FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

1

Section 300

Change #01-2022

January 11, 2022

FNS 300 SOURCES OF INCOME

Change #01-2022

January 11, 2022

300.01 TYPES OF INCOME

A. Earned Income

Earned income is payment for labor or services rendered from paid employment or

business ownership. Some common examples of earned income include wages, salaries,

tips, and self-employment.

B. Unearned Income

Unearned income is all income that is not earned from one’s job or from one’s business.

Some common examples of unearned income include contributions, railroad

retirement, Social Security, and Veteran’s benefits.

C. Lump sum Payments

Earned or unearned income from any source that is received in a lump sum payment is

not countable as income. Some types of lump sum payments include but are not limited

to:

• Supplemental Security or Social Security back payments received in one lump

sum payment,

• Federal or State tax returns,

• Stimulus payments,

• Insurance settlements.

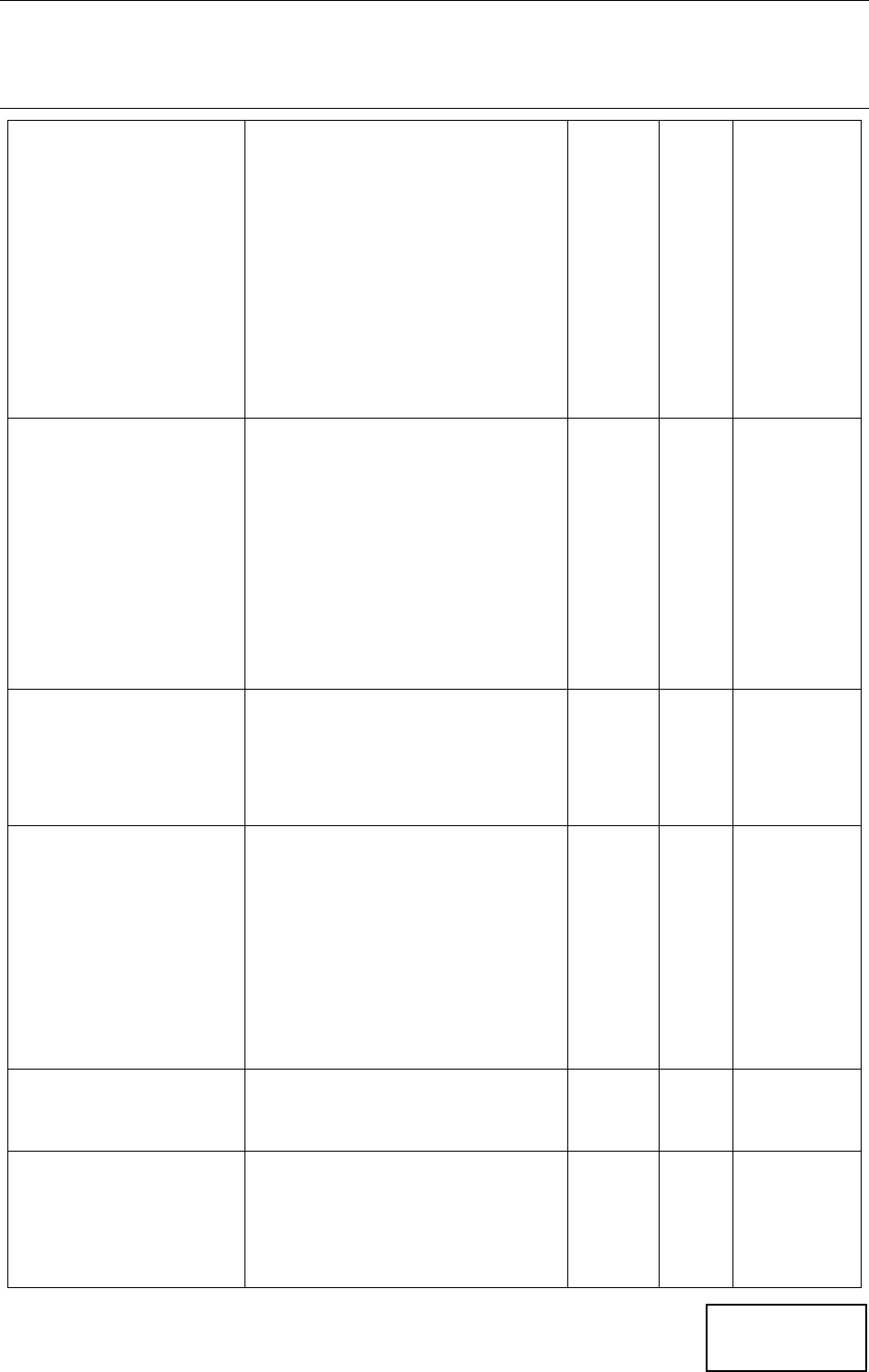

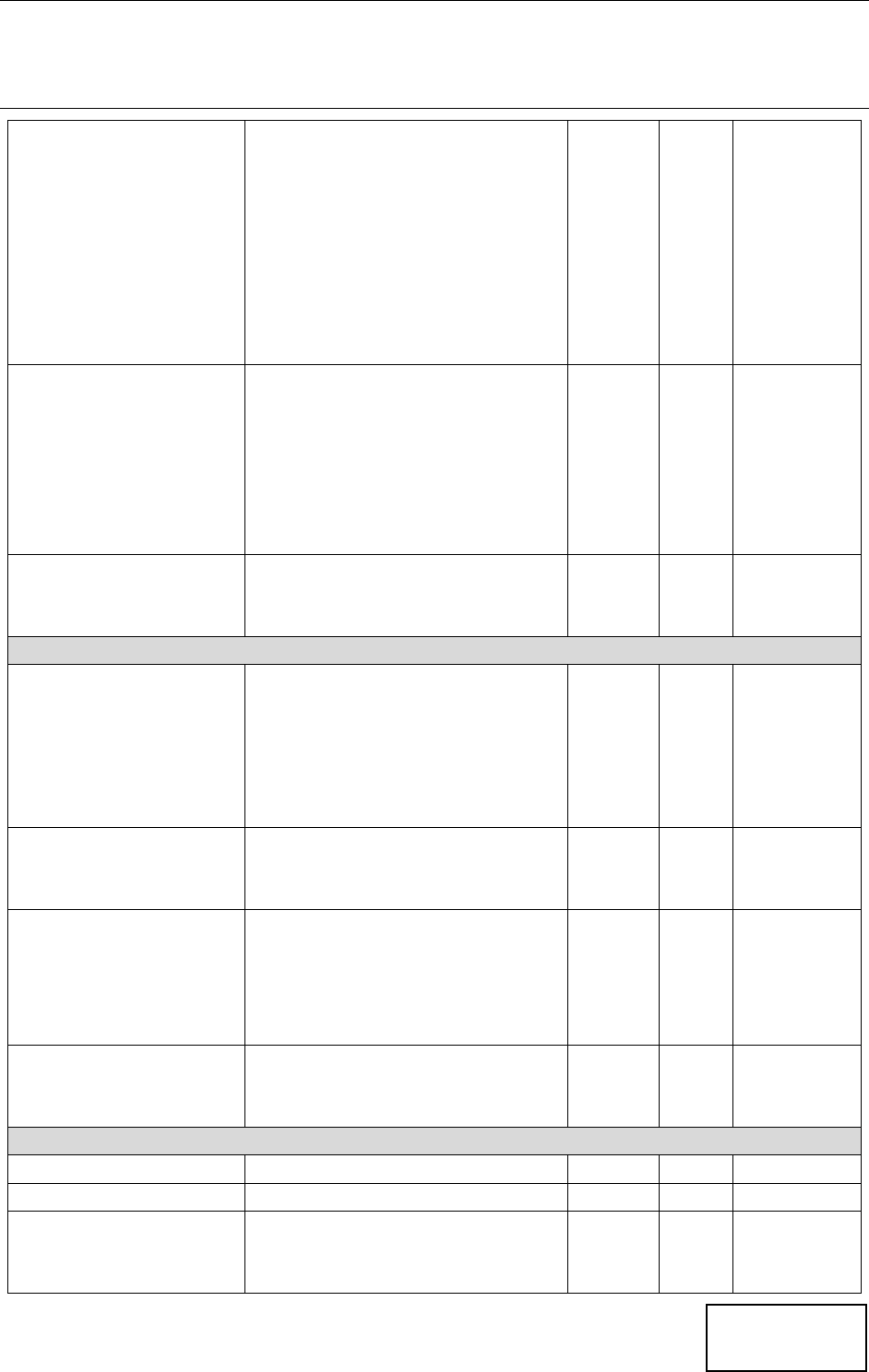

300.02 SOURCES OF INCOME CHART

The sources of income chart list the most common types of income available to the Food

and Nutrition Services (FNS) unit. It would be impossible to list every income type, if a

worker encounters a type of income that is not listed in the chart, they should use their

prudent person concept to determine the type of income and verification required.

Different organizations have different names for programs funded by the same source. It is

necessary in those circumstances to determine the source of the income to determine if it is

countable.

Example: A FNS unit member works for Helping Hands Services and states they were told

the income would not count for FNS. The worker contacts the employer and

verifies that the source of the income is Title V of the Older Americans Act. The

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

2

Section 300

Change #01-2022

January 11, 2022

worker determines that the income is not countable and documents the record

to indicate the income is not countable.

If the worker is unable to determine the type of income, their supervisor or other

authorized personnel may submit a question to their Operational Support Team

representative for assistance.

Source of Income

Description

Count

Type

Reference

Section

-A-

Active Corps of

Executives (ACE)

Volunteer organization where

executives in business donate

their time in order to assist small

businesses in the United States

with planning, strategy, and

marketing. Established in 1969

and is affiliated with the Service

Corps of Retired Executives, or

SCORE.

N

--

--

Adoption Assistance or

Subsidy

Adoption assistance programs

provide payments and/or

services for children whom

unassisted adoption is unlikely

because of age, ethnic

background, physical, mental or

emotional disability, etc.

Usually adoption assistance will

be formalized in a written

agreement between the

adopting parents and the agency

involved.

Y

U

--

Adult Developmental

Activities Program

(ADAP)

A program that provides long-

term care clients appropriate

opportunities to learn skills in

center or community-based

settings.

N

--

--

Aid to Families with

Dependent Children

(AFDC)

See Work First Family Assistance

Y

U

315.36

Alien Sponsor’s Income

A sponsor is a person who signed

an affidavit or other statement

accepted by the U.S. Citizenship

and Immigration Service (USCIS)

agreeing to support an alien as a

Y

U

315.02

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

3

Section 300

Change #01-2022

January 11, 2022

condition of the alien's admission

for permanent residence.

A sponsor is an individual, not an

organization.

Alimony / Spousal

Support

Alimony is money paid by one

spouse to the other either during

the divorce process or after.

Once referred to exclusively as

alimony, it is now more

commonly called Spousal

Maintenance or Spousal Support.

Y

U

--

Americorps Payments

Payments received for services

performed through the

AmeriCorps organization.

N

--

--

Annuities (if paid

annually, average over

12 months)

Annuities are paid yearly or at

specified intervals. They may be

purchased from an insurance

company or by an employer for

services rendered, sometimes

referred to as retirement plans.

Y

U

--

Attendant Care

Payments

Payments for attending to

individuals with special needs

that require assistance with

activities of daily living.

Y

U

315.03

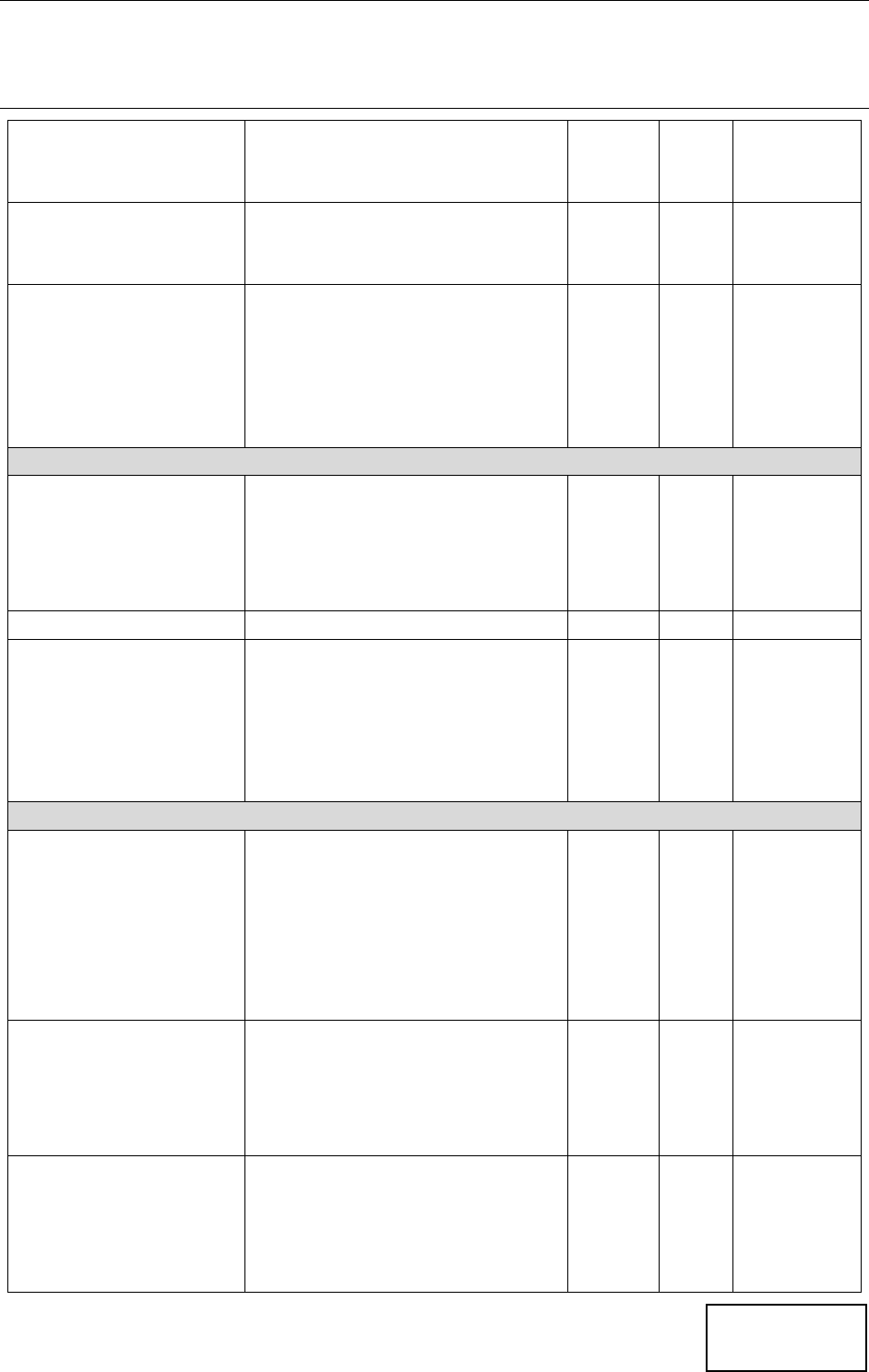

-B-

Basic Allowance for

Quarters (BAQ)

(Military Pay)

BAQ is designed to provide

uniformed service members

housing compensation based on

housing costs in each local

market.

Y

E

315.24

Benefit Diversion

Cash payment assistance

alternative to Work First for

families with a temporary non-

recurring situation associated

with employment or other

sources of financial stability.

N

--

--

Black Lung Benefits

Brown Lung Benefits

Black Lung Benefits Act (BLBA) is

administered by the Office of

Workers’ Compensation

Programs (OWCP). The Act

provides for monthly payments

to and medical treatment for

coal miners totally disabled from

Y

U

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

4

Section 300

Change #01-2022

January 11, 2022

pneumoconiosis (black lung

disease) arising from their

employment in or around the

nation's coal mines.

Brown Lung Benefits Act - Directs

the Secretary of Health,

Education, and Welfare to pay

benefits to any textile worker

and to the surviving dependents

of any such worker whose death

was caused who has been totally

disabled by chronic dust disease

of the lung arising out of

employment in a textile plant.

Boarders

Income from individuals living

with others and paying

reasonable compensation to the

others for lodging and meals

(excluding residents of a

commercial boarding house).

Y

E

--

Bonus Pay

Money given by the employer to

an employee in addition to

employee’s regular pay.

Y

E

315.04

Bureau of Indian Affairs

(BIA) Educational Aid

Educational Assistance received

through the Bureau of Indian

Affairs

N

--

--

-C-

Cafeteria Plans and

Flexible Benefits

Monetary credits available to the

employee to be used for a

variety of things such as health

insurance.

N/Y

U

315.05

Campaign Contributions

Donations towards a political

campaign.

N

--

--

Capital Gains

The actual capital gain from the

sale of capital good or

equipment.

Y

E

315.06

Census Income

(Permanent Employees)

This is earnings received by

permanent census employees.

Y

E

315.35

Census Income

(Temporary Employees)

This is earnings received by

temporary census employees.

Note: Exemptions to temporary

census income are

periodically allowed by

Y

E

315.35

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

5

Section 300

Change #01-2022

January 11, 2022

USDA. Dear County

Director Letters will be

issued to inform of any

exemption periods.

Child Care Wages

Self-employment income.

Y

E

315.28

Child Nutrition Act of

1966 Assistance Value

This act extended, expanded,

and strengthened the school

lunch program to more

effectively meet the nutritional

needs of our children.

N

--

--

Child Support

Child support is a payment made

by a child’s absent parent which

is available to meet the child’s

basic needs.

It may be paid voluntarily, under

a court order or enforced in

compliance with a State

agreement under title IV-D.

Y

U

315.08

College Work Study

Federal Work-Study that

provides part-time jobs for

undergraduate and graduate

students with financial need,

allowing them to earn money to

help pay education expenses.

N

--

315.09

Commissions

A fee paid to an agent or

employee for transacting a piece

of business or performing a

service

Y

E

315.35

Community Service

Administration’s Energy

Crisis Assistance

A crisis assistance component

through their Low Income Home

Energy Assistance Program

(LIHEAP).

N

--

--

Community

Spouse/Dependent

Income Allowance

(payments received

from an

institutionalized

Medicaid recipient)

The community spouse may keep

one-half of the couple's total

"countable" assets up to a limit

set by Medicaid policy. Called the

"community spouse resource

allowance," this is the most that

a state may allow a community

spouse to retain without a

hearing or a court order.

Y

U

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

6

Section 300

Change #01-2022

January 11, 2022

Contract Sales paid in

installments for the sale

of a resource.

Agreement to sell something in

exchange for installment

payments made over time.

Y

U

--

Contract Wages

This is money paid to an

individual, such as teachers and

other school employees, based

on a written or verbal agreement

(contract).

Y

E

315.10

Contributions

Cash or monetary gifts including

charitable contributions given on

a regular basis to meet FNS unit’s

needs. Count only if recurring.

Y

U

315.07

Court Ordered

Restitution

Restitution is an order of the

court by which offenders are

held accountable for the financial

losses they caused to the victims

of their crimes.

Y

U

315.12

Crisis Intervention

Program (CIP)

Payments

Federally funded program that

assists individuals and families

who are experiencing a heating

or cooling related crisis.

N

--

--

-D-

Dependent Care

Payments

Payments received to care for a

FNS unit member due to

disability.

Y

U

315.13

Disability Payments

(Other than SSI or

Social Security)

Payments made by a federal,

state or private entity to an

individual who does not have the

ability to engage in substantial

gainful activity (SGA). Does not

include SSI.

Y

U

--

Disaster Relief Act of

1974 Assistance

Payments

Includes federal emergency

situation such as disaster, natural

catastrophe, or emergency that

the President determines as

needing federal assistance.

N

--

--

Domestic Employment

(Self-Employment)

Employment in domestic services

such as housekeeping.

Y

E

315.14

Domestic Volunteer

Service

Act of 1973 Payments

Includes Active Corps of

Executives (ACE), Service Corps

of Retired Executive (SCORE),

AmeriCorps and VISTA Payments,

Retired Senior Volunteer

Y

U

315.34

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

7

Section 300

Change #01-2022

January 11, 2022

Program (RSVP), Senior

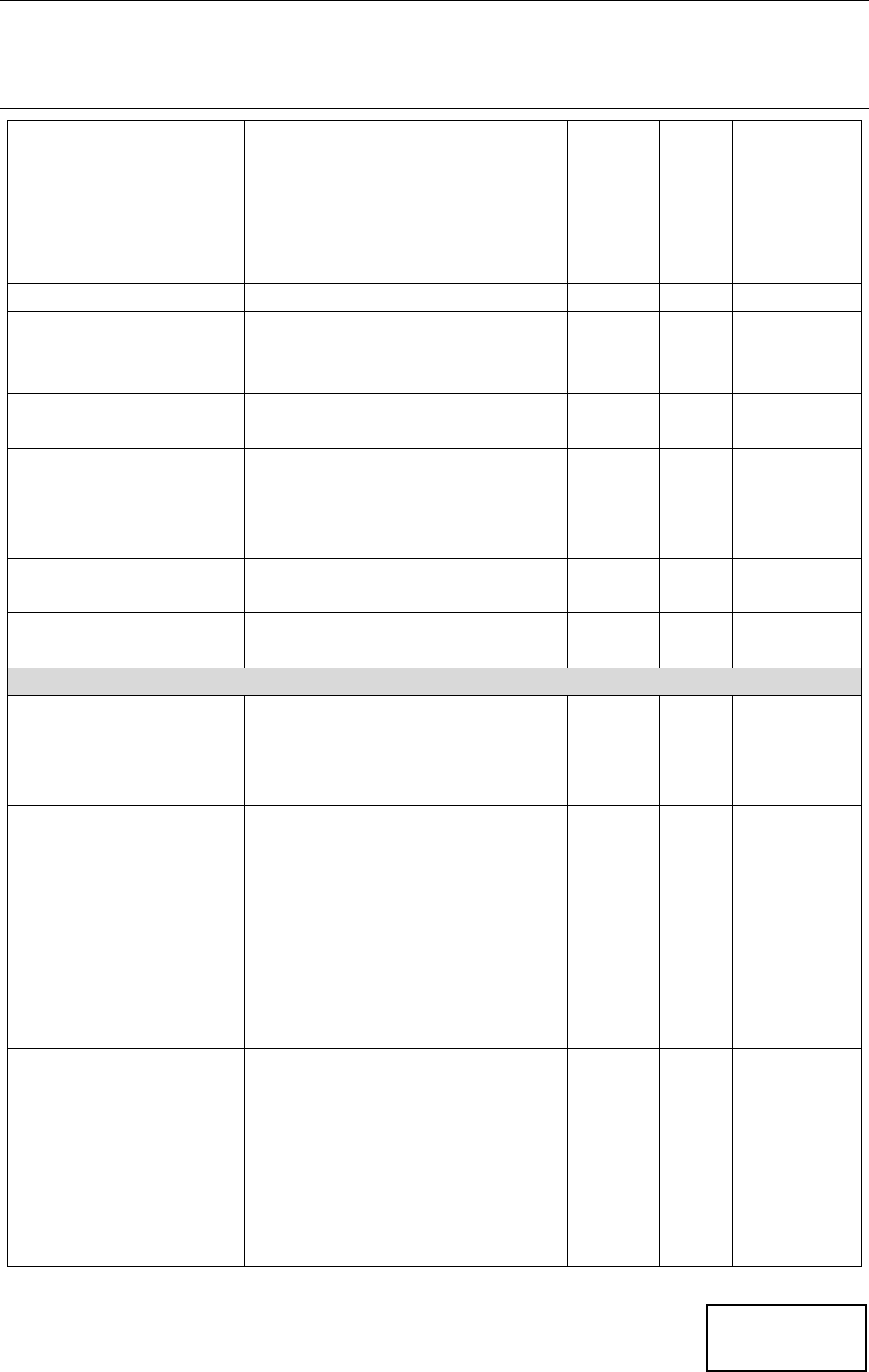

Companion Program.

-E-

Earned Income Tax

Credit

A refundable tax credit for low-

to moderate-income working

individuals and couples,

particularly those with children.

N

--

--

Educational Assistance

not designated for

room and board.

Includes federal assistance

including Pell Grants, and

assistance from civic groups,

educational institutions, and

athletic scholarships. Includes

Title VII and Bureau of Indian

Affairs Educational Aid.

N

--

315.15

Educational Assistance

designated for room

and board.

Includes federal assistance

including assistance from civic

groups, educational institutions,

and athletic scholarships.

Includes Title VII and Bureau of

Indian Affairs Educational Aid.

Y

U

315.15

Education Stipend

Fixed and regular payments for

services rendered in an

educational setting. Does not

include stipends for non-

students.

N

--

--

Energy Assistance

Payments

Includes Community Service

Administration's Energy Crisis

Assistance, LIEAP, CIP, Project

Share, (Progress Energy), and

Utility Assistance Payments

(HUD).

N

--

--

Experimental Housing

Allowance Program

(EHAP) Payments

Special Housing improvements

programs and grants; such as

HUD payments.

N

--

--

-F-

Family Subsistence

Supplemental

Allowance

Program established to

supplement a military member's

income to a high enough level so

that the member's family doesn't

need to get benefits under the

United States Department of

Y

E

315.24

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

8

Section 300

Change #01-2022

January 11, 2022

Agriculture (USDA) Supplemental

Nutrition Assistance Program.

Farm Income (gross

sales, non-excluded

crop insurance

settlements, ASCS

payments, and capital

gains)

Self-employment income derived

from farming. This can include

but not limited to crops, fish, and

livestock.

Y

E

315.28

Federal Crop Insurance

Corporation (FCIC)

Payments to farmers that

experience crop losses.

N

--

315.16

Federal Emergency

Management Act

(FEMA) Payments

Includes federal emergency

situation such as disaster, natural

catastrophe, or emergency that

the President determines as

needing federal assistance.

N

--

--

Federal Employee’s

Compensation Act

(FECA) Benefits

Provides compensation benefits

to Federal employees for work-

related injuries or illnesses and

to their surviving dependents if a

work-related injury or illness

results in the employee’s death.

Y

U

--

Federal Income Tax

Refunds

N

--

--

Food Assistance

Includes food subsidies, Free and

Reduced Lunch Program,

National School Lunch Act,

Nutrition Program for the

Elderly, Food Stamps and Surplus

Commodities.

N

--

--

Foster Care Payments

Including foster care

payments for

individuals age 18 and

up.

Financial compensation from the

placement agency for a foster

child's room, board, and other

living expenses.

Note: Payments are countable if

child is a member of the FNS

Unit. If child is not included,

exclude payments.

Y

U

315.17

Foster-grandparents

Program Volunteer

Services (Title II)

Provides grants to qualified

agencies and organizations for

the dual purpose of engaging

persons 60 or older, with limited

incomes, in volunteer service to

meet critical community needs

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

9

Section 300

Change #01-2022

January 11, 2022

and to provide a high quality

volunteer experience that will

enrich the lives of the volunteers.

-G-

Gaming Proceeds, per

Capita proceeds to

Members of the

Eastern Band of

Cherokee Nation semi-

annually (prorate over

the six-month period

between payments)

Bi-annual payment received from

the operation of casino on tribal

land.

Y

U

315.18

General Assistance (GA)

Payments

Short-term payments to clients

through DSS. Count if ongoing or

recurring. Do not count one-time

lump sum payments.

Y

U

--

GI Bill Income

The GI Bill provides educational

assistance to servicemembers,

veterans, and their dependents.

N

--

315.19

Gifts (Monetary)

Money given voluntarily by one

person to another without

compensation.

Y

U

315.07

Guardianship Payments

Note: Payments are

countable if child is a

member of the FNS

unit. If child is not

included, exclude

payments

Financial assistance to caregivers

who assume legal guardianship

of a child in out-of-home care.

Y

U

315.17

-H-

Held Wages

Wages held at the employee’s

request in the month the wages

would otherwise be paid.

Y

E

315.35

Home Produce for

household’s

consumption

Produce grown or raised for

personal consumption. If sold for

compensation, count as earned

income.

N

--

--

Housing Improvement

Grants

Grants program to promote

improvement of lower income

housing.

N

--

--

-I-

In-kind Income

In-kind donations which are not

in the form of direct cash

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

10

Section 300

Change #01-2022

January 11, 2022

payments to

applicant/recipients. This may

include food, clothing, furniture

contributions, in-kind military

benefits and vendor payments.

Does not include instances when

individuals use their business to

pay for such types of items. In-

kind donations do not include

direct cash payments to

applicant/recipient.

Independent Living

Initiatives of Title IV-E

of the Social Security

Act (payments or

services provided)

Currently known as the John

Chafee Foster care independent

act. Builds a network of service

so the child will have ongoing

connection with family,

community, employer’s

education, financial assistance,

skills training, and other

resources to facilitate the

transition to adulthood.

N

--

--

Indian Payments (All

Types)

Payments to Indian tribe

members as permitted by federal

law. Does not include per capita

gaming proceeds (unearned

income).

Y

U

300.03

Individual Development

Accounts (IDA)

Withdrawn Funds

Interest Accrued on IDA

as long as it is paid into

the IDA

IDAs are special bank accounts

designed to help an individual

save for education, purchase a

home or start a business.

Includes Plan for Achieving Self-

Support (PASS) Account Deposit,

an SSI provision to help

individuals with disabilities

return to work.

N

--

--

Infrequent/irregular

Income that doesn’t

exceed $30 in a quarter

N

--

315.07

Inheritance

Note: Lump sums are

not countable as

income but as resource.

An inheritance payment is cash

received as the result of

someone's death.

Count inheritance paid in

installments, not in a lump sum.

Y

U

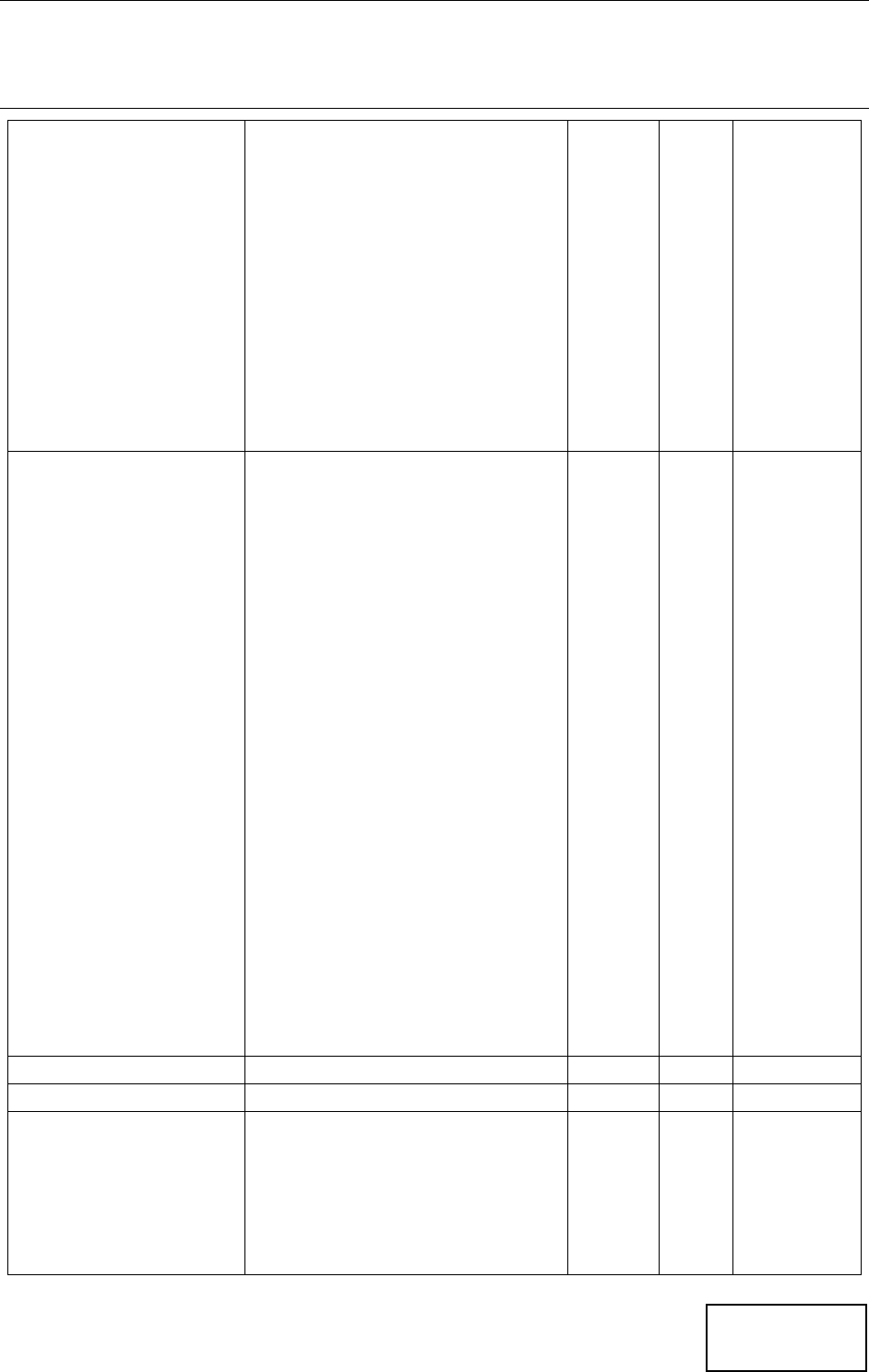

315.20

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

11

Section 300

Change #01-2022

January 11, 2022

Installment Payments

received for the sale of

a resource

Y

U

315.21

Insurance Settlements

Installment payments received

from a settlement with an

insurance company

Y

E

315.22

Interest and Dividend

Income

Interest paid from stocks, bonds,

bank accounts and other

Investments including dividend

payments from a life insurance

company’s annual surplus

earnings.

Y

U

--

-J-

Job Corp

This is income received while

participating in an education and

vocational training program

administered by the U.S.

Department of Labor.

N

--

--

Jump Pay (Military)

Y

E

315.24

Jury Duty Payments

This is income received while

participating in jury duty or

witness pay. Does not include

witness in professional capacity,

which would count as earned

income.

N

--

--

-L-

Legally Obligated

Money payable to any

FNS unit member but

diverted to pay an

expense.

Money that is otherwise payable

to a member of the FNS unit but

is diverted by the provider of the

payment to a third party for a

household expense, shall be

counted as income and not

excluded.

Y

U

315.23

Loans

A loan is not considered income.

This applies to legally binding

loan agreements as well as

verbal agreements between

private parties.

N

--

--

Long Term Care

Insurance Payments

Long Term Care (LTC) insurance

is considered a third-party

payment and can help pay for

skilled nursing care, domiciliary

level of care and/or home care.

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

12

Section 300

Change #01-2022

January 11, 2022

A Long-Term Care policy is a

contractual agreement that the

owner can activate at their own

discretion, therefore it is not

considered a benefit that the A/B

must activate.

Longevity Pay

Annual compensation to an

employee based on seniority.

Count if reasonably expected or

will reoccur during the

certification period.

Y

E

315.35

Lottery / Gambling /

Bingo Winnings (if paid

annually, average over

twelve months.) Count

only if received on a

regular basis. One-time

only count as resources

Gambling, lottery and prizes won

in a game of chance lottery or

contest.

Y

U

--

Low Income Energy

Assistance Program

(LIEAP) Payments

Programs to assist households

with heating, cooling, water, and

waste water expenses.

N

--

--

Lump Sum Payments

(non-recurring)

(including, but not

limited to income tax

refunds, rebates, or

credits, retroactive on-

time lump sum

payment of social

security, SSI, Railroad

retirement benefits,

and unemployment

insurance; retroactive

lump-sum WFFA/TANF

payments; annual VA

disability pension

adjustments; lump-sum

insurance settlements;

and refunds of security

deposits on rental

property or utilities)

This is income that is received in

a one-time payment and is

nonrecurring unless exceptions

noted in specific income type.

Count as resource, not income.

Severance pay is not considered

a lump sum payment.

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

13

Section 300

Change #01-2022

January 11, 2022

Count as a resource and

use actual amount

received

-M-

Migrant Income

If the FNS unit receives one

payment for work performed by

all FNS unit members, do not

count earnings of children age 17

or younger who are not the head

of household and attending

elementary or secondary school

after academic breaks. Prorate

equally among the persons who

worked. Do not count the

children’s prorated share

Y

E

315.35

Military Allotments

Benefits received by dependents

of military personnel.

Y

U

315.24

Military Clothing

Maintenance Allowance

(CMA)

N

--

315.24

Military Pay –

Including:

• Base Pay

• Basic Pay

• Basic Allowance for Housing

(BAH)

• Basic Allowance for Quarters

(BAQ)

• Basic Allowance for

Subsistence (BAS)

• Bonuses

• Combat Pay

• Career Sea Pay

• Enlistment Bonus

• Family Subsistence

Supplemental Allowance

(FSSA)

• Incentive Pay

• Family Allowances

• Flight Pay

• Jump Pay

• Leave

• Living Allowances

Y

E

315.24

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

14

Section 300

Change #01-2022

January 11, 2022

• Reenlistment Bonus

• Separate Rations

• Sea Duty

• Special Pay

• Variable Housing Allowance

(VHA)

Military Mandatory

Salary Reduction to

Fund GI bill

This is a military income

reduction to fund veteran's

Education Act of 1984.

N

--

315.24

Monthly Disbursements

from a Trust Fund

(unless set up as an SSI

lump sum)

Count as unearned income

periodic disbursements or

dividends received by the FNS

unit member from the trust fund

when these amounts can be

anticipated with reasonable

certainty.

Y

U

315.32

-N-

Native American

Gaming Proceeds

Includes Cherokee tribal per

capita income paid to adult

family members.

Y

U

315.18

North America Free

Trade Agreement

(NAFTA) Payments.

Note: Exclude money

received as a

reimbursement.

NAFTA-TRA Program assists

workers who lose their jobs or

whose hours of work and wages

are reduced as a result of trade

with, or a shift in production to,

Canada or Mexico.

Y

U

--

National Flood

Insurance Program

(NFIP) Payments

The National Flood Insurance

Program (NFIP), managed by the

Federal Emergency

Management Agency (FEMA),

enables homeowners, business

owners and renters in

participating

communities to purchase

federally backed flood insurance.

N

--

--

National School Lunch

Program

The National School Lunch

Program (NSLP) is a federally

assisted meal program operating

in public and nonprofit private

schools and residential child care

institutions. It provides

nutritionally balanced, low-cost

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

15

Section 300

Change #01-2022

January 11, 2022

or free lunches to children each

school day.

Nutrition Program for

the Elderly Funds, of

the Older Americans

Act of 1965

These services include both

home-delivered meals and

healthy meals served in group

settings, such as senior centers

and faith-based locations.

N

--

--

-O-

On-the-job Training

(OJT) Payments

On-the-job Training is funded

through the federal Workforce

Investment Act (WIA). OJT

provides an opportunity for

employers to receive financial

assistance for training new

employees in the skills needed to

perform effectively.

Y

E

315.38

Overpayments to the

same source

Exclude any money used to repay

an overpayment to the same

source.

Example: SSA over payment

being recouped out of the SSA.

Note: SSI and SSA are both

administered by the SSA but are

two separate sources of income.

N

--

--

-P-

Pass through Payments

This is a payment that a

household receives from and

uses on behalf of a third-party

(e.g. portion of utility bills).

Count as roomer income if

household receives payments for

property it owns.

Y/N

U

315.25

Pay Advances

Count when received. Do not

count again when it is deducted

from the next pay.

Y

E

315.35

Payments made to FNS

unit members because

of their status as

victims of Nazi

persecution.

N

--

--

Pell Grants

The Pell Grant is a form of need-

based federal financial aid that

typically does not have to be

N

--

315.15

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

16

Section 300

Change #01-2022

January 11, 2022

repaid. It is awarded by the U.S.

Department of Education to help

eligible low-income students pay

for college costs, including

tuition, fees, room and board,

and other educational expenses.

Pensions

Y

U

--

Plan for Achieving Self-

Support (PASS) Account

Deposit

N

--

--

Private Disability

Benefits

Y

E

--

Private Unemployment

Benefits

Y

U

--

Produce Grown for the

family’s own use

N

--

--

Project Share (Progress

Energy) Payments

N

--

--

Public Service

Employment (PSE)

Y

E

--

-R-

Radiation Exposure

Compensation Act

(October 15, 1990)

Payments

N

--

--

Railroad Retirement

(Administered by the

U.S. Railroad

Retirement Board, Mart

OFC Building, 800 Briar

Creek Rd., Rm AA-405,

Charlotte, NC 28205-

6903, Phone: 704-344-

6118

Y

U

--

Refugee Income from

Reception and

Placement (R&P) and

Cuban/Haitian Entrant

Programs

The R&P Program promotes the

successful reception and

placement of all persons who are

admitted to the US under the

U.S. Refugee Admissions

Program/Section 207 and is

usually provided by local

resettlement agencies.

Y

U

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

17

Section 300

Change #01-2022

January 11, 2022

These services include help with

housing, essential furnishings,

food, clothing, and other basic

necessities. Special Immigrant

Visa Holders (SIVs) may also be

eligible for R&P.

Refugee Match Grants

A federal program designed to

help Office of Refugee

Resettlement (ORR) eligible

populations (refugees, asylees,

Cuban/Haitian entrants, certain

Amerasians from Vietnam,

Victims of Severe Forms of

Trafficking, and Special

Immigrant Visa Holders (SIVs)) to

become economically self-

sufficient within 120 to 180 days

of program eligibility, without

accessing public cash assistance.

Participating local resettlement

agencies match the ORR grant

with cash and in-kind

contributions.

Y

U

--

Reimbursements

Includes income to compensate

for expenses that do not

represent a gain or benefit, such

as loans and promissory notes

when there is an agreed upon

timetable for reimbursement.

Y/N

E

315.26

Rental Assistance paid

to landlord

This is income paid by a third

party to assist with shelter

expenses. Includes government

subsidized housing paid to

landlord. Only count rental

assistance if paid directly to

household.

N

--

--

Rental Income

FNS unit member

manages property 20

hours or more a week.

(Self-employment)

Income from property owned

directly by the individual, such as

heir property. If the claimant has

an ownership interest in

property that produces income,

Y

E/U

315.28

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

18

Section 300

Change #01-2022

January 11, 2022

FNS unit member

manages property

under 20 hours a week

considered unearned

income but deductions

for cost of doing

business allowed.

the claimant also has a legal

interest in the income.

Repatriated Americans

Program

This is loans which provide

temporary assistance for eligible

repatriates referred by the U. S.

Department of State.

N

--

--

Representative

Payments

Monies received by a protective

payee and legally intended to be

used for the care and

maintenance of a beneficiary

who is not a household member

of the protective payee. If funds

are NOT used for care and

maintenance of beneficiary,

count as unearned income.

Y

U

315.27

Restitution Under the

Civil Liberties Act of

1988

N

--

--

Retired Senior

Volunteer Program

(RSVP) Title II

N

--

--

Retirement Benefits

Payments paid to someone from

a qualified retirement plan. May

be set up by employers,

insurance companies, the

government or other institutions

such as employer associations or

trade unions.

Y

U

--

Reverse Mortgages

A loan allowing certain

homeowners to access the

equity of their home.

N

--

--

Royalties

Royalties include compensation

paid to the owner of property for

the use of the property.

Y

U

--

-S-

Salary

Y

E

315.35

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

19

Section 300

Change #01-2022

January 11, 2022

Scholarships received

from Civic Groups,

Educational

Institutions, and

Athletic Scholarships

Y

U

315.15

Section 8 Utility

Assistance

N

--

--

Self-Employment

Income from being employed in

one's own trade, profession, or

business; not by an employer.

Including but not limited to:

• Uber/Lyft

• Door dash /Grub hub

• Tupperware

• Babysitting

• Blood/Plasma Sales

• Capital Gains

• Commercial Fishing

• Consignment Sales from a

business

• Cosmetology

• Crabbing

• Home Assembly of Products

• Notary Public Fees Earned

• Roomers

• Seasonal Employment

• Selling Recyclables

• Yard Work

Y

E

315.28

Senior companions

Payment Program (Title

II of the Older

Americans Act)

Organizations include, but not

limited to:

• Green Thumb,

• National Council on Aging,

• National Council of Senior

Citizens,

• American Association of

Retired Persons,

• U.S. Forest Service,

• National Association for

Spanish Speaking Elderly,

• National Urban League,

• National Council on Black

Aging.

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

20

Section 300

Change #01-2022

January 11, 2022

Service Corps of Retired

Executives (SCORES)

Payments

N

--

315.15

Severance Pay

A severance package is pay and

benefits an employee receives

when he or she leaves

employment at a company.

Y

U

Shared Expenses (See

pass-through payments

for exceptions)

N

--

315.25

Sick Pay

Y

E

315.35

Social Security Benefits

(SSA, OASDI, and RSDI)

Note: Count the gross

amount of the social

security benefit if the

benefits are reduced

due to federal offset to

repay a federal debt.

Offset information will

not appear on the

BENDEX record but may

appear on the award

letter to the client. (Use

BENDEX record for

verification.)

Income received monthly by

retired workers and their

surviving spouses / dependents

who have paid into the Social

Security system during their

working years or to those who

are permanently and totally

disabled according to the strict

criteria set forth by the Social

Security Administration.

Y

U

--

Special Assistance (SA)

Demonstration Project

Income allows

individuals living at

home to receive SA

payments

State-County Special Assistance

for Adults (SA) provides a cash

supplement to help low-income

individuals residing in adult care

homes (such as assisted living)

The SA In-Home Program

provides assistance to adults

who need the level of care in an

adult care home but live in a

private living situation. This also

include SA for the Certain

Disabled

Y

U

315.29

Special Government

Compensation

Includes but not limited to

payments from:

• Alaska Native Claims

Settlement Act

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

21

Section 300

Change #01-2022

January 11, 2022

• Payments to Victims of Nazi

Persecution

• Radiation Exposure

Compensation Act

• Restitution under the Civil

Liberties Act of 1988

• Relocation/Acquisition Act

Payments

• Wartime Relocation of

Civilian's Law Payments

• Agent Orange

• Allowances paid under the

law to Vietnam veterans’

child(ren) born with spina

bifida and other birth

defects, Eugenics

Asexualization and

Sterilization Compensation

(EASCP).

State Income Tax

Refunds

This is income is due to allowable

tax credits which can include EIC

and Dependent Care Tax Credits.

N

--

--

Stipends.

Y

U

--

Stipends for

educational assistance

N

--

--

Striker’s Benefits

(including picket pay)

Does not include strike duty pay,

which is earned income. Strike

benefits paid by a union to its

members are not wages whether

or not such members actually do

picket duty during the strike or

are subject to call to do so. These

benefits are paid as a result of

the affiliation of the member

with the union and are not

compensation for services.

Y

E

315.30

Student Earned Income

(Students age 17 and

younger who are

attending elementary

or secondary school

and are not the head of

household)

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

22

Section 300

Change #01-2022

January 11, 2022

Summer Youth

Employment Program

(WIA)

N

--

315.38

Supplemental Security

Income (SSI)

The Supplemental Security

Income (SSI) program pays

benefits to disabled adults and

children who have limited

income and resources and to

people 65 and older without

disabilities who meet the

financial limits. Administered by

SSA.

Y

U

315.31

SSI retroactive lump-

sum installments

payable in not more

than three installments

at six-month intervals

N

--

--

Surplus Commodities

N

--

--

-T-

Temporary Assistance

for Needy Families

(TANF) (WFFA)

Y

U

315.36

TANF-EA (WFFA-EA)

N

--

--

Tax Intercept Payments

(Support)

N

--

--

Telamon Payments

Y

U

--

Tips

Y

E

315.35

Title IV, Educational Aid

Including but not

limited to:

• Basic Educational Opportunity

Grants

• Federal Pell Grants

• Presidential Access Scholarships

• Federal Supplemental

Educational Opportunity Grants

• State Student Incentives Grants

• Federal Direct Student Loan

Programs

• Federal Perkins Loan Program

• Federal Work Study Program

• TRIO Grants

• Upward Bound

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

23

Section 300

Change #01-2022

January 11, 2022

• Student Support Services

• Robert E. McNair Post-

Baccalaureate Achievement

• Robert C. Byrd Honors

Scholarship

• College Assistance Migrant

Program

• High School Equivalency

Program

National Early Intervention

Scholarship and Partnership

Program

Title V of the Older

Americans Act Funds

Includes, but not

limited to, Senior

Community Service

Employment Program

(SCSEP),

A community service and work-

based training program for older

workers that provides subsidized,

service-based training for low-

income persons 55 or older who

are unemployed and have poor

employment prospects.

Some organizations receiving

these funds are but not limited

to:

• Green Thumb

• National Council on Aging

• National Council of Senior

Citizens

• American Association of Retired

Persons

• U.S. Forest Service

• National Association for

Spanish Speaking Elderly

• National Urban League

• National Council on Black Aging

N

--

--

Title VII Funds

N

--

--

Title XX Funds

N

--

--

Tobacco Allotment

Settlement Buy-out

Compensation received as cash

payments as a result of the

elimination of the tobacco quota

or allotment system. Include as

earned income if paid in annual

payments.

Y

E

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

24

Section 300

Change #01-2022

January 11, 2022

Trade Readjustment

Benefits

Trade Readjustment Allowances

are income support payments to

individuals who have exhausted

Unemployment Compensation

and whose jobs were affected by

foreign imports as determined by

a certification of group coverage

issued by the Department of

Labor.

Y

U

--

Training Allowances

from Vocational and

Rehabilitative Programs

recognized by federal,

State, and local

governments (except

WIOA)

Y

E

--

Trust Funds and

Dividends from Trust

Funds

Dividends paid from a trust fund.

Y

U

315.32

-U-

Unemployment

Insurance Benefits (UIB)

Note: If taxes or child

support are deducted,

count gross amount.

Public or private income received

by an individual as compensation

for loss of employment due to

layoff, suspension, or firing. It

may include additional amounts

paid by unions or employers.

Y

U

--

Unemployment

Insurance Benefits

received in a Disaster

N

--

--

Uniform Relocation

Assistance and Real

Property Acquisition

Act of 1970

Reimbursements

N

--

--

Utility Assistance

Payments (HUD or

Section 8)

N

--

--

-V-

Vacation Pay

Y

E/U

315.35

Vendor Payments

N

--

315.33

VA Educational Benefits

and GI Bill

Income received by veterans for

educational expenses. For FNS

this does not include the

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

25

Section 300

Change #01-2022

January 11, 2022

monthly housing allowance

(MHA) under the Post 9/11 GI

Bill.

Veterans

Administration Benefits

(VA) Including:

• Pension and

Compensation

• Aid and Attendance

• Aid to the

Homebound

• Caregiver’s Stipend

Program

• Reduced Improved

Pension

• Unreimbursed

Medical Expenses

Pension-supplemental income

through veterans’ pension and

survivor benefit programs.

Compensation-Compensation for

veterans at least 10% disabled

because of injuries or disease

that occurred or were

aggravated during active military

service.

Aid and Attendance - Additional

monthly pension benefit

administered by the Department

of Veterans Affairs that may be

available to wartime Veterans

and surviving spouses who have

in-home care or who live in

nursing homes or assisted-living

facilities.

Aid to the Homebound - An

additional monthly pension

benefit administered by the VA

when a person is substantially

confined to their immediate

premises because of permanent

disability.

Caregiver’s Stipend Program –

Stipend provided to caregivers of

a veteran injured after

September 11, 2001.

Reduced Improved Pension - The

Improved Disability Pension

provides a monthly benefit to

certain low-income veterans.

Unreimbursed Medical Expenses

- Reimbursement from VA for

medical bills that the veteran has

paid.

Y

U

--

Vocational

Rehabilitation

Y

U

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

26

Section 300

Change #01-2022

January 11, 2022

Volunteers in Service to

America (VISTA)

Y

E

315.34

-W-

Wages

Note: If wages are

garnished for any

reason other than to

repay a prior

overpayment to the

current employer,

count the gross

amount.

Wages, salaries, and tips

received for performing services

as an employee of an employer.

Y

E

315.35

Wartime Relocation of

Civilian’s Law Payments

N

--

--

Witness Pay

N

--

--

Work First Family

Assistance (TANF)

Cash payment program for

families with children who are

low income. Known as TANF on

the national level.

Y

U

315.36

Work First Family

Assistance Emergency

Assistance (WFFA-EA)

This is short term assistance used

to alleviate a crisis.

N

--

--

Work First Employment

Services Payments

Income received by participants

in the program are

reimbursements for employment

expenses.

N

--

--

Works for Rent / Room

(provided free shelter

by landlord)

N

--

--

Work Release

Payments to dependents from a

prisoner who is employed.

Y

U

--

Work Study

N

--

315.09

Worker’s Compensation

Benefits resulting from loss of

employment due to injury on the

job.

Y

U

--

Workforce Investment

Act

Y/N

E

315.38

-Y-

Youthbuild allowances,

earnings and payments

under Youthbuild of the

Housing and

Community

This is income and payments

received under the Youthbuild of

the Housing and Community

Development Act of 1992.

N

--

--

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

27

Section 300

Change #01-2022

January 11, 2022

Development Act of

1992

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

28

Section 300

Change #01-2022

January 11, 2022

300.03 PAYMENTS TO CERTAIN INDIAN TRIBES

The following Indian Payments are excluded as Income. Therefore, do not count Indian

payments to tribes and from sources listed below as income.

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

29

Section 300

Change #01-2022

January 11, 2022

Source of Payment

-A-

Alaska Native Claims Settlement Act

Apache Tribe of the Mescalero Reservation Payments

Aroostook Band of Micmac Settlement Payments

Assiniboine and Sioux Tribes Payments

Assiniboine Tribe of Montana Payments

Assiniboine Tribe of the Fort Belknap Indian Community, Montana, Per Capita and Interest

Payments

Assiniboine Tribe of the Fort Peck Indian Reservation, Montana Per Capita and Interest

Payments

-B-

Bad River Band of the Lake Superior Tribe of Chippewa Indians of Wisconsin Payments

Blackfeet Tribe Payments

Blackfeet Tribe of Montana Payments

-C-

Cherokee Nation of Oklahoma Payments

Cheyenne River Sioux Tribe Payments

Chippewas of Lake Superior Per Capita Payments

Chippewas of the Mississippi Per Capita Payments

Confederated Tribes and Bands of the Yakima Indian Nation Indian Claims Commission

Payments

Crow Creek Sioux Tribe Payments

-D-

Devils Lake Sioux Tribe Payments

-F-

Fond du Lac Reservation Per Capita Payments

Fort Belknap Indian Community Payments

Fort Belknap Indian Community Montana, Payments

-G-

Grand Portage Reservation Per Capita Payments

Grand River Band of Ottawa Indians Payments

Grosvenor Tribe of Montana Payments

-H-

Hopi Tribal Relocation Assistance

Houlton Band of the Maliseet Indians Payments Under the Maine Settlement Act of 1980

-I-

Independent Seminole Indians of Florida (Per Capita Payments of $2,000 or Less)

Indian Child Welfare Programs Assistance

Indian Judgment Fund Act (Per Capita Payments of $2,000 or Less)

-K-

Keweenaw Bay Indian Community Payments

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

30

Section 300

Change #01-2022

January 11, 2022

Keweenaw Bay Indian Community (L’Anse, Lac Vieux Desert, and Ontonagon Bands) Per

Capita

-L-

Lac Courte Oreilles Band of Lake Superior Chippewa Indians Payments

Lac Courte Oreilles Reservation of Wisconsin Per Capita Payments

Lac du Flambeau Reservation Per Capita Payments

Lower Brule Sioux Tribe Payments

-M-

Maine Indian Claims Settlement Act of 1980 Payments

Miccosukee Tribe of Indians of Florida (Per Capita Payments of $2,000 or Less)

Mille Lac Reservation, Minnesota, Per Capita Payments

Minnesota Chippewa Tribe Payments

-N-

Navajo Tribe Payments and Relocation Assistance Payments

Nett Lake Reservation (including Deer Creek and Vermillion Lake) Per Capita Payments

-O-

Oglala Sioux Tribe Payments

Old Age Assistance Claims Settlement Act Payments to Heirs (Per Capita Shares of $2,000 or

Less)

-P-

Papago Tribe of Arizona Payments

Passamaquoddy Tribe Payments Under the Maine Indian Claims Settlement Act of 1980

Penobscot Nation Payments Under the Maine Indian Claims Settlement Act of 1980

Puyallup Tribe of Indians Settlement Act of 1989 Funds

-R-

Red Cliff Reservation Per Capita Payments

Red Lake Band of Chippewa Funds

Rosebud Sioux Tribe Payments

-S-

Sac and Fox Tribe of Oklahoma Per Capita Payments

Sac and Fox Tribe of the Mississippi in Iowa Per Capita Payments

Saginaw Chippewa Indian Tribe of Michigan Payments

Seminole Nation of Oklahoma Per Capita Payments (Per Capita Payments of $2,000 or Less)

Seminole Tribe of Florida (Per Capita Payments of $2,000 or Less)

Seneca nation Settlement Act of 1990 Funds

Shoshone Bannock Tribes Payments

St. Croix Reservation Per Capita Payments

-T-

Turtle Mountain Band of Chippewas, Arizona, Payments

-W-

White Earth Band of Chippewa Indians in Minnesota Payments

White Earth Reservation Per Capita Payments

FOOD AND NUTRITION SERVICES CERTIFICATION

INCOME AND RESOURCES

FNS 300 SOURCES OF INCOME

31

Section 300

Change #01-2022

January 11, 2022

White Earth Reservation Land Settlement Act of 1985 Payments