors that might

potentially affect the dependent variable. Specifically, we introduce the overall capital

requirement (L.OCR),

11

the logarithm of bank total assets (L.TA.log), the risk-weight

density (L.RW), the ratio of debt securities-to-total assets (L.MKT FUNDING/TA), the

net interest margins (L.NIM) the ratio of non-performing loans-to-gross loans (L.NPLs),

the ratio of cash and financial assets held for trading-to-total assets (L.LIQUID/TA), the

share of non-interest income-to-operating income (L.DIVERS), the ratio of off balance

balance sheet greater than EUR 43 million. A medium firm employs less than 250 but more than 50

employees, has an annual turnover not exceeding EUR 50 million, and/or an annual balance sheet total

not exceeding EUR 43 million. A small firm employs fewer than 50 persons and has an annual turnover

and/or annual balance sheet total that does not exceed EUR 10 million. Finally, a micro firm employs

fewer than 10 persons and whose annual turnover and/or annual balance sheet total does not exceed

EUR 2 million

9

The decision to collapse the dataset into pre (2019Q3-Q4) and post (2020Q3-Q4)-event averages is

also aimed at avoiding that our results are driven by the credit surge that occurred in 2020Q2, hence

immediately after the pandemic. However, in unreported tests we also collapsed the quarterly data into

pre (2019Q1-2020Q1 and 2019Q2-2019Q4)- and post(2020Q2-2020Q4). The results are in line to the

collapsing strategy used throughout the paper.

10

In a robustness check in Section 5 we test a different computation of the dummy variable Low.D2MDA

11

The OCR is the sum of minimum requirements and the combined buffer requirement, the CBR.

ECB Working Paper Series No 2644 / February 2022

11

sheet activities-to-total assets (L.OFF BS), the ratio of credit exposures-to-total assets

(L.LOAN/TA), the cost-to-income ratio (L.CIR) and the ratio of provisions-to-total as-

sets (L.PROVISION/TA). Z is a vector of bank-firm policy control variables included to

account for the unconventional monetary policies as well as the fiscal measures adopted in

reaction to the pandemic. Specifically, we add the ratio of targeted longer term refinancing

operations (TLTROs III)-to-total assets, two additional variables capturing the percent-

age share of loans from the bank that are subject to government moratoria (S.MORA)

and guarantees (S.GUAR), the ratio of dividend planned in 2019 but not paid in 2020-to-

risk weighted assets (DIVIDEND.REST) and the lag of the take up of other forbearance

measures (L.FORBEARANCE).

12

α identifies firm (or ILS) fixed-effects employed to cap-

ture heterogeneity in credit demand across firms and to account for the possibility that

firm demand was already impaired prior to the pandemic. γ reflects country fixed effects

based on banks’ headquarter which absorb the different intensities of the spread of the

pandemic between countries. Standard errors are double clustered at the bank and firm

level (Jimenez et al., 2017).

The DiD approach requires that several assumptions hold. First, assignment of the

treatment has to be exogenous. In a nutshell, the shock should affect the outcome vari-

ables and not vice versa. Arguably, in our empirical setting, meeting this assumption is

reasonable as the Covid-19 pandemic was indeed an unanticipated exogenous ”shock” to

the economy. Second and according to Bertrand et al. (2004) and Imbens and Wooldridge

(2009), the DiD approach is only valid under the so-called “parallel trend assumption”

whereby changes in the outcome variable prior to the shock would be the same in both the

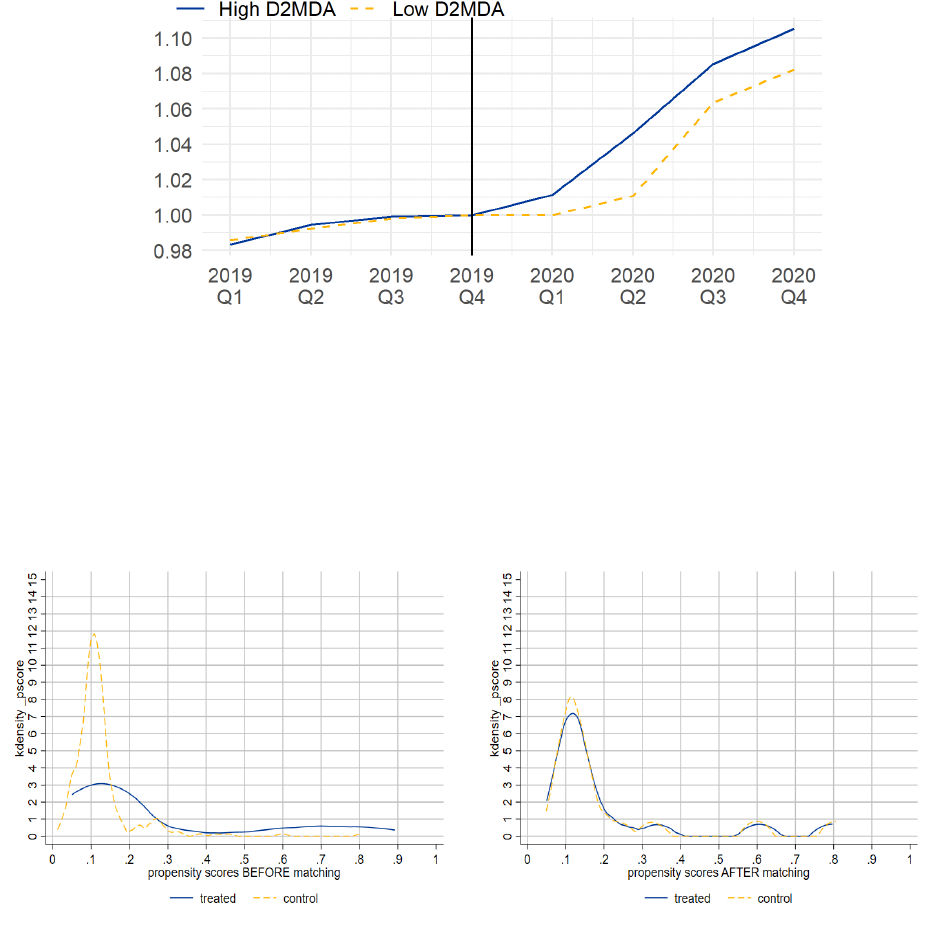

treatment (Low.D2MDA banks) and the control groups (High.D2MDA banks). Figure 3

shows the normalised trends of the average bank-firm level logarithmic change in lending

for the group of banks that were in proximity of the MDA trigger (our treatment group)

and the control group over time (2019Q1-2020Q4). As noticeable and although the trends

between the two groups appear to move similarly in the pre-treatment period, banks with

12

Table A in the Appendix provides a definition of the variables used in the paper and the respective

sources.

ECB Working Paper Series No 2644 / February 2022

12

sizeable MDA headroom showcase stronger lending following the escalation of the virus.

13

[Insert Figure 3 Here]

Third, the control group must constitute a valid counterfactual for the treatment, i.e.

banks in the control group should share similar characteristics with treated banks. On

the one hand, banks closer to the MDA trigger may suffer from weaker balance sheets

and, for instance, poorer profitability and/or deteriorated asset quality than banks further

away from it. Additionally, banks closer to the MDA trigger could exploit - more than

other banks - the exceptional measures undertaken by policy makers as a reaction to the

pandemic outbreak. On the other hand, it is also plausible that larger banks lie closer

to the MDA trigger as they adopt capital management strategies to limit the amount of

profitless excess capital.

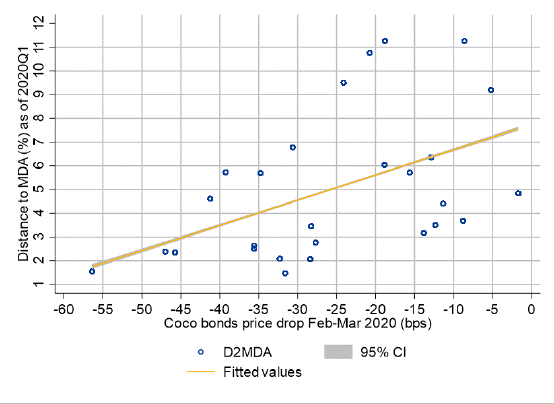

In order to address this endogeneity concern, Panel A of Table 1 shows the pre-

treatment mean values of the covariates employed in equation (1). We use the Welch’s

test to test for mean differences between the two groups. As shown, banks closer to the

MDA trigger in the collapsed quarters prior to the pandemic have, on average, higher risk

weight density, are less profitable, hold greater amount of legacy assets (although lower

provisions), have lower capital requirements and engage more in off-balance sheet activi-

ties than banks further away from it. Moreover, banks in proximity of the MDA trigger

appear to have resorted more to TLTRO III uptakes during the pandemic. Although

equation (1) is saturated with bank and policy-specific control variables, we complement

the baseline regression by using the propensity score matching (PSM) approach (Rosen-

baum and Rubin, 1983) which, by pairing each bank with a control unit, allows us to

control for banks with similar characteristics as well as to mitigate the concerns that our

results are driven by bank specific-attributes. In the spirit of Bersch et al. (2020), we

13

While both groups increase lending during the pandemic, Figure 3 only shows unconditional lending

developments and thus does not allow to control for the heterogeneity in credit demand across firms

as well as for the simultaneity of fiscal and monetary policy measures deployed as a reaction to the

pandemic. Therefore the need to rely on granular data and loan-level econometric analysis to disentangle

the distance to the MDA trigger from support measures.

ECB Working Paper Series No 2644 / February 2022

13

allow treated banks to be matched with at least one and up to three control banks, whilst

both treated and control banks are discarded from the analysis if proper matching is not

found (Heckman et al. 1997).

14

Figure 4 plots the density curves of the treatment and

the control groups before and after the PSM. After matching, the two density curves

almost overlap. Additionally, Panel B of Table 1 presents the corresponding result of the

two-sample Welch t-test after the PSM. There are no statistically significant differences

between the treatment and the control groups post matching indicating that the PSM

acts as an accurate balancing mechanism. In fact, the number of control group banks

diminish by 206 (from 282 to 76), whilst 18 treated banks are dropped from the analysis

in the absence of a well suited matching.

[Insert Table 1 Here]

[Insert Figure 4 Here]

2.2 Firm-level analysis

In this section, we empirically investigate whether firms more exposed to banks in

proximity of the MDA trigger prior to the pandemic outbreak manage to raise funds from

banks with greater MDA headroom to replace the lost lending. We also look at whether

prudential buffers have interacted with the fiscal support measures introduced after the

pandemic. Theoretically, a reduction in credit supply from those banks in proximity of the

MDA trigger would not be contractionary at the firm-level if: (i) banks further away from

it pick up the slack and/or (ii) the government offers credit risk protection via guaranteed

schemes which help capital constrained banks. If this is the case, there will be no effect on

total credit supply to the real economy but a mere redistribution of market shares across

banks and/or more government intervention. In practise, however, firms exposed to banks

in proximity of the MDA trigger point may struggle to replace existing sources of financing

with alternative ones or to establish new credit relationships during turbulent times. In

14

The counterfactual is created via a logit model and we apply one-to-one nearest neighbour, imposing a

tolerance level on the maximum propensity score distance (caliper) between the control and the treatment

group equalling to 0.01 (Dehejia and Wahba, 2002)

ECB Working Paper Series No 2644 / February 2022

14

addition, banks in proximity to the MDA trigger may leverage on guaranteed credit to

reduce their credit risk exposure reducing the guarantees’ effectiveness in providing credit

to constrained firms (Altavilla et al., 2021). Since, on average, firm exposure to banks

with limited MDA headroom prior to the pandemic is sizeable (Figure 5), we delve into

this question by following Behn et al. (2016) and adopting the following econometric

identification strategy:

∆Log(borrowing)

k

= α

ils

+ βExp.F irm

k

+ λS.GU AR

k

+ σExp.F irm

k

∗ S.GU AR

k

+ τ X

i

+ δZ

i

+ γ

j

+

k

(2)

The dependent variable is the change in the logarithm of a firm’s total bank loans over

the pandemic shock. α identifies ILS fixed effects that we use to control for heterogeneity

in credit demand across firms. Exp.F irm is a dummy variable indicating whether a firm

is exposed to a bank in proximity of the MDA trigger prior to the pandemic, 0 otherwise.

Specifically, we define as exposed those firms that prior to the pandemic have more than

25% (first quartile) of their credit originating from more vulnerable banks, i.e. those in

proximity of the MDA trigger. In equation (2), our interest lies in the β and σ coefficients.

β captures whether firms’ borrowing from vulnerable banks that did not receive loans

pledged by government guaranteed schemes is impaired in comparison to firms connected

to banks with greater MDA headroom, while σ indicates whether guarantees schemes

have been effective in providing more credit to firms constrained by banks in proximity

of the MDA trigger. The vectors X and Z are weighted averages (weighting each bank

value by its loan volume to firm k prior to the shock over total bank loans taken by this

firm) of the same bank and policy-control variables as adopted in equation (1).

∆Log(N.emplo)

k

= α

ils

+ βExp.F irm

k

+ λS.GU AR

k

+ σExp.F irm

k

∗ S.GU AR

k

+ τ X

i

+ δZ

i

+ γ

j

+

k

(3)

In the spirit of Jimenez et al. (2017), in equation (3), we look at whether exposed firms’

ECB Working Paper Series No 2644 / February 2022

15

headcounts is affected during the pandemic as this can have repercussions on firms’ perfor-

mance and, more broadly, on the level of unemployment and economic output.

15

If firms

did not manage to raise funds from banks with greater MDA headroom and/or through

guaranteed schemes, they may have been forced the to cut the number of employees.

[Insert Figure 5 Here]

3 Data

Our analysis relies on datasets collected from multiple sources. First, we construct a

bank-level dataset by combining information from several supervisory sources. Bank-level

balance sheet as well as capital stack (Pillar 1 and 2) and buffer requirements data are

gathered from ECB Supervisory Statistics, while TLTRO take-up information is drawn

from the ECB market operations database. Bank-level data is matched with loan-level

information that is taken from AnaCredit, the credit register of the European System

of Central Banks which contains information on all individual bank loans to firms above

€25,000 in the euro area.

16

AnaCredit encompasses information on key bank and borrower

characteristics such as credit volume, firm location, firm size and firm sector. Our initial

dataset (pre-collapse) contains roughly 30 million loans in the euro area. Importantly,

AnaCredit collects unique data on the protection received for each loan contract which

allows us to identify whether the loan is subject to a public guarantee.

17

Furthermore,

by using information on loan maturity dates at origination and checking whether these

are extended following the pandemic outbreak, we are also able to identify which loan is

benefitting from a payment moratoria. The data are collected by the European Central

Bank from the national central banks of the Eurosystem in a harmonised manner to ensure

15

We rely on the available firm-level data in AnaCredit for this exercise as matching external database

providers with Anacredit would greatly reduce the coverage of firms in the sample.

16

AnaCredit stands for analytical credit datasets. Additional documentation can be found here: https:

//www.ecb.europa.eu/stats/money credit banking/anacredit/html/index.en.html

17

COVID guaranteed loans have been identified by using registry information (e.g. LEIs and RIAD

codes) of the promotional lenders charged with this task in each country (for example, ICO in Spain,

KFW in Germany, BPI in France and SACE/Fondo di Garanzia in Italy). In addition to the registry

information of the guarantor, the starting date of the public guarantee scheme has also been used as an

identifying device.

ECB Working Paper Series No 2644 / February 2022

16

consistency across countries.

3.1 Descriptive statistics

Table 2 reports the number of banks by country, matching strategy and treatment

status. As expected, Germany showcases the greatest number of banks for both samples

(matched and unmatched). Notwithstanding sample size differences, the number of banks

appears to be well distributed after matching suggesting that the PSM did not alter the

sample composition but rather it scaled down the number of banks withing each coun-

try to find proper comparables (the only exception being the Netherlands and Slovenia

for which the number of control group banks after matching dropped by 13 and 4, re-

spectively). While the reduction of treated banks following the application of the PSM

strategy is marginal, the numbers of non-suitable banks in the control group is quite large

(205) indicating the appropriateness of complementing the baseline regression with a more

comparable sample of banks.

[Insert Table 2 Here]

Table 3 and Panel A reports the descriptive statistics of the variables employed. On

average, lending increases immediately after the pandemic outbreak by 12.4%. This is

likely driven by monetary and prudential policy actions that ameliorated the worst eco-

nomic effects of the pandemic by ensuring accomodative financing condition overall and

for banks as well as by fiscal measures that enabled the transmission of supporting fund-

ing conditions to the economy. For instance, TLTROs uptake (TLTRO.III) as well as the

bank-firm share of loans under guarantee schemes weighted by total loans (S.GUAR) is

not negligible as shown by mean and standard deviation of Table 3 and Panel C. Sim-

ilarly, firm borrowing increase largely during the pandemic (by 33.5%) confirming the

large surge in credit demand from firms for emergency liquidity needs. Panel B of Table 3

outlines the variable of interest, namely the distance to the MDA trigger. As mentioned

in the explanation of equation (1), banks considered as treated have a distance to the

MDA below 2.6% (first quartile of the distance to the MDA distribution). For graphical

ECB Working Paper Series No 2644 / February 2022

17

purposes, in Figure 6 we report the distribution of the distance to the MDA trigger.

18

[Insert Table 3 Here]

[Insert Figure 6 Here]

4 Results

4.1 Loan-level results

Table 4 reports the results from estimating equation (1). The Table is divided in 4

columns. Columns 1 and 3 report the results of Khwaja and Mian (2008) approach for the

matched and unmatched sample whilst columns 2 and 4 report the results of the Degryse

et al. (2019) approach for the matched and unmatched sample. The dataset is collapsed

into pre- (2019Q2-2019Q4) and post-event (2020Q2-2020Q4) averages as in Betrand et al.

(2004).

The dummy Low.D2MDA is our coefficient of interest as it indicates whether proximity

to the MDA results in weaker credit supply at the onset of the pandemic. The first column

of Table 4 shows that banks closer to the MDA trigger contract their lending supply by

3.5% after the pandemic outbreak compared to the control group. This specification

includes firm fixed effects which control for firm credit demand. The second column of

Table 4 displays the results for the matched sample which addresses the concerns that

differences in bank-specific characteristics may drive the results. Notwithstanding the

smaller sample in the matched analysis, the variable of interest (Low.D2MDA) retains

sign in-line with the unmatched sample providing robustness to the unmatched sample

results. In addition, the magnitude of the coefficient is improved in the matched sample

which suggests a contraction of about 9.2%. In columns 3 and 4, we replace firm fixed

effect with ILS fixed effects to allow the inclusion of single-bank relationships which are

mostly determined by SMEs. ILS allow us to retain more than 1.3 million single-bank

18

Table B in the Appendix provides a pairwise correlation matrix for all the right-hand side variables

of equation (1).

ECB Working Paper Series No 2644 / February 2022

18

relationships in our estimation. The coefficients reported in columns 3 and 4 of Table

4 have sign and statistical significance in line with the firm FE regressions. As in the

firm FE econometric specification, we find a stronger effect in the matched sample. In

particular, we find a contraction in bank lending supply by about 3.4% - 8.9% in the

unmatched and matched sample, respectively.

These results show that proximity of the MDA trigger encourages banks to react to

the distressed period followed by the health emergency by reducing outstanding loans to

NFCs. The loan-level analysis developed in this section confirms that the credit curtail-

ment can be attributed to a reduction in credit supply and is not instead driven by firm

demand. Moreover, the consistency of the results in the matched and unmatched sam-

ple certifies that our results are not driven by differences in bank-specific characteristics

between banks in proximity of the MDA trigger and banks farther away from it.

Among the bank-specific controls, we document an inverse relationship between the

OCR and the change in bank lending during the pandemic. Specifically, a 1 pp increase

in the OCR is associated to a contraction of lending supply of 4.2% (column 1). This

result is in line with a large literature suggesting a negative relationship between capital

requirements and bank lending (see, amongst others, Behn et al., 2016; Fraisse et al.,

2019; Gropp et al., 2019). A negative and statistically significant link is also displayed

between MKT FUNDING/TA and the change in bank lending. In particular, a 1 pp

increase in MKT FUNDING/TA leads to about 0.4% (column 1) decrease in lending sup-

ply during the pandemic. Banks relying on non-deposit sources of funds may have an

increased sensitivity to the exceptional monetary policy tools implemented against the

pandemic, thus being able to exploit favourable financing conditions and extend more

credit than banks relying more on deposits as a source of funding (Disyatat, 2011). We

also document a positive relation between NIM and the change in bank lending during

the shock. Particularly, a 1 pp increase in NIM increases lending supply by about 6.12%

(column 1) suggesting that more profitable banks provide more credit during the pan-

demic (Molyneux et al., 2019). As expected, we find a positive and strongly statistically

significant (at the 1% level) relationship between the share of loans under government

ECB Working Paper Series No 2644 / February 2022

19

guaranteed schemes (S.GUAR) and the change in bank lending supply. A 1 pp increase

in the share of guaranteed loans results in about 1.5% increase in bank lending supply

(column 1).

[Insert Table 4 Here]

4.2 Firm-level results

In this section, we analyse whether the proximity to the MDA trigger entails credit

rationing at the firm level. In practise, this will depend on (i) the extent to which other

banks, not close to the MDA trigger, are able or willing to pick up the slack and/or

(ii) the effectiveness of government guaranteed schemes in helping capital constrained

banks. To analyse the occurrence of this substitution, we use the dummy Exp.Firm as

in equation 2 that is equal to one if a firm receives more than 25% of credit prior to

the pandemic by banks with smaller MDA headroom. To investigate whether prudential

buffers have interacted with the fiscal support measures introduced after the pandemic we

use the interaction term Exp.Firm × S.GUAR. The inclusion of ILS allows us to control

for heterogeneity in credit demand across firms.

19

Results to these questions are reported in Table 5. Columns 1 and 2 display the

results of the dummy Exp.Firm (column 1) and the interaction term Exp.Firm × S.GUAR

(column 2).

By looking at credit from the firms’ perspective, e.g. through their borrowing, we find

that firms exposed to banks in proximity of the MDA trigger exhibit about 2.6% lower

borrowing after the pandemic outbreak than firms exposed to banks with additional cap-

ital on top of the MDA trigger. The economic effect is not negligible given the saturation

of the model as firms’ borrowing capability has been highly impacted by government

guarantees and payment moratoria (Core and De Marco, 2021). In our empirical set-

ting, by including ILS fixed effects and controlling for guarantees and moratoria, firms’

19

In this econometric exercise the inclusion of firm fixed effects is not possible as they would absorb

the dummy variables of interest (Exp.F irm).

ECB Working Paper Series No 2644 / February 2022

20

lower borrowing capability can be attributed to differences in banks’ distance to the MDA

trigger.

The interaction term in column 2 provides useful insights on the relationship between

proximity to the MDA trigger and government guarantees. The single coefficient Exp.Firm

is still negative and statistically significant (at the 1% level) indicating substitution im-

pediments for those firms that prior to the health emergency borrowed mostly from banks

closer to the MDA and that were not able to replace outstanding borrowing with guaran-

teed credit. However, we find a positive and statistically significant (at the 1% level) effect

of government guarantees in mitigating the negative effect of proximity to the MDA on

firms’ borrowing capability. Ceteris paribus, firms receiving loans pledged by government

schemes were able to substitute for the lack of borrowing coming from vulnerable banks,

as confirmed by the insignificance of an F-test for joint significance testing the sum of the

single (Exp.Firm) and double coefficient (Exp.Firm × S.GUAR). This result highlights

both the negative aggregate effects originating from localised credit supply constraints and

the positive effects of guaranteed credit in mitigating capital buffers usability constrains.

Since firms are unable to substitute funding from MDA constrained banks, this is likely

to have negative repercussions at the firm level through lower employment, investments

and growth. Table 5 and column 1 reports the results when we regress the dummy

variable of interest (Exp.Firm) on the logarithmic change in the number of employees. As

shown, impediments to credit substitution results in firms reducing headcounts by 0.8%

in comparison to firms borrowing from MDA unconstrained banks. The interaction term

Exp.Firm × S.GUAR is statistically insignificant (column 2) indicating that guaranteed

loans did not affect the number of employees during the pandemic.

[Insert Table 5 Here]

ECB Working Paper Series No 2644 / February 2022

21

5 Robustness checks

5.1 Placebo test

When using a DiD estimation approach it is important to eliminate the possibility that

the identified behaviour on the dependent variable of interest might have already emerged

prior to the shock. In practise we need to ensure that bank lending in the treatment group

had not already diverged prior to the pandemic — for example, in anticipation of the

adverse effects of the spread of the virus, or for some non identified bank-specific reasons.

This would invalidate our choice of DiD estimation. To do so, placebo exercises can be

set up in which the data is tricked to think that a shock occurs at an earlier date. If the

estimated coefficients on the ‘false’ Covid shock are not statistically significant, we can

be more confident that our baseline coefficient is capturing a genuine shock.

In Table 6, we report the results from estimates in which we limit our time dimension to

the pre-Covid period (2019Q1-Q4), collapsing the quarterly data into pre- (2019Q1-Q2)

and post (2019Q3-Q4)-‘fake’ event averages. The coefficient of the Low.D2MDA variable

is negative in almost all specifications but the magnitude of the coefficient smaller and,

most importantly, it is not statistically significant in any of the econometric specifications

(matched/unmatched sample and firm/ILS fixed effects) further supporting the validity

of our baseline estimation and the selection of the difference-in-difference econometric

strategy.

[Insert Table 6 Here]

5.2 Alternative definition of the treatment variable

In the baseline specification, we defined as treated banks with a distance to MDA

trigger below the fist quartile of the distance to the MDA trigger distribution and as

control those banks with a distance to the MDA trigger above the first quartile. In this

set up, we allow some banks to be considered as controls even though they lay slightly

above the first quartile. Therefore, in this section, we provide a variation to the baseline

ECB Working Paper Series No 2644 / February 2022

22

specification by redefining the dummy Low.D2MDA in order to consider only the first

and last quartile of the distance to the MDA distribution, i.e. omitting the banks in the

middle of the distribution. Specifically, for this test the dummy Low.D2MDA takes the

value 1 for banks with an average pre-pandemic (2019Q3-Q4) distance to the MDA trigger

below the first quartile of the distance to the MDA trigger distribution (as in the baseline

specification in equation (1)) while it takes the value 0 only for banks with a distance to

MDA trigger above the third quartile of distance to MDA trigger distribution.

The results from this test are reported in Table 7. Although dropping banks between

the first and third quartile results in a lower number of banks, firms and observations

that enter into the estimation, we find that sign and statistical significance of the dummy

variable of interest (Low.D2MDA) is in line with the baseline findings of Table 4. In

addition, we find - in the majority of the specifications - a stronger magnitude of the

coefficients of interest in the unmatched sample. Specifically, banks in proximity of the

MDA trigger contract lending supply by about 4.9% - 7.5% in the specification including

firm fixed effects and about 5.6% - 4.2% in the specification which account for the inclusion

of single-bank relationships via ILS fixed effects in comparison with banks with a distance

to the MDA trigger above the last quartile.

[Insert Table 7 Here]

5.3 Continuous distance to the MDA trigger

As a third robustness check, we replace our dummy variable of interest (Low.D2MDA)

with the lag of the distance to the MDA, expressed as a continuous variable (labelled

L.Dist.MDA). One advantage of the continuous variable over the dummy variable is that

it allows for a better estimation of the intensity of the effect of the distance to the MDA

trigger on changes in bank lending supply. On the contrary, the dummy variable groups

banks according to a specific threshold determined by their distance to the MDA trigger.

However, in our empirical setting, the dummy variable has two main advantages compared

to the continuous variable. First and most important, it allows to apply sample matching

ECB Working Paper Series No 2644 / February 2022

23

strategies (in our case the PSM). This ensures that our results are not endogenous, i.e.

not driven by banks that are close to the MDA trigger because of weaker balance sheets.

Second, it allows for non-linearity in the estimation of the distance to the MDA and bank

lending supply. This method is employed also by other studies in the banking literature

(see, amongst others, Heider et al., 2019)

Nevertheless, the results displayed in Table 8 (columns 1 and 2) show a positive and

statistically significant (at the 1% level) relationship between the distance to the MDA

trigger and bank lending supply. Specifically, a 1 pp increase in the distance to the MDA

trigger is associated to about 0.6% higher lending in the specification with firm fixed

effects and about 0.3% when single-bank relationships are included via ILS fixed effects,

although not statistically significant. This test further corroborates our baseline findings

suggesting that the distance to MDA trigger is a pivotal determinant for bank lending

decision following a major systemic event.

[Insert Table 8 Here]

5.4 Matching by CET1 ratio

As a fourth robustness check, we change our matching strategy by replacing the OCR

with the CET1 ratio.

20

In the matching strategy employed throughout the paper, we

constrain the OCR between the treated and control group to be similar (either by using it

in the matching strategy or controlling for it in the regressions) while allowing the CET1

ratio to vary. While it is important in the empirical strategy to control for differences

in terms of bank capital requirements, we may face the possibility that our results are

driven by lower levels of CET1 ratio and not necessarily by the proximity to the MDA

trigger. To control for this possibility we use the CET1 ratio as a control variable in the

matching strategy, replacing the OCR. Matching by the CET1 ratio creates a matched

20

In unreported tests, we employ different matching techniques to control for the reliability of our

results. Specifically, we use - instead of the nearest neighbours matching - the radius matching. In

addition, we also limit the number of nearest neighbours (3 in the baseline specification) to 1 and 2

control units to be matched with treated banks. Finally, we use other calipers calibrations. The results

hold up well in the face of these additional checks and are available upon request.

ECB Working Paper Series No 2644 / February 2022

24

group of banks that are similar in terms of capital ratios but differ only in respect to their

distance to the MDA trigger.

The results of this test are reported in Table 9. In columns 1 and 3 of Table 9 we

report the estimate of the unmatched sample where we replace the OCR with the lag of

the CET1 ratio as a control variable in the estimation. As shown, the results have sign,

magnitude and statistical significance in line with the baseline findings further corrobo-

rating their validity. In columns 2 and 4, we apply the aforementioned matching strategy.

Notwithstanding the large loss of observations in the matched sample which indicates a

smaller group of banks having similar CET1 ratio but, at the same time, different distance

to the MDA trigger, the results hold up well, further validating our baseline analysis and

suggesting, again, that the distance to the MDA trigger is an important determinant for

bank lending decision during a systemic shock.

[Insert Table 9 Here]

6 Conclusion

In this paper we ask whether the Basel III capital framework creates unintended incen-

tives for banks to behave pro-cyclically when confronted with a situation of widespread

economic distress, as the one generated by the Covid-19 pandemic. We approach the

issue empirically by investigating how banks that prior to the pandemic outbreak main-

tained a lower buffer on top of regulatory requirements adjusted their balance sheets when

compared to other banks.

We find robust evidence that banks proximity to the MDA trigger results in lower

lending supply during the Covid-19 pandemic. The results hold when controlling for

a number of possible alternative explanations (e.g. credit demand, bank solvency, asset

quality, etc) and when controlling for a broad range of pandemic policy support measures.

The pro-cyclical behaviour of banks in proximity of the MDA trigger resulted in credit

constraints for firms mostly exposed to them as they were unable to fully replace the

ECB Working Paper Series No 2644 / February 2022

25

curtailed loans.

While several factors can explain the identified behaviour of banks in proximity of the

MDA trigger during the pandemic, it remains difficult to pin down a single mechanism

triggering banks’ balance sheet adjustments. First, banks may want to avoid restrictions

to distributions triggered by the MDA mechanism when banks dip into the CBR. Second,

beyond the stigmas associated with the MDA mechanism, banks may want to avoid

operating within the CBR as this could be perceived as a sign of weakness, leading to

market pressures and/or rating downgrades. Third, banks prefer to stay out of close

supervisory scrutiny. Lastly, other minimum regulatory requirements (e.g. leverage ratio

or MREL) might be more binding than risk based requirements, thereby making the

CBR at least partially unusable. Cursory evidence on the relationship between contingent

convertible bonds prices and MDA headroom immediately after the pandemic outbreak

suggests that Coco prices dropped more for banks closer to the MDA trigger (Figure 6).

21

While this could indeed indicate a role for the MDA trigger and market stigmas, the

identification of the specific factors causing banks’ adjustments is left for future research.

21

We collect CoCo bond prices from Thompson Eikon. The sample involves 27 SSM supervised banks,

accounting for existing data availability constraints.

ECB Working Paper Series No 2644 / February 2022

26

References

Acharya, V. V., Le, H. T., Shin, H. S. (2017). Bank capital and dividend externalities.

The Review of Financial Studies, 30, 988-1018. https://doi.org/10.1093/rfs/hhw096

Acharya, V. V., Eisert, T., Eufinger, C., Hirsch, C. (2019). Whatever it takes: The

real effects of unconventional monetary policy. The Review of Financial Studies, 32,

3366-3411. https://doi.org/10.1093/rfs/hhz005

Aiyar, S., Calomiris, C. W., Hooley, J., Korniyenko, Y., Wieladek, T. (2014). The in-

ternational transmission of bank capital requirements: Evidence from the UK. Journal

of Financial Economics, 113, 368-382. https://doi.org/10.1016/j.jfineco.2014.05.003

Altavilla, C., Barbiero, F., Boucinha, M., Burlon, L. (2020). The great lockdown:

Pandemic response policies and bank lending conditions. CEPR Discussion Paper

No. DP15298, Centre for Economic Policy Research.

Altavilla, C., Boucinha, M., Peydro, J. L., Smets, F. (2020) Banking supervision, mon-

etary policy and risk-taking: big data evidence from 15 credit registers, ECB Working

Paper No 2349.

Altavilla, C. Ellul, A., Pagano, M., Polo, A., Vlassopoulos, T. 2021. Loan guarantees,

bank lending and credi risk reallocation. CEPR Working Paper DP16727, Centre for

Economic Policy Research.

Auer, R. and Ongena, S. (2016). The countercyclical capital buffer and the composition

of bank lending. BIS Working Papers No. 593., Bank for International Settlements.

Baker, M., Wurgler, J. (2015). Do strict capital requirements raise the cost of capital?

Bank regulation, capital structure, and the low-risk anomaly. American Economic Re-

view, 105, 315-320. DOI:10.1257/aer.p20151092

Basten, C. (2020). Higher bank capital requirements and mortgage pricing: Ev-

idence from the counter-cyclical capital buffer. Review of Finance, 24, 453-495.

https://doi.org/10.1093/rof/rfz009

ECB Working Paper Series No 2644 / February 2022

27

BCBS. (2011). Basel III: A global regulatory framework for more resilient banks and

banking systems. Basel Committee on Banking Supervision, Bank for International

Settlements.

Behn M., Haselmann, R., Wachtel, P. (2016). Procyclical capital regulation and lend-

ing. The Journal of Finance, 71, 919-956. https://doi.org/10.1111/jofi.12368

Behn, M., Schramm, A. (2020). The impact of G-SIB identification on bank lending:

Evidence from syndicated loans. ECB Working Paper Series No. 2479, European Cen-

tral Bank. doi:10.2866/784184

Behn, M. Rancoita, E., Rodriguez d’Acri, C. (2020). Macroprudential capital buffers

- objectives and usability. Macroprudential Bulletin No. 11, European Central Bank.

Berger, A. N., Udell, F. G. (1994). Did risk-based capital allocate bank credit and

cause a ”credit crunch” in the United States? Journal of Money, Credit and Banking,

26, 585-628. https://doi.org/10.2307/2077994

Bernanke, B. S., Lown, C. S., Friedman, B. M. (1991). The credit crunch. Brookings

Papers on Economic Activity, 205-247. https://doi.org/10.2307/2534592

Berrospide, J. M., Edge, R. M. (2010). The effect of bank capital on lending: What

do we know, and what does it mean? International Journal of Central Banking, 6,

5-54.

Berrospide, J. M., Edge, R. M. (2019). The effect of bank capital buffers on bank

lending and firm activity: What can we learn from five year of stress-test results? Fi-

nance and Economics Discussion Series 2019-050, Board of Governors of the Federal

Reserve System. https://doi.org/10.17016/FEDS.2019.050

Bersch, J., Degryse, H., Kick, T., Stein, I. (2020). The real effects of bank distress:

Evidence from bank bailouts in Germany. Journal of Corporate Finance, 60, 101521.

https://doi.org/10.1016/j.jcorpfin.2019.101521

Bertrand, M., Duflo, E., Mullainathan, S. (2004). How much should we trust

ECB Working Paper Series No 2644 / February 2022

28

differences-in-differences estimates? The Quarterly Journal of Economics, 119, 249-

275. https://doi.org/10.1162/003355304772839588

BIS. (2020). Basel Committee meets; discusses impact of Covid-19; reiterates guid-

ance on buffers. Press Release Basel Committee on Banking Supervision, 17 June 2020,

Bank for International Settlements. Available at: https://www.bis.org/press/p200617.

htm.

BIS. (2021). Evaluating the effectiveness of Basel III during Covid-19 and beyond.

Speech by Pablo Hern´andez de Cos Chairman of the Basel Committee on Banking

Supervision and Governor of the Bank of Spain. Bank for International Settlements.

Bolton, P., Freixas, X. (2006). Corporate finance and the monetary transmission mech-

anism. The Review of Financial Studies, 19, 829-870. https://doi.org/10.1093/rfs/

hhl002

BoP. (2020). Interaction betweeen regulatory minimum requirements and capital

buffers. Financial Stability Report, June 2020, Banco de Portugal.

Borio, C., Farag, M., Tarashev, N. (2020). Post-crisis international financial regulatory

reforms: A primer. BIS Working Papers No. 859, Bank for International Settlements.

Borsuk, M., Budnik, K., Volk, M. (2020). Buffer use and lending impact. Macropru-

dential Bulletin No. 11, European Central Bank.

Claessens, S., Law, A., Wang, T. (2018). How do credit ratings affect bank lending

under capital constrains? BIS Working Papers No. 747, Bank for International Set-

tlements.

Core, F., De Marco, F. (2021). Public guarantees for small businesses in Italy during

Covid-19. CEPR Discussion Paper No. DP15799, Centre for Economic Policy Re-

search..

Cornett, M. M., McNutt, J. J., Strahan, P. E., Tehranian, H. (2011). Liquidity risk

ECB Working Paper Series No 2644 / February 2022

29

management and credit supply in the financial crisis. Journal of Financial Economics,

101, 297-312. https://doi.org/10.1016/j.jfineco.2011.03.001.

Couaillier, C. (2020). What are banks’ actual capital targets? Lessons for policymak-

ers. Available at: https://ssrn.com/abstract=3899288.

Degryse, H., De Jonghe, O., Jakovljevi´c, S., Mulier, K., Schepens, G. (2019). Identi-

fying credit supply shocks with bank-firm data: Methods and applications. Journal of

Financial Intermediation, 40, 100813.

Degryse, H., Mariathasan, M., Tang, T. H. (2020). GSIB status and corporate lending:

An international analysis. CEPR Discussion Paper N. 15564, Centre for Economic

Policy Research.

Dehejia, R. H., Wahba, S. (2002). Propensity score-matching methods for nonex-

perimental causal studies. The Review of Economics and Statistics, 84, 151-161.

https://doi.org/10.1162/003465302317331982

De Jonghe, O., Dewachter, H., Ongena, S. (2020). Bank capital (requirements) and

credit supply: Evidence from pillar 2 decisions. Journal of Corporate Finance, 60,

101518. https://doi.org/10.1016/j.jcorpfin.2019.101518

Diamond, W. D., Rajan, R. (2002). A theory of bank capital.The Journal of Finance,

55, 2431-2465. https://doi.org/10.1111/0022-1082.00296

Disyatat, P. (2011). The bank lending channel revisited. Journal of Money, Credit and

Banking, 43, 711-734. https://doi.org/10.1111/j.1538-4616.2011.00394.x

Donald, S. G., Lang, K. (2007). Inference with difference-in-differences and other panel

data. The Review of Economics and Statistics, 89, 221-233.https://doi.org/10.1162/

rest.89.2.221

Drehmann, M., Fara, M., Tarashev, N., Tsatsaronis, K. (2020). Buffering Covid-19

losses - The role of prudential policy. BIS Bulletin No. 9, Bank for International Set-

tlement.

ECB Working Paper Series No 2644 / February 2022

30

EBA. (2021). Draft revised guidelines on recovery plan indicators under Article 9 of

Directive 2014/59/EU/. Consultation paper, European Banking Authority.

ECB. (2020). Financial stability consideration arising from the interaction of

coronavirus-related policy measures. Financial Stability Review , November 2020, Eu-

ropean Central Bank.

Enria, A. (2021). Introductory statement. Speech at the Press Conference on

the Supervisory Review and Evaluation Process, 28 January 2021. Available

at: https://www.bankingsupervision.europa.eu/press/speeches/date/2021/html/ssm.

sp210128

∼

78f262dd04.en.html

FED. (2020). Statement on the Use of Capital and Liquidity Buffers. Joint Release,

Board of Governors of the Federal Reserve System Federal Deposit Insurance Corpo-

ration Office of the Comptroller of the Currency.

Fraisse, H., Le, M., Thesmar, D. (2019). The real effects of bank capital requirements.

Management Science, 66, 5-23. https://doi.org/10.1287/mnsc.2018.3222

FSB. (2020). Covid-19 pandemic: Financial stability implications and policy measures

taken. Report submitted to the G20 finance ministers and governors. Financial Stabil-

ity Board.

Gambacorta, L., Mistrulli, P. E. (2004). Does bank capital affect lending behaviour?

Journal of Financial Intermediation, 13, 436-457. https://doi.org/10.1016/j.jfi.2004.

06.001

Gambacorta, L., Shin, H. S. (2018). Why bank capital matters for monetary policy?

Journal of Financial Intermediation, 35, 17-29. https://doi.org/10.1016/j.jfi.2016.09.

005

Gersbach, H., Rochet, J. C. (2017). Capital regulation and credit fluctuations. Journal

of Monetary Economics, 90, 113-124. https://doi.org/10.1016/j.jmoneco.2017.05.008

Gropp, R., Monsk, T., Ongena, S., Wix, C. (2019). Banks response to higher capital

ECB Working Paper Series No 2644 / February 2022

31

requirements: Evidence from a quasi-natural experiment. The Review of Financial

Studies, 32, 266-299. https://doi.org/10.1093/rfs/hhy052

Hancock, D., Laing, A. J., Wilcox, J. A. (1995). Bank capital shocks: Dynamic ef-

fects on securities, loans, and capital. Journal of Banking and Finance, 19, 661-677.

https://doi.org/10.1016/0378-4266(94)00147-U

Heckman, J. J., Ichimura, H., Todd, P. E. (1997). Matching as an econometric evalu-

ation estimator: Evidence from evaluating a job training programme. The Review of

Economic Studies, 64, 605-654. https://doi.org/10.2307/2971733

Heider, F., Saidi, F., Schepens, G. (2019). Life below zero: Bank lending un-

der negative policy rates. The Review of Financial Studies, 32, 3278-3761. https:

//doi.org/10.1093/rfs/hhz016

Imbens, G. W., Wooldridge, J. M. (2009). Recent developments in the econometrics of

program evaluation. Journal of Economic Literature, 47, 5-86. DOI:10.1257/jel.47.1.5

IMF. (2021). Covid-19: How will european bank fare? Departmental Paper No.

2021/008. International Monetary Fund.

Jimenez, G., Ongena, S., Peydro, J. L., Saurina, J. (2017). Macroprudential policy,

countercyclical bank capital buffers, and credit supply: Evidence from the Spanish

Dynamic Provisioning experiments. Journal of Political Economy, 125, 2126-2177.

https://doi.org/10.1086/694289

Jimenez, G., Mian, A., Peydro, J. L., Saurina, J. (2020). The real effects of the bank

lending channel. Journal of Monetary Economics, 115, 162-179. https://doi.org/10.

1016/j.jmoneco.2019.06.002.

Khwaja, A. I., Mian, A. (2008). Tracing the impact of bank liquidity shocks: Ev-

idence from an emerging market. American Economic Review, 98, 1413-42.DOI:

10.1257/aer.98.4.1413

ECB Working Paper Series No 2644 / February 2022

32

Lown, C., Morgan, D. P. (2006). The credit cycle and the business cycle: New find-

ings using the loan officer opinion survey. Journal of Money, Credit and Banking, 38,

1575-1597. https://www.jstor.org/stable/3839114

Martinez-Miera, D., Sanchez, V. R. (2021). Impact of dividend distribution restriction

on the flow of credit to non-financial corporations in Spain. Banco de Espana Working

Paper, No 07/21.

Molyneux, P., Reghezza, A., Xie, R. (2021). Bank margins and profits in a world of

negative rates. Journal of Banking and Finance, 107, 105613.

Peek, J., Rosengren, E. S. (1997). The international transmission of financial shocks:

The case of Japan. American Economic Review, 87, 495-505. https://www.jstor.org/

stable/2951360

Peek, J., Rosengren, E. S. (2000). Collateral damage: Effects of the Japanese bank

crisis on real activity in the United States. American Economic Review, 90, 30-45.

DOI:10.1257/aer.90.1.30

Petersen, M. A. (2009) Estimating standard errors in finance panel data sets: Com-

paring approaches. The Review of Financial Studies, 22, 435-480. https://doi.org/10.

1093/rfs/hhn053

Popov, A., Van Horen, N. (2015). Exporting sovereign stress: Evidence from syndi-

cated bank lending during the euro area sovereign debt crisis. Review of Finance, 19,

1825-1866. https://doi.org/10.1093/rof/rfu046.

Puri, M., Rocholl, J., Steffen, S. (2011). Global retail lending in the aftermatch of

the US financial crisis; Distinguishing between supply and demand effects. Journal of

Financial Economics, 100, 556-578. https://doi.org/10.1016/j.jfineco.2010.12.001.

Reghezza, A., Rodriguez d’Acri, C., Spaggiari, M., Cappelletti, G. (2020). Composi-

tional effects of O-SII capital buffers and the role of monetary policy. ECB Working

Paper Series No 2440, European Central Bank. doi:10.2866/897417.

Rosenbaum, P. R., Rubin, D. B. (1983). The central role of the propensity score in ob-

ECB Working Paper Series No 2644 / February 2022

33

servational studies for causal effects. Biometrika, 70, 41-55. https://doi.org/10.1093/

biomet/70.1.41.

SSM. (2021). ECB banking supervision provides temporary capital and operational re-

lief in reaction to coronavirus. Press Release Single Supervisory Mechanism, 12 March

2020, available at: https://www.bankingsupervision.europa.eu/press/pr/date/2020/

html/ssm.pr200312

∼

43351ac3ac.en.html

Svoronos, J. P., Vrbaski, R. (2020). Banks’ dividends in Covid-19 times. FSI Briefs

No. 6, Financial Stability Institute, Bank for International Settlements.

Van den Heuvel, S. J. (2008). The welfare cost of bank capital requirements. Journal

of Monetary Economics, 55, 298-320. https://doi.org/10.1016/j.jmoneco.2007.12.001.

ECB Working Paper Series No 2644 / February 2022

34

Figure 1. Evolution of bank CET1 capital ratios and their components

This figure shows the evolution of bank capital ratios divided by components for the sample

of euro area significant and less significant banks used throughout the paper over 2018-2020.

Capital stack is represented as a percentage of risk-weighted assets (y axis). The decline in

P2R in 2020 stems from a change in the composition of capital that can be used to fulfil this

requirement. The thinness of the dark green section of the bar, representing the O-SII, G-SIBs

and SRyB buffer, is due to the lack of such buffer requirements for some banks in the sample.

Figure 2. Capital stack

This figure shows Pillar 1 and Pillar 2 CET1 capital requirements along with the combined buffer

requirement. The red horizontal line indicates the MDA trigger point below which supervisory

actions apply.

ECB Working Paper Series No 2644 / February 2022

35