QUARTERLY STATEMENT

OF THE

JACKSON NATIONAL LIFE INSURANCE COMPANY

TO THE

Insurance Department

OF THE

STATE OF

Michigan

FOR THE QUARTER ENDED

MARCH 31, 2020

LIFE AND ACCIDENT AND HEALTH

FRATERNAL BENEFIT SOCIETIES

2020

*65056202020100101*

LIFE, ACCIDENT AND HEALTH COMPANIES/FRATERNAL BENEFIT SOCIETIES - ASSOCIATION EDITION

QUARTERLY STATEMENT

AS OF MARCH 31, 2020

OF THE CONDITION AND AFFAIRS OF THE

Jackson National Life Insurance Company

NAIC Group Code 0918 0918 NAIC Company Code 65056 Employer's ID Number 38-1659835

(Current) (Prior)

Organized under the Laws of Michigan , State of Domicile or Port of Entry MI

Country of Domicile

United States of America

Licensed as business type:

Life, Accident and Health [ X ] Fraternal Benefit Societies [ ]

Incorporated/Organized

06/19/1961 Commenced Business 08/30/1961

Statutory Home Office

1 Corporate Way , Lansing, MI, US 48951

(Street and Number) (City or Town, State, Country and Zip Code)

Main Administrative Office

1 Corporate Way

(Street and Number)

Lansing, MI, US 48951 , 517-381-5500

(City or Town, State, Country and Zip Code) (Area Code) (Telephone Number)

Mail Address

1 Corporate Way , Lansing, MI, US 48951

(Street and Number or P.O. Box) (City or Town, State, Country and Zip Code)

Primary Location of Books and Records

1 Corporate Way

(Street and Number)

Lansing, MI, US 48951 , 517-381-5500

(City or Town, State, Country and Zip Code) (Area Code) (Telephone Number)

Internet Website Address

www.jackson.com

Statutory Statement Contact

Michael Alan Costello , 517-381-5500

(Name) (Area Code) (Telephone Number)

(E-mail Address) (FAX Number)

OFFICERS

President

Michael Irving Falcon

Treasurer

Michael Alan Costello

Secretary

Andrew John Bowden

Chief Actuary

Marcia Lynn Wadsten

OTHER

Axel Philippe Alain Andre #, Chief Financial Officer Aimee Rochelle DeCamillo, Chief Commercial Officer Bradley Olan Harris #, Chief Risk Officer

Laura Louene Prieskorn, Chief Operating Officer Kenneth Harold Stewart #, EVP Savvas (Steve) Panagiotis Binioris, SVP

Devkumar Dilip Ganguly, SVP Guillermo Esteban Guerra #, SVP Thomas Paul Hyatte, SVP

Dana Scamarcia Rapier, SVP Stacey Lynn Schabel #, SVP Richard Charles White, SVP

Marina Costa Ashiotou, VP Dennis Allen Blue, VP Barrett Mark Bonemer, VP

Pamela Lynn Bottles, VP William Thomas Devanney Jr., VP Lisa Ilene Fox, VP

Heather Anne Gahir, VP Joseph Kent Garrett, VP Scott Jay Golde, VP

Robert William Hajdu, VP Laura Louise Hanson, VP Courtney Ann Hoffmann, VP

Thomas Andrew Janda, VP Scott Francis Klus, VP Toni Lee Klus, VP

Matthew Fox Laker, VP Diahn Marie McHenry, VP Ryan Tait Mellott, VP

Dean Michael Miller, VP Jacky Morin, VP James Aaron Schultz, VP

Muhammad Sajid Shami, VP Dr. Bhatt Lakshmi Narayana Vadlamani, VP Brian Michael Walta, VP

Weston Bartley Wetherell, VP

DIRECTORS OR TRUSTEES

Axel Philippe Alain Andre # Michael Irving Falcon Morten Nicolai Friis

Bradley Olan Harris Dennis James Manning (Chairman) Edward Ronald Morrissey

Kenneth Harold Stewart

SS:

State of

Michigan

County of

Ingham

The officers of this reporting entity being duly sworn, each depose and say that they are the described officers of said reporting entity, and that on the reporting period stated above,

all of the herein described assets were the absolute property of the said reporting entity, free and clear from any liens or claims thereon, except as herein stated, and that this

statement, together with related exhibits, schedules and explanations therein contained, annexed or referred to, is a full and true statement of all the assets and liabilities and of the

condition and affairs of the said reporting entity as of the reporting period stated above, and of its income and deductions therefrom for the period ended, and have been completed

in accordance with the NAIC Annual Statement Instructions and Accounting Practices and Procedures manual except to the extent that: (1) state law may differ; or, (2) that state

rules or regulations require differences in reporting not related to accounting practices and procedures, according to the best of their information, knowledge and belief,

respectively. Furthermore, the scope of this attestation by the described officers also includes the related corresponding electronic filing with the NAIC, when required, that is an

exact copy (except for formatting differences due to electronic filing) of the enclosed statement. The electronic filing may be requested by various regulators in lieu of or in addition

to the enclosed statement.

Michael I. Falcon Andrew J. Bowden Michael A. Costello

President Secretary Treasurer

a. Is this an original filing?

Yes [ X ] No [ ]

Subscribed and sworn to before me this b. If no,

___ day of

1. State the amendment number

2. Date filed

3. Number of pages attached

Rhonda Phillips-Langham

Notary Public

10-Nov-24

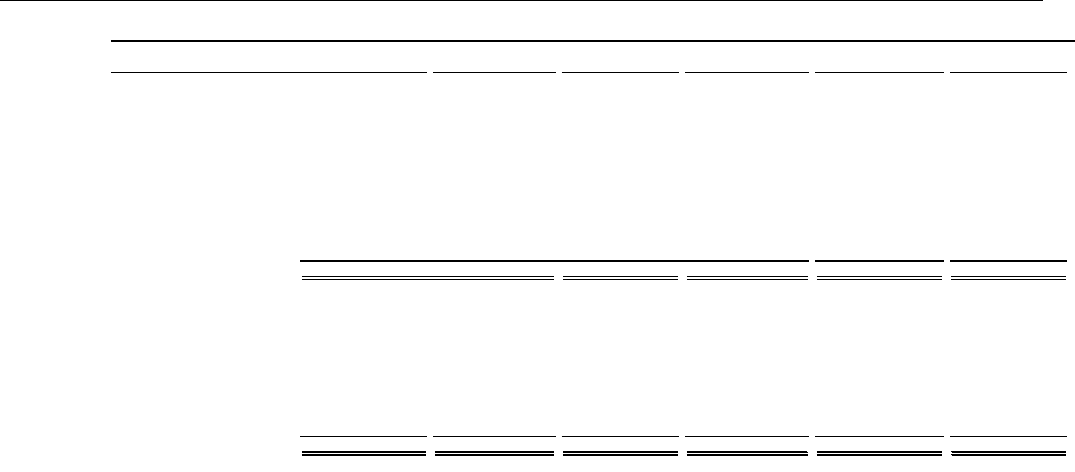

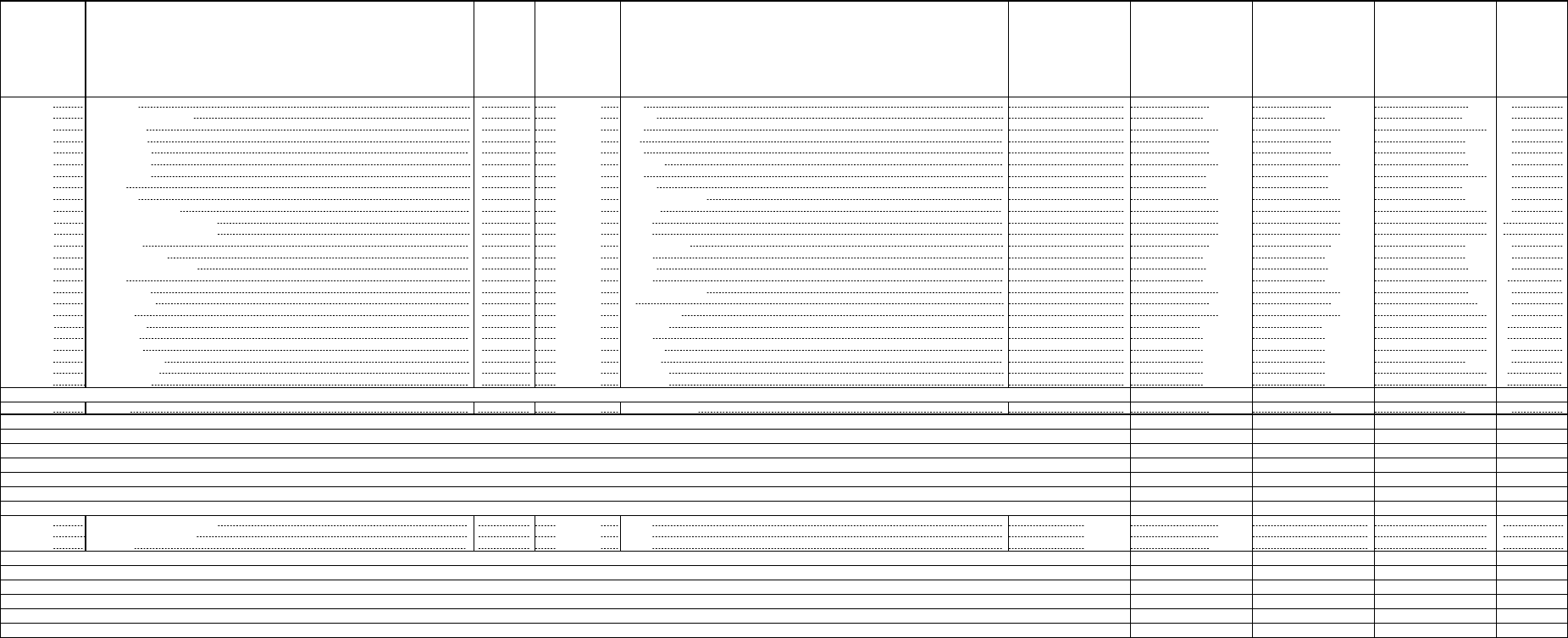

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

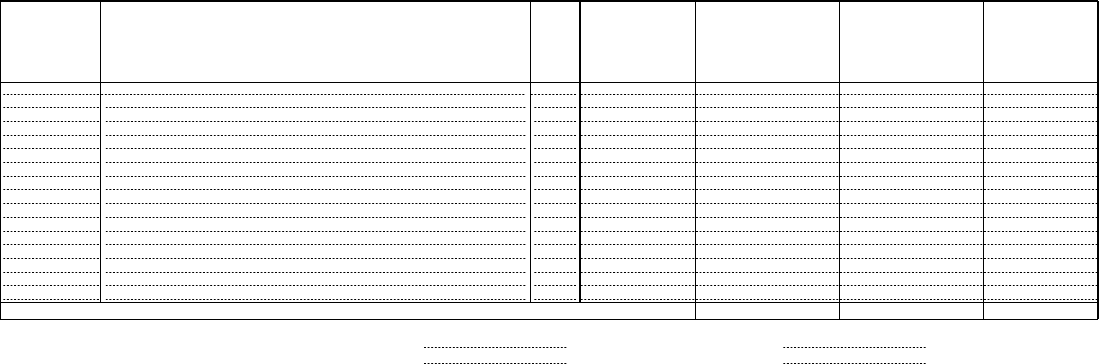

ASSETS

Current Statement Date 4

1

Assets

2

Nonadmitted Assets

3

Net Admitted Assets

(Cols. 1 - 2)

December 31

Prior Year Net

Admitted Assets

1. Bonds

54,959,671,331 0 54,959,671,331 51,622,738,742

2. Stocks:

2.1 Preferred stocks

0 0 0 0

2.2 Common stocks

852,031,849 6,025,753 846,006,096 884,796,589

3. Mortgage loans on real estate:

3.1 First liens

9,926,650,437 0 9,926,650,437 9,912,447,248

3.2 Other than first liens

0 0 0 0

4. Real estate:

4.1 Properties occupied by the company (less $

0

encumbrances)

247,332,429 0 247,332,429 248,959,944

4.2 Properties held for the production of income (less

$

0

encumbrances)

7,172,124 0 7,172,124 7,172,124

4.3 Properties held for sale (less $

0

encumbrances)

2,826,669 0 2,826,669 2,826,669

5. Cash ($

3,305,579,377

), cash equivalents

($

7,559,189,037

) and short-term

investments ($

0

)

10,864,768,414 0 10,864,768,414 1,160,849,203

6. Contract loans (including $

0

premium notes)

4,539,693,617 1,735,227 4,537,958,390 4,578,652,838

7. Derivatives

5,776,308,321 0 5,776,308,321 1,446,740,408

8. Other invested assets

1,554,717,932 65,274,677 1,489,443,255 1,441,693,986

9. Receivables for securities

502,418,824 0 502,418,824 64,886,145

10. Securities lending reinvested collateral assets

26,650,492 0 26,650,492 48,063,148

11. Aggregate write-ins for invested assets

0 0 0 0

12. Subtotals, cash and invested assets (Lines 1 to 11)

89,260,242,439 73,035,657 89,187,206,782 71,419,827,044

13. Title plants less $

0

charged off (for Title insurers

only)

0 0 0 0

14. Investment income due and accrued

747,258,141 0 747,258,141 704,567,228

15. Premiums and considerations:

15.1 Uncollected premiums and agents' balances in the course of collection

305,420,487 0 305,420,487 279,390,437

15.2 Deferred premiums, agents' balances and installments booked but

deferred and not yet due (including $

0

earned but unbilled premiums)

51,894,767 0 51,894,767 56,609,528

15.3 Accrued retrospective premiums ($

0

) and

contracts subject to redetermination ($

0

)

0 0 0 0

16. Reinsurance:

16.1 Amounts recoverable from reinsurers

63,598,405 0 63,598,405 36,107,814

16.2 Funds held by or deposited with reinsured companies

0 0 0 0

16.3 Other amounts receivable under reinsurance contracts

(186,951,818) 0 (186,951,818) (190,059,048)

17. Amounts receivable relating to uninsured plans

0 0 0 0

18.1 Current federal and foreign income tax recoverable and interest thereon

1,756,440,634 0 1,756,440,634 347,315,477

18.2 Net deferred tax asset

66,413,996 0 66,413,996 619,913,799

19. Guaranty funds receivable or on deposit

2,067,829 0 2,067,829 1,982,904

20. Electronic data processing equipment and software

5,898,337 0 5,898,337 7,268,534

21. Furniture and equipment, including health care delivery assets

($

0

)

31,463,729 31,463,729 0 0

22. Net adjustment in assets and liabilities due to foreign exchange rates

0 0 0 0

23. Receivables from parent, subsidiaries and affiliates

43,882,245 0 43,882,245 60,622,597

24. Health care ($

0

) and other amounts receivable

0 0 0 0

25. Aggregate write-ins for other than invested assets

155,375,516 36,649,626 118,725,890 131,007,878

26. Total assets excluding Separate Accounts, Segregated Accounts and

Protected Cell Accounts (Lines 12 to 25)

92,303,004,707 141,149,012 92,161,855,695 73,474,554,192

27. From Separate Accounts, Segregated Accounts and Protected Cell

Accounts

146,117,106,803 0 146,117,106,803 181,581,358,253

28. Total (Lines 26 and 27)

238,420,111,510 141,149,012 238,278,962,498 255,055,912,445

DETAILS OF WRITE-INS

1101.

1102.

1103.

1198. Summary of remaining write-ins for Line 11 from overflow page

0 0 0 0

1199. Totals (Lines 1101 through 1103 plus 1198)(Line 11 above)

0 0 0 0

2501.

Agents' balances (net)

3,257,507 3,257,507 0 0

2502.

Capitalized software and associated costs 19,997,231 19,997,231 0 0

2503.

Goodwill and value of business acquired 118,725,890 0 118,725,890 131,007,878

2598. Summary of remaining write-ins for Line 25 from overflow page

13,394,888 13,394,888 0 0

2599. Totals (Lines 2501 through 2503 plus 2598)(Line 25 above)

155,375,516 36,649,626 118,725,890 131,007,878

2

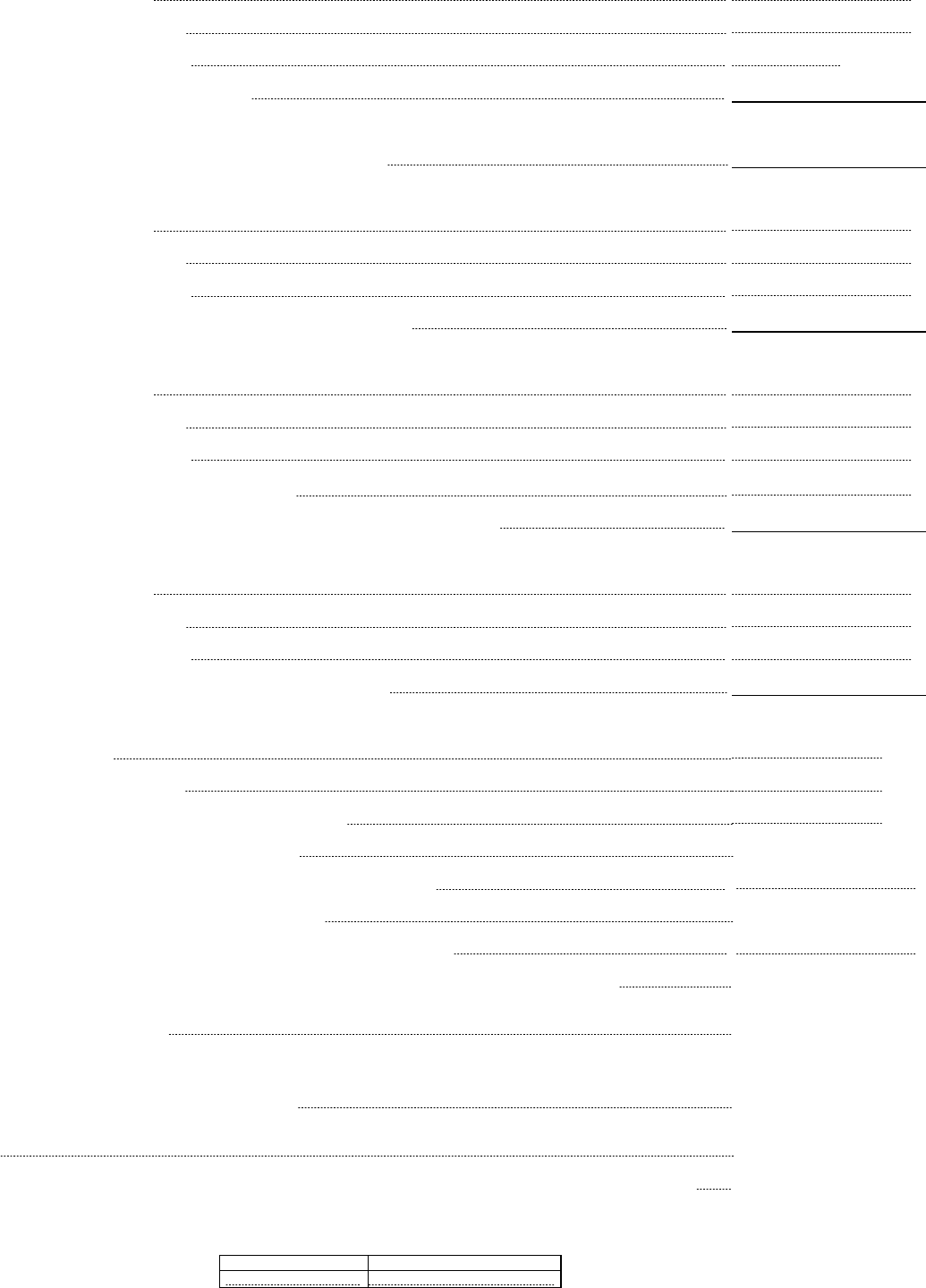

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

LIABILITIES, SURPLUS AND OTHER FUNDS

1

Current

Statement Date

2

December 31

Prior Year

1. Aggregate reserve for life contracts $

64,917,000,339

less $

0

included in Line 6.3

(including $

0

Modco Reserve)

64,637,140,072 52,691,932,555

2. Aggregate reserve for accident and health contracts (including $

0

Modco Reserve)

0 0

3. Liability for deposit-type contracts (including $

0

Modco Reserve)

13,741,796,136 13,092,200,315

4. Contract claims:

4.1 Life

825,554,108 809,047,789

4.2 Accident and health

0 0

5. Policyholders’ dividends/refunds to members $

209,325

and coupons $

0

due

and unpaid

209,325 229,030

6. Provision for policyholders’ dividends, refunds to members and coupons payable in following calendar year - estimated

amounts:

6.1 Policyholders’ dividends and refunds to members apportioned for payment (including $

0

Modco)

9,017,188 9,047,483

6.2 Policyholders’ dividends and refunds to members not yet apportioned (including $

0

Modco)

177,831 179,548

6.3 Coupons and similar benefits (including $

0

Modco)

49,306 49,340

7. Amount provisionally held for deferred dividend policies not included in Line 6

0 0

8. Premiums and annuity considerations for life and accident and health contracts received in advance less

$

0

discount; including $

0

accident and health premiums

3,030,879 2,500,537

9. Contract liabilities not included elsewhere:

9.1 Surrender values on canceled contracts

529,327 448,095

9.2 Provision for experience rating refunds, including the liability of $

0

accident and health

experience rating refunds of which $

0

is for medical loss ratio rebate per the Public Health

Service Act

0 0

9.3 Other amounts payable on reinsurance, including $

(46,238,118)

assumed and $

222,712

ceded

(46,015,406) (23,117,357)

9.4 Interest Maintenance Reserve

345,439,268 442,449,568

10. Commissions to agents due or accrued-life and annuity contracts $

94,406,792

, accident and health

$

0

and deposit-type contract funds $

0

94,406,792 117,677,812

11. Commissions and expense allowances payable on reinsurance assumed

86,365 88,379

12. General expenses due or accrued

154,906,287 220,282,864

13. Transfers to Separate Accounts due or accrued (net) (including $

(5,201,565,585)

accrued for expense

allowances recognized in reserves, net of reinsured allowances)

(5,212,253,430) (5,332,639,488)

14. Taxes, licenses and fees due or accrued, excluding federal income taxes

(4,122,748) (4,396,758)

15.1 Current federal and foreign income taxes, including $

0

on realized capital gains (losses)

0 0

15.2 Net deferred tax liability

0 0

16. Unearned investment income

7,419,769 7,898,188

17. Amounts withheld or retained by reporting entity as agent or trustee

3,804,984 6,026,304

18. Amounts held for agents' account, including $

6,253,854

agents' credit balances

6,253,854 6,316,081

19. Remittances and items not allocated

32,113,058 20,967,517

20. Net adjustment in assets and liabilities due to foreign exchange rates

0 0

21. Liability for benefits for employees and agents if not included above

0 0

22. Borrowed money $

73,092,108

and interest thereon $

49,044

73,141,152 377,548,328

23. Dividends to stockholders declared and unpaid

0 0

24. Miscellaneous liabilities:

24.01 Asset valuation reserve

754,985,514 448,441,678

24.02 Reinsurance in unauthorized and certified ($

0

) companies

31,888,430 64,948,976

24.03 Funds held under reinsurance treaties with unauthorized and certified ($

0

) reinsurers

3,763,882,070 3,753,821,449

24.04 Payable to parent, subsidiaries and affiliates

201,051,355 255,332,143

24.05 Drafts outstanding

0 0

24.06 Liability for amounts held under uninsured plans

0 0

24.07 Funds held under coinsurance

294,576,951 293,690,292

24.08 Derivatives

(23,821,111) (15,364,417)

24.09 Payable for securities

709,283,244 196,296,169

24.10 Payable for securities lending

26,650,492 48,063,148

24.11 Capital notes $

0

and interest thereon $

0

0 0

25. Aggregate write-ins for liabilities

4,106,362,772 1,225,010,887

26. Total liabilities excluding Separate Accounts business (Lines 1 to 25)

84,537,543,834 68,714,976,454

27. From Separate Accounts Statement

146,117,106,803 181,581,358,253

28. Total liabilities (Lines 26 and 27)

230,654,650,637 250,296,334,707

29. Common capital stock

13,800,000 13,800,000

30. Preferred capital stock

0 0

31. Aggregate write-ins for other than special surplus funds

0 0

32. Surplus notes

249,655,955 249,611,466

33. Gross paid in and contributed surplus

3,506,054,966 3,506,054,966

34. Aggregate write-ins for special surplus funds

0 0

35. Unassigned funds (surplus)

3,854,800,940 990,111,306

36. Less treasury stock, at cost:

36.1

0

shares common (value included in Line 29 $

0

)

0 0

36.2

0

shares preferred (value included in Line 30 $

0

)

0 0

37. Surplus (Total Lines 31+32+33+34+35-36) (including $

0

in Separate Accounts Statement)

7,610,511,861 4,745,777,738

38. Totals of Lines 29, 30 and 37

7,624,311,861 4,759,577,738

39. Totals of Lines 28 and 38 (Page 2, Line 28, Col. 3)

238,278,962,498 255,055,912,445

DETAILS OF WRITE-INS

2501.

Deferred compensation 316,604,259 351,807,270

2502.

Deferred rent 11,619,933 11,567,876

2503.

Founders Plan liability 120,671 96,679

2598. Summary of remaining write-ins for Line 25 from overflow page

3,778,017,909 861,539,062

2599. Totals (Lines 2501 through 2503 plus 2598)(Line 25 above)

4,106,362,772 1,225,010,887

3101.

3102.

3103.

3198. Summary of remaining write-ins for Line 31 from overflow page

0 0

3199. Totals (Lines 3101 through 3103 plus 3198)(Line 31 above)

0 0

3401.

3402.

3403.

3498. Summary of remaining write-ins for Line 34 from overflow page

0 0

3499. Totals (Lines 3401 through 3403 plus 3498)(Line 34 above)

0 0

3

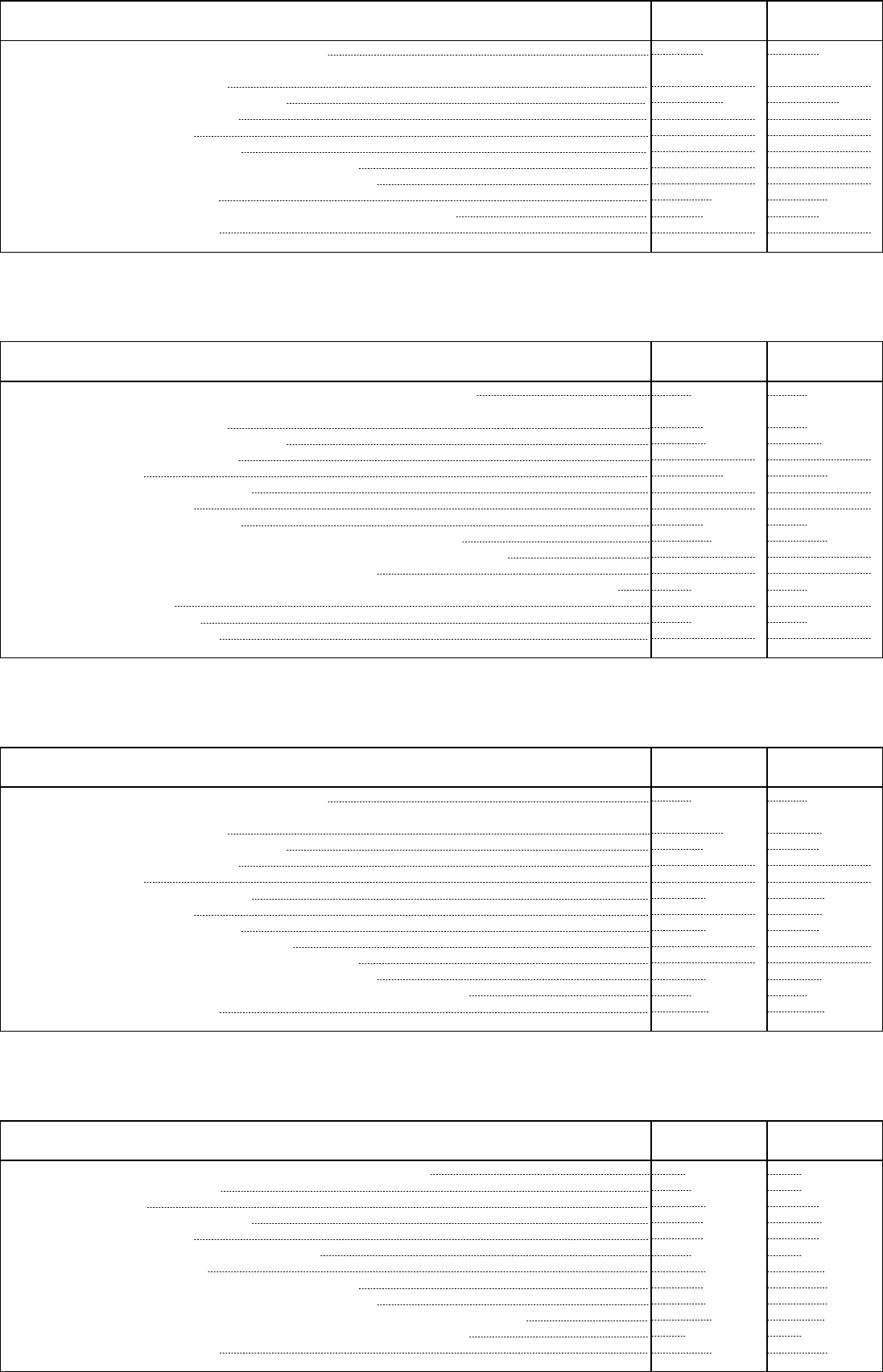

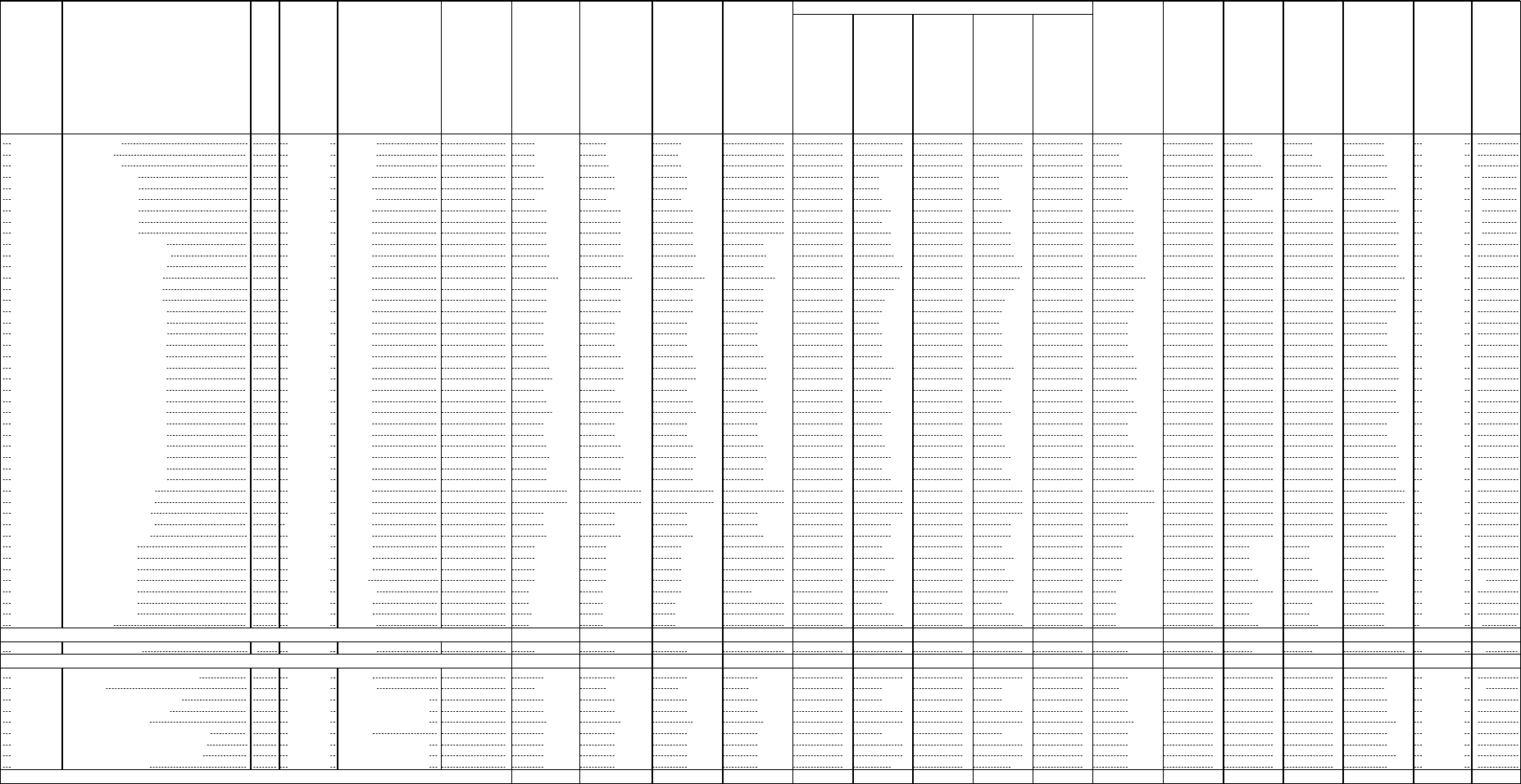

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

SUMMARY OF OPERATIONS

1

Current Year

To Date

2

Prior Year

To Date

3

Prior Year Ended

December 31

1. Premiums and annuity considerations for life and accident and health contracts

5,177,926,171 4,419,154,721 20,569,180,872

2. Considerations for supplementary contracts with life contingencies

2,361,763 2,587,170 7,217,341

3. Net investment income

973,903,809 870,721,297 3,648,162,584

4. Amortization of Interest Maintenance Reserve (IMR)

17,698,907 24,189,187 98,245,065

5. Separate Accounts net gain from operations excluding unrealized gains or losses

0 0 0

6. Commissions and expense allowances on reinsurance ceded

(12,726,115) 493,922 33,079,871

7. Reserve adjustments on reinsurance ceded

0 0 0

8. Miscellaneous Income:

8.1 Income from fees associated with investment management, administration and contract

guarantees from Separate Accounts

1,056,492,129 1,010,179,046 4,179,600,794

8.2 Charges and fees for deposit-type contracts

0 0 0

8.3 Aggregate write-ins for miscellaneous income

226,077,914 210,967,150 885,205,291

9. Totals (Lines 1 to 8.3)

7,441,734,578 6,538,292,493 29,420,691,818

10. Death benefits

262,151,118 256,721,815 1,010,714,835

11. Matured endowments (excluding guaranteed annual pure endowments)

754,347 1,475,008 5,149,399

12. Annuity benefits

907,045,511 866,542,880 3,300,435,068

13. Disability benefits and benefits under accident and health contracts

2,824,263 2,945,724 11,736,434

14. Coupons, guaranteed annual pure endowments and similar benefits

19,825 21,162 82,407

15. Surrender benefits and withdrawals for life contracts

4,888,263,373 4,206,611,919 18,744,955,458

16. Group conversions

0 0 0

17. Interest and adjustments on contract or deposit-type contract funds

89,151,240 88,630,062 369,867,358

18. Payments on supplementary contracts with life contingencies

2,231,397 2,687,511 9,440,699

19. Increase in aggregate reserves for life and accident and health contracts

11,945,207,517 (2,406,657,393) (629,449,440)

20. Totals (Lines 10 to 19)

18,097,648,591 3,018,978,688 22,822,932,218

21. Commissions on premiums, annuity considerations, and deposit-type contract funds (direct

business only)

448,313,426 391,252,981 1,775,305,677

22. Commissions and expense allowances on reinsurance assumed

50,231,560 21,996,676 146,915,190

23. General insurance expenses and fraternal expenses

161,708,771 175,430,330 682,307,529

24. Insurance taxes, licenses and fees, excluding federal income taxes

17,512,174 18,795,881 58,515,407

25. Increase in loading on deferred and uncollected premiums

(922,910) (792,554) (3,468,801)

26. Net transfers to or (from) Separate Accounts net of reinsurance

(1,814,099,235) (396,833,638) (2,391,064,547)

27. Aggregate write-ins for deductions

93,950,538 93,480,664 425,532,017

28. Totals (Lines 20 to 27)

17,054,342,915 3,322,309,028 23,516,974,690

29. Net gain from operations before dividends to policyholders and federal income taxes (Line 9 minus

Line 28)

(9,612,608,337) 3,215,983,465 5,903,717,128

30. Dividends to policyholders and refunds to members

2,473,683 2,514,550 9,422,606

31. Net gain from operations after dividends to policyholders, refunds to members and before federal

income taxes (Line 29 minus Line 30)

(9,615,082,020) 3,213,468,915 5,894,294,522

32. Federal and foreign income taxes incurred (excluding tax on capital gains)

(3,058,388,537) 554,299,832 1,579,682,572

33. Net gain from operations after dividends to policyholders, refunds to members and federal income

taxes and before realized capital gains or (losses) (Line 31 minus Line 32)

(6,556,693,483) 2,659,169,083 4,314,611,950

34. Net realized capital gains (losses) (excluding gains (losses) transferred to the IMR) less capital

gains tax of $

1,662,377,515

(excluding taxes of $

(13,177,129)

transferred to the IMR)

6,188,163,766 (1,812,972,970) (5,372,238,088)

35. Net income (Line 33 plus Line 34)

(368,529,717) 846,196,113 (1,057,626,138)

CAPITAL AND SURPLUS ACCOUNT

36. Capital and surplus, December 31, prior year

4,759,577,738 4,788,440,264 4,788,440,264

37. Net income (Line 35)

(368,529,717) 846,196,113 (1,057,626,138)

38. Change in net unrealized capital gains (losses) less capital gains tax of $

856,035,216 3,239,890,973 (604,686,918) 119,356,066

39. Change in net unrealized foreign exchange capital gain (loss)

0 0 0

40. Change in net deferred income tax

(581,693,879) (107,804,962) 457,434,864

41. Change in nonadmitted assets

852,366,634 (37,698,516) (350,692,003)

42. Change in liability for reinsurance in unauthorized and certified companies

33,060,546 0 (64,898,726)

43. Change in reserve on account of change in valuation basis, (increase) or decrease

0 0 438,371,407

44. Change in asset valuation reserve

(306,543,836) 279,973,755 269,445,741

45. Change in treasury stock

0 0 0

46. Surplus (contributed to) withdrawn from Separate Accounts during period

0 0 0

47. Other changes in surplus in Separate Accounts Statement

0 0 0

48. Change in surplus notes

44,489 9,560 53,295

49. Cumulative effect of changes in accounting principles

0 0 0

50. Capital changes:

50.1 Paid in

0 0 0

50.2 Transferred from surplus (Stock Dividend)

0 0 0

50.3 Transferred to surplus

0 0 0

51. Surplus adjustment:

51.1 Paid in

0 0 120,000,000

51.2 Transferred to capital (Stock Dividend)

0 0 0

51.3 Transferred from capital

0 0 0

51.4 Change in surplus as a result of reinsurance

(3,861,087) (1,289,991) (24,118,543)

52. Dividends to stockholders

0 0 (525,000,000)

53. Aggregate write-ins for gains and losses in surplus

0 (156,398,126) 588,811,512

54. Net change in capital and surplus for the year (Lines 37 through 53)

2,864,734,123 218,300,915 (28,862,525)

55. Capital and surplus, as of statement date (Lines 36 + 54)

7,624,311,861 5,006,741,179 4,759,577,738

DETAILS OF WRITE-INS

08.301.

General account policy fees 86,697,052 80,552,479 338,400,587

08.302.

Marketing fees 136,790,123 128,639,461 543,429,724

08.303.

Miscellaneous income 63,547 881,757 2,862,700

08.398. Summary of remaining write-ins for Line 8.3 from overflow page

2,527,192 893,453 512,280

08.399. Totals (Lines 08.301 through 08.303 plus 08.398) (Line 8.3 above)

226,077,914 210,967,150 885,205,291

2701.

Additional contract benefits to Founders Plan policyholders 24,124 23,982 96,042

2702.

Amortization of goodwill and value of business acquired 12,281,989 9,416,966 105,481,086

2703.

Interest on funds withheld treaties 85,505,512 85,329,707 344,073,432

2798. Summary of remaining write-ins for Line 27 from overflow page

(3,861,087) (1,289,991) (24,118,543)

2799. Totals (Lines 2701 through 2703 plus 2798)(Line 27 above)

93,950,538 93,480,664 425,532,017

5301.

Interest rate swaps adjustment per permitted practice 0 (156,398,126) 164,710,140

5302.

Change in CARVM allowance on account of change in valuation basis 0 0 424,101,372

5303.

5398. Summary of remaining write-ins for Line 53 from overflow page

0 0 0

5399. Totals (Lines 5301 through 5303 plus 5398)(Line 53 above)

0 (156,398,126) 588,811,512

4

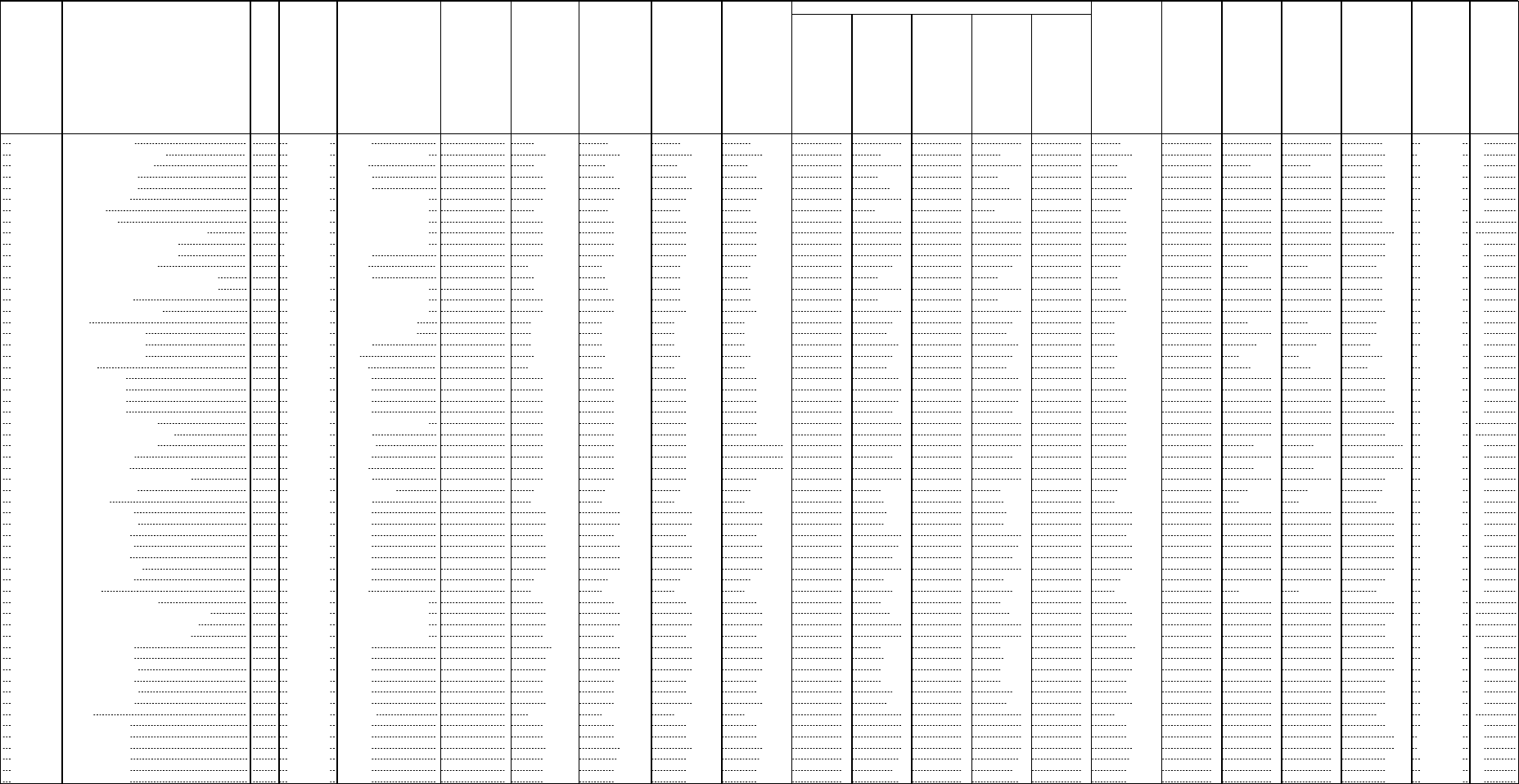

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

CASH FLOW

1

Current Year

To Date

2

Prior Year

To Date

3

Prior Year Ended

December 31

Cash from Operations

1. Premiums collected net of reinsurance

5,158,075,713 4,046,063,343 20,208,575,620

2. Net investment income

780,883,827 418,011,786 2,614,584,390

3. Miscellaneous income

1,286,401,024 1,211,005,202 5,079,440,472

4. Total (Lines 1 to 3)

7,225,360,564 5,675,080,331 27,902,600,482

5. Benefit and loss related payments

6,027,144,123 5,297,126,626 22,862,640,867

6. Net transfers to Separate Accounts, Segregated Accounts and Protected Cell Accounts

(1,934,485,293) (328,108,341) (2,605,619,731)

7. Commissions, expenses paid and aggregate write-ins for deductions

764,125,572 664,783,924 2,667,951,798

8. Dividends paid to policyholders

2,525,400 2,504,042 9,586,625

9. Federal and foreign income taxes paid (recovered) net of $

0

tax on capital

gains (losses)

(43,913) 0 376,247,276

10. Total (Lines 5 through 9)

4,859,265,889 5,636,306,251 23,310,806,835

11. Net cash from operations (Line 4 minus Line 10)

2,366,094,675 38,774,080 4,591,793,647

Cash from Investments

12. Proceeds from investments sold, matured or repaid:

12.1 Bonds

2,456,343,536 2,449,692,045 9,797,989,355

12.2 Stocks

2,975,971 2,430,376 469,598,100

12.3 Mortgage loans

540,173,463 246,296,458 1,242,741,594

12.4 Real estate

0 0 0

12.5 Other invested assets

36,050,104 100,787,912 246,940,252

12.6 Net gains or (losses) on cash, cash equivalents and short-term investments

0 0 0

12.7 Miscellaneous proceeds

9,030,573,476 (2,898,991,123) (5,457,725,010)

12.8 Total investment proceeds (Lines 12.1 to 12.7)

12,066,116,550 (99,784,332) 6,299,544,291

13. Cost of investments acquired (long-term only):

13.1 Bonds

5,913,397,772 1,991,340,212 9,889,710,024

13.2 Stocks

659,283 992,940 137,133,562

13.3 Mortgage loans

555,520,000 261,344,500 1,750,063,184

13.4 Real estate

350,449 224,860 952,828

13.5 Other invested assets

101,575,408 85,526,541 293,642,577

13.6 Miscellaneous applications

1,256,985,525 450,234,761 2,462,588,470

13.7 Total investments acquired (Lines 13.1 to 13.6)

7,828,488,437 2,789,663,814 14,534,090,645

14. Net increase (or decrease) in contract loans and premium notes

(40,694,447) (65,097,270) 17,657,059

15. Net cash from investments (Line 12.8 minus Line 13.7 and Line 14)

4,278,322,560 (2,824,350,876) (8,252,203,413)

Cash from Financing and Miscellaneous Sources

16. Cash provided (applied):

16.1 Surplus notes, capital notes

0 0 0

16.2 Capital and paid in surplus, less treasury stock

0 0 83,376,366

16.3 Borrowed funds

(304,250,000) (2,500,000) 294,960,527

16.4 Net deposits on deposit-type contracts and other insurance liabilities

649,595,821 948,391,484 1,345,319,839

16.5 Dividends to stockholders

0 0 525,000,000

16.6 Other cash provided (applied)

2,714,156,155 150,927,348 801,284,265

17. Net cash from financing and miscellaneous sources (Line 16.1 through Line 16.4 minus Line 16.5

plus Line 16.6)

3,059,501,976 1,096,818,832 1,999,940,997

RECONCILIATION OF CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS

18. Net change in cash, cash equivalents and short-term investments (Line 11, plus Lines 15 and 17)

9,703,919,212 (1,688,757,964) (1,660,468,769)

19. Cash, cash equivalents and short-term investments:

19.1 Beginning of year

1,160,849,203 2,821,317,972 2,821,317,972

19.2 End of period (Line 18 plus Line 19.1)

10,864,768,414 1,132,560,008 1,160,849,203

Note: Supplemental disclosures of cash flow information for non-cash transactions:

20.0001.

Assets transferred on reinsurance transaction 0 428,792,376 428,792,376

20.0002.

Transfer of debt securities for debt securities and / or equity securities 32,333,222 215,557,458 730,432,476

20.0003.

Non-cash financial assets acquired from parent as a capital contribution 0 0 36,623,634

5

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

EXHIBIT 1

DIRECT PREMIUMS AND DEPOSIT-TYPE CONTRACTS

1

Current Year

To Date

2

Prior Year

To Date

3

Prior Year Ended

December 31

1. Industrial life

43,708 58,912 231,971

2. Ordinary life insurance

41,791,848 172,457,274 781,685,146

3. Ordinary individual annuities

4,571,605,195 3,172,021,549 17,317,005,341

4. Credit life (group and individual)

0 0 0

5. Group life insurance

5,519,806 3,527,210 18,833,540

6. Group annuities

155,006,200 437,590,969 1,264,633,767

7. A & H - group

36,793 39,429 146,632

8. A & H - credit (group and individual)

0 0 0

9. A & H - other

9,503,895 10,469,723 39,968,647

10. Aggregate of all other lines of business

0 0 0

11. Subtotal (Lines 1 through 10)

4,783,507,445 3,796,165,066 19,422,505,044

12. Fraternal (Fraternal Benefit Societies Only)

0 0 0

13. Subtotal (Lines 11 through 12)

4,783,507,445 3,796,165,066 19,422,505,044

14. Deposit-type contracts

1,287,699,215 1,178,631,422 2,534,151,039

15. Total (Lines 13 and 14)

6,071,206,660 4,974,796,488 21,956,656,083

DETAILS OF WRITE-INS

1001.

1002.

1003.

1098. Summary of remaining write-ins for Line 10 from overflow page

0 0 0

1099. Totals (Lines 1001 through 1003 plus 1098)(Line 10 above)

0 0 0

6

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7

NOTES TO FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies and Going Concern

A. Accounting Practices

The financial statements of Jackson National Life Insurance Company (the “Company”) are presented on the basis of accounting

practices prescribed or permitted by the Michigan Department of Insurance and Financial Services.

The Department of Insurance and Financial Services recognizes statutory accounting practices prescribed or permitted by the state

of Michigan for determining and reporting the financial condition and results of operations of an insurance company, and for

determining its solvency under Michigan Insurance Law. The Department of Insurance and Financial Services has adopted the

National Association of Insurance Commissioners' (“NAIC”) Accounting Practices and Procedures Manual (“NAIC SAP”) to the

extent that the accounting practices, procedures, and reporting standards are not modified by the Michigan Insurance Code. The

state of Michigan has adopted certain prescribed accounting practices that differ from those defined in NAIC SAP. Specifically,

the value of the book of business arising from the acquisition of a subsidiary or through reinsurance may be recognized as an

admitted asset if certain criteria are met. In NAIC SAP, goodwill may be admitted in amounts not to exceed 10% of an insurer’s

capital and surplus, as adjusted, and is eliminated in the event of a merger. The commissioner of insurance has the right to permit

other specific practices that deviate from prescribed practices.

The Valuation of Life Insurance Policies Model Regulation (“Model 830”, also known as Regulation XXX), was effective for NAIC

SAP in 2000. The state of Michigan did not permit Model 830 for reserve calculations until January 1, 2002. Thus, reserves for

life business issued in calendar years 2000-2001 are not valued according to Model 830 and NAIC SAP, but rather, are valued under

the prior method of the Standard Valuation Law, referred to as the ‘unitary’ method.

Actuarial Guideline XXXV (“Actuarial Guideline 35” or the “Guideline”) was adopted by the NAIC in December 1998. The

purpose of Actuarial Guideline 35 is to interpret the standards for the valuation of statutory reserves for fixed index annuities. NAIC

SAP requires application of Actuarial Guideline 35 for all fixed index annuities issued after December 31, 2000. Michigan law

prescribes the valuation of fixed index annuities without consideration of the Guideline. As a result, the Guideline is not reflected

in the Company’s accounts as of March 31, 2020 and December 31, 2019.

As a result of an acquisition accounted for as a statutory purchase in accordance with Statement of Statutory Accounting Principles

(“SSAP”) No. 68 and an indemnity reinsurance agreement, the Company has goodwill attributed to the value of the book of business

acquired (“VOBA”). The VOBA value is fully recoverable by the present value of the future cash flows of the businesses acquired

and assumed. Under Michigan law, the entire balance is recognized as an admitted asset. Under statutory goodwill accounting in

accordance with paragraph 13 of SSAP No. 68, the entire VOBA of $118,725,890 at March 31, 2020, would be a reduction from

the Michigan basis capital and surplus, as shown in the table below.

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.1

NOTES TO FINANCIAL STATEMENTS

A reconciliation of the Company's net income and capital and surplus between NAIC SAP and practices prescribed or

permitted by the state of Michigan is shown below:

F/S

F/S

SSAP #

Page

Line #

3/31/2020

12/31/2019

Net Income

Jackson National Life Insurance Company, Michigan basis

(368,529,717)

$

(263,497,629)

$

Michigan Prescribed Practices that increase/(decrease) NAIC SAP:

Valuation of Life Insurance Policies Model Regulation (XXX)

Decrease in aggregate reserves for life and accident

and health policies and contracts

51

4

19

(353,309)

(1,707,661)

Actuarial Guideline XXXV

(Decrease)/increase in aggregate reserves for life and accident

and health policies and contracts

51

4

19

(51,194,141)

97,290,647

Amortization of value of business acquired

68

4

2702

(12,281,989)

(105,481,086)

Prescribed practices adjustment

(63,829,439)

(9,898,100)

Tax effect of prescribed practice differences

51, 68

4

32

10,827,285

(20,166,330)

NAIC SAP

(315,527,563)

$

(233,433,199)

$

Capital and Surplus

Jackson National Life Insurance Company, Michigan basis

7,624,311,861

$

4,759,577,738

$

Michigan Prescribed Practices that increase/(decrease) NAIC SAP:

Valuation of Life Insurance Policies Model Regulation (XXX):

Reserve, Michigan basis

51

3

1

(8,564,331)

(8,673,613)

Reserve, NAIC SAP

51

3

1

(21,442,359)

(21,904,950)

Model Regulation (XXX) adjustment

12,878,028

13,231,337

Actuarial Guideline XXXV:

Reserve, Michigan basis

51

3

1

(9,135,583,848)

(8,752,871,985)

Reserve, NAIC SAP

51

3

1

(9,184,120,641)

(8,852,602,919)

Actuarial Guideline XXXV adjustment

48,536,793

99,730,934

Value of business acquired

68

2

2503

118,725,890

131,007,878

Tax effect of prescribed practice differences

12,598,157

9,721,195

Net impact of prescribed practices

192,738,868

253,691,344

NAIC SAP

7,431,572,993

$

4,505,886,394

$

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 1, item B.

C. Accounting Policy

(2) Bonds not backed by other loans are stated at amortized cost except those with an NAIC rating of “6,” which are

stated at the lower of amortized cost or fair value. Acquisition premiums and discounts are amortized into

investment income through call or maturity dates using the interest method. The Company did not have SVO-

Identified investments reported at a different measurement method from prior periods.

(6) Loan-backed and structured securities, hereafter collectively referred to as “loan-backed securities”, are stated at

amortized cost except those with an NAIC carry rating of “6,” which are carried at the lower of amortized cost or

fair value. The retrospective adjustment method is used to value loan-backed securities where the collection of

all contractual cash flows is probable. For loan-backed securities where the collection of all contractual cash

flows is not probable, the Company:

• Recognizes the accretable yield over the life of the loan-backed security as determined at the acquisition or

transaction date,

• Continues to estimate cash flows expected to be collected at least quarterly, and

• Recognizes an other-than-temporary impairment loss if the loan-backed security is impaired (i.e., the fair value

is less than the amortized cost basis) and if the Company does not expect to recover the entire amortized cost

basis when compared to the present value of cash flows expected to be collected.

Investments are reduced to estimated fair value (discounted cash flows for loan-backed securities) for declines in

value that are determined to be other-than-temporary. In determining whether an other-than-temporary

impairment has occurred, the Company considers a security’s forecasted cash flows as well as the severity and

duration of depressed fair values.

If the Company intends to sell an impaired loan-backed security or does not have the intent and ability to retain

the impaired loan-backed security for a period of time sufficient to recover the amortized cost basis, an other-

than-temporary impairment has occurred. In these situations, the other-than-temporary impairment loss

recognized is the difference between the amortized cost basis and fair value. For loan-backed securities, the credit

portion of the recognized loss is recorded to the asset valuation reserve (“AVR”) and the non-credit portion is

recorded to the interest maintenance reserve (“IMR”). If the Company does not expect to recover the entire

amortized cost basis when compared to the present value of cash flows expected to be collected, it cannot assert

that it has the ability to recover the loan-backed security’s amortized cost basis even though it has no intent to sell

and has the intent and ability to retain the loan-backed security. Therefore, an other-than-temporary impairment

has occurred and a realized loss is recognized for the non-interest related decline, which is calculated as the

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.2

NOTES TO FINANCIAL STATEMENTS

has occurred and a realized loss is recognized for the non-interest related decline, which is calculated as the

difference between the loan-backed security’s amortized cost basis and the present value of cash flows expected

to be collected.

For situations where an other-than-temporary impairment is recognized, the previous amortized cost basis less

the other-than temporary impairment recognized as a realized loss becomes the new amortized cost basis of the

loan-backed security. The new amortized cost basis is not adjusted for subsequent recoveries in fair value.

Therefore, the prospective adjustment method is used for periods subsequent to other-than-temporary impairment

loss recognition.

D. Going Concern

There is not substantial doubt about the Company’s ability to continue as a going concern.

2. Accounting Changes and Corrections of Errors

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 2.

3. Business Combinations and Goodwill

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 3.

4. Discontinued Operations

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 4.

5. Investments

D. Loan Backed and Structured Securities

(1) Principal prepayment assumptions for loan-backed and structured securities are obtained from broker-dealers,

independent providers of broker-dealer estimates, or internal models.

(2) There were no loan-backed and structured securities with a recognized other-than-temporary impairment where the

Company has either the intent to sell the securities or lacks the ability or intent to retain the securities as of the

statement date.

(3) The following table details loan-backed and structured securities with a recognized other-than-temporary

impairment recorded in 2020 where the Company has the intent and ability to hold the securities for sufficient time

to recover the amortized cost:

(4) The following table summarizes loan-backed and structured securities in an unrealized loss position as of March

31, 2020:

Total <12 Months 12+ Months

Fair Valu e

2,515,593,272$ 2,476,560,744$ 39,032,528$

Unre alize d Loss

153,026,379$ 148,126,444$ 4,899,935$

The carrying value and fair value of all loan-backed and structured securities, regardless of whether the security is

in an unrealized loss position, was $6,166,569,499 and $6,154,877,022, respectively.

(5) The Company periodically reviews its debt securities and equities on a case-by-case basis to determine if any decline

in fair value to below amortized cost is other-than-temporary. Factors considered in determining whether a decline

is other-than-temporary include the length of time a security has been in an unrealized loss position, reasons for the

decline in value, expectations for the amount and timing of a recovery in value, and the Company’s intent and ability

not to sell a security prior to a recovery in fair value.

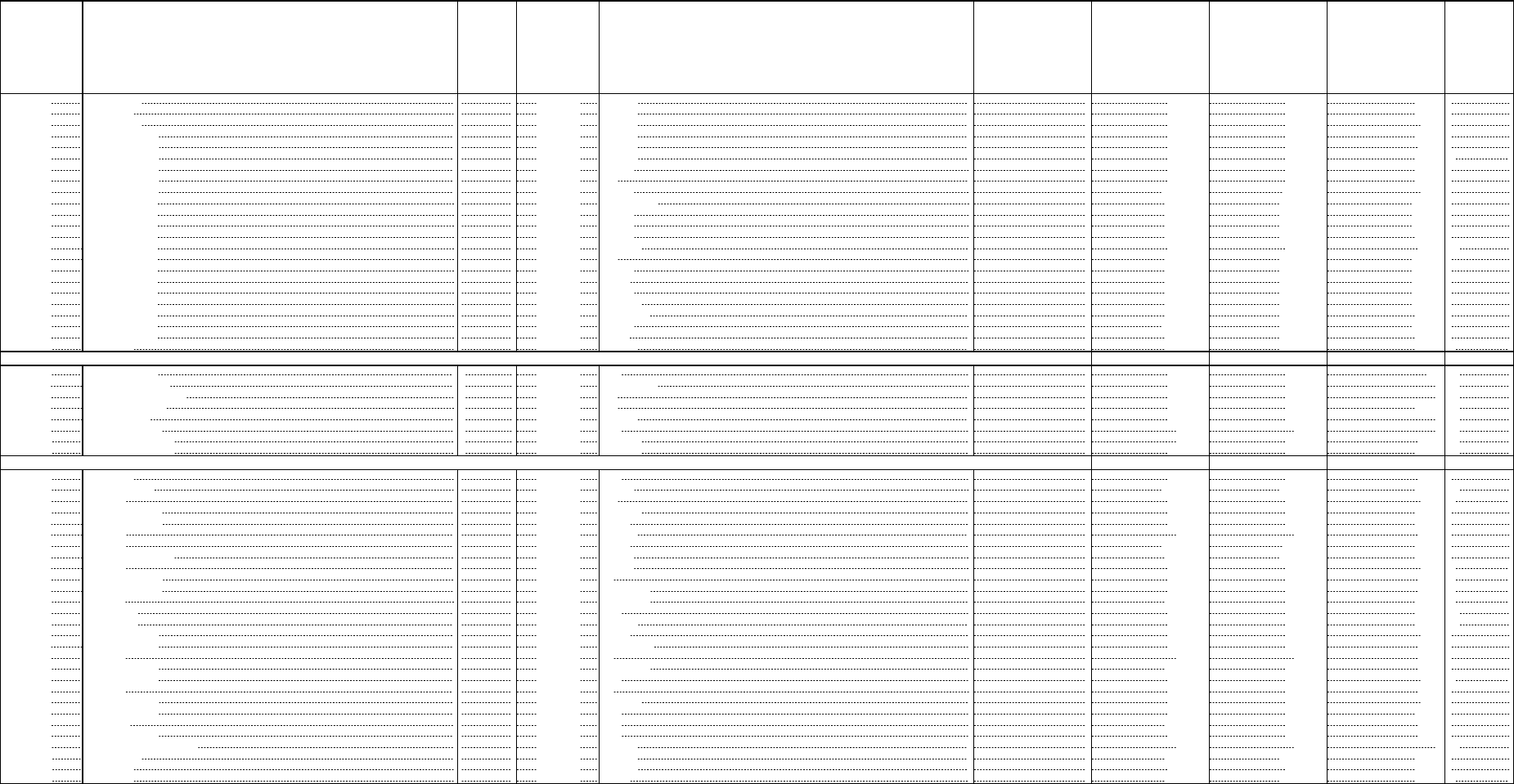

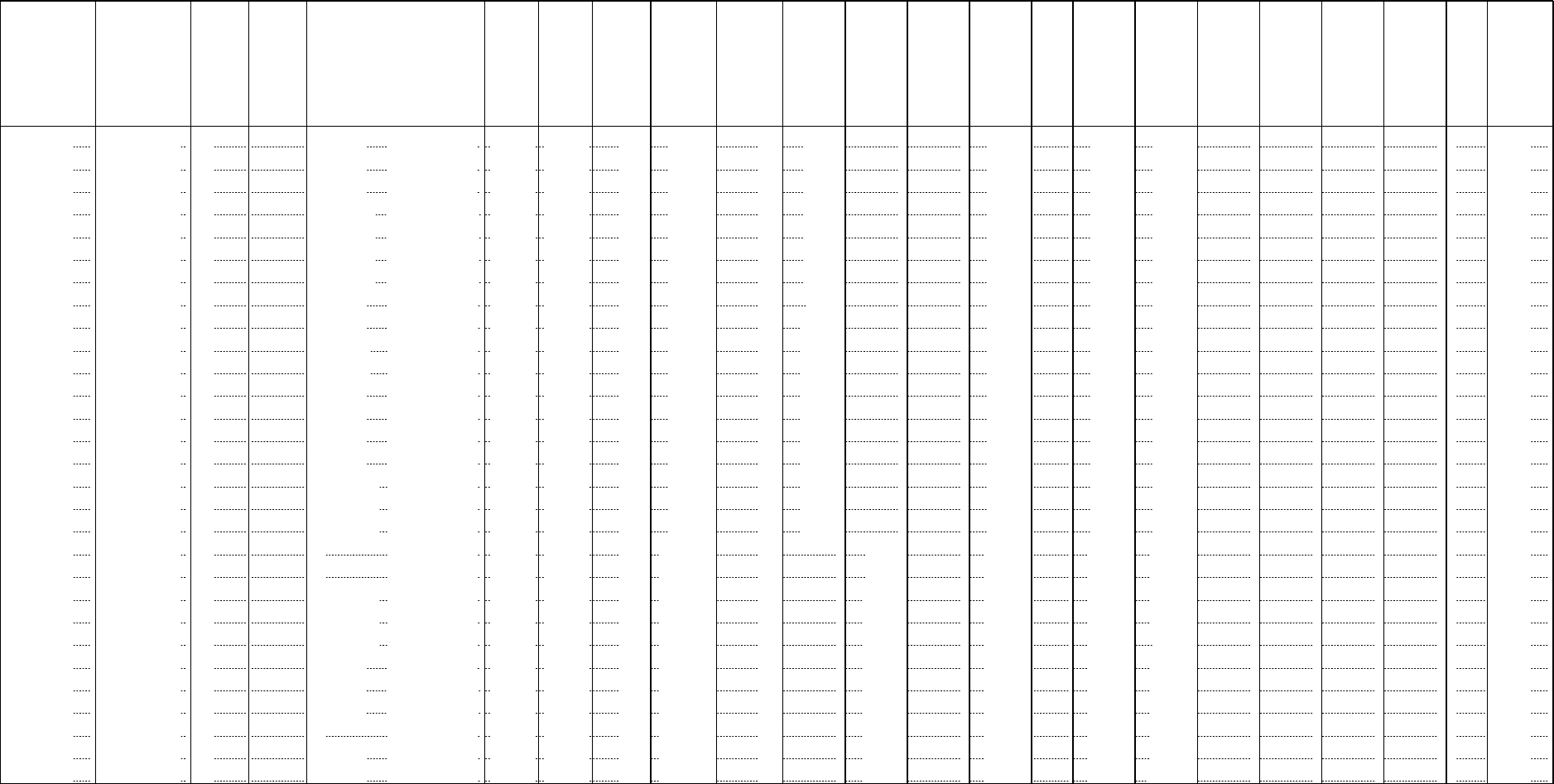

1 2 3 4 5 6 7

Book/Adj

Carrying Value Recognized Am ortized cost Financial

Am ortized cost other-than- after other-than Statement

before current Projected temporary tem porary Reporting

CUSIP period OTTI Cash Flow s impairm e nt impairm ent Fair Value Period

74959RAB2 10,823,285 5,807,259 5,016,026 5,807,259 4,585,480 Q1-2020

74959RAD8 14,075,110 7,091,803 6,983,307 7,091,803 5,874,120 Q1-2020

74959RAF3 11,253,718 6,067,443 5,186,276 6,067,443 5,031,890 Q1-2020

12669GYN5 1,973,959 1,858,915 115,044 1,858,915 1,859,690 Q1-2020

32051GWU5 2,626,420 2,594,334 32,086 2,594,334 2,571,574 Q1-2020

32055WAC0 790,757 779,868 10,889 779,868 721,991 Q1-2020

36185MEG3 5,126,260 4,898,348 227,913 4,898,348 5,104,179 Q1-2020

76111XZY2 3,126,886 3,056,574 70,312 3,056,574 3,099,064 Q1-2020

576434YS7 704,257 691,572 12,685 691,572 669,754 Q1-2020

05949A3H1 134,689 130,615 4,074 130,615 123,783 Q1-2020

000780GH3 433,261 404,511 28,750 404,511 404,285 Q1-2020

000780PR1 261,135 260,481 653 260,481 248,388 Q1-2020

617445CJ8 23,513 13,322 10,190 13,322 22,778 Q1-2020

Total 17,698,204

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.3

NOTES TO FINANCIAL STATEMENTS

Securities the Company determines are underperforming or potential problem securities are subject to regular

review. To facilitate this review, securities with significant declines in value or where other objective criteria

evidencing credit deterioration have been met, are included on a watch list. Among the criteria for securities to be

included on a watch list are: credit deterioration that has led to a significant decline in fair value of the security; a

significant covenant related to the security has been breached; or an issuer has filed or indicated a possibility of

filing for bankruptcy, has missed or announced it intends to miss a scheduled interest or principal payment, or has

experienced a specific material adverse change that may impair its creditworthiness.

In performing these reviews, the Company considers the relevant facts and circumstances relating to each

investment and exercises considerable judgment in determining whether a security is other-than-temporarily

impaired. Assessment factors include judgments about an obligor’s current and projected financial position, an

issuer’s current and projected ability to service and repay its debt obligations, the existence of, and realizable value

of, any collateral supporting the obligations, and the macro-economic and micro-economic outlooks for specific

industries and issuers. This assessment may also involve assumptions regarding underlying collateral such as

prepayment rates, default and recovery rates, and third-party servicing capabilities.

E. Dollar Repurchase Agreements and/or Securities Lending Transactions

(3) b. The aggregate fair value of all securities acquired from the sale, trade, or use of the accepted collateral (reinvested

collateral) was $26,650,492 and $48,063,148 as of March 31, 2020 and December 31, 2019, respectively.

F. Repurchase Agreements Transactions Accounted for as Secured Borrowing – Cash Taker

(1) The Company routinely enters into repurchase agreements whereby the Company agrees to sell and repurchase

securities. Repurchase agreements are accounted for as collateralized borrowings. Collateral securities sold under

such agreements continue to be included in invested assets. Proceeds received from the sale of securities subject

to repurchase agreements are included in liabilities.

(2) Type of Repo Trades Used

First Quarter

a. Bilateral Yes

b. Tri-Party No

(3) Original (Flow) & Residual Maturity

Firs t Quarter

a. Maximum Amount

1. Op en - No Maturity -$

2 . Overnig ht 2 75,655,0 2 5$

3 . 2 Days t o 1 Week 2 2 0 ,58 0 ,8 8 2$

4 . >1 Week to 1 M o nth -$

5. > 1 Mo nth to 3 M o nths -$

6 . > 3 M o nt hs to 1 Year -$

7. > 1 Year -$

b . End ing Balance

1. Op en - No Maturity -$

2 . Overnig ht -$

3 . 2 Days t o 1 Week -$

4 . >1 Week to 1 M o nth -$

5. > 1 Mo nth to 3 M o nths -$

6 . > 3 M o nt hs to 1 Year -$

7. > 1 Year -$

(4) The Company had no securities sold and/or acquired that resulted in default.

(5) Securities Sold Under Repo – Secured Borrowing

a. Maximum Amount

1. BACV XXX

2 . Nonad mit t ed - Sub s et o f BACV XXX

3 . Fair Value 4 0 0,6 4 8 ,158$

b . End ing Balance

1. BACV XXX

2 . Nonad mit t ed - Sub s et o f BACV XXX

3 . Fair Value -$

First Quart er

(6) Securities Sold Under Repo – Secured Borrowing by NAIC Designation

Ending Balance NAIC 1

a. Bonds - BACV -$

b. Bonds - FV -$

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.4

NOTES TO FINANCIAL STATEMENTS

(7) Collateral Received – Secured Borrowing

a. Maximum Amount

1. Cash 3 9 6 ,14 6 ,50 7$

2 . Securities (FV) -$

b . End ing Balance

1. Cash -$

2 . Securities (FV) -$

First Quarter

(8) Cash & Non-Cash Collateral Received – Secured Borrowing by NAIC Designation

Ending Balance NAIC 1

b. Bonds - FV -$

(9) Allocation of Aggregate Collateral by Remaining Contractual Maturity

Fair Value

a. Overnight and Continuous -$

b. 30 Days or Less -$

c. 31 to 90 Days -$

d. >90 Days -$

(10) Allocation of Aggregate Collateral Reinvested by Remaining Contractual Maturity

Amortized Cost Fair Value

a. 30 Days or Less -$ -$

b. 31 to 60 Days -$ -$

c. 61 to 90 Days -$ -$

d. 91 to 120 Days -$ -$

e. 121 to 180 Days -$ -$

f. 181 to 365 Days -$ -$

g. 1 to 2 Years -$ -$

h. 2 to 3 Years -$ -$

i. >3 Years -$ -$

(11) Liability to Return Collateral – Secured Borrowing (Total)

a. M aximum Amount

1. Cash (Collateral - All) 3 9 6 ,14 6 ,50 7$

2 . Securities Collateral (FV) -$

b . End ing Balance

1. Cash (Collateral - All) -$

2 . Securities Collateral (FV) -$

First Quart er

G. Reverse Repurchase Agreements Transactions Accounted for as Secured Borrowing

The Company does not have reverse repurchase agreements.

H. Repurchase Agreements Transactions Accounted for as a Sale

The Company did not have repurchase agreements accounted for as a sale during 2020 or 2019.

I. Reverse Repurchase Agreements Transactions Accounted for as a Sale

The Company does not have reverse repurchase agreements.

M. Working Capital Finance Investments

(2) The Company does not have working capital finance investments.

(3) The Company did not have any defaults on working capital finance investments.

N. Offsetting and Netting of Assets and Liabilities

The Company reports derivatives, repurchase agreements and securities lending assets and liabilities on a gross basis.

No other significant changes have occurred since 12/31/2019 that warrant disclosure in Note 5.

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.5

NOTES TO FINANCIAL STATEMENTS

6. Joint Ventures, Partnerships and Limited Liability Companies

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 6.

7. Investment Income

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 7.

8. Derivative Instruments

A. Derivatives under SSAP No. 86-Derivatives

(8) The Company does not have any future derivative premium payments due.

B. Derivatives under SSAP No. 108-Derivatives Hedging Variable Annuity Guarantees

The Company does not have any derivative hedging variable annuity guarantees.

No other significant changes have occurred since 12/31/2019 that warrant disclosure in Note 8.

9. Income Taxes

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 9.

10. Information Concerning Parent, Subsidiaries and Affiliates

During the first quarter of 2020, the Company received membership distributions from Jackson National Asset Management, LLC

of $134,500,000.

In 2019, the Company recorded a return of capital receivable of $25,000,000 from National Planning Holdings LLC, which was

settled in first quarter 2020.

No other significant changes have occurred since 12/31/2019 that warrant disclosure in Note 10.

11. Debt

B. Federal Home Loan Bank (“FHLB”) Agreements

(1) The Company is a member of the Federal Home Loan Bank of Indianapolis primarily for the purpose of participating

in the bank’s mortgage-collateralized loan advance program. Members are required to purchase and hold a minimum

amount of FHLB capital stock, plus additional stock based on outstanding advances. Advances are in the form of debt

or funding agreements issued to FHLB and held in the general account.

Short-term debt is generally used for liquidity and long-term debt is used to fund qualifying construction projects.

Debt is reported in borrowed money in the financial statements. Funding agreements are reported in liability for

deposit-type contracts in the financial statements. The Company calculated the maximum borrowing capacity in

accordance with current FHLB capital stock and limitations in the FHLB credit policy.

(2) FHLB Capital Stock

March 31, 2020 December 31, 2019

Membership Stock - Class A -$ -$

Membership Stock - Class B 27,866,900$ 27,866,900$

Activity Stock 61,068,100$ 74,759,300$

Excess Stock 36,457,100$ 22,765,900$

Aggregate Total 125,392,100$ 125,392,100$

Actual or Estimated Borrowing Capacity as

Determined by the Insurer 2,786,489,886$ 2,786,490,997$

Not Eligible Less 6 Months 1 to Less

Current Year for Than to Less Than Than 3 to 5

Total Redemption 6 Months 1 Year 3 Years Years

Class A -$ -$ -$ -$ -$ -$

Class B 27,866,900$ 27,866,900$ -$ -$ -$ -$

Membership

Stock

Eligible for Redemption

(3) Collateral Pledged to FHLB

Fair Value

March 31, 2020 2,840,103,697$ 2,845,239,571$ 1,976,332,108$

December 31, 2019 3,420,960,048$ 3,346,252,844$ 2,280,582,108$

Carrying Value

Aggregate Total

Borrowing

Total collateral pledged

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.6

NOTES TO FINANCIAL STATEMENTS

Maximum Amount Pledged during the Reporting Period

Fair Value

Period ended March 31, 2020 3,420,960,048$ 3,346,252,844$ 2,280,582,108$

Period ended December 31, 2019 4,151,803,357$ 4,165,411,933$ 2,732,371,581$

Aggregate Total

BorrowingCarrying Value

(4) Borrowing from FHLB

T otal Total

Debt

Short-term -$ XXX 300,000,000$ XXX

Long-term 73,092,108 XXX 77,342,108 XXX

Funding Agreements 1,903,240,000 1,903,240,000$ 1,903,240,000 1,903,240,000$

Aggregate T otal 1,976,332,108$ 1,903,240,000$ 2,280,582,108$ 1,903,240,000$

March 31, 2020

Funding Agreements

Reserves Established

December 31, 2019

Funding Agreements

Reserves Established

Maximum Amount Borrowed during the Reporting Period

2020

Debt 417,342,108$

Funding Agreements 1,903,240,000

Aggregate Total 2,320,582,108$

Does the company have prepayment obligations under the following arrangements?

Debt No

Funding Agreements Yes

12. Retirement Plans, Deferred Compensation, Postemployment Benefits and Compensated Absences and Other Postretirement Benefit

Plans

A. Defined Benefit Plan

The Company does not offer a defined benefit plan.

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 12.

13. Capital and Surplus, Shareholders' Dividend Restrictions and Quasi-Reorganizations

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 13.

14. Liabilities, Contingencies and Assessments

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 14.

15. Leases

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 15.

16. Information about Financial Instruments with Off-Balance Sheet Risk and Financial Instruments with Concentrations of Credit Risk

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 16.

17. Sale, Transfer and Servicing of Financial Assets and Extinguishments of Liabilities

B(2)b. The Company does not have servicing assets or liabilities.

B(4)a. Not applicable.

B(4)b. Not applicable.

C. Wash Sales - No reportable wash sales have occurred during the year.

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 17.

18. Gain or Loss to the Reporting Entity from Uninsured A&H Plans and the Uninsured Portion of Partially Insured Plans

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 18.

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.7

NOTES TO FINANCIAL STATEMENTS

19. Direct Premium Written/Produced by Managing General Agents/Third Party Administrators

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 19.

20. Fair Value Measurements

A. (1) Fair Value Measurements at Reporting Date

Net As s et Va lue

Des c riptio n Le vel 1 Leve l 2 Leve l 3 (NAV) To ta l

As s e ts at fa ir value :

Co m m o n s to c k 218,179,583$ 27,495,919$ 1,129,918$ -$ 246,805,420$

Othe r inve s te d as s e ts - - 1,070,000 1,427,775,364 1,428,845,364

Deriva tive s - 5,776,308,321 - - 5,776,308,321

Se pa ra te acco unt a s s ets - 146,117,106,803 - - 146,117,106,803

To ta l a s s ets at fair value/NAV 218,179,583$ 151,920,911,043$ 2,199,918$ 1,427,775,364$ 153,569,065,908$

Liabilities at fair value:

Deriva tive s -$ (23,821,111)$ -$ -$ (23,821,111)$

(2) Financial Assets Measured at Fair Value Using Significant Unobservable Inputs (Level 3):

To tal gains To tal ga ins

Balanc e Tra ns fe rs Tra ns fers a nd (lo s s es ) and (lo s s e s ) B a lanc e

at in o ut inc luded in include d in at

De s c riptio n 12/31/2019 Leve l 3 Leve l 3 Ne t Inco m e S urplus P urc ha s e s Is s uanc e s S a les Settlements 3/31/2020

Co m m o n s to c k 10,869,953$ -$ (110,906)$ (9,700,000)$ 70,871$ -$ -$ -$ -$ 1,129,918$

Othe r inve s ted as s e ts 1,070,000 - - - - - - - - 1,070,000

To tal 11,939,953$ -$ (110,906)$ (9,700,000)$ 70,871$ -$ -$ -$ -$ 2,199,918$

(3) The Company’s policy for determining and disclosing transfers between levels is to recognize transfers using

beginning-of-year balances.

(4) Bonds and Equity Securities

The fair values for bonds and equity securities are determined by management using information available from

independent pricing services, broker-dealer quotes, or internally derived estimates. Priority is given to publicly available

prices from independent sources, when available. Securities for which the independent pricing service does not provide a

quotation are either submitted to independent broker-dealers for prices or priced internally. Typical inputs used by these

three pricing methods include, but are not limited to, reported trades, benchmark yields, credit spreads, liquidity premiums,

and/or estimated cash flows based on default and prepayment assumptions.

As a result of typical trading volumes and the lack of specific quoted market prices for most bonds, independent pricing

services will normally derive the security prices through recently reported trades for identical or similar securities, making

adjustments through the reporting date based upon available market observable information as outlined above. If there are

no recently reported trades, the independent pricing services and brokers may use matrix or pricing model processes to

develop a security price where future cash flow expectations are developed based upon collateral performance and

discounted at relevant market rates. Certain securities are priced using broker-dealer quotes, which may utilize proprietary

inputs and models. Additionally, the majority of these quotes are non-binding.

Included in the pricing of asset-backed securities are estimates of the rate of future prepayments of principal over the

remaining life of the securities. Such estimates are derived based on the characteristics of the underlying structure and

prepayment assumptions believed to be relevant for the underlying collateral. Actual prepayment experience may vary

from these estimates.

Internally derived estimates may be used to develop a fair value for securities for which the Company is unable to obtain

either a reliable price from an independent pricing service or a suitable broker-dealer quote. These estimates may

incorporate Level 2 and Level 3 inputs and are generally derived using expected future cash flows, discounted at market

interest rates available from market sources based on the credit quality and duration of the instrument to determine fair

value. For securities that may not be reliably priced using these internally developed pricing models, a fair value may be

estimated using indicative market prices. These prices are indicative of an exit price, but the assumptions used to establish

the fair value may not be observable or corroborated by market observable information and, therefore, are considered to

be Level 3 inputs.

The Company performs a monthly analysis on the prices and credit spreads received from third parties to ensure that the

prices represent a reasonable estimate of the fair value. This process involves quantitative and qualitative analysis and is

overseen by investment and accounting professionals. Examples of procedures performed include, but are not limited to,

initial and on-going review of third party pricing service methodologies, review of pricing statistics and trends, back testing

recent trades and monitoring of trading volumes. In addition, the Company considers whether prices received from

independent brokers represent a reasonable estimate of fair value through the use of internal and external cash flow models,

which are developed based on spreads and, when available, market indices. As a result of this analysis, if the Company

determines there is a more appropriate fair value based upon the available market data, the price received from the third

party may be adjusted accordingly.

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.8

NOTES TO FINANCIAL STATEMENTS

For those securities that were internally valued at March 31, 2020 and December 31, 2019, an internally developed model

was used to determine the fair value. The pricing model used by the Company utilizes current spread levels of similarly

rated securities to determine the market discount rate for the security. Furthermore, appropriate risk premiums for

illiquidity and non-performance are incorporated in the discount rate. Cash flows, as estimated by the Company using

issuer-specific default statistics and prepayment assumptions, are discounted to determine an estimated fair value.

On an ongoing basis, the Company reviews the independent pricing services’ valuation methodologies and related inputs,

and evaluates the various types of securities in its investment portfolio to determine an appropriate fair value hierarchy

distribution based upon trading activity and the observability of market inputs. Based on the results of this evaluation, each

price is classified into Level 1, 2, or 3. Most prices provided by independent pricing services, including broker quotes, are

classified into Level 2 due to their use of market observable inputs.

Other Invested Assets

Other invested assets include investments in limited partnerships and real estate. In most cases, fair value for limited

partnerships is determined by using the proportion of Jackson’s investment in each fund (NAV equivalent) as a practical

expedient for fair value. No adjustments to these amounts were deemed necessary at March 31, 2020. As a result of using

the net asset value per share practical expedient, these investments are not classified in the fair value hierarchy.

In cases when the Company expects to sell the limited partnership, the estimated sales price is used to determine the

fair value. These limited partnerships are classified as Level 2 in the fair value hierarchy.

In cases when a limited partnership’s financial statements are unavailable and a NAV equivalent is not available or

practical, an internally developed model was used to determine fair value for that fund. These investments are

classified as Level 3 in the fair value hierarchy.

Derivative Instruments

Fair value of derivative instruments reflects the estimated amounts, net of payment accruals, which the Company would

receive or pay upon sale or termination of the contracts at the reporting date. Derivatives priced using valuation models

incorporate inputs that are predominantly observable in the market. Inputs used to value derivatives include, but are not

limited to, interest rate swap curves, credit spreads, interest rates, counterparty credit risk, equity volatility and equity index

levels.

Derivative instruments classified as Level 1 include futures, which are traded on active exchanges.

Derivative instruments classified as Level 2 include interest rate swaps, cross currency swaps, credit default swaps, put

swaptions and equity index call and put options. These derivative valuations are determined using pricing models with

inputs that are observable in the market or can be derived principally from, or corroborated by, observable market data.

Derivative instruments classified as Level 3 include interest rate contingent options that are valued by third-party pricing

services utilizing significant unobservable inputs.

Fair Values of Separate Account Assets and Liabilities

Separate account assets are invested in mutual funds, which are categorized as Level 2 assets. The value of separate

account liabilities are set equal to the value of separate account assets.

B. The Company provides additional fair value information in Note 5.

C. The following tables detail the aggregate fair value of the Company’s financial instruments:

Ag g reg ate Ad mitted Net As s et

Des criptio n Fair Value Value Level 1 Level 2 Level 3 Value (NAV)

As s ets :

Bo nd s 58 ,557,2 30,852$ 54,959,671,3 3 1$ 7,59 3 ,4 0 3,6 71$ 50 ,9 6 3 ,827,152$ 29$ -$

Preferred s tock 973,750 - - - 9 73,750 -

Co mmon s t o ck 24 6 ,8 0 5,4 2 0 2 4 6 ,8 0 5,4 2 0 218 ,179 ,58 3 2 7,4 9 5,9 19 1,12 9 ,9 18 -

Mortgag e lo ans 9 ,8 6 4 ,4 71,79 1 9 ,926,650,4 3 7 - - 9,86 4 ,4 71,79 1 -

Cas h and cas h eq uivalents 10 ,8 6 4 ,768,413 10 ,8 6 4 ,76 8 ,4 13 10 ,8 6 4 ,76 8,413 - - -

Po licy loans 4 ,53 7,9 58 ,3 9 0 4 ,53 7,9 58,390 - - 4 ,53 7,9 58 ,3 9 0 -

Derivatives 5,776 ,3 08,32 1 5,776 ,3 0 8 ,321 - 5,776,308,3 2 1 - -

Ot her invested as sets 1,4 2 8 ,8 4 5,3 6 4 1,4 2 8 ,8 4 5,364 - - 1,0 70,000 1,4 2 7,775,3 6 4

Securities lend ing asset s 26,650,4 9 2 2 6 ,6 50 ,4 9 2 26,650,4 9 2 - - -

Sep arate acco unt as sets 14 6 ,117,10 6 ,8 0 3 14 6 ,117,10 6 ,8 0 3 - 14 6 ,117,10 6 ,803 - -

To tal assets at fair value/ NAV 2 3 7,4 2 1,119,596$ 23 3 ,8 8 4 ,76 4,971$ 18 ,70 3 ,002,159$ 20 2 ,8 8 4 ,73 8 ,195$ 14 ,4 0 5,6 0 3,878$ 1,4 27,775,364$

Liab ilities :

Res erves fo r life insurance

and annuities (1) 57,8 6 9 ,4 14 ,557$ 52 ,6 3 3 ,0 76 ,10 1$ -$ 1,173 ,118 ,209$ 56,696,296,3 4 8$ -$

Liab ility fo r d ep o sit-t yp e co ntract s 13,977,3 80,326 13 ,74 1,79 6,13 6 - - 13 ,9 77,3 8 0 ,3 2 6 -

Fund s held und er reinsurance treat ies 4 ,0 6 7,18 3 ,0 8 6 4 ,0 58 ,459 ,021 - - 4 ,0 6 7,18 3 ,0 8 6 -

Payab le fo r s ecurities lending 2 6 ,6 50,492 2 6 ,6 50 ,4 9 2 - 2 6,650 ,492 - -

Sep arate acco unt liabilities 14 6 ,117,10 6 ,8 0 3 14 6 ,117,10 6 ,8 0 3 - 14 6 ,117,10 6 ,803 - -

Derivatives (2 3 ,8 2 1,111) (2 3 ,8 2 1,111) - (2 3 ,8 2 1,111) - -

Deb t 73,14 1,152 73,14 1,152 - 73 ,14 1,152 - -

To tal liab ilities at fair value 22 2 ,10 7,055,305$ 2 16 ,6 2 6 ,4 0 8,594$ -$ 14 7,366,19 5,54 5$ 74,740,859 ,76 0$ -$

(1) Annuity res erves rep res ent o nly the co mp o nents o f d ep o sits o n invest ment co nt racts that are co ns idered to be financial inst ruments.

March 3 1, 2 0 20

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.9

NOTES TO FINANCIAL STATEMENTS

Ag g reg at e Ad mitted Net As s et

Des crip tio n Fair Value Value Level 1 Level 2 Level 3 Value (NAV)

As s ets at fair value:

Bo nd s 55,76 2 ,3 52 ,4 8 1$ 51,622,738,742$ 6 ,0 76 ,6 6 8 ,53 7$ 49 ,6 8 5,6 8 3 ,8 60$ 8 4$ -$

Preferred s tock 973 ,750 - - - 973,750 -

Co mmon s t o ck 2 72 ,10 2 ,535 2 72 ,10 2 ,535 2 2 6 ,58 2 ,2 0 2 3 4 ,6 50 ,3 8 0 10 ,8 6 9 ,9 53 -

Co mmercial mo rtg ag es 10 ,2 3 2 ,0 9 1,557 9 ,9 12 ,4 4 7,248 - - 10 ,2 32 ,0 9 1,557 -

Cas h and cas h eq uivalent s 1,16 0 ,8 4 9 ,2 0 3 1,16 0 ,8 4 9 ,2 0 3 1,160 ,8 49 ,20 3 - - -

Po licy loans 4,578 ,6 52 ,8 3 8 4 ,578 ,6 52 ,8 3 8 - - 4 ,578 ,6 52,838 -

Derivative instrument s 1,4 4 6 ,74 0 ,4 0 8 1,4 4 6 ,74 0 ,4 0 8 - 1,4 46 ,74 0,4 0 8 - -

Other inves ted as s ets 1,3 79 ,4 3 5,8 76 1,3 79 ,4 3 5,8 76 - 18 0,9 40 1,0 70 ,0 0 0 1,3 78 ,18 4 ,9 3 6

Securities lend ing asset s 4 8 ,0 6 3 ,14 8 4 8 ,0 6 3 ,14 8 48,0 63 ,14 8 - - -

Sep arate acco unt as set s 18 1,581,3 58 ,2 53 18 1,58 1,3 58 ,2 53 - 18 1,58 1,3 58 ,2 53 - -

To tal as set s at fair value/ NAV 2 56 ,4 6 2 ,6 2 0 ,0 4 9$ 2 52 ,0 0 2 ,3 8 8 ,2 51$ 7,512 ,16 3 ,0 9 0$ 232,748,613 ,8 4 1$ 14 ,8 23,6 58,18 2$ 1,3 78 ,18 4 ,9 3 6$

Liab ilities at fair value:

Res erves fo r life insurance

and annuities (1) 52 ,0 4 7,59 9 ,3 56$ 4 0 ,3 3 7,8 54 ,13 8$ -$ 1,3 8 1,53 3 ,8 9 9$ 50 ,6 66 ,065,4 57$ -$

Liab ility fo r d ep o s it-t yp e co ntract s

13 ,2 4 3 ,153 ,4 2 3 13 ,0 9 2 ,2 0 0 ,3 15 - - 13 ,2 4 3 ,153 ,4 2 3 -

Fund s held under reinsurance treaties

4,0 53 ,98 4 ,69 2 4,0 4 7,511,74 1 - - 4 ,0 53 ,9 8 4 ,6 9 2 -

Securities lend ing liab ilities 48,063,14 8 4 8 ,0 6 3 ,14 8 - 48,06 3,14 8 - -

Sep arate acco unt liab ilities 18 1,58 1,3 58 ,2 53 18 1,58 1,358 ,2 53 - 18 1,58 1,3 58 ,2 53 - -

Derivative instrument s (15,3 6 4 ,4 17) (15,3 6 4 ,4 17) - (15,3 64 ,417) - -

Deb t 3 77,54 8 ,3 2 8 3 77,54 8 ,3 2 8 - 3 77,54 8 ,3 28 - -

To tal liab ilities at fair value 2 51,3 3 6 ,3 4 2 ,78 3$ 2 3 9 ,4 6 9 ,171,50 6$ -$ 18 3 ,3 73 ,13 9 ,2 11$ 6 7,9 6 3 ,2 0 3 ,572$ -$

December 3 1, 2 0 19

D. At March 31, 2020 and December 31, 2019, the Company had no financial instruments for which it was not practicable to

estimate fair value.

21. Other Items

As a result of the spread of the COVID-19 coronavirus, economic uncertainties have arisen which are likely to impact the

Company’s capital position. As the economic uncertainties are on-going, the potential impact continues to vary and is unknown at

this time. The Company has implemented business continuity plans that were already in place to ensure the availability of services

for our customers, work at home capabilities for our staff, where appropriate, and other ongoing risk management activities related

to the current ongoing market stress.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act, “the CARES Act”, was signed into legislation. Some

of the significant changes include reducing the interest expense disallowance for 2019 and 2020, allowing the five year carryback

of net operating losses for 2018-2020, suspension of the 80% limitation of taxable income for net operating loss carryforwards for

2018-2020, and the acceleration of depreciation expense from 2018 and forward on qualified improvement property. The Company

is required to recognize the effect on the financial statements in the period the law was enacted. As of March 31, 2020, the impact

of the CARES Act on the Company’s financial position was a net increase to capital and surplus of $558,365,949 and is highly

dependent on final year end results.

In its year-end 2019 regulatory filing, Jackson noted that it elected early adoption of the changes to the valuation requirements for

variable annuities. As was noted, the Company continues to remain within its existing risk appetite.

In addition to the capital impact due to the CARES Act, as noted above, total available capital increased over the period as a result

of positive hedge payoffs and favorable changes in US corporate tax exceeding market-related increases in policyholder liabilities.

This was offset by higher required capital reflecting the combination of equity market falls and interest rate falls increasing the cost

of guarantees disproportionately in the tail scenarios. Operational capital generation remains in line with our expectations.

On March 11, 2020, the Company’s ultimate parent Prudential announced that they have commenced preparations for a minority

Initial Public Offering of its US business operations.

At March 31, 2020, the Company included $281,078,171 of miscellaneous group annuity reserves initially established by John

Hancock and John Hancock of New York on closed blocks of group payout annuities, which the Company assumes. The additional

reserves are in excess of those required under minimum statutory standards.

No other significant changes have occurred since 12/31/2019 that warrant disclosure in Note 21.

22. Events Subsequent

The Company is not aware of any events occurring subsequent to the balance sheet date which require disclosure to keep the

financial statements from being misleading or that may have a material effect on the financial condition of the Company.

23. Reinsurance

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 23.

24. Retrospectively Rated Contracts & Contracts Subject to Redetermination

The Company does not issue health insurance, and therefore, does not have premium subject to the risk sharing provisions of the

Affordable Care Act.

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 24.

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

7.10

NOTES TO FINANCIAL STATEMENTS

25. Change in Incurred Losses and Loss Adjustment Expenses

The Company does not have incurred losses or loss adjustment expenses that require disclosure in Note 25.

26. Intercompany Pooling Arrangements

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 26.

27. Structured Settlements

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 27.

28. Health Care Receivables

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 28.

29. Participating Policies

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 29.

30. Premium Deficiency Reserves

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 30.

31. Reserves for Life Contracts and Annuity Contracts

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 31.

32. Analysis of Annuity Actuarial Reserves and Deposit Type Contract Liabilities by Withdrawal Characteristics

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 32.

33. Analysis of Life Actuarial Reserves by Withdrawal Characteristics

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 33.

34. Premium and Annuity Considerations Deferred and Uncollected

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 34.

35. Separate Accounts

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 35.

36. Loss/Claim Adjustment Expenses

Significant changes have not occurred since 12/31/2019 that warrant disclosure in Note 36.

STATEMENT AS OF MARCH 31, 2020 OF THE JACKSON NATIONAL LIFE INSURANCE COMPANY

GENERAL INTERROGATORIES

PART 1 - COMMON INTERROGATORIES

GENERAL

1.1 Did the reporting entity experience any material transactions requiring the filing of Disclosure of Material Transactions with the State of

Domicile, as required by the Model Act?

Yes [ ] No [ X ]

1.2 If yes, has the report been filed with the domiciliary state?

Yes [ ] No [ ]

2.1 Has any change been made during the year of this statement in the charter, by-laws, articles of incorporation, or deed of settlement of the

reporting entity?

Yes [ ] No [ X ]

2.2 If yes, date of change:

3.1 Is the reporting entity a member of an Insurance Holding Company System consisting of two or more affiliated persons, one or more of which

is an insurer?

Yes [ X ] No [ ]

If yes, complete Schedule Y, Parts 1 and 1A.

3.2 Have there been any substantial changes in the organizational chart since the prior quarter end?

Yes [ ] No [ X ]

3.3 If the response to 3.2 is yes, provide a brief description of those changes.

3.4 Is the reporting entity publicly traded or a member of a publicly traded group?

Yes [ X ] No [ ]

3.5 If the response to 3.4 is yes, provide the CIK (Central Index Key) code issued by the SEC for the entity/group.

0001116578