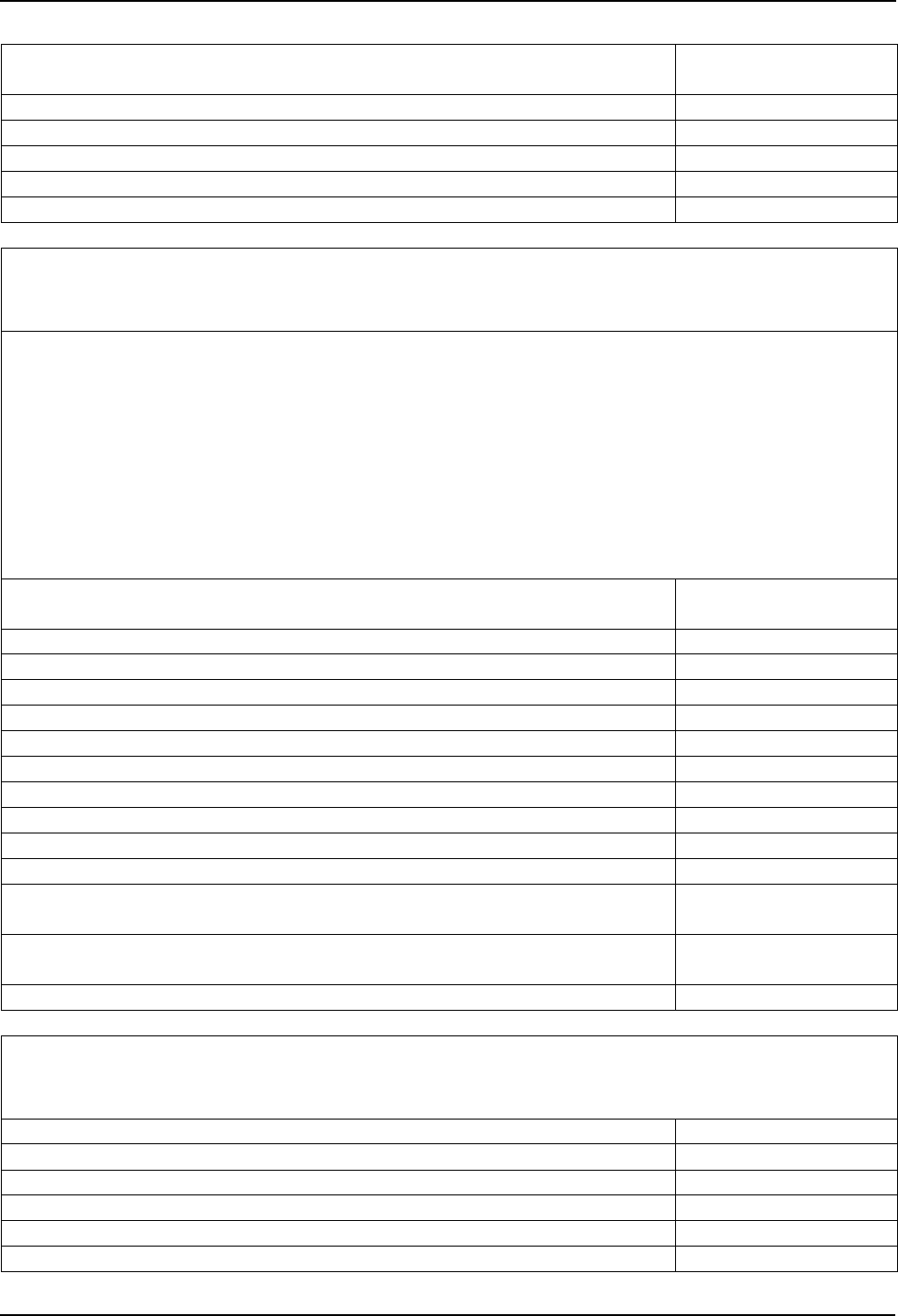

NEW JERSEY TAX RECORDS

State tax returns

Permanent

Sales tax exempt certificates

7 years

New Jersey Sales Tax records

4 years

Employer tax deposit records

5 years

Payroll records showing amounts and dates of pay, any deductions or

bonuses, and taxes withheld

5 years *

W-2 and W-4 forms

5 years *

EMPLOYMENT RECORDS

Immigration (INS Form I-9)

As long as employed,

then after termination

for 3 years after hiring,

or 1 year after

termination, whichever

is longer*

Employer sponsored group health plan records required under HIPAA

relating to the privacy of employee medical information

6 years *

Employment applications (not hired)

1 year *

Employee handbook

Permanent

Pension and retirement records

7 years after employee

leaves plan

Personnel files

3 years after

termination

2024 RECORD RETENTION GUIDE FOR

NEW JERSEY AUTO DEALERS

This guide lists both mandatory document retention periods and guidelines for prudent practice

regarding records for which there is no specific legal requirement. Legally mandatory retention periods

are those marked with an asterisk (*). It should be remembered, however, that these are minimum

required periods. In some cases, sound practice requires preserving such records for a longer time, while

there may be other cases in which they may be disposed of as soon as is permitted.

This guide is intended to serve as a tool to assist in fashioning a document retention policy. Dealers

are encouraged to consult with their accountant or legal counsel to ensure their policy and practices are

appropriate. Page 5 contains the recordkeeping requirements of the new FTC CARS Rule.

There will be further information provided concerning these new requirements. If there is

conflict between similar provisions, the higher term governs.

NJ CAR RECORD RETENTION GUIDE (CONT.)

PAGE 2

Record of name, address, date of birth, social security number, occupation,

and period of employment for all employees

5 years

Required employee notifications

Permanent

Time cards or time sheets

7 years

Records documenting earned sick leave used, paid, and carried over

5 years

Unemployment Insurance records

7 years

Worker’s Comp claims and related documents

7 years

FEDERAL TAX AND IRS RECORDS

NOTE: The Internal Revenue Code requires you to keep “records appropriate to your trade or

business” and to keep such records for so long as they “may become material in the administration of

any internal revenue law.” The general limitation period for an IRS audit is three years, but this is

extended to six years in cases of serious tax misconduct. Prudent practice, therefore, requires keeping all

records necessary to document tax returns and schedules for a minimum of six years. As a general rule,

no records relating to federal or State taxes should be disposed of “automatically” pursuant to a schedule

or policy. Instead, tax records should only be disposed of after an affirmative decision to do so by the

person responsible for tax audits, such as the dealer’s CFO or accountant.

Depreciation schedules and backup

7 years after disposition

of asset

Filed tax returns, schedules, statements, and supporting documentation

Permanent

Other tax records

3 years after filing *

Tax files material to the administration or enforcement of IRS law

Permanent

Employment withholding tax records

4 years *

Medicare and FUTA taxes

4 years *

FICA (Social Security) wage records

4 years *

W-2 forms

4 years *

W-4 forms

4 years *

Form 8300 (cash transaction reports)

7 years *

1099 Forms

5 years *

Excise tax returns, schedules, statements, and supporting records and

documentation

3 years *

Excise tax - gross vehicle weight and serial numbers for trucks, tractors, and

trailers sold

3 years *

Records of taxable or tax-free transactions

Permanent

RECORDS REQUIRED BY THE FAIR LABOR STANDARDS ACT

Employee’s name, DOB, gender, occupation

3 years *

Rate of pay and method of calculation

3 years *

Hours worked each week

3 years *

Regular and overtime pay each week

3 years *

Withholding and bonuses

3 years *

Time Cards

2 years *

NJ CAR RECORD RETENTION GUIDE (CONT.)

PAGE 3

Records of wage assignments or garnishments

2 years *

FAMILY AND MEDICAL LEAVE ACT RECORDS

All FMLA records

3 years *

OSHA RECORDS

All OSHA records and correspondence (including the log and summary of all

occupational injuries and illnesses)

5 years *

DEPARTMENT OF TRANSPORTATION RECORDS

Odometer mileage disclosures

5 years *

Tire purchase records (name, address of purchasers and tire I.D. nos.)

3 years *

Gray market importers – certificate of conformity

8 years *

Gray market importers – all records regarding purchase, transport,

modification, and testing

8 years *

ENVIRONMENTAL RECORDS

New Jersey DEP and federal EPA environmental records, manifests and

receipts

Permanent

Freon – a record of every instance in which Freon is recovered from a

vehicle

3 years *

Gray market importers – all records of purchase, importation, modification,

testing, and certification

Permanent

GENERAL BUSINESS RECORDS

Accounts receivable and payable

7 years

Accident reports/claims

7 years after settled

Audit reports

7 years

Bank deposit slips

7 years

Bank reconciliations and cancelled checks

7 years

Brokerage statements and stock transaction records

Permanent

Appraisal and valuation reports

7 years

Contributions to charities and nonprofit organizations

7 years

Corporate books, records, and stock transactions

Permanent

Correspondence (legal and important matters)

7 years

Contracts, notes, and leases

7 years after expiration

Evacuation and emergency action plan

Permanent

NJ CAR RECORD RETENTION GUIDE (CONT.)

PAGE 4

Insurance policies and certificates, including proof of Workers’

Compensation coverage from vendors and contractors

Permanent

Journals and ledgers

Permanent

Safeguard Policy (document safeguard plan required by FTC)

Permanent *

AUTOMOTIVE AND FINANCE BUSINESS RECORDS

Advertising copy (

++

clock starts from the date of sale of an advertised vehicle)

(See

FTC CARS Rule Below)

180 days*

++

Air bag repairs, activation and deactivation records

Permanent

Bills of lading, copies

7 years

Consumer credit applications

25 months *

(even

when there is no

purchase)

Privacy Notices

2 years

Adverse Action Notices

(when required)

5 years

Risk Based Pricing Notices

5 years

Credit Reports

5 years

ECOA-Fair Credit Compliance records

5 years

Safeguards Rule Policy and Compliance Records

Permanent

Red Flags Rule Policy and Compliance Records

Permanent

Customer buyer’s order or contract, when sale not completed

1 year

Deal jackets

7 years

Dealer swap transactions

7 years

Demo vehicle file

7 years

Financing dealer agreements

5 years after expiration

Parts tickets

2 years

Repair orders and estimates

2 years

eTemp Registrations – voided copies for both in and out-of-state temporary

registrations

3 years *

Warranty, incentives, and rebate submission documents

7 years

Odometer Disclosure Statements, POAs

5 years

ECOA Compliance Program Records

5 years

PROPERTY/FACILITIES RECORDS

Appraisals

Permanent

Blueprints, plans, drawings

Permanent

Deeds, titles, mortgages

Permanent

Maintenance and improvement records

Permanent

Depreciation schedules and supporting documentation

7 years after asset

disposition

Property tax records

Permanent

NJ CAR RECORD RETENTION GUIDE (CONT.)

PAGE 5

FTC CARS RULE RECORDKEEPING REQUIREMENTS

Effective July 30,

2024

Copies of materially different advertisements, sales scripts, training materials,

and marketing materials regarding the price, financing, or lease.

24 months from the

date the record is

created*

Copies of all materially different add-on lists and all documents describing

such products or services that are offered to consumers.

24 months from the

date the record is

created*

Copies of all purchase orders; financing and lease documents with the dealer

signed by the consumer, whether or not final approval is received for a financing or

lease transaction.

24 months from the

date the record is

created*

Copies of all written communications relating to sales, financing, or leasing

between the dealer and any consumer who signs a purchase order or

financing or lease contract with the dealer.

24 months from the

date the record is

created*

Copies of records demonstrating that add-ons in consumers’ contracts

provides a benefit, including copies of all service contracts, GAP

agreements, and calculations of loan-to-value ratios in contracts including

GAP agreements.

24 months from the

date the record is

created*

Copies of all written consumer complaints relating to sales, financing, or

leasing, inquiries related to add-ons, and inquiries and responses about

vehicles.

24 months from the

date the record is

created*