2007 Annual Report to Congress: The Most Serious Problems (MSPs) Encountered by Taxpayers

2007 ARC – MSP Topic #1 – THE IMPACT OF LATE-YEAR TAX-LAW CHANGES ON TAXPAYERS

Problem

In recent years, Congress has made significant changes to the tax code in December that apply to the current tax year

(e.g., the “extenders bill” in December 2006 and the Alternative Minimum Tax (AMT) “patch” in December 2007). The IRS

currently finalizes Form 1040 and its accompanying instructions in early November, and tax software companies finalize

their shrink-wrapped software packages around the same time. If Congress changes the law after those products have

been finalized, significant problems arise. Because of systemic limitations and to minimize taxpayer confusion, the IRS

generally does not update Form 1040 or its accompanying instructions after initial publication. As a result, taxpayers filing

paper returns are particularly likely to complete their returns without taking into account late-year changes. Taxpayers who

purchase shrink-wrapped software have the option of downloading a “patch” to update their software, but some taxpayers

do not do so. As a result, some taxpayers who prepare their returns electronically also do not take late-year changes into

account. In Tax Year 2006, Congress waited until after the Form 1040 package and shrink-wrapped tax software products

had been finalized to “extend” several popular tax deductions. Taxpayers ultimately claimed these deductions about 1.4

million times less frequently than in tax year 2005, when the deductions were included in the Form 1040 instructions and

built into all tax software. Thus, it appears that numerous taxpayers did not claim tax deductions to which they were

entitled simply because they did not know about them.

Late-year tax-law changes also place enormous stress on the IRS’s ability to deliver a successful filing season. The IRS

must develop updated forms, develop training materials for its telephone assistors and field assistance personnel, provide

instruction for Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) sites and, most

significantly, write programming code that allows the IRS to accept returns and perform numerous automated reviews of

returns. The programming challenges are particularly time-consuming and have delayed the start of the filing season for

millions of taxpayers. Delays in the filing season can create severe hardships. The overwhelming majority of tax returns

(more than 100 million) result in refunds, and a delay in processing returns means a delay in issuing refunds to taxpayers,

including low income taxpayers who rely on tax refunds to pay essential bills. Among taxpayers claiming refunds and

receiving the Earned Income Tax Credit (EITC), the average refund equals 20 percent of their yearly income. To ensure

that members of Congress better understand the filing-season impact of late tax legislation, the National Taxpayer

Advocate recommends that the Treasury Department and the tax-writing committees create a formal process by which

IRS estimates of the filing-season impact of significant tax legislation are transmitted to the tax-writing committees at

several points during the year, perhaps on June 30, September 30, and monthly thereafter.

1

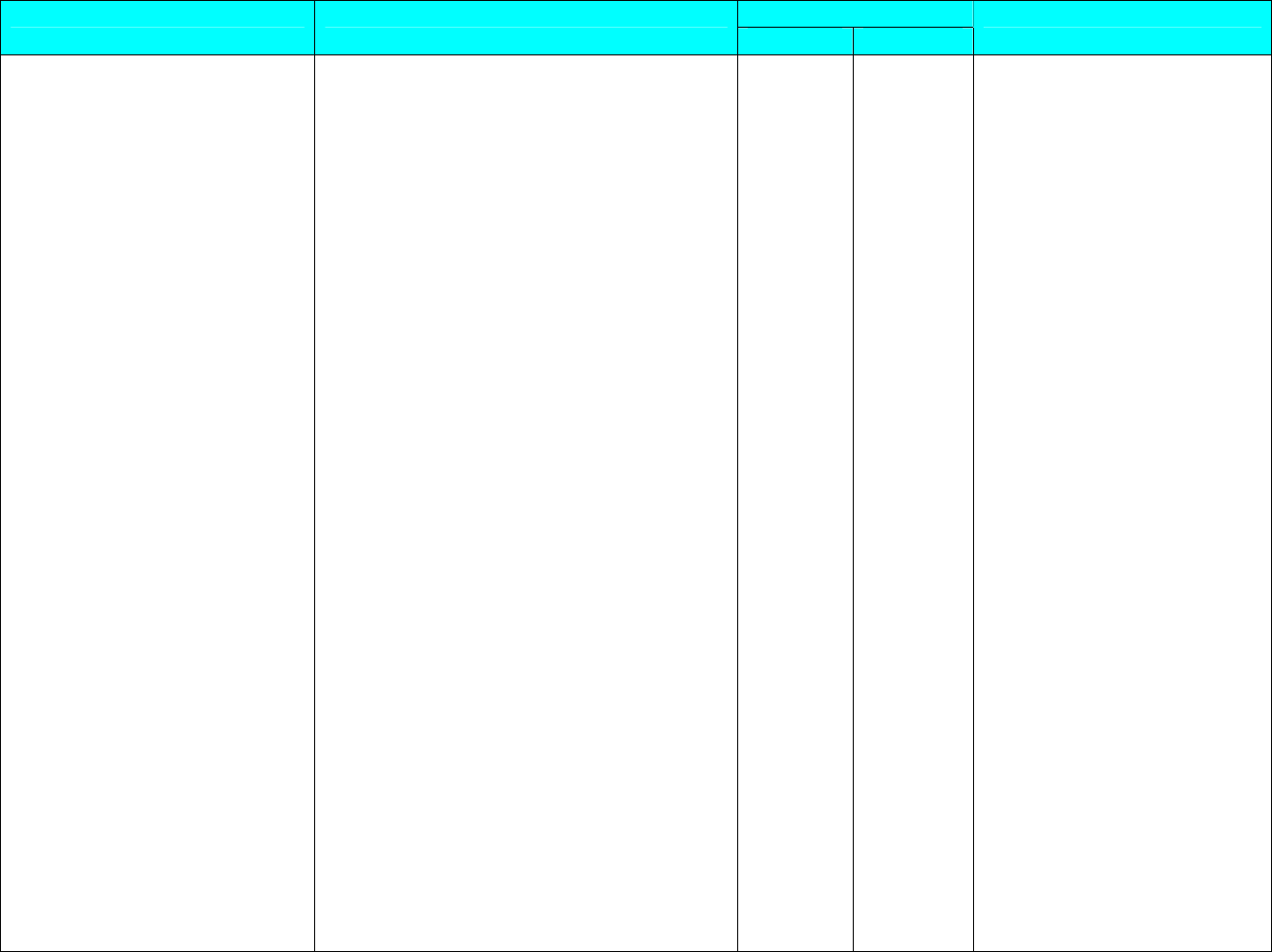

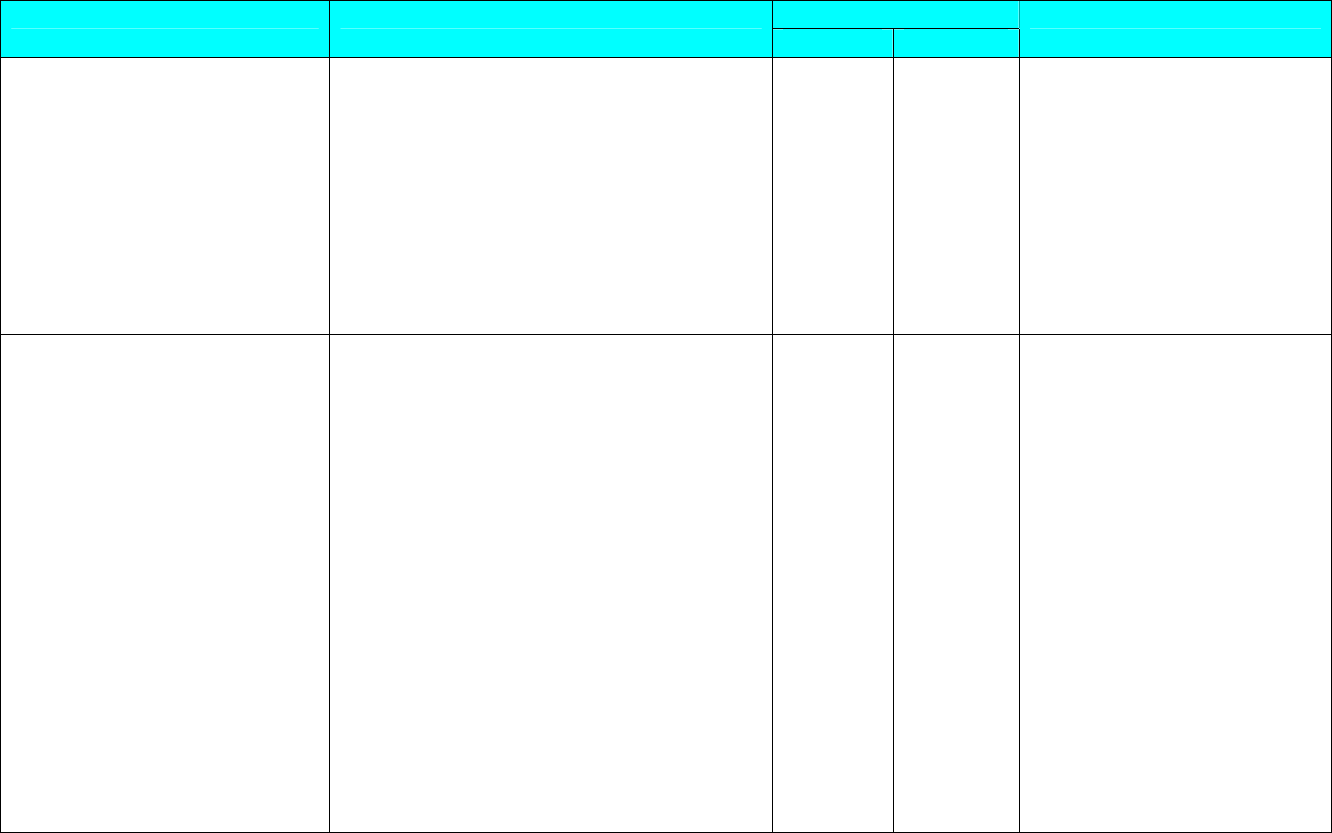

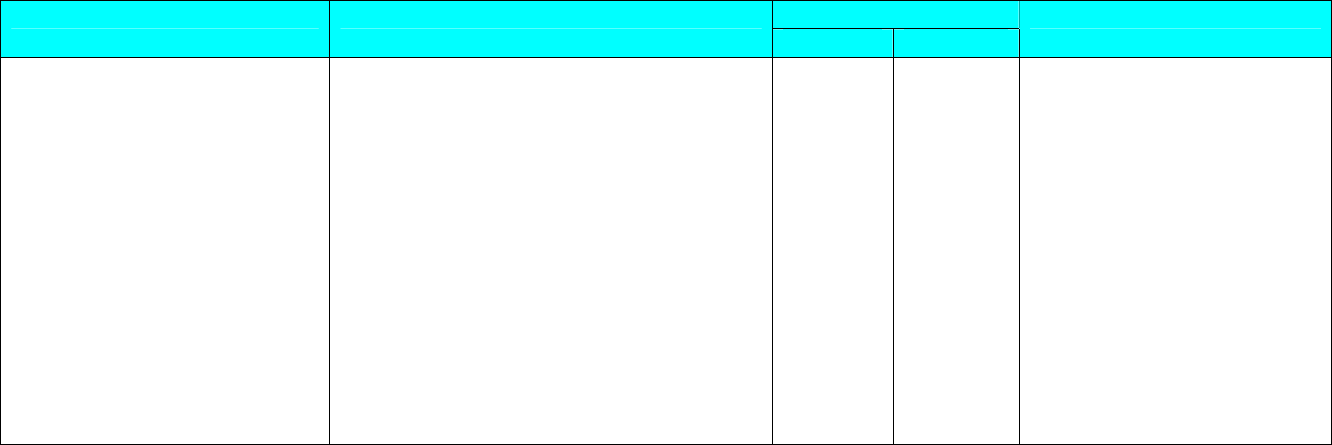

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. To ensure that members

of Congress understand

the filing-season impact

of tax legislation, we

recommend that the

Treasury Department

and the tax-writing

committees create a

formal process through

which IRS estimates of

the filing-season impact

of significant tax

legislation are

transmitted to the tax-

writing committees at

several points during the

year, perhaps on June

30, September 30, and

monthly thereafter. The

estimates should focus

on legislation to extend

expiring tax provisions.

N/A – Congressional Recommendation

2

2007 ARC – MSP Topic #2 – TAX CONSEQUENCES OF CANCELLATION OF DEBT INCOME

Problem

When a taxpayer is unable to pay a debt and the creditor cancels some or all of it, the amount of the canceled debt is

generally treated as taxable income to the taxpayer. Debt cancellation arises in numerous contexts, such as when a

taxpayer defaults on an automobile loan or a credit card bill, and affects a significant number of taxpayers. In 2006,

creditors issued to borrowers nearly two million Forms 1099-C, Cancellation of Debt, reporting canceled debts. The tax

treatment of canceled debts is extremely complex and poses a significant challenge to affected taxpayers. If the lender

incorrectly values property, the amount of canceled debt it reports will be wrong. If the taxpayer is insolvent (i.e., the

taxpayer’s liabilities exceed the taxpayer’s assets), the canceled debt is excludable from gross income up to the amount

of insolvency. If the debt is nonrecourse (i.e., the lender’s only remedy in case of default is to repossess the property to

which it relates), the canceled debt is not income. Our review of IRS forms, instructions, and publications reveals that the

IRS does not provide adequate guidance to taxpayers or practitioners. The IRS also has declared the subject of canceled

debts “out-of-scope” at its walk-in sites. As a result, IRS personnel at walk-in sites will not answer general taxpayer

questions about the tax treatment or reporting of canceled debts, and IRS personnel will not prepare tax returns for

taxpayers who have received a Form 1099-C even if the taxpayers are otherwise eligible for such assistance. The

National Taxpayer Advocate makes 11 recommendations to provide greater assistance to taxpayers, including a

recommendation that the IRS treat questions about canceled debts as “in scope” at its walk-in sites and a

recommendation that the IRS develop a publication on the tax treatment and reporting of cancellation of indebtedness

income that consolidates all relevant information in one place.

3

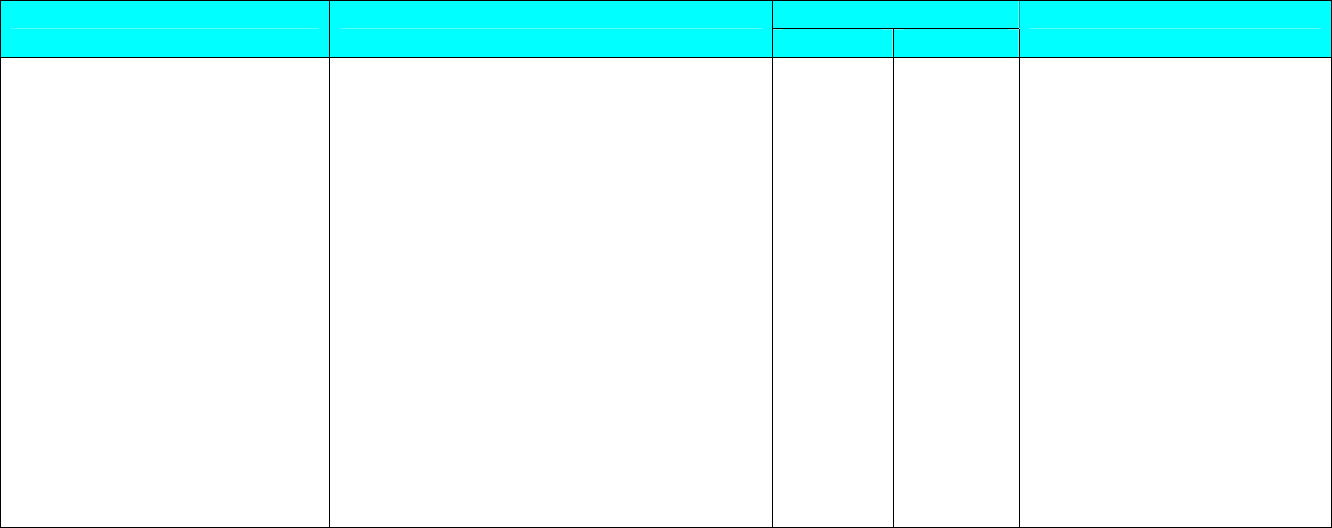

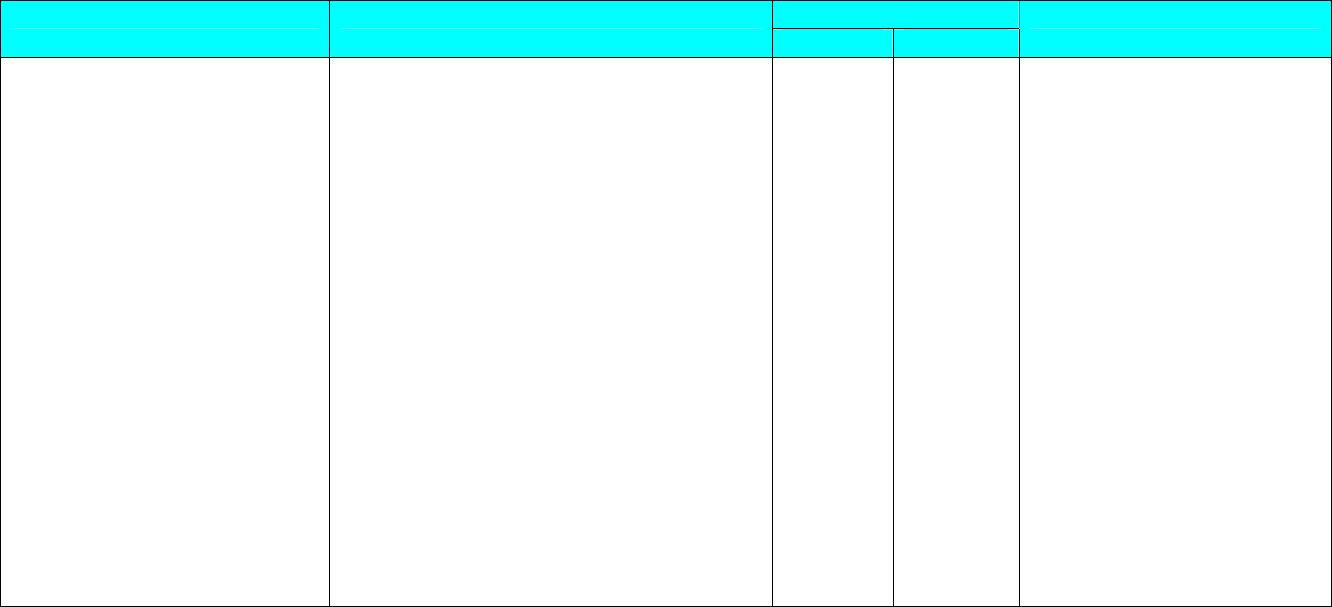

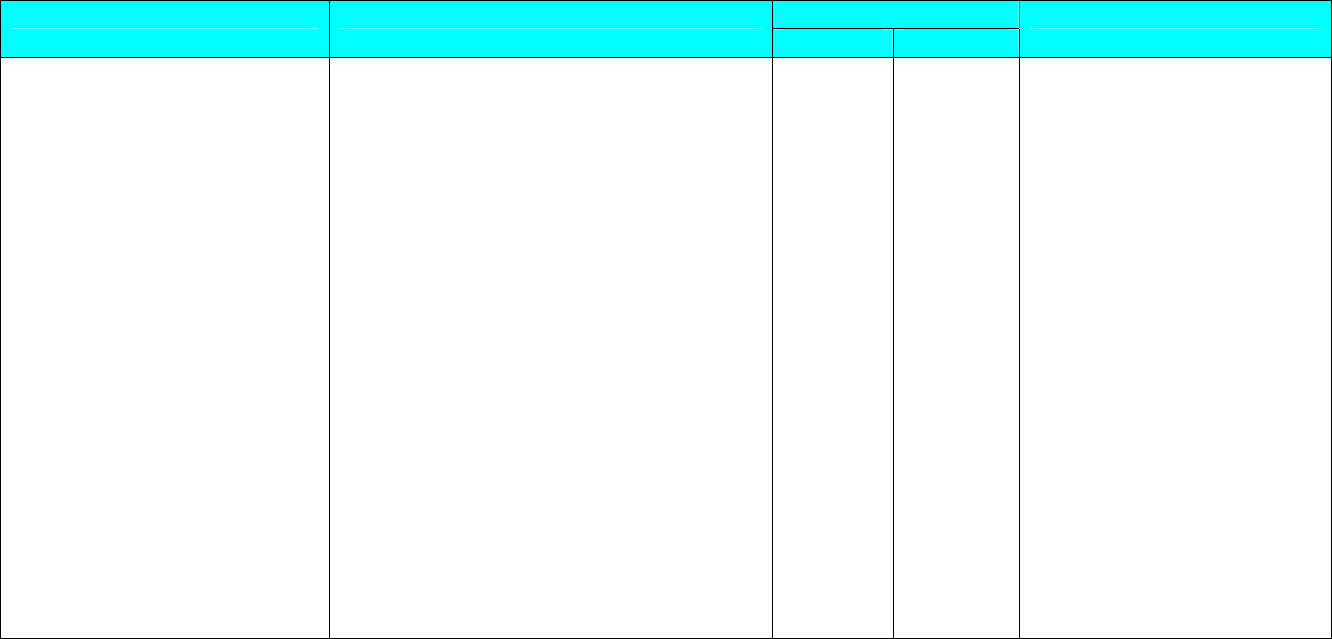

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. The IRS should

designate the tax

treatment of canceled

debts as "in scope" for

purposes of preparing

tax returns at the

Taxpayer Assistance

Centers (TACs).

As noted in the NTA’s Annual Report,

the IRS has developed and issued

information on home foreclosures and

debt cancellation for taxpayers on

IRS.gov and in multiple publications

and forms instructions. However, the

complexity of the basis issues in

determining the taxable portion of the

1099-C poses issues that in many

cases may exceed the expertise/grade

level of TAC employees. As a result,

we designate certain issues as out of

scope for TAC return preparation

assistance. However, Starting in FY

2009, Field Assistance will bring in

scope return preparation for

Cancellation of Debt (COD) only as it

relates to the forgiveness of qualified

principal residence debt governed by

provision of the Mortgage Forgiveness

Debt Relief Act of 2007. Taxpayers

with COD issues that are out of scope

for return preparation will be offered tax

law assistance.

Yes

2. The IRS should

designate the tax

treatment of canceled

debts as "in scope" for

purposes of answering

general questions at the

TACs.

Cancellation of Debt (COD) will be in

scope for Field Assistance for the

FY2009 filing season for answering

general tax law questions for

individuals. Taxpayers with COD

issues that are out of scope, including

business and farm issues, will be

referred to telephone assistors.

Yes

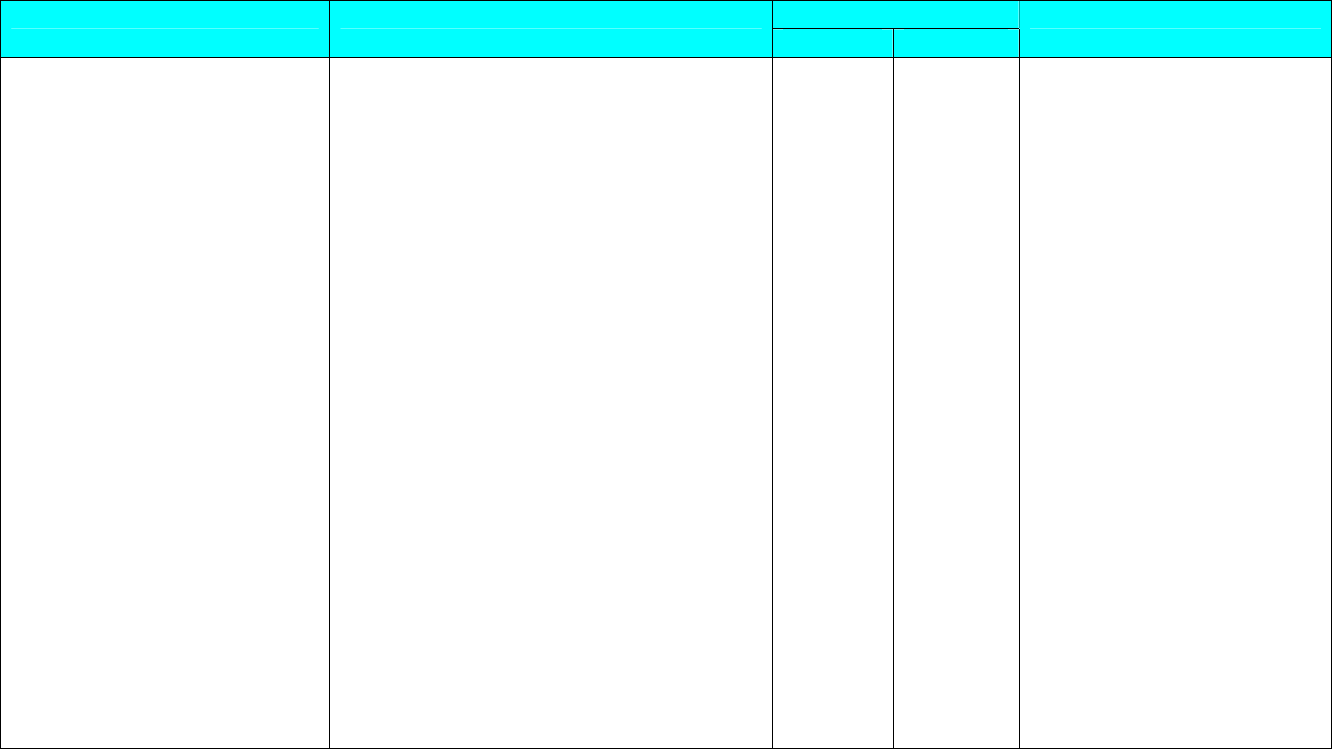

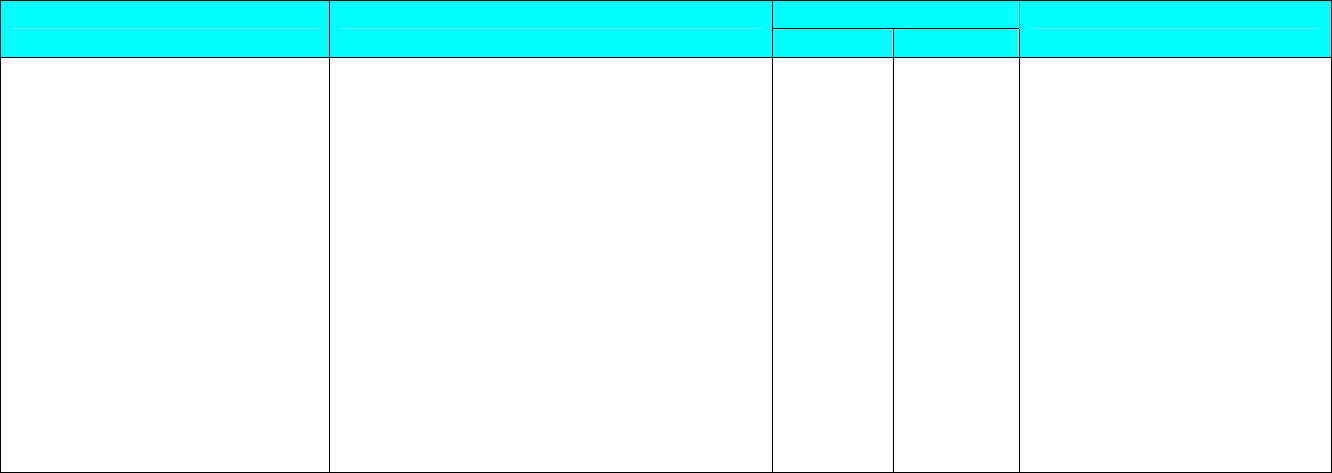

4

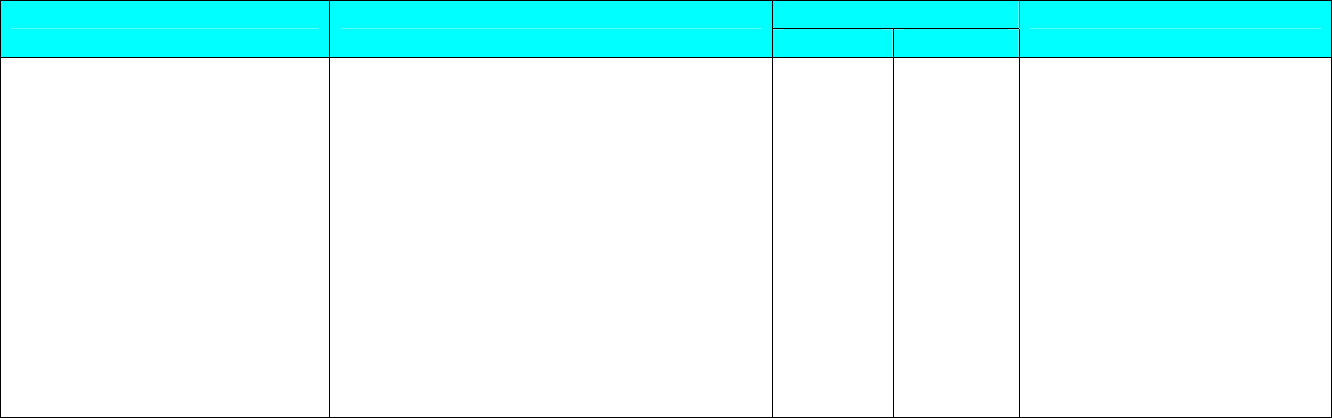

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

3. IRS should provide

specialized training on

cancellation of

indebtedness issues to a

unit of telephone

assisters and then "gate"

taxpayer calls on these

issues to those assisters.

The IRS’s Account Management office

already has an application (AP135,

Complex Individual Issues) that

receives training and specializes on

answering questions regarding

Cancellation of debt, Form 1099C and

related topics.

Yes 11/24/08

4. The IRS should develop

a publication that

specifically addresses

the tax consequences of

canceled debts that a

taxpayer who receives a

Form 1099-C will face.

Answers to some of the

questions addressed in

this discussion can be

found piecemeal in

various IRS publications,

but it is unlikely that a

taxpayer or even many

practitioners will have the

time and ability to ferret

out the answers, and

some of the questions

currently are not

answered in any

publication.

Completed 5-30-08. The IRS

developed new Publication 4681,

Canceled Debts, Foreclosures,

Repossessions, and Abandonments,

for this purpose.

Yes 11/19/08

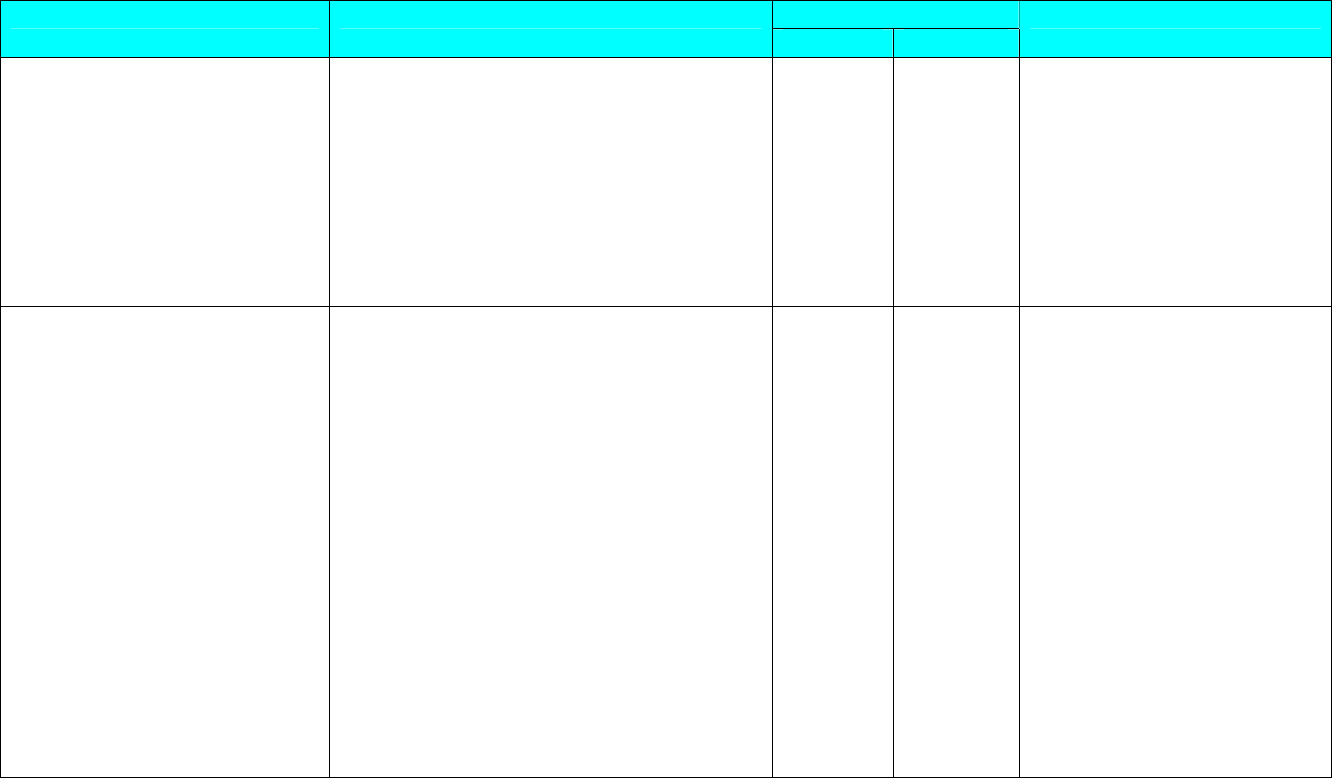

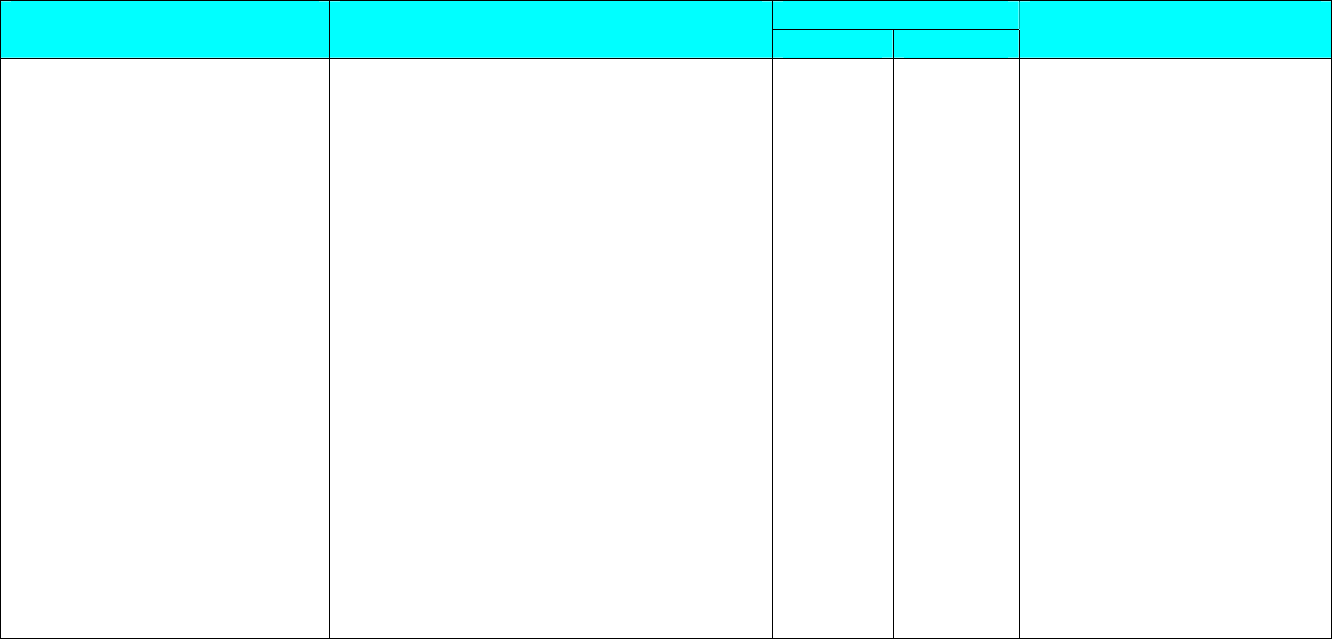

5

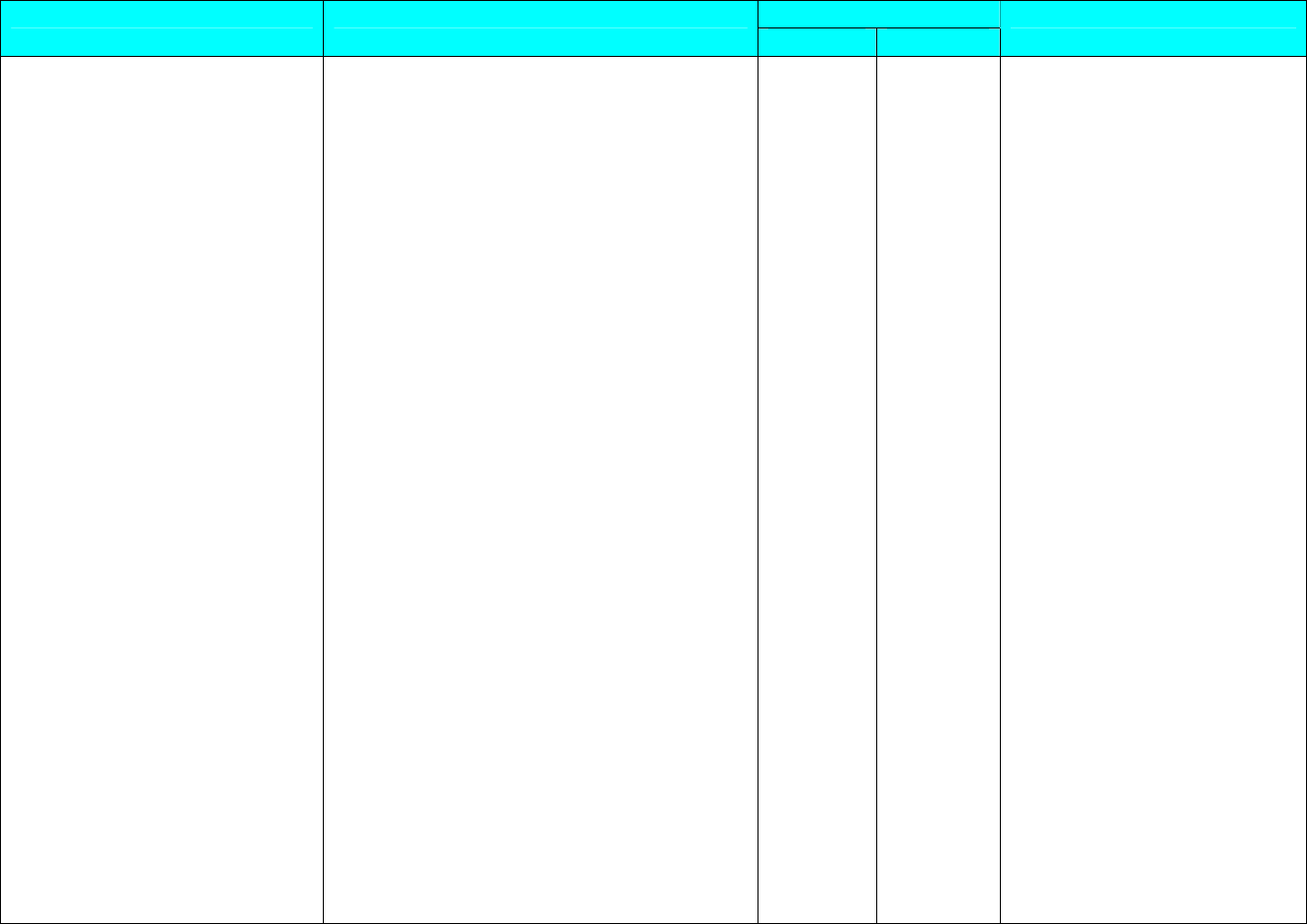

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

5. The IRS should require

issuers of Form 1099-C

to include a telephone

number on the form. The

IRS already requires

issuers of other forms in

the 1099 series,

including Form 1099-INT

reporting interest income

and Form 1099-DIV

reporting dividend

income, to include their

telephone numbers on

the form. When a debt

cancellation has

occurred, the likelihood

that a disagreement

about Form 1099

reporting is greater and

the relationship between

the issuer and the

taxpayer generally will

have terminated, making

it less likely that the

taxpayer would continue

to receive other

documents from the

issuer including a

telephone number.

Completed – pending OK to print. The

2009 Form 1099-C will provide a box

for payors to include a telephone

number.

Yes 11/19/08

6

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

6. The IRS should explore

the feasibility of requiring

issuers of Form 1099-C

to indicate whether debt

forgiveness relates to a

recourse loan or a

nonrecourse loan. In light

of the significantly

different tax

consequences, it would

be helpful both for

taxpayers in determining

their tax liabilities and

reporting requirements

and for the IRS in

determining whether a

taxpayer has under-

reported income to know

the type of debt at issue.

Completed – pending OK to print. The

2009 Form 1099-C will include yes and

no checkboxes for the lender to

indicate whether the borrower was

personally liable for the debt related to

the reported COD income.

Yes 11/19/08

7

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

7. The IRS should provide

more specific guidance

to assist taxpayers in

computing insolvency.

The explanation should

clearly state the IRS’s

view, which is currently

that insolvency means

the amount by which a

taxpayer’s aggregate

liabilities exceed his

aggregate assets. The

guidance should identify

the most common types

of assets and the most

common types of

liabilities to provide

taxpayers and

practitioners with a

clearer understanding of

what must be included in

the calculation.

The IRS agrees to include a definition

of insolvency, based on Internal

Revenue Code Section 108(d)(3), in

Publication 525 for 2008.

In addition, Publication 4681, published

5-30-08, provides specific guidance

under on insolvency in Chapter 1 at

page 4, where examples are given.

Yes 12/15/08

8

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

8. The IRS should make

clear in the Form 1040

instructions that

individuals should net the

amount of canceled debt

eligible for exclusion

against the amount of

canceled debt reported

on Form 1099-C when

reporting the canceled

debt amount includible in

income on line 21 of

Form 1040.

An explanation of how to determine the

amount of canceled debt eligible for

exclusion is beyond the scope of the

Form 1040 instructions due to the

complexity of the topic. A statement

that individuals should net the amount

of canceled debt eligible for exclusion

against the amount reported on Form

1099-C, although true, would not be

helpful since the difficult part is

determining the amount eligible for

exclusion.

No

9

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

9. The IRS should revise

the instructions for Form

982, Reduction of Tax

Attributes Due to

Discharge of

Indebtedness (and

Section 1082 Basis

Adjustment), to make

them clearer for

individual taxpayers who,

despite the title of the

form, have neither tax

attributes to reduce nor

basis to adjust. In our

view, the steps the IRS

states that it plans to

take are inadequate to

address the confusion

that Form 982 creates.

We continue to believe

that an initial set of

questions or worksheet

along the lines we

described above would

help taxpayers determine

whether they must

complete this complex

form in detail or may

simply check a box on

line 1 to indicate the

basis of the claimed

exclusion and list the

amount of the claimed

exclusion on line 2.

Completed. The IRS added a How To

Complete the Form table on page 2 of

the instructions for Form 982 (Rev.

Feb. 2008) to address the needs of

individual taxpayers with simpler tax

situations, including cancellation of

qualified principal residence debt

governed by the Mortgage Forgiveness

Debt Relief Act of 2007.

Yes 09/04/08

10

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

10. When the IRS issues

automated underreporter

(AUR) notices to

taxpayers in response to

Forms 1099-C, the IRS

should include more

information (perhaps a

"stuffer") explaining the

tax treatment of canceled

debt and the various

exceptions in detail. If the

IRS creates a publication

on canceled debt issues,

the publication could

serve as the stuffer.

The Automated Underreporter program

began including a special paragraph

that addresses FORM 1099-C,

CANCELLATION OF DEBT (COD) with

the CP 2000 Notice in 1996. It

instructs the taxpayer that under

certain conditions, canceled or forgiven

debt should be included on the tax

return as income. If the taxpayer

claims insolvency, they are instructed

to provide a breakdown of total assets

and liabilities immediately before the

cancellation of debt since debt

cancellation is excludable only up to

the insolvent amount. Additional

information is provided on

foreclosed or repossessed property

that may result in reportable ordinary

income from cancellation of debt.

Specific IRS publications and IRS.gov

are also provided as additional

resources for information.

Yes 11/24/08

11. When IRS issues AUR

notices to taxpayers in

response to Forms 1099-

C, the notices should

include information about

the availability of Low

Income Taxpayer Clinics

and TAS to assist

taxpayers who need help

understanding the issue

and responding to the

notice.

The Automated Underreporter program

will begin including Publication 3498-A

in 2501 and CP 2000 Notice mail outs

in January 2009. This publication will

provide information on the availability

of Low Income Taxpayer Clinics and

TAS. The Statutory Notice of

Deficiency issued by AUR, currently

includes a paragraph that provides

contact information for the Taxpayer

Advocate Office.

Yes

11

2007 ARC – MSP Topic #3 – THE CASH ECONOMY

Problem

Income from the “cash economy” – taxable income from legal activities that is not subject to information reporting or

withholding – is the type of income most likely to go unreported. Unreported income from the cash economy is probably

the single largest component of the tax gap, likely accounting for over $100 billion per year. Noncompliance in the cash

economy is difficult for the IRS to detect. Thus, the IRS should be using different strategies to address this problem than it

uses to address noncompliance in other areas. The National Taxpayer Advocate has identified a number of steps that the

IRS can take to address this problem without additional legislation. While the IRS can never achieve full compliance,

these recommendations should help the IRS make significant progress in improving compliance in the cash economy.

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. Establish a Cash

Economy Program Office

to coordinate efforts to

improve compliance in

the cash economy.

IRS is committed to improving current

compliance levels and continuing to

address all forms of noncompliance.

Accordingly, the IRS in conjunction with

Treasury and the IRS Oversight Board,

have developed a comprehensive

Strategy for Reducing the Tax Gap.

The Strategy sets forth steps that will

be taken to improve compliance and

enhance the IRS’ ability to measure

compliance.

IRS agrees that “income that is not

subject to information reporting or

withholding” (i.e. what the taxpayer

advocate terms as cash economy) is a

large component of the tax gap and is

accordingly addressing this issue

through the Strategy for Reducing the

Tax Gap.

Rather than establishing a separate

“Cash Economy Program Office”, our

No

12

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

activities will be governed by:

• The broader, but detailed, Strategy

for Reducing the Tax Gap,

• Administered through our strategic

planning process and

accompanying strategic plans

• The operating units/programs

responsible for implementation.

• The recently completed Taxpayer

Assistance Blueprint

• Service-wide Examination

Enforcement Council and

Enterprise Examination Plan

2. Develop a strategic plan

for providing services,

education, and outreach

to small businesses.

The IRS had previously identified the

need to provide education and support

to small businesses and has an

extensive annual strategic planning

process through which the small

business owner needs are addressed:

Examples include:

• Each of its operating divisions

(including the SB/SE Division)

develop and estimate resource

requirements needed to achieve

functional priorities and

performance targets based on

budget allocations.

• Detailed action plans, which are

part of the IRS’ strategic planning

process, identify specific sub-goals

and measures as well as

accountable parties, and fully

support the overarching Strategy for

Reducing the Tax Gap.

Yes 11/24/08

13

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

• The SB/SE Division's Stakeholder

Liaison Headquarters' Task Force

to Enhance Small Business

Outreach, with Service-wide

representation, also recently

recommended the development of a

five-year outreach strategic plan to

more effectively provide outreach

and education to the small business

community. Development of this

plan and deliverables is already

underway and it is somewhat of a

fluid and living/working document.

SB/SE also maintains a database of

outreach initiatives to the small

business community.

• The SB/SE Communications

Function currently prepares

communications strategies in

partnership with the SB/SE

functions which directly tie into the

IRS and SB/SE strategic plans that

focus on outreach to small

businesses.

3. Research and test the

effectiveness of a

targeted education

campaign to improve

attitudes about tax

compliance.

The IRS had already identified this

need and had developed a strategy to

resolve the problem by January 31,

2010. IRS agrees that research is

essential to identify sources of

noncompliance so that IRS resources

can be targeted properly and to test the

effectiveness of our targeted education

campaigns to improve attitudes about

tax compliance. HQ C&L is in the early

Yes

14

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

stages of determining a course of

action to explore the feasibility of this

long-term recommendation. Extensive

research is required to help with

creating the right kind of campaign

including appropriate measurements.

Budget for the research and campaign

will be extensive and may require

specific appropriations.

In the short term, HQ C&L is reviewing

existing products available for

educating young taxpayers and

undertaking an effort to reinvigorate

IRS efforts with those products.

“Understanding Taxes” curriculum is

currently under review for possible

revisions and is available for use in

secondary schools, community

colleges and to the general public. It

features more than 1,100 pages of

interactive programs and learning tools

to help understand filing and payment

obligations, and learn about the history,

theory and use of taxes in the United

States.

SL HQ is leading a Cash Economy

Research Project with SB/SE Research

aimed at practitioners and small

business owners to determine

behaviors related to businesses who

deal predominantly in cash. The

vendor is conducting focus groups with

15

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

questions directly related to operating a

business with cash. The data from

these focus groups will enable CLD (SL

HQ and Communications) to develop

targeted educational messages to

deliver to the practitioner and small

business community. These messages

can best influence behaviors of small

business owners and independent

contractors who receive income in

cash, so they are more compliant.

SB/SE is also conducting research to

connect non-compliance issues to

specific industries. This research will

provide valuable insight to target

educational materials for small

business owners within those

industries. We will also consider

research to segment the small

business community into other types of

social and behavioral categories.

We have also completed a number of

other studies that aimed to quantify the

effect or impact of a particular

outreach/education campaign. In the

past 4 years, nine such studies were

completed, with varying results. For

the most part, past research showed

either a positive effect, or no apparent

effect. Factors which come into play

include the target market segment, the

timeframe for the message and the

16

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

test, the message type and delivery

method, the previous tax behaviors, the

desired change, and others. Each

outreach campaign will combine a

different set of factors. There are also

many factors which affect how an

outreach campaign will be received

and the results it will achieve, many of

which are uncontrollable and

influenced by the current world

environment where outreach

campaigns are conducted. For that

reason, it is often not possible to be

certain that observed changes in tax-

related behaviors are the direct result

of outreach. While it is not

operationally feasible to conduct a

measurement study for every outreach

or education campaign, additional

studies on new market segments or

using new techniques will add to the

knowledge we have about the impact

of outreach.

4. Conduct research to

identify tax rules that

often confuse taxpayers

and provide simplifying

guidance. Contract for

additional analysis of the

reason taxpayers made

errors (including errors in

interpreting the rules –

not just math errors)

detected in connection

The IRS had previously identified this

as a potential problem and has actions

in motion to address the concerns by

January 31, 2009. Current plans

include research to identify tax rules

that often confuse taxpayers and

provide simplifying guidance. Several

research projects are underway that

will attempt to quantify where errors on

returns are made, and look at whether

errors are intentional or accidental

Yes

17

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

with the National

Research Program

(NRP).

(mistakes).

A First-Time Schedule C Filers

Strategy is also in process and

includes both long-term and short term

actions and messages to assist this

market segment. One activity already

completed is an analysis of the math

error codes seen on returns where the

first-time filer box on Schedule C is

checked. This will be expanded into a

multi-year study that tracks the math

errors made in the first three or five

years of business.

SL HQ incorporated research data on

common filing errors in their outreach

to First Time Schedule C Filers. This

educational campaign was launched in

April 2008 during Small Business

Week.

5. Create an "income"

database to help identify

underreporting and

improve audit efficiency.

IRS concurs that multiple forms of

gross receipt information need to be

electronically accessible to properly

address under-reporting and non-

reporting during selection,

classification, matching, and

examination processes, and continues

to work towards that end. However,

IRS does not believe that there is

presently sufficient evidence that a

single database is the best approach.

We continue to pursue alternative ways

to obtain audit efficiency.

No

18

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

In May 2008 the IRS piloted the

Compliance Data Environment (CDE).

The CDE will provide agents with case

building capability for analysis of

information including a 3-year return

comparison allowing for the

identification of income fluctuations.

CBRS (Currency & Banking) Info on

CTRs, F 8300s and transfer of cash in

or out of the country will be available

for case building of audit files.

Thru Choice Point research, CDE will

also provide asset acquisition data.

Each file will include Information Return

Program data on various F 1099s for

multi-year comparison to identify

consumption or hiding of cash

payments.

IRS also has an Integrated Production

Model (IPM) project underway which

provides common computer data

storage for both tax return and tax

account information. All of our

compliance activities (Collection,

Campus, Examination and Specialty in

particular) rely on tax return and

account data to assist with case

selection issues. Rather than creating

separate individual databases, IPM is

designed to serve as a central

repository for this commonly needed

19

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

tax data. The IPM data base will

continue to grow as new releases are

built out—and we expect it to improve

case selection for enforcement activity

as it houses a broader scope of data

for risk identification and workload

selection models. While the project is

just in initial stages, we anticipate that

third party payer information will be

added to the data base in FY10.

One component of the proposed Tax

Gap Legislation will provide the Service

with information pertaining to sales

made by a company that are paid by

the buyer with a credit card (i.e.

Internet sales). This will allow the

examiner to compare credit card sales

and profit margins and extrapolate to

total sales.

Examiners can access various sites to

identify companies selling on the

Internet as well as take an Internet

address and trace it back to a company

or individual. Point of sale training on

retailers is available which will assist

examiners with identification of the use

of software programs to intentionally

reduce sales. Availability of most

popular small business accounting

books software will assist examiners

with the identification of internal

changes to information recorded in the

20

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

books.

6. Obtain more state and

local receipts-related

data, match it against

income reported on

federal income tax

returns, and use it to

improve audit efficiency.

The IRS had already identified this

potential source of information and

already has a number of initiatives

underway. For example, we are

reviewing state sales data to identify

discrepancies with gross receipts

through the State Reverse File

Matching Initiative (SRFMI) project.

• States match Governmental

Liaison Data Exchange Program

(GLDEP) returns transaction

files against their master files to

identify

– Non-filers: Individuals

and businesses who filed

state returns but not

federal returns

– Under-reporters: More

income reported on state

returns than on federal

returns

– Taxpayers who filed state

returns under amnesty

programs

• States will send the IRS four

SRFMI extracts, each containing

non-filers and under-reporters in

a uniform format

– Individual, Corporate

(1120 only), Sales,

Withholding

Four states, (Arkansas, Iowa,

Yes 11/24/08

21

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

Massachusetts, and New York) are

submitting sales data as part of SRFMI

Phase 2. As part of Phase 2,

Examination will assign individual,

sales, corporate, and withholding cases

for examination.

The State Audit Report Initiative was

implemented in February 2005 to

develop policies and procedures to

effectively utilize state audit report

information. Under this initiative,

standard criteria and a request letter

template for audit report requests to

state tax agencies were developed,

along with procedures for receiving and

transmitting cases. A centralized

process for classifying, working and

tracking cases was also established.

States now send their audit reports

directly to Brookhaven or Cincinnati

(specialty tax only).

The QETP (Questionable Employment

Tax Practices) program allows the IRS

and participating state workforce

agencies to exchange audit reports,

audit plans, participate in side-by-side

examinations when appropriate, and

collaborate on outreach and

educational opportunities. The

standardized information exchanges

allow the IRS and the states to be more

consistent with examination results.

22

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

Over 30 states are already participating

in this effort and we are meeting with

each state to determine the best types

of information we can exchange to

meet each other’s needs. Thus, the

program allows us to leverage our

resources with the states in a more

effective manner than ever, which will

allow us to reach more employers and

ultimately, help us reduce the

employment tax portion of the tax gap.

These initiatives are ongoing.

7. Revise Form 1040,

Schedule C to break out

income not reported on

information returns.

IRS agrees that separating of income

from information reporting sources and

that generated from business activities

with no information source on Schedule

C could potentially improve

transparency and reporting

compliance. However, IRS disagrees

to implement this recommendation as

known increase in taxpayer burden and

transcription costs outweighs the

unknown benefits of this

recommendation.

No

8. Revise business income

tax return forms to

highlight information

reporting requirements.

A similar requirement was included on

Form 1120 until 1980, but was

removed because: (a) taxpayer burden

(b) the question did not improve

compliance, and (c) it has been the

IRS’s experience that taxpayers

provide the most favorable answer,

regardless of whether they completed

what was asked of them.

No

23

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

9. Create a preparer

database that tracks

errors on client returns

and use it for targeted

outreach and, if outreach

fails, test its

effectiveness as a factor

in selecting returns for

audit.

The Director of the Office of

Professional Responsibility (OPR) and

SB/SE Commissioner hosted an IRS

Return Preparer Summit in September

2007. The summit included functional

representatives from Taxpayer

Advocate, Criminal Investigation,

Research, Electronic Tax

Administration, Appeals, and the other

three Operating Divisions (W&I, TEGE

& LMSB). This was a first step toward

creating a service wide Return

Preparer plan of action and the

recommendation from the Taxpayer

Advocate was only one of the items

being considered in development of the

action plans. The plan has been

approved and finalized and we

assembled working teams who to

identify the actual actions and

deliverables needed in order to

accomplish the plan. The plan focuses

on enhancing our current service and

enforcement operations by ensuring

maximum collaboration of efforts to

increase efficiency and overall

effectiveness of program operations

and that these programs are built upon

a solid foundation of knowledge and

supported by the necessary

technology.

We had previously identified tracking

return preparer data on a large scale

Yes 11/24/08

24

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

as a possible component of a solution

to improve return preparer compliance

and we had implemented plans to

address this concern as well as others.

The preparer “database” is a goal but

we have not identified requirements or

determined design and whether to link

tax return errors to a preparer “profile”.

We are pursuing a better data system

for preparer information and evaluating

ways we might us alternative treatment

streams to increase overall interaction

with preparers.

In addition to actions already planned

in support of the Tax Gap and Return

Preparer plans, the IRS has a number

of initiatives underway.

• We have identified some trends,

issues and errors on paid preparer

returns through the Examination

Operational Automation Database,

and subsequently developed fact

sheets and targeted outreach and

education to address the issues.

• Some of the annual compliance

visits to Electronic Return

Originators may also be selected

based on the frequency of issues

and errors identified on e-filed

returns.

10. Develop a specialized

audit program to detect

the omission of gross

Tax Gap studies have consistently

shown that unreported income is a

larger contributor to the tax gap than

No

25

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

receipts. overstated expenses, and all of our

audit selection tools, examination

priorities and program are designed

with this in mind. All examination

employees are considered to be

specialists in the identification and

detection on unreported income. Our

efforts continue to be focused not only

on workload selection and delivery

(and identification of returns with the

greatest potential for unreported

income), but also on training our

examiners on identifying and

developing unreported income cases.

To that end, we have a number of

ongoing efforts in this area:

• SB/SE Examination, Campus

Compliance, Fraud, and Collection

have many efforts directed at

detecting unreported gross receipts

and continue to make use of data

from multiple sources.

• The SB/SE Exam Specialization

and Technical Guidance (ESTG)

Program has audit technique guides

(ATGs) that addresses income

issues by industries. One ATG that

is undergoing revision focuses on

Cash Intensive Businesses.

• Revenue Agents, Taxpayer

Compliance Officer, and respective

managers have been receiving

specialized “Toolkit” training on

investigative skills, uncovering

26

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

unreported income. This

mandatory course in included in the

Continuing Professional Education

that Examination employees are

receiving during FY08.

• Specific examination initiatives that

focus on detection of omitted

receipts and issues particularly

egregious to our tax system

including offshore activities and

abusive transactions and the

Special Enforcement Program.

11. Research the most

effective use of IRS audit

resources after taking

into account the direct

and indirect effects of

audits on tax revenue.

The steps outlined in the Strategy for

Reducing the Tax Gap are, in many

respects, only initial steps toward

improving compliance. One of the

primary challenges that the IRS faces

in improving compliance is to get a

better understanding of the current

sources of noncompliance by

improving research in this area. Until

that understanding is clarified, efforts to

improve compliance may be

misdirected and progress may not be

measurable.

The IRS has taken significant steps in

this direction, most importantly through

the National Research Program (NRP),

which is the source of updated

estimates of compliance among

individual taxpayers for 2001. The IRS

is committed to furthering its work in

this area through updated individual

No

27

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

taxpayer NRP examinations and a

current study focusing on compliance

among Subchapter S corporations (S

corporations).

The impact of compliance activities

does not lend itself to traditional

revenue-estimating analysis, and it is

difficult to quantify the effect that such

activities have on taxpayer behavior.

And while audits, for example, are a

key tool to combat the tax gap, they are

not the only one. Recent NRP data

and associated legislation proposals

have acknowledged that increasing the

transparency and visibility of income

may be a more effective means of

addressing the cash economy tax gap

than targeted audits. Reducing

opportunities for evasion is one of the

key initiatives in our Strategy for

Reducing the Tax Gap and our initial

efforts will be focused on the steps

outlined in the Strategy. Our

enforcement efforts otherwise have

and will continue to be targeted to

coverage in high risk categories.

IRS has also developed an Enterprise

Examination Plan which establishes

and sets Service-wide examination

priorities. The Enterprise Plan takes

into consideration a number of factors

and categories including: externally

28

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

mandated priorities (such as the

National Research Program),

egregious areas of non-compliance,

high risk and Service-wide priorities

(such as abusive transactions), and

additional areas of emphasis such as

risk, yield and coverage. Workstreams

are first aligned by priority and

secondarily aligned by emphasis area.

29

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

12. Make payment

compliance easier by

sending out estimated

tax payment reminders to

businesses that have

been late in the past.

The IRS Submission Processing

function has developed and

implemented a number of programs

over the past few years to encourage

prompt and electronic payments,

including:

• Express Enrollment- new

businesses with depository

requirement are pre-enrolled in

EFTPS

• FTD Coupon Reorders - based

on specific requirements, 20% of

businesses are pre-enrolled in

EFTPS in lieu of receiving an

FTD coupon booklet

• Individuals making ES payments

through Electronic Funds

Withdrawal are pre-enrolled in

EFTPS and encouraged to

make future payments using

EFTPS. An enrollment package

is mailed to them regarding this

program.

The IRS already includes detailed

estimated payment information in our

notices, publications, and form

instructions, and the additional

resource usage for sending reminder

notices would not be practical from a

cost/benefit standpoint.

No

30

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

13. Encourage taxpayers to

pay estimated taxes

electronically using the

Electronic Federal Tax

Payment System

(EFTPS).

The IRS had previously identified this

as a problem and had placed corrective

actions in place to address the

concerns. IRS agrees that taxpayers

should be encouraged to submit their

estimated tax payments electronically

and has already put functionality into

place for 2008 for taxpayers to use a

debit card from STAR, Pulse, or NYCE

networks to pay their taxes for a $3.95

flat fee.

EFTPS also encourages taxpayers to

pay their estimated tax payments both

through EFTPS and EFW payment

options. Both programs allow the

taxpayer to schedule all 4 ES

payments at one time. The success of

this program is shown in the increase

in EFW payments. In addition, new

businesses with depository

requirements and individuals making

ES payments through EFW are pre-

enrolled in EFTPS. An enrollment

package is sent to each pre-enrolled

taxpayer. In addition, 20% of

businesses are pre-enrolled in EFTPS

in lieu of receiving an FTD Coupon

booklet.

Yes 9/23/08

14. Revise IRS collection

policies to offer a

reasonable payment

alternative to all

taxpayers who cannot

IRS disagrees with this

recommendation as we believe that

current policies and procedures provide

sufficient collection alternatives for

taxpayers who cannot immediately pay

No

31

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

fully pay what they owe. the amounts due in full. The current

“streamlined” installment agreement

criteria strike the appropriate balance

between efficient accounts

management, reduced burden for

taxpayers, and the need to arrive at

realistic payment arrangements

consistent with taxpayers’ ability to pay.

Taxpayers are generally granted an

installment agreement regardless of

their actual ability to pay in full on

accounts below $25,000. We also

accept installment agreements for

accounts over $25,000 and in FY07,

IRS granted 87,978 installment

agreements on accounts over $25,000.

The rate of IAs granted for this

population is proportional to the

population of these accounts in

inventory.

Accounts that do not qualify for

installment agreements may be

resolved through liquidation of

nonessential assets, or collection may

be suspended to protect the taxpayer

from suffering economic hardship. The

“currently not collectible” resolution

represents several conditions besides

the inability to pay. These conditions

include accounts where the Service is

unable to locate or contact the

taxpayer, or the taxpayer is in

bankruptcy. Accounts are placed in

32

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

this status temporarily allowing for

consideration in the future when

circumstances have changed.

15. Research what the IRS

can do to improve filing

compliance among

various taxpayer

populations.

The IRS had previously identified this

as a problem and has completed the

actions determined necessary to

effectively address the issue. A

Service-wide Non-filer Program Plan

was developed and focuses on

accomplishing three goals:

• Effectively use enforcement to deter

filing noncompliance

• Help taxpayers understand and

meet their filing obligations

• Leverage technology to identify

non-filers and remove impediments

to filing

The Plan was recently approved by the

Enforcement Committee and includes

the following more specific initiatives:

• Allocate resources based on a

Servicewide approach to ensure

end-to-end accountability for Non-

filer treatment decisions.

• Develop and implement consistent

Servicewide performance and

outcome measures to determine

impact on filing compliance.

• Implement a Servicewide Non-filer

Communication Program that

includes an internal and external

focus to address filing

requirements.

Yes 9/23/08

33

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

• Expand the use of third party

information and research tools to

enhance identification, selection

and resolution of Nonfiler cases.

• Ensure Nonfiler cases meeting

fraud criteria are referred for civil

fraud penalties and/or referred for

criminal investigation.

• Encourage the development and

submission of legislative proposals

and other regulatory actions to

increase filing compliance.

The Servicewide Non-filer Program will

be governed by an Executive Advisory

Council which will ensure achievement

of outcome and performance goals.

34

2007 ARC – MSP Topic #4 – USER FEES: TAXPAYER SERVICE FOR SALE

Problem

The IRS lacks a consistent strategy for the user fees charged to taxpayers. This makes many basic services unaffordable

to the public, in part because the IRS often neglects or is slow to waive fees for lower income taxpayers. The IRS collects

about $180 million in user fee receipts annually, mostly from the installment agreement fee, and it uses this revenue to

pay for taxpayer services, information technology, and other program costs. The National Taxpayer Advocate believes

that the IRS should employ strong criteria for establishing and setting fees, along with vigilant oversight and review of

existing fees. Otherwise, taxpayers’ access to service may be reduced and their rights harmed as the IRS establishes

new fees and raises others to make up for budgetary shortfalls. The National Taxpayer Advocate makes several

recommendations to assist the IRS in establishing and setting fees in the future.

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. The IRS should publish

an analysis of the likely

effect of any user fee (or

user fee increase) on

taxpayers and tax

administration before

adopting the fee (or fee

increase) so the public

can be sure the IRS has

not put revenue

considerations ahead of

tax administration

considerations when

making decisions about

user fees.

The IRS complies with OMB Circular A-

25 in determining whether to charge a

user fee and for determining the cost of

providing the service. Fees that lack

specific statutory authority are

promulgated through a federal

regulation allowing for public comment.

The IRS also complies with the Small

Business Regulatory Enforcement

Fairness Act (SBREFA) and the

Paperwork Reduction Act and provides

appropriate background information

and the impact on taxpayers during the

regulatory process. We address

comments received from the public

when we publish the final user fee

regulation. In the case of fees

specifically authorized by statute,

Congress has already made the

determination that taxpayers should

bear the full cost of obtaining the

special benefits.

No

35

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

2. Before establishing or

raising any user fee, the

IRS should research both

the cost of administering

it and the effect of the fee

(or fee increase) on the

demand for the specific

service in question. It

should also conduct

additional research and

analysis sufficient to

justify the fee and show

that:

• The proposed fee will

not have a significant

negative impact on

voluntary compliance

or IRS collections, or

otherwise impair the

IRS’s ability to

accomplish its

mission (i.e., the IRS

should not charge a

fee for services that

significantly benefit

tax administration);

• The proposed fee will

not cost more to

administer than the

IRS could otherwise

produce by using the

same resources on

tax administration;

• The fee does not

The IRS complies with OMB Circular A-

25 in determining whether to charge a

user fee and for determining the cost of

providing the service. Our

methodology for all fees is subject to

audit by TIGTA and the GAO to ensure

that proper costing methodologies are

used. Fees that lack specific statutory

authority are promulgated through a

federal regulation allowing for public

comment. The IRS also complies with

the SBREFA and the Paperwork

Reduction Act and provides

appropriate background information

and the impact on taxpayers during the

regulatory process. We address

comments received from the public

when we publish the final user fee

regulation. In the case of fees

specifically authorized by statute,

Congress has already made the

determination that taxpayers should

bear the full cost of obtaining the

special benefits.

No

36

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

apply to services that

taxpayers have little

choice in obtaining;

• The fee will not deny

basic services to

taxpayers who cannot

afford them (i.e., the

IRS should consider a

low income waiver);

and

• The services subject

to a fee are provided

in a reasonably

efficient manner so

that the fee is not

disproportionate to

the value received by

the service recipient

(e.g., a fee of $105 to

"process payments"

should not generally

be acceptable).

37

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

3. The IRS should publish

the research and

analysis described in

recommendation 2

(above) along with a

specific explanation

showing exactly how it

computed any proposed

fee or fee increase. The

IRS should only

implement (or increase)

a fee after revising its

analysis to address

comments from internal

and external

stakeholders.

The IRS complies with OMB Circular A-

25 in determining whether to charge a

user fee and for determining the cost of

providing the service. Fees that lack

specific statutory authority are

promulgated through a federal

regulation allowing for public comment.

The IRS also complies with the

SBREFA and the Paperwork Reduction

Act and provides appropriate

background information and the impact

on taxpayers during the regulatory

process. We address comments

received from the public when we

publish the final user fee regulation. In

the case of fees specifically authorized

by statute, Congress has already made

the determination that taxpayers should

bear the full cost of obtaining the

special benefits.

No

38

2007 ARC – MSP Topic #5 – THE USE AND DISCLOSURE OF TAX RETURN INFORMATION BY PREPARERS TO

FACILITATE THE MARKETING OF REFUND ANTICIPATION LOANS AND OTHER PRODUCTS WITH HIGH ABUSE

POTENTIAL

Problem

Tax return preparers use the preparation process to sell a variety of products to their clients. The sale of certain

commercial products, such as refund anticipation loans (RALs), refund anticipation checks (RACs), and audit insurance, is

disproportionately targeted toward low income taxpayers and may exploit those taxpayers’ trust in their preparers and

their own lack of financial sophistication. Some preparers who market RALs also have a financial incentive to

inappropriately inflate refund amounts. To the extent that problems arise with a RAL or similar product, taxpayers may

incorrectly assume there are problems with the administration of the tax laws. However, despite concerns repeatedly

expressed by both internal and external stakeholders, the IRS has declined to conduct any significant research into the

impact of commercial products on tax compliance or taxpayer exploitation. Within the existing statutory framework of IRC

§ 7216, the Treasury Department has the discretion to restrict the ability of preparers to obtain taxpayer consent to either

use or disclose tax return information in the marketing of RALs, audit protection, and similar products.

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. The National Taxpayer

Advocate recommends

that the IRS conduct

research in conjunction

with the Office of the

Taxpayer Advocate to

determine the impact

certain commercial

products have on tax

compliance and taxpayer

exploitation. The

research should include,

but is not limited to, the

following items:

• The role commercial

products play in retail

preparer

noncompliance;

IRS concurs with the need for research

and is already committed to an

iterative research approach to

determine whether: 1) preparers are

taking improper positions that cause

inflated refunds; 2) if so, how

widespread and systemic is the

problem; 3) if so, what creates the

incentive for preparers to engage in

non-compliant behavior; 4) if action is

needed, what can IRS do to combat

the problem. As part of this research,

we will consider the questions raised

by the NTA. However, some of this

work may take considerable time, will

require significant resources, and will

thus depend on resource availability to

complete. The Research analysis is

Yes

39

IRS Addressed NT RecoA mmendation IRS Response

Yes/No

TAS Assessment

Date

• Whether the

marketing of

commercial products

by preparers creates

a financial incentive

to inflate refunds or

exploit taxpayers;

• Whether financial

incentives received

by preparers at the

corporate level impact

the behavior of

preparers at the retail

level;

• The resulting impact

such marketing of

commercial products

by preparers has on

tax administration and

the public fisc;

• Options to address

preparer

noncompliance

related to the

marketing of

commercial products;

and

• Whether taxpayers

understand the terms

of the commercial

products and can

separate the act of

purchasing the

product from the

being finalized and will be released in

late October 2008.

40

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

return preparation

process.

2. The National Taxpayer

Advocate recommends

that the Department of

Treasury and the IRS,

after careful review of

findings from the above-

mentioned research and

public comments, amend

Treasury Regulation

§301.7216-3 as set forth

in the advance notice of

proposed rulemaking

(ANPR).

This recommendation is premature

and presupposes the results of the

research suggested above and the

outcome of public comment on the

ANPR. As a result, we cannot concur

until the research recommended

above is completed and reviewed. We

will also have to consider the

responses we received from the ANPR

before reaching a conclusion about

what, if any, action is needed.

No

41

2007 ARC – MSP Topic #6 – IDENTITY THEFT PROCEDURES

Problem

The National Taxpayer Advocate first raised her concerns about the IRS’s identity theft procedures in her 2005 Annual

Report to Congress. While the IRS has made some improvements, it has not done enough to improve procedures for

victims of identity theft or to secure its filing system from fraudulent filers. The IRS’s identity theft measures are reactive

rather than proactive and require taxpayers to contact the IRS and work their way through layers of employees until they

reach someone with authority to adjust their accounts. Too often, victims of identity theft receive more scrutiny from the

IRS than perpetrators, such as those who use the electronic filing system and bank account direct deposit to commit

refund fraud. The IRS should make a PIN process mandatory for all electronic filers, increase the security of direct

deposits, and generally take a more taxpayer-centric approach to identity theft and put procedural and preventive changes

on a fast track.

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. The IRS should develop

a dedicated, centralized

unit to handle all identity

theft cases, as well as a

centralized IRM to house

all identity theft

procedures across the

IRS. This IRM would

provide various

scenarios for account

resolution.

-The IRS is establishing the Special

Victim Assistance Unit as a single

point of contact for taxpayers with

identity theft issues

- A Comprehensive Identity Theft

Manual or IRM Hub will provide

consistent case resolution guidance to

IRS employees

Yes

42

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

2. The IRS should develop

a form that taxpayers can

file when they believe

they have been victims of

identity theft. The

instructions on the form

should explain which

steps the IRS will take

and which steps the

taxpayer should take

(e.g., obtaining an FTC

affidavit) to restore the

integrity of the taxpayer’s

account.

-The IRS is developing the capability

for taxpayers to self-report non-tax

administration instances of identity

theft; a marker will be applied to each

taxpayer account

Yes

3. The IRS should issue a

soft notice to taxpayers

whose refunds have

been frozen because of a

duplicate filing. A refund

freeze can have the

same effect as a refund

denial if the taxpayer is

unaware of the freeze or

the reasons behind it.

-The IRS is chartering a team that will

conduct further analysis to evaluate

the potential delay

-The team will use the analysis results

to define and recommend solutions

-The IRS will report back to the Identity

Theft Advisory Committee (ITIM AC)

and the National Taxpayer Advocate

on October 15, 2008 with a status

update on analysis results and

recommended solutions.

Yes

43

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

4. The IRS should also

freeze collection actions

when a duplicate filing is

present until an

investigation can

determine the whether

an identity theft has

taken place.

-The IRS is chartering a team that will

conduct further analysis to determine

the scope of the issue

-The team will use the analysis results

to define and recommend solutions

- The IRS will report back to the

Identity Theft Advisory Committee

(ITIM AC) and the National Taxpayer

Advocate on October 15, 2008 with a

status update on analysis results and

recommended solutions.

Yes

5. The IRS should eliminate

Form 8453-OL from the

electronic return process

and make the personal

identification number

(PIN) process mandatory

because it will increase

security, save money,

and help eliminate

taxpayer burden.

- A PIN will be required to process

electronic returns

Taxpayers filing electronic returns will

no longer be able to submit a hand

written signature using form 8453-OL

-The programming for this process is

complete and the form has been

updated to reflect the changes.

Yes

44

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

6. The IRS should also give

identity theft victims the

ability to take proactive

measures such as

blocking the e-filing

option on their accounts.

-The IRS is developing proactive

initiatives to enable identity theft

victims to reduce future harm; this

includes the development of a process

for victims to notify the IRS of misuse

of PII

-The IRS is evaluating additional

enhancements to e-file security and

functionality

- The IRS will report back to the

Identity Theft Advisory Committee

(ITIM AC) and the National Taxpayer

Advocate on October 15, 2008 with a

status update on the implementation of

proactive initiatives and

recommendations for additional

enhancements to e-file

Yes

7. The IRS should create a

prefix for IRS numbers

(IRSNs) or some other

system so that it does

not deny tax benefits to

the rightful owner of the

Social Security number

(SSN). While assignment

of IRSNs may be the

only way to isolate the

fraud taking place under

an SSN, it is inequitable

to assign the IRSN to

identity theft victims and

then deny tax benefits

that depend on the SSN.

-The IRS is conducting an in-depth

analysis to identify Scramble process

improvements using lean six sigma

methodologies

-The IRS will define and recommend

solutions to the Scramble process

based upon the analysis

- The IRS will report back to the

Identity Theft Advisory Committee

(ITIM AC) and the National Taxpayer

Advocate on October 15, 2008 with the

recommended Scramble process

solutions.

Yes

45

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

8. The IRS should plan an

Identity Theft Summit in

FY 2008 to bring

together all IRS functions

that deal with identity

theft issues to discuss

the problems in a

collaborative effort.

-The IRS is hosting an Identity Theft

Forum July 21 – 22, 2008

Yes

46

2007 ARC – MSP Topic #7 – MORTGAGE VERFICIATION

Problem

When closing on a mortgage, borrowers often must consent to disclose certain tax information in order to verify their

income, including signing a blank copy of Form 4506-T, Request for Transcript of Tax Return, which gives the lender

access to four years of tax information for 60 days from the date on the form. However, the information disclosed is not

subject to the same protection and limits on use as other taxpayer information, which raises numerous privacy concerns.

The IRS should revise Forms 4506, 4506-T, and 8821 (and their instructions) to state in clear and plain language that

taxpayers should not sign a blank or incomplete form. The IRS should also revise the forms to allow a taxpayer to specify

the purpose for which the information can be used by third parties.

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. The National Taxpayer

Advocate recommends

that the IRS revise Form

8821 and its instructions

to state in clear and plain

language that taxpayers

should not sign a blank

or incomplete form.

The Form 8821 and instructions have

been revised to include the cautionary

statements as recommended.

Yes 12/15/08

2. The National Taxpayer

Advocate recommends

that the IRS revise the

cautionary language on

Forms 4506 and 4506-T

to state in clear and plain

language that taxpayers

should not sign a blank

or incomplete form.

The current versions of Form 4506 and

Form 4506-T contain multiple

cautionary statements on the face of

the forms.

No

47

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

3. The National Taxpayer

Advocate recommends

that the IRS revise

Forms 4506, 4506-T and

8821 to allow a taxpayer

to specify the purpose for

which the information he

or she is consenting to

disclose can be used by

third parties.

IRC Section 6103(c) consent-based

disclosures are not subject to third

party use limitations and the civil and

criminal sanctions of the Code do not

apply. Practically, it is beyond the

jurisdiction of the IRS to monitor the

use of information disclosed for non-tax

purposes by third parties.

No

4. The National Taxpayer

Advocate recommends

that the IRS engage in

an outreach campaign to

advise taxpayers of their

privacy rights and the

importance of not signing

blank forms.

Existing cautionary statements on

Form 4506 and Form 4506-T, with

emphasis, and the revisions to Form

8821 and the instructions to include the

cautionary statements, as

recommended, are satisfactory.

No

48

2007 ARC – MSP Topic #8 – TRANSPARENCY OF THE OFFICE OF PROFESSIONAL RESPONSIBILITY

Problem

The IRS’s Office of Professional Responsibility (OPR), which is charged with regulating tax practitioners, has not

published sufficient guidance or procedures to assure the public that it operates fairly and independently. If there is any

question about OPR's independence from the IRS, practitioners (and taxpayers) may fear OPR will serve as an extension

of the IRS enforcement function and arbitrarily target practitioners who are appropriately advocating for taxpayers. This

belief would chill zealous advocacy by practitioners and harm taxpayers as well. OPR should improve both the reality and

perception of its independence and establish reasonable limits on its discretion by issuing guidance on which practitioners

can rely. This guidance should more directly address who is subject to regulation by OPR, what conduct is prohibited, how

OPR follows up on referrals, how OPR will adjudicate an allegation (including policies governing practitioner access to

information that could bear on the result), and what penalties OPR will seek for a given offense. OPR should develop such

guidance quickly using an open process.

IRS Addressed NTA Recommendation IRS Response

Yes/No Date

TAS Assessment

1. The National Taxpayer

Advocate recommends

that the Office of

Professional

Responsibility (OPR)

quickly formalize and

publish a more detailed

description of its

enforcement processes,

including the analysis

OPR employees use to

determine which cases

are worth pursuing or

what sanctions (or range

of sanctions) are

appropriate for a given

offense.

The Office of Professional

Responsibility had already begun

drafting a set of internal operating

procedures to publish in the Internal

Revenue Manual. These procedures

are nearing completion and are

expected to be circulated both within

the Internal Revenue Service and with

the OPR Advisory Group by the fall of

2008. OPR is also working to develop

publishable guidance on the types of

sanctions that are appropriate for given

offenses. We are discussing what

approach(es) may be most appropriate

with our Advisory Committee of tax

practitioners.

Yes

49

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

2. The National Taxpayer

Advocate recommends

that OPR establish a

timetable for when the

guidance referenced in

Recommendation 1 will

be circulated inside the

IRS and ultimately

published.

The procedures and guidance are

nearly complete as we had begun

working on these before the National

Taxpayer Advocate’s

recommendations were drafted. We

expect to circulate our IRMs within the

IRS in the fall of 2008.

Yes

3. The National Taxpayer

Advocate recommends

that OPR expedite efforts

to publish examples or

other guidance to clarify

important rules,

including:

• How to determine

whether written tax

advice is a "covered

opinion;"

• What constitutes

"willful" conduct for

purposes of Circular 230;

• Whether a statute of

limitations applies to

violations of Circular 230;

and

• What it means to

"practice" before the IRS.

The Office of Professional

Responsibility has wanted for a

considerable period of time to be able

to publish examples and guidance to

clarify important rules. To expedite this

process, we created an OPR Advisory

Group to help us develop scenarios on

issues relevant to the private

practitioner community. We are

looking for the OPR Advisory Group to

help us prioritize the types of guidance

most desired by practitioners and plan

to publish scenarios and guidance on

those topics. OPR has also been

active in speaking to practitioner

groups and using scenarios to illustrate

areas of Circular 230. Furthermore,

recent amendments to Circular 230 will

allow OPR to publish decisions of

Administrative Law Judges in actual

cases, which will provide additional

guidance on interpreting Circular 230.

Yes

50

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

4. The National Taxpayer

Advocate recommends

that OPR work with the

Department of the

Treasury to amend

Circular 230 to

incorporate guidance

about how the

practitioners may obtain

exculpatory evidence

and how and when they

can obtain "open file"

discovery.

Circular 230 was amended on

September 26, 2007, in section

10.63(d) that requires OPR to provide

evidence to the practitioner when the

complaint is filed. Prior to that time,

OPR routinely turned over information

from OPR’s file to the practitioner upon

request. This step will be part of the

internal OPR procedures that are

published in the Internal Revenue

Manual later this year.

Yes

51

IRS Addressed NTA Recommendation IRS Response

Yes/No

TAS Assessment

Date

5. The National Taxpayer

Advocate recommends

that OPR establish a

stand-alone advisory

committee under the

Federal Advisory

Committee Act for OPR

so that a diverse array of

tax professionals,

including those with

experience defending

practitioners in

proceedings against

OPR, has an opportunity

to serve.

OPR agrees that an OPR Advisory

Group is a valuable addition. OPR also

agrees that the committee should

consist of a diverse array of tax

professionals, including those with

experience defending practitioners.

OPR created an advisory group in early

2008 that consists of members from

the American Association of Attorney-

Certified Public Accountants, the

American Bar Association, the

American Institute of Certified Public

Accountants, the American Society of

Appraisers, the Council for Electronic

Revenue Communication

Advancement, H&R Block, the National

Association of Enrolled Agents, the

National Association of Tax

Professionals, the National Society of

Accountants, the National Society of

Tax Professionals and the Tax