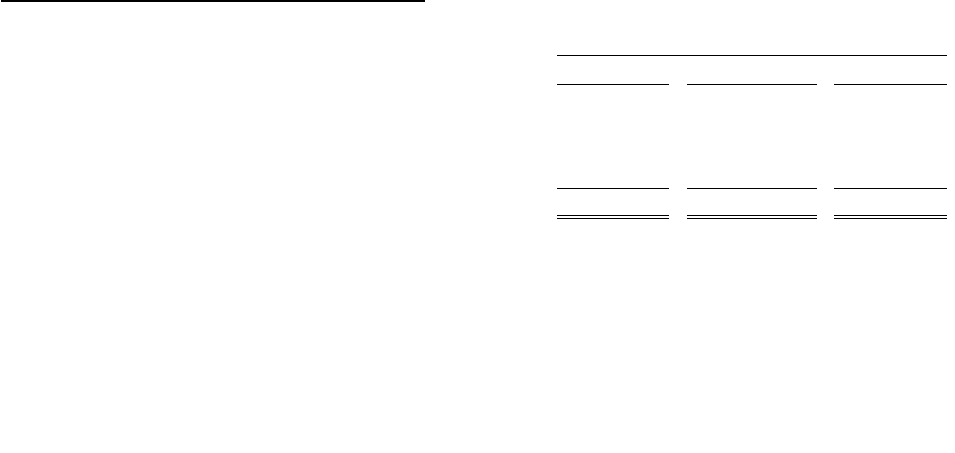

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2020

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number 1-9961

TOYOTA MOTOR CREDIT CORPORATION

(Exact name of registrant as specified in its charter)

California

95-3775816

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

6565 Headquarters Drive

Plano, Texas

75024

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code: (469) 486-9300

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Trading Symbol(s)

Name of each exchange on which registered

Medium-Term Notes, Series B

Stated Maturity Date January 11, 2028

TM/28

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

(Title of class)

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

Accelerated filer

Non-accelerated filer

Smaller reporting company

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

As of April 30, 2020, the number of outstanding shares of capital stock, no par value per share, of the registrant was 91,500, all of which shares were

held by Toyota Financial Services International Corporation.

Documents incorporated by reference: None

Reduced Disclosure Format

The registrant meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with

the reduced disclosure format.

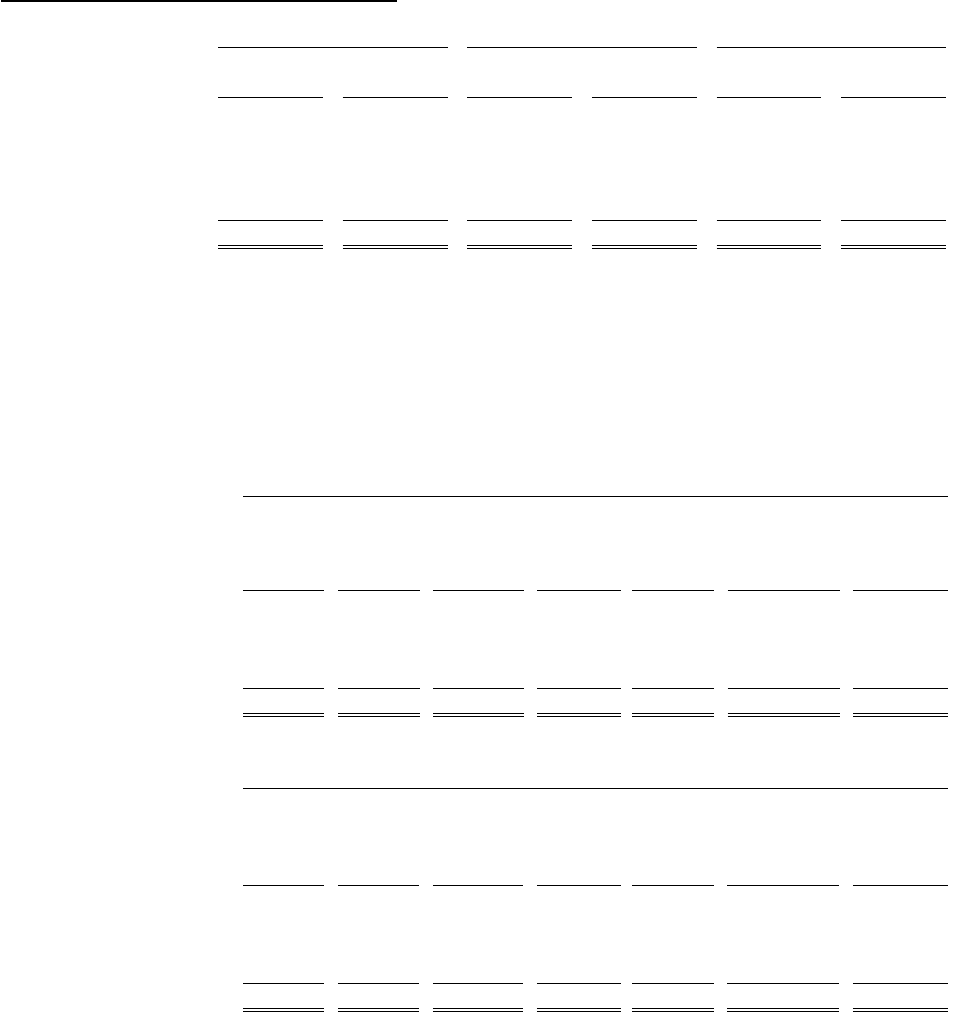

2

TOYOTA MOTOR CREDIT CORPORATION

FORM 10-K

For the fiscal year ended March 31, 2020

INDEX

PART I.................................................................................................................................................................................................

3

Item 1.

Business..........................................................................................................................................................................

3

Item 1A.

Risk Factors....................................................................................................................................................................

14

Item 1B.

Unresolved Staff Comments...........................................................................................................................................

25

Item 2.

Properties........................................................................................................................................................................

25

Item 3.

Legal Proceedings...........................................................................................................................................................

25

Item 4.

Mine Safety Disclosures.................................................................................................................................................

25

PART II ...............................................................................................................................................................................................

26

Item 5.

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ..........................

26

Item 6.

Selected Financial Data....................................................................................................................................................

27

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations..........................................

29

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk.........................................................................................

63

Item 8.

Financial Statements and Supplementary Data................................................................................................................

66

Report of Independent Registered Public Accounting Firm............................................................................................

66

Consolidated Statements of Income.................................................................................................................................

67

Consolidated Statements of Comprehensive Income.......................................................................................................

67

Consolidated Balance Sheets ...........................................................................................................................................

68

Consolidated Statements of Shareholder’s Equity...........................................................................................................

69

Consolidated Statements of Cash Flows..........................................................................................................................

70

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures ........................................

121

Item 9A.

Controls and Procedures ..................................................................................................................................................

121

Item 9B.

Other Information.............................................................................................................................................................

121

PART III..............................................................................................................................................................................................

122

Item 10.

Directors, Executive Officers and Corporate Governance.............................................................................................

122

Item 11.

Executive Compensation................................................................................................................................................

125

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters......................

125

Item 13.

Certain Relationships and Related Transactions, and Director Independence...............................................................

125

Item 14.

Principal Accounting Fees and Services........................................................................................................................

125

PART IV ..............................................................................................................................................................................................

126

Item 15.

Exhibits, Financial Statement Schedules .......................................................................................................................

126

Item 16.

Form 10-K Summary .....................................................................................................................................................

130

Signatures.......................................................................................................................................................................

131

3

PART I

ITEM 1. BUSINESS

GENERAL

Toyota Motor Credit Corporation was incorporated in California in 1982 and commenced operations in 1983.

References herein to “TMCC” denote Toyota Motor Credit Corporation, and references herein to “we”, “our”, and

“us” denote Toyota Motor Credit Corporation and its consolidated subsidiaries. We are wholly-owned by Toyota

Financial Services International Corporation (“TFSIC”), a California corporation, which is a wholly-owned subsidiary

of Toyota Financial Services Corporation (“TFSC”), a Japanese corporation. TFSC, in turn, is a wholly-owned

subsidiary of Toyota Motor Corporation (“TMC”), a Japanese corporation. TFSC manages TMC’s worldwide

financial services operations. TMCC is marketed under the brands of Toyota Financial Services and Lexus Financial

Services.

We provide a variety of finance and insurance products to authorized Toyota and Lexus dealers or dealer groups and,

to a lesser extent, other domestic and import franchise dealers (collectively referred to as “dealers”) and their

customers in the United States of America (excluding Hawaii) (the “U.S.”) and Puerto Rico. Our products fall

primarily into the following categories:

• Finance - We acquire retail installment sales contracts from dealers in the U.S. and Puerto Rico (“retail

contracts”) and leasing contracts accounted for as operating leases (“lease contracts”) from dealers in the

U.S. We collectively refer to our retail and lease contracts as the “consumer portfolio.” We also provide

dealer financing, including wholesale financing, working capital loans, revolving lines of credit and real

estate financing to dealers in the U.S. and Puerto Rico. We collectively refer to our dealer financing

portfolio as the “dealer portfolio.”

• Insurance - Through Toyota Motor Insurance Services, Inc., a wholly-owned subsidiary, and its insurance

company subsidiaries (collectively referred to as “TMIS”), we provide marketing, underwriting, and

claims administration for vehicle and payment protection products sold by dealers in the U.S. Our vehicle

and payment protection products include vehicle service agreements, guaranteed auto protection

agreements, prepaid maintenance contracts, excess wear and use agreements, tire and wheel protection

agreements, key replacement protection and used vehicle limited warranty agreements. TMIS also

provides coverage and related administrative services to certain of our affiliates in the U.S. Although the

vehicle and payment protection products are generally not regulated as insurance products, for ease of

reference we collectively refer to the group of products provided by TMIS herein as “insurance products.”

We support growth in earning assets through funding obtained primarily in the global capital markets as well as funds

provided by investing and operating activities. Refer to Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations, “Liquidity and Capital Resources” for a discussion of our funding activities.

On April 16, 2019, we announced that we will restructure our field operations to better serve our dealer partners by

streamlining our field office structure and investing in new technology. We are currently in the process of

consolidating our field operations locations, which consist of dealer sales and service offices (“DSSOs”) and regional

management offices located in cities throughout the U.S., into three new regional dealer service centers (“DSCs”)

located in Chandler, Arizona (serving the West region), Plano, Texas (serving the Central region) and Alpharetta,

Georgia (serving the East region). The consolidation of field operations is expected to be complete by the end of fiscal

year 2021. The regional DSCs acquire retail and lease contracts from dealers, and market TMIS insurance products to

dealers.

The dealer lending function, previously located at the various DSSO’s, is now centralized at the DSC located in Plano,

Texas. The dealer lending function supports the dealers by providing wholesale financing and other dealer financing

activities such as business acquisitions, facilities refurbishment, real estate purchases, and working capital

requirements.

We service contracts through three regional customer service centers (“CSCs”) located throughout the U.S. The CSCs

support customer account servicing functions such as collections, lease terminations, and administration of both retail

and lease contract customer accounts. The Central region CSC also supports insurance product operations by

providing agreement and claims administrative services.

4

As of April 1, 2020, we began providing private label financial services to third-party automotive and mobility

companies commencing with the provision of services to Mazda Motor of America, Inc. (“Mazda”). Pursuant to our

previously disclosed agreement with Mazda, we currently offer exclusive private label automotive retail, lease, and

dealer financing products and services, and later in fiscal year 2021 intend to offer exclusive vehicle protection

products and services, marketed under the brand Mazda Financial Services to Mazda customers and dealers in the

United States. Our agreement with Mazda is for an initial term of approximately five years.

Available Information

Our filings with the Securities and Exchange Commission (“SEC”) may be found by accessing the SEC website

(http://www.sec.gov). A link to the SEC website and certain of our SEC filings are contained on our website located

at: www.toyotafinancial.com under “Investor Relations, SEC Filings”.

Investors and others should note that we announce material financial information using the investor relations section

of our website. We use our website, press releases, as well as social media to communicate with our investors,

customers and the general public about our company, our services and other issues. While not all of the information

that we post on our website or on social media is of a material nature, some information could be material. Therefore,

we encourage investors, the media, and others interested in our company to review the information we post on the

investor relations section of our website and our Twitter feed (http://www.twitter.com/toyotafinancial). We are not

incorporating any of the information set forth on our website or on social media channels into this filing on Form 10-

K.

Seasonality

Revenues generated by our retail and lease contracts are generally not subject to seasonal variations. Financing

volume is subject to a certain degree of seasonality. This seasonality does not have a significant impact on revenues as

collections, generally in the form of fixed payments, occur over the course of several years. We are subject to

seasonal variations in credit losses, which are historically higher in the first and fourth calendar quarters of the year.

5

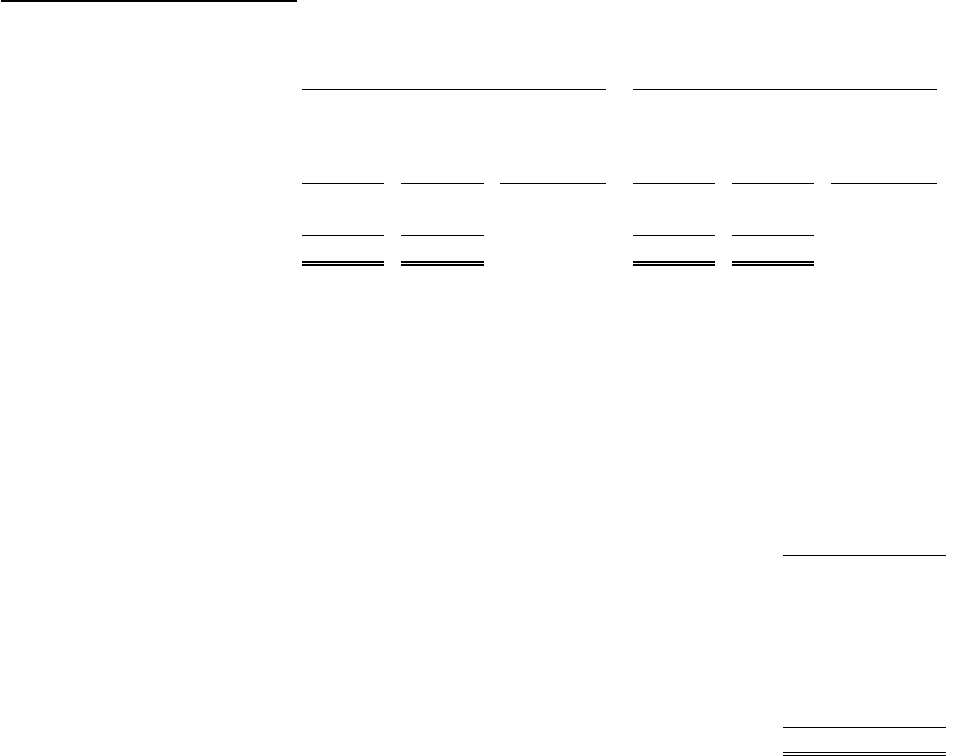

FINANCE OPERATIONS

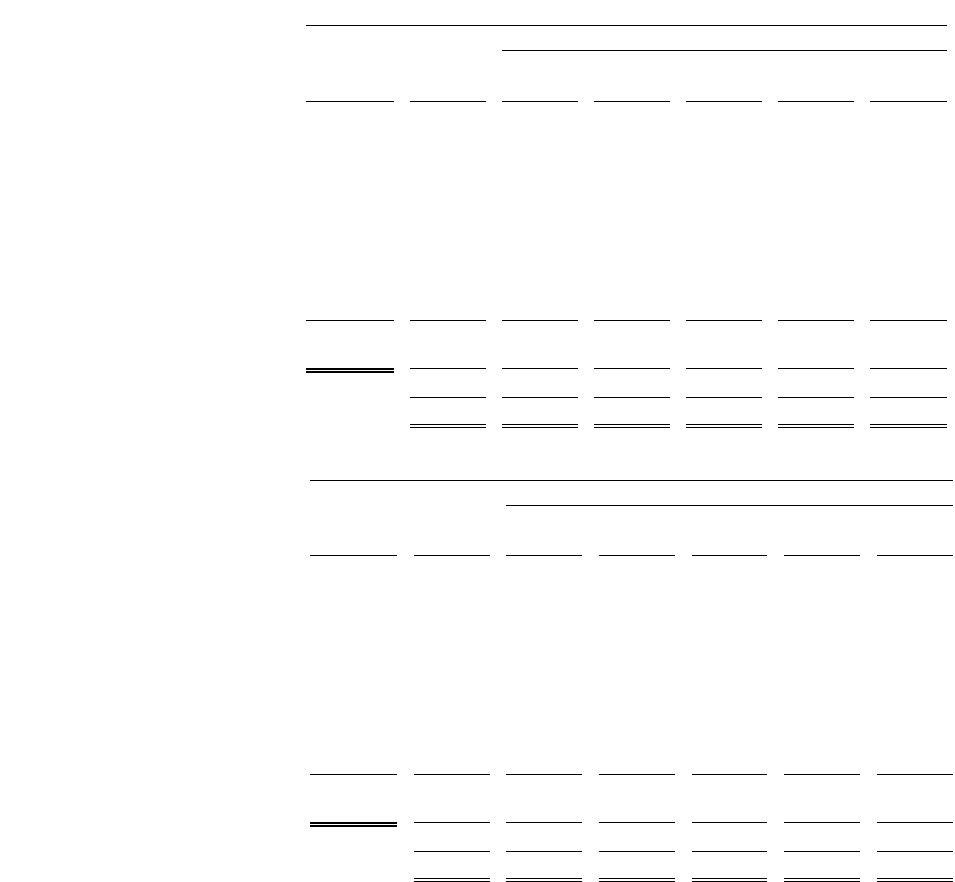

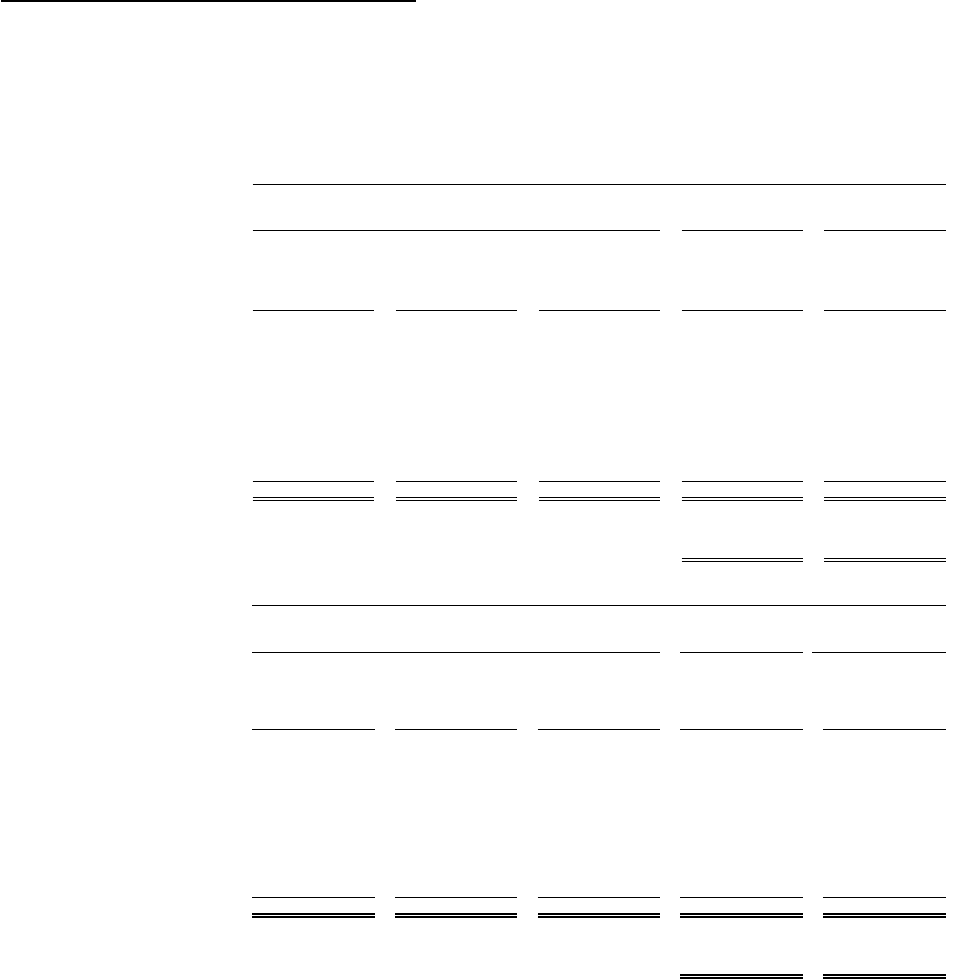

The table below summarizes our financing revenues, net of depreciation by product.

Years ended March 31,

2020

2019

2018

Percentage of financing revenues, net of depreciation:

Operating leases, net of depreciation

38

%

38

%

30

%

Retail

49

%

47

%

54

%

Dealer

13

%

15

%

16

%

Financing revenues, net of depreciation

100

%

100

%

100

%

Retail and Lease Financing

Pricing

We utilize a tiered pricing program, which matches interest rates with customer risk as defined by credit bureau scores

and other factors for a range of price and risk combinations. Each application is assigned a credit tier. Rates vary

based on credit tier, term, loan-to-value and collateral, including whether a new or used vehicle is financed. In

addition, special rates may apply as a result of promotional activities. We review and adjust interest rates based on

competitive and economic factors and distribute the rates, by tier, to dealers.

Underwriting

Dealers transmit customer credit applications electronically through our online system for contract acquisition. The

customer may submit a credit application directly to our website, in which case, the credit application is sent to the

dealer of the customer’s choice and is considered by us for preapproval. Upon receipt of the credit application, our

loan origination system automatically requests a credit bureau report from one of the major credit bureaus. We use a

proprietary credit scoring system to evaluate an applicant’s risk profile. Factors used by the credit scoring system

(based on the applicant’s credit history) include the term of the contract, ability to pay, debt ratios, amount financed

relative to the value of the vehicle to be financed, and credit bureau attributes such as number of trade lines, utilization

ratio and number of credit inquiries.

Credit applications are subject to systematic evaluation. Our loan origination system evaluates each application to

determine if it qualifies for automatic approval or decline without manual intervention (“auto-decisioning”) using

specific requirements, including internal credit score and other application characteristics. Typically, the highest

quality credit applications are approved automatically, and the lowest quality credit applications are automatically

declined.

Credit analysts (working in our field operations) approve or decline all credit applications that are not auto-decisioned

and may also approve an application that has been the subject of an automated decline. Failure to be automatically

approved through auto-decisioning does not mean that an application does not meet our underwriting guidelines. A

credit analyst decisions applications based on an evaluation that considers an applicant’s creditworthiness and

projected ability to meet the monthly payment obligation, which is derived from, among other things, the amount

financed and the term. A credit analyst will verify information contained in the credit application if the application

presents an elevated level of credit risk. Our proprietary scoring system assists the credit analyst in the credit review

process. The credit analyst’s final credit decision is made based upon the degree of credit risk perceived by the credit

analyst after assessing the strengths and weaknesses of the application.

Completion of the financing process is dependent upon whether the transaction is a retail or lease contract. For a retail

contract, we acquire the retail contract from the dealer and obtain a security interest in the vehicle. We perfect our

security interests in the financed retail vehicles through the applicable state department of motor vehicles (or

equivalent) with certificate of title filings or with Uniform Commercial Code (“UCC”) filings, as appropriate. For a

lease contract, except as described below under “Servicing”, we acquire the lease contract and concurrently assume

ownership of the leased vehicle. We have the right to pursue collection actions against a delinquent customer, as well

as repossess a vehicle if a customer fails to meet contractual obligations.

We regularly review and analyze our consumer portfolio to evaluate the effectiveness of our underwriting guidelines

and purchasing criteria. If external economic factors, credit losses, delinquency experience, market conditions or other

factors change, we may adjust our underwriting guidelines and purchasing criteria in order to change the asset quality

of our portfolio or to achieve other goals and objectives.

6

Subvention and Incentive Programs

Toyota Motor Sales, U.S.A., Inc. (“TMS”), a subsidiary of Toyota Motor North America, Inc. (“TMNA”), is the

primary distributor of Toyota and Lexus vehicles in the United States. In partnership with TMNA and certain non-

affiliated third party distributors, we may offer special promotional rates, which we refer to as subvention programs.

TMNA pays us the majority of the difference between our standard rate and the promotional rate. Amounts received

in connection with these programs allow us to maintain yields at levels consistent with standard program levels. The

level of subvention program activity varies based on the marketing strategies of TMNA, economic conditions, and

volume of new and used vehicle sales. The amount of subvention received varies based on the mix of Toyota and

Lexus vehicles included in the promotional rate programs and the timing of the programs. The majority of our lease

contracts and a significant portion of our retail contracts are subvened. We may also offer cash and contractual

residual value support incentive programs in partnership with TMNA. Subvention and other cash incentive program

payments offered in partnership with TMNA are settled at the beginning of the retail or lease contract. We may also

offer our own cash incentives and other competitive rate programs. We defer the payments and recognize them over

the life of the contract as a yield adjustment for retail contracts and as rental income or a reduction to depreciation

expense for lease contracts.

Servicing

Our CSCs are responsible for servicing the consumer portfolio. A centralized department manages third party vendor

relationships responsible for bankruptcy administration, liquidation and post charge-off recovery activities, certain

administrative activities, customer services activities and pre-charge-off collections with support from the CSCs.

We use an online collection and auto dialer system that prioritizes collection efforts and signals our collections

personnel to make telephone contact with delinquent customers. We also use a behavioral-based collection strategy to

minimize risk of loss and employ various collection methods based on behavioral scoring models (which analyze

borrowers’ payment performance, vehicle valuation and credit bureau scores to predict future payment behavior). We

generally determine whether to commence repossession efforts after an account is approximately 80 days past due.

Repossessed vehicles are held for sale to comply with statutory requirements and then sold at private auctions, unless

public auctions are required by state law. Any unpaid amounts remaining after the repossessed vehicle is sold or after

taking the full balance charge-off are pursued by us to the extent practical and legally permissible. Any surplus

amounts remaining after recovery fees, disposition costs, and other expenses have been paid, and after any reserve

charge-backs, dealer guarantees and optional product refunds have been credited to the customer’s account, are

refunded to the customers. Collections of post-sale deficiencies and full-balance charge-offs are handled by third

party vendors and the CSCs. We charge-off uncollectible portions of accounts when an account is deemed to be

uncollectible or when the account balance becomes 120 days contractually delinquent, whichever occurs first.

However, the CSCs will continue to collect or pursue recovery of the vehicle up to 190 days after the account is past

due.

We may, in accordance with our customary servicing procedures, offer rebates or waive any prepayment charge, late

payment charge, or any other fees that may be collected in the ordinary course of servicing the consumer portfolio. In

addition, we may defer a customer’s obligation to make a payment by extending the contract term. Refer to Item 1A.

Risk Factors, “Industry and Business Risk”-“We face various risks related to health epidemics and other outbreaks,

which have had and may continue to have material adverse effects on our business, financial condition, results of

operations and cash flows” and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations, “Recent Developments Related to COVID-19” for further discussion of payment relief programs offered

to customers affected by the coronavirus.

Substantially all of our retail and lease contracts are purchased as non-recourse from the dealers. This relieves the

dealers of financial responsibility in the event of a customer default.

We may experience a higher risk of loss if customers fail to maintain required insurance coverage. The terms of our

retail contracts require customers to maintain physical damage insurance covering loss or damage to the financed

vehicle in an amount not less than the full value of the vehicle and to provide evidence of such insurance upon our

request. The terms of each contract allow but do not require us to obtain any such insurance coverage on behalf of the

customer. In accordance with our customary servicing procedures, we do not exercise our right to obtain insurance

coverage on behalf of the customer. Our lease contracts require lessees to maintain minimum liability insurance and

physical damage insurance covering loss or damage to the leased vehicle in an amount not less than the full value of

the vehicle. We currently do not monitor ongoing customer insurance coverage as part of our customary servicing

procedures for the consumer portfolio.

7

Toyota Lease Trust, a Delaware business trust (the “Titling Trust”), acts as lessor and holds title to leased vehicles in

the U.S. This arrangement was established to facilitate lease securitizations. TMCC services lease contracts acquired

by the Titling Trust from Toyota and Lexus dealers. TMCC holds an undivided interest in lease contracts owned by

the Titling Trust, and these lease contracts are included in Investments in operating leases, net on our Consolidated

Balance Sheets.

Remarketing

The lessee may purchase the leased vehicle at the contractual residual value or return the leased vehicle to the dealer.

If the leased vehicle is returned to the dealer, the dealer may purchase the leased vehicle or return it to us. We are

responsible for disposing of the leased vehicle if the lessee or dealer does not purchase the vehicle at lease maturity.

In order to minimize losses when vehicles are returned to us, we have developed remarketing strategies to maximize

proceeds and minimize disposition costs on used vehicles. We use various channels to sell vehicles returned at lease-

end or repossessed prior to lease-end, including a dealer direct program (“Dealer Direct”) and physical auctions.

The goal of Dealer Direct is to increase dealer purchases of off-lease vehicles thereby reducing the disposition costs of

such vehicles. Through Dealer Direct, the dealer accepting return of the lease vehicle (the “grounding dealer”) has the

option to purchase the vehicle at the contractual residual value, purchase the vehicle at an assessed market value, or

return the vehicle to us. Vehicles not purchased by the grounding dealer are made available to all Toyota and Lexus

dealers through the Dealer Direct online auction. Vehicles not purchased through Dealer Direct are sold at physical

vehicle auction sites throughout the country. Where deemed necessary, we recondition used vehicles prior to sale in

order to enhance the vehicle values at auction. Refer to Item 1A. Risk Factors, “Industry and Business Risk”-“We

face various risks related to health epidemics and other outbreaks, which have had and may continue to have material

adverse effects on our business, financial condition, results of operations and cash flows”, -“A decrease in the residual

values of our off-lease vehicles and a higher number of returned lease assets could negatively affect our results of

operations and financial condition” and Item 7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations, “Recent Developments Related to COVID-19” for further discussion of the impact of

coronavirus on our remarketing activities and residual values.

Dealer Financing

Dealer financing is comprised of wholesale financing and other financing options designed to meet dealer business

needs.

Wholesale Financing

We provide wholesale financing to dealers for inventories of new and used Toyota, Lexus and other domestic and

import vehicles. We acquire a security interest in the vehicle inventory, and/or other dealership assets, as appropriate,

which we perfect through UCC filings. Wholesale financing may also be backed by corporate or individual guarantees

from, or on behalf of, affiliated dealers, dealer groups, or dealer principals. In the event of a dealer default under a

wholesale loan agreement, we have the right to liquidate assets in which we have a perfected security interest and to

seek legal remedies pursuant to the wholesale loan agreement and any applicable guarantees.

TMCC and TMNA are parties to an agreement pursuant to which TMNA will arrange for the repurchase of new

Toyota and Lexus vehicles at the aggregate cost financed by TMCC in the event of a dealer default under wholesale

financing. In addition, we provide other types of wholesale financing to certain Toyota and Lexus dealers and other

third parties, at the request of TMNA or private Toyota distributors, and TMNA or the applicable private distributor

guarantees the payments by such borrowers.

Other Dealer Financing

We provide fixed and variable rate working capital loans, revolving lines of credit, and real estate financing to dealers

and various multi-franchise organizations referred to as dealer groups for facilities construction and refurbishment,

working capital requirements, real estate purchases, business acquisitions and other general business purposes. These

loans are typically secured with liens on real estate, vehicle inventory, and/or other dealership assets, as appropriate,

and may be guaranteed by individual or corporate guarantees of affiliated dealers, dealer groups, or dealer principals.

Although the loans are typically collateralized or guaranteed, the value of the underlying collateral or guarantees may

not be sufficient to cover our exposure under such agreements. Our pricing reflects market conditions, the competitive

environment, the level of support dealers provide our retail, lease and insurance products and the creditworthiness of

each dealer.

8

Before establishing a wholesale loan or other dealer financing agreement, we perform a credit analysis of the dealer.

During this analysis, we:

• Review financial statements and we may obtain credit reports and bank references;

• Evaluate the dealer’s financial condition and history of servicing debt; and

• Assess the dealer’s operations and management.

On the basis of this analysis, we may approve the issuance of a loan or financing agreement and determine the

appropriate amount to lend.

As part of our monitoring processes, we may require dealers to submit periodic financial statements. We also perform

periodic physical audits of vehicle inventory as well as monitor the timeliness of dealer inventory financing payoffs in

accordance with the agreed-upon terms to identify possible risks.

9

INSURANCE OPERATIONS

TMIS offers vehicle and payment protection products on Toyota, Lexus and other domestic and import vehicles that

are sold by dealers as part of the dealer’s sale of a vehicle as further described below. Vehicle service agreements

offer vehicle owners and lessees mechanical breakdown protection for new and used vehicles secondary to the

manufacturer’s new vehicle warranty. Guaranteed auto protection agreements provide coverage for a lease or retail

contract deficiency balance in the event of a total loss or theft of the covered vehicle. Prepaid maintenance contracts

provide maintenance services at manufacturer recommended intervals. Excess wear and use agreements are available

on leases of Toyota and Lexus vehicles and protect against excess wear and use charges that may be assessed at lease

termination. Tire and wheel protection agreements provide coverage in the event that a covered vehicle’s tires or

wheels become damaged as a result of a road hazard or structural failure due to a defect in material or workmanship, to

the extent not covered by the manufacturer or the tire distributor warranties. Certain tire and wheel protection

agreements also cover expenses related either to replacing or reprogramming a vehicle key or vehicle key remote in

the event of loss or damage. Key replacement protection provides stand-alone coverage for expenses related either to

replacing or reprogramming a vehicle key or vehicle key remote in the event of loss or damage. Used vehicle limited

warranty agreements are included with the purchase of a used vehicle and provides for the repair or replacement of

certain covered components that have mechanically failed on the covered used vehicle.

TMIS provides TMNA contractual indemnity insurance coverage for limited warranties on certified Toyota and Lexus

pre-owned vehicles. TMIS also provides umbrella liability insurance to TMNA and other affiliates covering certain

dollar value layers of risk above various primary or self-insured retentions. On all layers in which TMIS provides

coverage, 99 percent of the risk is ceded to a reinsurer.

Effective September 2018, TMIS discontinued the wholesale inventory insurance program for which certain Toyota,

Lexus and other domestic and import dealers obtained coverage for eligible vehicle inventory. The discontinuation of

the wholesale inventory program did not have a significant impact on our results of operations or financial condition

for our insurance operations.

10

RELATIONSHIPS WITH AFFILIATES

TMCC is party to agreements with TMNA and certain TMNA subsidiaries. For ease of reference herein, we refer

solely to the parent entity, TMNA. As a result, all references to the agreements or activities of TMNA herein that are

carried out by a TMNA subsidiary are deemed to also make reference to and include the applicable TMNA subsidiary.

TMNA sponsors subvention, cash and contractual residual value support incentive programs on certain new and used

Toyota and Lexus vehicles. The level of incentive program activity varies based on TMNA marketing strategies,

economic conditions, and volume of vehicle sales.

TMCC and TMNA are parties to an agreement pursuant to which TMNA will arrange for the repurchase of new

Toyota and Lexus vehicles at the aggregate cost financed by TMCC in the event of a dealer default under wholesale

financing. In addition, we provide other types of financing to certain Toyota and Lexus dealers and other third parties,

at the request of TMNA or private Toyota distributors, and TMNA or the applicable private distributor guarantees the

payments by such borrowers.

TMNA provides shared services to TMCC, including certain technological and administrative services, such as

information systems support, facilities, insurance coverage, human resources and other corporate services. TMCC

also provides shared services to TMNA, including certain treasury and procurement services.

Prior to January 1, 2015, our employees were generally eligible to participate in the Toyota Motor Sales, U.S.A., Inc.

Pension Plan (the “Pension Plan”). Effective January 1, 2015, the Pension Plan was closed to employees first

employed or reemployed on or after such date. Employees meeting certain eligibility requirements may participate in

the Toyota Motor North America, Inc. Retirement Savings Plan (the “Savings Plan”). Certain employees hired on or

after January 1, 2015, may be eligible to receive an additional contribution to the Savings Plan calculated based on

their age and compensation. Various health, life and other post-retirement benefits are offered and sponsored by

TMNA, as discussed further in Note 10 – Pension and Other Benefit Plans of the Notes to Consolidated Financial

Statements.

TMCC is party to agreements with TMNA and other affiliates relating to the team member vehicle benefit program,

which allows team members to lease Toyota and Lexus vehicles on terms exclusive to the benefit program. TMNA

serves as the chief administrator of the program. TMCC acquires and services team member leases entered into after

the third quarter of fiscal 2018. A portion of the vehicles used for the team member vehicle benefit program are

acquired from TMNA. TMCC receives a per vehicle contribution from participating affiliates to assist with the costs

of its contribution to the benefit program, and TMCC pays a per vehicle participation fee to TMNA to participate in

the benefit program.

TMCC and Toyota Financial Savings Bank (“TFSB”), a Nevada thrift company owned by TFSIC, are parties to a

master shared services agreement under which TMCC and TFSB provide certain services to each other. TMCC and

TFSB are also parties to an expense reimbursement agreement, which provides that TMCC will reimburse certain

expenses incurred by TFSB in connection with providing certain financial products and services to TMCC’s customers

and dealers in support of TMCC’s customer loyalty strategy and programs.

TMCC is party to a revolving credit facility with TMS expiring in fiscal 2022 which may be used for general corporate

purposes. This agreement is further discussed in Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations, “Liquidity and Capital Resources.”

Credit support agreements exist between TMCC and TFSC and between TFSC and TMC. These agreements are

further discussed in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,

“Liquidity and Capital Resources.”

TMIS provides administrative services and various types of coverage to TMNA and other affiliates, including

contractual indemnity coverage for limited warranties on TMNA’s certified pre-owned vehicle program and umbrella

liability insurance.

Refer to Note 12 – Related Party Transactions of the Notes to Consolidated Financial Statements for further

information.

11

COMPETITION

We operate in a highly competitive environment and compete with other financial institutions including national and

regional commercial banks, credit unions, savings and loan associations, online banks, and finance companies. To a

lesser extent, we compete with other automobile manufacturers’ affiliated finance companies that actively seek to

purchase retail contracts through Toyota and Lexus dealers. We also compete with national and regional commercial

banks and other automobile manufacturers’ affiliated finance companies for dealer financing. No single competitor is

dominant in the industry. We compete primarily through service quality, our relationship with TMNA, and financing

rates. We seek to provide exceptional customer service and competitive financing programs to our dealers and to their

customers. Our affiliation with TMNA offers an advantage in providing financing or leasing of Toyota and Lexus

vehicles.

Competition for the insurance products is primarily from national and regional independent service contract providers.

We compete primarily through service quality, our relationship with TMNA and product benefits. Our affiliation with

TMNA provides an advantage in selling our insurance products and services.

REGULATORY ENVIRONMENT

Our finance and insurance products are regulated under both federal and state law.

Federal Consumer Finance Regulation

Our finance operations are governed by, among other federal laws, the Equal Credit Opportunity Act, the Truth in

Lending Act, the Consumer Leasing Act, the Fair Credit Reporting Act, the Servicemembers Civil Relief Act, the

unfair, deceptive and abusive practices (UDAAP) provisions of the Dodd-Frank Wall Street Reform and Consumer

Protection Act (the “Dodd-Frank Act”), and the consumer data privacy and security provisions of the Gramm-Leach

Bliley Act.

The Equal Credit Opportunity Act is designed to prevent credit discrimination on the basis of certain protected classes,

requires the distribution of specified credit decision notices and limits the information that may be requested and

considered in a credit transaction. The Truth in Lending Act and the Consumer Leasing Act place disclosure and

substantive transaction restrictions on consumer credit and leasing transactions. The Fair Credit Reporting Act

imposes restrictions and requirements regarding our use and sharing of credit reports, the reporting of data to credit

reporting agencies including the accuracy and integrity of information reported, credit decision notices, consumer

dispute handling procedures and identity theft prevention requirements. The Servicemembers Civil Relief Act

provides additional protections for certain customers in the military. For example, it requires us, in most

circumstances, to reduce the interest rate charged to customers who have subsequently joined, enlisted, been inducted

or called to active military duty, and also requires us to allow eligible servicemembers to terminate their lease

agreements with us early without penalty. UDAAP laws prohibit practices that are unfair, deceptive or abusive

towards consumers.

Federal privacy and data security laws place restrictions on our use and sharing of consumer data, impose privacy

notice requirements, give consumers the right to opt out of certain uses and sharing of their data and impose

safeguarding rules regarding the maintenance, storage, transmission and destruction of consumer data. Cybersecurity

and data privacy are areas of heightened legislative and regulatory focus. The timing and effects of potential

legislative or regulatory changes to data privacy regulations is uncertain.

In addition, the dealers who originate our retail and lease contracts also must comply with federal credit and trade

practice statutes and regulations. Failure of the dealers to comply with these statutes and regulations could result in

remedies that could have an adverse effect on us.

The Consumer Financial Protection Bureau (“CFPB”) has broad rulemaking, supervisory and enforcement authority

over entities offering consumer financial services or products, including non-bank companies, such as TMCC

(“Covered Entities”).

The CFPB’s supervisory authority has focused on fair lending compliance, the marketing and sale of certain optional

products, including products similar to those we finance or sell through TMIS and credit reporting.

The CFPB’s supervisory authority permits it to examine Covered Entities for compliance with consumer financial

protection laws. These examinations could result in enforcement actions, regulatory fines and mandated changes to our

business, products, policies and procedures.

12

The CFPB’s enforcement authority permits it to conduct investigations (which may include a joint investigation with

other agencies and regulators) of, and initiate enforcement actions related to, violations of federal consumer financial

protection laws. The CFPB has the authority to obtain cease and desist orders (which can include orders for restitution

or rescission of contracts, as well as other types of affirmative relief), or other forms of remediation, and/or impose

monetary penalties. The CFPB and the Federal Trade Commission (“FTC”) may investigate the products, services and

operations of credit providers, including banks and other finance companies engaged in auto finance activities. As a

result of such investigations, both the CFPB and FTC have announced various enforcement actions against lenders in

the past few years involving significant penalties, consent orders, cease and desist orders and similar remedies that, if

applicable to us or the products, services and operations we offer, may require us to cease or alter certain business

practices, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

State Regulation

A majority of states (and Puerto Rico) have enacted legislation establishing licensing requirements to conduct

financing activities. We must renew these licenses periodically. Most states also impose limits on the maximum rate

of finance charges. In certain states, the margin between the present statutory maximum interest rates and borrowing

costs is sufficiently narrow that, in periods of rapidly increasing or high interest rates, there could be an adverse effect

on our operations in these states if we were unable to pass on increased interest costs to our customers. Some state

laws impose rate and other restrictions on credit transactions with customers in active military status in addition to

those imposed by the Servicemembers Civil Relief Act.

State laws also impose requirements and restrictions on us with respect to, among other matters, required credit

application and finance and lease disclosures, late fees and other charges, the right to repossess a vehicle for failure to

pay or other defaults under the retail or lease contract, other rights and remedies we may exercise in the event of a

default under the retail or lease contract, and other consumer protection matters. Many states are also focusing on

cybersecurity and data privacy as areas warranting consumer protection. Some states have passed complex legislation

dealing with consumer information, which impacts companies such as TMCC. For example, in California a new data

protection regime has taken effect, that grants consumers broad new rights relating to access to, deletion of, and

sharing of personal information that is collected by businesses and requiring regulated entities to establish measures to

identify, manage, secure, track, produce and delete personal information. In some jurisdictions, these laws and

regulations provide a private right of action that would allow customers to bring suit directly against us for

mishandling their data for certain violations of these laws and regulations.

TMIS operations are subject to state regulations and licensing requirements. State laws vary with respect to which

products are regulated and what types of corporate licenses and filings are required to offer certain products. Certain

products offered by TMIS are covered by state privacy laws as well as new cybersecurity and data privacy legislation.

Our insurance company subsidiaries must be appropriately licensed in certain states in which they conduct business,

must maintain minimum capital requirements and file annual financial information as determined by their state of

domicile and the National Association of Insurance Commissioners. Failure to comply with these requirements could

have an adverse effect on insurance operations in a particular state. We actively monitor applicable laws and

regulations in each state in order to maintain compliance.

State regulators are taking a more stringent approach to supervising and regulating providers of financial products and

services subject to their jurisdiction. We expect to continue to face greater supervisory scrutiny and enhanced

supervisory requirements for the foreseeable future.

Other Federal and International Regulation

Under the Volcker Rule, companies affiliated with U.S. insured depository institutions are generally prohibited from

engaging in “proprietary trading” and certain transactions with certain privately offered funds. The activities

prohibited by the Volcker Rule are not core activities for us. In the future, however, the federal financial regulatory

agencies charged with implementing the Volcker Rule could amend the rule or change their approach to administering,

enforcing or interpreting the rule, which could negatively affect us and potentially require us to limit or change our

activities or operations.

The Dodd-Frank Act amended the U.S. Commodity Exchange Act (“CEA”) to establish a comprehensive framework

for the regulation of certain over-the-counter (“OTC”) derivatives referred to as swaps. Under the Dodd-Frank Act,

the Commodity Futures Trading Commission (“CFTC”) is required to adopt certain rules and regulations governing

swaps. The CFTC has completed almost all of its regulations in this area, most of which are in effect.

13

The OTC derivatives provisions of the CEA, as amended by the Dodd-Frank Act, impose clearing, trading and margin

requirements on certain contracts. At present, we qualify for exceptions from these requirements for the swaps that we

enter into to hedge our commercial risks. However, if we were to no longer qualify for such exceptions, we could

become subject to some or all of these requirements, which would increase our cost of entering into and maintaining

such hedging positions.

If we reduce our use of OTC derivatives as a result of the Dodd-Frank Act and resulting regulations, our results of

operations may become more volatile and our cash flows may be less predictable, which could adversely affect our

ability to plan for and fund capital expenditures.

We continually review our operations for compliance with applicable laws. Future administrative rulings, judicial

decisions, legislation, regulations and regulatory guidance, and supervision and enforcement actions may result in

monetary penalties, increase our compliance costs, require changes in our business practices, affect our

competitiveness, impair our profitability, harm our reputation or otherwise adversely affect our business.

Refer to Part 1, Item 1A. Risk Factors – “The regulatory environment in which we operate could have a material

adverse effect on our business and results of operations.”

EMPLOYEE RELATIONS

At April 30, 2020, we had approximately 3,300 employees. We consider our employee relations to be satisfactory.

We are not subject to any collective bargaining agreements with our employees.

14

ITEM 1A. RISK FACTORS

We are exposed to certain risks and uncertainties that could have a material adverse impact on our business, results of

operations and financial condition. There may be additional risks and uncertainties not presently known to us or that

we currently consider immaterial that may also have a material adverse impact on our business, results of operations

and financial condition.

Industry and Business Risk

We face various risks related to health epidemics and other outbreaks, which have had and are expected to

continue to have material adverse effects on our business, financial condition, results of operations and cash flows.

We face various risks related to health epidemics and other outbreaks, including the global outbreak of coronavirus

(“COVID-19”). The COVID-19 pandemic, changes in consumer behavior related to illness, pandemic fears and

market downturns, and restrictions intended to slow the spread of COVID-19, including quarantines, government-

mandated actions, stay-at-home orders and other restrictions, have led to disruption and volatility in the global capital

markets, which has increased our cost of capital and adversely affected our ability to access the capital markets. For

more information on how a disruption in the global capital markets affects our liquidity, please see risk factor “A

disruption in our funding sources and access to the capital markets would have an adverse effect on our liquidity”.

In addition, the COVID-19 pandemic and restrictions intended to slow the spread of COVID-19 have adversely

affected our business, and the business of our affiliate, TMNA, and our ultimate parent, TMC, in a number of ways.

Similar to relief options we offer to customers and dealers impacted by natural disasters such as hurricanes, floods,

tornadoes and wildfires, we are offering payment relief options to customers and dealers impacted by COVID-19,

including finance contract extensions, lease deferred payments, temporary interest deferrals for dealer floorplan

financing, and principal payment deferral options for dealer real estate and working capital loans, and temporarily

suspended outbound collection activities in states with state-wide stay-at-home orders and repossession activities

nationwide for a period of time, but have since resumed outbound collection activities in nearly all states (collectively,

the “COVID-19 Relief”). Our payment relief programs currently allow existing customers who request assistance to

defer their loan or lease payments for up to 120 days and waive certain fees, but with interest continuing to accrue.

We may terminate, or modify the scope, duration and terms of, our COVID-19 payment relief programs at any time.

Unlike the relief options offered for natural disasters, which were limited to the affected geographies, the COVID-19

Relief is being offered nationwide due to the global impact of the COVID-19 pandemic, and may not be successful in

reducing future increases to our provisions for credit losses. The COVID-19 pandemic has increased our residual

value losses, and has adversely affected our business, financial condition, results of operations, and cash flows and

may continue to do so if there is not a substantial economic recovery. We have also temporarily transitioned nearly all

of our team members to remote work arrangements, and many Toyota and Lexus dealerships have temporarily closed

and more may voluntarily close, or be mandated to close, in the near future. TMNA temporarily suspended production

at all of its automobile and components plants in North America from March 23, 2020 through May 8, 2020 and TMC

has temporarily suspended production at selected plants in countries outside of North America. Although TMNA and

many of its suppliers are resuming production, unexpected delays affecting the supply chain or logistics network could

negatively impact dealer inventory levels, vehicle sales, the sale of our financing and insurance products, dealer

profitability and creditworthiness, and our future results of operations.

These events have disrupted the supply chains of the vehicles we finance, and have had a material adverse effect on

the sale of vehicles and our financing and insurance products. These events have also caused an unprecedented level

of unemployment claims, resulted in a significant decline in consumer confidence and spending, and a sharp decline in

economic conditions. In addition, these events have caused a significant decline in used vehicle prices, and significant

increase in delinquencies and may cause an increase in dealer defaults, which have resulted in materially increased

provisions for credit losses and residual value losses, which may continue if there is not a substantial economic

recovery. The foregoing events, and the uncertainty relating thereto, have also adversely affected our credit rating and

may result in further actions or downgrades by credit ratings agencies. For more information regarding impacts of

credit rating changes on TMCC, please see risk factor “Our borrowing costs and access to the unsecured debt capital

markets depend significantly on the credit ratings of TMCC and its parent companies and our credit support

arrangements”.

15

If significant portions of our workforce are unable to work effectively as a result of the COVID-19 pandemic,

including because of illness, quarantines, facility closures, ineffective remote work arrangements or technology

failures or limitations, our operations would be adversely impacted. Certain of our third-party suppliers and business

partners that we rely on to deliver our products and services and to operate our business have informed us that they

will be unable to perform fully, and we may receive similar notifications from other suppliers and business partners in

the near future, which could adversely impact our ability to operate our business and increase our costs and expenses.

These increased costs and expenses may not be fully recoverable or adequately covered by insurance. We are working

with our stakeholders (including customers, dealers, team members, suppliers and business partners) to assess the

ongoing impact of the COVID-19 pandemic and to take actions in an effort to mitigate adverse consequences.

The duration and possible resurgence of the COVID-19 pandemic is uncertain. The extension of curtailed economic

activities as a result of further outbreak of COVID-19, extended or additional government restrictions intended to slow

the spread of the virus, or delayed consumer response once restrictions have been lifted could have further negative

impact on used vehicle values, consumer economics, dealerships, and auction sites, which could have a material

adverse impact on our future results of operations. If the number of our customers and dealers experiencing hardship

increases or it becomes necessary to further extend our payment relief options, it could have a material adverse effect

on our business, financial condition and our future results of operations.

The foregoing impacts and other unforeseen impacts not referenced herein, as well as the ultimate impact of the

COVID-19 pandemic, are difficult to predict and have had and are expected to have a material adverse effect on our

business, financial condition, results of operations and cash flows.

General business, economic, and geopolitical conditions, as well as other market events, may adversely affect our

business, results of operations and financial condition.

Our results of operations and financial condition are affected by a variety of factors, including changes in the overall

market for retail contracts, wholesale motor vehicle financing, leasing or dealer financing, the new and used vehicle

market, changes in the level of sales of Toyota and Lexus vehicles, the rate of growth in the number and average

balance of customer accounts, the U.S. regulatory environment, competition from other financiers, rate of default by

our customers, the interest rates we are required to pay on the funding we require to support our business, amounts of

funding available to us, changes in the U.S. and international wholesale capital funding markets, our credit ratings, the

success of efforts to expand our product lines, levels of operating and administrative expenses (including, but not

limited to, personnel costs, technology costs and premises costs (including costs associated with reorganization or

relocation), general economic conditions, inflation, and fiscal and monetary policies in the U.S., Europe and other

countries in which we issue debt. Further, a significant and sustained increase in fuel prices could lead to lower new

and used vehicle purchases. This could reduce the demand for retail, lease and wholesale financing. In turn, lower

used vehicle values could affect return rates, charge-offs and depreciation on operating leases.

Economic slowdown and recession in the United States may lead to diminished consumer and business confidence,

lower household incomes, increases in unemployment rates, higher consumer debt levels as well as higher consumer

and commercial bankruptcy filings, any of which could adversely affect vehicle sales and discretionary consumer

spending. These conditions may decrease the demand for our financing products, as well as increase our

delinquencies and credit losses. In addition, because our credit exposures are generally collateralized by vehicles, the

severity of losses can be particularly affected by declines in used vehicle values. Dealers are also be affected by

economic slowdown and recession, which increases the risk of default of certain dealers within our dealer portfolio.

Elevated levels of market disruption and volatility, such as in the U.S., Europe and Asia, could increase our cost of

capital and adversely affect our ability to access the global capital markets and fund our business in a similar manner,

and at a similar cost to the funding raised in the past. These market conditions could also have an adverse effect on

our results of operations and financial condition by diminishing the value of our investment portfolio and increasing

our cost of funding. If as a result we increase the rates we charge to our customers and dealers, our competitive

position could be negatively affected.

Challenging market conditions may result in less liquidity, greater volatility, widening of credit spreads and lack of

price transparency in credit markets. Changes in investment markets, including changes in interest rates, exchange

rates and returns from equity, property and other investments, will affect (directly or indirectly) our financial

performance.

16

If there is a continued and sustained period of market disruption and volatility:

• there can be no assurance that we will continue to have access to the capital markets in a similar manner

and at a similar cost as we have had in the past;

• issues of debt securities may be undertaken at spreads above benchmark rates that are greater than those

on similar issuances undertaken during the prior several years;

• we may be subject to over-reliance on a particular funding source or a simultaneous increase in funding

costs across a broad range of sources; and

• the ratio of our short-term debt outstanding to total debt outstanding may increase if negative conditions in

the debt markets lead us to replace some maturing long-term liabilities with short-term liabilities (for

example, commercial paper).

Any of these developments could have an adverse effect on our results of operations and financial condition.

Geopolitical conditions and other market events may also impact our results of operations. Restrictive exchange or

import controls or other disruptive trade policies, disruption of operations as a result of systemic political or economic

instability, social unrest, outbreak of war or expansion of hostilities, health epidemics and other outbreaks, and acts of

terrorism, could each have a material adverse effect on our results of operations and financial condition.

Developments related to the United Kingdom’s recent withdrawal from the European Union (“Brexit”) have created

significant political and economic uncertainty in the United Kingdom and in other European Union member states.

While we operate in the U.S. and Puerto Rico, the global financial, trade, and legal implications of Brexit could lead to

declines in market liquidity and activity levels, volatile market conditions, a contraction of available credit,

fluctuations in interest rates, weaker economic growth, and reduced business confidence on an international level, each

of which could have a material adverse effect on our results of operations and financial condition.

Our results of operations and financial condition are substantially dependent upon the sale of Toyota and Lexus

vehicles, as well as our ability to offer competitive financing and insurance products.

We primarily provide a variety of finance and insurance products to authorized Toyota and Lexus dealers and their

customers in the U.S. Accordingly, our business is substantially dependent upon the sale of Toyota and Lexus

vehicles in the U.S. Changes in the volume of sales may result from governmental action or changes in governmental

regulation or trade policies, changes in consumer demand, new vehicle incentive programs, recalls, the actual or

perceived quality, safety or reliability of Toyota and Lexus vehicles, economic conditions, increased competition,

increases in the price of vehicles due to increased raw material costs, changes in import fees or tariffs on raw materials

or imported vehicles, changes to or withdrawals from trade agreements (including the United States-Mexico-Canada

Agreement, which is expected to go into effect during fiscal year 2021, currency fluctuations, fluctuations in interest

rates, decreased or delayed vehicle production due to natural disasters, supply chain interruptions or other events. In

addition, many manufacturers have increased their level of incentive programs on new vehicles in an attempt to

maintain and grow market share; these incentives historically have included a combination of subvention, price

rebates, and other incentives. Any negative impact on the volume of TMNA sales could have a material adverse effect

on our business, results of operations, and financial condition.

TMS, a subsidiary of TMNA, is the primary distributor of Toyota and Lexus vehicles in the U.S. While TMNA

conducts extensive market research before launching new or refreshed vehicles and introducing new services, many

factors both within and outside TMNA’s control affect the success of new or existing products and services in the

marketplace. Offering vehicles and services that customers want and value can mitigate the risks of increasing price

competition and declining demand, but products and services that are perceived to be less desirable (whether in terms

of product mix, price, quality, styling, safety, overall value, fuel efficiency, or other attributes) and the level of

availability of products and services that are desirable can exacerbate these risks. With increased consumer

interconnectedness through the internet, social media, and other media, mere allegations relating to quality, safety, fuel

efficiency, corporate social responsibility, or other key attributes can negatively impact TMNA’s reputation or market

acceptance of its products or services, even where such allegations prove to be inaccurate or unfounded.

In addition, the volume of TMNA sales may also be affected by Toyota’s ability to successfully grow through

investments in the area of emerging opportunities such as mobility and connected services, vehicle electrification, fuel

cell technology and autonomy, which depends on many factors, including advancements in technology, regulatory

changes, and other factors that are difficult to predict.

17

We operate in a highly competitive environment and compete with other financial institutions and, to a lesser extent,

other automobile manufacturers’ affiliated finance companies primarily through service, quality, our relationship with

TMNA, and financing rates. TMNA sponsors subvention, cash, and contractual residual value support incentive

programs offered by us on certain new and used Toyota and Lexus vehicles. Our ability to offer competitive financing

and insurance products in the U.S. depends in part on the level of TMNA sponsored subvention, cash, and contractual

residual value support incentive program activity, which varies based on TMNA marketing strategies, economic

conditions, and the volume of vehicle sales, among other factors. Any negative impact on the level of TMNA

sponsored subvention, cash, and contractual residual value support incentive programs could in turn have a material

adverse effect on our business, results of operations, and financial condition.

Changes in consumer behavior could affect the automotive industry, TMNA and TMC, and, as a result, our

business, results of operations and financial condition.

A number of trends are affecting the automotive industry. These include a market shift from cars to sport utility

vehicles (“SUVs”) and trucks, high demand for incentives, the rise of mobility services such as vehicle sharing and

ride hailing, the development of autonomous and alternative-energy vehicles, the impact of demographic shifts on

attitudes and behaviors toward vehicle ownership and use, the development of flexible alternatives to traditional

financing and leasing such as subscription service offerings, changing expectations around the vehicle buying

experience, adjustments in the geographic distribution of new and used vehicle sales, and advancements in

communications and technology. Any one or more of these trends could adversely affect the automotive industry,

TMNA and TMC, and could in turn have an impact on our business, results of operations and financial condition.

Recalls and other related announcements by TMNA could affect our business, results of operations and financial

condition.

TMNA periodically conducts vehicle recalls which could include temporary suspensions of sales and production of

certain Toyota and Lexus models. Because our business is substantially dependent upon the sale of Toyota and Lexus

vehicles, such events could adversely affect our business. A decrease in the level of sales, including as a result of the

actual or perceived quality, safety or reliability of Toyota and Lexus vehicles or a change in standards of regulatory

bodies will have a negative impact on the level of our financing volume, insurance volume, earning assets, Net

financing revenues and insurance revenues. The credit performance of our dealer and consumer portfolios may also be

adversely affected. In addition, a decline in the values of used Toyota and Lexus vehicles would have a negative

effect on residual values and return rates, which, in turn, could increase depreciation expense and credit

losses. Further, certain of TMCC’s affiliated entities are or may become subject to litigation and governmental

investigations and have been or may become subject to fines or other penalties. These factors could affect sales of

Toyota and Lexus vehicles and, accordingly, could have a negative effect on our business, results of operations and

financial condition.

If we are unable to compete successfully or if competition increases in the businesses in which we operate, our

results of operations could be negatively affected.

We operate in a highly competitive environment. We compete with other financial institutions including national and

regional commercial banks, credit unions, savings and loan associations, finance companies, and to a lesser extent,

other automobile manufacturers’ affiliated finance companies. In addition, online financing options provide

consumers with alternative financing sources. Increases in competitive pressures could have an adverse impact on our

contract volume, market share, Net financing revenues, insurance revenues and margins. Further, the financial

condition and viability of our competitors and peers may have an adverse impact on the financial services industry in

which we operate, resulting in a decrease in the demand for our products and services. This could have an adverse

impact on the volume of our business and our results of operations.

A failure or interruption in our operations could adversely affect our results of operations and financial condition.

Operational risk is the risk of loss resulting from, among other factors, lack of established processes, inadequate or

failed processes, systems or internal controls, theft, fraud, natural disasters or other catastrophes (including without

limitation, explosions, fires, floods, earthquakes, terrorist attacks, riots, civil disturbances and health epidemics and

other outbreaks). Operational risk can occur in many forms including, but not limited to, errors, business

interruptions, failure of controls, failure of systems or other technology, deficiencies in our insurance risk management

program, inappropriate behavior or misconduct by our employees or those contracted to perform services for us, and

vendors that do not perform in accordance with their contractual agreements. We have established business recovery

plans to address interruptions in our operations, but we can give no assurance that these plans will be adequate to

remediate all events that we may face. A catastrophic event that results in the destruction or disruption of any of our

18

critical business or information technology systems could harm our ability to conduct normal business

operations. These events can potentially result in financial losses or other damage to us, including damage to our

reputation.

We rely on a framework of internal controls designed to provide a sound and well-controlled operating

environment. Due to the complexity of our business and the challenges inherent in implementing control structures

across large organizations, control issues could be identified in the future that could have a material adverse effect on

our operations.

We are currently in the process of consolidating our field operations, which consist of DSSO’s, three regional

management offices, and two dealer funding teams, into three new regional dealer service centers. Our dealer lending

function will be centralized at the new dealer service center located in Plano, Texas. Refer to Item 1. Business,

“General” for further discussion of the field operations restructuring. We can give no assurance that the restructuring

of our field operations will be completed as planned or within the expected timing or budget, and the expected benefits

may not be fully realized due to associated disruption to field operations and personnel.

In addition, many parts of our business are dependent on key personnel. Our future success depends on our ability to

retain existing, and attract, hire and integrate new key personnel and other necessary employees. Any failure to do so

could adversely affect our business, results of operations and financial condition.

Our private label financial services for third-party automotive and mobility companies may expose us to additional

risks that could adversely affect our business, results of operations and financial condition.

As of April 1, 2020, we began providing private label financial services to third-party automotive and mobility

companies commencing with the provision of services to Mazda Motor of America, Inc. (“Mazda”). Pursuant to our

previously disclosed agreement with Mazda, we currently offer exclusive private label automotive retail, lease, and

dealer financing products and services, and later in fiscal year 2021 intend to offer exclusive vehicle protection

products and services, marketed under the brand Mazda Financial Services to Mazda customers and dealers in the

United States. Our agreement with Mazda is for an initial term of approximately five years.

Although we intend to leverage our strengths and capabilities to serve and retain new Mazda customers, we may

encounter additional costs and may fail to realize the anticipated benefits of our private label finance services program.

The provision of wholesale and retail financing to Mazda dealers and customers may result in additional credit risk

exposure, which if we are unable to appropriately monitor and mitigate may result in an adverse effect on our results

of operations and financial condition. Our private label finance services may also expose us to additional operating

risks related to consumer demand for Mazda vehicles, the profitability and financial condition of Mazda, the level of

Mazda’s incentivized retail financing, recalls announced by Mazda and the perceived quality, safety or reliability of