PROPERTY TAX

EXEMPTION MANUAL

Approved by the

State Board of Equalization

•

October 2023

State Board of equalization ProPerty tax exemPtion manual

Contents

i

I. Introduction ....................................................................................................................1

II. WhatQualiesforExemption? ..................................................................................2

a. Basicl Requirements .......................................................................................................2

b. PropertyofReligious,Charitable,Scientic,orNon-ProtEducationalInstitutions ....2

i. Owner,OccupancyandUse ......................................................................................2

ii. ChurchesorReligiousInstitutions ...........................................................................3

iii.CharitableInstitutions ............................................................................................. 4

iv.MedicalFacilitiesandNursingHomes .....................................................................5

v. ScienticandNon-ProtEducationalInstitutions ................................................. 6

vi.MiscellaneousExemptions....................................................................................... 6

c. Government Property.....................................................................................................7

d.PropertyofHousingAuthorities ................................................................................... 8

e. HousingProjectsConstructedwithHOMEorHousingTrustFunds ......................... 8

f. LowCostHousingforLow-IncomeDisabledandElderly .......................................... 9

g. PropertyOwnedbyCharitableInstitutionsforConstructionofResidential

HousingforLow-IncomeFamilies .............................................................................10

h.RecyclingorWasteDisposalFacilities ........................................................................ 11

i. PrivateActHospitals .................................................................................................... 11

j. BurialPlacesandCemeteries ....................................................................................... 11

k. Crops,Livestock,andPoultry ......................................................................................12

l. PropertyPassingThroughTennessee ..........................................................................12

m.ImprovementorRestorationofHistoricProperties ...................................................12

n.Public-UseAirportRunways ........................................................................................14

o. CommunityandPerformingArtsCenters ...................................................................14

p.FamilyWellnessCenters .............................................................................................. 15

q. Museums ......................................................................................................................16

III.ApplyingforExemption ................................................................................................16

a. NewPropertyUnderConstruction ............................................................................. 20

b.PartialExemptions ....................................................................................................... 21

c. EectiveDateofExemption ....................................................................................... 22

IV. TheAppealProcess .................................................................................................... 24

V. LeasedorRentedProperty........................................................................................25

VI. RevocationofExemption ...........................................................................................25

VII. ChangestoPropertyAfterInitialExemption ...................................................... 26

a. ChangeinUseofProperty .......................................................................................... 26

b.NewConstructionLandRenovationofExemptProperty .......................................... 26

c. NameChangesofExemptInstitution......................................................................... 26

d.CombiningParcels .......................................................................................................27

e. TransferofExemptProperty .......................................................................................27

VIII.ShouldIPayMyTaxesWhileMyApplicationorAppealisPending? ...........27

IX. FAQ ................................................................................................................................ 28

I

1

State Board of equalization ProPerty tax exemPtion manual

ThepurposeofthismanualistoeducatethereaderaboutpropertytaxexemptionsinTennessee

andinformtaxpayersandgovernmentocialsabouthowexemptiondecisionsaremade.

TheTennesseeStateConstitutionrequiresthatallrealandpersonalpropertybetaxed,except

“thedirectproductofthesoil”whenownedbytheproducerortherstbuyer,moneydeposited

inanindividualorfamily’scheckingaccount,andarticlesmanufacturedfromTennesseeraw

materials.

1

TheConstitutiongrantstothelegislaturetheauthoritytoexemptothercategoriesof

propertyifthepropertyisownedbystateorlocalgovernments,orifitisownedbyaqualifying

organizationandusedforpurelyreligious,charitable,scientic,literaryoreducationalpurposes.

PropertytaxexemptionsareaddressedinTitle67,Chapter5,oftheTennesseeCode.Thecode

denesthetypesofpropertythatmayqualifyfortaxexemptionandestablishestherequirements

for obtaining an exemption. This manual will discuss the categories of exempt property, the

processofapplyingforapropertytaxexemption,andhowpreviouslyapprovedpropertythat

nolongermeetstherequirementsmaybeaddedbacktothecounty’staxrolls.Unlessasection

saysotherwise,thismanualappliestobothrealandpersonalproperty.Propertiesapprovedfor

exemptionareremovedfromacounty’staxrole(i.e.,theownersdonotpaypropertytaxes).

The State Board of Equalization (the “State Board”) reviews all property tax exemption

applications.TheStateBoardwillassignan“ExemptionDesignee”toreview theapplication.

An Exemption Designee is an attorney working for the State Board. He or she is a neutral

partyresponsibleforreviewinganapplicationanddeterminingifthepropertymeetsthelaws’

requirements.AftertheExemptionDesigneehasreviewedtheapplication,heorshewillissuean

“InitialDetermination”totheapplicantandappropriatecountyocialsidentifyingwhetherthe

propertyqualiesfortaxexemptionand,ifapproved,whenthatexemptionbegins.Inadditionto

thetopicspreviouslyidentied,thismanualwilldiscusshowtoappealanInitialDetermination

andaddresssomefrequentlyreceivedquestionsbyouroce.Shouldyouhavespecicquestions

outsideofthosediscussed,pleasecontactusattheinformationbelow.

HowtoContacttheStateBoard

ByPhone: (615)401-7883

ByFax: (615)253-4847

ByMail: TennesseeComptrolleroftheTreasury

StateBoardofEqualization

CordellHullBuilding

425Rep.JohnLewisWayN.

Nashville,TN37243

FileanApplicationorAppeal: www.comptroller.tn.gov/boards/state-board-of-equalization.html

PurPose of the exemPtion manual

introduCtion

1

Tenn.Const.Art.II§§28,30.

2

State Board of equalization ProPerty tax exemPtion manual

Tennesseelawholdsthatallproperty,realandpersonal,mustbeassessedfortaxationunless

itis exempt. Thereare three broadcategories ofexemptproperty: productsofthe Stateof

Tennessee; government-owned property; and religious, charitable, scientic, or non-prot

educationalproperty.

TheTennesseeCodesetsforthspecicrequirementsforeachoftheabovecategories.Withinthe

broadcategoryofreligious,charitable,scientic,ornon-proteducationalproperties,thereisone

broad,generalstatute,andseveralmorespecicstatutes.Ifapropertymeetstherequirements

ofoneormorestatutes,itwillbeexempted.Ifapropertydoesnotmeettherequirementsofone

sectionbutdoesmeettherequirementsofanother,thepropertywillstillbeexempted.Unlessthe

categorythepropertyisapprovedunderimposesspecicrequirements,theoutcomewillbethe

same.Thedierentcategoriesandtheirspecicrequirementsandlimitationsarediscussedbelow.

BasicRequirements

Therearesomebasicrequirementstoqualifyforexemptioninanycategory.Inalmosteverycase,

theentityseekinganexemptionmustapplytotheStateBoard.Iftheapplicantisnotrequiredto

applyduetothetypeofpropertyorexemptionsoughtitwillbenotedinthecorrespondingsection

ofthismanual.Thesecondbasicrequirementisthattheentitymustownthepropertyinquestion.

ExceptionsHappen

Thereareafewexemptionsavailableonlyunderspeciccircumstances.Thesespeciccategories

andexceptionsarenotdiscussedhere,butrestassured–theStateBoardwillreviewallexemption

applicationsinallcategories,eventheoddones.

IndividualPersonalProperty

Alltangible personalpropertythat isowned by individualsor familiesiseither exemptfrom

taxationorconsideredtohavenovalueforpropertytaxpurposes.Additionally,theentirevalue

ofanindividual’sorafamily’spersonalcheckingandsavingsaccountsisexempt.Thissection

doesnotapplytocommercialorindustrialproperty.

Tennesseelawexemptsthepropertyofreligious,charitable,scientic,andnon-proteducational

institutions.Thereareseveralgeneralprovisionswhichapplytoeachofthesecategories.

Ownership,Occupancy,andUse

Propertymustbeowned,occupied,andactuallyusedbyaqualifyinginstitutiontobeexempted.

An“exemptinstitution”isareligious,charitable,scientic,ornon-proteducationalinstitution.

Theentityapplyingforexemptionmustowntheproperty,inwholeorinpart.Partialownership

maybeacceptableinsomecasesandisdiscussedininmoredetailunderthe“PartialExemption”

section on page 21.

What Qualifies for ProPerty tax exemPtion?

ProPerty of religious, Charitable, sCientifiC or nonProfit eduCational institutions

3

State Board of equalization ProPerty tax exemPtion manual

Thepropertymustalsobeoccupiedtobeapproved.Therearenopredeterminedstandardsof

usetoconsiderapropertyoccupied.Propertythatisownedforapurposebutisneverusedis

insucient – in this case, the property is not occupied or used. Likewise, the property must

beused,andnotheldforuseinthefuture.Adeterminationthatapropertyisnotsuciently

usedoroccupiedisfact-dependent,andmadeaftertheExemptionDesigneehasobtainedthe

relevantinformationfromtheapplicantandcountyassessor.TheStateBoardwillpresumethat

therstveacresofapropertyareinuseunlesstoldorotherwisediscoveredthroughreasonable

investigation.

2

Thepropertymustbeusedforanexemptpurposeoftheinstitution.Thisrequirementisread

broadly.Itincludesusesdirectlyincidentaltoorreasonablynecessaryfortheexemptpurpose

oftheinstitution;forexample,achurchdoesnotexisttoprovideparking,butprovidingparking

toworshippersisreasonablynecessaryfortheuseofthechurch.Achurchmayuseitsbuilding

forworshipservicesbutusingabuildingforstoringchurchpropertyorformeetingsofchurch

smallgroupsmayalsobeconsideredanexemptuseoftheproperty.Likewise,propertyusedby

acharitableinstitutionforadministrativedutiesorstatrainingmaybeconsideredusedforan

exemptpurpose.Despitethebroadreadingofthisrequirement,therearelimitations.

3

Thepropertyofaqualifyinginstitutionmaynotbeexemptwheretheuseofthepropertyonly

generallypromotestheinstitution’spurpose.Itistheuseoftheproperty,andnotthecharitable

natureofitsowner,whichdeterminesitsexemptstatus.Thiscaveatisparticularlyapplicable

where the suspect use of the property generates revenue.

4

Itistheuseoftheproperty,andnot

thecharitablenatureofits owner,whichdetermines itsexemptstatus.Acharitable property

withanattachedbar,orareligiouspropertywithanattachedcoeeshop,willnotqualifyeven

whentherevenueearnedsupportstheinstitutionasawhole.

Finally,acharitableinstitutiondoesnothavetoberegisteredwiththeInternalRevenueService

asa§501(c)(3)organizationtobeexempted.Likewise,thepropertyofaregistered§501(c)(3)is

notautomaticallyexempted.

Propertyownedbyaqualifyinginstitutionthatisleased,rented,orotherwiseusedbyanotherexempt

institutionmayalsobeexempt.See“LeasedorRentedProperty”onpage25formoreinformation.

Theprimarychurch,temple,orotherhouseofworshipofareligiousinstitutioncanbeexempted,

butotherpropertiesownedbyareligiousinstitutionmayqualifyforexemptionaswell.Other

propertiesqualifyingcouldbeaseparatefacilityusedforstorage,lotsforoverowparking,or

buildingsusedtocollectanddistributefoodandclothestoneedymembersofthecommunity.

Ofcourse,therearelimitationsonwhatreligious propertywillqualify.Asinterpretedbythe

TennesseeCourtofAppeals,theuseofthepropertymustbe“directlyincidentalto”or“anintegral

partof”theinstitution’sexemptpurpose.Forexample,achurchmaysupportmissionarywork,

butaresidenceformissionariestostayinwhentheyareintheareawillnotqualifyforexemption.

2

Tenn.Comp.R.&Regs.0600-08-.02(2)(b).

3

See First Presbyterian Church of Chattanooga v. Tennessee Bd. of Equalization,127S.W.3d742(Tenn.Ct.App.2003).

4

Christ Church Pentecostal v. Tennessee State Bd. of Equalization,428S.W.3d800,813(Tenn.Ct.App.2013).

ChurChes or religious institutions

4

State Board of equalization ProPerty tax exemPtion manual

Inthiscase,thepropertyisnot“directlyincidental”tothechurch’sreligiouspurpose.

5

Property

ownedbyachurchbutnotusedisalsonotexempt.Achurchmaypurchaseapropertywiththe

intenttodemolishthestructuresandputinaparkinglot,butifthatpropertyisnotcurrently

beinguseditisnotexempt.

Aspartoftheirapplication,theStateBoardwillrequestreligiousinstitutionstoprovidetheir

charter, articles of incorporation, or other governing documents (e.g., bylaws or operating

agreements),inadditiontorecentnancialdocumentssuchasataxreturn,budget,orincome

andexpensestatement.Ifareligiousinstitutionisunincorporatedandwithoutanygoverning

documentsitmustprovideabriefwrittenexplanationofhowdecisionsaremade.Afterreceiving

thewrittenexplanation,theExemptionDesigneewilldetermineifitissucientandwillrequest

anyadditionaldocumentationasneeded.

Religious institutions may benet from an additional provision regarding the date their

exemptionbegins.See“SpecialEectiveDateProvisionforReligiousInstitutions”onpage22

for more information.

Parsonage

Areligiousinstitutionmayalsoobtainanexemptionforoneparsonage.Asdened,a“parsonage”

is a residence owned by a religious institution where a full-time regular minister resides.

6

A

religiousinstitutionmayonlyhaveoneexemptparsonage,andmaynotincludemorethanthree

acresofland.

Propertyownedbyacharitableinstitutionandusedforanexemptpurpose,orforausedirectly

incidentalthereto,maybeexempted.

For exemption purposes, a “charitable institution” includes “any nonprot organization

or association devoting its eorts and property, or any portion thereof, exclusively to the

improvementofhumanrightsand/orconditionsinthecommunity.”

7

Whether an institution is

consideredcharitablewilloftendependonwhattheinstitutiondoes,andwhatitdoeswiththe

property in question.

Anexemptpurposeoruseofacharitablepropertyisonethatsupportstheinstitution’scharitable

mission.Thecharitablemissionofaninstitutioncanrangebroadly.Forexample,distributing

clothingorfoodtothepoorisconsideredcharitable,butsoisasanctuaryforat-riskelephants

andagolfcoursepurposebuilttoteachyouthshowtoplaygolf.

Whether a property is depends on the circumstances. No two properties are identical and,

depending on the application, additional information may be needed to make a proper

determination.Ajudgeupheldthepurpose-builtgolfcourseaboveascharitablebecausetheholes

5

Missionary housing-First Presbyterian Church of Chattanooga v. Tennessee State Bd. of Equalization,127S.W.3d742

(Tenn.Ct.App.2003).

6

Tenn.Comp.R.&Regs.0600-08-.02(6); See also Blackwood Bros. Evangelistic Ass’n v. State Bd. of Equalization, 614S.W.2d

364(Tenn.Ct.App.1980).

7

Tenn.CodeAnn.§67-5-212(c).

Charitable institutions

5

State Board of equalization ProPerty tax exemPtion manual

wereshortertoaccommodateyoungpeople,theownermadeeortstoencourageparticipation

byminorities,low-income,anddisabledindividuals,andtheinstitution’sfeeswerewaivedfor

thoseunabletopay.Ultimately,theinstitutionapplyingfortheexemptionisinthebestposition

toshow itsworkis charitableand shouldsupplywhatever informationwill demonstratethis

to the Exemption Designee. The institution may provide a list of the services or programs it

provides,whoitstargetaudienceis,adescriptionofitsfeestructureand/orfeewaivers,etc.

AllofthesemayfactorintotheExemptionDesignee’sdecisionastowhethertheinstitutionis

charitableundertheapplicableexemptionlaws.

Apropertymaybeheldasnon-charitable(andnon-exempt)wheretheprimaryuseisnotcharitable

innature.TheTennesseeSupremeCourthasheldthatwhereaclubwasoverwhelminglydevoted

toathleticsandsocialevents,aminimalamountofcharitableworkwasinsucienttoexempt

thepropertybased onthose minimal charitableuses.

8

Similar reasoning hasbeen applied to

ChambersofCommerceand,morerecently,VanderbiltUniversity’sfraternityhouses.

9

Medicalfacilitiesandnursinghomesmaybeexemptedascharitableinstitutions.Ofcourse,this

determinationdependsonthefactsatissue.Aninitialconsiderationiswhethertheinstitutionis

for-protornot-forprot.For-protmedicalfacilitiesarenoteligibleforpropertytaxexemption.

Anotherimportantdistinctionisdrawnbetweena“clinic,”andahospitalorotherlicensedhealthcare

facilitythatprovides medical care. Clinicswillbe discussed below. Licensednon-prothospitals,

nursinghomes,dialysisclinics,andothersimilarlyregulatedfacilitieswillalmostalwaysqualifyfor

exemption.Thereisageneralpresumptionthatlicensedorcertiedmedicalandnursingfacilities

areexempt.

10

Otherfactorsthatshowthefacilityisorisnotcharitablewillalsobeconsidered.

Forexemptionpurposes,a“clinic”isanyfacilityotherthanahospitalorotherlicensedhealthcare

facilitythatprovidesprimarymedicalcare.Tenn.Comp.R.&Regs.0600-08-.03(1).Specialty

facilitiessuchascardiovascularorsurgicalclinicsareconsidered“clinics”forthispurpose.For

aclinictoqualifyforexemptionitmust:

1. Beownedbyacharitableinstitution;

2. Belocatedinamedicallyunderservedareaorserveamedicallyunderserved

population.Thedeterminationthatanareaorpopulationismedicallyunderserved

ismadebytheU.S.DepartmentofHealthandHumanServicesortheStateof

Tennessee;

3. Provideserviceswithoutregardfortheabilitytopay.Iftheclinicacceptsany

insuranceitmustalsoacceptTennCare,Medicare,anduninsuredpatients;

4. Eithernotchargeforitsservices,oritsfeesmustbeadjustedforhouseholdincome

andfamilysize;and,

5. Notpayanyemployeemorethanwhatisreasonable,comparedtoothersimilarly

qualiedandexperiencedstaatotherinstitutionsprovidingthesameservices.

8

State v. Rowan, 171Tenn.612,106S.W.2d861(Tenn.1937).

9

Memphis Chamber of Commerce v. City of Memphis,232S.W.73,73(Tenn.1921);SeealsoVanderbilt Univ. v. Tennessee State

Bd. of Equalization,No.M201401386COAR3CV,2015WL1870194,at*9(Tenn.Ct.App.Apr.22,2015).

10

See Baptist Hosp. v. City of Nashville,3S.W.2d1059(Tenn.1928);Downtown Hosp. Ass’n v. Tennessee State Bd. of

Equalization,760S.W.2d954,957(Tenn.Ct.App.1988);Christian Home For The Aged, Inc. v. Tenn. Assessment Appeals

Comm’n, 790S.W.2d288(Tenn.Ct.App.1990)(armingtheexemptionofanursinghomewithlittlediscussionaboutitexcept

thefactualrecitation).

mediCal faCilities and nursing homes

6

State Board of equalization ProPerty tax exemPtion manual

The property of a scientic or non-prot educational institution may be exempt if it meets the

generalownership,occupancy,anduserequirementsdescribedabove.Thiscanincludeusesdirectly

incidentaltotheeducationalorscienticusesoftheproperty–auniversitymayneedlargeparking

areasforitsstudents,orwalkwaystofacilitatestudentsgettingfromoneareaofcampustoanother.

Thereareseveralinstitutionsandpropertyusesthatarespecicallyidentiedunderthesection

generallyexemptingreligious,charitable,scientic,ornon-proteducationalproperties.These

arelistedandbrieydescribedbelow.

FraternalOrganizationsExemptedfromFederalIncomeTaxes

11

The property of fraternal organizations (Shriners International, Veterans of Foreign Wars,

etc.)recognizedasa§501(c)organizationbytheIRSmaybeexemptedtotheextentthatthe

propertyis useddirectly andexclusively forreligious, charitable,scientic andeducational

activities.Areasusedasabar,kitchen,orothermeansofgeneratingrevenueareconsidered

commercialusesandwillnotqualify.

Non-ProtCountyFairAssociations

12

Thepropertyofanon-protcountyfairassociationisexemptfrompropertytaxes.

Caretaker’sResidenceinaPark

13

Acommunityparkthatisopentothegeneralpublicmaybeexemptedforoneoccupiedresidence

locatedinthepark.Theresidencemustbeownedbyanon-protreligious,charitable,scientic

oreducationalinstitution.Thepurposeoftheresidence,andcaretaker,mustbetodiscourage

vandalismoftheproperty.Theinstitutionmustnotchargethecaretaker,andthecaretakermust

not live there in lieu of receiving a salary.

Additionally, a caretaker’s residence on property owned by a non-prot institution that is

charteredbytheUnitedStatesCongressmaybeexemptifthecaretaker’spresenceisrequired

forthesecurityofusersoftheproperty,andtodiscouragevandalism.Ofcourse,thisexemption

onlyappliesifthelandisusedforreligious,charitable,educational,orscienticpurposes.

PublicBroadcastRadioandTelevision

14

Thepropertyofapublicradiobroadcasterholdinganeducationalbroadcastlicenseissuedby

theFederalCommunicationsCommission(the“FCC”)isexemptfrompropertytaxation,tothe

extentthepropertyisusedconsistentlywiththelicense.

misCellaneous exemPtions

sCientifiC and non-Profit eduCational institutions

11

Tenn.CodeAnn.§67-5-212(g).

12

Tenn.CodeAnn.§67-5-212(h).

13

Tenn.CodeAnn.§67-5-212(i).

14

Tenn.CodeAnn.§67-5-212(k).

7

State Board of equalization ProPerty tax exemPtion manual

Thepropertyofapublictelevisionbroadcasterthathasanoncommercialeducationalbroadcast

license issued by the FCC is exempt, if the broadcaster is an aliate member of the public

broadcastingnetworkandisorganizedasanonprotcharitableoreducationalinstitution.

ReligiousandCharitableThriftShops

15

Thepropertyofareligious orcharitableinstitutionusedas athriftshopmaybe exemptifit

meets the following requirements:

1) TheinstitutionisexemptedbytheIRSunder§501(c)(3)oftheInternalRevenue

Code;

2) Thethriftshopisoperatedprimarilybyvolunteers,orasatrainingvenueforthose

needingoccupationalrehabilitation;

3) Theinventoryofthethriftshopisdonatedtotheinstitutionthatownsandoperatesit;

4) Goodsarepricedatusedvalues;

5) Goodsaregiventoindividualswhoarenanciallyunabletopay;and,

6) Thenetproceedsareusedsolelyforthecharitablepurpose(s)oftheinstitution.

LaborOrganizations

Thepropertyoflabororganizationsrecognizedas§501(c)(5)organizationsbytheIRSisexempt

whenitisusedforcharitableoreducationalpurposes.Partialexemptionsunderthischaptermay

begrantedifpartofthepropertyisusedforrevenue-producingactivities.Theimprovementsused

fornon-exemptpurposesarenotexempt,but,inthissectiononly,theunderlyinglandisexempt.

Propertyownedbyfederal,state,orlocalgovernmentsisexemptfromtaxationsolongasitis

usedforpublicpurposes.

17

Governmentpropertyincludesthepropertyofaschooloruniversity

owned by the state or operated by the state as a trustee. Likewise, any roads, alleys, streets,

orpromenadesthatarededicatedtoandavailableforpublicusefreeofchargeareexempt.

18

Finally,state,county,andmunicipalbondsarenotsubjecttotaxation.

19

Anexemptionapplicationdoesnotneedto besubmittedforpropertyunder thesestatutes –

rather,thecountyassessorwherethepropertyislocatedmayexempttheseproperties.Ifitis

questionablewhetherpropertyisexempt,thetaxpayermaycontacttheStateBoardforassistance

ormaychoosetoapplytopreservetheearliestpossibleeectivedate.

SplitOwnership

Propertyinwhichthegovernmenthasapartialownershipinterestwillbeexempttotheextent

ofthegovernment’sinterest.

15

Tenn.CodeAnn.§67-5-212(m).

16

SeeTenn.CodeAnn.§67-5-203forpropertyusedexclusivelyforgovernmentalpurposes;Tenn.CodeAnn.§67-5-204for

dedicatedrights-of-way;and,Tenn.CodeAnn.§67-5-205forState,County,andMunicipalbonds.

17

Tenn.CodeAnn.§67-5-203specicallyprovides“thatrealpropertypurchasedforinvestmentpurposesbytheTennessee

consolidatedretirementsystemshallbesubjecttopropertytaxation.”

18

Tenn.CodeAnn.§67-5-204.

19

Tenn.CodeAnn.§67-5-205(a)(1)speciesthatstateorstateagencybondsaresubjecttoinheritance,transfer,andestatetaxes.

government ProPerty

16

8

State Board of equalization ProPerty tax exemPtion manual

Propertyownedbyhousingauthoritiesmaybeexemptifthehousingauthorityagreestomake

apaymentinlieuoftaxes(a“PILOT”)totheappropriategovernmentorpoliticalsubdivision

for“services, improvements,orfacilities” providedby thatsubdivision forthebenet ofthat

housing authority.

20

“Services”doesnotmeangeneralserviceslikeaccesstoroads,thecourtsystem,orprotection

by law enforcement, but more specic services such as utilities.

21

If services are provided by

multiplepoliticalsubdivisions.

Exemptionunderthissubsectionisimplementedbythecountyassessorwherethepropertyis

located–theinstitutiondoesnotneedtoapplytotheStateBoard.

Propertiesthatprovidelow-incomehousingforelderly

23

ordisabled

24

individualsthatarefunded

byoneoftwospecicsourcesmaybeexempted.Thepropertiesmustbefundedbyeitherthe

HOMEInvestmentPartnershipsProgram,

25

orbyahousingtrustfundcreatedunderTenn.Code

Ann.§§7-8-101et.seq.or13-23-501et.seq.

The property must also be owned by a non-prot institution registered with the Tennessee

SecretaryofState.TheIRSmustrecognizetheinstitutionasexemptfromfederalincometaxes,

eitherasanexemptcharitableinstitutionoranexemptsocialwelfareinstitution.Inaddition,the

institution must have the following charter provisions:

1) Directorsandocersservewithoutcompensation;

2) Thecorporationisdedicatedtoandoperatedexclusivelyfornon-protpurposes;

3) Theincomeorassetsofthecorporationwillnotbedistributedtobenetanyindividual;

4) Ifthecorporationisdissolved,itspropertywillnotbeconveyedtoanyindividualfor

lessthanfairmarketvalue;and

5) Whenthecorporationdissolves,allremainingassetswillbedistributedonlytonon-

protorganizationswithasimilarpurpose.

20

Tenn.CodeAnn.§67-5-206.Propertyofhousingauthorities.

21

Tenn.Op.Att’yGen.No.96-097(July29,1996).

22

Tenn.CodeAnn.§67-5-207(d).

23

Asdened,ahouseholdwillqualifyas“elderly”ifitiscomposedofoneormorepersonsatleastoneofwhomis62yearsofage

ormoreatthetimeofinitialoccupancy.24C.F.R.891.205.

24

Asdened,ahouseholdwillqualifyas“disabled”ifitisahouseholdwithatleastonedisabledindividualwhoisaged18or

older,acaretakeriftheindividualneedsone,asdeterminedbytheDepartmentofHousingandUrbanDevelopment,orthe

survivinghouseholdmembersifthedisabledindividualisdeceased.24C.F.R.891.305.

25

42U.S.C.§12701etseq.

housing ProjeCts ConstruCted With home or housing trust funds

22

ProPerty of housing authorities

9

State Board of equalization ProPerty tax exemPtion manual

Property providing permanent housing for low-income disabled individuals or low-income

elderlyindividualsmaybeexemptifcertainspecicrequirementsaremet.Theserequirements

canbecomplex.

First,thepropertymustbeownedbyaregisterednon-protinstitution.TheIRSmustrecognize

thenon-protinstitutionasexemptfromfederalincometaxes,eitherasanexemptcharitable

institution or an exempt social welfare institution. In addition, the institution’s charter or

governingdocumentsmusthavethefollowingprovisions:

1) Directorsandocersservewithoutcompensation;

2) Thecorporationisdedicatedtoandoperatedexclusivelyfornon-protpurposes;

3) Theincomeorassetsofthecorporationwillnotbedistributedtobenetanyindividual;

4) Ifthecorporationisdissolved,itspropertywillnotbeconveyedtoanyindividualfor

lessthanfairmarketvalue;and

5) Upondissolution,allremainingassetswillbedistributedonlytonon-prot

organizations with a similar purpose.

Second,thepropertymustbeusedtoprovidebelow-costhousingtohouseholdsqualifyingas

either“low-incomeelderly”or“low-incomedisabled”undertheappropriateregulations.Below-

cost housing and “low-income” housing may be addressed in the loan or grant agreements

nancingtheproperty.Generally,below-costhousingwillnotexceed30%ofthehousehold’s

monthlyoryearlyincome,andlow-incomewillgenerallyrefertospeciedincomethresholds

denedby the Departmentof Housing andUrban Development(“HUD”).

27,28

A household is

considered“elderly”ifoneormorepeopleinthehouseholdare62yearsofageorolderwhen

initial occupancy begins.

29

Under the applicable federal regulations, a household will qualify

as“disabled”ifitcontains:atleastoneadult(18yearsorolder)withadisability;twoormore

persons with disabilities living together, or one or more of such persons living with another

whoisdetermined by HUD,basedon the certicationofan appropriate professional(e.g., a

rehabilitativecounselor,socialworker,orlicensedphysician)tobeimportanttotheircareor

wellbeing;or,thesurvivingmemberormembersofanyhouseholdpreviouslyhousingadisabled

adultwhoisnowdeceased,providedtheywerelivingwiththedisabledadultatthetimeofhis

orherdeath.

30

Third,thepropertymustbenancedbyoneofthefollowingfederalprograms:

- Agrantunder§211or§811oftheNationalAordableHousingAct(42U.S.C.§§

12741and8013)

- AgrantundertheMcKinney-VentoHomelessAssistanceAct(42U.S.C.§11301etseq.)

- Financedorrenancedbyaloanmade,insured,orguaranteedbyabranchofthe

federalgovernmentunderoneofthefollowinglaws:

1) §515(b)or§521oftheHousingActof1949(42U.S.C.§§1485(b)and1490(a)respectively);

2)§202oftheHousingActof1959(12U.S.C.§1701q,§221,§223,§231);

26

Tenn.CodeAnn.§67-5-207.

27

Thisinformationcanbefoundbynavigatingtoyourcountyfrom:https://www.huduser.gov/portal/datasets/il.html

28

24C.F.R.§92.252.

29

24C.F.R.891.205.

30

24C.F.R.891.305.

loW Cost housing for loW-inCome disabled and elderly

26

10

State Board of equalization ProPerty tax exemPtion manual

3)§236oftheNationalHousingAct(12U.S.C.§§1715l,1715n,1715vand1715z-1,

respectively);or,

4)§8oftheUnitedStatesHousingActof1937(42U.S.C.§1437f).

Aloanisconsideredtobe“guaranteed”ifthefederalhousingagencyconsentedtotheassignment

of a housing assistance program contract as security for the loan.

Theoriginalfundingmustcomefromoneoftheaboveprograms,butthatfundingwillalmost

always be administered by a state agency through a state program. An applicant wishing to

qualifyunderthissectionmustprovidedocumentationregardingthenancingofthehousing

projecttoshowtheoriginalsourceofthefunding.Theapplicationcannotbeapprovedifthe

StateBoardisunabletoidentifytheoriginalsourceoffunding.

Apropertyexemptedunderthissectionandnancedbyaqualifyingloanremainsexemptwhile

thereisanunpaidbalanceontheloan.Whentheloanispaidinfull,thepropertyremainsexempt

aslongasthepropertyisonlyusedforhousingelderlyordisabledindividuals.

Propertynancedbyagrantremainsexemptaslongasitisusedasbelow-costhousingforelderly

ordisabledindividualswithahouseholdincomeatorbelowthelimitestablishedbyHUD.Ifthe

programprovidingthegrantdidnotprovideincomeguidelines,thepropertymaybeexemptif

atleast50%oftheresidentshaveincomesunderHUDguidelinesforanyoftheaboveprograms.

Inthiscase,thepropertyisgrantedapartialexemption.Thepercentageoftheexemptionisthe

percentage of units occupied by low-income elderly or disabled households. This percentage

mustbeestablishedbytheentityseekingtheexemption.Informationsupportingthepercentage

oftheexemptionmustbeprovidedtothecountyassessorbyApril20,andthatpercentageis

appliedbeginningJanuary1ofthatyear.

PILOTAgreementRequired

Ifahousingprojectunderthissectionhasmorethan12units,theownersmustenter,orattempt

toenter,intoaPILOTagreementwiththetaxjurisdiction(s)wheretheprojectislocated.These

paymentsshouldbenegotiatedtocoverthecostsofservices,improvements,orfacilitiesprovided

bythejurisdiction(s).IfnoPILOTagreementisenteredinto,thepaymentsmustbeatleast25%

oftheamountofpropertytaxesthatwouldbecollectediftheprojectwasnotexempt.

Subjecttothegeneralrequirementsof§212,propertyownedbycharitableinstitutionssuchas

HabitatforHumanitymaybeexemptedduringtheperiodofownershiptothedatetheproperty

isconveyedtoaqualifyinglow-incomehousehold.Asdenedforpurposesofthissection,a“low

incomehousehold”isanindividualorfamilyunitwhoseincomedoesnotexceedeightypercent

(80%)oftheareaorstatemedianincome,whicheverisgreater,adjustedforfamilysize.

32

31

Tenn.CodeAnn.§67-5-221.

32

Tenn.CodeAnn.§13-23-103(12).

ProPerty oWned by Charitable institutions for ConstruCtion

of

residential housing for loW-inCome families

31

11

State Board of equalization ProPerty tax exemPtion manual

Thepropertymustbeownedbyacharitableinstitutionandheldforthepurposeofconstructing

one or more single-family dwellings that will be conveyed to a low-income household. If a

property meets these requirements and is a single lot for the construction of a single family

home,itcanbeexemptedforupto18-monthsfrominitialownership.Ifitisalargerparcelthat

willbesubdividedintomorethanonelot,itmaybeexemptedfor18monthsplusanadditional

6-monthsforeachhomepasttherst.

Anexemptionapprovedunderthissectionendswhenthepropertyisconveyedtoaqualifying

household.Iftheproperty,oranyportionoftheproperty,isnotdevelopedandtransferredto

alow-incomehouseholdwithintheexemptionperiodestablishedabovealltaxesthatwould

otherwisehavebeenduefortheproperty,plusanydelinquencypenaltiesandinterest,accrued

fromthedateownershipbegan.

Propertyownedbyanon-protcorporationthatisusedtorecycleordisposeofwasteproductsto

produceheatingorcoolingofpublicfacilitiesmaybeexempt,providedthestateoranypolitical

subdivisionownsthereversionaryinterestintheproperty.Thepropertymaybeexemptevenif

by-productsoftherecyclingordisposalareprovidedtoprivateentities.Exemptionunderthis

sectiondoesnotrequireanapplicationtotheStateBoard.

ThepropertyofaprivateacthospitalestablishedunderTitle7,Chapter57,Part6oftheTennessee

Codemaybeexempted.

Allpropertywithintheboundariesofthepoliticalsubdivisionswhichcreatedorparticipatedinthe

creationofthehospitalisexempt,withouttheneedforanapplicationtotheStateBoard,aprivate

acthospitalmayenterintoaPILOTagreementwiththecreatingorparticipatingjurisdiction.

The hospital must apply to the State Board for exemption of properties that are outside the

boundariesoftheircreatingorparticipatingjurisdictions.TheStateBoardwillevaluatethese

propertiesasthoughtheywerecharitablehospitalsunderTenn.CodeAnn.§ 67-5-212.See“Medical

FacilitiesandNursingHomes”page5formoreinformation.

Non-protcemeteriesandotherplacesofburialareexemptfrompropertytaxes.Iftheowners

ofsuchpropertydonotchargetouseburialplots,theownersdonotneedtoapplyforexemption

totheStateBoard–instead,theassessorofthecountyinwhichtheburialplaceislocatedwill

exempttheproperties.Ifthereisachargetobeburiedontheproperty,thepropertymaystillbe

exempt,butthepropertyownermustapplytotheStateBoard.

33

Tenn.CodeAnn.§67-5-208.

34

Tenn.CodeAnn.§67-5-209.

35

Tenn.CodeAnn.§67-5-214.

reCyCling or Waste disPosal faCilities

33

Private aCt hosPitals

34

burial PlaCes and Cemeteries

35

12

State Board of equalization ProPerty tax exemPtion manual

Therealpropertyofafor-protcemeterymaybeexempt,ifthepropertywaslandscapedand

preparedtobeusedasacemetery,andthesizeofthepropertyisnotbeyondthereasonable

needsofthepublic.Afor-protcemeterymustapplyforexemptionwiththeStateBoard.

Allgrowingcrops,includingtimber,productsinanursery,andornamentaltrees,areexempt

frompropertytaxeswhileownedandheldbytheproducerortheindividualbuyingdirectly

fromtheproducer.

Agedwhiskeybarrels,whileownedorleasedbyapersonthatproducesormanufactureswhiskey

inthosebarrels,areconsideredarticlesmanufacturedinthestate.

37

TangiblepersonalpropertytravelingthroughTennesseemaybeexemptedundertwosectionsof

theTennesseeCode.

PropertyinInterstateCommerce

38

TangiblepersonalpropertymovingthroughTennessee,butdestinedtolandoutsidethestate,

is exempt from property taxes. This section covers property that is housed temporarily in a

warehouse for storage.

This section also exempts property transported to a plant or warehouse in Tennessee from

outsidethestateforstorageorrepackagingbutdestinedforeventualsaleoutsidethestate.Ifa

portionofthepropertyexemptedunderthissubsectionissoldwithinthestate,theexemption

onlyappliestothepropertysoldoutofthestate.

NotethatpropertyintransitdoesnotneedaspecicdestinationwhenitisstoredinTennessee,

solongasitwillbesoldormovedoutsidethestate.

ImportedPropertyinaForeignTradeZone

39

Tangible personal property which is imported from outside the United States and held in a

foreigntradezoneorsubzoneforthepurposeofsale,processing,assembly,grading,cleaning,

mixing,ordisplayisexemptedwhileintheforeigntradezone,solongasitistobetransported

outsideofTennessee.

Propertiesthatare on theTennesseeRegister of HistoricPlaces,or other structuresthatare

certiedbyacounty’shistoricpropertiesreviewboard,maybeeligibleforapartialtaxexemption

36

Tenn.CodeAnn.§67-5-216.

37

Tenn.CodeAnn.§67-5-216(c).

38

Tenn.CodeAnn.§67-5-217.

39

Tenn.CodeAnn.§67-5-220.

40

Tenn.CodeAnn.§67-5-218.

CroPs, livestoCk, and Poultry

36

ProPerty Passing through tennessee

imProvement or restoration of historiC ProPerties

40

13

State Board of equalization ProPerty tax exemPtion manual

whenperformingrestorationsorrenovations.Exemptionunderthissectionisonlyavailablein

countieswithapopulationof200,000orhigheraccordingthe1970oranysubsequentfederal

censusandonlyincountieswherethegoverningbodyhaselectedtograntexemptionsunderthis

section.Anexemptiongrantedunderthissectiondoesnotfullyexemptthelandorstructures

ontheland.Instead,thissectionexemptsthevalueofimprovementstoorrestorationsofthe

structure,iftheimprovementsarenecessaryunder:

1) Acomprehensiveplanfortheredevelopmentofadistrictorzone;

2) ThepreservationplanofthestateofTennessee;

3) Anyotherfederalorstateplanthatincludespreservationorrestorationofstructures

coveredunderthissection;or,

4) Byagreementoftheownertorestorethepropertyunderguidelinessetoutbya

historicpropertiesreviewboard.Theserequirementswillincluderestrictionson

signicantlyalteringordemolishingthestructure.

Propertiesthatare175yearsoldorolderarepresumed,byvirtueofage,tomeettherequirements

of a county’s historic properties review board, and therefore may qualify under this section.

Properties125yearsoldbutlessthan175yearsoldarepresumedtomeettherequirements,but

thispresumptioncanbechallengedbyanyinterestedparty.Properties75yearsoldbutlessthan

125yearsmustbereviewedindividually.

Exemption under this section only applies to the value of improvements, restoration, or

renovations.Theexemptionisalsotimelimited.Theexemptionwillapplyfortenyearsifthe

restorationislimited oronlyanexteriorrestoration.Itmay last15years ifitisconsidereda

totalrestoration.Thehistoricpropertiesreviewboardwillmakethisdetermination.Whenthe

exemptionends,thestructurewillbeassessedandtaxedatitsfullmarketvalue.

Inadditiontothehistoricstructure,thisexemptionmayalsoapplytostructuresorresidences

necessary to manage or care for the historic structure.

Ifthehistoricpropertiesreviewboarddeterminesthatthehistoricstructureisdemolishedor

signicantlyalteredtheexemptionwillendimmediately.

Finally,unlikemostexemptions,thisexemptionwillcontinueforthespeciedperiodoftime

even if ownership of the property changes.

Exemptionsunderthissectionaregrantedbycountyauthorities,ratherthantheStateBoard.

HistoricPropertiesOwnedbyCharitableInstitutions

41

PropertythatisontheNationalRegisterofHistoricPlacesownedbyacharitable institution

for10yearsormoremaybefullyexempt (asopposedtothepartialexemptionsabove)from

propertytaxes.Thisexemptionisonlyavailableincountiesormunicipalitieswhichhaveelected

tograntsuchexemptions.Ifthecountyormunicipalityhaschosentogranttheseexemptions

thereareadditionalrequirements.

41

Tenn.CodeAnn.§67-5-222.

14

State Board of equalization ProPerty tax exemPtion manual

First,thepropertymustnotberentedoutmorethan180daysperyear,andrentalsmaynot

lastmorethantwodaysperevent.Theproceedsfromrentalsmustbeusedsolelytodefraythe

maintenancecostsandupkeepoftheproperty.

Second,theinstitutionmustsubmitacomprehensivepreservationandmaintenanceplanforthe

propertytothecounty’shistoricalpropertyreviewboarddemonstratinghowthepropertytax

savingswillbeusedtopreserveandmaintaintheproperty.Thehistoricalpropertyreviewboard

mayhaveadditionalguidelinesfortheseplans.

Exemptionsunderthissectionaregrantedfortenyears.Attheconclusionofthetenyearperiod,

theinstitutionmaysubmitanotherapplicationwithanupdatedpreservationandmaintenance

plan.ApplicationsunderthissectionaremadetotheStateBoard.

Airportrunwaysandapronsbelongingtoprivatepublic-useairportsareexemptfromproperty

taxes.

Propertyownedbynon-protcommunityandperformingartsinstitutionsmaybeexemptfrom

propertytaxes,totheextentthatthepropertyisusedbyanon-protorcharitableinstitution

forcharitableoreducationalpurposes.Forthissection,useofthepropertyforperformingarts,

publicmuseums,artgalleries,ortheatersisanexemptibleuse,asareanyusesdirectlyincidental

tothisuse(e.g.,parkingoradministrativespace).

First,thisexemptionisonlyavailableincountiesthatapprovethisexemptionbya2/3voteof

thecounty’sgoverningbody.Thecounty’sgoverningbodymayrequireanypropertiesexempted

under this section to be periodically reviewed by local authorities, or that the exemption be

renewed.

Second,theinstitutionwhichownsthepropertymustmeetcertaininstitutionalrequirements:

- Theinstitutionmustbeapublicbenetnon-protinstitution,eitherestablishedas

anon-protcorporationoranunincorporatedentityoperatingaseitheran

associationoperatingforthepublicbenet,oratrustorfoundationoperatingunder

writtenarticlesofgovernancerequiringthatitbeoperatedforthepublicbenet.

- Theinstitution’sgoverningbodymustmeetthefollowingrequirements:

o Nomorethanthreemembersofthegoverningbodyoftheinstitution

(includingtheboardofdirectorsandanyotherocers)maybeemployedby

theorganization;

o Nomemberofthegoverningbodymaybecompensatedunlessthememberis

anemployee;

o Nomemberofthegoverningbodymayprovideservicestotheinstitutionin

returnformonetarypayment,eitherdirectlyorindirectly;

o Nomemberofthegoverningbodymaylendmoneytotheinstitutionifsuch

42

Tenn.CodeAnn.§67-5-219.

43

Tenn.CodeAnn.§67-5-223.

PubliC-use airPort runWays

42

Community and Performing arts Centers

43

15

State Board of equalization ProPerty tax exemPtion manual

loanissecuredbytheinstitution’sproperty;and,

o Nomemberofthegoverningbodymayprotfromanyoftheshows,exhibits,

etc.,forwhichthepropertyisused,unlessthiscompensationisnormalpayas

an employee.

Finally,ifanyexemptpropertyoftheinstitutionistobesold,theinstitutionmustprovide

noticetotheTennesseeAttorneyGeneralandReporteroftheintentiontosell.Thisnotice

mustbeprovidedatleast21-daysbeforethedateofthesale,butnomorethan60-daysbefore

thedateofthesale.

Each of the above requirements must be incorporated into the articles of governance of any

unincorporatedinstitution.

Theinstitutionmustsubmitacopyofitsarticlesofgovernancetothecountyassessorofthe

county where the exempt property is located, in addition to ling these documents with any

otherrequiredentities(i.e.,theSecretaryofState’sOce).Theinstitutionmustsendanannual

reporttothecountyassessorwithareportlistingtheactivitiesandusesoftheexemptproperty,

currentnancialstatements,andanyotherinformationthecountyassessorrequires.Finally,

thecountyassessormustmaintainanestimateofthemarketvalueofthepropertyasofthedate

ofthelastcounty-widereappraisal.

A family wellness center is the property of a charitable institution used to provide physical

exerciseopportunitiesforchildrenandadults,suchasaYMCA.Afamilywellnesscentermaybe

exemptifitmeetsthefollowingrequirements:

- Theinstitution’shistoricpurposemustbetopromoteholisticphysical,mental,and

spiritual health.

- Theinstitutionmustprovideatleast5ofthefollowing8-services:

o Daycareprogramsforpreschoolandschool-agedchildren;

o Teamsportsopportunitiesforyouthandteens;

o Leadershipdevelopmentforyouth,teens,andadults;

o Servicesforat-riskyouthandteams;

o Summerprogramsforat-riskyouthandteens;

o Outreachandexerciseprogramsforseniors;

o Aquaticprogramsforallagesandskilllevels;and,

o Servicesfordisabledchildrenandadults.

- Theinstitutionmustchargeforservicesbasedonasliding-scalefeestructureto

accommodateindividualswithlimitedmeans.Thisfeestructurewilltypically

accountforfamilysizeandhouseholdincome.

- Theinstitutionmustbeaexemptedasaqualifying§501(c)(3)undertheInternal

RevenueCode.

44

Tenn.CodeAnn.§67-5-225.

family Wellness Centers

44

16

State Board of equalization ProPerty tax exemPtion manual

- Theinstitutionmustalsoincludethefollowingprovisionsinitsgoverningdocuments:

o Thedirectorsandocersshallservewithoutcompensationbeyond

reasonablecompensationforservicesperformed;

o Thecorporationisdedicatedtoandoperatedexclusivelyfornonprotpurposes;

o Nopartoftheincomeortheassetsofthecorporationshallbedistributedto

inuretothebenetofanyindividual;and,

o Uponliquidationordissolution,allassetsremainingafterpaymentofthe

corporation’sdebtsshallbeconveyedordistributedonlyinaccordancewith

therequirementsapplicabletoa§501(c)(3)organization.

TheinstitutionmustapplytotheStateBoardtobeapprovedunderthissection.

Propertyusedasamuseummaybeexemptfrompropertytaxes.Therstrequirementisthat

the property must be located within an incorporated municipality. If the property is located

withinan incorporated municipality,the propertymaybe exemptedifit meetsthefollowing

requirements:

1) Theinstitutionseekingexemptionmustbeanon-protcorporationrecognizedasa

§501(c)(3)bytheIRS;

2) Theinstitutionmustowntheproperty;

3) Theinstitutionseekingexemptionmustoperatethemuseum;

4) Themuseummustdisplaylocal,regional,andstatecrafts,and/oritemsofhistorical

interest;and,

5) Theinstitution’sboardofdirectorsorgoverningocialsmustnotreceive

compensation for their services.

Alsoexemptunderthissectionisthepropertyofamuseumthatislocatedonlandownedby

stateorlocalgovernments.Tobeexemptunderthissection,themuseummust:

1) Displayitemsofhistoricsignicanceandinstruction;

2) BedesignatedbytheStateofTennesseeasanocialstaterepositoryandarchive;

3) Theinstitutionseekingexemptionmustbeexemptedasa§501(c)(3);

4) Theinstitution’sboardofdirectorsorothergoverningbodyorocersmustreceive

nocompensationfortheirservice;and,

5) Theinstitutionmustmanageandstathemuseum.

PropertyqualifyingunderthissectionisfullyexemptbutmustapplywiththeStateBoard.

InitialApplication

Exceptaspreviouslyidentied,anapplicationmustbeledwiththeStateBoardforapropertyto

receiveanexemption.AnexemptionapplicationmaybeledonlinebygoingtotheStateBoard’s

https://www.comptroller.tn.gov/boards/state-board-of-equalization/property-tax-exemptions.html.

Aseparateapplicationmustbeledforeachparcelforwhichexemptionissought.

45

Tenn.CodeAnn.§67-5-226.

46

Tenn.CodeAnn.§67-5-212;Tenn.Comp.R.&Regs.0600-08-.01.

aPPlying for ProPerty tax exemPtion

34

museums

45

17

State Board of equalization ProPerty tax exemPtion manual

Therearetwobasicitemsthatwillberequiredwitheveryapplication:proofofownershipofthe

subjectproperty(i.e.,aquitclaimorwarrantydeed),andpaymentofthelingfee.Pleasenote

thatadeedoftrustisnotsucientproofofownershipforexemptionpurposes.Withoutthese

twoitems,anapplicationisdeemedincompleteandwillnotbeprocessed.Anapplicantmust

alsosubmittheirinstitution’scharterandbylawsorothergoverningdocuments.

Thelingfeeforanapplicationisbasedonthevalueofthesubjectpropertyuptoamaximumof

$120.00.Ifmultipleapplicationsaresubmittedformultipleparcelsatthesametime,thefeeis

basedontheaggregatevalueofalltheproperties.

AggregateValueoftheProperty: ApplicationFee:

Less than $100,000 $30

$100,000-$250,000 $42

$250,000-$400,000 $60

$400,000 or more $120

Paymentissubmittedthroughtheonlineportalafterllingouttheapplicationanduploading

allrequireddocumentation.Ifanapplicantisunabletopaythelingfee,theymaycontactthe

StateBoard.

In addition to evidence of ownership and the ling fee, the applicant should provide the

organization’s articles of governance (e.g., the organization’s charter and bylaws) and recent

nancialdocumentation(e.g.,incomestatement,taxreturn,orotherreliabledocumentation).

Althoughanapplicationwillbeacceptedwithonlyproofofownershipandpaymentoftheling

fee,itwillnotbeapprovedwithouttheseadditionaldocuments.

ApplicationsareprocessedbyExemptionDesigneeswiththeStateBoard.ExemptionDesignees

areahighlytrainedandfriendlycadreofattorneysemployedbytheStateBoard.Theassigned

Exemption Designee will review the application, request additional information if necessary,

andultimatelymakeanInitialDeterminationeitherapprovingordenyingtheexemption.The

InitialDetermination maybeappealed, ortheapplicant mayask theExemptionDesignee to

reconsiderthedeterminationandmakeadierentdecision.Anapplicantonlyhas90daysfrom

thedateanInitialDeterminationisissuedtoleanappeal,regardlessofwhethertheapplicant

isincontactwiththeExemptionDesignee.

Whetherapropertyqualiesforexemptiondependsonthefactsofeachcase.Thedecisionmay

turn on small but important facts such as the phrasing of a fee structure or whether a property

isinsideoroutsideanincorporatedmunicipality.Inmanycases,theExemptionDesigneewill

needtorequestadditionalinformationtorenderanaccuratedetermination.

Arequest foradditionalinformationwillbe sentto thee-mail listedontheapplicationor,if

oneisnotprovided,totheapplicant’saddress.TheExemptionDesigneemaywishtodiscuss

the request for information by telephone to ensure the applicant knows what information is

ProCessing aPPliCations at a glanCe

reQuests for additional information

18

State Board of equalization ProPerty tax exemPtion manual

neededandhowtoprovideit.Forallofthesereasons,anapplicantmustkeephisorhercontact

informationuptodatewiththeStateBoard.

ArequestforadditionalinformationwillincludetheExemptionRecordnumber(“ER#”),and

parcelidenticationnumber.Itwillspecifywhatinformationisneeded,howthatinformation

maybeprovided,andthattheinformationmustbeprovidedwithin30daysoftherequest.If

sucientinformationisnotprovidedwithinthetimeprovidedtheapplicationmaybedenied.

47

AttheExemptionDesignee’sdiscretion,additionaleortsmaybemadetogatheranynecessary

information. This could include sending additional requests, requesting the county assessor

reviewapropertyor,ifappropriate,theexemptiondesigneepersonallyreviewingtheproperty.

AftertheExemptionDesigneehasgatheredthenecessaryinformationandisabletomakean

accuratedecision,heorshewillissueanInitialDetermination.AnInitialDeterminationisissued

intheformofaletternotifyinganapplicantandtherelevantcountyocials(typicallyonlythe

countyassessorandcountytrustee)severalimportantthings.

First,theInitialDeterminationwillidentifytheapplicationsitappliestobyreferringtotheER#.

TheInitialDeterminationwillalsolisttheparcelidenticationnumberstoidentifytheproperty

orpropertiesthedeterminationappliesto.

TheInitialDeterminationwilladvisetherecipientswhethertheapplication(s)isapprovedor

deniedandwillbrieystatewhy.Iftheapplicationisapprovedinpartthedeterminationwill

explainwhy, andwhat portionofthe propertyis exempt.The InitialDeterminationwillalso

specifythedatetheexemptionbecomeseective(thisisknownasthe“eectivedate”andwill

beexplainedinmoredetailonpage22).

Finally,theInitialDeterminationwilladvisethatboththeapplicantandthecountytaxassessor

mayappealthedetermination,howtoletheappeal,andthatitmustbeappealedwithin90

daysofthedatethenoticeisissued.

TheExemptionDesigneemayreconsiderhisorherdeterminationiftheapplicantcanidentifywhy

thedeterminationisincorrect.ReconsiderationisatthediscretionoftheExemptionDesignee

andisseparatefromtheappealprocess.The90dayperiodtoleanappealbeginsonthedateof

theInitialDeterminationandisnotsuspendedbyconversationswiththeExemptionDesignee

aboutareconsideration.IfasubsequentInitialDeterminationisrendered,thisisconsidereda

separateaction,andanew90dayperiodtoappealbeginstorun.

initial determinations

reConsideration

47

“Anyownerofrealorpersonalpropertyclaimingexemption...shallleanapplicationfortheexemption...andsupplysuchfurther

informationastheboardmayrequiretodeterminewhetherthepropertyqualiesforexemption.”Tenn.CodeAnn.§67-5-212(b)(1).

19

State Board of equalization ProPerty tax exemPtion manual

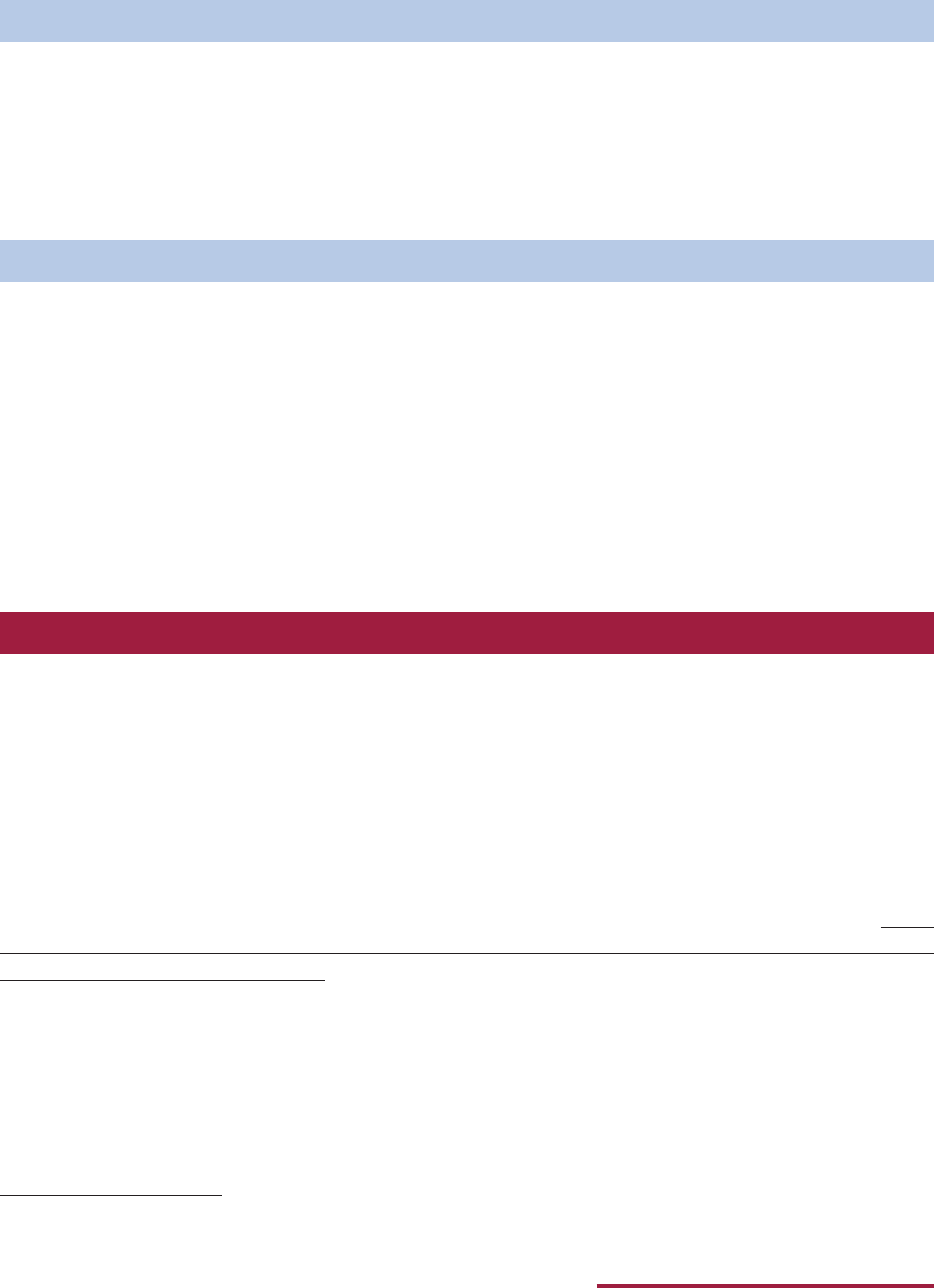

InitialDeterminationIssuedto

ApplicantandCountyOcials

ExemptionDesignee

forInitialReview

ExemptionDesignee

RequestsAnyOtherInformationNeeded

ExemptionDesignee

WillApproveorDenyApplication

AppealtoChanceryCourt

Reconsiderationwith

ExemptionDesignee

on Request

AppealtoanAdministrativeJudge

(MustAppealWithin90Days

ofInitialDeterminationIssued)

CycleofanExemptionApplication

20

State Board of equalization ProPerty tax exemPtion manual

Propertyunderconstructionorextremerenovationmaybeconsidered“inuse”iftheconstruction

iscompletedwithin12months.Inthiscase,thefullproperty,boththelandandtheimprovements,

canbeexemptedasthoughitwasinuseasofthedateoftheapplication,andnormaleective

daterulesapply.

Ifconstructionisnotcompletedwithin12months,theunderlyinglandwillremaintaxableduring

theconstructionperiod,butthevalueofanyconstructedimprovementsmaybeexempted.The

landmaybeexemptedwhenconstructioniscompletedandthepropertyisbeingusedforan

exemptpurpose.

TheinstitutionmustapplyforapropertytaxexemptionwiththeStateBoard.Theinstitution

shouldstatewhenconstructiondidorwillbeginandwhentheinstitutionbelievesconstruction

willbecomplete.Ifconstructionhasnotbegunwhentheapplicationisprocessed,theapplication

maybedenied–prospectiveuseisnotenough.Ifnecessary,theExemptionDesigneewillrequest

proofthatconstructionhasbegun,orproofofwhenitwillbegin.Thismaytaketheformofa

buildingpermitorasignedcontractwithabuilder.Otherproofmaybeacceptable.

AftertheExemptionDesigneehasreviewedthecase,heorshewillsendaletteradvisingthe

applicantofthestatusoftheirapplication.ThismaytaketheformofanInitialDeterminationor

anoticethattheapplicationisbeingplacedinanadministrativehold.

Applications for property undergoing construction will be placed in an administrative hold

and heldbytheStateBoard for twelve (12) months pending the completion of construction.

If construction is completed during the administrative hold period, the Applicant or County

AssessormaycontacttheStateBoardtoadvisethatconstructionhasbeencompletedandan

InitialDeterminationmaybeissued.Ifconstructionisnotcompletedduringtheadministrative

holdperiodtheExemptionDesigneemayissueanInitialDeterminationidentifyingtheproperty

ispartiallyexempt,buttheunderlyinglandistoremaintaxable.Onceconstructionhasbeen

completedthepropertyownermayneedtoapplyforexemptionontheunderlyingland.

Applicationsplacedinanadministrativeholdarenotdenied.Anadministrativeholdmeansthe

applicationisbeinghelduntiltheinstitutionnotiestheExemptionDesigneethatconstruction

is complete. The institution must contact the State Board to let them know construction is

complete. The institution must also send in proof that the property is being used. This may

beacerticateofoccupancy,achurchbulletinormuseumprogram,orotherproof.Then,the

ExemptionDesigneewillissueanInitialDetermination.TheInitialDeterminationwilladvise

iftheapplicationisapprovedordenied.Iftheapplicationisapproved,theletterwillstatethe

datesthatthevalueofimprovementsareexempt,andthedatethatthepropertyisfullyexempt.

Ifaninstitutionisusingpropertywhileconstructionorrenovationisongoing,thepropertymay

befullyexemptdespitetheconstruction.Forinstance,achurchorcharitymightstilluseanewly

acquiredfacility,iftherenovationswillnotinterferewiththeinstitution’suseoftheproperty.

TheExemptionDesigneemustdeterminehowmuchofthepropertyisbeingusedandmayfully

exemptthepropertywithoutdelay.

neW ProPerty under ConstruCtion

21

State Board of equalization ProPerty tax exemPtion manual

A property may be partially exempt when only a part of the property meets the exemption

requirements:a church mayrent spacetoa for-protdaycare, a museummay operateagift

shopandrestaurant,oracharitymaynotuseaportionofthelanditowns.Inanyofthesecases,

theStateBoardwillexempttheportionqualifyingforexemption.TheExemptionDesigneewill

specifythepartsofthepropertythatareexemptandthepartsthatarenot.

There are several methods to determine the extent of an exemption. First, the Exemption

Designeemayspecifyastructureoraportionofapropertythatisnotexempt.Inthecaseofthe

for-protdaycare,theExemptionDesigneemayspecifythatanumberofsquarefeetequaling

thatusedbythedaycareisnolongerexempt.

48

Ifapropertyisusedbymorethanoneinstitutiontheexemptionmaybedividedbasedonthe

useofthe property.Forinstance, ifacharitable institutionoperatesa members-onlygymin

thesamebuildingasotherexemptuses,theexemptionforthegymspacemaybebasedonthe

percentage of gym members that work for the charity.

49

Insomesituations,itmaybemoreappropriatetodeterminetheportionofexemptionbasedon

thetimeofexemptuse.Thismethodmaybeappropriatewherethewholepropertyisusedfor

bothexemptandnon-exemptusesatdierenttimes;forinstance,whereanon-prottheater

rentsitsspacetootherinstitutionsforfor-protproductions,thepercentageofexemptionmay

bedeterminedbymeasuringthetimethetheaterisusedforexempt(non-prot)productions,

andthetimerentedoutforfor-protproductions.

50

Anotherwaytodeterminetheportionofanexemptionisbycomparingexemptandnon-exempt

income.Thismethodmaybeappropriatewhenthewholepropertyisusedforbothexemptand

non-exemptuseatthesametime,orwheredivisionbytimeisnotfeasible.

51

Analwayexemptionmaybedeterminedistosimplyexemptlandunderlyinganyimprovements,

but not exempt certain structures. For example, where a non-prot school is using a lot for

parking, but not using another structure on the property.

Inadditiontoexemptingonlyaportionofthefullproperty,itmaybeappropriatetoexempta

percentageof dierentsections ofthe property.This willbe seenmorefrequentlyinmulti-use

properties,likeabuildingownedbyacharitableinstitution,wherethecharityalsooperatesagym.

How a partial exemption will be determined and what information will be needed is fact-

dependent.Ultimately,theExemptionDesigneewillusethemethodthatmostaccuratelyreects

thedivideduseoftheproperty.

48

City of Nashville v. State Bd. of Equalization,360S.W.2d458,468-69(Tenn.1962).

49

Christ Church Pentecostal v. Tennessee State Bd. of Equalization,428S.W.3d800,808(Tenn.Ct.App.2013).

50

Memphis Dev’t Foundation v. State Board of Equalization,653S.W.2d266(Tenn.Ct.ofAppeals1983).

51

Book Agents of Methodist Episcopal Church, S. v. State Bd. of Equalization,513S.W.2d514,524(Tenn.1974).

Partial exemPtion

22

State Board of equalization ProPerty tax exemPtion manual

The eective date of an exemption is the date the exemption begins. The Tennessee Code

specieshowtheeectivedateofanexemptionisdeterminedandtheExemptionDesigneedoes

nothavetheauthoritytograntadierentdate.Ifapropertyisnotexemptforthefullyearthen

propertytaxesmaybeleviedagainsttheproperty,butthetaxeswillbeproratedtotheportionof

theyearthepropertywasnotexempt.

Ifanexemptionapplicationisreceivedby,orpostmarkedto,theStateBoardonorbeforeMay

20,theexemptioncanbeginonJanuary1oftheyearapplied.

IftheapplicationisreceivedorpostmarkedafterMay20,theExemptionDesigneewilllookat

thedatethepropertywasrstusedforanexemptpurpose.Ifthepropertywasrstusedfor

anexemptpurposewithin30daysofthedatetheapplicationwasreceivedorpostmarked,the

exemptionwillbegrantedasofthedatethepropertywasrstusedforthatpurpose.Iftheuse

ofthepropertybeganmorethan30daysbeforetheapplicationwasreceivedorpostmarked,the

eectivedateoftheexemptionwillbethedatetheapplicationwasreceivedorstamped.

Ifapropertyisnotbeingusedforanexemptpurposewhentheapplicationisreceivedbutisby

the time the application is processed, the Exemption Designee may approve the application;

however,theeectivedatewillbethedatethepropertywasrstusedforanexemptpurpose,

notthedateoftheapplication.

Religious institutions may benet from one additional provision. If a religious institution

purchases a property from another religious institution, and the property was exempt at the

time oftransfer,the exemption for the purchasing institution may bebackdated,or“thrown

back,”upto3yearspriortothedateofapplication,potentiallyclosinganygapintheexemption.

Thepropertymusthavebeenexemptundertheownershipofthepreviousreligiousinstitution,

andthepurchasinginstitutionmustsubmitanewapplication.Theeectivedatemayalsobe

“thrown back” in this way when a religious institution acquires property to replace its own

exempt property, or if the institution purchases property previously approved for a religious

exemptionfromalenderfollowingforeclosure.

52

Tenn.CodeAnn.§67-5-212(b)(3).

53

Tenn.CodeAnn.§67-5-212(b)(3)(B).

effeCtive date

52

sPeCial effeCtive date Provision for religious institutions

53

23

State Board of equalization ProPerty tax exemPtion manual

On or Before May 20?

January 1 or whenever the

propertywasownedandused

forexemptpurposes,

whichever is later.

Wasthepropertyownedand

usedforexemptpurposes

within30dayspriortothe

application?

Datethepropertywasrst

usedforexemptpurposes.

Dateofapplication.

AfterMay20?

YES NO

WhenwouldmyExemptionbeeective?

WhendidtheStateBoardreceiveyourapplication?

24

State Board of equalization ProPerty tax exemPtion manual

WhatCanbeAppealed?

MostactionstakenbytheStateBoardregardinganexemptionapplicationcanbeappealed.This

commonlyincludes:

1) Thedenialofanexemption;

2) Theeectivedateofanapprovedexemption;

3) Thatonlyapartialexemptionwasgranted,ratherthanafullexemption;

4) Theextentofapartialexemption;or,

5) Thendingofprobablecausetorevokeanexemption,inwholeorinpart.

Thisisdiscussedinmoredetailinthe“RevocationofExemption”sectiononpage25.

AnypartyaectedbyanInitialDeterminationcanappeal.Inmostcases,thiswillbeeitherthe

applicant or county assessor.

An appeal must be led with the State Board within 90 days of the Initial Determination or

otherappealableaction.Onceanappealhasbeenproperlyled,thenextstepistogobeforean

AdministrativeJudge.

Hearings are held in person, virtually, or telephonically. The State Board will send a notice

ofhearingatleast30daysbeforethehearingadvisingwhenandwherethehearingwilltake

place.Boththetaxpayerandcountyassessorwillhaveanopportunitytopresenttheircaseto

thejudgeandmaypresenttestimony,documents,andwitnessestothejudge.Theindividual

whorequestedtheappealhastheburdenofprooftoshowthattheStateBoardmadethewrong

decision.Thejudgewillissueanorderwithhisorherdecisionwithin90daysofthehearing.

Itisimportantthat,atthishearing,thetaxpayerandcountyassessorputontheirbestcase.If

eitherpartyis dissatised withthe Administrative Judge’sorder,they canhavesome, all, or

none,oftheissuesreviewedbytheappointedmembersoftheStateBoardofEqualization.Such

membersmaychooseordeclinetoaccepttheappeal.Ifthemembersdecidetoexercisereview,

a hearing may be scheduled before nal action is taken and you will be provided additional

instructions at that time.

the aPPeal ProCess

Who Can aPPeal?

hoW does an aPPeal Work?

25

State Board of equalization ProPerty tax exemPtion manual

Generally,propertymustbeusedforanexemptpurposeoftheowninginstitutiontobeexempt.

Thepropertyofanexemptinstitutionmayalsobeexemptwhenitisusedbyanotherqualifying

institutionforanexemptpurpose.Forexample,ifachurchownsanddoesnotuseabuildingbut

allowsalocalcharitableinstitutiontousethebuilding,thispropertymaybeexempt.Similarly,

spacethatacharityleasestoanothercharitymayalsobeexempt.

Inthesesituations,theExemptionDesigneemustverifythatboththeowninginstitutionandleasing

institutionareexemptandmustknowwhattheleasinginstitutionusesthepropertyfor.

Ifpropertyisleasedoutafterthe StateBoardhasdeterminedthat itis exempt,thetaxpayer

shouldnotifytheStateBoardortheircountyassessor.TheStateBoardwillneedtoverifythat

thelesseeanduseofthepropertystillcomplywiththerulesandlawsregardingexemptions.

ExemptionspreviouslygrantedbytheStateBoardmaylosetheirexemptstatus,eitherinwholeor

inpart,forseveralreasons.Examplesincludeexemptionsbasedonfraudormisrepresentation,

wherethecurrentownernolongerqualies,andwhenthepropertyisnolongerbeingusedfor

anexemptpurpose(e.g.,propertyusedforrevenue-generatingpurposes,propertyrentedtoa

for-protinstitution,abandonedproperty,andpropertydeclareduntforhumanhabitation).

Apropertywillloseitsexemptstatusthrougharevocationproceedingbeginningwithaprobable

causereviewinitiateduponthewrittencomplaintofanypersonorbytheStateBoarditself.An

Exemption Designee will start the review by investigating the property’s use and ownership.

TheDesigneewilltypicallycontactthepropertyownertoaskquestionsandrequestadditional

information. Depending on the specic circumstances, the time required to complete the

investigation can range from a few weeks to multiple months.

Aftertheappropriate investigationtakesplace theExemptionDesignee willeitherdetermine

thatinsucientprobablecauseexiststorevokeor,withspecicndingsforoneormoreofthe

reasonsabove,thatthepropertynolongerqualiesforexemption.Ifprobablecauseisfound,

the Exemption Designee will issue written notice to the property owner, county assessor of

property,andcountytrusteeprovidingthebasisforrevocationandthedateitbecomeseective.

Revocationsarenot retroactive unlesstheExemption Designee providesaspecic nding of

fraudormisrepresentationonbehalfoftheapplicant,orafailureoftheapplicanttogiveproper

noticeofthechangeintheuseand/orownershipofthepropertyasrequiredbylaw.Seethe

“ChangestoPropertyAfterInitialExemption”sectiononpage26formoredetailedinformation.

Should the property owner or county assessor disagree with the revocation notice, they may

leanappealwiththeStateBoardwithin90daysofreceipt.Arevocationappealistreatedthe

sameasan appeal of anInitialDetermination of a property exemptionandwill be heard by

anAdministrativeLawJudgeassignedtothecasebytheAdministrativeProceduresDivision

oftheSecretaryofState’sOce.Pleaseseethe“AppealsProcess”sectiononpage24formore

information.Ifnoappealisled,after90daystherevocationbecomesnal.

leased or rented ProPerty, or use of ProPerty by other institutions

revoCation of exemPtion

26

State Board of equalization ProPerty tax exemPtion manual

Shouldthecountyassessorandpropertyowneragreethatallorpartofanexemptionshouldbe

revokedtheExemption Designee canexpedite the revocationprocess by memorializingtheir

agreementandsendingittotheparties.

ChangeinUseofProperty

Aspreviouslystated, if anexempt property is usedby another institution orused for anon-

exemptpurpose,thischangeshouldbereportedtotheStateBoard.AnExemptionDesigneewill

reviewthesituation,requestanynecessaryinformationordocumentation,anddecideiffurther

actionshouldbetaken.

Achangeintheuseofpropertymayoccurifaninstitutionbeginstorentspacetoanotherentity,

oriftheuseofthebuildingchanges.

Generally,ifanexemptinstitutionrenovatespropertythatisalreadyexempt,thepropertywill

remainexemptduringtheperiodofconstructionorrenovation.

Whethernewstructuresareexemptorwillrequireanewapplicationdependsonthespecic

situation.YoumaycontacttheStateBoardifyouhavequestions,andtaxpayersmaychooseto

leanewapplicationforexemptiontopreservetheearliestpossibleeectivedate.

Generally,whenownershipofpropertychanges,anyexistingexemptionendsandtheproperty

isreturnedtothetaxroll.However,thisisnotthecasewhenthechangeisinnameonly.For

instance,ifachurchbuildingownedbythetrusteesofachurchistransferredtothecorporate

formofthechurch,butthecongregationandchurchbodydonotchange,theexemptionmay

continue.

Inthesecircumstances,theExemptionDesigneewillneedtoreviewthedeedtransferringthe

property,andanyotherdocumentssupportingthatthechangeisinnameonly.Ifitisclearthat

actualownershipdoesnotchange,thepropertywillremainexemptandtheExemptionDesignee

willsendthetaxpayerandcountyassessoraletterconrmingthis.

If the available evidence shows that ownership of the property has changed, the Exemption

Designeewillinformthecountyassessor,whowillreturnthepropertytothetaxroll.Inthis

case,thepropertyownermustsubmitanewapplicationforexemption,andthenormalrules

regardingwhentheexemptioncouldbeginwillapply.

Changes to ProPerty after initial exemPtion

neW ConstruCtion and renovation of exemPt ProPerties

Change in the name of an exemPt institution

27

State Board of equalization ProPerty tax exemPtion manual

Realpropertyistypicallyidentiedandrecordedbyparcelidenticationnumber.Anexemption

ofrealpropertyapplieseveniftheexemptparceliscombinedwithanotherparcel.Ifanexempt

parceliscombinedwithanon-exemptparcel,theexemptionwillcontinuefortheexemptparcel

andthenon-exemptportionwillremaintaxable.Inotherwords,anon-exemptparceldoesnot

becomeexemptsimplybecauseitiscombinedwith anexemptone. Ofcourse,if twoexempt

parcelsarecombinedtheentirepropertyisexempt.

Whenanexemptpropertyistransferredtoanotherindividualorinstitution,thepropertytypically

losesitsexemptstatus.

54

Propertytaxexemptionscannotbetransferredorassigned.Thenew

ownerisnotautomaticallyexemptunlessthenewownerandnewuseofthelandfallunderone

oftheveryfewexceptionsthatdonotrequireapropertyownertosubmitanapplication,(e.g.,

federal,state,orlocalgovernments).Thenewownermayimmediatelysubmitanewapplication

forpropertytaxexemption.Ifthenewownerapplieswithin30daysofthetransferandbegins

usingthepropertyimmediately,thenewownercanavoidagapintheexemptstatus.

Aspreviouslyidentied,religiousinstitutionscanbenetfromthespecialeectivedateprovision

containedinTenn.CodeAnn.§67-5-212(b)(3)(B).Seethe“SpecialEectiveDateProvisionfor

ReligiousInstitutions”sectiononpage22formoreinformation.

Thisisajudgmentcallthatmustbemadebythetaxpayer.Thelawstates:

Taxesrelatedtoaproperlyappealedassessmentbeforethecountyandstateboardsof

equalization,shallnotbedeemeddelinquentifthetaxpayerhaspaidatleast

theundisputedportionoftaxwhiletheappealispending.Delinquencypenaltyand

interestpostponedunderthissectionshallbegintoaccruethirty(30)daysafter

issuanceofthenalassessmentcerticateofthestateboardofequalization

anduntilthetaxispaid.

55

Thetaxpayermaychoosenottopaytaxesiftheybelievethepropertywillbeexempt.Ifthe

applicationorappealisnotsuccessful,thetaxpayermayhavetopaydelinquencypenaltiesand

interestfor theunpaidamount.Thetaxpayer maychoose topaytheirtaxesunder protestto

avoidtheseextrafees,andthencollectarefundiftheirapplicationorappealissuccessful.

Thelawstatesthatthetaxpayerwillnotbesubjecttofeesandpenaltiesiftheyhavepaidthe

undisputed portion of the property taxes due. There may not be an undisputed portion of

propertytaxes,ifthetaxpayerbelievestheentirepropertyshouldbeexempt.Theremaybea

disputedportionifthetaxpayerbelievesonlyaportionofthepropertyshouldbeexempt.

Combining ParCels

transfer of exemPt ProPerty

should i Pay my taxes While my aPPliCation or aPPeal is Pending?

54

ThelanguageofTenn.CodeAnn.§67-5-201isambiguous;however,whenreadinconjunctionwith§67-5-212,anapplicationis

required.See Senter Sch. Found., Inc. v. Nobles,No.C.A.900,1990WL3983,at*2(Tenn.Ct.App.Jan.24,1990).

55

Tenn.CodeAnn.§67-5-1512(b).

28

State Board of equalization ProPerty tax exemPtion manual

WhatdoIdoifmypropertyisbeinguseddierentlynow?

Ifthereisachangeintheuseofyourexemptpropertyyoushouldreportittoyourcounty’stax

assessorandtheStateBoard.

Isoldmyproperty.DoIneedtoletsomeoneknow?

Forthepurposesoftheproperty’stax-exemptstatus,no.Exemptionsgenerallydonottransfer

betweenowners,so thepropertywill be addedback to thetaxroll withoutyouhaving to let

anyone know.

Whenwillmyexemptionbegin?

Todeterminewhenyourtaxexemptionwillbegin,reviewthesectiontitled“EffectiveDate”

on page 22.

Willmyorganizationbeexempt?

Thisanswerdependsonawidevarietyoffacts.Thebestansweristoconsulttherelevantsections

ofthismanual,therelevantstatutes,and/oranattorney.

Howlongbeforeadecisionismade?

Thiswillvarygreatlydependingonthetimeoftheyear,howmanyotherapplicationsarepending

beforetheExemptionDesignee,andthecomplexityofyourcase.Yourapplicationwillgenerally

beprocessedwithin6monthsunlessyourcaseisexceptionallycomplexortheapplicationis

placedonhold.

DoIhavetoleaseparateapplicationforeachparcel?

Yes–youmustleaseparateapplicationforeachparcel,includingany“SpecialInterest”parcels

thecountyassessormayhavecreatedforyourproperty.

Whatistheapplicationfee?

Thelingfeeforaninstitutionisbasedonthecombinedvalueofallthepropertiesforwhichan

applicationissubmitted.

AggregateValueofProperty: ApplicationFee:

Less than $100,000 $30

$100,000-$250,000 $42

$250,000-$400,000 $60

$400,000 or more $120

freQuently asked Questions

29

State Board of equalization ProPerty tax exemPtion manual

Paymentmaybesubmittedthroughtheonlineportal,orbycheckformailedorfaxedapplications.

Ifanapplicantisunabletopaythelingfee,pleasecontacttheStateBoard.

Willtheexemptionberetroactive?

No,unlesstheorganizationqualiesforthelimitedthrow-backprovisioncontainedinTenn.

CodeAnn.§67-5-212(b)(3)(B).

DoIhavetoreapplyeachyear?

No,butyou mustnotifythe StateBoardand yourassessorof any changein ownership, use,

lease, etc.

Whatismycasenumber?

Ifwerefertoacasenumber,wearereferringtotheExemptionRecordnumber,orER#,that

shouldbefoundonanycorrespondencewehavesentyou.

WhydoIowepropertytaxesifmypropertyisexempt?

Youmayowepropertytaxesfrombeforeyourpropertywasexempt,orbeforetheeectivedate

of the property’s tax-exempt status. Your property also may not be fully exempt. The Initial

Determinationwilltellyouifyourpropertyisfullyexemptorpartiallyexempt,andwhy.

Yourcounty’staxassessorortrusteecantellyouhowtopayyourtaxes,andmaybeabletowork

outapaymentplan.TheStateBoardhasnocontroloverthat.TheStateBoardonlydetermines

whether your property is exempt and when that exemption starts. If you owe taxes for your

propertyyoushouldcontactyourcountytaxassessorortrusteeforhelp.

MyappealispendingbeforetheAdministrativeJudge.Canwesettlethiswithout

ahearing?

AnExemptionDesigneemayreviewyourappealbeforeitisforwardedtoanAdministrativeLaw

Judgeandreviewanyneworadditionalinformation.