Extreme Events and Overreaction to News

Spencer Yongwook Kwon and Johnny Tang

∗

January 26, 2023

Abstract

The presence of both systematic under-and-overreaction to news in financial mar-

kets is a major puzzle. We propose a systematic predictor of under-and-overreaction to

news: the extremeness of the associated distribution of fundamentals. Using a compre-

hensive database of corporate news events, we identify substantial heterogeneity in both

reactions to news and extremeness of fundamentals across types of corporate events. We

document overreaction to more extreme event-types, such as leadership changes, M&A,

and customer announcements, and underreaction to less extreme event-types such as

earnings announcements. We show this is consistent with diagnostic expectations, a

model of belief formation based on the representativeness heuristic. The model further

predicts greater trading volume holding fixed fundamentals and more sensitive belief

changes to more extreme corporate events, which we confirm in the data. We calibrate

our model and show that it quantitatively matches the key features in our data.

∗

Tang: Harvard University, [email protected]ard.edu. We thank Malcolm Baker, Nick Barberis, Francesca

Bastianello, Michael Blank, Pedro Bordalo, John Campbell, Nicola Gennaioli, Mark Egan, Paul Fontanier,

Xavier Gabaix, Robin Greenwood, Sam Hanson, Alex Imas, Yueran Ma, Peter Maxted, Josh Schwartzstein,

Kelly Shue, Andrei Shleifer, David Solomon (discussant), Jeremy Stein, Adi Sunderam, Paul Tetlock, and

seminar participants at Harvard, Yale, and the 2021 Spring NBER Behavioral Finance meeting for helpful

comments and feedback.

1 Introduction

How do stock prices react to news? There has been extensive evidence of both over- and

under-reaction in financial markets. On one hand, investors tend to be overly optimistic

about the long-term prospects of firms that have experienced a period of sustained earnings

growth, which lead to long-run reversals (De Bondt and Thaler (1985), Cutler et al. (1991),

Lakonishok et al. (1994), La Porta (1996), Bordalo et al. (2019)). At a shorter horizon, in-

vestors may overreact to a range of corporate news (Antweiler and Frank (2006)), potentially

spurred by spikes in media coverage, investor interest, or sentiment (Da et al. (2011), Tetlock

(2007)). On the other hand, a large literature documents that prices can react sluggishly

to news and lead to drift following earnings announcements (Bernard and Thomas (1989)),

the underpricing of profitable firms (Bouchaud et al. (2019)), and momentum (Chan et al.

(1996)).

The presence of both systematic over- and under-reaction is a major puzzle. Some skep-

tics view the variation in market reaction to news as random fluctuations around the ra-

tional benchmark (e.g. Fama (1998)). In this paper, we offer an alternative perspective by

proposing a systematic determinant of under-and-overreaction – the extremeness of funda-

mentals associated with the news. We show that a core feature of corporate news is that

the distribution of fundamentals is extreme: while most corporate news tend to have a rela-

tively immaterial impact on overall valuation, there are tail events with major implications

that significantly shape investor reactions to future analogous news. We formally define

the extremeness of a type of news, or an event-type (e.g. earnings announcements) as the

tail-fatness (Gabaix (2009)) of the distribution of fundamentals. In other words, we define

extremeness to be a property of the whole event-type, rather than of a particular news event:

the more extreme the event-type, the greater the relative difference between the fundamen-

tals of its tail, e.g. the top 1% earnings announcements, to that of its typical event, e.g.

the median. We hypothesize that more extreme types of news are associated with greater

1

overreaction, as investors are relatively likelier to focus on the tail events when reacting to

news.

To formalize this intuition, we apply diagnostic expectations (DE) (Bordalo et al. (2018)),

a model of belief formation based on Kahneman and Tversky’s representativeness heuristic,

to the setting of reaction to corporate news. DE capture the insight that agents overrepresent

states of the world that have become likelier in light of news and have been used to model ex-

uberance in credit booms, overreaction in macroeconomic forecasts (Bordalo et al. (2020b)),

and closest to our setting, the overvaluation of firms with high long-term growth prospects

(Bordalo et al. (2019)). Relative to these papers, we highlight the role of extreme events in

investor reaction to news. Our model predicts that as the extremeness of the type of news

increases, tail outcomes become more representative in light of news. When the distribution

of associated fundamentals becomes more extreme than the distribution in the absence of

news announcements, diagnostic expectations of fundamentals overshoot the rational bench-

mark and lead to overreaction. Conversely, if the news is sufficiently less extreme, events

associated with no change in fundamentals become more representative and overweighted,

which causes underreaction. Our application consequently yields both underreaction and

overreaction, whereas previous applications of DE have largely focused on overreaction.

To derive predictions regarding asset prices and trading behavior, we introduce DE agents

into a stylized asset pricing model, where agents receive idiosyncratic signals of the funda-

mentals. In reaction to an extreme type of news, the average beliefs of investors and asset

prices overreact. This leads to reversals when prices eventually return to the rational bench-

mark. Furthermore, as all investors overreact to their idiosyncratic signal, there is greater

disagreement between investors who receive different signals, which leads to higher trading

volume holding fixed fundamentals. Conversely, in response to a less extreme type of news,

beliefs underreact, which leads to drift and lower trading volume. Our model thus gener-

ates the key predictions that more extreme types of news have greater return reversals and

2

disagreement-driven trading volume.

1

In the second part of the paper, we empirically test the predictions of the model. First, we

confirm that investor reaction to different types of corporate news is highly heterogeneous.

Drawing from a comprehensive database of corporate news events in the US from 2011 to

2018, we find not only post-announcement drift for events such as earnings announcements,

but also reversals for a wide range of event-types, including leadership changes, business

expansions, mergers, acquisitions, and customer-related events. Short-term overreaction to

news seems to be the norm across corporate events that do not frequently coincide with

earnings announcements.

2

The cross-section of drift and reversal across these types of news

is robust to different measurement methods, such as estimation using portfolio sorts and a

full firm-day panel specification, which accounts for overlapping returns and unconditional

market autocorrelations. We also show that the cross-section of drift and reversal is not

driven by sampling variation or non-event-driven forces.

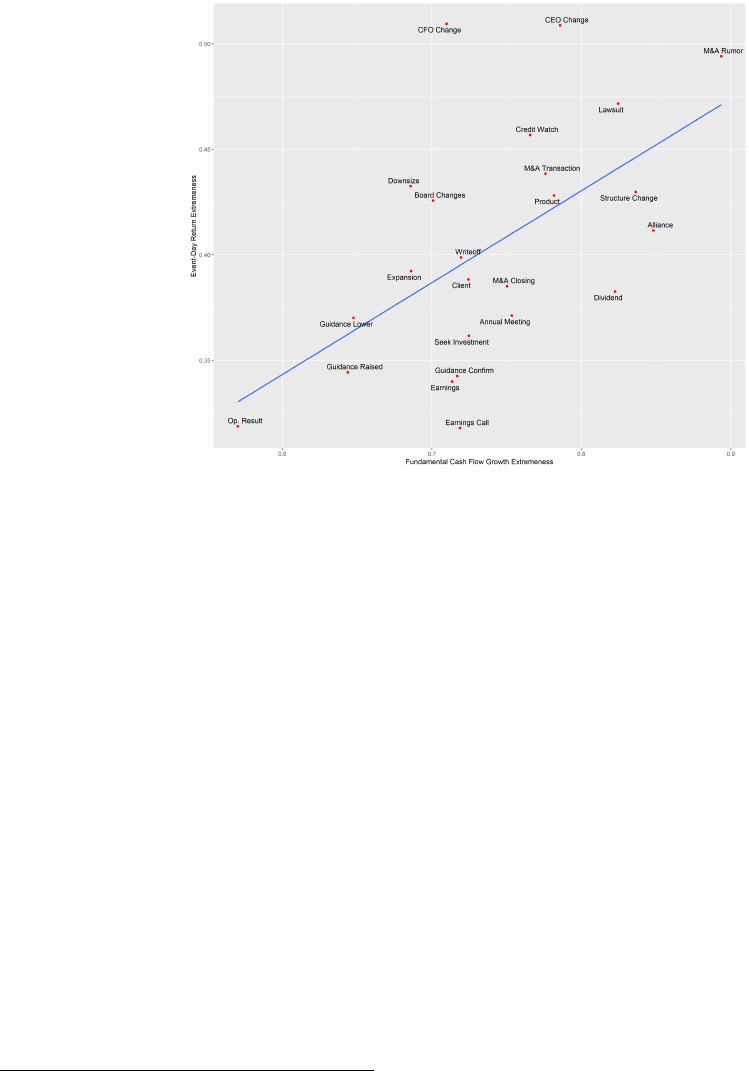

We next measure the extremeness of the fundamentals and document significant differ-

ences across the news categories in our sample. Statistically, the extremeness of a news type

is captured by the fatness of the tail of the distribution of outcomes: the fatter the tail, the

farther the extreme, e.g. top 1%, events are from the median event. We measure extremeness

in several ways, with the Pareto tail index of power-law distributions being our preferred

measure.

3

We find that the distribution of outcomes of an event-type, measured by realized

1

Our theory does not focus on why arbitrageurs cannot price out the distortions by trading against DE

agents. One of the reasons can be that by trading against potentially extreme events, the arbitrageurs are

taking on a negative skew-risk, which can command a significant risk premium. Short-sale constraints on the

part of the arbitrageur in response to positive company news can also contribute to the limits of arbitrage.

To focus on the distortions due to investor psychology, we simplify the arbitrageur response by positing a

simple reduced-form asset demand function that captures these risk and capital concerns.

2

We have chosen 90 days as our main choice of horizon, as it approximately corresponds to the range of

post-earnings drift studies (e.g. Bernard and Thomas (1989)). Our findings are robust to the exact horizon

of the reversal (from 60 days to 3 months).

3

The Pareto tail index is given by the slope of the log-log rank-size regressions of event-day returns, also

known as power-law regressions (Gabaix (2016)). For power-law, or Pareto, distributions, this regression

precisely measures the tail fatness, also known as the Pareto index. The measurement of fat tails has received

recent attention in economics, from wealth distributions and city size, to stock market returns and trading

3

cash flow growth, event-day returns, and longer-term returns, are very well described by the

fat-tailed power-law distribution, consistent with earlier findings (e.g. Gabaix (2016)), with

significant variation in the Pareto tail index across event-types.

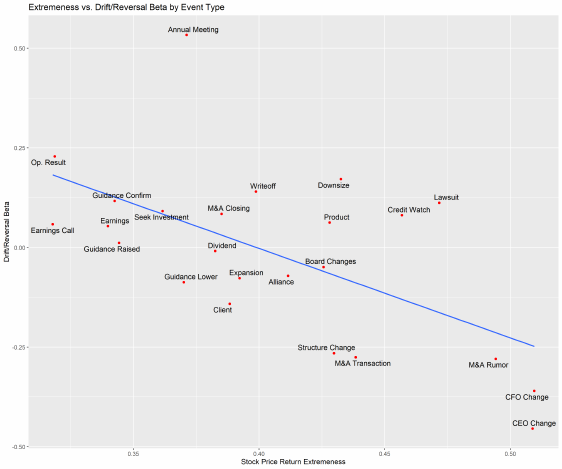

Equipped with these baseline results, we test the core asset-pricing predictions of our

model: more extreme event types are more overreacted to, with greater reversals and trading

volume. Consistent with our first prediction, we find that more extreme corporate event types

exhibit more post-announcement return reversals, whereas less extreme event types exhibit

more post-announcement drift. We estimate that fatter-tailed events exhibit reversals up

to 14% of the event-day return, while thinner-tailed events experience continued drifts of

up to 10% of the event-day return. We show that this pattern is robustly found across

return horizons and rule out alternative explanations such as familiarity or seasonality across

different event-types. Turning to our second prediction, we confirm that more extreme

corporate events have higher trading volumes conditional on the magnitudes of event-day

returns. Conditional on a 10% event-day return, we estimate that turnover for different event-

types would range from 4.8% for the thinnest-tailed event-types to 6.3% for the fattest-tailed

event-types. This range of estimated conditional turnovers quantitatively matches the range

(4.6% to 7.0%) of the actual conditional turnovers across event-types we observe in our data.

To further validate the explanatory power of extremeness in under- and overreaction, we

turn to expectations data to directly measure how investor beliefs change in response to news.

We use stock analysts’ earnings per share (EPS) forecasts as a proxy for investor beliefs, and

we measure belief under- and overreaction using the Coibion and Gorodnichenko (2015)

methodology of comparing ex-post forecast errors to forecast revisions. Consistent with our

model, we find evidence suggesting that analyst forecasts react more sensitively to more

extreme event types. The analysis allows us to move beyond trading data to provide further

volume. For a general reference, see Gabaix (2016). The extremeness of a distribution has been computed

using various alternative measures, ranging from quantile ratios to higher normalized moments such as skew

and kurtosis. In Section 4, we discuss the relative merits of each measures and confirm that our results are

robust to the choice of a particular measure.

4

evidence consistent with beliefs playing a central role in explaining under- and overreaction

in asset prices.

We conclude with a calibration of our model to assess its explanatory power. We empir-

ically estimate the diagnostic parameter θ and generate model-implied price drift/reversal

and trading behaviors and compare these model-implied quantities to those we observe in

the data. We find that the model-implied quantities quantitatively fit the cross-sectional

variation in under- and overreaction in asset prices and in trading volumes across event

types, with the calibrated diagnostic parameter θ = 0.95 broadly in line with the estimates

obtained in earlier works (Bordalo et al. (2020b, 2019)).

Our paper relates to the extensive theoretical (Barberis et al. (1998), Hong and Stein

(1999), Daniel et al. (1998)) and empirical (De Bondt and Thaler (1985), Lakonishok et al.

(1994), La Porta (1996), Daniel and Titman (2006), Bernard and Thomas (1989), and Bor-

dalo et al. (2019)) literature studying investor over- and underreaction in asset pricing. A

large literature focuses on horizon as the key variation and documents short-term underreac-

tion and long-term overreaction in stock prices (Bernard and Thomas (1989), De Bondt and

Thaler (1985), Bordalo et al. (2019)) and in yield curves (Giglio and Kelly (2018)). Recent

work has also connected asset price over- and underreaction to expectations (Bordalo et al.

(2019); d’Arienzo (2020); Wang (2019)). While this research focuses on the variation in

horizon, we fix the horizon to the short-term and focus on variations in the types of events.

In this sense, our work also relates to Daniel and Titman (2006), which finds evidence of

long-horizon overreaction to intangible information, Antweiler and Frank (2006), which finds

overreaction to a wider range of news, and Chang et al. (2017) and Hartzmark and Shue

(2018), which find short-term investor overreaction to predictable seasonal components of

earnings and contrast to previous earnings. Relative to this work, we focus primarily on

explaining the variation in overreaction and underreaction across types of corporate news

through the lens of the extremeness of fundamentals.

Our work also relates to the growing literature that studies psychological foundations

5

of information processing and their applications to financial settings. Overreaction has also

been attributed to extrapolation (Barberis et al. (2015, 2018)), cursedness (Eyster et al.

(2019)), and partial-equilibrium thinking (Bastianello and Fontanier (2019)). A related re-

cent literature also delves into fundamental mechanisms of memory in asset pricing (Wachter

and Kahana (2019); Nagel and Xu (2019)) and in an experimental context (Enke et al. (2020),

Bordalo et al. (2020a, 2021)). While our model also emphasizes the role of recall of extreme

outcomes in light of news, we focus on the variation in short-term asset price reactions to

specific news items across different types of events.

Lastly, our work relates to the large literature on asset price reactions to news and

media coverage. Prior work on this topic has found that individual investors are prone to

buying attention-grabbing stocks which appear in the news (Barber and Odean (2008)).

Consistent with these findings, there is evidence of short-term overreaction driven by spikes

in investor interest and sentiment (Tetlock (2007), Da et al. (2011)), which can be spurred

partially by media coverage (Engelberg et al. (2012)). While media and investor sentiment

can generate short-term overreaction, our work connects investor attention and overreaction

to the fundamentals of the news. In our framework, investor attention is drawn to news that

bring to mind extreme outcomes in the past. Furthermore, our psychologically-motivated

framework points to extremeness as a measurable quantity which can explain the quantitative

variation in both under- and over-reaction.

The rest of the paper is organized as follows. Section 2 presents the model and discusses

its motivation in financial narratives and psychology research. Section 3 describes the data.

Section 4 documents heterogeneity in the short-term reaction to different corporate develop-

ments and identifies significant differences in the extremeness of the fundamental distribution

across different event-types. Section 5 tests the main asset pricing predictions of the model,

linking extremeness of fundamentals to overreaction, validate our hypothesis on expectations

data, and provides a calibration of our model. Section 6 concludes.

6

2 Tail events and reaction to news

In this section, we apply diagnostic expectations (DE) to the setting of reactions to corporate

news announcements. We assume that the fundamentals associated with corporate news

follow an extreme distribution and that different types of news are differently extreme. This

difference in the underlying fundamental distribution will be a key driver of the differences

in market reactions to news, with greater overreaction for more extreme types of news. We

revisit and verify these assumptions in the empirical section.

2.1 Diagnostic Expectations of Fundamentals

Let E be an event-type and λ be the fundamentals associated with an event of type E, which

is drawn from the distribution π(λ|E). Each investor i receives a noisy, idiosyncratic signal

s

i

drawn from a distribution f (s|λ). For simplicity, we assume that λ ≥ 0: the event has

positive impact. The negative case follows analogously.

We assume that the distribution of fundamentals for a given event-type follows a power-

law distribution:

π(λ|E) = ζ

−1

E

λ

ζ

−1

E

0,E

λ

ζ

−1

E

+1

for λ ≥ λ

0,E

.

4

(1)

There are two parameters of the distribution: λ

0,E

, the scale parameter, and 0 < ζ

E

< 1, the

tail parameter, which governs the extremeness of the distribution and varies across E: the

higher the ζ

E

, the more extreme the event-type. Upon the release of news, an agent i learns

of the event-type E and receives an idiosyncratic noisy signal s

i

of the latent fundamentals

4

For analytical tractability, we assume that the distribution of fundamentals has either positive or negative

support. This assumption can be given an intuitive framing if the investor interprets news according to both

its event-type and whether it is good or bad news. In practice, we find that the extremeness of event-types

is similar for both good and bad news, which motivates us to make the above simplifying assumption.

7

λ. We assume that s

i

is drawn from the conjugate distribution:

s

i

= λ · u

i

, u

i

∼ Unif[0, 1].

5

(2)

Then, the rational posterior distribution of fundamentals given (E, s

i

) are given by:

π(λ|E, s

i

) = (ζ

−1

E

+ 1) ·

λ

ζ

−1

E

+1

1,E

λ

ζ

−1

E

+2

for λ ≥ λ

1,E

= max{s

i

, λ

0,E

}. (3)

We assume that investors form diagnostic expectations of fundamentals given news (Bor-

dalo et al. (2018)), such that the posterior distribution of fundamentals is given by:

π

θ

(λ|E, s

i

) ∝ π(λ|E, s

i

) ·

π(λ|E, s

i

)

π(λ|No News)

θ

. (4)

The likelihood ratio

π(λ|E,s

i

)

π(λ|No News)

reflects the representativeness of fundamentals λ given the

news (E, s

i

), relative to the common benchmark π(λ|No News), the distribution of funda-

mentals that would prevail in the absence of news. The parameter θ reflects the degree

to which more representative fundamentals are overweighted, with θ = 0 corresponding to

the rational case. In this sense, DE capture the psychology that investors overweight the

probability of outcomes that have become likelier in light of news.

6

5

This can be generalized to a sub-class of the Beta distribution: f(s|θ) = γ ·

s

γ−1

θ

γ

.

6

In general, diagnostic expectations are motivated by Kahneman and Tversky’s representativeness heuris-

tic, the psychological tendency to overrepresent representative attributes of a class, where “an attribute is

representative ... if ... the relative frequency of this attribute is much higher in that class than in a reference

class” (Tversky and Kahneman (1983)). In other words, agents overestimate a trait t that is representative

of group G compared to a reference group −G:

π

θ

(t|G) ∝ π(t|G) ·

π(t|G)

π(t| − G)

θ

For example, in the context of stereotypes, the trait t = red hair is representative of G = Irish compared to

−G = rest of the world, and is overestimated. In the context of news and expectation formation, Bordalo

et al. (2018) set G as the arrival of new information and −G as the counterfactual in which no news arrives,

where the realized signal is equal to its ex ante expected value.

8

Following Bordalo et al. (2019, 2020b), we define the No-News distribution,

π(λ|No News), as the distribution of fundamentals in the absence of an event, conditional

on the idiosyncratic signal s

i

equal to its ex ante expected value. In other words, we first

let π

d

(λ) be the distribution of fundamentals in the absence of any news announcement. We

assume that this distribution is symmetric around 0, with the tails of the distribution also

following a power-law:

π

d

(λ) =

π

0

(|λ|) for |λ| < λ

0,d

C · |λ|

−(ζ

−1

d

+1)

for |λ| > λ

0,d

,

with 0 < λ

0,d

≤ λ

0,E

for all event-types E. π

d

(λ) captures the movement in valuation unre-

lated to any particular announcement (e.g. Cutler et al. (1988), Savor (2012)). Furthermore,

we assume the tails of π

d

are also fat with tail index ζ

d

. This assumption is made not only

for analytical tractability, but also reflects a key feature of the data, that the distribution

of unconditional fundamentals, even outside of news-announcement days, has a fat tail (e.g.

Gabaix et al. (2003), Plerou et al. (1999), and Oh and Wachter (2018)). Then, the No-News

distribution is given by:

π(λ|No News) = π

d

(λ|s

i

= 0). (5)

Applying Equation 5 to Equation 4 gives the following characterization of investor beliefs in

reaction to an event of type E.

Proposition 1 (Diagnostic expectations with extreme fundamentals). The diagnostic ex-

pectations of fundamentals is given by:

E

θ

[λ|E, s

i

] = ψ(ζ

E

, ζ

d

, θ) · E[λ|E, s

i

] =

1 + ζ

E

+ θ

1 −

ζ

E

ζ

d

1 + ζ

E

+ (1 + ζ

E

) · θ

1 −

ζ

E

ζ

d

· E[λ|E, s

i

], (6)

where E[λ|E, s

i

] is the rational expectations. The distortion term ψ(ζ

E

, ζ

d

, θ) is increasing

9

in ζ

E

, with diagnostic expectations overreacting (ψ > 1) if and only if ζ

E

> ζ

d

.

0.03 0.04 0.05 0.06 0.07 0.08

0 20 40 60 80 100 120

Fundamentals

Density

Reference

Rational

Diagnostic

(a) DE, more extreme event-type

0.030 0.035 0.040 0.045 0.050 0.055 0.060

0 20 40 60 80 100 120

Fundamentals

Density

Reference

Rational

Diagnostic

(b) DE, less extreme event-type

Figure 1: Diagnostic expectations and the under-overreaction

Note: Figures 1a and 1b show the DE distortions of subjective fundamentals for more and less

extreme event-types, respectively. The solid red and blue curves plot the density functions

of the distributions of subjective fundamentals under diagnostic expectations. The solid

black curves plot the density functions under the rational distributions. The dotted black

curves plot the reference distributions. The solid black vertical lines plot the expectation of

fundamentals for the rational agents. The solid red and blue vertical lines plot the subjective

expectations of fundamentals for the diagnostic agents.

Figure 1 illustrates how DE distorts the expectations of fundamentals. In the left panel,

the fundamentals associated with event-type E is more extreme than what one may expect

from unconditional stock price fluctuations: the rational posterior, in the solid black curve,

has a fatter tail than the reference distribution, in the dotted curve. In this case, diagnostic

expectations, shown in the red curve, further exaggerate the prevalence of extreme events,

causing the posterior mean to overshoot. On the other hand, if the event-type E is less

extreme relative to the reference distribution, the prevalence of extreme outcomes becomes

10

less likely in light of news. Consequently, diagnostic investors exaggerate this difference,

with the diagnostic posterior mean undershooting the rational benchmark.

The combination of diagnostic expectations with variation in fundamental extremeness

can help explain the cross-section of under-overreaction across event types. If news increases

the probability of extreme outcomes relative to the reference distribution, diagnostic agents

overestimate the probability of a tail outcome and overreact. This is similar to the intuition

given in Bordalo et al. (2019) – in response to news that significantly increases the long-term

growth prospects of a company, investors exaggerate the probability that the company will

become “the next Google”. On the other hand, diagnostic expectations can also generate

underreaction if the underlying fundamental distribution is sufficiently less extreme. While

a news may have a positive impact on valuations, if the distribution of potential outcomes

is less extreme than the reference distribution, expectations undershoot. Intuitively, agents

reason that while the event may be good news, it is less significant relative to other extreme

outcomes they have seen in the market, leading to underreaction.

2.2 Asset pricing predictions

We now apply our model of expectations to a simple asset market setting, and derive implica-

tions for price, post-announcement drifts and reversals, and volume. We make the following

standard assumptions regarding the asset market. At t = 1, an event of type E and fun-

damentals λ occurs, with each agent i receiving an idiosyncratic signal of fundamentals,

s

i

= λ · u

i

. Based on their signal, each agent has a linear demand for the asset based on their

subjective fundamentals:

7

D

DE

i

(s

i

, p) = κ ·

E

θ

[λ|s

i

] − p

.

7

This can be justified from a standard mean-variance utility.

11

The price p

1

adjusts to clear the asset market, where we assume that the asset is in

zero net supply. As is standard, we also define the total trading volume to be V ol =

1

2

R

|D

i

(s

i

, p)|ds

i

, or half of the average absolute asset holdings in the economy. For nota-

tional simplicity, it is also convenient to define ζ

−1

θ,E

= ζ

−1

E

+ θ

ζ

−1

E

− ζ

−1

d

, where ζ

θ,E

> ζ

E

if

and only if ζ

E

> ζ

d

. Using these assumptions, one can derive the expression for price impact

and resulting volume of an event with fundamentals λ.

p

1

= (1 + ζ

θ,E

) ·

λ

2

0,E

+ λ

2

2λ

V ol =

1

2

κ · (1 + ζ

θ,E

) ·

λ

2

− λ

2

0,E

2λ

2

(7)

We assume that at t = 2, prices revert back to the rational benchmark, p

2

= (1 + ζ

E

) ·

λ

2

0,E

+λ

2

2λ

. In other words, the short-term price response to event E is given by the initial diag-

nostic price response p

1

, followed by the eventual drift or reversal to the rational benchmark

p

2

. This assumption is consistent with earlier findings which document excited, news-driven

investors initially entering the market (Barber and Odean (2008)), with arbitrageur capital

bringing prices back to rationality after a delay (Duffie (2010)). Eventually, at t = 3, the

long-run fundamentals λ are revealed. Note that p

2

6= λ: while the true fundamental may

be revealed to the investors in the long-run, it is unlikely to do so in the short-term, which

corresponds to our main empirical specification.

One can define the theoretical drift-reversal coefficients as:

β

E

=

p

2

− p

1

p

1

=

ζ

E

− ζ

θ,E

1 + ζ

θ,E

. (8)

β

E

is positive if p

1

undershoots p

2

and the market initially underreacts to the event. Con-

versely, if the market initially overreacts to the event and p

1

overshoots p

2

, β

E

is negative.

Figure 2 shows the relationship between β

E

and ζ

E

. Consistent with Proposition 1,

there is aggregate underreaction and drift, or β

E

≥ 0, if ζ

E

< ζ

d

: event-types that are less

12

0.25 0.30 0.35 0.40 0.45 0.50

−0.25 −0.20 −0.15 −0.10 −0.05 0.00 0.05

Fundamentals

Drift / Reversal

ζ

d

(a) Drift-Reversals vs Extremeness

0.25 0.30 0.35 0.40 0.45 0.50 0.55

0.006 0.007 0.008 0.009 0.010 0.011

Extremeness (zeta)

Volume

Rational

DE

(b) Volume vs Extremeness

Figure 2: DE predictions: over- and under-reaction, volume, and extremeness

Note: Figure 2a plots the theoretical relationship between stock price drift/reversal and the

extremeness of the distribution of fundamentals. The dashed vertical line (ζ

d

) corresponds

to the extremeness of the distribution of fundamentals for the reference distribution. Figure

2b plots the theoretical relationship between trading volume and the extremeness of the

distribution of fundamentals for rational agents in black and for DE agents in red.

extreme than the reference distribution are underreacted to. Conversely, if E is sufficiently

extreme, ζ

E

> ζ

d

, the market overreacts to the event-type, resulting in reversals, i.e. β

e

≤ 0.

Furthermore, as depicted on the right panel of Figure 2, our theory also has implications for

the aggregate trading volume, holding fixed fundamentals λ. Intuitively, as the underlying

fundamental distribution grows more extreme, diagnostic agents trade more aggressively

based on their private signals, leading to greater trading volume. While this relationship

is also true for the rational case, the dependence of volume on fundamental extremeness is

much more subdued relative to the diagnostic case.

The following proposition summarizes the above insights.

Proposition 2. 1. The drift-reversal coefficient β

E

decreases in ζ

E

and the diagnostic

13

parameter θ. In particular, event-types whose distribution of fundamentals are more

extreme than the reference distribution (ζ

E

> ζ

d

) are associated with reversals. Con-

versely, event-types that are less extreme (ζ

E

< ζ

d

) are associated with drift.

2. The extremeness of the distribution of the short-term price movement, ζ(p

1

; E), in-

creases with the extremeness of the fundamentals ζ

E

.

3. Holding fundamentals λ fixed, the total trading volume increases in ζ

E

.

The result that the extremeness of the short-term price movement is tightly linked with

the extremeness of fundamentals serves not only as a prediction of independent interest, but

also as a way to motivate our main empirical specification. The extremeness of event-day

returns can be measured at a much higher frequency immediately following the news, in

contrast to the distribution of realized fundamentals, which are measured at a much lower

frequency and farther removed from the actual announcement. Proposition 2.2 allows us

to proxy the extremeness of event-type E with the more precisely measured extremeness of

event-day returns

ˆ

ζ(p

1

; E). Nonetheless, we show that our results are robust to alternative

proxies, including directly the extremeness of fundamentals.

To summarize, we make the following testable predictions regarding under-and-

overreaction to corporate news:

Prediction 1. Event-types with fatter-tailed distributions of fundamentals are associated

with greater price reversals. Conversely, event-types with thinner-tailed distributions of

fundamentals are associated with less reversal and greater drift.

Prediction 2. More extreme event-types are associated with greater trading volume, holding

fixed the fundamentals of the event.

The core insight that generates our prediction is very simple: if over- and under-reaction

to news are driven by the propensity, or lack thereof, of tail outcomes to disproportion-

14

ately come to mind, then measuring exactly how extreme these tail outcomes are is key to

understanding the degree of over-and-underreaction to news.

2.3 Alternative explanations

Diagnostic expectations, when applied to corporate news with extreme fundamentals, provide

a natural way to understand the variation in how the market reacts to news. The model

predicts that news associated with more extreme distribution of fundamentals are tied to

greater overreaction, reversals, and trading volume. In this section, we discuss a number of

closely related alternative mechanisms that can also generate some of our core predictions.

Availability of extreme events

As evidenced by a rich literature on availability (Tversky and Kahneman (1973), Kahneman

(2011)), extreme tail events are dominantly available and have an outsized influence.

8

For

example, applying a simple probability weighting function (Kahneman and Tversky (1979))

that over-weights the probability of rare tail events would generate overreaction that is

increasing in the extremeness of the underlying distribution of fundamentals.

While this approach is also psychologically well-founded and can generate our core in-

tuition, it has a few limitations. First, in its simplest formulation, this model states that

tail events are always available, rather than being available in light of news. Second, the

over-representation of tail events always leads to over-reaction. In contrast, diagnostic ex-

pectation emphasizes the contrast between the distribution in light of the news to a reference

distribution, which not only leads to over-representation of tail events conditional on news,

but also leads to the full spectrum of over-and-underreaction.

8

Malmendier and Nagel (2011) and Knüpfer et al. (2017) document life-long impacts that experienced

economic depressions have on individuals’ investment and consumption choices.

15

Overconfidence and noisy information

Different types of news may vary in their informativeness, or the “weight” of the associated

signals. For example, earnings announcements may be much more informative about the

future valuation of the company, while a CEO firing may have much more uncertain impli-

cations for the future of the firm. If individuals insufficiently regard the weight of the signal,

they will underreact to informative news and overreact to less informative news (Griffin

and Tversky (1992)). This is in line with Solomon (2012), who documents that soft, and

potentially noisy, information can be spun in a positive way, leading to investor overreaction.

If more extreme event-types are also those associated with greater ambiguity or unin-

formative signals, this mechanism can also generate our predictions. A major challenge

for accounting for this explanation is that the degree of informativeness of news is difficult

to measure empirically. In Section 5, we test this hypothesis by proxying for the unin-

formativeness of the signal with the average trading volume conditional on a given level of

fundamental news and find that the explanatory power of fundamental extremeness is robust

to this alternative mechanism.

General drivers of investor attention

Tetlock (2014) points to the centrality of investor attention in driving short-term overreac-

tion, with attention-grabbing yet “uninformative media content” eliciting overreaction and

“informative content” otherwise eliciting underreaction. Our framework provides a psycho-

logical foundation for why investor attention to certain content can lead to over- and under-

reaction: if news coverage creates an association between a current event and past outcomes

that are more extreme, investors would overreact. Our model focuses on the simplest driver

of such an association, where extreme outcomes are likelier to come to mind if the distribu-

tion of fundamentals belonging to the same news type (e.g. past leadership changes) is more

16

extreme relative to the reference distribution.

9

Alternative explanations of underreaction

While DE predicts underreaction for types of news that are less extreme than the refer-

ence distribution, the extensive literature on PEAD documents many other potential causes

for underreaction. For instance, investors may be inattentive or face information frictions

unrelated to the distribution of underlying fundamentals (DellaVigna and Pollet (2009), En-

gelberg (2008)). Alternatively, institutional frictions, such as sluggish capital (Duffie (2010))

may dampen short-term price reaction to news. While we do not rule out these other im-

portant drivers of overall underreaction, we focus on what drives the differences in market

reaction across different event-types through the lens of the the distribution of fundamentals.

3 Data

We use two main datasets for our news events and stock prices. First, we compile our list

of corporate news events from the Capital IQ Key Developments. The Capital IQ dataset

tracks major corporate news events such as earnings announcements, product and client

announcements, lawsuits/legal issues, leadership changes, and mergers and acquisitions, but

excludes macroeconomic news announcements such as interest rates and unemployment rates

that may affect stock price returns. Among the corporate events in our dataset, we identify

the universe of events associated with US companies listed on a major US stock exchange

(NASDAQ, NYSE, and AMEX) that occurred between 2011 and 2018. Second, we obtain

daily stock returns and trading volume from CRSP, which we merge onto the Capital IQ

dataset.

As noted by the market microstructure literature, short-term price reversals can occur

9

In particular, we abstract away from any non-fundamental determinants of associations, such as general

features of similarity between the event and past extreme events.

17

due to liquidity concerns: at extremely short time scales, bid ask bounces generate negative

return autocorrelation. Even at longer time scales, there may be transient price pressure

as market makers demand compensation for liquidity while trading against uninformed flow

(Kyle (1985), Nagel (2012)). To ameliorate these concerns, we exclude small-cap stocks from

our main analysis, which we define to be companies that have less than 2 billion dollars in

market capitalization at the time of the event.

10

Event types

We focus our analysis on news events that pertain to the real economic activities of the firm,

in particular its corporate and business operations, to filter out extraneous event-types.

In other words, we wish to use events that have direct relevance to the firm’s valuation

and its expected future cash flows. As such, we select event types based on the following

methodology: first, we select event types that have happened at least 1000 times across

all US companies in our sample between 2011 and 2018. Second, to focus on news related

to the fundamental operations of the firm, we exclude administrative events (such as name

changes and address changes)

11

, capital structure changes (such as debt and equity issuances

including IPOs

12

and SEOs), or trading activities, such as index exclusion, delisting, and

delayed SEC filings. Appendix B provides the full list of event types and which are included

and excluded in our main analysis.

Our final universe of events comprise of 24 different major event-types, including earnings

announcements, mergers and acquisitions, leadership changes, product and client-related

announcements, labor activities, and business reorganizations. The list of event-types we

use in our analysis is shown in Table 1. While we focus our main analyses on these events,

10

We repeat our analysis for the small-cap sample, and qualitatively replicate our main findings.

11

We note that some administrative events, such as announcements of earnings dates, or even name

changes, could be value-relevant for the firm. As a robustness check, we test our main empirical predictions

with the full set of events and obtain similar results.

12

We exclude IPOs in particular to avoid conflating IPO event day returns with the IPO premium.

18

we conduct robustness checks on the full sample of event types and show that our results

are robust to the precise inclusion/exclusion criteria that we employ.

Summary statistics

Table 1 reports summary statistics of the events in our sample. In general, corporate an-

nouncement days are characterized by significant price movements and trading behavior.

The unconditional means across all the event-types are largely centered around zero with

a small but notable positive mean: with the exception of lowered earnings guidance, most

event-types are associated with a small positive daily return.

Corporate event days also tend to matter for stock prices: the standard deviation of

returns on the event days for almost all event-types exceed 2.1%, which is the average daily

return volatility of stocks in our sample. There is also meaningful variation in stock price

movements across event types. Earnings announcements and calls, credit rating downgrades,

and leadership changes tend to have higher absolute daily moves, while annual general meet-

ings, credit rating confirmations, and CFO changes tend to have lower absolute daily moves.

In addition to returns, event days are also characterized by high trading volume. There

is also meaningful variation in the higher moments of the event day returns for the differ-

ent event-types. As we explore in later sections, both the fundamentals and the event-day

returns associated with most event-types are fat-tailed, or extreme.

13

Are news announcement days separate?

Given the regularity of earnings announcements, one potential concern may be that the an-

nouncement dates in our sample largely coincide with the major earnings announcements.

The literature on strategic corporate announcement documents evidence of corporations

strategically timing their announcements, such as bunching multiple news events together

13

We introduce our measure of extremeness, given by the power-law exponent, in Section 4.

19

(e.g. Graffin et al. (2011)). If corporate events significantly co-occur with earnings announce-

ments, isolating the component of event day return attributable to earnings announcement

from the effects of other concurrent events could be challenging.

Table A2 presents the percentage of event occurrences in each event-type that overlaps

with an earnings announcement of the same firm. The results suggest that while some cor-

porate announcements are indeed concurrent with earnings announcements, a vast majority

of events occur on different dates: 16 of the 24 event-types had less than half of their events

occurring on earnings announcement days. In fact, for most of these major events, over 90%

of these announcements do not occur on earnings announcement days.

4 Event-Type Heterogeneity

In this section and the next, we take our model to the data. We document three sets of

findings. First, the market reacts heterogeneously to different types of news events. Second,

the distributions of fundamentals vary in their extremeness across event types. Third, con-

sistent with the core predictions of our model, event types with more extreme fundamentals

experience overreaction and greater trading volumes, while event types with less extreme

fundamentals experience underreaction and lower trading volumes.

4.1 Heterogeneous price reaction to corporate announcements

We first document significant heterogeneity in the stock price reactions to corporate news.

14

We estimate return autoregressions (e.g. Campbell et al. (1993)) and find that while stock

14

These findings relate to prior work in the event-studies literature that jointly study a wider array of

corporate events. Antweiler and Frank (2006) classifies WSJ articles into various corporate event types, and

documents overall overreaction. Neuhierl et al. (2013) studies corporate press releases and documents higher

return volatility and uncertainty post-announcements, and also finds reversals for a few event types such as

management changes and corporate restructuring. Relative to both works, our paper quantifies the degree

of over-and-underreaction and highlights systematic differences across event types. Most importantly, our

paper documents variation in the extremeness of the fundamentals across different event types, and shows

that it can explain the variation in over- and underreaction to news.

20

prices following earnings announcements exhibit post-announcement drift, many other types

of corporate events such as mergers, acquisitions, client announcements, and leadership

changes have post-announcement reversals. In fact, the majority of corporate events that do

not coincide with earnings announcements display reversals, with the economic magnitudes

of the reversals comparable to that of PEADs. We conduct robustness exercises and show

that the drift and reversal patterns are unlikely to be generated by sampling variation or

non-event-driven market dynamics, such as unconditional stock price autocorrelations, and

are robust to industry effects and alternative return measures.

4.1.1 Cross-section of return drift and reversal

We first present evidence of heterogeneity of drifts and reversals across corporate event

types by estimating return autocorrelation regressions. For each corporate event type e, we

estimate:

r

e,c,t+1,t+k

= α

e

+ β

e

· r

e,c,t,t+1

+

e,c,t

, (9)

where each observation is an occurrence of a corporate event of type e to company c at date

t. r

e,c,t+1,t+k

is the cumulative stock return following the event from date t + 1 to date t + k,

where days are restricted to trading days, and r

e,c,t,t+1

is the event-day stock return on date

t.

15

β

e

, our measure of interest, reflects the degree of return drift/reversals of event type e.

If β

e

= 1, then half of the price movements are realized on the event day on average, with a

predictable drift of equal proportion over the next k days. If β

e

= 0, excess returns are on

average not predictable by event-day returns, as implied by rational expectations. Finally,

if β

e

= −1, event-day returns are on average fully reversed. We set k = 90 trading days

for our baseline specification of the stock price drift/reversal horizon, similar to the horizon

15

For example, let e be earnings announcements, c be Apple Inc., t be November 1st, 2018, and k be 90

days. Then the regression captures the relationship between the cumulative logarithmic return to Apple

stock price from November 1st, 2018 to 90 trading days in the future (March 18th, 2019), and the Apple

stock return on the day of November 1st, 2018.

21

considered by the PEAD literature.

16

We benchmark stock price returns relative to the S&P

500 returns and repeat our analysis without benchmarking as robustness checks. To ensure

our β

e

estimates are not driven by outliers, for each event type, we winsorize events at the

1% level. Standard errors are computed to account for cross-sectional and serial correlations

in the error term.

Figure 3: Reversal vs Drift

Note: Figure 3 plots the estimated β

e

for each of the 24 event types corresponding to eq.

(9).

Figure 3 plots the estimated β

e

coefficients and Table 2 reports the estimates numerically.

Notably, the β

e

estimates exhibit considerable variation across different types of events. In

particular, 11 out of the 24 event types in our sample exhibit post-announcement reversals.

While we find positive return autocorrelation indicating post-announcement drift for earnings

16

We also set k = 30, 60, and 120 as robustness checks and obtain qualitatively similar results.

22

announcements, we also find meaningful reversals for other corporate event types, including

leadership changes, mergers and acquistions, and client-related announcements. Table 2 also

reports the standard errors corresponding to individual β

e

estimates and we find that seven

of the individual β

e

estimates are statistically distinguishable from zero at the 5% level.

These event types are among the most common event types in our sample. To evaluate

the overall statistical significance of post-announcement drifts and reversals, we estimate a

pooled version of eq. (9) across all event types e:

r

e,c,t+1,t+k

= α + β

e

· 1(Event

e

) · r

e,c,t,t+1

+

e,c,t

, (10)

where each observation is a corporate event, and 1(Event

e

) is a dummy variable for event

type e. The joint F-statistic of the pooled specification is 1.79, which strongly rejects the null

hypothesis that the event type-specific β

e

’s are jointly zero (p < 0.01). An analogous test also

strongly rejects the null hypothesis that the β

e

’s are jointly equal (F = 1.85, p < 0.01) As

such, the analysis indicates significant variation in post-announcement drifts and reversals

in stock prices.

To interpret the economic magnitudes of the post-announcement drifts and reversals,

we construct sorted portfolios based on the event-day returns for each type of corporate

news. We divide our event types into two types based on the overlap of each event type

with earnings announcements. We define an event type as earnings-overlapping if more

than 50% of the events of the event type occur within a 5-day window around the same

firm’s earnings announcements and non-earnings-overlapping otherwise. Table A2 reports

each event type’s overlap with earnings announcements, which is bimodal: certain types of

news are frequently announced around earnings announcements, including announcements

of operating results, dividends, and corporate guidances, while other types of news, such

as mergers and acquisitions, client and product announcements, and legal issues, are rarely

announced around earnings announcements. For each of the two categories, we sort all events

23

within the category by their event-day returns and create ten sorted portfolios based on the

event-day returns. For example, portfolio 1 in each category represents the 10% of events

that had the lowest event-day returns and portfolio 10 represents the 10% with the highest

event-day returns. We calculate the cumulative returns to an equal-weighted winner-minus-

loser trading strategy that buys portfolio 10 and sells portfolio 1, which delivers positive

cumulative returns for events with post-announcement drifts and negative for reversals.

Figure 4: Sorted Portfolios of Earnings-Overlapping vs. Non-Earnings-Overlapping Events

Note: Figure 4 plots the cumulative abnormal returns to winner-minus-loser strategies for

sorted portfolios created on earnings-overlapping events (blue) and non-earnings-overlapping

events (red). The stocks are sorted based on the event-day returns into ten equally-sized

portfolios. The winner-minus-loser strategy buys the portfolio with the highest event-day

returns and shorts the portfolio with the lowest event-day returns.

24

Figure 4 presents the results. Consistent with Bernard and Thomas (1989) and the

PEAD literature, for earnings-overlapping events, a top-minus-bottom strategy generates

128 basis points of cumulative returns over a 90 day period. On the other hand, for non-

earning-overlapping events, the same strategy loses 46 basis points over a 90 day period.

The evidence thus suggests that while post-announcement drift occurs for earnings, post-

announcement reversals of a slightly lower but comparable magnitude are prevalent for other

event types.

4.1.2 Robustness exercises

We now conduct a series of robustness checks to test for alternative hypotheses that could

generate our results.

A. Full firm-day panel specification to account for unconditional market au-

tocorrelations and event overlap

We present a panel specification for our results to address two potential concerns. First,

not all corporate events occur at regularly scheduled intervals, so the event windows that

we study could contain overlapping event windows across different events. For instance, if a

firm changed their CEO on October 1 and then announced their earnings on October 31, the

period immediately after the earnings announcement on October 31 would also be contained

in the event window for the CEO change. Another potential concern is that our results

may be driven by unconditional market dynamics unrelated to corporate news, for example

due to unconditional reversals to large returns (Chan (2003)). Then event types with larger

event-day returns may mechanically experience more post-event reversals and not because

market participants overreact more to those event types.

To address these two sets of concerns, we estimate our return autoregression in a panel

specification. We construct a full firm-day panel where the observations are all firm-days over

the entire sample period. This ensures that the return of each firm on each day is sampled

25

only once and also accounts for overlapping news events that occur to the same firm over

the same time period, thus mitigating the overlapping observations concern. To account

for unconditional market return autocorrelations, we flexibly control for the unconditional

market response to non-event-day returns. Our panel regression specification is as follows:

r

c,t+1,t+90

= α + f(r

c,t

) +

X

e∈E

β

e

· 1(e

ct

) · r

c,t

+

ct

, (11)

where 1(e

ct

) is an indicator variable for whether a corporate event of type e occurred for firm

c on day t.

17

The term f(r

c,t

) captures the component of future market returns predictable

by unconditional returns, regardless of whether it is due to a particular event type. β

e

therefore identifies the drift and reversal attributed to event type e in excess of the component

predictable by unconditional returns. We compute standard errors following Driscoll and

Kraay (1998) to account for overlaps and autocorrelated errors. We implement two versions

of f(r

c,t

). First, we set f (r

c,t

) = γ · r

c,t

, with γ capturing the unconditional drift or reversals.

Second, to address potential non-linearities in the autocorrelation of unconditional returns,

we set f(r

c,t

) =

P

10

i=1

γ

i

· 1(r

c,t

∈ ∆

i

), where 1(r

c,t

∈ ∆

i

) is an indicator variable for whether

r

c,t

is in the i-th decile of event-day returns.

Table A5 reports the corresponding results. Across all specifications, we find that the

heterogeneity in the cross-section of drift and reversal to different types of corporate events

are quantitatively consistent across specifications controlling for event-day returns. The β

e

estimates in the full firm-day panel regression range from 0.41 to -0.38 (based on the non-

parametric specification of f), and are quantitatively similar to our previous β

e

estimates

from eq. (9). Overall, the results of the firm-day panel specification with flexible event-

day return controls suggest that our β estimates are robust to overlapping observations and

reflect true heterogeneity in responses to different event types.

17

To avoid potential collinearities, the set of events E excludes event types that co-occur within five days

of earnings announcements at least 50% of the time, so there are 17 total event type indicators.

26

B. Sampling variation and placebo exercises

To ensure that the cross-sectional variation in β

e

estimates is not driven by sampling

variation, we perform two bootstrap exercises. First, we create a placebo sample from all

firm-days on which no corporate event occurred for each given firm, which we call the no-

event-placebo sample. For example, if company c did not have a corporate event occur on

date t, we include firm-day c, t in the non-event sample. Second, to contrast the market

reaction to our event types with that to earnings announcements, we also construct the

earnings-placebo sample, where we similarly sample from earnings-announcements days. For

both approaches, we bootstrap 1000 draws with replacement, with each draw having the

same number of events as the pooled sample of all actual events. We compute the β

bootstrap

i

coefficients for each draw following eq. (9), for i = 1, 2, ..., 1000, and compare the estimated

β

e

coefficients to the distribution of β

bootstrap

i

.

Figure 5 shows the results. As depicted by the blue no-event-placebo histogram of β

estimates, the 95% interval of no-event-placebo is [−0.06, 0.11]. We find that 58% (14 out

of 24) of the observed β

e

estimates lie outside of the 95% interval, which is significantly

more than 5% implied by the null hypothesis that our drift/reversal patterns for event days

are statistically indistinguishable from non-event-days. For our earnings-placebo exercise,

we similarly find that 81% (13 out of 16) of the non-earnings-overlapping event types have

post-announcement drift/reversal coefficients outside the 95% interval of the boostrapped

earnings estimates β

i

earnings

. Furthermore, all but one of the 13 have β

e

estimates that

are more negative than the 95% interval of β

i

earnings

, indicating that there is less post-

announcement drift and more post-announcement reversal for these event types. Overall,

our placebo exercise suggests that there is an economically and statistically significant cross-

sectional variation in stock price reactions to a wide range of event types.

C. Drifts and Reversals as Sorted Portfolios

Two additional concerns may be raised about our choice of the regression coefficient β

e

as the measure of drift and reversal. First, the regression coefficients may not be robust to

27

Figure 5: Reversal vs Drift: Non-Event and Earnings Permutation Tests

Note: Figure 5 plots the density distributions of placebo β

i

’s estimated according to a

bootstrap for days where no corporate events occurred for the firms (Non-Events, in blue)

and days where earnings were announced for the firms (Earnings, in red). The point estimates

of β

e

coefficients for each event type are plotted as labeled points on the line.

outliers even after winsorizing. Second, β

e

is a relative measure, which may not capture the

economic magnitude of the drifts and reversals. While we have partially addressed the second

point by comparing the earnings-overlapping and non-earnings-overlapping sorted portfolios,

we now extend the sorted portfolio approach to all of our event types by estimating the

28

following regression specification:

UMD

e

= E[r

e,c,t+1,t+k

|r

e,c,t

> 5%] − E[r

e,c,t+1,t+k

|r

e,c,t

< −5%].

18

(13)

UMD

e

can be interpreted as the returns to a winner-minus-loser portfolio that buys the firms

whose event-day returns are greater than 5% and sells the firms whose event-day returns are

less than -5%. We set k = 90 days following eq. (9). UMD

e

is positive (negative) if there

is drift (reversal), i.e. event-day winners (losers) have future positive (negative) returns.

UMD

e

not only measures the absolute magnitudes of drifts and returns, but also equal

weighs the observations in the portfolio rather than assigning more weight to the extremes,

as is done in the regression specification.

Figure A1 plots the estimated UMD

e

’s against the estimated β

e

’s. The UMD

e

measures

are highly positively correlated with the β

e

estimates with a correlation coefficient of 0.80

(p-value < 0.01). The drifts and reversals from the β

e

estimates coincide with the sign of the

UMD

e

measure, with the only exception being lawsuits, for which the β

e

is slightly positive

and the UMD

e

is slightly negative. In particular, the returns on the UMD

e

portfolios of

events with reversals are of a comparable magnitude to those of drifts. For instance, the

median return on the UMD

e

portfolio for event types with reversals is -7.3% annualized,

compared to 4.5% annualized for the median event type with drift. For reference, the UM D

e

portfolio for earnings announcements earns 2.4% annualized returns. Overall, these results

suggest that our β

e

estimates are closely linked to the returns to a standard sorted portfolio,

with the reversals of a comparable economic magnitude to that of PEAD.

D. Additional Robustness Exercises

In Section C in the Online Appendix, we include additional robustness exercises. We

18

We estimate U M D

e

from the following regression:

r

e,c,t+1,t+k

= α

e

+ D

e

· 1(r

e,c,t

< −5%) + U

e

· 1(r

e,c,t

> 5%) +

e,c,t

, (13)

with

\

UM D

e

=

ˆ

U

e

−

ˆ

D

e

.

29

show that our results are robust to using log-returns and absolute returns, to controlling for

industry effects, and to both large and small-cap stocks.

4.2 Corporate news are heterogeneously extreme

Having documented the cross-sectional variation in short term reaction to corporate de-

velopments, we now measure the extremeness of the fundamental distributions across our

evenypes and also find significant heterogeneity.

We measure the fundamental impact of an event by its event-day return as the main

measure and repeat our analysis using alternative measures, such as long-run returns and

realized cash-flow growths. For our main measure of extremeness, we draw on the extremal

distribution literature (e.g. Embrechts et al. (2013) and Gabaix (2016)) and measure the

relationship between the log-rank and the log-value of the top 10% absolute event-day returns

for each event type. This relationship is negative by design: the value decreases as one moves

down the rank. A flatter relationship indicates a greater increase in the value as one moves up

the rank, and hence a fatter tail, or more extreme distribution. In particular, the relationship

is exactly linear for the case of power-law distributions.

19

Figure 6 plots the relationship for earnings and M&A announcements as well as for a

simulated normal distribution with a similar standard deviation. As is evident from the

plot and previous work (Gabaix (2016)), the tail of the event-day returns is far better fit

by a power-law than a normal distribution, whose log-rank log-value curve decays faster

than any linear fit. While we have shown only two event types for simplicity, the conclusion

holds generally: the R

2

associated with the linear fit is close to 1 for all types of corporate

events, suggesting that the distribution of fundamentals for all event types are extreme and

described well by a power-law.

20

19

To see this, note that 1 − F (x) = (x/x

min

)

−k

for power-law distributions, which implies log(1 − F (x))

is affine in log(x).

20

The extremal distribution literature has a precise way of categorizing thin-tailed (such as log-normal,

normal, exponential) distributions and fat-tailed (such as power-law, Student-t, Cauchy, etc) distributions.

30

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●

●●