[Agency Name]

INSURANCE

DISASTER RESPONSE

PLAN

[Date]

Table of Contents

Introduction .............................................................................................................................................................. 4

What this document provides .............................................................................................................................. 4

The purpose of the disaster response plan ......................................................................................................... 4

Information the disaster response plan provides ................................................................................................ 5

NAIC Disaster Assistance Program .................................................................................................................... 5

Ways a jurisdiction can prepare to receive NAIC assistance .............................................................................. 5

NAIC services set-up time after approval of assistance ..................................................................................... 6

Additional information .......................................................................................................................................... 6

Disaster relief call center ..................................................................................................................................... 6

DRC insurance regulator staff ............................................................................................................................. 7

NAIC-hosted insurance department website ....................................................................................................... 7

NAIC-coordinated data call ................................................................................................................................. 7

Preparation .............................................................................................................................................................. 8

The steps to preparation ..................................................................................................................................... 8

Important planning considerations ...................................................................................................................... 8

Available training ................................................................................................................................................. 8

Insurance contact information that a DOI should regularly collect ...................................................................... 9

Insurance company contacts:.............................................................................................................................. 9

Requirements of insurance company contacts ................................................................................................... 9

Other necessary contacts .................................................................................................................................... 9

Types of information that should be ready for dissemination in the event of a disaster ................................... 10

Types of data a DOI should collect regarding disasters ................................................................................... 10

Data collection tools the NAIC can provide ....................................................................................................... 10

The NAIC coordinated data call ........................................................................................................................ 10

Ty

pes of information a DOI, in coordination with Public Affairs, should maintain, update, post on the state’s

website, and distribute via social media ............................................................................................................ 11

Resources required for emergency response ................................................................................................... 11

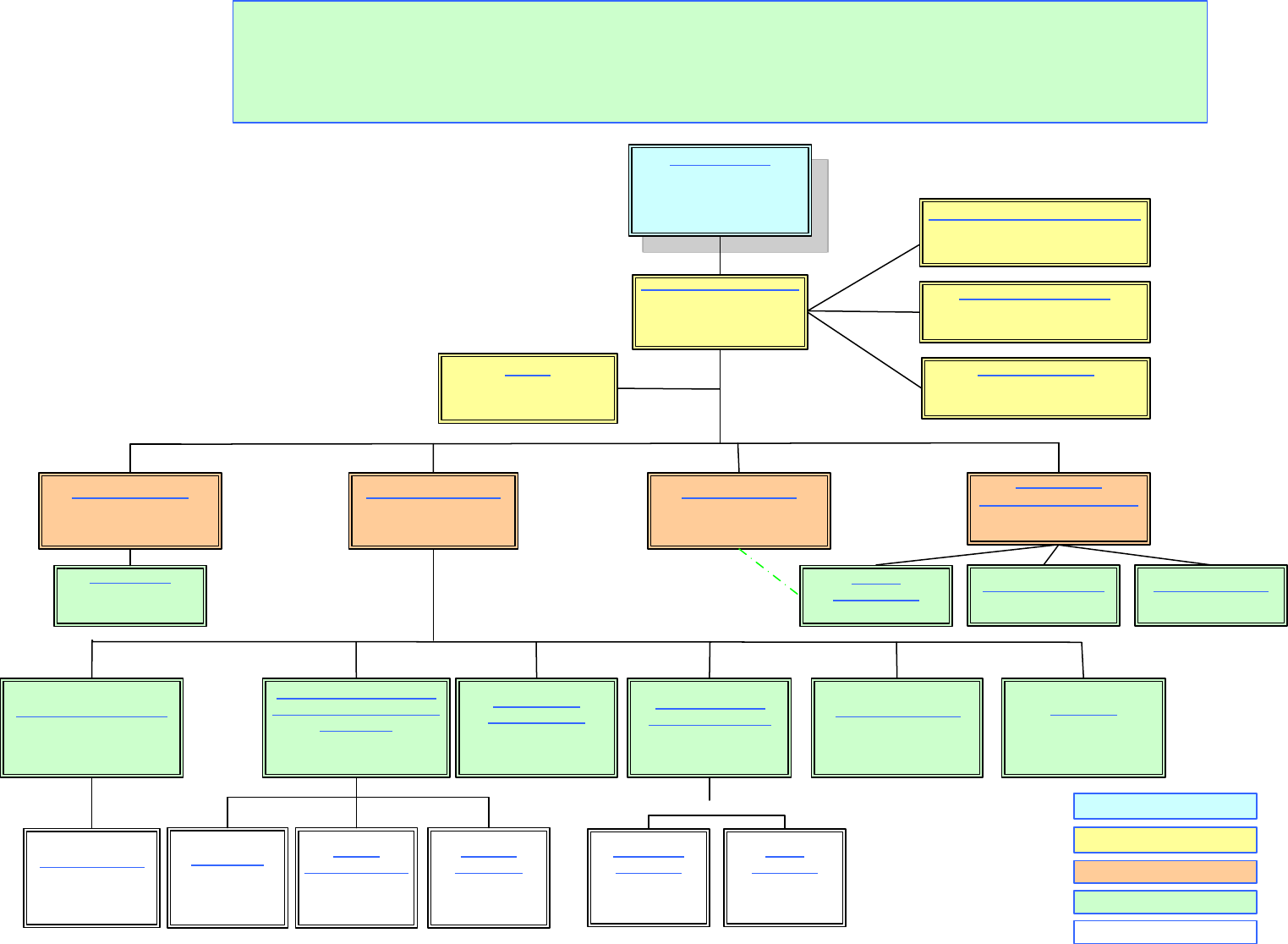

Brief description of the Major Incident Management Functions (See org chart template - Appendix 1)........... 12

Disaster Response/Incident Management Team .................................................................................................. 13

Incident Commander (IC) – (may be the Agency Head or their designee) ....................................................... 13

Public Information Officer (PIO) ........................................................................................................................ 14

Safety Officer (SO) ............................................................................................................................................ 15

Legal Counsel (LC) ........................................................................................................................................... 15

Emergency Liaison Officer (ELO)...................................................................................................................... 15

Roles and Responsibilities .................................................................................................................................... 16

Financial & Administration Section Chief .......................................................................................................... 16

Finance and Administration Section Team Leads ............................................................................................ 17

Logistics Section Chief ...................................................................................................................................... 17

Operations Section Chief .................................................................................................................................. 18

Operation Section Team Leads......................................................................................................................... 18

Planning Section Chief ...................................................................................................................................... 18

Deputy ............................................................................................................................................................... 19

Statistics Operational Network Task Group ...................................................................................................... 19

Consumer Operational Team Lead ................................................................................................................... 20

Communications Operations Task Group ......................................................................................................... 20

Logistics Task Group ......................................................................................................................................... 22

Branch Office(s) ................................................................................................................................................ 22

Appendix 1 – Business Continuity Org Chart .................................................................................................... 22

Appendix 2 – Response Levels and Definitions ................................................................................................ 22

Appendix 3 – Sample Contact Lists .................................................................................................................. 22

Appendix 4 – Example Bulletins ........................................................................................................................ 22

Introduction

In the event of a disaster that requires an extraordinary response, the [state insurance

regulatory entity] has adopted the following disaster response plan.

What this document provides

Following a disaster, this document provides a template for departments of insurance

(DOIs) to use when assisting consumers. In advance of a disaster, this document also

provides guidance to insurers and other licensees.

This document details how a DOI can work with other agencies to assist consumers,

including:

• Federal agencies

• State or local agencies

• The NAIC

• Other state DOIs

This document does not provide information regarding a Continuity of Operations Plan

(COOP). Check to see if your department has a COOP that provides detailed information

regarding how it is to be implemented.

The purpose of the disaster response plan

The purpose of the disaster response plan is to:

• Provide states with information regarding quick and effective responses to meet the

insurance information needs of its citizens.

• Provide information regarding the coordination of resources with other state agencies

to mitigate the effects of a disaster.

The disaster response plan will be activated by the commissioner,

director or superintendent. It will be implemented by the disaster or

incident management team.

© 2020 National Association of Insurance Commissioners

Page 1

Information the disaster response plan provides

This disaster response plan template provides information to assist state insurance

departments in responding to disasters. This disaster response plan is scalable to

respond to disasters affecting:

• Limited areas within the state.

• Several locations throughout the state.

• The entire state.

NAIC Disaster Assistance Program

The NAIC Disaster Assistance Program is a series of services provided by the NAIC to

any member jurisdiction experiencing the aftermath of a disaster where additional support

is needed.

The NAIC can provide the following services following a disaster:

• Disaster Relief Call Center

• Disaster Recovery Center (DRC) Insurance Regulator Staff

• Communications Services

• NAIC Coordinated Data Call

Services are provided once a formal request is made by an NAIC member (a jurisdiction’s

appointed/elected insurance commissioner) to the NAIC officers, asking them to direct

NAIC senior management to allocate budgeted funds and resources toward their need for

disaster relief assistance. The day-to-day project is then overseen by the NAIC Director

of Member Services who coordinates a variety of NAIC department staff overseeing

operations and volunteers throughout the length of services needed.

Ways a jurisdiction can prepare to receive NAIC assistance

Jurisdictions can prepare information that will better facilitate NAIC assistance after a

catastrophic event. These items may be incorporated as part of your jurisdiction’s

Business Continuity Plan. Jurisdictions need to consider how they want calls and

complaints tracked by NAIC volunteers and provide templates, if appropriate.

The following are some high-level action items to do prior to contacting the NAIC:

• Identify your critical staff and who will be coordinating with the NAIC.

• Assess the level of impact to your staff. This level of impact may determine the support

you need from the NAIC.

• Assess the functionality of your systems and facilities—i.e., phone, internet, other

communications and office—after the event.

• Assess access to power and your critical infrastructure.

• Assess business impact analysis; i.e., the minimum you need to function.

• If possible, consider the type of assistance you may need: call center overflow, onsite

regulatory staff support, website, or remote office. However, the NAIC is also prepared

to consider new services to meet your unique needs.

• Document how a trusted third party may access your communications systems: phone

and internet.

© 2020 National Association of Insurance Commissioners

Page 2

• Prepare and provide talking points for the NAIC, frequently asked questions (FAQ),

jurisdiction guidelines—i.e., emergency adjuster licensing rules—which can be shared

with call center staff and onsite DRC volunteers.

• Share jurisdiction-issued bulletins and how we are to handle them.

NAIC services set-up time after approval of assistance

The NAIC is ready to help at any time after a member has requested assistance.

• Call center: within 24–48 hours after contact.

• DRC volunteers may be available within 48–72 hours after contact.

• Communications services are available within 24–48 hours after contact and member

approval of information.

• NAIC Coordinated Data Call within 24–48 hours after contact.

Additional information

Where possible, the NAIC may reach out to a member jurisdiction prior to an imminent

disaster to offer information about our program or answer any questions they may have

about systems that may be affected in the event of a disaster.

NAIC Research and Government Relations departments are able to participate in

briefings with the Financial and Banking Information Infrastructure Committee (FBIIC), the

Federal Emergency Management Agency (FEMA), and Homeland Security to share

information from, and to, NAIC jurisdictions.

The National Insurance Producer Registry (NIPR) and/or the Interstate Insurance Product

Regulation Commission (Compact) are able to assist affected jurisdictions who may need

emergency adjuster licenses and/or help processing product filings.

Disaster relief call center

The NAIC works with your department’s technical team to connect a 1-800 NAIC

telephone line and/or computer system—State Based Systems (SBS)—with your

jurisdiction’s consumer phone line and/or complaint tracking system.

• Call center is staffed with experienced insurance department regulator volunteers

capable of answering consumer concerns.

• Call center is flexible enough to handle your entire call volume, allowing your staff to

assist people in the field.

• Call center may also be set to roll-over to state insurance regulator volunteers

whenever you experience call overflow.

Cost:

• There is no cost to your jurisdiction for this service.

• The NAIC covers the cost for the 1-800 phone line; call center equipment, facilities

and coordination; and the travel/lodging reservations and expense for state insurance

regulator volunteers.

• Your fellow members/commissioners provide their state insurance regulator staff as

volunteers.

© 2020 National Association of Insurance Commissioners

Page 3

DRC insurance regulator staff

The NAIC facilitates and coordinates insurance department regulator volunteers to staff

your designated DRC location(s).

• Volunteers cover one to two week shift rotations to man the daily operation of the DRC.

• The NAIC will arrange travel and lodging for the assigned state insurance regulator

volunteers.

• If needed, the NAIC can help provide loaner laptops or cell phones for state insurance

regulator volunteer use at a DRC location.

Cost:

• There is no cost to your jurisdiction for this service.

• The NAIC covers the cost of the loaner equipment and travel/lodging expenses for the

state insurance regulator volunteers.

• Your fellow members/commissioners proffer their state insurance regulator staff as

volunteers.

To deploy this service, an insurance department staff/disaster coordinator contacts Trish

Schoettger, NAIC Director of Member Services at tschoettger@naic.org or 816.783.8506.

She will coordinate a call with the member/commissioner, NAIC President, and NAIC

Chief Executive Officer (CEO) or Chief Operating Officer (COO) to utilize these services.

NAIC-hosted insurance department website

In the case where the affected jurisdiction has lost the use of its facility or their website

becomes inoperable, the NAIC can act as an interim host for the jurisdiction’s insurance

department website. If needed, the NAIC can also serve as a resource to communicate

your updated status to other jurisdictions and/or agencies or change information.

Cost:

• There is no cost to your jurisdiction for this service.

• The NAIC covers the cost of hosting the site.

NAIC-coordinated data call

The NAIC assists states with data calls related to the collection of claims data following

disasters. Data calls are typically conducted weekly immediately after a disaster and then

biweekly or monthly as a higher percentage of claims close.

© 2020 National Association of Insurance Commissioners

Page 4

Preparation

The steps to preparation

A DOI needs to promptly and efficiently respond to a disaster. Effective response to a

disaster requires preparation and planning, including:

• Identifying appropriate staff to perform necessary activities.

• Training appropriate staff.

• Identifying available resources.

• Identifying any resource shortfalls and how these might be addressed.

Important planning considerations

Preparedness for disasters requires identifying resources and expertise in advance and

planning how these can be used in a disaster. Planning considerations include:

• Putting procedures in place for internal tracking and reimbursement costs expended

by the DOI in response to a disaster.

• Designating a team of individuals and assigning responsibilities to ensure that

everyone on the team understands their roles and responsibilities during a disaster

situation.

• Updating plans and procedures based upon post-mortem evaluation of the DOI’s

performance in prior disaster response efforts.

Available training

As a part of efforts to prepare for response to disasters, state DOIs and agencies

participate with local jurisdictions and private entities in exercises and training.

Staff should be periodically trained on how to assist consumers during a disaster.

Training regarding information on FEMA assistance programs and the National Flood

Insurance Program (NFIP) is recommended.

FEMA has free courses available to emergency management teams. These courses can

be found by using the following link: https://training.fema.gov/is/.

The NFIP has developed a reference guide on flood-related issues for state insurance

regulators and other officials. This document can be found using the following link:

https://www.fema.gov/media-library-data/1525272377818-

3cb0cf795a73c135c8543d2459e12c80/NFIPDeskReferencev18_508_V4.1.pdf.

© 2020 National Association of Insurance Commissioners

Page 5

Insurance contact information that a DOI should regularly

collect

It is important for a DOI to maintain current insurance company contacts for insurers

licensed to do business in the state, including non-admitted surplus lines insurers. Some

states may maintain contact information in SBS, another database, or through a Microsoft

Outlook contact list obtained by an annual request.

Partnerships with private volunteer organizations can also be useful in coordinating

response after a disaster. [State Insurance Department] should identify consumer or non-

profit organizations that would be open to a partnership.

Insurance company contacts:

Following a disaster, a DOI will likely need to contact insurers. The contact information

should include:

• Insurers doing business in a state.

• A primary contact and a secondary contact (both would likely be a member of the

insurer’s disaster response team).

• High-level senior management to respond to questions or issues promptly.

Requirements of insurance company contacts

After a disaster, state insurance regulators will need to be able to contact insurers for

information. Contacts should:

• Be able to provide coverage data and loss statistics, by county or region, according to

a standardized format developed by the DOI.

• Be knowledgeable regarding their internal information systems and sources and

authorized to access such systems so that applicable and timely information can be

provided upon the request of the DOI.

• Be able to respond to requests for information from legislators, the governor’s office,

FEMA officials, or press inquiries.

Other necessary contacts

DOIs will need contacts for local, state and federal officials (these should be maintained

and updated).

Contacts will report other disaster information to the DOI, including lists of

company claim offices and phone numbers, adjuster information, and company

toll-free numbers, etc.

© 2020 National Association of Insurance Commissioners

Page 6

Types of information that should be ready for dissemination in

the event of a disaster

Following a disaster, a DOI will be responsible for helping consumers regarding claims.

Some of the items a DOI will want to have on hand to provide to consumers include:

• Consumer brochures.

• Consumer alerts.

• Insurer contacts for consumers.

• Other forms of information relating to preparation and response to all types of disasters

(this information should be updated prior to a disaster).

The NAIC’s Transparency and Readability of Consumer Information (C) Working Group created a

document to help guide consumers through a claim following a disaster. This document can be

passed out following a disaster:

https://content.naic.org/sites/default/files/inline-

files/Claim%20Disaster%20Guide%20-%20Generic%20FINAL%207%2023%202019.pdf.

Types of data a DOI should collect regarding disasters

A DOI should define the appropriate area in their department responsible for creating and

maintaining a database that holds coverage data and loss statistics collected from

insurers. If a DOI does not have the resources to maintain a database, the NAIC can

provide this service.

Information to be collected (generally collected by ZIP code) includes such items as the:

• Number of claims reported

• Number of claims closed with and without payment

• Paid losses

• Incurred losses

Data collection tools the NAIC can provide

The NAIC can provide the data template adopted by the NAIC Property and Casualty (C)

Committee and Executive (EX) Committee and Plenary if the DOI does not have its own

data call template. This template can be found on the Catastrophe Insurance (C) Working

Group’s webpage under the Related Documents tab. The link to the webpage is:

https://www.naic.org/cmte_c_catastrophe.htm.

The NAIC coordinated data call

The NAIC assists states with data calls related to the collection of claims data following

disasters. Data calls are typically conducted weekly immediately after a disaster and then

biweekly or monthly as a higher percentage of claims close. The length of time that data

is collected is usually dependent upon the severity of the event. For example, a minor

hurricane, like Irma, will not necessitate weekly reporting, even in the beginning. Having

the NAIC assist with a data call could require a confidentiality agreement if the state does

not already have one that would encompass the data call.

© 2020 National Association of Insurance Commissioners

Page 7

Types of information a DOI, in coordination with Public Affairs,

should maintain, update, post on the state’s website, and

distribute via social media

• https://www.insureuonline.org/disaster_prep_flood.pdf

• https://www.insureuonline.org/disaster_prep_tornado.pdf

• https://www.insureuonline.org/disaster_prep_hurricanes.pdf

• https://www.insureuonline.org/disaster_prep_wildfires.pdf

• https://www.insureuonline.org/disaster_prep_earthquakes.pdf

• https://www.insureuonline.org/home_inventory_checklist.pdf

• https://www.naic.org/documents/consumer_alert_wake_of_the_storm.htm

• https://www.naic.org/documents/consumer_alert_flood_insurance_understanding_risk.htm

Resources required for emergency response

The availability and capability of resources needs to be determined and includes the

following:

• People

• Facilities

• Materials and supplies

• Funding

• Information regarding threats or hazards

Periodically review resources dedicated to the Disaster Response Team to

make certain that there are enough cell phones, laptops, and other

equipment and materials available for staff.

Disaster Recovery Team Personnel within the DOI should be identified to

act as first responders if the DOI is required to respond to an emergency.

DOI employees are divided into those who will work outside of the office and

those who will work at the DOI in an onsite or offsite call center.

Contact information for members of the team should be maintained.

Employees should receive periodic training and updates on procedures

for assisting consumers in the event of a disaster.

The DOI shall maintain Disaster Recovery supplies and information for use

by the Team.

© 2020 National Association of Insurance Commissioners

Page 8

Brief description of the Major Incident Management Functions

(See org chart template - Appendix 1)

COMMAND

Sets the incident objectives, strategies and priorities. Has overall responsibility for the

incident.

OPERATIONS

Conducts operations to reach the incident objectives. Establishes tactics and directs all

operational resources.

PLANNING

Supports the incident action planning process by tracking resources, collecting/analyzing

information, and maintaining documentation.

LOGISTICS

Arranges for resources and needed services to support achievement of the incident

objectives.

FINANCE AND ADMINISTRATION

Monitors costs related to the incident. Provides accounting, procurement, time recording

and cost analysis.

Keep in mind, larger states may have more resources available than smaller

states. See important note to DOIs.

© 2020 National Association of Insurance Commissioners

Page 9

Disaster Response/Incident Management Team

Response Leadership Team (Your State Emergency Management Agency would call this

the Command Support Staff)

The purpose of this team is to:

• Provide direction before, during and after a disaster.

• Ensure periodic review and assessment of the State Disaster Response Plan and hold

the incident management team accountable for implementation.

• Test and update the plan on a regular and consistent basis.

Location

This team is located at the [Home office] unless an alternative location is needed.

Duties:

Upon notification of a significant disaster, the commissioner, superintendent or director

will notify this team to begin implementation of the Disaster Response Plan.

Identify which other disaster response units should be activated.

Members:

The response leadership team should include the following:

• Incident Commander (IC) (commissioner, director, superintendent, chief deputy or

their designee).

• Public Information Officer (PIO) (the person that handles media and communication

requests).

• Safety Officer (SO) (this person is the human resources (HR) chief manager).

• Finance /Administration Section Chief.

• Legal Counsel (LC).

• Emergency Operations Center (EOC) Liaison Officer (ELO) (this could be your lead

consumer affairs staff member).

• Any other positions, as required, who report directly to the IC (they may have an

assistant or assistants, as needed).

Incident Commander (IC) – (may be the Agency Head or their

designee)

The IC is responsible for all incident action plans (IAPs) and activities to sustain critical

functions and services. These tasks include:

• Developing strategies and tactics before the execution of action plans in the event of

a disaster.

• Ordering and releasing resources.

• Conducting incident operations.

The IC is responsible for:

• Managing all incident operations.

• Ensuring overall incident safety.

© 2020 National Association of Insurance Commissioners

Page 10

• Assessing the situation and notifying internal teams and departments.

• Appointing others.

• Carrying out all ICS management functions until they delegate a function.

• Providing information services to internal and external stakeholders.

• Managing all operations at the disaster site.

Public Information Officer (PIO)

The PIO is responsible for interfacing with the public, industry, media, and/or other

agencies with incident-related information requirements.

The PIO is responsible for:

• Drafting and issuing all public announcements.

• Making all press releases.

• Establishing an event-specific webpage (if needed).

• Sending event-specific updates out via social media and posting them online.

• Giving all interviews with the communications media relative to the incident and the

Agency’s action plan to address the situation. The PIO establishes communications with

PIOs in other State Agencies and the Governor’s Media Office to convey situation status,

progress toward resolving the incident, and any actions needed in support of or to address

the situation.

It is possible for the IC to accomplish all management functions during

the aftermath of a small event.

The IC only creates the sections that are needed. If a section is not staffed, the IC

will personally manage those functions.

The PIO works directly with the IC and Agency Head on all sensitive communications and

may seek advice and counsel from other members of the Command Support Staff on

legal or personnel matters and from the Section Chiefs on background relating to the

situation and the actions the Agency are taking.

© 2020 National Association of Insurance Commissioners

Page 11

Safety Officer (SO)

The SO monitors incident operations and advises the IC on all matters relating to

operational safety, including the health and safety of agency personnel.

The SO is responsible for:

• Monitoring conditions and developing measures for assuring safety of personnel.

• Advising the IC about incident safety issues.

• Conducting risk analyses.

• Implementing safety measures.

• Monitoring building accessibility.

• Communicating with the IC and staff.

Legal Counsel (LC)

The LC is the member of the Incident Command Support Team who provides legal

counsel to the IC.

Examples of support would include:

• Providing advice relative to Agency jurisdiction and contractual obligations.

• Completing other tasks as assigned by the IC.

The LC may also be asked to:

• Review any public statements to be issued by the PIO.

• Provide opinion and guidance on employee relations-based issues.

• Provide opinion and guidance on issues that relate to the Agency mission and the

public.

Emergency Liaison Officer (ELO)

The ELO is the point of contact for representatives of other governmental agencies,

nongovernmental organizations, and the private sector.

The ELO provides a liaison between the DOI and the state’s Department of Emergency

Management and Homeland Security (DEMHS), especially when the DEMHS has elected

to activate its EOC.

A close working relationship between the Agency and the EOC is required for timely

communication and action appropriate to directives received. The ELO will represent the

Agency at the EOC and establish ongoing communications and scheduled status reviews

with the Agency Incident Command.

© 2020 National Association of Insurance Commissioners

Page 12

Roles and Responsibilities

Financial & Administration Section Chief

The Financial and Administration Section Chief is a member of the Incident Command

General Staff. This person is also the leader of the Administration Section. In the context

of the COOP, the Financial and Administration Section Chief is responsible for the internal

processes within the Agency, including financial and human resource functions, which

are necessary to enable the critical functions being addressed by the Operations Section.

The Administration Section Chief sustains or recovers processes to maintain the fiscal

integrity of the Agency and ensure that essential human resource processes are

sustained. The Administration Section Chief works closely with the Operations and

Logistics Sections to identify requirements and assess available options.

The Finance/Administration Section Chief is responsible for:

• Analyzing all financial, administrative and cost aspects of an incident.

• Maintaining daily contact with agency administrative headquarters on finance and

administration matters.

• Meeting with assisting and cooperating agency representatives.

• Advising the IC on financial and administrative matters.

• Developing the operating plan for the Finance/Administrative Section.

• Coordinating finances at the local level.

• Establishing or transitioning into an existing Finance/Administrative Section.

• Supervising and configuring section with units to support, as necessary.

• Negotiating and monitoring contracts.

• Timekeeping.

• Analyzing cost.

• Compensating for injury or damage to property.

• Documenting reimbursement (e.g., under mutual aid agreements and assistance

agreements).

The Finance/Administration Section is set up for any incident that requires incident-

specific financial management.

The Time, Compensation/Claims, Cost and Procurement Units may be established

within this section.

© 2020 National Association of Insurance Commissioners

Page 13

Finance and Administration Section Team Leads

The Finance and Administration Section Team Leads should be a qualified member of

the Incident Command General Staff. This person reports to the Administration Section

Chief.

Finance and Administration Section Team Leads are responsible for:

• The coordination of the initial action plan execution and recovery efforts for one of the

Administration Section Teams.

• Business continuity interruption preparedness.

• Response coordination.

• Post-interruption corrective action based on lessons learned for the functions that are

part of the normal operational responsibilities of the work group.

Logistics Section Chief

This Logistics Section Chief is a member of the Incident Command General Staff and the

leader of the Logistics Section.

The Logistics Section Chief is responsible for:

• Overseeing the resources and processes needed to sustain or recreate the work

environment for Operations and Administration Section functions (in the context of the

COOP), including facility, technology, equipment and supplies.

• Addressing plant, tool, technology and information security (including the Health

Insurance Portability and Accountability Act of 1996 [HIPAA]) requirements for the

Incident Command.

• Working closely with the Operations and Administration Sections to identify

requirements and assess available options.

The Logistics Section is responsible for all services and support needs,

including:

• Ordering, obtaining, maintaining and accounting for essential personnel, equipment

and supplies.

• Providing communication planning and resources.

• Setting up food services for responders.

• Setting up and maintaining incident facilities.

• Providing support transportation.

• Providing medical services to incident personnel.

In the National Incident Management System (NIMS) these Team Leads often head

branches or divisions.

Section Chiefs will determine the organization appropriate under respective

sections.

© 2020 National Association of Insurance Commissioners

Page 14

Operations Section Chief

Typically, the Operations Section Chief is the person with the greatest tactical expertise

in dealing with the problem at hand. The Operations Section Chief is a member of the

Incident Command General Staff and the leader of the Operations Section. This person

is responsible for the sustenance or recovery of the functions within the agency that serve

the citizens of the state. The Operations Section Chief may have one or more Deputies

who are qualified to fill this position.

The Operations Section Chief is responsible for:

• Directly managing all incident tactical activities.

• Implementing the IAP.

• Developing and implementing strategies and tactics to carry out the incident

objectives.

• Organizing, assigning and supervising the tactical response resources.

• Having one or more Deputies who are qualified to assume these responsibilities. (This

is recommended where multiple shifts are needed, as well as for succession planning).

Operation Section Team Leads

An Operation Section Team Lead is a qualified member of the Incident Command General

Staff who reports to the Operation Section Chief. This individual is responsible for the

coordination of the initial action plan and recovery effort of the Operation Section Teams.

Operation Section Team Leads are responsible for:

• Pre-incident preparedness.

• IAP coordination.

• Post-incident corrective action based on lessons learned for the functions that are part

of the normal operational responsibilities of the work group.

Planning Section Chief

The Planning Section Chief is a member of the Incident Command General Staff and

leader of the Planning Section. This individual is responsible for the development of the

Business Continuity Plan and COOP document and works closely with the IC, General

Staff (other Section Chiefs), and Command Support Staff to ensure that critical functions

and their resource requirements are identified and that preparatory actions are taken. The

Planning Section Chief ensures that communications information needed to execute the

COOP has been captured.

In the continuity plan action period, the Planning Section Chief is

responsible for:

• Serving as a coach to Incident Command.

• Ensuring that regular crisis action plan review sessions are held.

• Ensuring that outstanding issues are identified.

• Ensuring that appropriate alternatives are considered.

• Ensuring that action assignments are clearly distributed.

© 2020 National Association of Insurance Commissioners

Page 15

The Planning Section Chief may have one or more Deputies who are qualified to assume

these responsibilities. This is recommended where multiple shifts are needed, as well as

for succession planning.

The major activities of the Planning Section may include:

• Collecting, evaluating and displaying incident intelligence and information.

• Preparing and documenting IAPs.

• Tracking resources assigned to the incident.

• Maintaining incident documentation.

• Developing plans for demobilization.

Deputy

The Deputy is a fully qualified individual who, in the absence of a superior, can be

delegated the authority to manage a functional operation or perform a specific task. In

some cases, the Deputy acts as relief for a superior; therefore, the Deputy must be fully

qualified in the position.

Deputies can be assigned to the IC, Command Support Staff, and the Section Chief

positions.

Statistics Operational Network Task Group

The purpose of this group is to facilitate an analysis of a catastrophe with insurance

companies and the [agency name] whenever a catastrophic event occurs.

The Statistics Operational Network Task Group will be located [insert location of home

office or other designated location] unless otherwise chosen due to necessity.

The Statistics Operational Network Task Group is charged with the responsibility of

creating a “contact list” of insurance community liaisons. This contact list will allow for

prompt contact of people within the insurance industry who should be able to provide

coverage data and loss statistics, by region, according to any standardized format

developed by [agency].

The Team Lead should be knowledgeable of company internal information systems and

sources authorized to access such systems so that applicable and timely information can

be provided to [agency] or emergency response agencies upon request.

Members of this Task Group should include divisions that perform data collection/analysis,

market conduct, and financial regulation.

© 2020 National Association of Insurance Commissioners

Page 16

Consumer Operational Team Lead

The Consumer Operational Team Lead works with the PIO to provide consumers with the

information needed to contact their insurance companies and the fundamentals to file a

claim and convey necessary information to the Emergency Response Team.

A Consumer Information Task Group will be located [insert location of home office or other

designated location] unless otherwise selected by the Disaster Executive Committee due

to necessity.

If a disaster is declared, a consumer hotline should be immediately activated, but

consideration may be needed to relocate it. The hotline:

• Should be able to ramp up to provide a 24-hour service.

1

• Should operate utilizing four six-hour shifts.

Hotline staff should:

• Have a list of 800 numbers of the major property/casualty (P/C) insurers in the state.

• Have the list of Emergency Response Task Group key personnel.

• Have other emergency agency numbers to be used in the event of a disaster.

• Be provided with a communications kit, which will be used to tell consumers about

claim procedures.

Members should include:

• Consumer services unit senior management.

• Internal resource senior management.

Communications Operations Task Group

The purpose of this group is to work with the PIO to create a central source for media

information relevant to disaster insurance and the disaster plan response activities.

This Group:

• Prepares news releases about the steps to take before, during and after a disaster.

• Produces brochures about preparedness.

• Dispatches speakers to various locations, as needed.

• Maintains contact with all media.

1

It may not be necessary to operate 24 hours a day, but it is likely that the hotline may need to be open for hours longer than the agency is

typically open. The agency will need to be prepared for these circumstances.

Branch offices might initially be made operational through the use of cell

phones until other landlines are established.

© 2020 National Association of Insurance Commissioners

Page 17

The Communications Team will be [insert location of home office or other designated

location] unless otherwise chosen by the Disaster Executive Committee due to necessity.

The Communications Operations Task Group is responsible for:

• Developing a consistent message to be communicated to consumers.

• Distributing advisories and brochures to units of government throughout the state so

that they may reproduce them for local residents. (The NAIC may be contacted for

assistance in bulk reproduction).

The Communications Task Group should:

• Be in constant contact with the [State Emergency Management Agency’s

Communications Team] to coordinate media announcements.

• Contact news organizations throughout the state with a Media Advisory.

• Notify news agencies that [agency name] is the primary source for obtaining and

forwarding information relative to insurance and a disaster.

• Be in constant touch with the Emergency Response Task Group and branch offices

to coordinate the information flow.

The Communications Task Group is:

• Responsible for ensuring that messaging is consistent.

• Responsible for developing an Outreach Team to operate quickly and efficiently in

affected areas to answer questions in town meetings and other informational

gatherings.

• Responsible for supplement information provided through the media and other

sources about how to quickly and effectively prepare insurance claims information.

Members include:

• Senior media or communications staff.

• Legislative personnel.

• Key agency staff with public speaking experience.

Much of the information will be obtained from the designated liaison persons of

the Emergency Response Task Group.

This system ensures that information being supplied to the media is consistent,

accurate, and up-to-the-minute.

© 2020 National Association of Insurance Commissioners

Page 18

Logistics Task Group

The purpose of this Task Group is:

• To consult with other task groups regarding the DOI’s logistical and technical

capabilities, and requirements, to enable the efficient execution of the DOI’s State

Disaster Response Plan.

• To coordinate with the Emergency Response Task Group regarding logistical and

technical capabilities for Emergency Response Task Group and/or field or temporary

offices.

• To coordinate with other areas regarding logistical and technical capabilities for hotline

and other consumer communication needs.

The Logistics Task Group will be [insert location of home office or other designated

location] unless otherwise chosen by the Disaster Executive Committee due to necessity.

The duties of the Logistics Task Group are:

• To identify resource needs of the other task groups regarding the DOI’s logistical and

technical capabilities and requirements to enable the insurance department to respond

better and faster to disasters and include these in the implementation plan.

• To coordinate technical requirements for an alternate designated facility to ensure its

immediate activation in case the DOI’s home or central office is damaged/destroyed

in a disaster and include these in the implementation plan.

Members include:

• Senior staff from internal resource or budget.

• Senior staff from the information technology (IT) unit.

• Senior staff from any branch office locations.

Branch Office(s)

Branch offices will be responsible for addressing and solving problems where possible and

overseeing operations in their responsibility area.

While the composition and basic duties will be the same as those of the Emergency

Response Task Group, the branch office(s) will deal with the local problems and handle

them from a closer vantage point.

Branch offices will be established at the existing location of the branch offices, unless the

Emergency Response Task Group indicates a more appropriate location.

The branch office will be responsible for:

• Channeling information within the zone for which the branch office is responsible.

• Forwarding requests for speakers and press contacts to the Communications Task

Group.

• Obtaining general insurance information and all written material explaining how to

prepare claims from the Consumer Services Task Group.

© 2020 National Association of Insurance Commissioners

Page 19

• Routinely reporting to the Emergency Response Task Group about daily activities.

• Sending all problems that cannot be worked out locally to the Emergency Response

Task Group for review.

• Obtaining DOI brochures.

Members include senior staff from branch office location(s).

Where serious disputes or problems arise, the branch office will forward these

back to the Emergency Response Task Group; otherwise, the branch office will

manage its own operation and report only.

It is imperative that senior staff remain at the Branch Office Operations center for

command purposes.

These centers fall under the direction of the Emergency Response Task Group.

© 2020 National Association of Insurance Commissioners

Page 20

Appendix 1

Business Continuity Org

Chart

© 2020 National Association of Insurance Commissioners

Page 21

AGENCY HEAD

Insurance

Commissioner

INCIDENT COMMANDER

Commissioner or

Designee

[alt. ]

SAFETY OFFICER

Primary

[alt.]

EOC LIAISON OFFICER

Primary

[alt.

PUBLIC INFORMATION OFFICER

Primary

[alt. ]

LEGAL

Primary

[alt]

FINANCIAL &

ADMINISTRATIVE CHIEF

Primary

[alt.]

LOGISTICS CHIEF

Primary

[alt.]

PLANNING CHIEF

Primary

[alt.

OPERATIONS CHIEF

Primary

[alt.]

IT SUPPORT

Primary

[alt.]

FINANCIAL DIV &

ACTUARIAL STAFF

Primary

[alt.]

LIFE & HEALTH DIV

Primary

[alt.]

CONSUMER SERVICES

Primary

[alt.]

PROPERTY &

CASUALTY DIV

Primary

[alt.]

ADMINISTRATION

Primary [alt]

FINANCIAL

ANALYSIS

Primary

[alt.]

MARKET

CONDUCT

Primary

[alt.]

FRAUD

INVESTIGATION

Primary

[alt.]

LICENSING

Primary

[alt.]

FIELD

ANALYSIS

Primary

[alt.]

[ STATE ] INSURANCE DEPARTMENT

BUSINESS CONTINUITY PLAN - INCIDENT MANAGEMENT TEAM

Command Support Staff

Section Chiefs

Section Team Leads

Agency Head - Executive

Team Lead Support Staff

Rev. 7-25-2019 GBB

HUMAN

RESOURCES

Primary [alt]

BUSINESS OFFICE

Primary [alt]

Consumer Affairs

Primary

[alt.]

CAPTIVES

Primary

[alt.]

MARKET CONDUCT AND

FRAUD INVESTIGATION &

LICENSING

Primary

[alt.]

© 2020 National Association of Insurance Commissioners

Page 22

Appendix2

ResponseLe v elsand

De finitions

© 2020 National Association of Insurance Commissioners

Page 23

RESPONS

E LEVELS

AND

DEFINITIO

NS

Disaster Level 1

Disaster Level 2

Disaster Level 3

Disaster Level 4

Typical

Damage

Exterior Damage to

Private Property

Exterior Damage, Possibly Some

Interior Damage

, and Possibly Some

Structural Damage to Private and

Commercial Property. Infrastructure

Damage to Telephone and Power

Lines.

Exterior Damage, Interior

Damage

, and Structural Damage

to Private and Commercial

Property.

Infrastructure

Damage to Telephone and

Power Lines. Temporary

Interruption of Normal Public

Services.

Significant to Massive Exterior, Interior

and Structural Damage to Private and

Commercial Prop

erty. Infrastructure

Damage to

Telephone and Power Lines

and Possibly Cell Towers.

Communications, Public Services Lost for

Extended Time.

Insured Losses

Less than $100 Million

Between $100 Million and $1 Billion

Between $1 Billion and

$10

Billion

Greater than $10 Billion

Types of

Events

Rural Tornadoes

Rural Hailstorms

Rural Windstorms

Local Flash Floods

Town-leveling tornadoes

Suburban Hail and/or

windstorms

Area

-wide ice storms

Area

-wide flash floods

Rural & Residential

Forest/Wildfires

Region-wide

Region

-wide ice storms

Urban Tornadoes

Major outbreak

multiple tornadoes

Urban Floods

Urban/Suburban

Fires

Significant Blizzards

Moderate

earthquakes

Significant Earthquakes

A major New Madrid EQ

Significant record

-breaking

floods

Major influenza outbreak

Geographical

Extent

Localized

Localized to disbursed

Localized to widespread

Disbursed to widespread

Affected

Population

Small

Small to Moderate

Small to Large

Moderate to Large

Examples

Hoisington, Kansas

F4 Tornado (April 21,

2001) $43 Billion in

Damages

La Plata, Maryland F4 Tornado (April

28, 2002) $100M in Damage

Nashville Flood (May 1, 2010)

$1.5 Billion in Damages

Great Flood of 1993 (Missouri & Mississippi

Rivers) $15

–20 Billion in Damages

Haysville/Wichita, Kansas F4 Tornado

(May 3, 1999) $150 Million in

Damage

Oakland/Berkeley Firestorm

(October 19, 1991) $1.54

Billion in Damages

Northridge Earthquake (January 17,

1994) (Mag. 6.7 Mom. Mag.)

$15 Billion in

Damages

Greensburg, Kansas EF5 Tornado

(May 4, 2007) $153 million in

Damage

(Approx. 2

,000 claims)

Tornado Outbreak in KC, Okla.

City (May

2005) F3s & F4s

$3.2 Billion

FEMA Estimate for a Mag. 7.7

Earthquake

in Missouri: $30+ Billion in

Damages

© 2020 National Association of Insurance Commissioners

Page 24

DIRECTOR’S CONTACTS

TOP 20 P/C INDU

STRY CONTACT

LIST

Carrier Name

Director's Contact Name

Director's Contact Title

Director's Contact

Address

Director's

Contact E-mail

Director's

Contact Cell

Phone #

Director's

Contact Fax #

DIRECTOR’S CONTACTS

TOP 20 COMMERCIAL/ALLIED

LINES CONTACT LIST

Carrier Name

Director's Contact Name

Director's Contact Title

Director's Contact

Address

Director's

Contact E-mail

Director's

Contact Cell

Phone #

Director's

Contact Fax #

© 2020 National Association of Insurance Commissioners

Page 25

Appendix 3

Sample Contact Lists

© 2020 National Association of Insurance Commissioners

Page 26

INSURANCE TRADE ASSOCIATION and KEY INDUSTRY GROUPS

CONTACT LIST

STATE INSURANCE TRADE ASSOCIATION (SITA)

Address 1

Address 2

Executive Director:

Phone:

Fax:

E-mail Address:

Internet Address:

STATE INSURANCE AGENT ASSOCIATION

Address 1

Address 2

Executive Director:

Phone:

Fax:

E-mail Address:

Internet Address:

NATIONAL ASSOCIATION OF MUTUAL INSURANCE COMPANIES (NAMIC)

3601 Vincennes Rd

Indianapolis, IN 46268

Key Executive: Charles Chamness, CFO

Phone: 317-875-5250

Fax: 317-879-8408

E-mail Address: lforrester@namic.org or cchamness@namic.org

Internet Address: www.namic.org

© 2020 National Association of Insurance Commissioners

Page 27

INSURANCE SERVICES OFFICE (ISO)

2828 E. Trinity Mills Road, Suite 315

Carrolton, TX 75006

Assistant Regional Manager:

Phone

Fax:

E-mail Address:

Internet Address: www.iso.com

AMERICAN PROPERTY CASUALTY INSURANCE ASSOCIATION (APCIA)

Address:

City, State, Zip:

Contact:

Phone:

Fax:

E-mail Address:

Internet Address: www.pciaa.net

INSURANCE INFORMATION INSTITUTE (III)

110 William Street

New York, NY 10038

Key Executive:

Phone:

Fax:

E-mail Address

Internet Address: www.iii.org

© 2020 National Association of Insurance Commissioners

Page 28

STATE INSURANCE GUARANTY ASSOCIATIONS

Address1

Address 2

Contact:

Phone:

Fax:

E-mail Address:

Internet Address:

NATIONAL ASSOCIATION OF INSURANCE AND FINANCIAL ADVISORS (NAIFA)

Address 1

Address 2

Contact:

Phone:

Fax:

E-mail Address:

Internet Address:

NATIONAL COUNCIL ON COMPENSATION INSURANCE (NCCI)

Address 1

Address 2

Contact:

Phone:

Mobile:

Fax:

E-mail Address:

Internet Address:

© 2020 National Association of Insurance Commissioners

Page 29

STATE PROPERTY RESIDUAL MARKET OR FAIR PLAN

Address 1

Address 2

Manager:

Phone:

Fax:

E-mail Address:

Internet Address:

© 2020 National Association of Insurance Commissioners

Page 30

MEDIA CONTACTS (EXAMPLE FROM MISSOURI Department of Insurance)

Newspapers

Blue Springs Examiner

dbrendel @examiner.net

(816) 229-9161

Boonville Daily News, The

news@boonvillenews.com

(660) 882-5335

Branson Daily News, The

bdn@tri-lakes.ent

(417) 334-3161

Carthage Press, The

(417) 358-2191

Broadcast

Associated Press

pstevens@ap.org

Television Stations

KCTV

kctv@kctv.com

913-677-5555

KETC

letters@ketc.pbs.org

800-729-9966

Radio Stations

KAAN

rodneyh@netins.net

660-425-7575

KAHR

kool967@semo.net

866-917-9797

KALM -

417-264-7211

KAOL

660-542-0404

KBDZ

news@suntimesnews.com

573-547-2980

© 2020 National Association of Insurance Commissioners

Page 31

Appendix 4

Example Bulletins

© 2020 National Association of Insurance Commissioners

Page 32

TableofContents

UnderwritingGuidelinesforPersonalAutoandResidentialPropertyInsurance..................................................34

ExtensionofDeadlineforTWIAClaimantstoDemandAppraisalforClaims.........................................................35

MandatoryDataCallforInformationRegardingClaimsResultingfromHurricaneHarvey...................................36

HurricaneHarvey–UnderwritingGuidelinesforPersonalAutoandResidentialPropertyInsurance..................37

HurricaneHarvey–UnderwritingGuidelinesforPersonalAutoandResidentialPropertyInsurance.................38

HurricaneHarvey–FloodDamagedVehicles........................................................................................................ 39

HurricaneHarvey–PolicyNonrenewal.................................................................................................................40

HurricaneHarvey–RestrictingNewBusinessforPersonalAutoandResidentialPropertyInsurance................41

HurricaneHarvey–SuspensionofCertainLicensingRequirementsandFeesforCertainPersonsandEntities

LivingintheAreasAffectedbytheHarveyDisaster.............................................................................................42

HurricaneHarvey–SuspensionofCertainLicensingRequirementsandFees.....................................................43

HurricaneHarvey–Weather‐RelatedEventthatOccurredAugust25,2017,throughAugust31,2017............44

HurricaneHarvey–DenialofFloodLosses...........................................................................................................45

HurricaneHarvey–Anextraordinaryevent;Workers’compensationissuesconcerninghurricanevictimsor

evacuees................................................................................................................................................................46

Hurricane Harvey – Vacancy Provisions ................................................................................................................48

Hurricane Harvey – Vacancy Provisions ................................................................................................................49

HurricaneHarvey–Denial of Wind Loses ............................................................................................................50

HurricaneHarvey–CreditScoringandCreditInformation..................................................................................51

HurricaneHarvey–PropertyandCasualtyRatingandUnderwriting..................................................................52

HurricaneHarvey–PrescriptionMedicationCoverages......................................................................................53

HurricaneHarvey–CommercialAutomobileInsurance.......................................................................................54

HurricaneHarvey–PreauthorizedHealthCare,Referrals,NotificationofHospitalAdmissions,andMedical

NecessityReviews.................................................................................................................................................55

HurricaneHarvey–ClaimsAdjustingandAdjusters.............................................................................................57

HurricaneHarvey–MedicalEquipmentandServices..........................................................................................59

HurricaneHarvey–PremiumPaymentsGracePeriod.........................................................................................60

Weather‐RelatedEventthatOccurredMarch26,2017throughMarch27,2017...............................................61

© 2020 National Association of Insurance Commissioners

Page 33

UnderwritingGuidelinesforPersonalAutoandResidentialProperty

Insurance

To: ALL INSURANCE COMPANIES, CORPORATIONS, EXCHANGES, FARM MUTUALS,

COUNTY MUTUALS, MUTUALS, RECIPROCALS, ASSOCIATIONS, LLOYDS, OR

OTHER INSURERS WRITING PROPERTY AND CASUALTY INSURANCE IN THE STATE

OF TEXAS; AGENTS AND REPRESENTATIVES; AND THE PUBLIC GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under §418.017 of the Texas Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to

supplement state and local recovery efforts in the area affected by Hurricane Harvey.

Under Insurance Code §38.002, insurers must file updated underwriting guidelines with TDI each

time the guidelines change.

TDI also reminds insurers of the following laws related to underwriting:

Insurance Code Chapter 544, particularly §§544.303, 544.353, and 544.553;

Insurance Code §551.113; and

28 TAC §21.1007.

Insurers that do not comply with statutory requirements are subject to enforcement action.

Questions regarding this bulletin should be directed to the Property and Casualty Lines Office by

calling (512) 676-6710, or by email at CommercialPC@tdi.texas.gov.

For more information contact: Commercia[email protected]

© 2020 National Association of Insurance Commissioners

Page 34

ExtensionofDeadlineforTWIAClaimantstoDemandAppraisalforClaims

To: The Texas Windstorm Insurance Association; Agents and Representatives;

Adjusters; and the General Public.

The Texas Department of Insurance recently issued Commissioner's Order No. 2017-5226,

extending the deadline for a policyholder to demand appraisal of a claim arising from the weather-

related event, Hurricane Harvey, which occurred August 25, 2017, through August 31, 2017.

A policy claimant must timely demand appraisal to resolve disputes about the amount of loss

TWIA will pay for an accepted claim or accepted portions of a claim. With the extended deadline,

a claimant will have 120 days to demand appraisal after receiving TWIA’s written notice accepting

all or part of a claim arising from Hurricane Harvey.

TWIA’s appraisal process and requirements are described in Insurance Code §2210.574 and 28

Texas Administrative Code §§5.4211-5.4222, as well as TWIA’s policy contracts.

Commissioner's Order No. 2017-5226 can be found at: http://www.tdi.texas.gov/orders/index.html

For more information contact: Commercia[email protected]

© 2020 National Association of Insurance Commissioners

Page 35

MandatoryDataCallforInformationRegardingClaimsResultingfrom

HurricaneHarvey

To: All Companies, Corporations, Exchanges, Mutuals, County Mutuals, Farm Mutuals,

Reciprocals, Associations, Lloyds, or Other Insurers Writing Property and Casualty

Insurance in the State of Texas, and their Agents and Representatives

The Texas Department of Insurance issues a mandatory data call for certain information related

to claims resulting from Hurricane Harvey in Angelina, Aransas, Atascosa, Austin, Bastrop, Bee,

Bexar, Brazoria, Brazos, Burleson, Caldwell, Calhoun, Cameron, Chambers, Colorado, Comal,

DeWitt, Fayette, Fort Bend, Galveston, Goliad, Gonzales, Grimes, Guadalupe, Hardin, Harris,

Hays, Hidalgo, Jackson, Jasper, Jefferson, Jim Wells, Karnes, Kerr, Kleberg, Lavaca, Lee, Leon,

Liberty, Live Oak, Madison, Matagorda, Montgomery, Newton, Nueces, Orange, Polk, Refugio,

Sabine, San Jacinto, San Patricio, Travis, Trinity, Tyler, Victoria, Walker, Waller, Washington,

Wharton, Willacy, Williamson, and Wilson counties. TDI requests this information under

Insurance Code Chapters 401 and 402.

This call is designed to provide TDI with immediate access to information necessary to determine

the financial and other impacts of claims related to Hurricane Harvey on the various property and

casualty insurers doing business in the State of Texas, and the property and casualty industry as

a whole.

TDI directs all of the above-referenced insurers and their agents and representatives to provide

data using the attached Hurricane Harvey reporting forms and instructions. You must complete

and return your initial response to this data call no later than October 31, 2017. Subsequent

submissions are due monthly.

Certain property and casualty insurers doing business in the State of Texas will be required to file

additional data related to residential property claims.

Please email completed submissions to [email protected].

For questions regarding this bulletin, please contact the Property and Casualty Actuarial Office,

Data Services Team at (512) 676-6690, or HurricaneData@tdi.texas.gov.

Attachments:

Harvey Data Call Reporting Form

Harvey Data Call Instructions

For more information contact: [email protected]exas.gov

© 2020 National Association of Insurance Commissioners

Page 36

HurricaneHarvey–UnderwritingGuidelinesforPersonalAutoand

ResidentialPropertyInsurance

To: ALL INSURANCE COMPANIES, CORPORATIONS, EXCHANGES, FARM MUTUALS,

COUNTY MUTUALS, MUTUALS, RECIPROCALS, ASSOCIATIONS, LLOYDS, OR

OTHER INSURERS WRITING PROPERTY AND CASUALTY INSURANCE IN THE STATE

OF TEXAS; AGENTS AND REPRESENTATIVES; AND THE PUBLIC GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under §418.017 of the Texas Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to

supplement state and local recovery efforts in the area affected by Hurricane Harvey.

Under Insurance Code §38.002, insurers must file updated underwriting guidelines with TDI each

time the guidelines change.

TDI also reminds insurers of the following laws related to underwriting:

Insurance Code Chapter 544, particularly §§544.303, 544.353, and 544.553;

Insurance Code §551.113; and

28 TAC §21.1007.

Insurers that do not comply with statutory requirements are subject to enforcement action.

Questions regarding this bulletin should be directed to the Property and Casualty Lines Office by

calling (512) 676-6710, or by email at CommercialPC@tdi.texas.gov.

© 2020 National Association of Insurance Commissioners

Page 37

HurricaneHarvey–UnderwritingGuidelinesforPersonalAutoand

ResidentialPropertyInsurance

To: ALL INSURANCE COMPANIES, CORPORATIONS, EXCHANGES, COUNTY MUTUALS,

MUTUALS, RECIPROCALS, ASSOCIATIONS, LLOYDS, OR OTHER INSURERS

WRITING PROPERTY AND CASUALTY INSURANCE IN THE STATE OF TEXAS;

AGENTS AND REPRESENTATIVES; AND THE PUBLIC GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under §418.017 of the Texas Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to

supplement state and local recovery efforts in the area affected by Hurricane Harvey.

TDI reminds insurers that the Insurance Code requires that when contemplating reducing

business below the thresholds set out in Insurance Code §827.003, they must file a withdrawal

plan with TDI for prior approval. The withdrawal plan must contain the provisions listed in

Insurance Code §827.004, and TDI's approval process is described in Insurance Code §827.005.

See also 28 TAC Chapter 7, Subchapter R. Insurers file withdrawal plans with the Company

Licensing and Registration Office by email at [email protected].

Insurers that do not comply with statutory requirements are subject to enforcement action.

Questions regarding this bulletin should be directed to the Company Licensing and Registration

Office by calling 512-676-6375, or by email at CompanyLicense@tdi.texas.gov.

For more information contact: ChiefCler[email protected]

© 2020 National Association of Insurance Commissioners

Page 38

HurricaneHarvey–FloodDamagedVehicles

To: ALL PROPERTY AND CASUALTY INSURANCE COMPANIES, CORPORATIONS,

EXCHANGES, MUTUALS, COUNTY MUTUALS, RECIPROCALS, ASSOCIATIONS,

LLOYDS INSURERS WRITING PROPERTY AND CASUALTY INSURANCE IN THE

STATE OF TEXAS; AGENTS AND REPRESENTATIVES; AND THE PUBLIC

GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under §418.017 of the Texas Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to

supplement state and local recovery efforts in the areas affected by Hurricane Harvey.

Because of the recent heavy rains and flooding across Texas, the Texas Department of

Insurance issues this bulletin to remind insurers of their obligations regarding losses to motor

vehicles due to flood damage. Titles for flood-damaged vehicles must comply with the Texas

Transportation Code.

Under Transportation Code §501.1001(a), an insurance company licensed to conduct business in

Texas that acquires, through payment of a claim, ownership, or possession of a salvage motor

vehicle or nonrepairable motor must surrender the properly assigned evidence of ownership and

apply for the appropriate title under Transportation Code §501.097. Transportation Code

§501.095 prohibits an insurer from selling a motor vehicle to which §501.095 applies unless the

Texas Department of Motor Vehicles (TxDMV) has issued a salvage vehicle title or a

nonrepairable vehicle title for the motor vehicle, or a comparable ownership document has been

issued by another state or jurisdiction for the motor vehicle.

Transportation Code §501.09112(d) and (f) require that a salvage or nonrepairable vehicle title or

a salvage or nonrepairable record of title for a vehicle that is a salvage or nonrepairable motor

vehicle because of damage caused exclusively by flood must bear a notation that the TxDMV

considers appropriate. The TxDMV applies the “FLOOD DAMAGE” notation to these vehicles.

TDI encourages insurers to take measures to ensure that Vehicle Identification Numbers and

other pertinent information are accurate. You can find further information about salvage vehicle

titles and requirements at www.txdmv.gov/salvage-nonrepairable-manual.

Direct questions about this bulletin to the Property and Casualty Lines Office by calling (512) 676-

6710, or by email at Commerc[email protected].

For more information contact: ChiefCler[email protected]

© 2020 National Association of Insurance Commissioners

Page 39

HurricaneHarvey–PolicyNonrenewal

To: ALL INSURANCE COMPANIES, CORPORATIONS, EXCHANGES, COUNTY MUTUALS,

FARM MUTUALS, MUTUALS, RECIPROCALS, ASSOCIATIONS, LLOYDS, OR OTHER

INSURERS WRITING PROPERTY AND CASUALTY INSURANCE IN THE STATE OF

TEXAS; AGENTS AND REPRESENTATIVES; AND THE PUBLIC GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under §418.017 of the Texas Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to

supplement state and local recovery efforts in the area affected by Hurricane Harvey.

TDI reminds insurers of their obligations under Insurance Code Chapter 551:

Under Insurance Code 551.107 when nonrenewing a standard fire, homeowners, or farm

or ranch owners policy due to a policyholder filing three or more claims under a policy in

any three-year period, insurers may not consider:

losses caused by natural causes;

claims filed but not paid or payable; or

claims history for water damage under Insurance Code §544.353.

Insurers may not consider a customer inquiry as a basis for nonrenewal under Insurance

Code §551.113.

All insurers should remember to comply with the requirements of Insurance Code Chapter

551 as applicable to the lines of coverage they write.

In addition, insurers should remember that practices related to nonrenewal are subject to

restrictions against unfair discrimination under Insurance Code Chapter 544, Subchapters A and

B.

Insurers that do not comply with statutory requirements are subject to enforcement action.

Questions regarding this bulletin should be directed to the Property and Casualty Lines Office by

calling (512) 676-6710, or by email at CommercialPC@tdi.texas.gov.

For more information contact: Commercia[email protected]

© 2020 National Association of Insurance Commissioners

Page 40

HurricaneHarvey–RestrictingNewBusinessforPersonalAutoand

ResidentialPropertyInsurance

To: ALL INSURANCE COMPANIES, CORPORATIONS, EXCHANGES, COUNTY MUTUALS,

MUTUALS, RECIPROCALS, ASSOCIATIONS, LLOYDS, OR OTHER INSURERS

WRITING PROPERTY AND CASUALTY INSURANCE IN THE STATE OF TEXAS;

AGENTS AND REPRESENTATIVES; AND THE PUBLIC GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under §418.017 of the Texas Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to

supplement state and local recovery efforts in the area affected by Hurricane Harvey.

TDI reminds insurers that before they may restrict writing new business in response to a

catastrophic natural event, they must file a restriction plan with TDI and obtain prior approval

under Insurance Code §827.008. Insurers file restriction plans with the Company Licensing and

Registration Office by email at [email protected].

Insurers that do not comply with statutory requirements are subject to enforcement action.

Questions regarding this bulletin should be directed to the Company Licensing and Registration

Office by calling 512-676-6375, or by email at CompanyLicense@tdi.texas.gov.

For more information contact: [email protected]as.gov

© 2020 National Association of Insurance Commissioners

Page 41

HurricaneHarvey–SuspensionofCertainLicensingRequirementsandFees

forCertainPersonsandEntitiesLivingintheAreasAffectedbytheHarvey

Disaster

To: TITLE AGENTS; ESCROW OFFICERS; LIFE SETTLEMENT BROKERS; LIFE

SETTLEMENT PROVIDERS; PREMIUM FINANCE COMPANIES; UTILIZATION REVIEW

AGENTS; AND THE PUBLIC GENERALLY

Governor Greg Abbott issued a proclamation declaring a disaster due to the effects of Hurricane

Harvey. The proclamation directs that all necessary measures, both public and private, as

authorized under § 418.017 of the Government Code, be implemented to meet that threat.

President Donald Trump issued a major disaster declaration and ordered federal aid to