1

INDIVIDUAL INCOME TAX IN THE UNITED STATES AND MONTANA: A

ROADMAP FOR FUTURE COMMITTEE DECISIONS ON HOUSE JOINT

RESOLUTION 13 (2011)

Prepared for the Revenue and Transportation Committee

By Jaret Coles, Legislative Staff Attorney

September 2011

“The hardest thing in the world to understand is the income tax.”

1

-- Albert Einstein, physicist.

INTRODUCTION

The purpose of this report is to provide a roadmap for the Revenue and Transportation

Interim Committee to evaluate the issues presented in House Joint Resolution No. 13 (HJ

13) from the 2011 Regular Session (contained in Appendix A). This report relies heavily

on the Department of Revenue‟s 2008 – 2010 Biennial Report

2

and citations are provided

to relevant pages. The most relevant material to HJ 13 is found in the Individual and

Corporate Income Taxes portion and the Tax Expenditures portion of the Biennial Report

(contained in Appendix B).

The specific topics covered are as follows:

1) Calculation of federal individual income tax liability;

1

Internal Revenue Service, Tax Quotes (May 20, 2011), available at

http://www.irs.gov/newsroom/article/0,,id=110483,00.html .

2

Montana Department of Revenue, Biennial Report: July 1, 2008 – June 30, 2010 (2010) (hereinafter

Biennial Report).

Note: Electronic hyperlinks are provided to Montana code provisions

and various publications for individuals and legislators who utilize

this report in electronic format with an internet connection. Some of

the hyperlinks involve outside sources and may not function properly

as content is moved or deleted.

This publication does not constitute written tax advice and was not

written by the practitioner to be used by the recipient or any

taxpayers for the purpose of avoiding penalties that may be imposed

on the recipient or any other taxpayer.

2

i. Gross income calculation;

ii. Adjusted gross income;

iii. Itemized vs. standard deduction;

iv. Personal exemptions;

v. Calculation of taxable income;

vi. Tax calculation (rate tables);

vii. Tax credits;

2) Calculation of Montana individual income tax liability;

i. Montana gross income calculation;

ii. Montana adjusted gross income and exemptions;

iii. Montana itemized vs. Montana standard deduction;

iv. Montana personal exemptions;

v. Calculation of Montana Taxable income;

vi. Montana tax calculation (rate tables);

vii. Montana tax credits;

a. Nonrefundable credits with no carryover;

b. Nonrefundable credits with a carryover;

c. Refundable credits;

d. The bottom line -- fiscal impact of Montana tax credits;

3) Tax brackets, rates, and filing options in the United States;

i. 1937-1947: Community property vs. non-community property states and

the assignment of income problem;

ii. 1948-1951: Major change to rate schedule to encourage joint returns and

the addition of head of household rates;

iii. 1968: Single taxpayers protest rate structure and creation of the

“marriage tax penalty”;

iv. 2001: Congress revises rate table to mitigate the “marriage tax penalty”;

v. 2009: Modern federal rate structure;

a. Married individuals and single individuals pay the same lower

levels of tax;

b. Married couples pay more when income increases;

c. 2007 federal filing statistics;

4) Montana‟s history of individual income tax filing options, including an analysis of

the rationale for allowing married taxpayers to file separately on the same form;

i. 1933: Enactment of Montana individual income tax;

ii. 1957: More Montanans required to file a return;

iii. 1963: Montana joint income tax return provided for by statute;

iv. 1966-1972: Montana Legislative Council report on Montana taxation;

v. 1973-1976: Subcommittee on taxation study;

vi. 1983-1985: Married filing separately on the same form recognized in

Montana statute for child and dependent care expenses;

vii. 1992: Married filing separately on the same form recognized in Montana

statute for estimated tax payments;

3

viii. 2007: Married filing separately on the same form recognized in Montana

statute for adoption tax credit;

ix. Montana‟s current rate structure encourages most married couples to file

separately on the same form; and

5) Individual Income Tax Provisions in the States: The Wisconsin Legislative Fiscal

Bureau publication (contained in Appendix D).

1. INDIVIDUAL INCOME TAX IN THE UNITED STATES

In 2009, Montana was one of 43 states with an individual income tax.

3

However, in order

to understand Montana income tax a basic understanding of the federal individual income

tax

4

is necessary. As such, this section provides a very brief overview of the federal

individual income tax system. Federal individual income tax liability is generally

calculated by taking into account the following major steps:

1. Determine gross income;

2. Determine adjusted gross income (above the line deductions or AGI) by

subtracting certain “super” deductions from gross income;

3. Calculate allowable itemized deductions (below the line deductions);

a. Note: The itemized deduction calculations can be dependent on the

adjusted gross income calculation.

b. Note: Certain itemized deductions are limited by statute and may be

eliminated for the failure to meet a certain percentage of AGI, or may

be reduced or phased out based on AGI being too high.

c. Note: Typically taxpayers reduce AGI by the higher of the itemized

deductions or the standard deduction (specific dollar amount in

statute) – see step 5.

4. Determine the personal exemption deduction;

5. Calculate taxable income as follows:

AGI minus (higher of itemized deductions or standard deduction plus

personal exemption);

6. Apply the progressive tax rate structure (the more you make the higher the

percentage of tax) against taxable income using tax tables in order to

determine tax liability; and

7. Calculate the amount of refund or amount of tax that is remitted to the IRS by

subtracting wage withholdings and any allowable tax credits from the tax

figure derived from step 6.

i. Step 1: Gross Income Calculation

3

Rick Olin and Sandy Swain, Wisconsin Legislative Fiscal Bureau, Individual Income Tax Provisions in

the States, at 1 (Jan. 2011).

4

The Sixteenth Amendment to the United States Constitution authorizing an unapportioned income tax was

adopted on March 1, 1913. Eight months after the amendment, Congress passed a statute that taxed

individual income at a rate of 1%, with progressive surtaxes when net income exceeded $20,000.

4

Section 61(a) of the Internal Revenue Code of 1986 (I.R.C.)

5

provides that unless

provided otherwise gross income “means all income from whatever source derived”. The

United States Supreme Court, in Commissioner v. Glenshaw Glass Co., determined that

the definition of gross income is broad and that Congress intended to exert “the full

measure of its taxing power”.

6

Congress has defined the criteria as “including (but not

limited to) the following items:

(1) Compensation for services, including fees, commissions, fringe benefits,

and similar items;

(2) Gross income derived from business;

(3) Gains derived from dealings in property;

(4) Interest;

(5) Rents;

(6) Royalties;

(7) Dividends;

(8) Alimony and separate maintenance payments;

(9) Annuities;

(10) Income from life insurance and endowment contracts;

(11) Pensions;

(12) Income from discharge of indebtedness;

(13) Distributive share of partnership gross income;

(14) Income in respect of a decedent; and

(15) Income from an interest in an estate or trust.”

7

The federal system is one that taxes gains and profits, not gross receipts. As such, in

calculating gross income the cost of goods sold for manufacturing, merchandising, and

mining businesses is subtracted from gross receipts in order to determine gross income.

8

ii. Step 2: Adjusted Gross Income

Section 62(a) of the I.R.C. defines adjusted gross income (AGI) as gross income minus

certain specific deductions, most of which contain restrictions that are detailed in other

5

The Internal Revenue Code is codified in Title 26 of the United States Code.

6

Commissioner v. Glenshaw Glass, 348 U.S. 426, 429 (1955).

7

I.R.C. § 61.

8

Treas. Reg. § 1.61-3(a) provides: “In general. In a manufacturing, merchandising, or mining business,

"gross income" means the total sales, less the cost of goods sold, plus any income from investments and

from incidental or outside operations or sources. Gross income is determined without subtraction of

depletion allowances based on a percentage of income to the extent that it exceeds cost depletion which

may be required to be included in the amount of inventoriable costs as provided in § 1.471-11 and without

subtraction of selling expenses, losses or other items not ordinarily used in computing costs of goods sold

or amounts which are of a type for which a deduction would be disallowed under section 162(c), (f), or (g)

in the case of a business expense. The cost of goods sold should be determined in accordance with the

method of accounting consistently used by the taxpayer. Thus, for example, an amount cannot be taken into

account in the computation of cost of goods sold any earlier than the taxable year in which economic

performance occurs with respect to the amount (see § 1.446-1(c)(1)(ii)).”

5

code sections. The deductions listed in section 62 are often referred to as “above the line”

deductions. Generally, these deductions include:

(1) Trade and business deductions that are attributable to a trade or business

carried on by the taxpayer if such trade or business does not consist of the

performance of services by the taxpayer as an employee (see I.R.C. § 162 and

I.R.S. Form 1040 – Schedule C)

9

;

(2) Certain trade and business deductions of certain employees;

(3) Losses from sale or exchange of property;

(4) Deductions attributable to rents and royalties;

(5) Certain deductions of life tenants and income beneficiaries of property;

(6) Pension, profit-sharing, and annuity plans of self-employed individuals (see

I.R.C. § 404 and Biennial Report, p. 211, table 2.6);

(7) Retirement savings (see I.R.C. § 219 and Biennial Report, p. 209, table 2.3);

(8) Penalties forfeited because of premature withdrawal of funds from time

savings accounts or deposits (I.R.C. § 165);

(9) Alimony (see I.R.C. § 215);

(10) Reforestation expenses (see I.R.C. § 194);

(11) Certain required repayments of supplemental unemployment compensation

benefits (see I.R.C. § 165);

(12) Jury duty pay remitted to employer;

(13) Deduction for clean-fuel vehicles and certain refueling property (see I.R.C. §

179A);

(14) Moving expenses (see I.R.C. § 217);

(15) Archer MSAs (see I.R.C. § 220);

(16) Interest on education loans (see I.R.C. § 221 and Biennial Report, p. 210,

table 2.4);

(17) Higher education expenses (see I.R.C. § 222 and Biennial Report, p. 210,

table 2.5);

(18) Health savings accounts (see I.R.C. § 223 and Biennial Report, p. 209, table

2.2);

(19) Costs involving discrimination suits, etc;

(20) Attorney fees relating to awards to whistleblowers;

(21) One-half self-employment tax (see Biennial Report, p. 211, table 2.6);

(22) Self-employed health insurance deduction (see Biennial Report, p. 211, table

2.6); and

(23) Domestic production activities deduction (see Biennial Report, p. 211, table

2.7).

The concept of AGI dates back to World War II, when individuals were able to itemize

all of their deductions, both business and personal.

10

During this timeframe the number of

taxpayers that were required to file income tax returns increased enough that it became an

administrative problem for the IRS to review returns. As such, in 1944 Congress gave

9

See I.R.C. § 162(a) (providing a deduction for all ordinary and necessary expenses paid or incurred during

the taxable year in carrying on any trade or business).

10

See United States Internal Revenue, 1943 Form 1040, at 1.

6

taxpayers the option of claiming a standard deduction for personal expenses while at the

same time allowing taxpayers to deduct actual trade or business expenses. AGI continues

as a concept today, and individual taxpayers are allowed to deduct above the line

deductions regardless of whether they itemize or claim the standard deduction. However,

the term AGI includes more than just business expenses. Moreover, AGI is a key element

in determining the extent of itemized deductions that are allowed.

iii. Step 3: Itemized vs. Standard Deduction

Not all deductions are related to the production of income. Some deductions exist based

on economic and social policies of Congress. In order for a taxpayer to take a deduction,

it must be allowed by a specific code section. A taxpayer must determine whether to take

the itemized deductions or the standard deduction.

11

In most cases federal income tax will

be less if a taxpayer takes the larger of the itemized deductions or the standard deduction.

The following were common itemized deductions for tax year 2010, all of which are

claimed on IRS Form 1040 - Schedule A:

(1) Medical and dental expenses not reimbursed or paid by others, including

travel to get medical care (must be over 7.5% of AGI before it can be claimed

– portion that is under 7.5% of AGI cannot be deducted).

(2) Taxes paid by the taxpayer including state income or sales taxes, real estate

taxes, certain mandatory contributions to state funds, and certain motor

vehicle taxes (cannot deduct federal income taxes, social security, Medicare,

and federal unemployment insurance).

(3) Home mortgage interest deduction on main home or second home, mortgage

insurance premiums, and points.

12

(4) Gifts to charity.

(5) Casualty and theft losses.

(6) Job expenses that cannot be claimed as above the line deductions and certain

miscellaneous deductions including unreimbursed employee expenses, tax

preparation fees, and investment expenses (must be over 2% of AGI before it

can be claimed – portion that is under 2% of AGI cannot be deducted).

The fact that a taxpayer had expenses does not automatically mean that all of the

expenses can be deducted. In the case of medical and dental expenses, a taxpayer is not

entitled to take a deduction until expenses exceed 7.5% of AGI. For example, if a

taxpayer had $100,000 AGI in tax year 2010 then $7,500 in medical and dental expenses

could not be deducted, but everything above $7,500 in medical expenses could be

deducted. Starting in 2012 this threshold is increased to 10% of AGI, but taxpayers 65

and older will be able to deduct expenses that exceed 7.5% of AGI through 2016.

13

11

Generally, the standard deduction for tax year 2010 was $5,700 for single or married filling separately,

$11,400 for married filing jointly, and $8,400 for head of household. United States Internal Revenue, 2010

Instructions for Form 1040, at 33.

12

United States Internal Revenue, 2010 Instructions for Schedule A (Form 1040), at A-8.

13

I.R.C. § 213(a) amended by Patient Protection and Affordable Care Act, Pub. L. No. 111-148, § 9013,

124 Stat. 119 (2010) (striking 7.5 percent and inserting 10 percent.).

7

Additionally, some itemized deductions are limited and a taxpayer‟s ability to utilize

them can fade. For example, a married couple filing jointly with AGI of more than

$100,000 in tax year 2010 would need to reduce any qualified mortgage insurance

deduction and the deduction would be completely eliminated once AGI reaches

$109,000.

14

iv. Step 4: Personal Exemptions

As the name implies, a taxpayer is exempt from paying income tax on a certain amount

of income.

15

The personal exemption is adjusted for inflation and is calculated by

multiplying the dollar amount of the exemption by the number of exemptions (i.e.,

taxpayer, spouse, children, dependents). For example, a family of four would be entitled

to an exemption of $14,600 ($3,650 x 4) in tax year 2010.

16

In the past this exemption has

been subject to a phaseout amount whereby a taxpayer with AGI above a “threshold

amount” of $150,000 would face a reduction in the exemption.

17

The personal exemption

is essentially a floor that assures a taxpayer will not be taxed unless income is greater

than the exemption.

v. Step 5: Calculate Taxable Income

Taxable income is calculated using AGI, the higher of itemized deductions or the

standard deduction, and allowable personal exemptions.

18

For example taxable income

for a family of four filing a married filing joint return with $100,000 AGI and $20,000 in

itemized deductions would be calculated as follows:

AGI: $100,000

Minus: Itemized Deduction - $ 20,000 (the Standard Deduction was

$11,400 in 2010)

Minus: Personal Exemptions - $ 14,600 ($3,650 x 4 in 2010)

TAXABLE INCOME = $ 65,400

This would appear as follows on Form 1040:

14

United States Internal Revenue, 2010 Instructions for Schedule A (Form 1040), at A-8.

15

I.R.C. § 151.

16

The exemption is $3,700 for tax year 2011. Rev. Proc. 2011-12, § 2.07(1).

17

I.R.C. § 151(d)(3).

18

See I.R.C. § 63(a)-(b).

8

vi. Step 6: Tax Calculation

As discussed in further detail in section 3 of this paper, different brackets exist depending

on filing status. The income levels are adjusted annually by the U.S. Secretary of the

Treasury to allow for a cost-of-living adjustment using the Consumer Price Index.

19

Generally, the more taxable income you have, the higher your rate of tax. For example,

the following are examples of brackets in tax years 2001, 2006, and 2011:

Tax Year 2001

For tax years beginning in 2001, the tax rate table was as follows for Married Individuals

Filing Joint Returns and Surviving Spouses:

If Taxable Income Is:

The Tax Is:

Not Over $45,200

15% of the taxable income

Over $45,200 but not over $109,250

$6,780.00 plus 28% of the excess over $45,200

Over $109,250 but not over $166,500

$24,714.00 plus 31% of the excess over $109,250

Over $166,500 but not over $297,350

$42,461.50 plus 36% of the excess over $166,500

Over $297,350

$89,567.50 plus 39.6% of the excess over $297,350

20

Tax Year 2006

For tax year 2006, the tax rate table was as follows for Married Individuals Filing Joint

Returns and Surviving Spouses:

If Taxable Income Is:

The Tax Is:

Not over $ 15,100

10% of the taxable income

Over $ 15,100 but not over $ 61,300

$ 1,510 plus 15% of the excess over $ 15,100

Over $ 61,300 but not over $ 123,700

$ 8,440 plus 25% of the excess over $ 61,300

Over $ 123,700 but not over $ 188,450

$ 24,040 plus 28% of the excess over $ 123,700

Over $ 188,450 but not over $ 336,550

$ 42,170 plus 33% of the excess over $ 188,450

Over $ 336,550

$ 91,043 plus 35% of the excess over $ 336,550

21

19

See I.R.C. § 1(f).

20

Rev. Proc. 2001-13, § 3.01 (Jan. 16, 2001):

21

Rev. Proc. 2005-70, § 3.01 (Nov. 21, 2005):

9

Tax Year 2011

For tax year 2011, the tax rate table is as follows for Married Individuals Filing Joint

Returns and Surviving Spouses:

If Taxable Income Is:

The Tax Is:

Not over $17,000

10% of the taxable income

Over $17,000 but not over $69,000

$1,700 plus 15% of the excess over $17,000

Over $69,000 but not over $139,350

$9,500 plus 25% of the excess over $69,000

Over $139,350 but not over $212,300

$27,087.50 plus 28% of the excess over $139,350

Over $212,300 but not over $379,150

$47,513.50 plus 33% of the excess over $212,300

Over $379,150

$102,574 plus 35% of the excess over $379,150

22

The easiest way to calculate total tax is to use the tax tables published by the IRS in the

instructions to Form 1040. These tables have already taken into account the progressive

rates of tax, cost-of-living adjustments, and filing status. For example, using taxable

income of $65,400 in the above example the married couple would have a tax of $8,976

in tax year 2010.

23

There is one major exception to the above rates. Section 1(h) of the Internal Revenue

Code gives taxpayers preferential treatment for certain capital gains. The determination

of whether a taxpayer has a capital gain depends on whether the taxpayer has a capital

asset.

24

In the event a taxpayer has capital gains, a variety of calculations need to be

performed to determine whether the gains were short term (year or less), long term

(longer than 1 year), or both. Additionally, there are limitations on the deductibility of

capital losses. Generally speaking, long-term capital gains receive preferential treatment

22

Rev. Proc. 2011-12, § 2.01 (Mar. 29, 2010):

23

United States Internal Revenue, 2010 Instructions for Form 1040, at 81.

24

I.R.C. § 1221.

10

while short-term capital gains do not. An overview of these issues goes beyond the scope

of this paper.

vii. Step 7: Tax Credits

The final computation deals with applying tax credits and payments made through

withholdings or estimated payments toward the tax in order to determine the size of the

refund or the amount of money due. Tax credits are more powerful than deductions as

they typically offset tax dollar for dollar, whereas deductions only offset income. For

example, a $1,000 deduction could put an additional $100 to $350 (assuming 10%

through 35% tax brackets) in a taxpayer‟s pocket, while a $1,000 tax credit could put

$1,000 in the taxpayer‟s pocket regardless of income. The following were some of the

federal credits for tax year 2010 (see 2010 IRS Form 1040, lines 47 – 54 and 61 – 72):

(1) Foreign tax credit (2010 IRS Form 1116);

(2) Credit for child and dependent care expenses (2010 IRS Form 2441);

(3) Education credits (2010 IRS Form 8863);

(4) Retirement savings contribution credit (2010 IRS Form 8880);

(5) Child tax credit (2010 Instructions for Form 1040, pp. 39 – 41);

(6) Residential energy credits (2010 IRS Form 5695);

(7) General business credits claimed on 2010 IRS Form 3800, including:

a. Investment credit;

b. Increasing research activities;

c. Low-income housing credit;

d. Disabled access credit;

e. Renewable electricity production credit;

f. Indian employment credit;

g. Orphan drug credit;

h. New markets credit;

i. Credit for small employer pension plan startup costs;

j. Credit for employer-provided child care facilities and services;

k. Biodiesel and renewable diesel fuels credit;

l. Low sulfur diesel fuel production credit;

m. Distilled spirits credit;

n. Nonconventional source fuel credit;

o. Energy-efficient home credit;

p. Energy-efficient appliance credit;

q. Alternative motor vehicle credit;

r. Alternative fuel vehicle refueling property credit;

s. Employer housing credit;

t. Mine rescue team training credit;

u. Agricultural chemicals security credit;

v. Credit for employer differential wage payments;

w. Carbon dioxide sequestration credit;

x. Qualified plug-in electric drive motor vehicle credit;

y. Qualified plug-in electric vehicle credit;

11

z. New hire retention credit;

aa. Passive activity credits;

(8) Credit for prior year minimum tax claimed on 2010 IRS Form 8801;

(9) Federal income tax withheld on IRS Forms W-2 and 1099;

(10) Making work pay credit (2010 IRS Schedule M);

(11) Earned income credit (2010 IRS Schedule EIC);

(12) Nontaxable combat pay election (2010 Instructions for Form 1040, p. 47);

(13) Additional child tax credit (2010 IRS Form 8812);

(14) American opportunity credit (2010 IRS Form 8863);

(15) First-time homebuyer credit (2010 IRS Form 5405);

(16) Excess social security tax withheld (2010 Instructions for Form 1040, p. 69);

(17) Credit for federal tax on fuels (2010 IRS Form 4136); and

(18) Qualified adoption expenses (2010 IRS Form 8839).

Similar to deductions, credits can be phased out based on income and the ability to utilize

a credit in full can depend on a variety of facts and circumstances.

2. INDIVIDUAL INCOME TAX IN MONTANA

Montana enacted a graduated income tax in 1933 during the Great Depression, and it is

currently the largest source of state tax revenue. As enacted, a “taxpayer” was defined as

any person or fiduciary.

25

A person, in turn, was required to “make, under oath, a return

stating specifically the items of his gross income and the deductions and credits

allowed.”

26

However, the tax return requirement did not kick in unless the person had a

certain level of income. Specifically, a single person (or married but not living with or

supporting a husband, wife, or family) was entitled to earn $999.99 net income before the

filing requirement came into play, while a married person who was living with the other

spouse was entitled to earn $1,999.99 net income. However, if both of the spouses earned

income the statute provided that no more than $2,499.99 in “aggregate net income” could

be earned before a return was required.

27

25

Sec. 1, Ch. 181, L. 1933.

26

Id. § 14.

27

Id. There were also gross income guidelines.

12

28

The structure of Montana‟s personal income tax is based upon federal tax law. As such,

whenever Congress adds another exclusion or deduction the same feature can

automatically appear (i.e., rolling conformity) in the Montana income tax without any

action from the Legislature. For tax year 2010 the Internal Revenue Code was referenced

at least 30 times in Montana‟s Individual Income Tax Code (Title 15, Chapter 30, MCA).

When a reference appears to a specific provision of the Internal Revenue Code it

encompasses “those provisions as they may be otherwise labeled or further amended.” §

15-30-2101, MCA. Additionally, in the event a term is not defined in Montana law “the

term has the same meaning as it does when used in a comparable context in the Internal

Revenue Code”. § 15-30-2620(2), MCA.

A tie to the federal system reduces the Department‟s (DOR‟s) costs of administering the

income tax and taxpayers‟ costs of complying.

29

However, one could make the argument

that an automatic tie to the federal system as amended is an unlawful delegation of

legislative authority. During the 2007 -2008 interim this committee reviewed state

conformity with federal income tax laws as part of the House Joint Resolution No. 61

(2007) study. A staff outline (see Appendix C) highlighted the following issues regarding

automatic conformity with the federal system:

"Rolling" conformity changes the question from "shall we conform?" to "shall we

nonconform?" (if the question comes up at all)

Delegation of legislative authority (see related Legislative Services staff attorney

report regarding this issue in Appendix C)

Federal policy affects state policy

Taxpayer convenience and compliance

The outline highlighted further the following issues to consider regarding adoption of

provisions of the Internal Revenue Code on a specific date (i.e., fixed date conformity):

28

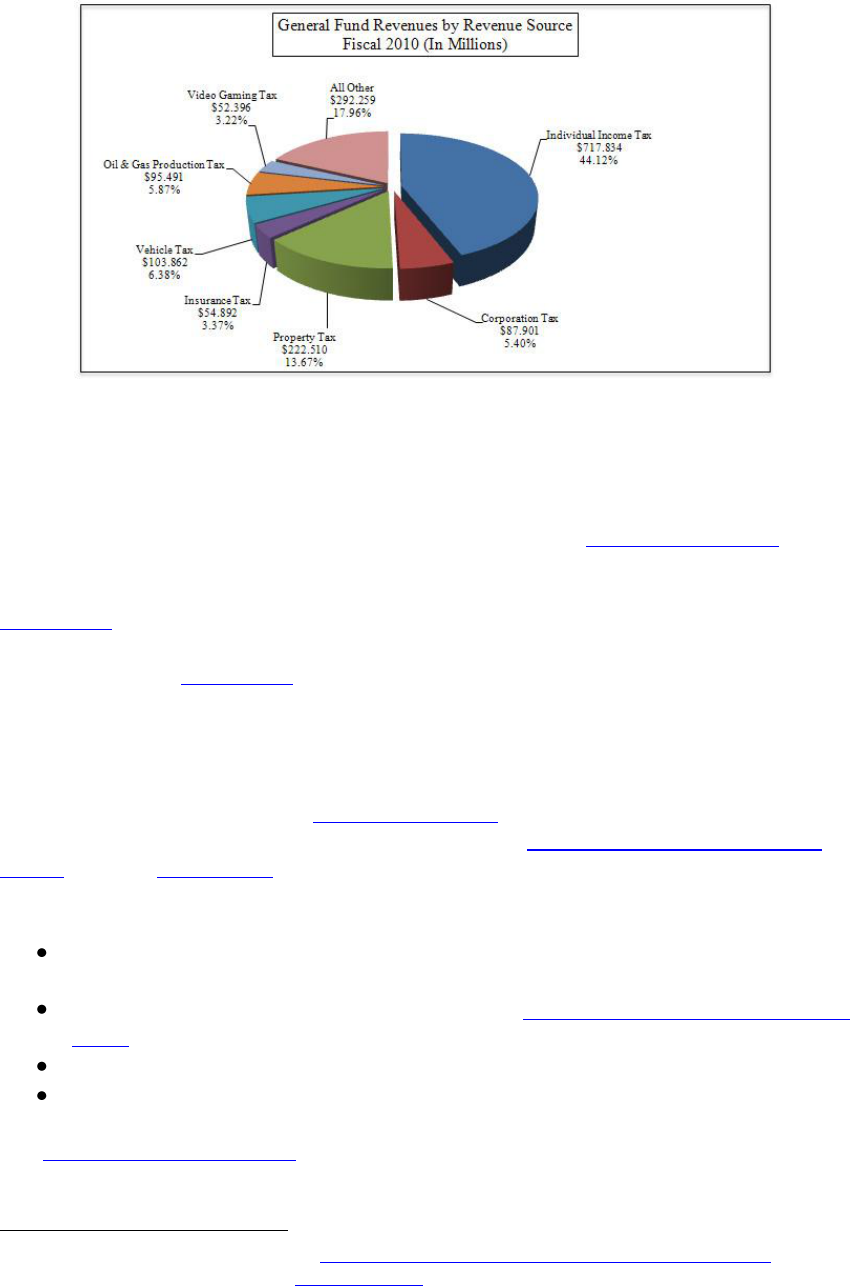

Montana Legislative Fiscal Division, General Fund Revenues by Revenue Source Fiscal 2010.

29

Montana Department of Revenue, Biennial Report: July 1, 2008 – June 30, 2010, p. 54 (2010).

13

If nonconformity involves a known amount then complexity not a problem

Nonconforming to depreciation--2 sets of books, different basis, recognize

different amounts on disposition--more complex for multistate taxpayers

Complexity may compel conformity, e.g. determining basis of IRAs

i. Step 1: Montana Gross Income Calculation

The Montana income tax starts by adopting the federal concept of gross income. Pursuant

to § 15-30-2101, MCA, gross income “means the taxpayer's gross income for federal

income tax purposes as defined in section 61 of the Internal Revenue Code (26 U.S.C.

61) or as that section may be labeled or amended, excluding unemployment

compensation included in federal gross income under the provisions of section 85 of the

Internal Revenue Code (26 U.S.C. 85) as amended.” As stated above, the federal

definition of gross income is comprehensive. Likewise, the Montana definition of gross

income is comprehensive.

ii. Step 2: Montana Adjusted Gross Income and Exemptions

The Montana definition of adjusted gross income has evolved substantially since 1933.

Pursuant to § 15-30-2110, MCA, except as otherwise provided “adjusted gross income is

the taxpayer's federal adjusted gross income as defined in section 62 of the Internal

Revenue Code, 26 U.S.C. 62”. Consequently, decisions of Congress can have a direct

impact on Montana AGI. However, there are multiple items that are specifically included

in Montana AGI regardless of what Congress does. These Montana additions include:

(1) Interest and mutual fund dividends from state, county, or municipal bonds

from other states (see § 15-30-2110(1)(a)(i), MCA);

(2) Dividends not included in federal adjusted gross income (see § 15-30-

2110(1)(a)(ii), MCA);

(3) Taxable federal refunds (see § 15-30-2110(1)(b), MCA);

(4) Other recoveries of amounts deducted in earlier years that reduced

Montana taxable income – primarily refunds of federal taxes previously

deducted (see § 15-30-2110(1)(e), MCA);

(5) Addition to federal taxable social security (see § 15-30-2101(18)(a)(xiv),

MCA);

(6) Sole proprietor‟s allocation of compensation to spouse;

(7) Medical care savings account nonqualified withdrawals (see §§ 15-61-101

through 15-61-205, MCA, and Biennial Report, pp. 217-218, tables 2.22

and 2.23);

(8) First-time home buyer savings account nonqualified withdrawals (see §§

15-63-101 through 15-63-205, MCA, and Biennial Report, pp. 218-219,

tables 2.24 and 2.25);

(9) Farm and ranch risk management account taxable distributions (see §§ 15-

30-3001 through 15-30-3005, MCA, and Biennial Report, pp. 219-220,

tables 2.27 and 2.28);

14

(10) Addition for dependent care assistance credit adjustment;

(11) Addition for smaller federal estate and trust taxable distributions (see §

15-30-2110(1)(f), MCA);

(12) Federal net operating loss carryover;

(13) Share of federal income taxes paid by an S corporation (see § 15-30-

2110(1)(c), MCA);

(14) Title plant depreciation and amortization (see § 15-30-2110(1)(d),

MCA); and

(15) Premiums for Insure Montana Small Business Health Insurance credit.

According to the DOR‟s Biennial Report, some Montana additions to federal AGI were

used regularly, while other additions were used sparingly. The Biennial Report (page 58)

contains the following statistics based on full-year residents‟ returns:

There are also multiple items that are specifically subtracted in Montana AGI regardless

of what Congress does. These Montana subtractions include:

(1) Exempt interest and mutual fund dividends from federal bonds, notes, and

obligations (required under federal law - see Biennial Report, p. 212, table

2.8);

(2) Exempt tribal income (required under federal law - see Biennial Report,

p. 212, table 2.9);

(3) Exempt unemployment compensation (see Biennial Report, p. 213, table

2.10);

(4) Exempt workers‟ compensation benefits (see Biennial Report, p. 213,

table 2.11);

(5) Exempt capital gains and dividends from small business investment

companies (see Biennial Report, p. 214, table 2.12);

(6) State income tax refunds included in federal AGI calculation;

(7) Recoveries of amounts deducted in earlier years that did not reduce

Montana income tax;

15

(8) Exempt military salary of residents on active duty (see Biennial Report, p.

214, table 2.13);

(9) Exempt income of nonresident military servicepersons (see Biennial

Report, p. 214, table 2.14);

(10) Exempt life-insurance premiums reimbursement for National Guard and

Reservist (see Biennial Report, p. 215, table 2.15);

(11) Partial pension and annuity income exemption (see Biennial Report, p.

215, table 2.16);

(12) Partial interest exemption for taxpayers 65 and older (see Biennial

Report, p. 215-216, table 2.17);

(13) Partial retirement disability income exemption for taxpayers under age

65 (see Biennial Report, p. 215-216, table 2.18);

(14) Exemption for certain taxed tips and gratuities (see Biennial Report, p.

216, table 2.19);

(15) Exemption for certain income of child taxed to parent (see § 15-30-

2110(2)(p), MCA);

(16) Exemption for certain health insurance premiums taxed to employee (see

§ 15-30-2110(2)(h), MCA and Biennial Report, pp. 216-217, table 2.20);

(17) Exemption for student loan repayments taxed to health care professional

(see § 15-30-2110(12), MCA, and Biennial Report, p. 217, table 2.21);

(18) Exempt medical care savings account deposits and earnings (see §§ 15-

61-101 through 15-61-205, MCA, and Biennial Report, pp. 217-218, tables

2.22 and 2.23);

(19) Exempt first-time home buyer savings account deposits and earnings

(see §§ 15-63-101 through 15-63-205, MCA, and Biennial Report, pp. 218-

219, tables 2.24 and 2.25);

(20) Exempt family education savings account deposits (see §§ 15-62-101

through 15-62-302, MCA, and Biennial Report, p. 219, table 2.26);

(21) Exempt farm and ranch risk management account deposits (see §§ 15-

30-3001 through 15-30-3005, MCA, and Biennial Report, pp. 219-220, tables

2.27 and 2.28);

(22) Subtraction from federal taxable social security/Tier I Railroad

Retirement reported in federal AGI calculation (see Biennial Report, p. 220);

(23) Subtraction for federal taxable Tier II Railroad Retirement benefits

reported in federal AGI calculation (required under federal law - see Biennial

Report, p. 220, table 2.29);

(24) Passive loss adjustment;

(25) Capital loss adjustment;

(26) Subtraction of sole proprietor for allocation of compensation to spouse;

(27) Montana net operating loss carryover;

(28) 40% capital gain exclusion for pre-1987 installment sales (see § 15-30-

2110(13), MCA, and Biennial Report, pp. 220-221, table 2.30);

(29) Subtraction for business related expenses for purchasing recycled

material (see §§ 15-32-609 through 15-32-611, MCA, and Biennial Report, p.

221, table 2.30);

16

(30) Subtraction for sales of land to beginning farmers (see § 80-12-211,

MCA, and Biennial Report, p. 221, table 2.32);

(31) Subtraction for larger federal estate and trust taxable distribution;

(32) Subtraction for wage deduction reduced by federal targeted jobs credit;

and

(33) Subtraction for certain gains recognized by liquidating corporation.

According to the DOR‟s Biennial Report, some Montana subtractions from federal AGI

were used regularly, while other subtractions were used sparingly. The Biennial Report

(page 58) contains the following statistics based on full-year residents‟ returns:

Section 15-30-2110, MCA, is a lengthy provision that has been amended 49 times since

1933. It is also a provision that can have a big impact on tax policy, what taxpayers pay,

and general fund revenue.

iii. Step 3: Montana Itemized vs. Montana Standard Deduction

Similar to the federal income tax, Montana allows taxpayers to choose between itemized

deductions or a standard deduction.

30

Generally Montana income tax will be less if a

taxpayer takes the larger of the itemized deductions or the standard deduction. The

determination of what is allowed for purposes of claiming itemized deductions starts out

with a reference to the federal tax code. Pursuant to § 15-30-2131, MCA, the items

30

I.R.C. § 63(b), (e); § 15-30-2132(1), MCA.

17

referred to in I.R.C. sections 161 and 211 are deductible, with some exceptions.

Additionally, Montana taxpayers are allowed to take some deductions regardless of what

Congress does. The following deductions are not allowed as itemized deductions

(computing net income), regardless of what Congress does:

(1) Personal, living, or family expenses (§§ 15-30-2131(1)(a)(i), 15-30-2133(1),

MCA);

(2) Any amount paid out for new buildings or for permanent improvements or

betterments made to increase the value of any property or estate (§§ 15-30-

2131(1)(a)(i), 15-30-2133(2), MCA);

(3) Any amount expended in restoring property or in making good the exhaustion

of the property for which an allowance is or has been made (§§ 15-30-

2131(1)(a)(i), 15-30-2133(3), MCA);

(4) Premiums paid on any life insurance policy covering the life of any officer or

employee or of any person financially interested in any trade or business

carried on by the taxpayer when the taxpayer is directly or indirectly a

beneficiary under the policy (§§ 15-30-2131(1)(a)(i), 15-30-2133(4), MCA);

(5) Expenses that are generally associated with the production of exempt or

excludable income (§§ 15-30-2131(1)(a)(i), 15-30-2133(4), MCA);

(6) State income taxes paid (§ 15-30-2131(1)(a)(ii), MCA); and

(7) A charitable contribution using a charitable gift annuity unless the annuity is a

qualified charitable gift annuity under Montana law (§§ 15-30-2131(1)(a)(v),

and 33-20-701, MCA).

The following deductions are allowed as itemized deductions (computing net income),

regardless of what Congress does:

(1) Federal income tax paid within the tax year, not to exceed $5,000 for each

taxpayer filing singly, head of household, or married filing separately or

$10,000 if married and filing jointly (§ 15-30-2131(1)(b), MCA);

(2) Subject to a variety of limitations, expenses of household and dependent care

services (§ 15-30-2131(1)(c), MCA);

(3) Political contributions determined in accordance with the provisions of section

218(a) and (b) of the Internal Revenue Code of 1954 (now repealed) that were

in effect for the tax year that ended December 31, 1978 (§ 15-30-2131(1)(d),

MCA);

(4) That portion of expenses for organic fertilizer and inorganic fertilizer

produced as a byproduct and not otherwise deducted in computing taxable

income (§ 15-30-2131(1)(e), MCA);

(5) Subject to conditions, contributions to the child abuse and neglect prevention

program (§ 15-30-2131(1)(f), MCA);

(6) The entire amount of premium payments made by the taxpayer, except

premiums deducted in determining Montana adjusted gross income, or for

which a credit was claimed for qualified elderly care expenses (§ 15-30-

2131(1)(g), MCA);

(7) Montana light vehicle registration fees (§ 15-30-2131(1)(h), MCA);

18

(8) Montana per capita livestock fees (§ 15-30-2131(1)(i), MCA);

(9) Donations to the veterans' services account and the state veterans' cemetery

program and the patriotic license plate surcharge (§ 15-30-2142, MCA).

According to the DOR‟s Biennial Report, some Montana income tax deductions were

used regularly, while other subtractions were used sparingly. The Biennial Report (page

59) contains the following statistics based on full-year residents‟ returns:

Additionally, as shown in the above table 210,558 and 200,130 full-year resident

taxpayers took the standard deduction in tax years 2008 and 2009, respectively. Pursuant

to § 15-30-2132, MCA, the minimum standard deduction is the greater of $1,580 (plus a

statutory adjustment for inflation) or 20% of AGI and the maximum standard deduction

is $3,560 (plus a statutory adjustment for inflation). Taking the inflation factor

31

into

account, the maximum standard deduction was $ 4,010, $3,950, and $3,990 for tax years

2008, 2009, and 2010, respectively.

31

Pursuant to § 15-30-2101, MCA, inflation factor “means a number determined for each tax year by

dividing the consumer price index for June of the tax year by the consumer price index for June 2005.”

19

iv. Step 4: Montana Personal Exemptions

Similar to the federal income tax, Montana allows taxpayers to claim personal

exemptions.

32

Pursuant to § 15-30-2114, MCA, the personal exemption is adjusted for

inflation and is calculated by multiplying the dollar amount of the exemption by the

number of exemptions (i.e., taxpayer, spouse, children, dependents, additional exemption

for age 65 and above, additional exemption for blind). Taking the inflation factor into

account, each personal exemption was $2,140, $2,110, and $2,130 for tax years 2008,

2009, and 2010, respectively.

v. Step 5: Calculate Montana Taxable Income

Pursuant to § 15-30-2101, MCA, Montana taxable income “means the adjusted gross

income of a taxpayer less the deductions and exemptions provided for” under the

Montana tax code. As such, taxable income is calculated using Montana AGI, the higher

of itemized deductions or the standard deduction, and allowable personal exemptions.

vi. Step 6: Montana Tax Calculation.

Montana uses a single rate structure for all taxpayers, regardless of filing status.

33

The

rate structure is modified by the DOR on a yearly basis by the inflation factor for the tax

year, as rounded to the nearest $100.

34

Montana‟s rate structure is progressive, since

taxpayers with higher incomes pay a higher percentage of their income in tax. However,

unlike the federal brackets Montana‟s rates max out at a fairly low level of taxable

income. The easiest way to calculate total Montana tax is to use the tax tables published

by the DOR. These tables have already taken into account the progressive rates of tax and

the inflation factor. Montana‟s tax tables for tax years 2008 through 2011 are as follows:

Tax Year 2008:

32

I.R.C. § 151; § 15-30-2114, MCA.

33

See § 15-30-2103, MCA.

34

Id. Montana‟s inflation factor was enacted by initiative in 1980. Sec. 2, I.M. No. 86, approved Nov. 4,

1980.

21

vii. Step 7: Montana Tax Credits

Similar to federal income taxes, the final computation deals with applying Montana tax

credits and payments made through withholdings or estimated payments toward the tax in

order to determine the size of the refund or the amount of money due. In some situations

a tax credit can reduce tax dollar for dollar. Also, unlike deductions, when Congress adds

another federal tax credit it does not generally appear automatically as a credit for

Montana individual income tax purposes.

Tax credits can be separated into three categories: nonrefundable credits with no

carryover, nonrefundable credits with a carryover, and refundable credits. When a credit

is nonrefundable, a taxpayer can only offset tax liability with the credit. In the event tax

liability is less than the amount of the credit, a refund will not be issued and the taxpayer

cannot reduce tax liability below zero. However, if a nonrefundable credit has a carryover

provision the taxpayer may be able to utilize the remaining portion of the credit in

another tax year. Moreover, if a tax credit is refundable the taxpayer may actually receive

a refund in situations where tax liability is less than the amount of the credit.

a. Nonrefundable Credits with No Carryover

(1) Capital gains credit (see § 15-30-2301, MCA, and Biennial Report, p. 231,

table 4.1)

(2) Credit for an income tax liability paid to another state or country (see §§ 15-

30-2104 and 15-30-2302, MCA, and Biennial Report, p. 251, table 4.29);

(3) College contribution credit (see § 15-30-2326, MCA, and Biennial Report, p.

232, table 4.2);

(4) Qualified endowment credit (see §§ 15-30-2327 through 15-30-2329, MCA,

and Biennial Report, p. 233, table 4.3);

(5) Energy conservation installation credit (see §§ 15-30-2319 and 15-32-109,

MCA, and Biennial Report, p. 234, table 4.4);

(6) Alternative fuel credit (see § 15-30-2320, MCA, and Biennial Report, p. 234,

table 4.5);

(7) Rural physician‟s credit (see §§ 15-30-2369 through 15-30-2372, MCA, and

Biennial Report, p. 235, table 4.6);

(8) Health insurance for uninsured Montanans credit (see §§ 15-30-2367 and 15-

31-132, MCA, and Biennial Report, p. 236, table 4.7);

(9) Elderly care credit (see § 15-30-2366, MCA, and Biennial Report, p. 237,

table 4.8); and

(10) Recycle credit (see §§ 15-32-601 through 15-32-611, MCA, and Biennial

Report, p. 238, table 4.10).

b. Nonrefundable Credits with a Carryover

(1) Oilseed crushing and biodiesel/biolubricant production facility credit (see §

15-32-701, MCA, and Biennial Report, p. 239, table 4.11);

22

(2) Biodiesel blending and storage credit (see § 15-32-703, MCA, and Biennial

Report, p. 240, table 4.12);

(3) Contractor‟s gross receipts tax credit (see § 15-50-207, MCA, and Biennial

Report, p. 257, table 6.2);

(4) Geothermal systems credit (see § 15-32-115, MCA, and Biennial Report, p.

240, table 4.13);

(5) Alternative energy systems credit (see §§ 15-32-201 through 15-32-203,

MCA, and Biennial Report, p. 241, table 4.14);

(6) Alternative energy production credit (see §§ 15-32-401 through 15-32-407,

MCA, and Biennial Report, p. 242, table 4.15);

(7) Dependent care assistance credit (see §§ 15-30-2365, 15-30-2373, 15-31-131,

and 15-31-133, MCA and Biennial Report, p. 243, table 4.16);

(8) Historic property preservation credit (see §§ 15-30-2342 and 15-31-151,

MCA, and Biennial Report, p. 244, table 4.17);

(9) Infrastructure users fee credit (see § 17-6-316, MCA, and Biennial Report, p.

245, table 4.19);

(10) Empowerment zone credit – expired from tax year 2011forward (see §§

15-30-2356 and 15-31-134, MCA, and Biennial Report, p. 246, table 4.20);

(11) Increasing research activities credit (see §§ 15-30-2358, 15-31-150,

MCA, and Biennial Report, p. 246, table 4.21);

(12) Mineral and coal exploration incentive credit (see §§ 15-32-501 through

15-32-510 MCA, and Biennial Report, p. 247, table 4.22);

(13) Film employment production credit – this credit can be carried forward or

refunded (see §§ 15-31-901 through 15-31-911, MCA, and Biennial Report,

pp. 247-248, tables 4.23 and 4.24);

(14) Adoption credit (see § 15-30-2364, MCA, and Biennial Report, p. 250,

table 4.27).

c. Refundable credits

(1) Elderly homeowner/renter credit (see §§ 15-30-2337 through 15-30-2341,

MCA, and Biennial Report, p. 250, table 4.28);

(2) Film employment production credit – this credit can be carried forward or

refunded (see §§ 15-31-901 through 15-31-911, MCA, and Biennial Report,

pp. 247-248, tables 4.23 and 4.24);

(3) Film qualified expenditures credit (see §§ 15-31-901 through 15-31-911,

MCA, and Biennial Report, p. 248, table 4.25);

(4) Insure Montana small business health insurance credit (see §§ 15-30-2368,

15-31-130, and 33-22-2006, MCA, and Biennial Report, p. 249, table 4.26);

(5) Temporary Emergency Lodging credit (see §§ 15-30-2381 and 50-51-114,

MCA, and Biennial Report, p. 252, table 4.30);

23

d. The Bottom Line – Fiscal Impact of Montana Tax Credits

Some Montana tax credits are used frequently while other credits are not as popular. The

following charts from the Biennial Report (pp. 61 and 231) shed light on how often

credits are used and their corresponding impact on the general fund.

24

3. TAX BRACKETS, RATES, AND FILING OPTIONS: AN OVERVIEW OF

THE FEDERAL SYSTEM

A basic understanding of federal filing options of the past and present is helpful when

evaluating policy issues. Consequently, this section provides an overview of the history

behind federal income tax filing options and the existing federal structure. It is not a

comprehensive review of the federal filing system, as numerous articles have been

written on this topic.

35

Section 4 of this paper then covers Montana‟s history regarding

income tax filing options for married taxpayers, which includes an analysis of when

Montana taxpayers started to file separately on the same form.

The original 1913 federal tax form was primarily designed for individuals, as opposed to

married couples. The instructions stated that a “return shall be made by every citizen of

the United States”.

36

And while a “joint return” was an option for married individuals,

there was no tax advantage to filing one. In fact, the early instructions during this era

cautioned that when spouses each had separate income they “should make a separate

return”.

37

This advice was especially true for high-income taxpayers that were subject to

highly progressive surtaxes. In 1918, these rates started at 1% for individuals with $6,000

in net income to 65% for those with incomes above $1,000,000.

38

i. 1930 – 1947: Community Property vs. Noncommunity Property

States and the Assignment of Income Problem

The highly progressive surtax of the federal system encouraged high-income taxpayers to

look for ways to lower their federal tax liabilities through income splitting. That is, if

they could each take a bite at the tax rate table, they would ultimately be subject to less

tax. In community property states it was common for taxpayers to claim that the income

of the community (i.e., the husband and the wife) was equally owned by each spouse, and

separate returns were filed using this theory.

39

Additionally, in noncommunity property

states couples tried to shift income from one spouse to the other through contracts that

were enforceable under state law.

40

These arrangements opened the floodgates of

35

See, e.g., Patricia A. Cain, Symposium, Taxing Families Fairly, 48 SANTA CLARA L. REV. 805 (2008);

Wendy Richards, Comment, An Analysis of Recent Tax Reforms from a Marital-Bias Perspective: It is

Time to Oust Marriage from the Tax Code, 2008 WIS. L. REV. 611 (2008); Lora Cicconi, Comment,

Competing Goals Amidst the "Opt-Out" Revolution: An Examination of Gender-Based Tax Reform in Light

of New Data on Female Labor Supply, 42 GONZ. L. REV. 257 (2006); Stephen W. Mazza & Tracy A. Kaye,

Restricting the Legislative Power to Tax in the United States, 54 AM. J. COMP. L. 641 (Supp. 2006); Shari

Motro, A New “I Do”: Towards a Marriage-Neutral Income Tax, 91 IOWA L. REV. 1509 (2006); Ann F.

Thomas, Symposium 1999 Part One: Marriage and the Income Tax Yesterday, Today, and Tomorrow: A

Primer and Legislative Scorecard, 16 N.Y.L. SCH. J. HUM. RTS. 1 (1999); Amy C. Christian, The Joint

Return Rate Structure: Identifying and Addressing the Gendered Nature of the Tax Law, 13 J. L. &

POLITICS 241 (1997); Richard B. Malamud, Allocation of the Joint Return Marriage Penalty and Bonus, 15

VA. TAX REV. 489 (1996).

36

United States Internal Revenue, 1913 Form 1040, at 4 (instructions).

37

United States Internal Revenue, 1918 Form 1040, at 3 (instructions).

38

Id. at 3 (table and instructions for calculation of surtax).

39

Cain, supra note 35, at 809.

40

See id. at 815.

25

litigation between the Collector of Internal Revenue (IRS) and individual taxpayers.

Eventually the United States Supreme Court had an opportunity to weigh in on income

splitting in what are now two very famous federal income tax cases.

In the 1930 case of Lucas v. Earl, a married couple agreed to share all of their income

jointly.

41

The agreement was enforceable under state law, and one spouse could demand

payment from the other. As such, the couple filed separate returns and took advantage of

the progressive rate structure. The IRS disagreed with this arrangement, and in a short

unanimous opinion Justice Holmes determined that the assignor of income was liable for

tax on the assigned earnings.

42

Holmes famously stated that this essentially attributed

fruits to “a different tree from that on which they grew.”

43

The Lucas case is frequently

cited by courts when one individual attempts to assign income to another individual.

44

In the 1930 case of Poe v. Seaborn, a married couple from a community property state

(Washington) split the community income 50/50, and each spouse filed separate

returns.

45

Unlike Lucas v. Earl, the U.S. Supreme Court held that it was appropriate for

the husband and wife to each claim one-half of the community income from the

property.

46

The Court ruled this way because each spouse had a vested interest in the

other spouse‟s wages under state law, and the earnings of the spouses belonged to the

community as a whole.

47

In 1937, President Roosevelt addressed Congress concerning revenue loss from

community property states.

48

In response, the U.S. Treasury proposed that all married

individuals should file a joint return that uses the same tax rate schedule as a single

person.

49

The proposal would have increased taxes on married couples and was therefore

defeated on moral grounds.

50

Interestingly, six states became temporary community

property states during this timeframe in order to take advantage of the federal tax rate

structure.

ii. 1948-1951: Major Change to the Rate Schedule to Encourage

Joint Returns and the Addition of Head of Household Rates

In 1948, Congress decided to deal with the community property problem by encouraging

married individuals to file a joint return.

51

If spouses decided to aggregate income and

41

Lucas v. Earl, 281 U.S. 111, 113-114 (1930).

42

Id. at 114-115.

43

Id. at 115; Motro, supra note 35, at 1517.

44

See, e.g., Commissioner v. Banks, 543 U.S. 426, 433 (2005); Sparkman v. Commissioner, 509 F.3d 1149,

1157 (9th Cir. 2007).

45

Poe v. Seaborn, 282 U.S. 101, 108-109 (1930).

46

Id. at 118.

47

Id. at 117.

48

Cain, supra note 35, at 816.

49

Id.

50

Id. (citing Boris I. Bittker, Federal Income Taxation and the Family, 27 STAN. L. REV. 1389, 1391

(1975)).

51

Id. at 817.

26

losses, they were allowed to take advantage of tax rates that were twice as wide as those

of a single person.

52

This effectively gave the citizens of the several states the ability to

pay the same amount of tax, regardless of state community property law. For example,

according to the 1948 federal tax table, a married couple with no dependents and $5,000

of taxable income would pay $544 in tax using a joint return.

53

Likewise, if the husband

and wife each had $2,500 in income and they both filed separate returns, they would each

face $272 in tax (i.e., exactly one-half of a married filing jointly return). Using the same

example, this hypothetical couple would have paid $689 in tax on a joint 1947 return

(i.e., before the change in the law), while paying $330 each by filing separate 1947

returns.

54

In other words, the couple saved $29 in 1947 by filing separate returns, prior to

the change in the law.

In 1952, another rate table was introduced into the federal system entitled “head of a

household”.

55

The new rate table was designed in response to arguments from single-

parent taxpayers that they should be allowed more tax benefits when they provided a

home for dependents.

56

The special rate entitled qualified single taxpayers to obtain better

tax treatment than a single person, but less favorable treatment than a couple using the

married filing jointly rate structure.

iii. 1968: Single Taxpayers Complain About Rate Structure and the

Creation of the “Marriage Tax Penalty”

Congress eventually faced complaints from single individuals who claimed that it was

unfair to give married individuals rate structures that were twice as wide as those for

single individuals.

57

This claim was made on the theory that single individuals had a

higher proportional cost of living based on “economies of scale” and the fact that they

were not taxed on the imputed income of spouses who stayed home providing household

services.

58

For example, if both a single and a married individual could rent an apartment

for $500 per month, the single person‟s effective cost would be $500 per month while the

married individual‟s effective cost would be $250 (i.e., 50%). Moreover, if one married

spouse obtained income from a job while the other spouse performed household services

at home, the married couple arguably received both the benefit of a lower tax rate and the

benefit of not having to pay someone to perform household repairs, care for children,

cook meals, wash clothes, and clean the house. This type of arrangement can be referred

to as a “marriage tax bonus.”

In 1969, Congress responded to this issue by changing the rate table for married

individuals “so that single taxpayers would never pay more than 120% what a married

52

Id.

53

United States Internal Revenue, 1948 Form 1040, at 4 (tax table).

54

United States Internal Revenue, 1947 Form 1040, at 4 (tax table).

55

United States Internal Revenue, 1952 Form 1040, at 4 (tax table).

56

Cain, supra note 35, at 818-819 (2008); see also 26 U.S.C. §§1(b), 2(b) (2000) (defining head of

household and providing the rates).

57

Cain, supra note 35, at 818.

58

Id.

27

couple would pay on the same amount of income.”

59

However, the new rate tables did not

end the debate, and economists pointed out that a “marriage tax penalty” was now being

imposed on married spouses who decided to re-enter the workforce, which in turn

reduced the economic effect of their labor.

60

For example, if a husband was making

$50,000 a year, he would be in a higher tax bracket and a wife who decided to enter the

workforce would be taxed at this higher bracket, as opposed to the lower bracket that

could be obtained through separate filing.

iv. 2001: Congress Revises Rate Table to Mitigate the “Marriage

Tax Penalty”

In 2001, Congress attempted to mitigate the marriage tax penalty by making the rate

brackets twice as wide for married individuals as for single individuals.

61

However, the

rate brackets were not designed to be twice as wide for all levels of income. Instead, the

rate brackets started to shrink between the 25% and 28% brackets.

62

Essentially, this

made a hybrid rate structure between the rate structure of 1969 that favored single

taxpayers, and the rate structure of 1948 that favored married individuals.

63

Married

individuals with lower levels of income received the marriage tax bonus, while married

individuals with higher levels of income were subjected to the marriage tax penalty.

v. 2009: Modern Federal Rate Structure: Examples and Statistics

Pursuant to the 2009 federal rate table, the marriage tax penalty kicks in when married

individuals filing separate returns have over $68,525 in taxable income or when a married

couple earns over $137,050 in taxable income and files a joint return.

64

Before this point,

an individual filing a single return and an individual filing a married filing separate return

faced the same rate of tax.

A. Modern Example of How Married Individuals and Single

Individuals Pay the Same at Lower Levels of Income

If we assume that a husband and wife each make $49,976 in taxable income (i.e, $99,952

joint), the couple has a tax liability of $17,369 if they file jointly and $17,362 (i.e.,

$8,681 each) if they file separately. Additionally, a single taxpayer with $49,976 in

taxable income has a tax liability of $8,681, which is the same amount as a married

taxpayer who files separately.

59

Cain, supra note 35, at 818; Motro, supra note 35, at 1531.

60

Thomas, supra note 35, at 54.

61

Motro, supra note 35, at 1532, 1566.

62

Id. at 1566.

63

Id.

64

Department of the Treasury, Internal Revenue Service, 1040: Instructions 2009, at 101 (Tax Rate

Schedules).

28

SOURCE: Department of the Treasury, Internal Revenue Service, 1040: Instructions 2009, at 82, 88 (Tax

Tables).

B. Modern Example of How Married Couples Pay More When

Income Increases

If we assume that a husband and wife each make $82,250 in taxable income (i.e.,

$164,500 joint), the couple has a tax liability of $35,136 if they file jointly and $17,568

each if they file separately. Additionally, a single taxpayer with $82,250 in taxable

income has a tax liability of $16,750, which is $818 less than a married taxpayer who

files separately. Consequently, it can be argued that an $818 marriage tax penalty exists

in this example.

SOURCE: See Department of the Treasury, Internal Revenue Service, 1040: Instructions 2009, at 101

(Applying Tax Rate Schedules).

$0.00

$2,000.00

$4,000.00

$6,000.00

$8,000.00

$10,000.00

$12,000.00

$14,000.00

$16,000.00

$18,000.00

2009 Rate Table

Example $49,976

Each Taxable

Income

Married Filing

Joint

Married Filing

Separate

Single

Marriage

Penalty

($5,000.00)

$0.00

$5,000.00

$10,000.00

$15,000.00

$20,000.00

$25,000.00

$30,000.00

$35,000.00

$40,000.00

2009 Rate Table

Example $82,250

Each Taxable

Income

Married Filing

Joint

Married Filing

Separate

Single

Marriage

Penalty

29

C. 2007 Federal Filing Statistics

In 2007, 54,065,030 returns were filed by married persons filing jointly, while only

2,730,935 (i.e., 1,365,468 couples) returns were filed by married persons filing

separately.

65

Consequently, less than 3% of couples decided to use the married filing

separately rate table. Additionally, 21,169,039 head of household returns were filed,

while 64,926,879 single taxpayer returns were filed and 86,923 surviving spouse returns

were filed. Statistically, these findings can be reported as follows:

Less Than 3% of Married Couples File Separate Federal Returns

66

Percentage of Individual Taxpayers Using the Federal Rate Structures

67

0%

10%

20%

30%

40%

50%

60%

2007 Federal Study

Married Filing

Joint

Single

Head of

Household

Married Filing

Separate

Surviving

Spouse

65

Internal Revenue Service, Statistics and Income Division, Tax Statistics: Table 1.2 All Returns: Adjusted

Gross Income, Exemptions, Deductions, and Tax Items, by Size of Adjusted Gross Income

and by Marital Status, Tax Year 2007, available at: http://www.irs.gov/pub/irs-soi/07in12ms.xls.

66

See id.

67

See id.

0

10,000,000

20,000,000

30,000,000

40,000,000

50,000,000

60,000,000

2007 Married

Taxpayers

Couples Filing

Joint Returns

Couples Filing

Separate

Returns

30

4. MONTANA’S HISTORY OF INDIVIDUAL INCOME TAX FILING

OPTIONS, INCLUDING AN ANALYSIS OF THE RATIONALE FOR

ALLOWING MARRIED TAXPAYERS TO FILE SEPARATELY ON THE

SAME FORM

This section provides an overview of important statutory changes in Montana law

regarding filing options. Additionally, it summarizes the results from two interim

committee studies in which changes to the Montana filing system were contemplated.

Interestingly, the ability to file separately on the same form was implemented by the

Department of Revenue (DOR) in 1972 because it was difficult to obtain and compare

two married filing separate returns for one couple during an audit or review. This section

concludes with an overview of Montana‟s current rate structure and some of the filing

pitfalls for married taxpayers.

i. 1933: Enactment of Montana Income Tax

Similar to the federal return during this timeframe, a joint return was technically an

option, but it provided no monetary advantage other than the fact that a person could

potentially pay less in tax preparation fees by filing jointly. Indeed, there was only one

tax rate table for both married and single taxpayers. The rate table imposed a 1% tax on

the first $2,000 of net income, a 2% tax on the second $2,000, a 3% tax on the third

$2,000, and a 4% tax on everything above $6,000.

68

Hence, if a husband and wife earned

$2,000 each, they could save $20 by doing separate returns.

69

Interestingly, in order to

file a tax return, a person had to pay a $1 filing fee to the State Board of Equalization

(Board).

70

ii. 1957: More People Required to File a Return

The tax return filing requirement stayed static until 1957, at which point a law made it

harder to escape the filing obligation. A single person (or married but not living with or

supporting a husband, wife, or family) was entitled to earn $599.99 net income before a

return was required, while a married person who was living with the other spouse was

entitled to earn $1,199.99 net income.

71

Moreover, the rate table became more

progressive.

72

68

Sec. 2, Ch. 181, L. 1933.

69

The $20 savings was calculated as follows: If the married individuals filed jointly the first $2,000 in net

income (after exemptions) would produce a $20 tax, while the second $2,000 would produce a $40 tax, for

a combined total of $60. Yet, if the married individuals filed separate returns they would each pay $20 in

tax, for a grand total of $40.

70

Sec. 19, Ch. 181, L. 1933.

71

Sec. 2, Ch. 227, L. 1957.

72

A 1% tax was imposed on the first $1,000 of income, a 1.5% tax on the second $1,000, a 2% tax on the

third $1,000, a 2.5% tax on the fourth $1,000, a 3% tax on the fifth $1,000, a 3.5% tax on the sixth $1,000,

a 4% tax on the seventh $1,000, and a 5% tax on everything above $7,000. Sec. 2, Ch. 228, L. 1957.

31

Unlike the 1933 statute, the joint return was not listed as an option but the Board was

given the power by the Legislature to create forms and instructions.

73

It is therefore

difficult to know whether the Board adopted a joint return, but it would still be more

advantageous to file married filing separately.

iii. 1963: The Joint Income Tax Return Is Provided for by Statute

In 1963, Senate Bill No. 102, which provided for the election of filing joint returns, easily

passed the Senate and the House without a single negative vote.

74

The bill contained a

provision that read:

(2) In accordance with instructions set forth by the board, every taxpayer

who is married and living with husband or wife and is required to file a

return may, at his or her option, file a joint return with husband or wife

even though one of the spouses has neither gross income nor deductions.

If a joint return is made, the tax shall be computed on the aggregate

taxable income and the liability with respect to the tax shall be joint and

several.

75

A review of the Senate Taxation Committee minutes does not shed light on the reasoning

behind the bill.

76

However, the minutes of the House Ways and Means Committee show

more. Specifically, the chairman of the Board testified that “many of the changes in [the]

bill do not change the effect of the existing provisions.” Additionally, the chairman

indicated the purpose was to “expressly provid[e] for the filing of joint returns by

husband and wife and to provide that the tax liability is joint and several”.

77

It is therefore

plausible that a joint return was implicitly allowable from 1957 through 1963. However,

since there was only one tax rate table it was generally more advantageous to file separate

returns in a two-income household. Moreover, due to the 1963 change in the law, both

spouses faced tax liabilities if a joint return was filed, even if the error or omission was

caused by the other spouse.

iv. 1966 - 1972: Montana Legislative Council Report on Montana

Taxation and the Start of Married Filing Separately on the Same

Form

In 1966, the Legislative Council (Council) undertook a major study of the existing tax

structure in Montana. The study created numerous staff reports, in addition to a 91-page

Report entitled Montana Taxation.

78

While individual income tax was only a small piece

73

Sec. 1, Ch. 227, L. 1957.

74

Senate Journal, 38

th

Sess., p. 175 (MT 1963); House Journal, 38

th

Sess., p. 571 (MT 1963).

75

Sec. 1, Ch. 201, L. 1963.

76

Minutes of the Senate Taxation Committee, p. 1 (12:00 p.m. Jan. 24, 1963). The minutes state that

Senate Bill No. 102 “was also discussed by Senator Brenner, the author of the bill.” The nature of the

discussion is not contained in the minutes, but a “Do Pass” motion carried unanimously.

77

Minutes of the House Ways and Means Committee, pp. 1-2 (9:00 a.m. Feb. 27, 1963).

78

Montana Taxation, A Report to the Fortieth Legislative Assembly, Montana Legislative Council, Report

No. 23 (Dec. 1966).

32

of the study, the Council addressed the fact that Montana encourages married filing

separately. The report states:

The Montana tax rates vary from 1.1 percent of the first $1,000 of

taxable income to 7.9 percent of income over $7,000. Although the

federal tax allows married couples to file joint returns and take

advantage of tax brackets twice as wide as single taxpayers,

Montana law allows no such provision. Montana law allows

separate filing of wife and husband if they both earn income.

79

Additionally, the report made the following recommendation:

Currently, if a wife earns income, she may file a return separate

from her husband. There is a major problem in auditing these

returns. The two returns must be together to properly audit them and

this is difficult to accomplish. Taxpayers are never sure how to

allocate income, deductions and exemptions between returns. Also,

there are a large number of taxpayers, especially in low income

groups, who unknowingly do not take advantage of filing separate

returns.

There are two main alternatives for solution to these

problems: (1) make some provision for income splitting; or (2)

eliminate the provision allowing separate filing in our income tax

law. The Task Force recommends that the provision for separate

filing be eliminated. The additional revenue forthcoming from this

change would be about $3 to $5 million per year.

80

Based on the Council report, it is clear that married filing separately was very common.

However, it is also clear that the Board had not created a form that allowed married

couples to file separately on the same form.

v. 1973 – 1976: The Department of Revenue and the 1976

Subcommittee on Taxation Study

“Following the adoption of the new Montana Constitution in 1972, the Forty-Third

Legislative Assembly abolished the three member State Board of Equalization and

established a reorganized State Department of Revenue.”

81

As such, in 1973 the

Legislature changed all statutory references from the Board to the DOR.

82

79

Id. at 47.

80

Id. at 76-77.

81

Report of the State Department of Revenue to the Governor and Members of the Forty-fourth Legislative

Assembly of the State of Montana for the Period July 1, 1972 to June 30, 1974, William A. Groff, Acting

Director, p. 1 (1974).

82

See Secs. 1 – 256, Ch. 516, L. 1973.

33

A review of the DOR‟s historical tax records confirmed that the modern tax return that

allows a husband and wife to file separately on the same form did not come into existence

until 1972.

83

The adoption of this form did not require a change in substantive law, but it

was a very popular option.

84

Presumably, this change made it much easier to audit

returns.

In 1976, the Subcommittee on Taxation undertook a study to investigate the gross income

tax, in addition to studying the “„income-splitting‟ problem - - the effects of Montana‟s

single set of rates and incentive to file separately upon married taxpayers with one source

of income”.

85

A meeting was held on April 23, 1976, and the DOR was asked “to draw

up alternative sets of rate tables which would favor joint husband-wife returns.”

86

The

subcommittee deliberations on this issue were summarized as follows in the report:

The second major area which the subcommittee was directed to

consider was income-splitting between husband and wife. Unlike the

Internal Revenue Code with its four sets of rates (married-joint,

married-filing separately, single-head of household, and single), the

state income tax has but one set of rates for all taxpayers. Since the

tax bill on $20,000 of taxable income is $1,439, while the bill for

$10,000 taxable income is $539, a husband and wife who each earn

$10,000 taxable income will always file separate state returns -- they

save $407 over what they would owe on a joint return on $20,000.

….

The subcommittee requested the department of revenue to draw up

sets of rate schedules to make filing the joint return more

advantageous for married taxpayers. The department went through

five sets and found that one or another of the following problems

always appeared:

(1) If we keep single taxpayers‟ liability where it is now and cut

the married-filing-jointly rate until it is advantageous for

nearly all couples, the revenue loss to the state is too large

($8 million to $11 million per year);

(2) If we design an advantageous joint rate within the limits of a

modest revenue loss ($3 million to $4 million), the taxes of

single persons generally have to go up;

83

The first sentence in the instructions for the 1972 Montana Individual Income Tax Return provides: “The

1972 return form has been redesigned to permit husbands and wives who desire to file separately to do so

using only one return form.”

84

A 1976 interim study by the Subcommittee on Taxation shows that out of 118,714 married filing separate

returns, 112,676 were married filing separate on the same form, 3,691 were separate on different forms, and

2,347 were separate with one spouse not filing. See Montana’s State Income Tax, A Report to the Forty-

Fifth Legislature, Interim Study by the Subcommittee on Taxation, App. B (Dec. 1976).

85