Iowa’s Tuition and Textbook Tax Credit

Tax Credits Program Evaluation Study

December 2022

By

John Good

Research and Policy Division

Iowa Department of Revenue

1

Preface

Iowa Code Section 2.48 requires certain state agencies, including the Department of

Revenue, to review a schedule of tax expenditures each year and file a report with the

legislature. Each review is required to assess the tax expenditure's equity, simplicity,

competitiveness, public purpose, adequacy, and extent of conformance with the original

purpose of the enacting legislation. A review may also include recommendations for better

aligning a tax expenditure with the original intent of the enacting legislation. The Tuition

and Textbook Tax Credit is scheduled for review in 2022. An evaluation study of the

Tuition and Textbook Tax Credit was completed in 2012 and 2017. This study updates

the information about claims and claimants provided in those earlier studies and provides

economic analysis.

As part of the evaluation, an advisory panel was convened to provide input and advice on

the study’s scope and analysis. We wish to thank the members of the panel:

Kassandra Cline Department of Education

Liesl Eathington Iowa State University

Brent Kreider Iowa State University

Thomas Mayes Department of Education

Shawn Snyder Iowa Association of School Boards

Trish Wilger Iowa Alliance for Choice in Education

This study and other evaluations of Iowa tax credits can be found on the evaluation study

web page on the Iowa Department of Revenue website.

2

Preface ............................................................................................................................ 1

I. Introduction ............................................................................................................... 4

II. Executive Summary .................................................................................................. 4

III. History of the Tuition and Textbook Tax Credit .......................................................... 7

A. Credit Enacted ................................................................................................... 7

B. Legal Challenges ............................................................................................... 7

C. End of Itemized Deduction and Expansion ........................................................ 8

D. Most Recent Changes ........................................................................................ 8

IV. Federal and Other State Programs Comparisons ...................................................... 9

V. Literature Review ...................................................................................................... 11

VI. Analysis of Iowa Tuition and Textbook Tax Credit Claims ....................................... 13

A. Historical Tuition and Textbook Tax Credit Claims (1999 – 2020)......................... 13

B. Tuition and Textbook Tax Credit Claimant Characteristics .................................... 14

C. Tuition and Textbook Tax Credit Claims by School District ................................... 16

D. Tuition and Textbook Tax Credit Impact Analysis ................................................. 17

E. Tuition and Textbook Tax Credit Potential Scenarios ............................................ 18

References .................................................................................................................... 22

Tables and Figures........................................................................................................ 23

Table 1. Expenses Eligible for the Tuition and Textbook Tax Credit.......................... 24

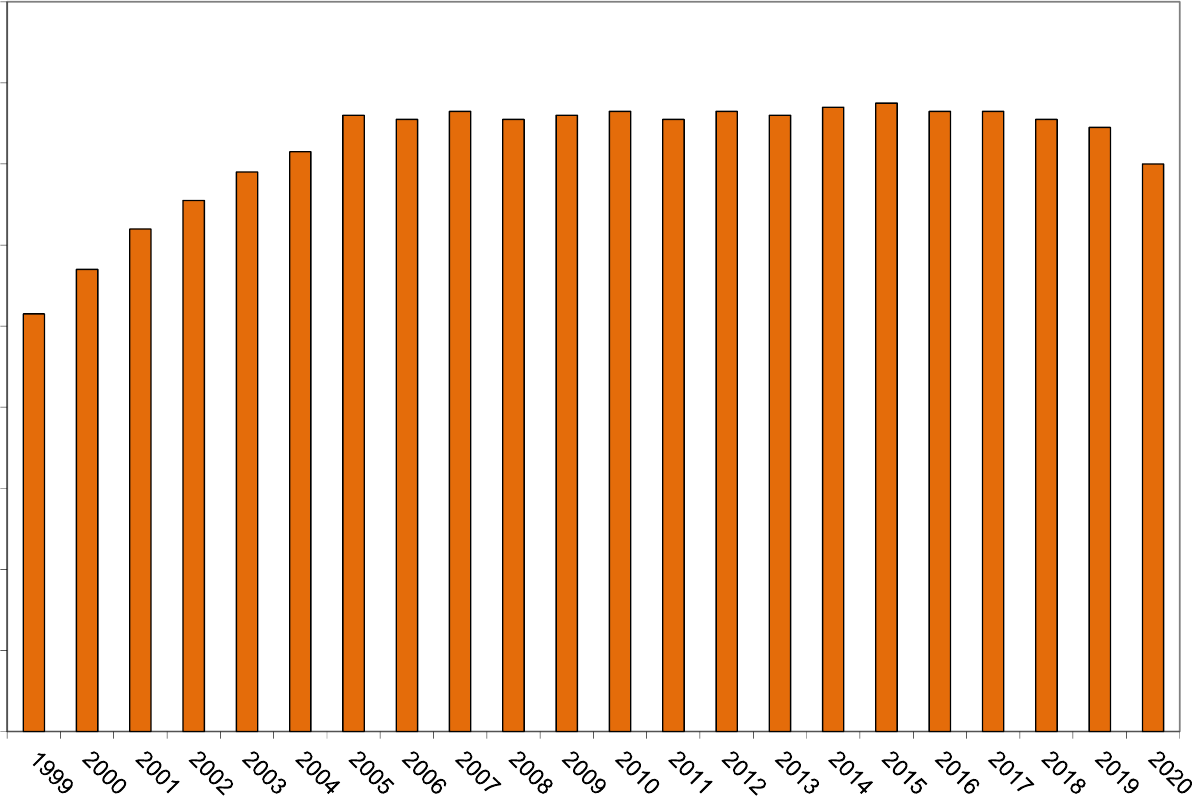

Figure 1. Number of Households Claiming the Tuition and Textbook Tax Credit, Tax

Years 1999 - 2020 ..................................................................................................... 25

Figure 2. Total Tuition and Textbook Tax Credit Claims, Tax Years 1999 – 2020 ..... 26

Figure 3. School Enrollment and Number of Tuition and Textbook Tax Credit Claims

................................................................................................................................... 27

Table 2. Age of Dependents Reported by Tuition and Textbook Tax Credit Claimants,

Tax Year 2020 ........................................................................................................... 28

3

Table 3. Tuition and Textbook Tax Credit Claims by Qualifying Dependents, Tax Year

2020 ........................................................................................................................... 29

Table 4. Share of Households Claiming the Maximum Tuition and Textbook Tax

Credit, Tax Years 2010 - 2020 ................................................................................... 29

Table 5. Tuition and Textbook Tax Credit Claims by Resident Status, Tax Year 2020

................................................................................................................................... 30

Table 6. Tuition and Textbook Tax Credit Claims by Filing Status, Tax Years 2010-

2020 ........................................................................................................................... 31

Table 7. Tuition and Textbook Tax Credit Claims by Adjusted Gross Income, Tax

Years 2010-2020 ....................................................................................................... 32

Figure 6. Average Tuition and Textbook Tax Credit Utilization Rates by School

District, Tax Years 2010-2020 ................................................................................... 33

Figure 7. Average Tuition and Textbook Tax Credit Claims by School District, Tax

Years 2010-2020 ....................................................................................................... 34

Table 8. Top Ten School Districts by Average Total Tuition and Textbook Tax Credit

Claims, Tax Years 2010-2020 ................................................................................... 35

Table 9. Top Ten School Districts by Average Tuition and Textbook Tax Credit Claim,

Tax Years 2010-2020 ................................................................................................ 36

Table 10. Top Ten School Districts by Average Tuition and Textbook Tax Credit

Utilization Rate, Tax Year 2010-2020 ........................................................................ 37

Table 11. Average Impact of the Tuition and Textbook Tax Credit to Claimants, Tax

Years 2013-2018 ....................................................................................................... 38

Table 12. Estimated Distribution of Tuition and Textbook Tax Credit Claimants

Experiencing Decreases and Increases in Total Tax Liability in Tax Year 2023 by

Potential Scenario...................................................................................................... 39

Table 13. Translation of Tax Year Estimated Impact to Fiscal Year Estimated Impacts

Under Potential Scenarios ......................................................................................... 40

4

I. Introduction

The Iowa Tuition and Textbook Tax Credit is available to individual taxpayers who have

one or more dependents receiving private instruction, as defined in Iowa Code section

422.12(1), or attending grades K-12 in an accredited Iowa school. Tuition and Textbook

Tax Credits do not require an award from a government agency. Taxpayers can claim the

credit, when eligible, on their individual income tax return. Tuition and Textbook Tax

Credits may not be sold, traded or otherwise transferred to a second party. For Tuition

and Textbook Tax Credits claimed by married taxpayers who file separately on a

combined return, the Tuition and Textbook Tax Credit must be claimed by the spouse

who claims the dependent on the return. Tuition and Textbook Tax Credits are

nonrefundable and unused credits may not be carried forward. This is the third evaluation

study completed on the Tuition and Textbook Tax Credit.

II. Executive Summary

A. Iowa and Other State Tuition and Textbook Benefit Programs

• For the period of this study, the Tuition and Textbook Tax Credit has been a

nonrefundable credit of 25 percent of the first $1,000 of eligible expenses for a

maximum $250 credit per eligible dependent. The definition of “textbooks and

tuition” includes non-public school tuition, books, materials, and equipment for

extracurricular activities.

• Iowa is not exclusive in providing tax incentives for educational expenses incurred

prior to higher education. Eight other states offer some form of either a tax credit

or deduction.

• A School Tuition Organization Tax Credit is available in Iowa, equal to 75.0 percent

of the amount of a voluntary cash or noncash contribution made by a taxpayer to

a School Tuition Organization (STO).

B. Historical Tuition and Textbook Tax Credit Claims (1999 – 2020)

• During the 2020-21 school year, a total of 516,848 students attended accredited

public and private elementary and secondary schools in Iowa.

• Public school enrollment decreased by an average of 0.5 percent per year from

1999 through 2010 before increasing by an average of 0.4 percent from 2010

through 2019 before decreasing 1.2 percent in 2020 associated with the pandemic.

• Since 2016, the count of claims has consistently decreased from nearly 118,000

to just over 104,500 in TY 2020. Likewise, the amount of credit awarded steadily

decreased from approximately $15.5 million in TY 2015 to $14.0 million in TY 2020.

5

C. Characteristics of Tuition and Textbook Tax Credit Claimants

• For tax year 2020, the most recent complete tax year, 118,348 households claimed

a total of $15.5 million in TTC. The average TTC claim in 2020 was $134 per

household.

• The largest number of households (39,181) claiming TTC reported two qualifying

dependents. These households accounted for the largest share of dependents for

which credits were claimed, at 41.9 percent, and the largest dollar share of credits

claimed, at 36.0 percent.

• In tax year 2020, 10,453 households, or 10.0 percent of all claimants claimed the

maximum credit of $250 for each qualifying dependent. Households receiving

maximum credits had 18,566 dependents, or 9.9 percent of all dependents. Since

2010, when the share of households claiming the max credit was 7.2 percent, the

share of households claiming the maximum credit per dependent has increased

nearly each year, to 10.0 percent in 2020.

• On average, in tax years 2010-2020, married households filing separately on a

combined return made up the largest share of the number of TTC claims (67.2

percent), followed by head of household (18.5 percent), married joint (11.9

percent) and single filers (1.5 percent).

D. Tuition and Textbook Tax Credit Claims by School District

• Across the state, 34.8 percent of taxpayers identified with qualifying dependents

claimed a Tuition and Textbook Tax Credit in tax years 2010-2020.

• Comparing utilization rates across the school districts in existence for the 2020-

2021 school year reveals significant variation. The utilization rate ranges from 8.4

percent in the Corning School District to 57.4 percent in the Pella School District.

Over one-half of households with qualifying dependents claimed the credit in 11

school districts while less than one-fifth made claims in 15 school districts.

• Average TTC claims from TY 2010-TY 2020 among school districts ranged from

$1,089 in the Hamburg School District to $884,874 in the Des Moines School

District. In tax years 2010-2020, the Des Moines, Cedar Rapids, and Davenport

school districts were the three largest school districts in the state based on the

number of eligible households. These three districts ranked as the top three

districts in terms of TTC claims and comprised three of the top districts in terms

of count of claims.

• Pella School District had the highest utilization rate in the state with 57.4 percent

of households with qualifying dependents making TTC claims. All of the top ten

school districts by utilization had utilization rates over 50 percent.

6

D. Tuition and Textbook Tax Credit Analysis

• The impact of the TTC to individual’s income tax liability varied depending upon

the adjusted gross income (AGI) group to which they belong. While results do

conclude that as an individual’s AGI increases, both their TTC claim amount

increases and their differential in total tax liability, their percent change in tax

liability does not.

• Five different policy scenarios are examined for changes in tax liability under

different permutations of the TTC.

o Under the first scenario (increase the credit rate from 25 percent of first

$2,000 of qualified expenses to 50 percent of first $2,000 of qualified

expenses). It is estimated that 88.8 percent of taxpayers will see no

change to their taxes. The estimated average tax liability decrease per

TTC claimant in TY 2023 is $206 but the average decrease is estimated to

rise with income from about $50 at the lowest income level up to $470 for

individuals with an AGI above $1.0 million.

o Under the second scenario (increase the credit rate from 25 percent of

first $2,000 of qualified expenses to 100 percent of first $2,000 of qualified

expenses). It is estimated that 88.9 percent of taxpayers will see no

change to their taxes. The estimated average tax liability decrease per

TTC claimant in TY 2023 is $551, but the average decrease is estimated

to rise with income from about $85 at the lowest income level up to $1,412

for individuals with an AGI above $1.0 million.

o Under the third scenario (increase the credit rate from 25 percent of first

$2,000 of qualified expenses to 25 percent of the first $4,000 of qualified

expenses). It is estimated that 98.8 percent of taxpayers will see no

change to their taxes. The estimated average tax liability decrease per

TTC claimant in TY 2023 is about $639, but the average decrease is

estimated to rise with income from about $133 at the lowest income level

up to $977 for individuals with an AGI above $1.0 million.

o Under the fourth scenario (revise the credit from a nonrefundable 25

percent of first $2,000 of qualified expenses to a refundable 25 percent of

the first $2,000 of qualified expenses). It is estimated that 91.0 percent of

TTC claimant will see no change to their taxes. $287, but the average

decrease is estimated to vary with income from about $265 at the lowest

income level up to $573 for individuals with an AGI between $500,000 to

$1.0 million.

o Under the fifth scenario (elimination of the TTC from the Iowa Tax Code).

It is estimated that 88.2 percent of taxpayers will see no change to their

7

taxes. The estimated average tax liability increase per TTC claimant in TY

2023 is about $223, but the average increase is estimated to increase with

income from about $94 at the lowest income level up to $470 for

individuals with an AGI above $1.0 million.

III. History of the Tuition and Textbook Tax Credit

A. Credit Enacted

Beginning in 1987, taxpayers who itemized deductions on their State income tax returns

could deduct up to $1,000 in eligible education expenses per dependent, while taxpayers

who took the standard deduction could claim a nonrefundable tax credit equal to five

percent of the first $1,000 in eligible expenses per dependent. Expenses must be incurred

for dependents attending kindergarten through 12th grade at an Iowa school, accredited

under Iowa Code section 256.11, not operated for profit, and adhering to the provisions

of the U.S. Civil Rights Act of 1964.1 Taxpayers with federal adjusted gross income of

$45,000 or more could not claim either the itemized deduction or the tax credit. Married

couples were required to combine their incomes in considering the $45,000 limitation,

even if filing separately. In the case of divorced parents, only the spouse claiming the

dependent credit could claim expenses for that dependent. Eligible education expenses

included tuition and fees; however, expenses for extracurricular activities were not

originally eligible for the deduction or the tax credit.

B. Legal Challenges

In 1992, Iowa’s Tuition and Textbook Tax Credit program faced a legal challenge over

whether the credit was constitutional. In the case of Luthens v. Bair, the plaintiffs argued

that the credit program favored religious schools over public schools and discriminated

against parents of children attending non-accredited schools. They further argued that

the credit program allowed for government entanglement with religion because the law

excludes expenses relating to “the teaching of religious tenets, doctrines or worship”; their

argument was that IDR would have to monitor and inspect school activities to ensure that

the law was not violated.

The District Court found that the credit did not favor one type of school over another as

the credit was available to all parents incurring education expenses regardless of whether

their children attended public, private sectarian, or private non-sectarian schools. Also,

the benefits of the credit were viewed as being distributed to the parents themselves and

not to the schools. In addition, the court ruled that the credit program did not violate the

rights of parents as the credit provision encouraged students to attend accredited schools

that meet state education requirements, which is a valid government interest. Finally, the

court ruled that provisions in the Iowa Administrative Rules provided for a proration of the

credit based on time spent in religious classes versus time spent in all classes, and no

8

monitoring by IDR was necessary. Therefore, Iowa’s TTC was upheld by the District

Court.

C. End of Itemized Deduction and Expansion

In 1996, the itemized deduction option was discontinued and the Tuition and Textbook

Tax Credit was made available to all taxpayers with eligible expenses. The tax credit

percentage was increased from five percent to ten percent of the first $1,000 of eligible

expenses per dependent and the $45,000 income restriction was eliminated.

Soon after the 1996 legislation became law, the Iowa Catholic Conference initiated a

campaign to expand the tax credit even further. The Catholic Conference’s proposal was

to increase the maximum credit from $100 per dependent (10 percent of the first $1,000

of eligible expenditures) to $500 per dependent in grades kindergarten through 8 and

$1,000 per dependent enrolled in high school. Their proposal would also have made the

credit refundable.

The proposal to change the TTC advanced through the 1997 Iowa Legislature. However,

concerns about the bill’s cost resulted in the bill being held over into the 1998 legislative

session.

In 1998, legislation was passed and signed into law which increased the tax credit

percentage from ten percent to 25 percent of the first $1,000 of eligible expenses. The

definition of “textbooks and tuition” was expanded to include books and materials for

extracurricular activities. However, the tax credit remained nonrefundable, meaning it can

only be used to offset current tax year liability, and there is no carry-forward provision.

D. Most Recent Changes

In 2021, the credit was increased to 25 percent of the first $2,000 of expenditures per

dependent, and was further modified to allow expenditures related to dependents

receiving private instruction. The 2021 modifications are not reflected in this study as the

reportable data is as yet unavailable.

Eligible expenses include costs for personnel, buildings, equipment, textbooks, and other

expenses for subjects legally and commonly taught in Iowa’s public elementary and

secondary schools as well as books and materials for extracurricular activities, such as

sporting events, music, drama or speech events, driver’s education, or programs of a

similar nature. Expenses relating to the teaching of religious doctrines, tenets, or worship,

are not eligible, nor are expenses related to home schooling, tutoring, or schooling outside

of an accredited school eligible for the credit.

9

IV. Federal and Other State Programs Comparisons

Iowa is not exclusive in providing tax incentives for educational expenses incurred prior

to higher education. Eight other states offer some form of either a tax credit or deduction.

Alabama offers a refundable tax credit to taxpayers who transfer their children enrolled in

or assigned to a failing public school to a non-failing public or private school. Alabama

defines a public school as failing if it meets one or more of the following requirements:

The school is labeled as persistently low-performing by the Alabama State Department

of Education; the school is designated as a failing school by the state Superintendent of

Education; the school does not exclusively serve a special population of students; or the

school has been listed three or more times during the most recent six years in the lowest

6 percent of public K–12 schools on the state standardized assessment in reading and

math. Taxpayers can claim a tax credit worth the lesser of either 80 percent of the average

annual state cost of attendance for a K–12 public school student during the applicable tax

year, or their children’s actual cost of attending school. If the taxpayer’s liability is less

than the total credit allowed, they may receive a rebate equal to the amount of the unused

credit. Taxpayers who transfer their children from failing public schools to non-failing

public or accredited private schools are eligible, as-well-as taxpayers with children who

are starting school for the first time and zoned to attend a failing public school.

Illinois allows individuals to claim a tax credit for educational expenses for dependent

students attending a public, private or home school. Taxpayers can claim a tax credit

worth 25 percent of their K–12 education expenditures after the first $250 spent, up to a

maximum credit of $750 per household. To qualify for the maximum credit of $750,

taxpayers must meet the expenditure limit of $3,250 on educational expenses.

Educational expenses must be for students who are residents of Illinois, who are younger

than 21 and attend K-12 in a public, private or home school in Illinois. Qualified expenses

include tuition, books and lab or activity fees. Beginning in 2018, Illinois imposed an

income limit for the tax credit. Married families with an AGI exceeding $500,000, as well

as non-married families with an AGI of $250,000, are no longer eligible for the credit.

Indiana’s Private School/Homeschool Deduction program is a tax deduction for

individuals who make educational expenditures for private schools or home schooling on

behalf of their dependent children. The tax deduction is worth up to $1,000 per child.

Households can utilize tax deductions for multiple children. Deductions are available for

taxpayers’ expenditures on either private schools or homeschooling for their dependent

children, including tuition, textbooks, fees, software, tutoring and supplies.

Louisiana Elementary and Secondary School Tuition Deduction is open to any taxpayer

who has private schooling expenses, including private school tuition and fees, uniforms,

textbooks, curricular materials, lab schools, and any supplies required by the school. The

10

deductions are worth 100 percent of the total amount spent on tuition, fees and other

eligible expenses at private schools. Taxpayers may deduct up to $5,000 per child.

Deductions are worth 100 percent of the total amount spent on tuition, fees and other

eligible expenses at private schools. All K–12 Louisiana private school students are

eligible. Any taxpayer that has private school educational expenses may claim the

deduction.

Minnesota has two tax incentive programs for education expenses. First, Minnesota

provides a tax deduction covering educational expenses for students in any public, private

or home school, including in North Dakota, South Dakota, Iowa or Wisconsin. Eligible

expenses reduce a family’s taxable income when taxes are filed. The tax deduction is

worth 100 percent of the amount spent on education, up to $1,625 per child in grades K–

6 and $2,500 per child in grades 7–12. The tax deduction lowers a family’s taxable income

and covers books, tutors, academic after-school programs and other educational

expenses, including tuition payments at private schools.

Minnesota’s second tax incentive program provides a tax credit covering educational

expenses including tutoring, educational after-school programs and books for students in

any public, private or home school, including in North Dakota, South Dakota, Iowa, or

Wisconsin. The tax credit is worth 75 percent of the amount spent on educational

expenses other than tuition. The maximum credit amount that a family may claim is equal

to $1,000 per child in the family. The tax credit reduces the family’s total tax liability and

covers books, tutors, academic after-school programs and other non-tuition educational

expenses.

The refundable tax credit is phased out for taxpayers who earn more than $33,500. For

families with one child, the maximum allowable credit is reduced by $1 for every $4 of

income above $33,500, and the family may not claim the credit at all if its income is above

$37,500. For families with two children, the maximum allowable credit is reduced by $2

for every $4 of income above $33,500, and, again, the family may not claim the credit if

its income is above $37,500. For families with more than two children, the phase-out is

still $2 for every $4 of income above $33,500, but the $37,500 income ceiling is raised by

$2,000 for each child after the first two. For example, a family with four children may not

claim the credit if its income is more than $41,500.

Ohio also has two tax incentive programs for education expenses. First, Ohio provides a

tax credit of up to $250 for qualifying home education expenses, including books,

supplementary materials, supplies, computer software, applications or subscriptions.

Ohio provides a nonrefundable tax credit of up to $250 for qualifying home education

expenses, including books, supplementary materials, supplies, computer software,

applications or subscriptions. All Ohio students who are excused from the state’s

11

compulsory attendance law for the purpose of home instruction are eligible to receive the

tax credit.

The second tax incentive that Ohio provides is a tax credit of up to $500 or $1,000,

depending on household income, for tuition paid for one or more dependents to attend a

non-chartered private school. Families are eligible if their total annual household income

is less than $100,000. Ohio provides a tax credit of up to $500 for families with a total

annual household income of less than $50,000 for tuition paid for one or more dependents

to attend a non-chartered private school. For families with a total annual household

income that is between $50,000 and $100,000, the tax credit is worth up to $1,000.

Families are eligible to receive the tax credit if at least one of their dependents is enrolled

in a non-chartered private school and their total annual household income is less than

$100,000.

The South Carolina Refundable Educational Credit for Exceptional Needs Children is a

refundable tax credit program, for what they paid out of pocket for private school tuition.

Parents or guardians receive a tax credit worth the lesser of $11,000 per student or their

children’s actual cost of attending school. However, if the student receives an Educational

Credit for Exceptional Needs Children Fund scholarship, then the credit claimed may

equal only the difference of $11,000 or the cost of tuition, whichever is lower, and the

amount of the tax credit-funded scholarship. The total cap on the program is $2 million.

Wisconsin provides an income tax deduction for individuals who pay private school tuition

for their dependent children. It has no income limit, and taxpaying families can apply for

an individual tax deduction after paying for K–12 private school tuition. The tax deduction

is worth up to $4,000 per child in grades K–8 and up to $10,000 per child in grades 9–12.

The deduction may not be applied for tuition paid for by a voucher or a college savings

account, nor may it be used for fees, transportation or room and board. Any Wisconsin

taxpayer enrolling their children in an approved private school is eligible. Approved private

schools must provide at least 875 hours of instruction per year in a sequentially

progressive curriculum including reading, language arts, math, social studies, science

and health.

V. Literature Review

The Iowa Tuition and Textbook Tax Credit is not confined to just tuition and textbook

expenses but also to resources that a student would require for extracurricular activities

such as sports, music, the arts, and debate. This evaluation study finds that approximately

90 percent of Iowa Tuition and Textbook Tax Credit claimants are utilizing this credit for

school supplies and possibly extracurricular activity equipment. Therefore, this literature

review is going to focus on the availability, benefits, and affordability of extracurricular

activities in the United States.

12

It is the policy of the Iowa Department of Education that no Iowa student enrolled in a

public school be excluded from participation in or denied the benefits of course offerings

and related activities due to the student’s or the student’s parent’s or guardian’s financial

inability to pay a fee associated with the class, program, or activity. There are no expressly

authorized fees related to extracurricular activities and therefore charging fees to

participate is prohibited in the State of Iowa.

There are numerous reports on the benefits of participation in extracurricular activities by

students. As public and non-public school systems in the US come under greater

pressure regarding their budgets and commitment to academic success, the necessity of

extracurricular activities in schools has been called into question (Israel, 2013; Vukic &

Zrilic, 2016). When a school district is faced with limited resources such as instructional

time, finances, and staff, school administrators must decide whether extracurricular

activities are a worthwhile investment (Israel, 2013; Vukic & Zrilic, 2016).

According to a study by Morse, Anderson, Christenson, and Lehr (2004), student

engagement is defined as the participation in school activities and the student’s

identification with school while accepting school values. They further define student’s

identification as obtaining a sense of belonging and safety security at school, maintaining

social commitments, and creating comfortable relationships with teachers to the extent

which the student values school success. School-related extracurricular activities such as

sports, music programs, and community service projects foster environments where

students are able to formulate strong identifications with school (Miller, 2016). As stated

before, a strong identification with school reduces school dropout rates and increases

school engagement characteristics for at risk adolescent students (Miller, 2016).

Some studies suggested the impacts that extracurricular activities have on at-risk

students are positive (Miller, 2016), and other studies suggested they were negative

(Miller, 2016). Research finds that parental involvement, socio-economic status, and

motivations are key factors in the success of children’s academic performances.

However, there are studies concluded extracurricular activities have the most influential

impact on attitudes towards school and academic achievement amongst at-risk students

(Miller, 2016). Research shows that household income is a significant predictor of whether

a child participates in an extracurricular activity. However, as mentioned earlier in this

literature review, Iowa cannot exclude students from participation in extracurricular

activities based upon financial needs.

Charging students to play makes it easier for the schools to offer the activity because they

are receiving an income. However, making students pay will decline the participation rate,

especially for the children who can’t afford it. Paying to play prevents a lot of students in

poverty from being able to participate (Hoff & Mitchell, 2006). There are many factors that

13

limit participation in extracurricular activities, but one key factor is the costs. Costs for

activities vary and are used for uniforms, equipment, coaches, referees, and locations to

play. It is especially difficult for low-income families to meet these needs. Activity fees that

exceed $300 causes the participation rate in school activities to drop by a third or more

(Burkhardt, 2016).

According to a survey by the University of Michigan C. S. Mott Children’s Hospital (2012),

61 percent of middle and high school students in the US were charged a pay-to-play fee.

According to survey results, the average fee was $93. It was found that 21 percent of

parents were charged a participation fee of $150 or more. According to a report by

Snellman, Silva, and Putnam (2015), these numbers do not include the cost of equipment,

uniforms, and additional fees like travel, which raise the average cost to $381. These

survey results are not reflective of Iowa’s statute against pay-to-play policies.

The fees identified in the Michigan survey disproportionately hinder children from families

who earn less than $60,000 per year, as 19 percent of these households reported that

their children’s participation dropped because of the cost (Snellman, Silva, and Putnam,

2015). On the other end of the spectrum, among households earning more than $60,000

per year, only 5 percent reported lower participation due to increased costs (Snellman,

Silva, and Putnam, 2015).

There are many negative effects for children living in poverty and joining extra activities

is one of them. Parents who work are more likely to allow their child to participate in

activities rather than a family who only has one or no parent working (Barnett, 2008).

Families living in poverty cannot afford the extra costs for extra activities, and as a result,

it can have negative effects on the child’s health. Extracurricular activities help to promote

physical, mental, emotional, and social wellness. Children that live in poverty miss out on

the health benefits because they cannot afford to participate. Extracurricular activities

have many great benefits and unfortunately research has shown that families living in

poverty are less likely to provide these opportunities to their children (Burkhardt, 2016).

VI. Analysis of Iowa Tuition and Textbook Tax Credit Claims

A. Historical Tuition and Textbook Tax Credit Claims (1999 – 2020)

Historical data show large increases in both the number of TTC claimed and the amount

of credits claimed from 1999 through 2007 (see Figures 1 and 2). An observable

plateauing with slight variation occurs from 2007 through 2015 in both the number of TTC

claimed and the amount of credits claimed. Since 2015, there has been an observable

decrease in number of TTC claims and amount of credits.

14

The number of TTC claims increased from 76,000 in 1999 to a high of 121,000 from 2009

through 2012 and the aggregate TTC claim amount increased from $10.3 million in 1999

to a high of $15.5 million in 2015. Since 2012, the number of claims has decreased each

year to 105,000 in 2020. The amount of credits has also decreased each year since 2015

to $14.0 million in 2020. During the 2020-21 school year, a total of 516,848 students

attended accredited public and non-public elementary and secondary schools in Iowa.

Public school enrollment decreased by an average of 0.5 percent per year from 1999

through 2010 before increasing by an average of 0.4 percent from 2010 through 2019

before decreasing 1.2 percent in 2020. This decrease in 2020-21 may be attributed to

parents choosing to pull their kids out of school due to the COVID Pandemic (see Figure

3). School enrollment trends reflect the school-age population dropping from 1999

through 2010 before increasing each year since. In contrast, non-public school enrollment

has declined from 42,800 students in 1998 to a low of 32,700 in 2020, or -23.6 percent.

Non-public school enrollment declined in 16 of 22 years from 1999 through 2020, for an

average annual decline of 1.2 percent.

The pattern of TTC claims does not follow either public or non-public school enrollment

patterns (see Figure 3). After moving to its most recent pre-2021 structure in 1998, a 25

percent nonrefundable tax credit with no income limit, taxpayer awareness drove the rise

in claims over the next nine years. After that point, the plateauing suggests widespread

knowledge and usage; later analysis will question that suggestion. However, in tax years

2014 and 2015, the counts of claims dipped below 120,000 while the value of claims

continued to rise (Figures 1 and 2). Since 2016 the count of claims has consistently

decreased from nearly 118,000 to just over 104,500 in TY 2020 (Figure 1). Likewise, the

amount of credit awarded steadily decreased from approximately $15.5 million in TY 2015

to $14.0 million in TY 2020 (Figure 2).

B. Tuition and Textbook Tax Credit Claimant Characteristics

For tax year 2020, the most recent complete tax year, 104,609 households claimed a total

of $14.0 million in TTC. Although taxpayers report the total number of dependents in the

household (209,722), taxpayers do not indicate on the return the number of dependents

with expenses for which Tuition and Textbook Tax Credits are being claimed. Dependents

claimed on the Iowa individual income tax return can be of all ages while the TTC is limited

to eligible expenses incurred for dependents in kindergarten through 12th grade. To

determine the number of dependents in grades K-12, Iowa income tax returns were

matched with federal tax return information containing the birth dates of up to four

dependents. Of the total number of dependents claimed on returns with a TTC claim,

187,110 dependents (89.2 percent) were identified as elementary and secondary school

age, 5 to 21, referred to as qualifying dependents (see Table 2).

1

No federal age data

could be matched to 3,575 dependents, in many cases because the household had more

than four dependents. It was assumed that any dependents in a household beyond four

and dependents with no age data matches were between ages 5 to 21. Under these

assumptions, 187,110 dependents are considered qualifying.

1

Disabled children can attend secondary school through age 21.

15

The largest number of households (39,181) claiming TTC reported two qualifying

dependents (see Table 3). These households accounted for the largest share of

dependents for which credits were claimed, at 41.9 percent, and the largest dollar share

of credits claimed, at 36.0 percent. Households with three dependents were the second

largest group with 26.0 percent of dependents and 23.2 percent of credits claimed.

Households with only one dependent accounted for 20.0 percent of the dependents for

which credits were claimed, and 21.6 percent of TTC claims. Not surprisingly, as the

number of qualifying dependents increases, the average claim per household increases.

Overall, the average household TTC claim was $134. The average claim per dependent

is highest for households with four or more dependents with an overall average claim per

dependent of $120.

Although the taxpayer is not required to report on the tax return the expenses for which

the credit was claimed or the school attended by each dependent, the size of the claim

may suggest claimants whose children attend non-public school. In tax year 2020, 10,453

households, or 10.0 percent of all claimants claimed the maximum credit of $250 for each

qualifying dependent (see Table 4). Because these taxpayers are claiming $1,000 in

eligible expenses for each dependent, it may be the case that they are paying tuition to a

non-public school.

2

The estimated 10.0 percent share is higher than the 6.4 percent share

of all Iowa students who attended non-public schools during the 2020-2021 school year

(Iowa Department of Education). Households receiving maximum credits had 18,566

dependents, or 9.9 percent of all dependents. Since 2010, when the share of households

claiming the max credit was 7.2 percent, the share of households claiming the maximum

credit per dependent has increased nearly each year, to 10.0 percent in 2020.

Given that only dependents attending an accredited Iowa school are qualifying, it is

expected that the tax credit is mainly claimed by Iowa residents. Based on the Iowa county

of residence reported on the tax return, 103,709 resident households claimed $13.8

million (98.8%) in credits (see Table 5). Nonresidents can claim the Tuition and Textbook

Tax Credit as long as their children are attending an accredited school in Iowa. There

were 896 nonresident households who claimed a total of $172,004 in TTC in tax year

2020. The nonresident claims with mailing addresses in neighboring states are broken

down as follows: Illinois (85), Minnesota (56), Missouri (39), Nebraska (162), South

Dakota (110), and Wisconsin (49). The other 395 nonresident returns had addresses from

states not contiguous to Iowa; these could reflect taxpayers who lived in Iowa at some

point during the year but had moved out of the state by December 31, 2020.

On average, in tax years 2010-2020, married households filing separately on a combined

return made up the largest share of the number of TTC claims (67.2 percent), followed by

head of household (18.5 percent), married joint (11.9 percent) and single filers (1.5

percent) (see Table 6). Married separate filers filing on separate returns and qualifying

widow(er)s made up less than one percent of all claimants (0.9 percent and 0.1 percent).

As expected, when considering the amount of TTC claimed, married taxpayers filing

2

The average non-public school tuition in Iowa is $5,359 per year in 2022.

16

separately on combined returns also had the largest share of dollar claims (70.5 percent)

(see Table 6). However, married joint filers had the second largest share of credit claims

(15.5 percent), followed by head of household filers (12.4 percent) and single filers (0.9

percent). Married separate filers filing on separate returns and qualifying widow(er)s

accounted for less than one percent of dollars claimed (0.6 percent and 0.1 percent).

Iowa taxpayers claiming the TTC are concentrated in middle- and upper-income levels,

with households reporting less than $20,000 in adjusted gross income (AGI) comprising

only 1.0 percent of TTC households and 0.7 percent of the dollars being claimed (see

Table 7). Low-income taxpayers are exempt from public school fees, reducing qualifying

expenses. These taxpayers also have less tax liability against which to claim the

nonrefundable tax credit. Claimants with AGI between $20,000 and $49,999 comprised

21.6 percent of the total number of claims and 15.6 percent of the total dollars claimed.

Households with AGI between $50,000 and $149,999 comprised 63.8 percent of the total

number of claims and 62.7 percent of the total amount claimed. The average TTC claim

rises from $76 to $230 as income rises. Because the average TTC claim rises as AGI

rises, the shares of dollars claimed exceed the shares of claimants at the higher income

levels (above $90,000). Households with income above $150,000 reported 13.7 percent

of the number of claims and 21.1 percent of the total amount of TTC claimed. As income

rises, taxpayers are able to spend more on their children’s education, including the choice

of non-public school.

C. Tuition and Textbook Tax Credit Claims by School District

Across the state, 34.8 percent of taxpayers identified with qualifying dependents claimed

a Tuition and Textbook Tax Credit in tax years 2010-2020 (see Table 6). The utilization

rate is defined as the ratio of resident households claiming the credit compared to all

resident households with dependents between ages 5 and 21. The households included

in the utilization rate are limited to resident taxpayers because dependents must attend

an Iowa accredited school in order for a taxpayer to claim the credit. In analyzing the

utilization rate by AGI, the highest rate occurred between $100,000 and $124,999 and

$125,000 and $149,999 (over 50.0% for these income ranges). The lowest rates were

found in the less than $20,000 group (2.4%) and the $20,000 to $29,999 income group

(17.1%). Recall that many households in these low-income groups may not face any

eligible expenses or may not have any Iowa tax liability against which to the claim the

nonrefundable TTC.

Comparing utilization rates across the school districts in existence for the 2020-2021

school year reveals significant variation. Iowa resident taxpayers must provide their

school district of residence on their individual income tax return. Although it is possible

that a taxpayer may reside in one school district and their children attend school in a

different district, for this analysis the taxpayer is considered in the school district of

residence. The utilization rate ranges from 8.4 percent in the Corning School District to

57.4 percent in the Pella School District (see Figure 6). Over one-half of households with

qualifying dependents claimed the credit in 11 school districts while less than one-fifth

17

made claims in 15 school districts. The highest utilization rates appear to coincide with

the location of non-public schools.

The top ten school districts with the highest total of TTC dollars claimed tended to be, not

surprisingly, the school districts with the most eligible households, defined as any resident

household with a dependent aged 5 to 21 (see Table 8). Average TTC claims from TY

2020-TY 2020 among school districts ranged from $1,089 in the Hamburg School District

to $884,874 in the Des Moines School District. In tax years 2010-2020, the Des Moines,

Cedar Rapids, and Davenport school districts were the three largest school districts in the

state based on the number of eligible households. These three districts ranked as the top

three districts in terms of TTC claims and comprised three of the top districts in terms of

count of claims. Five of the other seven districts with the highest amount of claims were

also in the top ten largest school districts based on eligible households. Despite these

districts claiming the highest amounts of credits, only four of the top ten had utilization

rates above the statewide average of 34.8 percent.

School districts were ranked by average TTC credit claim for households making claims.

The average credit claimed by school district from 2010 through 2020 ranged from $38 in

the Hamburg School District to $342 in the Rock Valley School District (see Table 9). The

ten school districts with the highest average household claim ranked from 27th in the

number of eligible households to 289th. Nearly all of these school districts had above

average utilization, with only the Sheldon school district below the statewide average. Six

of the school districts in the top ten based on the average household claim are located in

Sioux County in Northwest Iowa.

Pella School District had the highest utilization rate in the state with 57.4 percent of

households with qualifying dependents making TTC claims (see Table 10). All of the top

ten school districts by utilization had utilization rates over 50 percent. Western Dubuque

was the largest school district in the top ten with 1,453 eligible households and Remsen-

Union, which ranked 6th by utilization rate, was the smallest district with only 326

households with qualifying dependents.

D. Tuition and Textbook Tax Credit Impact Analysis

This section of the analysis will focus on the impact that the TTC has on an individual’s

tax liability. Analysis was performed as to the TTCs effect on taxpayer’s liability in terms

of how much a taxpayers’ liability is increased due to the elimination of the credit. The

average impact of the TTC to an individual’s income tax liability between tax year 2013

and 2018 was gathered utilizing the IDR individual income tax micro model.

Micro model

This analysis employs the IDR individual income tax micro model developed for previous

Legislative sessions. The model forecasts both federal and Iowa tax liability at household

level for all the Iowa individual income tax filers. Non-filers’ tax liability (essentially through

withholding payments) are also estimated as one category. To estimate tax liability in

18

individual years, individual tax return data for that particular tax year are used by the

model. The income components are then run through two tax calculators which reflect

current law during that particular tax year and removing the Tuition and Textbook Tax

Credit from the calculation of an individual’s nonrefundable tax credit calculation. Tax-

year impacts are converted into State fiscal-year changes using current or proposed

withholding tax formulas and historical patterns of estimates, final returns, and refunds.

Claimants of the TTC are aggregated into groupings based upon adjusted gross income

ranges and individual tax years between 2013 and 2018. The results will be presented in

chart form to show the percent by which the TTC affects an individual’s tax liability after

all the deductions, non-refundable credits, and refundable credits calculations are

completed.

The impact of the TTC to individual’s income tax liability varied depending upon the AGI

group to which they belong. While results do conclude that as an individual’s AGI

increases, both their TTC claim amount increases and their differential in total tax liability,

their percent change in liability does not. Though claimants with an AGI between $20,000

and $30,000 only experience a differential of $71 due to the TTC, their change in tax

liability due to the TTC is 24.0 percent (see table 11). TTC claimants with an AGI between

$30,000 and $40,000 had the second highest percent change in tax liability due to the

TTC at 10.3 percent, while the lowest percent change in tax liability was for claimants with

an AGI between $125,000 and $150,000 at 2.4 percent (see table 11).

E. Tuition and Textbook Tax Credit Potential Scenarios

The following analyses presents the fiscal impacts for potential scenarios that would

change the Tuition and Textbook Tax Credit. Scenarios include:

Scenario 1: raise the Tuition and Textbook Tax Credit from 25 percent of the first

$2,000 in qualified expenses for each student to 50 percent of the first

$2,000 in qualified expenses for each student.

Scenario 2: raise the Tuition and Textbook Tax Credit from 25 percent of the first

$2,000 in qualified expenses for each student to 100 percent of the

first $2,000 in qualified expenses for each student.

Scenario 3: increase to 25 percent of the first $4,000 in qualified expenses for each

student.

Scenario 4: the tax credit revised from nonrefundable to refundable.

Scenario 5: eliminate the tax credit from the Iowa Tax Code

These scenarios are assumed to be effective for tax years beginning on or after January

1, 2023.

When the State changes a tax credit from nonrefundable to refundable, some taxpayers

may experience a small tax increase as a result of increased school surtax. School surtax

is calculated on computed tax net of nonrefundable tax credits; thus, when a formerly

nonrefundable tax credit becomes refundable, the school surtax base (computed tax net

19

of nonrefundable tax credits) increases, resulting in a higher school surtax. For taxpayers

with comparatively low tax credit claims, this results in a net tax increase.

The revisions under the proposals described in these analyses would decrease Iowa

individual income tax liability and thereby decrease General Fund income tax revenues

and surtax revenues.

Micro model

These analyses employ the IDR individual income tax micro model. The model forecasts

both federal and Iowa tax liability at household level for all the Iowa individual income tax

filers. Non-filers’ tax liability (essentially through withholding payments) are also estimated

as one category.

To estimate tax liability in years after 2020, individual tax return data for tax year 2020

(the most recent complete tax year data) used by the model are adjusted for estimated

growth in income components and changes in the size and age distribution of the

population. The income growth forecasts are based on various income projections

produced by external economic models primarily from Moody’s Analytics. Economic

projections do not assume any specific unusual growth or recessionary periods.

Population projections are based on the REMI model for the State of Iowa.

The income components are then run through two tax calculators which reflect current

law and the proposal to calculate tax liability changes by tax year. Tax-year impacts are

converted into State fiscal-year changes using current or proposed withholding tax

formulas and historical patterns of estimates, final returns, and refunds. In the model,

temporary federal law changes under TCJA expire after TY 2025. All revisions to the Iowa

Tax Code during the 2022 legislative session are included in the micromodel, including

the phased in flat income tax rates.

Scenario 1

Under the first scenario (increase the credit rate from 25 percent of first $2,000 of qualified

expenses to 50 percent of first $2,000 of qualified expenses). It is estimated that 88.8

percent of taxpayers will see no change to their taxes. Approximately 11.2 percent of

taxpayers (over 192,000) will see a decrease in tax liability, including more than 30.0

percent of taxpayers with AGI over $100,000 and less than $500,000. The estimated

average tax liability decrease per TTC claimant in TY 2023 is $206, but the average

decrease is estimated to rise with income from about $50 at the lowest income level up

to $470 for individuals with an AGI above $1.0 million (see Table 12).

It is assumed that nearly all the higher tax credit claims would be realized when taxpayers

file final returns. State General Fund revenues are estimated to drop only $0.08 million in

FY 2023. This negative impact increases to $38.5 million in FY 2024, $38.3 million in FY

2025, $38.1 million in FY 2026, and then remains around $34.0 million from FY 2027

20

through FY 2028 (see Table 13). School surtax collections are estimated to decrease by

approximately $1.1 million each tax year (author’s calculations, not included in the tables).

Scenario 2

Under the second scenario (increase the credit rate from 25 percent of first $2,000 of

qualified expenses to 100 percent of first $2,000 of qualified expenses). It is estimated

that 88.9 percent of taxpayers will see no change to their taxes. Approximately 11.1

percent of taxpayers (over 191,000) will see a decrease in tax liability, including more

than 30.0 percent of taxpayers with AGI over $100,000 and less than $500,000. The

estimated average tax liability decrease per TTC claimant in TY 2023 is $551, but the

average decrease is estimated to rise with income from about $85 at the lowest income

level up to $1,412 for individuals with an AGI above $1.0 million (see Table 12).

It is assumed that nearly all the higher tax credit claims would be realized when taxpayers

file final returns. State General Fund revenues are estimated to drop only $1.19 million in

FY 2023. This negative impact increases to $101.21 million in FY 2024, $102.61 million

in FY 2025, $101.86 million in FY 2026, and then remains around $89.0 million from FY

2027 through FY 2028 (see Table 13). School surtax collections are estimated to

decrease by approximately $2.9 million each tax year (author’s calculations, not included

in the tables).

Scenario 3

Under the third scenario (increase the credit rate from 25 percent of first $2,000 of

qualified expenses to 25 percent of the first $4,000 of qualified expenses). It is estimated

that 98.8 percent of taxpayers will see no change to their taxes. Approximately 1.2

percent of taxpayers (over 20,000) will see a decrease in tax liability, including more than

5.0 percent of taxpayers with AGI over $175,000. The estimated average tax liability

decrease per TTC claimant in TY 2023 is about $639, but the average decrease is

estimated to rise with income from about $133 at the lowest income level up to $977 for

individuals with an AGI above $1.0 million (see Table 12).

It is assumed that nearly all the higher tax credit claims would be realized when taxpayers

file final returns. State General Fund revenues are estimated to drop only $0.03 million in

FY 2023. This negative impact increases to $12.5 million in FY 2024, $12.4 million in FY

2025, $12.3 million in FY 2026, and then remains around $11.0 million from FY 2027

through FY 2028 (see Table 13). School surtax collections are estimated to decrease by

approximately $0.3 million each tax year (author’s calculations, not included in the tables).

Scenario 4

Under the fourth scenario (revise the credit from a nonrefundable 25 percent of first

$2,000 of qualified expenses to a refundable 25 percent of the first $2,000 of qualified

expenses). It is estimated that 91.0 percent of taxpayers will see no change to their taxes.

Approximately 2.8 percent of taxpayers (over 48,000) will see a decrease in tax liability,

21

including more than 5.0 percent of taxpayers with AGI under $10,000. The estimated

average tax liability decrease per TTC claimant in TY 2023 is about $287, but the average

decrease is estimated to vary with income from about $265 at the lowest income level up

to $573 for individuals with an AGI between $500,000 to $1.0 million (see Table 12).

It is assumed that nearly all the higher tax credit claims would be realized when taxpayers

file final returns. State General Fund revenues are estimated to drop only $0.02 million in

FY 2023. This negative impact increases to $13.8 million in FY 2024, $14.3 million in FY

2025, $14.5 million in FY 2026, and then remains around $18.0 million from FY 2027

through FY 2028 (see Table 13). School surtax collections are estimated to decrease by

approximately $1.2 million each tax year (author’s calculations, not included in the tables).

Scenario 5

Under the fifth scenario (elimination of the TTC from the Iowa Tax Code). It is estimated

that 88.2 percent of taxpayers will see no change to their taxes. Approximately 11.8

percent of taxpayers (nearly 203,000) will see an increase in tax liability, including more

than 30.0 percent of taxpayers with AGI over $100,000 and less than $500,000. The

estimated average tax liability increase per TTC claimant in TY 2023 is about $223, but

the average increase is estimated to increase with income from about $94 at the lowest

income level up to $470 for individuals with an AGI above $1.0 million (see Table 12).

It is assumed that nearly all the higher tax credit claims would be realized when taxpayers

file final returns. State General Fund revenues are estimated to increase only $0.09

million in FY 2023. This impact increases to $43.66 million in FY 2024, $43.61 million in

FY 2025, $43.39 million in FY 2026, and then remains around $38.0 million from FY 2027

through FY 2028 (see Table 13). School surtax collections are estimated to increase by

approximately $1.25 million each tax year (author’s calculations, not included in the

tables).

22

References

Barnett, L. A. (2008). Predicting youth participation in extracurricular recreational

activities: Relationships with individual, parent, and family characteristics. Journal of Park

& Recreation Administration, 26(2), 28-60.

Burkhardt, Randi J. (2016). The Impact of Poverty on Participation in Extracurricular

Activities. Graduate Programs in Education Goucher College

C. S. Mott Children’s Hospital. 2012. “Pay-to-Play Keeping Lower-Income Kids out of the

Game,” C.S. Mott Children’s Hospital National Poll on Children’s Health 15, no. 3.

Hoff, D. L., & Mitchell, S. N. (2006). Pay-to-play: fair or foul? Phi Delta Kappan, 88(3),

230-234.

Hoff, D. L., & Mitchell, S. N. (2007). Should our students pay to play extracurricular

activities? Education Digest, 72(6), 27-34.

Israel, J. M. (2013). Student extracurricular participation, student achievement, and

school perception: An elementary school perspective. Doctoral Dissertation

Miller, Derek G., "The Impact of Formal Extracurricular Activities on Satisfaction and

Attitudes-toward-School among At-Risk Adolescents" (2016). MA IDS Thesis Projects.

39.

Morse, A. B., Anderson, A. R., Christenson, S. L., & Lehr, C. A. (2004). Promoting school

completion. National Association of School Psychologists.

Snellman, Kaisa; Silva, Jennifer M.; Putnam, Robert D. (2015). Inequity outside the

Classroom: Growing Class Differences in Participation in Extracurricular Activities. Voices

in Urban Education, n40 p7-14 2015

Vukic, V. V., & Zrilic, S. (2016). The Connection between Pupils’ School Success and

Their Inclusiveness in Extracurricular and Out-of-School Activities in Croatia. World

Journal of Education, 6(3).

23

Iowa’s Tuition and Textbook Tax Credit

Tables and Figures

24

Table 1. Expenses Eligible for the Tuition and Textbook Tax Credit

Sources: IDR individual income tax instructions and Iowa Administrative Rules Chapter 701.42.4.

Expenditure Category Eligible Expenditures Ineligible Expenditures

Tuition Tuition for any K-12 school that is accredited

Any amount for food, lodging, or clothing or

amounts paid relating to the teaching of

religious tenets, doctrines or worship;

amounts for private instruction or tutoring not

paid to a school

Textbooks and

Publications

Textbooks and other instructional materials

used in teaching subjects legally and

commonly taught in Iowa's public elementary

and secondary schools, including those

needed for extracurricular activities (including

fees for required textbooks and supplies);

computers, if required

Yearbooks or annuals; textbook fines

Clothing

Rental or purchase of “non-street” costumes

for a play or special clothing for a concert not

suitable for everyday wear; rental of prom

dresses and tuxedos

Clothes which can be used for street wear,

such as T-shirts for extracurricular events;

clothing for a play or concert that is suitable

for everyday wear; purchase of prom dresses

and tuxedos

Driver's Education Only if paid to the K-12 school Paid to other than a K-12 school

Dues, Fees and

Admissions

Annual school fees; fees or dues paid for

extracurricular activities ; booster club dues

(for dependent only); fees for athletics; activity

ticket or admission for K-12 school athletic,

academic, music, or dramatic events and

awards banquets or buffets; fees for a

physical education event such as roller

skating; advanced placement fees if paid to

high school; fees for homecoming, winter

formal, prom, or similar events

Sports-related socials; special education

programs like career conferences; special

testing like SAT, PSAT, ACT and Iowa talent

search tests; fees paid to K-12 schools for

college credit or special programs at colleges

and universities; advanced placement fees if

paid to a college or a university

Materials for

Extracurricular Activities

Materials for extracurricular activities, such as

sporting events, speech activities, musical or

dramatic events, awards banquets,

homecoming, prom, and other school-related

social events

Class rings

Music

Rental of musical instruments for school or

band; music / instrument lessons at a school;

sheet music used in a school; music books

and materials used in school bands or

orchestras for maintenance of instruments,

including reeds, strings, picks, grease, and

other consumables

Purchase of musical instruments (including

rent-to-own contracts); music lessons outside

of school; sheet music for private use

Religion --------

Amounts paid are not allowed if they relate to

teaching of religious tenets, doctrines, or

worship

Shoes

Football, soccer, and golf shoes; other shoes

with cleats or spikes not suitable for street

wear for teams associated with the school

Basketball shoes and other shoes suitable for

everyday wear

Supplies for Industrial

Arts, Home Economics

or Equivalent Classes

Cost of required basic materials for classes

such as shop class, mechanics class,

agricultural class, home economics class, or

equivalent classes

Optional expenditures or materials used for

personal projects of the dependents or for

family benefit

Travel

Fees for transportation to and from school if

paid to the school; fees for field trips if the trip

is during school hours

Travel expenses for overnight trips which

involve payment for meals and lodging

Uniforms Band and athletic uniforms --------

25

Figure 1. Number of Households Claiming the Tuition and Textbook Tax Credit, Tax Years 1999 - 2020

Source – IDR 1999 - 2020 individual income tax returns

75.9 75.9

78.0

99.4

102.7

106.3

113.8

118.6

120.0

119.4

121.4 121.4

120.7

121.1

120.3

117.3

118.3

117.8

116.7

113.9

111.9

104.6

0

20

40

60

80

100

120

140

Number of Households (thousands)

Tax Year

26

Figure 2. Total Tuition and Textbook Tax Credit Claims, Tax Years 1999 – 2020

Source – IDR 1999 - 2020 individual income tax returns

$10.3

$11.4

$12.4

$13.1

$13.8

$14.3

$15.2

$15.1

$15.3

$15.1

$15.2

$15.3

$15.1

$15.3

$15.2

$15.4

$15.5

$15.3 $15.3

$15.1

$14.9

$14.0

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

$ Millions

Tax Year

27

Figure 3. School Enrollment and Number of Tuition and Textbook Tax Credit Claims

Source – IDR 1999 - 2020 individual income tax returns

28

Table 2. Age of Dependents Reported by Tuition and Textbook Tax Credit Claimants,

Tax Year 2020

Source: 2020 IDR and Internal Revenue Service individual income tax returns

Notes: The IRS captures birth dates for the first four dependents. In households with five or

more dependents, the eligibility of the first four were verified against the IRS age data; all

additional dependents were assumed to be qualified.

Dependents missing age data are assumed to be from ages 5 through 21.

The Tuition and Textbook Tax Credit was not necessarily claimed for all dependents reported

by the taxpayer.

Age

Number of

Dependents

Distribution of

Dependents

5 8,337 3.98%

6 10,355 4.94%

7 11,066 5.28%

8 11,499 5.48%

9 11,925 5.69%

10 12,333 5.88%

11 13,171 6.28%

12 13,617 6.49%

13 14,090 6.72%

14 14,592 6.96%

15 14,256 6.80%

16 14,102 6.72%

17 13,789 6.57%

18 9,446 4.50%

19 5,251 2.50%

20 3,496 1.67%

21 2,210 1.05%

Subtotal 183,535 87.51%

Missing 3,575 1.70%

Subtotal 187,110 89.22%

0 to 4 20,125 9.60%

22 - 24 1,569 0.75%

25 and over 918 0.44%

Total 209,722 100%

29

Table 3. Tuition and Textbook Tax Credit Claims by Qualifying Dependents, Tax Year 2020

Source: 2020 IDR and Internal Revenue Service individual tax returns

Table 4. Share of Households Claiming the Maximum Tuition and Textbook Tax Credit, Tax Years 2010 - 2020

Source: IDR individual income tax returns

Number of Qualifying

Dependents

Number of

Households

Number of

Dependents

Distribution of

Dependents

Amount of

Claims

Distribution of

Claims

Average Claim

per Household

Average Claim

per Dependent

1 37,466 37,466 20.02% $3,020,641 21.57% $81 $81

2 39,181 78,362 41.88% $5,036,856 35.96% $129 $64

3 16,241 48,723 26.04% $3,244,635 23.16% $200 $67

4 or more 11,721 22,559 12.06% $2,704,505 19.31% $231 $120

Total 104,609 187,110 100% $14,006,637 100% $133.90 $75

Tax Year

Total Number

of Households

Total Amount

of Claims

(millions)

Households Claiming

Maximum Credit

Number of

Dependents

Share of Households

Claiming Max Credit

Amount of

Maximum Claims

(millions)

2010 121,400 $15.3 8,686 15,546 7.2% $3.9

2011 120,654 $15.1 8,916 15,952 7.4% $4.0

2012 121,071 $15.3 9,346 16,698 7.7% $4.2

2013 120,252 $15.2 9,269 16,647 7.7% $4.2

2014 117,284 $15.4 9,411 16,759 8.0% $4.2

2015 118,348 $15.5 9,694 17,237 8.2% $4.3

2016 117,788 $15.3 9,608 17,106 8.2% $2.4

2017 116,707 $15.3 9,891 17,628 8.5% $2.5

2018 113,938 $15.1 10,058 17,949 8.8% $2.5

2019 111,904 $14.9 10,042 17,927 9.0% $2.5

2020 104,609 $14.0 10,453 18,566 10.0% $2.6

30

Table 5. Tuition and Textbook Tax Credit Claims by Resident Status, Tax Year 2020

Source: IDR 2020 and Internal Revenue Service individual income tax returns

(1) There were 4 returns with an Iowa address that did not report a valid Iowa county number

State of Residence

Number of

Households

Share of

Households

Amount of Claims

Share of

Claims

Number of

Dependents

Share of

Dependents

Iowa Residents 103,709 99.14% $13,833,882 98.77% 220,436 99.15%

Iowa (1) 4 0.00% $751 0.01% 9 0.00%

Nonresidents

Illinois 85 0.08% $12,882 0.09% 181 0.08%

Minnesota 56 0.05% $9,952 0.07% 128 0.06%

Missouri 39 0.04% $7,237 0.05% 79 0.04%

Nebraska 162 0.15% $37,750 0.27% 339 0.15%

South Dakota 110 0.11% $31,641 0.23% 236 0.11%

Wisconsin 49 0.05% $9,777 0.07% 108 0.05%

Not Contiguous to Iowa 395 0.38% $62,765 0.45% 809 0.36%

Nonresidents Total 896 0.86% $172,004 1.23% 1,880 0.85%

Total 104,609 100% $14,006,637 100% 222,325 100%

31

Table 6. Tuition and Textbook Tax Credit Claims by Filing Status, Tax Years 2010-2020

Source: IDR 2010-2020 individual income tax returns

Note: Utilization Rate is the ratio of resident households claiming the credit compared to all resident households with

dependents between ages 5 and 21.

Filing Status

Average

Number of

Households

Distribution of

Households

Average

Amount of

Claims

Distribution of

Claims

Average

Claim

Average

Eligible

Expenses

Utilization

Rate*

Single 1,697 1.45% $140,725 0.93% $83 $562,898 11.1%

Married Joint 13,855 11.87% $2,345,910 15.52% $169 $9,383,641 28.6%

Married Separate

Combined

78,438 67.19% $10,648,982 70.46% $136 $42,595,928 47.7%

Married Separate 996 0.85% $91,867 0.61% $92 $367,467 30.9%

Head of Household 21,599 18.50% $1,865,722 12.35% $86 $7,462,889 21.2%

Qualified Widow(er) 155 0.13% $19,559 0.13% $126 $78,237 28.1%

Total 116,741 100% $15,112,765 100% $129 $60,451,062 34.8%

32

Table 7. Tuition and Textbook Tax Credit Claims by Adjusted Gross Income, Tax Years 2010-2020

Source: IDR 2020 individual income tax returns

Note: Utilization Rate is the ratio of resident households claiming the credit compared to all resident households with

dependents between ages 5 and 21.

Income Range

Average

Number of

Households

Distribution of

Households

Average

Amount of

Claims

Distribution of

Claims

Average

Claim

Average

Eligible

Expenses

Utilization

Rate*

Less than $20,000 1,130 0.97% $98,269 0.65% $87 $393,074 2.4%

$20,000 - $29,999 5,993 5.13% $454,638 3.01% $76 $1,818,550 17.1%

$30,000 - $39,999 9,379 8.03% $886,269 5.86% $94 $3,545,077 28.5%

$40,000 - $49,999 9,829 8.42% $1,016,156 6.72% $103 $4,064,626 35.0%

$50,000 - $59,999 10,041 8.60% $1,103,265 7.30% $110 $4,413,059 40.0%

$60,000 - $69,999 10,306 8.83% $1,176,562 7.79% $114 $4,706,247 44.0%

$70,000 - $79,999 10,098 8.65% $1,203,963 7.97% $119 $4,815,851 46.5%

$80,000 - $89,999 9,476 8.12% $1,175,448 7.78% $124 $4,701,792 48.1%

$90,000 - $99,999 8,659 7.42% $1,121,807 7.42% $130 $4,487,230 49.1%

$100,000 -$124,999 16,455 14.10% $2,273,093 15.04% $138 $9,092,374 50.4%

$125,000 -$149,999 9,406 8.06% $1,415,335 9.37% $150 $5,661,340 50.7%

$150,000 -$174,999 5,249 4.50% $870,670 5.76% $166 $3,482,678 50.0%

$175,000 -$199,999 3,003 2.57% $538,844 3.57% $179 $2,155,375 48.8%

$200,000 and Over 7,717 6.61% $1,778,447 11.77% $230 $7,113,788 46.4%

Total 116,741 100% $15,112,765 100% $129 $60,451,062 34.8%

33

Figure 6. Average Tuition and Textbook Tax Credit Utilization Rates by School District, Tax Years 2010-2020

Sources: IDR 2010-2020 individual income tax returns; Iowa State University Geographic Information Systems Support &

Research Facility

Note: Utilization Rate is the ratio of resident households claiming the credit compared to all resident households with

dependents between ages 5 and 21.

n

n

n

n

n

nn

n

n

n

n

n

n

n

n

n

n

n

n

n

nn

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

nn

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

n

nn

n

n

n

n

n

n

n

n

n

nn

nn

n

n

n

n

n

nn

nn

n

n

n

n

n

n

n

n

nnn

n

n

n

n

nn

n

n

n

n

n

n

nn

n

n

n

n

n

n

nn

n

n

n

n

n

n