Headquarters 510.549.7310

2560 Ninth Street, Suite 211 fax 510.549.7028

bayareaeconomics.com

San Francisco Tenant Survey

Summary Report

Commissioned by:

San Francisco Board of Supervisors

Study Moderator:

Joe Grubb

August 2002

Table of Contents

Executive Summary ..................................................................................................i

Introduction ..............................................................................................................1

Demographic Characteristics of San Francisco Tenants.........................................3

Tenant Mobility.......................................................................................................13

Rental Housing Stock.............................................................................................19

Housing Costs........................................................................................................27

Tenant Satisfaction ................................................................................................30

Experience with Violations of Rent Stabilization and Eviction Ordinance ..............36

Tenant Interest in Home Ownership ......................................................................38

Tenant Opinions Regarding Success of Ordinance...............................................41

Appendix A: Survey Instrument.............................................................................44

Appendix B: Determination of Market Status ........................................................54

Appendix C: Basic Response Characteristics.......................................................55

List of Tables and Figures

Figure 1: Market Status of Respondent Units ................................................................................ 3

Figure 2: Distribution of Responses by Zip Code Area ................................................................. 4

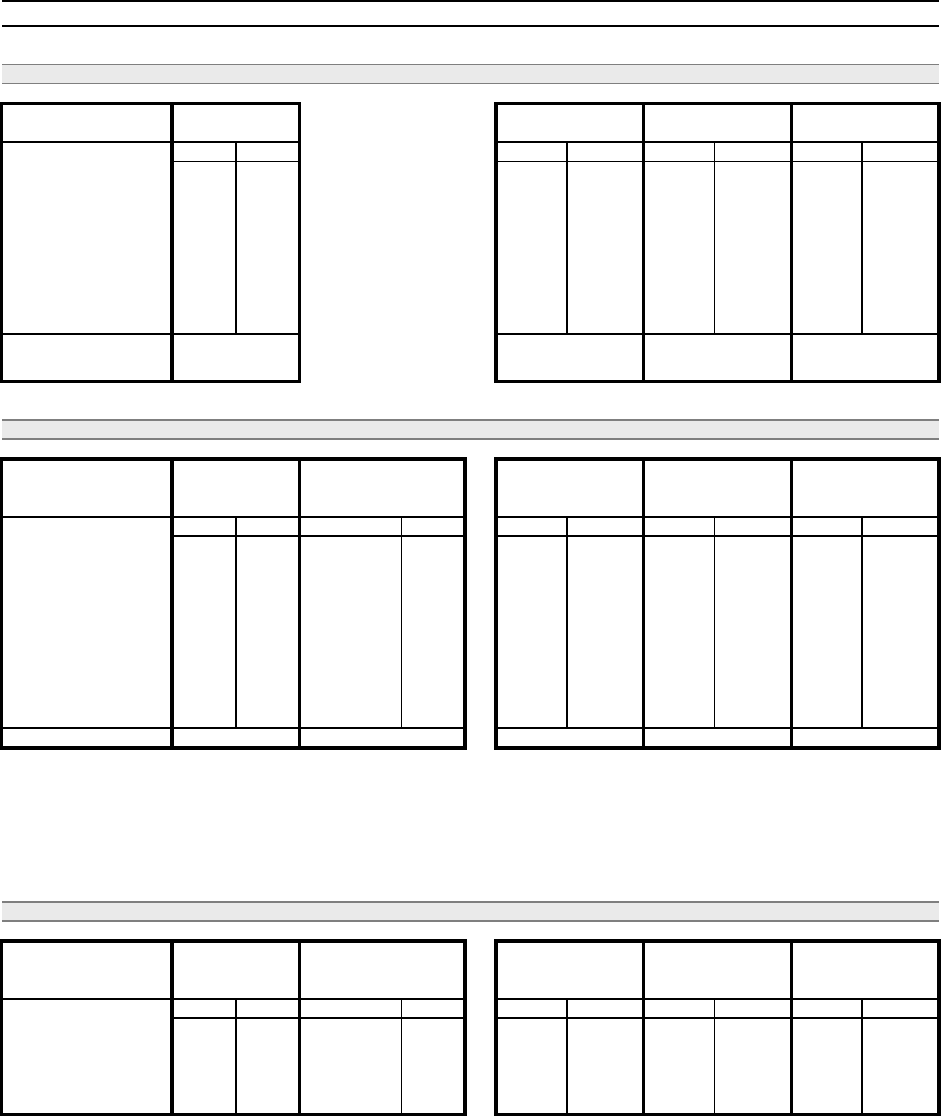

Table 1: Basic Demographic Characteristics.................................................................................. 6

Table 2: Basic Demographic Characteristics, continued................................................................ 8

Table 3: Household Type ............................................................................................................... 9

Table 4: Household Characteristics.............................................................................................. 10

Table 5: Employment and Occupation ......................................................................................... 12

Table 6: Tenant Mobility.............................................................................................................. 14

Table 7: Tenant Mobility, continued............................................................................................ 16

Table 8: Relationship to Property Owner..................................................................................... 18

Table 9: Housing Unit Characteristics ......................................................................................... 20

Table 10: Additional Housing Characteristics.............................................................................. 22

Table 11: Additional Housing Characteristics, continued............................................................ 24

Table 12: Subsidy and Rent Control Status.................................................................................. 26

Table 13: Rent and Rent Burden .................................................................................................. 29

Table 14: Respondent Satisfaction Level ..................................................................................... 31

Table 15: Respondent Satisfaction Level, continued ................................................................... 33

Table 16: Respondent Satisfaction Level, continued ................................................................... 35

Table 17: Respondent Experience with Violations of Ordinance ................................................ 37

Table 18: Respondents Who Considered Ownership ................................................................... 40

Table 19: Success of Ordinance in Achieving Its Goals .............................................................. 43

i

Executive Summary

The San Francisco Affordable Housing Study

The San Francisco Affordable Housing Study is a comprehensive analysis of current housing

issues based on both published and primary data. It was commissioned by resolution of the

Board of Supervisors of the City and County of San Francisco in 2000 to be “neutral and fact-

based” as per Ordinance No. 55-00. The designated Study Moderator is Mr. Joe Grubb,

Executive Director of the San Francisco Rent Arbitration and Stabilization Board. The Study is

composed of the following parts:

Ø San Francisco Housing DataBook (published Spring 2002)

Ø Citywide Tenant Survey

Ø Citywide Landlord Survey

It is important to note that the Study focuses on a myriad of housing issues present in San

Francisco, and is not intended to be a study of rent control.

Survey Methodology

The Tenant Survey was conducted by telephone, using a sample of random telephone numbers.

Calls were made on evenings and weekends over a period of several weeks in April and May

2002. In total, approximately 20,000 randomly generated phone numbers were called, resulting a

total of 583 usable responses. Respondents needing translation assistance to Spanish and

Cantonese were provided with survey personnel fluent in these languages. A copy of the survey

instrument is shown in Appendix A.

Demographic Characteristics

Based on the greater presence of children, seniors, minorities, women, and disabled in

subsidized/assisted units, the findings here indicate the importance of affordable units for

retaining these groups in the City. In addition to affordability issues for available market rate

and rent-controlled units, there are proportionately fewer suitable units (e.g., apartments with

several bedrooms) for many of these groups in the non-subsidized rental stock.

§ Market Status. San Francisco’s rental housing stock is still dominated by rent-controlled

units. Over two-thirds of survey respondents’ units were classified as rent-controlled; 13

percent were subsidized or assisted, 10 percent were market rate and the remainder were

either occupied by close relatives of the property owner or their market status was

undetermined.

ii

§ Household Size and Type. San Francisco renter households tend to be small, a finding

indicated by both Census data and survey responses. To a great extent, this is a function of

the available rental housing stock, which consists largely of small units. Rent-controlled

units tend to have the smallest households, followed by market rate units, with

subsidized/assisted units being the largest of the three major market status types. Not

surprisingly, the most common household type found by the Tenant Survey was persons

living alone, representing 37 percent of all respondents. Family households with children

were most common in subsidized/assisted units.

§ Children and Seniors in Household. In keeping with the small household size, less than

one-fifth of respondents reported children under 18 in their households. The proportion

was largest in subsidized/assisted units, where 35 percent of respondent households

contained children. Elderly were even less common in the respondent households than

children. As with children, the highest proportion was found in subsidized/assisted units.

§ Ethnicity. Nearly two-thirds of respondents were White, with Asians, African-Americans,

and Latinos more or less distributed equally among the remainder of respondents. The

highest proportion of Whites was in rent-controlled units. At one-fourth of respondents,

African-Americans made up a relatively large proportion of those surveyed in

subsidized/assisted housing.

§ Gender. While overall women and men responded in equal numbers to the survey, there

was a slightly higher proportion of female respondents in subsidized/assisted units, which

in conjunction with the presence of more children and elderly, may indicate more single-

parent families or elderly women living alone or in extended family situations.

§ Disability Status. Approximately one in six respondent households reported the presence

of at least one person with a disability or chronic illness. Over one-third of

subsidized/assisted units surveyed reported at least one person with a disability or chronic

illness.

§ Household Income. Renter households in San Francisco have a broad range of incomes,

with many renters in every category from extremely low to very high. Incomes were

similar for market rate and rent-controlled units, but were generally much lower for

subsidized/assisted units.

§ Employment Status, Place of Work, and Occupation. Most respondents were employed

at the time of the survey; nearly three fourths of respondents in market rate and rent-

controlled units were working, while only about half of those in subsidized/assisted units

were. The large majority of those employed worked in San Francisco. Over half of all

respondents had management, professional, or related occupations, with most of the

remainder in service, sales, or office occupations.

iii

Tenant Mobility Characteristics

Like renters in most places, San Francisco tenants show a high level of mobility. Not

surprisingly, most were previously renters elsewhere. Many found their current residence

informally, and in a short period of time (with the exception of those in subsidized/assisted

units). Very few are related to the owner of their housing unit.

§ Length of Residence and Previous Place of Residence. Over half of respondent

households had occupied their unit only since the beginning of 1997, while only

approximately one-quarter had been in their units for more than 10 years. While it might

be expected that households would be less mobile in rent-controlled units due to the desire

to keep lower rents, households in market rate units were actually less likely to have moved

recently than those in either rent-controlled or subsidized/assisted units. Nearly two-thirds

of respondents had moved from elsewhere in San Francisco, a proportion that was fairly

consistent across all market status types.

§ Previous Tenure Status. Over three-fourths of respondents had rented at their previous

place of residence. This was the case for all market status types also.

§ How Respondent Found Unit. Approximately half of respondents found their unit

through informal means, such as knowing a previous or current tenant or knowing the

landlord. Respondents in subsidized/assisted units were most likely to use informal means,

while those in market rate units were the least likely.

§ Length of Time to Find Unit. Perhaps one of the most interesting findings of the survey

was the period of time it took the respondents to find their current unit. Over 40 percent

reported finding their housing unit within one week or less, and 75 percent found their unit

within one month or less. While surveyed market rate and rent-controlled households

followed this general pattern, those in subsidized/assisted units tended to take longer, likely

due to the extensive waiting lists for much of this affordable housing stock.

§ Relationship to Property Owner. Very few of the tenants surveyed (four percent) were

related to the owner of their housing unit. About half of these were children or parents, in

which case the unit would be exempt from rent control.

Housing Stock Characteristics

Survey results regarding the housing stock mirror conditions as documented by Census data, with

responding tenants living in a variety of unit and building types. Interestingly, a significant

proportion of respondents were unsure of whether rent control applied to their housing unit, and

others were likely mistaken, based on their answers to other questions on the survey.

§ Type of Unit. The large majority of San Francisco’s rental housing stock as reported by

survey respondents (and confirmed by Census data) is in multi-unit buildings. Most of the

iv

remainder is single-family homes, with very few living in lofts or other types of housing.

Only four percent of those surveyed reported that they lived in condominiums.

§ Age of Housing. A large majority of the City’s rental housing is relatively old, again based

on both survey responses and Census data. The surveyed market rate rental units were

evenly split between those built before and after the beginning of 1980. By definition, the

rent-controlled units surveyed were all built prior to 1980. Nearly three-fourths of the

subsidized/assisted units were also built prior to 1980.

§ Size of Building and Unit. San Francisco tenants live in a broad array of building types,

ranging from single-family homes to large apartment buildings. In large part due to the

types of units covered by rent control and in subsidized housing developments, a much

higher proportion of respondents in market rate rentals live in single-family houses, over

half as compared to less than one-fifth in either rent controlled or subsidized/assisted units.

More than 80 percent of the surveyed units were small units of two bedrooms or less. The

lack of large units has a direct impact on the types of households that can readily find rental

housing in San Francisco, leading to a high number of smaller and non-family households,

as discussed in the demographics section above.

§ Overcrowding. Based on survey results, slightly over 10 percent of renter households are

overcrowded, a finding echoed by available Census data. Market rate units are least likely

to be overcrowded, with subsidized/assisted units exhibiting the highest proportion of

overcrowded units.

§ Sublease Status and Presence of Landlord/Manager. Only six percent of respondents

reported that they subleased their living quarters, and the same percentage reported that

they subleased to someone else. Less than one in five reported that their landlord lived in

their building. Nearly 40 percent of respondents reported that their building had a manager

other than the landlord.

§ Ownership Status. For each of the individual measures taken, the proportion of units

indicating government ownership (including public housing), or otherwise affirming the

presence of some type of rent subsidy or assistance was less than 10 percent. In

combination, these indicated that 13 percent of the respondent units were subsidized or

assisted.

§ Reported Rent Control Status. Nearly one-third of the respondents were unsure of the

rent control status of their units, and others may have been mistaken, based on their

responses to other questions in the survey.

v

Housing Costs

Based on survey results, rent control does appear to offer some protection against high rent

burdens relative to market rate units, with lower median rents and a pattern of lower rent

burdens. While subsidized/assisted units show much lower rents than market rate or rent-

controlled units, this is offset to a large degree by much lower household incomes, leaving most

of these households with high rent burdens.

§ Rent. Estimated median monthly gross rent (rent plus most utilities) was $1,078 for all

units; it was highest for market rate units, at $1,350, followed by rent-controlled units at

$1,094, with subsidized/assisted units showing the lowest median gross rent at $785.

§ Rent Burden. Nearly half of respondent households had rent-to-income ratios (rent

burdens) of 30 percent or more. A rent-to-income ratio exceeding 30 percent is a

commonly used threshold to indicate excessive rent burden. Households in rent-controlled

units showed the lowest percentage of excessive rent burdens (38 percent), while

households living in subsidized/assisted units showed the highest rate of excessive rent

burden (74 percent).

Tenant Satisfaction

Overall, tenants were satisfied with most aspects of their housing situation. Market rate

respondents were more satisfied for many items than respondents living in rent-controlled or

subsidized/assisted units. While still generally satisfied, tenants in rent-controlled were

somewhat less satisfied with items relating to maintenance and condition of their units. The only

item where a sizable number of respondents were very dissatisfied was parking (not necessarily

just landlord-provided parking).

§ Rent. Responding tenants were generally satisfied with the rent for their units. Over two-

thirds of respondents in each market status category reported being either somewhat

satisfied or very satisfied.

§ Size, Location, and Condition of Unit and Building. Over 80 percent of those surveyed

were satisfied with the size of their unit. Market rate units showed the most satisfied

respondents. Ninety percent of respondents were satisfied with the location of their unit,

and well over half were very satisfied. The proportion of respondents very satisfied with

the condition of their unit and building was considerably lower than for rent, size of unit,

and location. The respondents living in rent controlled units were much less likely to be

very satisfied than those in either market rate or subsidized units.

§ Maintenance and Landlord’s Response to Maintenance Requests. Over 70 percent of

respondents were satisfied with the maintenance of their rental unit, more or less evenly

split between those very satisfied and those somewhat satisfied. Satisfaction levels were

highest in market rate units, and lowest in rent-controlled units. With respect to

Landlord/Manager’s response to maintenance requests, nearly three-fourths of respondents

vi

were satisfied for this item, with slightly below half being very satisfied. Once again,

respondents in market rate units were most satisfied, and those in rent-controlled units

showed the lowest satisfaction, albeit with nearly three fourths showing some level of

satisfaction.

§ Noise and Parking. Only about one in five respondents noted dissatisfaction with noise

from neighbors. Slightly over half were very satisfied. Levels of satisfaction regarding

noise from traffic were slightly lower but still generally high. Although over half of

respondents reported satisfaction with parking, this item by far showed the highest

percentage that was very dissatisfied, at nearly thirty percent. Market rate respondents

showed the highest and rent controlled respondents the lowest average level of satisfaction

with parking. Parking was not specified to only include on-site spaces, and could indicate

also a lack of on-street parking.

§ Security of Building/Safety of Neighborhood. Most of those surveyed were satisfied

with the security of their building, with nearly half being very satisfied. Respondents in

market rate units were more likely to be very satisfied than those in rent-controlled or

subsidized/assisted units. Most respondents were satisfied with safety in their

neighborhood, with nearly half very satisfied. Levels of satisfaction were considerably

lower for subsidized/assisted units.

Experience with Violations of Ordinance

Fifteen percent of respondents stated that they had personally experienced a violation of the rent

control ordinance. While in some cases a violation may have involved more than one issue,

eviction-related violations appeared to be most prevalent.

Tenant Interest in Home Ownership

A substantial minority of respondents reported that they had considered purchasing a unit in the

previous three years. San Francisco was the location most considered, and single-family houses

were the unit type most commonly sought. Given these two factors, combined with the price of

single-family housing in the City and the City’s mix of housing types, it is not surprising that the

primary reason given for not purchasing was inability to afford the unit sought.

§ Consideration of Purchase in Last Three Years. Somewhat under half (44 percent) of

respondents reported considering the purchase of housing in the previous three years.

Interest was at these general levels for those surveyed in both market rate and rent-

controlled units; the level was much lower for respondents in subsidized/assisted units.

§ Location and Unit Type Considered for Purchase. San Francisco was considered as a

potential purchase location by slightly over half of respondents, with over one-third

considering locations elsewhere in the Bay Area. Ten percent or less of respondents had

considered locations elsewhere in California, elsewhere in the U.S., or outside the U.S.

Single-family houses were the preferred housing type for purchase consideration, with a

vii

sizable minority of respondents considering apartments of condominiums. Live/work lofts

were only considered by seven percent of respondents.

§ Reasons for Not Purchasing. Inability to afford the unit sought was by far the most

common reason given by respondents for not having purchased a unit.

Tenant Opinions of Ordinance Success

Survey results show a mixed picture regarding tenant opinions on the success of the ordinance in

several key areas. While over half of respondents felt the ordinance was successful in preventing

excessive rent increases and assuring property owners of fair and adequate rents, less than half

considered the ordinance successful in preventing illegal evictions, and only one-fourth believing

the ordinance successfully maintained affordable housing for special groups. Additionally,

respondents stating that they had no opinion ranged from 20 percent to over one-third of the

total, (depending on which attribute of the ordinance was under scrutiny), indicating a possible

lack of knowledge or concern regarding these particular housing issues.

§ Preventing Excessive Rent Increases. Over half of respondents considered the ordinance

successful in preventing excessive rent increases, with those in rent-controlled units most

likely to have considered the ordinance successful in this area. However, 20 percent of

respondents had no opinion on this aspect of the ordinance.

§ Assuring Property Owners of Fair and Adequate Rents. Over half of respondents also

considered the ordinance successful in this area. However, 26 percent had no opinion on

this aspect of the ordinance.

§ Preventing Illegal Evictions. Respondents were somewhat less likely to rate the

ordinance successful in preventing illegal evictions, with less than half with the opinion

that the ordinance was successful in this area. However, 34 percent reported having no

opinion on this aspect of the ordinance, a surprising finding considering the reported

increase in evictions in the late 1990s and subsequent changes in the ordinance to tighten

eviction controls.

§ Maintaining Affordable Housing for Special Groups. Respondents had a lower opinion

of the success of the ordinance in this area, with only about one quarter believing the

ordinance successful. Nearly half felt it was unsuccessful, a far higher level than for any of

the other items. However, 27 percent had no opinion on this aspect of the ordinance.

1

Introduction

The San Francisco Affordable Housing Study

The San Francisco Affordable Housing Study is a comprehensive analysis of current housing

issues based on both published and primary data. The Study is composed of the following parts:

Ø San Francisco Housing DataBook

Ø Citywide Tenant Survey

Ø Citywide Landlord Survey

The San Francisco Affordable Housing Study was commissioned by resolution of the Board of

Supervisors of the City and County of San Francisco in 2000. It is structured to be “neutral and

fact-based” as per Ordinance No. 55-00. The designated Study Moderator is Mr. Joe Grubb,

Executive Director of the San Francisco Rent Arbitration and Stabilization Board. It is important

to note that the Study focuses on a myriad of housing issues present in San Francisco, and is not

intended to be a study of rent control or the specific regulations and policies of the Rent

Arbitration and Stabilization Board. The DataBook was completed in Spring 2002. This

document summarizes part of the second step in the Study, the Citywide Tenant Survey. The

Citywide Landlord Survey is underway, and results will be published in Fall 2002.

Framework for the Study

The Study approach is based on a compilation of issues, questions, and research topics specified

during a series of meetings of housing stakeholders convened in 2000. The notes from these

meetings, along with subsequent written requests for study topics, were compiled by the Study

Moderator into the “Study Protocol.” After selection of the Study Consultant, Bay Area

Economics (BAE), the Study Protocol was converted into a database of issues and sorted

according to those that could be addressed through published data collection and analysis, those

that require primary research in the form of a citywide tenant and landlord survey, and those that

require special in-depth topical analysis.

The Tenant Survey represents the second step in the Study process, and responds to requested

Study Protocol items that can be analyzed through a survey of San Francisco tenants. The

purpose of the survey is to provide detailed and statistically reliable information regarding

tenants in the City, the quality and condition of the housing units they live in, the rents paid for

those units, the relationship between the tenants and their landlords and managers, and tenants'

overall impression of the success of the Rent Stabilization and Eviction Ordinance in meeting its

stated goals. Although there may be conclusions regarding City policy that can be drawn from

this work, this is not a policy document. No attempt has been made to use these results to

systematically evaluate the Rent Ordinance or the operating regulations used to implement it.

Moreover, no recommendations are made regarding the findings. Instead, this study seeks to

present objective, factual information that may serve as the basis for future policy discussions.

2

Survey Methodology

The Tenant Survey was conducted by telephone, with the sample of random telephone numbers

created by using a combination of purchased lists and random numbers generated in-house by

BAE. Calls were made on evenings and weekends over a period of several weeks in April and

May 2002. In total, approximately 20,000 randomly generated phone numbers were called,

resulting a total of 583 usable responses. Respondents needing translation assistance to Spanish

and Cantonese were provided with survey personnel fluent in these languages. A copy of the

survey instrument is shown in Appendix A.

If a sample such as the one used in this survey is unbiased, the sample will accurately represent

the total “population” from which the sample was taken. In other words, the distribution of

sample responses for a variable can be assumed to represent the distribution on that variable for

the entire population. However, the results of this survey, as with all surveys, must be

interpreted in light of the fact that the results compile only the responses of a sample and not the

entire population. These responses are only an estimator of the characteristics of the entire

population. Statistically, the quality of the estimate is based on the standard error and the

confidence intervals selected; the possible error is a function of the sample size, the bias in the

sample, and the distribution on the variable in the entire population. In ordinary parlance, this is

commonly referred to as the "margin of error." For the purposes of this survey, given the number

of the responses, a difference of a few percentage points does not necessarily represent a real

difference in the universe all San Francisco rental housing units. This margin of error, however,

varies for each possible response for each individual question, depending on the number of

responses to that particular question and the distribution of responses.

For key variables where data are available, comparisons to Census data from 1990 or 2000, or

American Housing Survey

1

data from 1998 are presented to indicate of how representative the

survey responses are of the general population of renters in the City.

1

The American Housing Survey is conducted by the U.S. Census Bureau every few years for the nation and

various metropolitan areas. The most current data for San Francisco can be found in American Housing

Survey for the San Francisco Metropolitan Area: 1998, U.S. Census Bureau, Current Housing Reports,

Series H170/98-39.

3

Demographic Characteristics of San Francisco Tenants

Survey respondents answered a range of questions regarding themselves and their households.

They provided information on household size, household type, presence of children and seniors

in the household, total household income, employment and occupation, and ethnicity. These

variables have been cross-tabulated by market status of the unit (e.g., unit is rent-controlled, see

next section of this chapter).

Market Status

Using the responses to various survey questions, respondent units were classified as market-rate,

rent-controlled, subsidized or assisted, occupied by parent or child of owner, or unclassified due

to lack of complete information.

2

Most of

the results shown henceforth will be

shown for all survey respondents and by

the key market status categories, to

highlight any differences between

responses by unit market status. It should

be noted that none of the cross-tabulations

include units occupied by the parent or

child of the owner or units of

undetermined status, due to the small

number of units in these categories.

The results from the survey shown in

Figure 1 correspond well with the findings

of the San Francisco Housing DataBook,

where American Housing Survey data indicated approximately 70 percent of the City’s units

were rent-controlled. This indicates that with respect to market status, the survey is

representative of all San Francisco rental households. (For the complete table regarding market

status, see Appendix C.)

Figure 1: Market Status of Respondent Units

Geographic Distribution of Respondents within San Francisco

Respondents also provided Zip Code location, and these responses were then sorted into areas

roughly corresponding to San Francisco’s Planning Areas. As shown in Figure 2, responses were

received from throughout San Francisco, with no area representing over 20 percent of the total.

Overall, the distribution of responses by area was similar to the distribution of renter households

in the City (see Appendix C). The Northeast/Downtown area was somewhat underrepresented,

2

Individual responses were classified based on a methodology outlined in Appendix B; this methodology

parallels that used to determine rent control status in the San Francisco Housing DataBook. While the

classification methodology is believed to provide good results, a small number of units may be misclassified

due to incorrect information from respondents and other factors.

Figure 1: Market Status of

Respondent Units

Rent

Controlled

68%

Occupied

by

Parent/Child

1%

Undeter-

mined

8%

Market Rate

10%

Subsidized/

Assisted

13%

4

and Mission/Bernal Heights was slightly over represented; for other areas, the proportion of

survey respondents was similar to the proportion of renter households from the 2000 Census.

Figure 2: Distribution of Responses by Zip Code Area

Household Size

San Francisco’s renter households tend to be relatively small, as shown in Table 1. Among

survey respondents, average household size was 2.24 persons per household, compared to 2.06

persons per household as reported by the 2000 Census for renter households. In contrast, the

average household size in California in 2000 was 2.79 persons for renter households and 2.87

persons for all households.

Household size varies somewhat by market status of the respondent’s unit. Rent-controlled units

have an average household size of 2.02 persons, market rate units have an average household size

of 2.38 persons, and subsidized/assisted units have an average household size of 2.67 persons.

5

Children in Household

Most respondent households do not report children in the household (see Table 1). Less than 20

percent report the presence of children in their unit. The survey results here parallel the

American Housing Survey data from 1998. Rent controlled units from the Tenant Survey show

only 13 percent with children, compared with 22 percent for market-rate units and 35 percent for

subsidized/assisted units.

Seniors in Households

The survey found a low percentage of seniors in San Francisco rental housing (see Table 1).

Less than 15 percent of respondents reported one or more persons 65 or older living in their

housing unit, mirroring the results from the 1998 American Housing Survey. For the Tenant

Survey, seniors were present in 11 percent of market rate units, 13 percent of rent-controlled

units, and 27 percent of subsidized/assisted units.

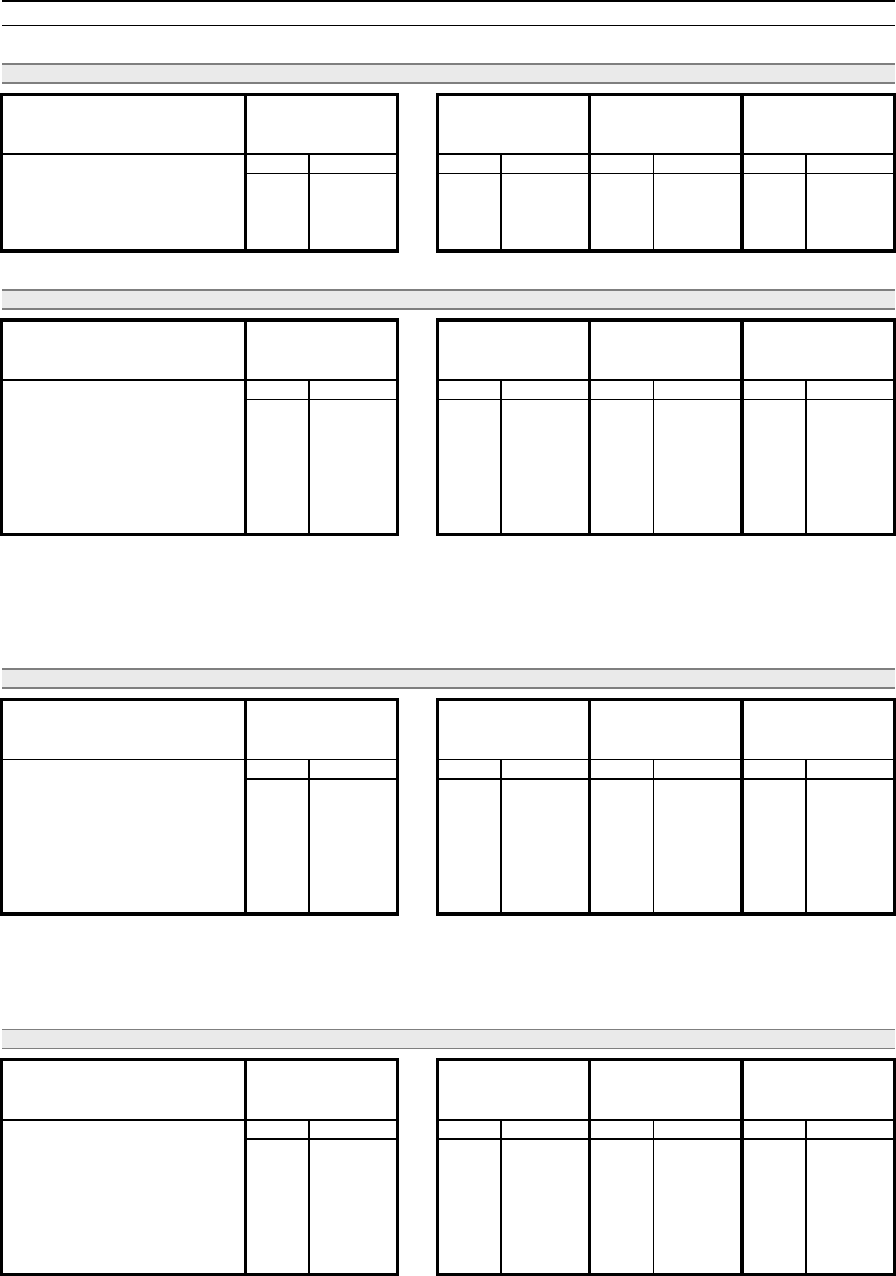

Table 1: Basic Demographic Characteristics

HOUSEHOLD SIZE

Number of

Persons in

Unit All Units

All San Francisco

Renters - 2000 U.S.

Census Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

1 212 37% 96,904 45% 16 29% 162 41% 26 33%

2 190 33% 65,017 30% 20 36% 139 35% 19 24%

3 88 15% 24,482 11% 9 16% 51 13% 16 21%

4 46 8% 14,283 7% 4 7% 27 7% 7 9%

5 or more 42 7% 13,623 6% 6 11% 17 4% 10 13%

Total 578 100% 214,309 100% 55 100% 396 100% 78 100%

Average

Household

Size

2.24 2.06 2.38 2.02 2.67

CHILDREN IN HOUSEHOLD

Children

Under 18 in

Unit All Units

Renters - 1998

American Housing

Survey (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

None

471 82% 161,100 79% 43 78% 345 87% 51 65%

1 55 10% 24,900 12% 6 11% 31 8% 9 12%

2 38 7% 12,500 6% 6 11% 13 3% 13 17%

3 or more 13 2% 6,500 3% - 0% 7 2% 5 6%

1 or more

106

18%

43,900

21%

12

22%

51

13%

27

35%

Total 577 100% 205,100 100% 55 100% 396 13% 78 35%

(a) Data not available from 2000 Census. Based on a sample of households. Numbers may not add due to independent rounding.

SENIORS IN HOUSEHOLD

Number of

Persons 65

or Older in

Unit All Units

All San Francisco

Renters - 1998

American Housing

Survey (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

None 494 86% 174,900 85% 49 89% 346 87% 57 73%

1 63 11% 25,300 12% 5 9% 39 10% 15 19%

2 20 3% 5,000 2% 1 2% 11 3% 6 8%

1 or more

83

14%

30,300

15%

6

11%

50

13%

21

27%

Total 577 100% 205,100 100% 55 100% 396 100% 78 100%

(a) Data not available from 2000 Census. Based on a sample of households. Numbers may not add due to independent

rounding.

Sources: U.S. Census Bureau, 1998 and 2000; Bay Area Economics, 2002.

7

Ethnicity

As shown in Table 2, nearly two-thirds of survey respondents were White. Latinos, African-

Americans, and Asians each made up between eight and twelve percent of respondents, with

mixed-race persons and respondents defining themselves as being of another ethnicity each made

up four percent of the total. There were only a handful of respondents who were Pacific

Islanders or Native Americans. The survey results are similar to the findings for renter

householders from the 2000 Census, except for the higher proportion of Asians reported in the

Census. This may be due to language barriers in administering the survey, although an effort was

made to reach Cantonese-speaking households.

The prevalence of Whites was greatest in rent-controlled units, where they constituted 72 percent

of respondents, compared to 54 percent for market rate units and only 36 percent for

subsidized/assisted units. African-Americans made up 25 percent of respondents in

subsidized/assisted housing, much higher than the overall rate of eight percent for all units.

Gender

Survey respondents were fairly evenly split between men and women (see Table 2), with a slight

majority of female respondents, while the overall population of San Francisco has slightly more

men than women.

Notable among the subgroups by market status was the higher percentage of women in

subsidized/assisted housing, who made up 58 percent of respondents for this group.

Disability Status

Approximately one in six respondents to the Tenant Survey reported at least one person in their

household with a disability or chronic illness, as shown in Table 2. This is similar to the

percentage for all San Francisco households (owners and renters) reported by the 2000 U.S.

Census. In the Tenant Survey, subsidized/assisted units showed a higher presence of disabled

persons, with such persons reported in over one-third of households.

Table 2: Basic Demographic Characteristics, continued

ETHNICITY

Ethnicity (a) All Units

San Francisco Renters,

Householder - 2000

U.S. Census Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number (b) Percent (b) Number Percent Number Percent Number Percent

White 346 62% 134,669 63% 28 54% 280 72% 26 36%

African-American 47 8% 17,084 8% 5 10% 19 5% 18 25%

Latino (b) 68 12% 23,068 11% 7 13% 31 8% 13 18%

Asian 48 9% 42,186 20% 6 12% 30 8% 4 6%

Pacific Islander 3 1% 793 0% 1 2% 2 1% - 0%

Native American 2 0% 1,089 1% 2 4% - 0% - 0%

More than one of above 24 4% 8,694 4% 2 4% 12 3% 8 11%

Other 23 4% 9,794 5% 1 2% 14 4% 3 4%

Total (b) 561 100% 214,309 100% (b) 52 100% 388 100% 72 100%

(a) For survey, ethnicity is for respondent. For Census, ethnicity is for householder. Note that Latinos are doubled counted in

Census frequency distribution shown here (see following footnote). Direct comparisons between two sources should be made

cautiously in light of the differences in how Latino householders were classified.

(b) Census identifies Latinos/Hispanics separately from its racial categories. As a result, Latinos are double-counted in the Census

frequency distribution shown here, and may be of any race. Total for 2000 Census excludes Latino category to avoid

double-counting in total.

GENDER

All Units

All San Francisco

Residents (Renters and

Owners) - 2000 U.S.

Census (a) Market Rate Rent-Controlled Subsidized

Number Percent Number Percent Number Percent Number Percent Number Percent

Male 270 47% 394,828 51% 29 53% 189 48% 33 42%

Female 305 53% 381,905 49% 26 47% 203 52% 45 58%

Total 575 100% 776,733 100% 55 100% 392 100% 78 100%

(a) Includes all occupants of both renter and owner households

PRESENCE OF DISABLED PERSON IN HOUSEHOLD

Disabled Person/

Person with Chronic

Illness in Household All Units

All San Francisco

Residents 5 Years or

Older- 2000 U.S.

Census (a) Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Yes 96 17% 150,131 20% 8 15% 55 14% 29 37%

No 478 83% 590,466 80% 47 85% 338 86% 49 63%

Total 574 100% 740,597 100% 55 100% 393 100% 78 100%

(a) Census count is for all residents in both renter and owner households, and reports number of total persons with a disability, not

merely the presence in the household of a person with a disability.

Sources: U.S. Census Bureau, 2000; Bay Area Economics, 2002.

9

Household Type

Each respondent was asked to categorize his or her household as shown in the following table:

Table 3: Household Type

Percent of

Household Type Respondents

Person living alone 37%

Married couple with children 12%

Married couple without children 14%

Unmarried couple with children 2%

Unmarried couple without children 5%

Single parent with children 4%

Related adults other than parents and children 5%

Unrelated persons other than couples 18%

Other 3%

Total 100.0%

Echoing the findings on household size, slightly over one-third of households consisted of one

person living alone. Married couples with and without children made up just over one-fourth of

the respondent households, split fairly evenly between those with children and those without.

The next largest category, representing 18 percent of all respondent units, was unrelated persons

other than couples. This category includes others sharing rental units for economic or lifestyle-

related reasons. No other category made up even 10 percent of the respondent households.

As shown in the detail in Table 4, a lower proportion of persons living alone distinguished

market rate households, and subsidized/assisted by higher proportions of households with

children, especially single parents. Rent controlled units showed a mix of household types

similar to the overall pattern shown in Table 3 above.

Household Income

Respondents reported broad range of annual household incomes; slightly over one-third had

household incomes below $30,000, 30 percent reported household incomes of $30,000 to

$60,000, and the remainder reported household incomes of $60,000 or more (see Table 4).

Median income for all respondents was $44,811. This is roughly comparable to the inflation-

adjusted median of $46,171 for San Francisco renters from the 1998 American Housing Survey.

By unit market status, respondents in market rate units report the highest median annual

household income, at $55,000. For rent-controlled units, the median was $51,714, and nearly

one-fifth had household incomes of $100,000 or more. The median was significantly lower for

subsidized/assisted units, at $17,000. Over seventy percent of the respondents in these units had

incomes of $30,000 or less.

Table 4: Household Characteristics

HOUSEHOLD TYPE

Number of Persons in Unit All Units Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number Percent Number Percent Number Percent

Person living alone

213 37% 16 29% 163 41% 26 35%

Married couple with children

67 12% 8 15% 38 10% 13 17%

Married couple without

children

82 14% 9 16% 60 15% 6 8%

Unmarried couple with

children

13 2% - 0% 10 3% 3 4%

Unmarried couple without

children

30 5% 5 9% 24 6% - 0%

Single parent with children

25 4% 4 7% 8 2% 9 12%

Related adults, not parents w.

children

26 5% - 0% 15 4% 3 4%

Unrelated persons other than

couples

102 18% 10 18% 67 17% 13 17%

Other

16 3% 3 5% 9 2% 2 3%

Total 574 100% 55 100% 394 100% 75 100%

HOUSEHOLD INCOME

Annual Household Income (a) All Units

All San Francisco

Renters - 1998 American

Housing Survey (b) Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Less than $10,000 47 9% 37,500 18% 2 4% 18 5% 21 30%

$10,000 to $20,000 64 12% 24,400 12% 4 8% 31 9% 20 29%

$20,000 to $30,000 62 12% 25,000 12% 6 12% 38 11% 9 13%

$30,000 to $40,000 59 11% 17,200 8% 8 15% 42 12% 5 7%

$40,000 to $50,000 53 10% 15,100 7% 4 8% 40 11% 4 6%

$50,000 to $60,000 44 9% 4 8% 35 10% 1 1%

$60,000 to $75,000 44 9% (c) 3 6% 37 11% 3 4%

$75,000 to $100,000 60 12% 10 19% 43 12% 3 4%

$100,000 to $150,000 47 9% 8 15% 35 10% 3 4%

$150,000 or more 35 7% 3 6% 31 9% 1 1%

Total 515 100% 205,100 100% 52 100% 350 100% 70 100%

(a) Survey data from 2001. American Housing Survey based on the period of 12 months prior to interview. 1998 data from AHS have

NOT been inflated to 2001 levels, with the exception of the median as noted.

(b) Data not available from 2000 Census. Based on a sample of households. Numbers may not add due to independent rounding.

(c) Available American Housing Survey categories had to be consolidated to match tenant survey category intervals.

(d) Median estimated from grouped interval data.

(e) Median from American Housing Survey adjusted using the Bay Area All Urban Consumers CPI change in annual average from 1997

to 2001.

Sources: U.S. Census Bureau, 1998 and 2000; Bay Area Economics, 2002.

No Census data available

35,200

50,600

17%

25%(c)

$17,000Median Income (d)

$46,171 (2001 $) (e)

$44,811

$38,999 (1997 $)

$51,714$55,000

}

}

11

Employment Status

As shown in Table 5, slightly over 70 percent of respondents reported that they were employed,

somewhat higher than the proportion reported for all working-age residents (in all housing types

regardless of tenure) by the 2000 Census. Nearly three-fourths of respondents in market rate and

rent-controlled reported that they were employed; in contrast, only about half of the respondents

in subsidized/assisted units reported that they were employed.

Place of Work

The large majority of respondents who were working reported that they worked in San Francisco

(see Table 5). This was true for respondents in units of every market status.

Occupation

Among respondent who were working, 55 percent had management, professional, or related

occupations, as shown in Table 5. This is slightly higher than the 48 percent reported by the

2000 Census for all residents (in all housing situations). Most of the remainder was in service or

sales and office occupations.

Professional, managerial, and related occupations were most prevalent among respondents in

rent-controlled units, were 62 percent were in this category. For market rate units, 45 percent of

respondents were in this category, and for subsidized/assisted units, only 38 percent were in this

category. For the subsidized assisted units there were actually slightly more respondents in

service occupations.

Summary of Demographic Characteristics

Based on comparisons on several key variables, the respondents to the tenants survey are a

representative sampling of all San Francisco renters. Based on the higher presence of children,

seniors, minorities, women, and disabled in subsidized/assisted units, the findings here indicate

the importance of affordable units for retaining these groups in the City. In addition to

affordability issues for available market rate and rent-controlled units, there are proportionately

fewer suitable units (e.g., apartments with several bedrooms) for many of these groups in the

non-subsidized rental stock.

Table 5: Employment and Occupation

CURRENT EMPLOYMENT STATUS

Employment Status All Units

San Francisco

Residents 16 or Older

-

2000 U.S. Census (a) Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Employed 408 71% 427,823 63% 40 74% 291 74% 37 48%

Not Currently Employed 167 29% 248,553 37% 14 26% 104 26% 40 52%

Total 575 100% 676,376 100% 54 100% 395 100% 77 100%

(a) Includes residents of all residents regardless of tenure.

PLACE OF EMPLOYMENT

Place of Employment All Units

San Francisco

Residents 16 or Older

-

2000 U.S. Census Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

San Francisco 322 81% 29 73% 231 82% 32 86%

Elsewhere 78 20% Not available 11 28% 52 18% 5 14%

Total 400 100% 40 100% 283 100% 37 100%

OCCUPATION

Occupation All Units

San Francisco

Residents 16 or Older

-

2000 U.S. Census Market Rate Rent-Controlled

Subsidized/

Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Management, professional,

and related

210 55% 206,804 48% 18 45% 169 62% 13 38%

Service 76 20% 61,364 14% 9 23% 38 14% 14 41%

Sales and office 59 15% 109,316 26% 8 20% 43 16% 3 9%

Farming, fishing, and forestry - 0% 462 0.1% - 0% - 0% - 0%

Construction, extraction, and

maintenance

24 6% 17,990 4% 2 5% 18 7% 2 6%

Production, transportation, and

material moving

13 3% 31,887 7% 3 8% 5 2% 2 6%

Total 382 100% 427,823 100% 40 100% 273 100% 34 100%

Sources: U.S. Census Bureau, 2000; Bay Area Economics, 2002.

13

Tenant Mobility

From time to time, tenants have a need or desire to move due to changing lifestyles, household

sizes, career changes, or a multitude of other reasons. The San Francisco Tenants Survey asked

respondents a number of questions regarding mobility, including length of residence at their

current address, their previous residence location, and the means used to find their current

residence.

Length of Residence

Over half of survey respondent households had moved into their unit since the beginning of 1997

(see Table 6). Only about one-fourth had been in their units for more than 10 years (prior to

1992). Census results from 1990 (most recent available) show a slightly higher degree of

mobility.

Respondent households in market rate units were actually less mobile than those in rent-

controlled units; only 38 percent of households in market rate units had moved into their units

since the beginning of 1997, compared with 53 percent of households in rent-controlled units.

Households in subsidized/assisted units were also more mobile than those in market rate units,

with 52 percent having moved into their unit since 1997.

Previous Place of Residence

Nearly two-thirds of respondents reported that their previous place of residence was San

Francisco, as shown in Table 6. An additional 13 percent were from elsewhere in the Bay Area.

This pattern was fairly consistent across unit types by market status, although respondents in

subsidized/assisted units were slightly more likely to be moving from elsewhere in the City.

Table 6: Tenant Mobility

YEAR FIRST MEMBER OF HOUSEHOLD (INCLUDING RESPONDENT) MOVED INTO UNIT

Year Moved In All Units

San Francisco Renter

Households - 1990 U.S.

Census (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

1971 or earlier 17 3% 4,110 2% 2 4% 11 3% 3 4%

1972-1981 42 8% 7,361 4% 6 11% 26 7% 7 10%

1982-1991 74 14% 29,379 15% 13 24% 46 13% 9 13%

1992-1996 120 23% 29,881 15% 13 24% 85 24% 13 19%

1997-2000 141 28% 64,854 32% 7 13% 104 30% 19 28%

2001-2002 117 23% 64,485 32% 14 25% 79 23% 16 24%

Total 511 100% 200,070 100% 55 100% 351 100% 67 100%

(a) 1990 distribution of households by when moved into unit and tenure derived from Census STF3. Equivalent data not yet available

from 2000 Census. 1990 categories for when householder moved in are nearly equivalent periods of time, as follows:

Survey 1990 Census

1971 or earlier 1959 or earlier

1972-1981 1960 to 1969

1982-1991 1970 to 1979

1992-1996 1980 to 1984

1997-2000 1985 to 1988

2001-2002 (April) 1989 or 1990 (March)

PREVIOUS PLACE OF RESIDENCE

Previous Place of

Residence All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

City of San Francisco 380 65% 37 66% 257 65% 57 73%

Elsewhere in Bay Area 77 13% 13 23% 52 13% 4 5%

Elsewhere in California 25 4% 1 2% 16 4% 4 5%

Elsewhere in U.S. 60 10% 3 5% 48 12% 7 9%

Outside U.S. 39 7% 2 4% 24 6% 6 8%

Total 581 100% 56 100% 397 100% 78 100%

Sources: U.S. Census Bureau, 2000; Bay Area Economics, 2002.

No Census data available

15

Tenure Status at Previous Place of Residence

The large majority of respondents were also renters at their previous place of residence (see

Table 7). This parallels findings from the 1998 American Housing Survey, and held true for all

categories for unit market status. For each group, 75 percent or more had previously been

renters.

How Respondent Found Unit

As indicated in Table 7, half of the respondents found their unit through informal means,

including referral from the previous tenant or another current tenant, knowing the landlord, or

"word of mouth." Among more formal methods, 11 percent used a rental agency, 17 percent

responded to a newspaper advertisement, 11 percent saw a sign on the building, and nine percent

used the Internet.

Subsidized/assisted units showed the greatest use of informal networking, with 60 percent of

respondents in these units finding their units this way; these respondents also used public

agencies to a limited extent, but far more than for other respondents. Respondents in market rate

units were the least likely to use informal means.

Length of Time to Find Unit

Perhaps one of the most interesting findings of the survey was the period of time it took the

respondent to find their current unit. Over 40 percent reported finding their housing unit within

one week or less, and 75 percent found their unit within one month or less (see Table 7). While

surveyed market rate and rent-controlled households followed this general pattern, those in

subsidized/assisted units tended to take longer, including 16 percent taking one year or more to

find their current unit. This is probably due to the extensive waiting lists for many subsidized

and assisted housing options, such as public housing.

Table 7: Tenant Mobility, continued

TENURE STATUS AT PREVIOUS PLACE OF RESIDENCE

Previous Tenure Status All Units

Renters who were

Recent Movers -

1998 American

Housing Survey (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Renter 489 84% 22,200 78% 42 75% 340 86% 66 86%

Owner 91 16% 6,200 22% 14 25% 57 14% 11 14%

Total 580 100% 28,400 100% 56 100% 397 100% 77 100%

(a) Data not available from 2000 Census. Based on a sample of households. Includes renters who moved during past year.

Numbers may not add due to independent rounding.

HOW RESPONDENT FOUND UNIT

How Respondent Found

Unit All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

From a current or

former tenant in unit

35 6% 4 7% 26 7% 4 5%

Knowing the landlord 32 6% 3 5% 21 5% 4 5%

Word of mouth 180 31% 12 21% 115 29% 29 38%

Newspaper ad 99 17% 13 23% 71 18% 4 5%

Rental agency 62 11% 7 13% 48 12% 6 8%

Internet web sites 54 9% 3 5% 41 10% 6 8%

Sign on building 65 11% 9 16% 46 12% 7 9%

Public Agency 11 2% 1 2% 2 1% 8 10%

Other 41 7% 4 7% 25 6% 9 12%

Total 579 100% 56 100% 395 100% 77 100%

LENGTH OF TIME TO FIND UNIT

Length of Time to Find

Unit All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Less than 1 week

168 30% 19 35% 112 29% 20 27%

1 week 67 12% 5 9% 47 12% 7 9%

2 weeks 68 12% 5 9% 56 15% 4 5%

3 weeks 27 5% 2 4% 20 5% 1 1%

1 month 93 17% 12 22% 66 17% 10 14%

2 months 62 11% 6 11% 45 12% 6 8%

3 to 5 months 39 7% 5 9% 22 6% 8 11%

6 to 11 months 17 3% 1 2% 9 2% 6 8%

1 year or more 22 4% - 0% 9 2% 12 16%

Total 563 100% 55 100% 386 100% 74 100%

Sources: U.S. Census Bureau, 2000; Bay Area Economics, 2002.

17

Relationship to Property Owner

Only four percent of respondents reported that they were related to the owner of the unit, as

shown in Table 8. This pattern held for market rate, rent-controlled, and subsidized/assisted

units, with none of these types showing more than seven percent of respondents related to the

owner.

These relatives were fairly evenly split between children/parents and other relatives (also in

Table 7). Presence of children or parents automatically excluded the units from classification as

market rate, rent-controlled, or subsidized. It should be noted that only 24 respondents indicated

that they were related to the unit owner, and only 18 of these identified their relationship, an

extremely small sample from which to draw conclusions regarding type of relationship.

Summary of Tenant Mobility Characteristics

Like renters in most places, San Francisco tenants show a high level of mobility. Not

surprisingly, most were previously renters elsewhere. Many found their current residence

informally, and in a short period of time (with the exception of those in subsidized/assisted

units). Very few are related to the owner of their housing unit.

Table 8: Relationship to Property Owner

RESPONDENT RELATED TO PROPERTY OWNER

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Yes 24 4% 4 7% 8 2% 3 4%

No 553 96% 51 93% 386 98% 75 96%

Total 577 100% 55 100% 394 100% 78 100%

TYPE OF RELATIONSHIP TO PROPERTY OWNER

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Parent 4 22% - 0% - 0% - 0%

Child 4 22% - 0% - 0% - 0%

Other 10 56% 4 100% 4 100% 1 100%

Total 18 100% 4 100% 4 100% 1 100%

Sources: Bay Area Economics, 2002.

19

Rental Housing Stock

Respondents were asked a number of questions regarding the characteristics of their rental units.

This included information on unit type, condominium status, year built, number of units in

building, number of bedrooms in unit, sublease status, presence of landlord and manager,

ownership by government or nonprofit entity, receipt of government assistance with rent, income

reporting requirements, and respondent-reported rent control status. Where available,

comparisons have been made with available Census data.

Type of Unit

Most San Francisco rental units are units in multifamily buildings, with eighty percent of the

respondents stating that they lived in apartments or flats (see Table 9). Of the remainder, most

reside in single-family houses, either detached or attached. A very small number reported living

in lofts or other types of units (e.g., cottage in back yard). These proportions are roughly similar

to the 1990 Census (most recent data available), although the Census shows a slightly higher

proportion in apartments and a slightly smaller percentage in single-family houses.

The distribution of unit types for market-rate units was markedly different from rent-controlled

or subsidized units, with only 41 percent in apartments and slightly over half in single-family

houses. This is likely due in large part to the exemption of many single-family units from rent

control.

Condominium Status

As shown in Table 9, only four percent of surveyed units were condominiums, which is similar

to the proportion found in the 1990 Census (most recent data available). While based on a small

sample, the survey results indicate a higher percentage of condominiums among market rate

units, likely due to the rent-control-exempt status of many condominiums.

Year Structure Built

Respondents were asked to estimate whether their units were built either before 1980, or 1980 or

later, as this is approximately the date used in determining rent control status (older units may be

rent controlled, newer units are not). For all surveyed units, 84 percent of respondents reported

them as constructed prior to 1980, as shown in Table 9.

Market rate respondent units were evenly split between those built prior to 1980 and those built

1980 or later. By definition, rent-controlled units were all built prior to 1980. Nearly three-

fourths of subsidized/assisted units were also built before 1980.

Table 9: Housing Unit Characteristics

TYPE OF HOUSING UNIT

Housing Unit Type All Units

Renter Households -

1990 U.S. Census

(a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Apartment or flat 462 80% 173,020 86% 23 41% 345 87% 63 81%

Single family, detached 68 12% 11,197 6% 18 32% 28 7% 6 8%

Single family, attached 33 6% 11,436 6% 12 21% 12 3% 6 8%

Live/work loft 7 1% (b) (b) 3 5% 4 1% - 0%

Other 11 2% 4,434 2% - 0% 8 2% 3 4%

Total 581 100% 200,087 100% 56 100% 397 100% 78 100%

(a) 2000 data not yet available.

(b) Category not used by Census.

CONDOMINIUM STATUS

Condominium Status All Units

All San Francisco

Renter Households -

1990 U.S. Census

(a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Condominium

22 4% 5,661 3% 9 16% 9 2% 3 4%

Not a condominium 552 96% 194,409 97% 46 84% 384 98% 75 96%

Total 574 100% 200,070 100% 55 100% 393 98% 78 96%

(a) Condominium status not available from 2000 Census.

YEAR STRUCTURE BUILT

Year Built All Units

All San Francisco

Households - 2000

U.S. Census (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

Before 1980 489 84% 315,317 91% 28 50% 397 100% 56 72%

1980 or later 37 6% 31,210 9% 28 50% - 0% 9 12%

Don't know 54 9% NA NA - 0% - 0% 13 17%

Total 580 100% 346,527 100% 56 100% 397 100% 78 100%

(a) Census data include all households, both owner and renter. Renter-only data not yet available.

Sources: U.S. Census Bureau, 2000; Bay Area Economics, 2002.

21

Number of Units in Building

Respondents were distributed fairly evenly among a range of unit sizes, ranging from 12 percent

in duplexes to 21 percent in buildings of 20 or more units (see Table 10). Survey respondents

were somewhat more likely to be in single-unit buildings and less likely to be in large buildings

of 20 or more units than was reported by the 1990 Census (2000 data not yet available).

Paralleling the findings regarding unit type, over half of the market rate respondents were in

single-unit buildings, in contrast to only 12 percent of respondents in rent-controlled units and 17

percent in subsidized/assisted units. Forty-three percent of respondents in subsidized/assisted

units were in large buildings of 20 units or more.

Number of Bedrooms in Unit

Most of the rental units surveyed had one or two bedrooms, with these two types comprising

nearly 70 percent of the respondent units (see Table 10). Studio units (zero bedrooms) made up

12 percent of units, and units of three or more bedrooms made up 18 percent of units. The 1990

Census indicates a somewhat higher proportion of studio units (21 percent) and lower proportion

of larger units.

The average number of bedrooms for all surveyed units was 1.64. Market rate units tended to be

somewhat larger, with an average of 2.05 bedrooms; only one market-rate unit was reported as a

studio, and nearly half were two-bedroom units. Rent-controlled units had an average of 1.53

bedrooms per unit, and subsidized/assisted units had 1.68 bedrooms per unit.

Overcrowding

One standard measure of the relative crowding in living quarters is the number of persons per

room in a unit, with more than one person per room being considered overcrowding. Based on

the number of bedrooms, BAE has estimated the total number of rooms per surveyed household,

as shown in Table 10. Slightly over 10 percent of all respondent households show as

overcrowded, which echoes 1990 Census results for San Francisco rental units (2000 data not yet

available). Market rate units were the least likely to be overcrowded, while subsidized/assisted

units were the most likely among the three key market status types.

Overall, the survey and Census data indicate that the proportion of overcrowded rent-controlled

units in San Francisco remains small. This is the case despite a long-term trend of substantial

rent increases, indicating that on average renters are not “doubling up” to decrease the impacts of

these increases.

Table 10: Additional Housing Characteristics

NUMBER OF UNITS IN BUILDING

Number of Units in

Building All Units

All San Francisco

Renter Households -

1990 U.S. Census (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

1 unit

104 19% 22,633 12% 30 56% 43 12% 12 17%

2 units

68 12% 24,237 12% 4 7% 47 13% 8 11%

3 to 4 units

87 16% 32,163 16% 2 4% 69 19% 8 11%

5 to 9 units

88 16% 31,993 16% 4 7% 73 20% 6 8%

10 to 19 units

82 15% 31,433 16% 4 7% 66 18% 7 10%

20 or more units 116 21% 53,194 27% 10 19% 73 20% 31 43%

Total 545 100% 195,653 (b) 100% 54 100% 371 20% 72 43%

(a) 2000 data not yet available.

(b) Excludes units classified as mobile home and other.

NUMBER OF BEDROOMS

Number of Bedrooms

in Unit All Units

All San Francisco

Renter Households -

1990 U.S. Census (a) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

0 bedrooms 70 12% 42,452 21% 1 2% 52 13% 14 18%

1 bedroom 212 37% 77,931 39% 14 25% 159 40% 24 31%

2 bedrooms 191 33% 55,049 28% 26 46% 128 32% 19 24%

3 bedrooms 83 14% 19,555 10% 12 21% 45 11% 17 22%

4 or more bedrooms 24 4% 5,083 3% 3 5% 13 3% 4 5%

Total 580 100% 200,070 100% 56 100% 397 100% 78 100%

Average Number of

Bedrooms

1.64 NA 2.05 1.53 1.68

(a) 2000 data not yet available.

PERSONS PER ROOM

Persons per Room

(a) All Units

All San Francisco

Renter Households -

1990 U.S. Census (b) Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent Number Percent

1.00 or less 515 89% 175,184 88% 53 96% 364 92% 65 83%

1.01 or more 62 11% 24,903 12% 2 4% 32 8% 13 17%

Total 577 100% 200,087 100% 55 100% 396 100% 78 100%

(a) Number of rooms were estimated by analysis of census microdata indicating average number of rooms for each bedroom size

for all rental units in San Francisco. Each response indicating a certain number of bedrooms was then estimated to have that

number of total rooms.

(b) 2000 data not yet available.

Sources: U.S. Census Bureau, 2000; Bay Area Economics, 2002.

23

Sublease Status

For six percent of all surveyed units, the respondent indicated that they subleased the unit or part

of the unit from someone other than the owner (see Table 11). Respondents in market-rate units

showed the highest rate of subleasing for the three primary market status types, at nine percent.

Conversely, six percent of the respondents indicated that they subleased part of their unit to

someone else. There was little difference in this proportion by market status.

Presence of Landlord in Building

As shown also in Table 11, slightly less than one in five respondents reported that their landlord

lived in their building. This was fairly consistent across all market status types, with the

exception of market rate units, which showed a slightly lower proportion.

Manager Other than Landlord

Nearly 40 percent of respondents stated that their building had a manager other than the landlord

(see Table 11). Market rate units showed the lowest proportion, with only 27 percent of

respondents’ building having a manager other than the property owner. Over half of respondents

in subsidized/assisted units reported a manager other than the property owner.

Table 11: Additional Housing Characteristics, continued

DOES RESPONDENT SUBLEASE UNIT OR PART OF IT FROM SOMEONE OTHER THAN OWNER?

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Yes 32 6% 5 9% 15 4% 3 4%

No 544 94% 51 91% 377 96% 75 96%

Total 576 100% 56 100% 392 100% 78 100%

DOES RESPONDENT SUBLEASE PART OF UNIT TO OTHER PERSONS?

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Yes 35 6% 3 5% 22 6% 4 5%

No 543 94% 53 95% 372 94% 74 95%

Total 578 100% 56 100% 394 100% 78 100%

LANDLORD LIVES IN BUILDING

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Yes 104 18% 7 13% 68 17% 13 17%

No 468 82% 46 87% 326 83% 63 83%

Total 572 100% 53 100% 394 100% 76 100%

MANAGER OTHER THAN LANDLORD

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number Percent Number Percent Number Percent Number Percent

Yes 222 39% 15 27% 157 40% 43 56%

No 351 61% 41 73% 237 60% 34 44%

Total 573 100% 56 100% 394 100% 77 100%

Sources: Bay Area Economics, 2002.

25

Subsidized/Assisted Housing

As shown in Table 12, six percent of respondents reported that the government or a nonprofit

entity owned their unit, five percent reported that their unit was in a public housing project, and

five percent reported that at least one occupant their unit was in a public housing project. In

addition, eight percent of respondents reported that their income was verified each year as a

condition of renting their unit. These units all been classified as subsidized/assisted.

Reported Rent Control Status

Nearly one-third of respondents did not know the rent control status of their unit, and many

others most likely did not report this correctly, as shown in Table 12. BAE used responses to

other questions regarding age of unit, type of unit and subsidy status to determine market status,

since the responses to the direct question were unusable or unreliable. Confusion about this

issue was common for all market status types.

Table 12: Subsidy and Rent Control Status

OWNERSHIP BY GOVERNMENT OR NONPROFIT ENTITY

Owned by Government or

Nonprofit Entity All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number

Percent

Number

Percent

Number

Percent

Number

Percent

Yes

32

6%

-

0%

-

0%

32

45%

No

532

94%

56

100%

391

100%

39

55%

Total 564 100% 56 100% 391 100% 71 100%

PUBLIC HOUSING

Respondent Unit in Public

Housing Project All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number

Percent

Number

Percent

Number

Percent

Number

Percent

Yes

27

5%

-

0%

-

0%

27

36%

No

548

95%

56

100%

396

100%

48

64%

Total 575 100% 56 100% 396 100% 75 100%

RECEIPT OF GOVERNMENT ASSISTANCE WITH RENT

At least one resident in unit

receives assistance with

rent All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number

Percent

Number

Percent

Number

Percent

Number

Percent

Yes

31

5%

-

0%

-

0%

31

41%

No

542

95%

56

100%

396

100%

44

59%

Total 573 100% 56 100% 396 100% 75 100%

REPORTING OF INCOME TO RENEW LEASE

Household Reports

Income to Renew Lease All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number

Percent

Number

Percent

Number

Percent

Number

Percent

Yes

47

8%

-

0%

-

0%

47

63%

No

508

92%

55

100%

381

100%

28

37%

Total 555 100% 55 100% 381 100% 75 100%

REPORTED RENT CONTROL STATUS (a)

All Units Market Rate Rent-Controlled Subsidized/ Assisted

Number

Percent

Number

Percent

Number

Percent

Number

Percent

Rent and Eviction Control

304

53%

22

40%

233

59%

38

49%

Eviction control only

5

1%

-

0%

3

1%

1

1%

Not covered

83

14%

15

27%

56

14%

8

10%

Don't know

185

32%

18

33%

103

26%

30

39%

Total 577 100% 55 100% 395 100% 77 100%

(a) For the purposes of this analysis, rent control status was determined independent of respondent-reported rent

control status, using responses regarding when unit was built, subsidy status, and other variables.

Sources: Bay Area Economics, 2002.

27

Housing Costs

The survey requested information regarding payment for housing, including contract rent and

utility charges not covered under the base (contract) rent. In some cases, contract rent includes

all services, but often the tenant pays separately for items such as utilities and garbage pickup.

The sum of all these charges, contract rent and additional charges for basic housing-related items,

is referred to as gross rent. Since it includes all tenant expenses for a residence, gross rent is a

better measure than contract rent for measuring the effective housing costs for a tenant

household. For instance, gross rent rather than contract rent is used to compute rent burden, the

rent-to-income ratio for a household.

Contract Rent

Contract rent is the rent paid directly to the landlord, which may or may not include utilities and

additional services. The median reported contract rent for surveyed households was $1,000 per

month (see Table 13). Contract rents did not cluster at any particular level, being spread fairly

evenly across a broad range from $500 to over $2,000.

The distribution of median rents reflected the determined market status of the respondent units.

Contract rents ranged highest for market rate units, with a median of $1,305 monthly. The

median monthly contract rent for rent-controlled units was $1,050. Subsidized/assisted units

showed the lowest median, at $700.

Gross Rent

Respondents were also asked about their gas and electric bills. For most tenants who pay an

additional charge over and above contract rent, this is the largest single item. BAE added the

amount reported to the reported contract rent to estimate a gross rent, which is shown in

Table 13.

3

The resulting distribution parallels that for contract rent, albeit at a slightly higher dollar level.

Median gross monthly rent for all respondent households was $1,078; this is somewhat above the

reported median from the 2000 U.S. Census, perhaps due to either an up tick in market rents from