P a g e 1 | 42

REQUEST FOR PROPOSAL (RFP)

FOR ENGAGEMENT OF CORPORATE

BUSINESS CORRESPONDENT

FOR PROVIDING FINANCIAL INCLUSION

BANKING SERVICES

P a g e 2 | 42

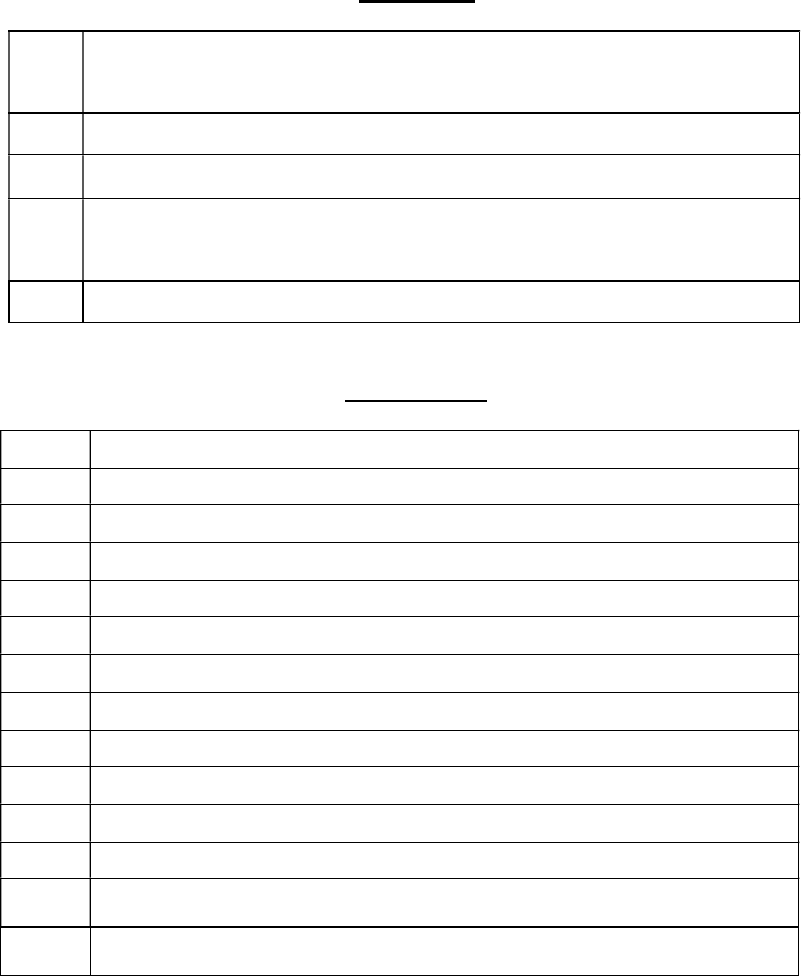

BID DETAILS IN BRIEF

Sl.

No.

Description Details

1. RFP No. and Date

RFP

No.

TNGB / FI / 01 /2021

-

22

2.

Brief Description of the RFP

Request for proposal for engagement of

Corporate Business Correspondent

A

gency

3.

Bank’s Address for Communication

and Submission of Tender

Financial Inclusion Department,

Tamil Nadu Grama Bank Head office

Annex, 27/1, Thirunagar, Yercaud

Main

Road, Hasthampatti, Salem-636007

Email : [email protected]

4. Date of Issue 04.06.2021

5.

Last Date of Submission of Queries

14.06.2021

6.

Last Date of Submission of Bids 28.06.2021 upto 11.00AM

7.

Date

and

time

of

Opening

of

Part

A

-

Technical

Bid.

28.06.2021 upto 11.30AM

8.

Date

and

time

opening

of

Part

-

B

Commercial Bid

Will be intimated at a later date.

9. Application Fees (Not Refundable) Rs.11,800/-

(Rs 10,000/- Application Fee Plus

18%GST )

10. Earnest Money Deposit(Refundable)

Rs.10,00,000/- (Rupees Ten Lakhs only)

This document can be downloaded from Bank’s website www.tamilnadugramabank.co.in In

that event, the bidders should pay the Application Fee for tender document by means of DD

drawn on any scheduled commercial Bank for the above amount in favour of Tamil Nadu

Grama Bank, payable at Salem and submit the same along with the Bid document.

P a g e 3 | 42

DISCLAIMER

The information contained in this Request for Proposal (“RFP”) document or

information provided subsequently to bidders or applicants whether verbally or in

documentary form by or on behalf of Tamil Nadu Grama Bank (or Bank), is provided

to the bidder(s) on the terms and conditions set out in this RFP document and all other

terms and conditions subject to which such information is provided. This RFP

document is not an agreement and is not an offer or invitation by Tamil Nadu Grama

Bank to any parties other than the applicants who are qualified to submit the bids

(hereinafter individually and collectively referred to as “Bidder” or “Bidders”

respectively). The purpose of this RFP is to provide the Bidders with information to

assist the formulation of their proposals. This RFP does not claim to contain all the

information each Bidder requires. Each Bidder may conduct its own independent

investigations and analysis and is free to check the accuracy, reliability and

completeness of the information in this RFP. Tamil Nadu Grama Bank makes no

representation or warranty and shall incur no liability under any law, statute, rules or

regulations as to the accuracy, reliability or completeness of this RFP. The information

contained in the RFP document is selective and is subject to updating, expansion,

revision and amendment. It does not purport to contain all the information that a Bidder

requires. Tamil Nadu Grama Bank does not undertake to provide any Bidder with

access to any additional information or to update the information in the RFP document

or to correct any inaccuracies therein, which may become apparent.

Tamil Nadu Grama Bank reserves the right of discretion to change, modify, add to or

alter any or all of the provisions of this RFP and/or the bidding process, without

assigning any reasons whatsoever. Such change will be published on the Bank's

Website www.tamilnadugrmabank,co.in and it will become part and parcel of RFP.

Tamil Nadu Grama Bank in its absolute discretion, but without being under any

obligation to do so, update, amend or supplement the information in this RFP. Tamil

Nadu Grama Bank reserves the right to reject any or all the Request for Proposals

received in response to this RFP document at any stage without assigning any reason

whatsoever. The decision of Tamil Nadu Grama Bank shall be final, conclusive and

binding on all the parties.

P a g e 4 | 42

Contents

1. ABOUT TAMIL NADU GRAMA BANK:............................................................................................... 8

2. ABOUT THE RFP: .............................................................................................................................. 8

3. DEFINITIONS: ..................................................................................................................................... 8

4. PRE-QUALIFICATION/ELIGIBILITY CRITERIA FOR BIDDERS: ..................................................... 9

5. REQUIREMENT DETAILS: .............................................................................................................. 11

6. RESPONSIBILITIES OF THE BIDDER: ........................................................................................... 12

7. COMPLIANCE REQUIREMENTS: ................................................................................................. 13

8. TECHNICAL DELIVERABLES: ...................................................................................................... 15

9. SCOPE OF BASIC BANKING PRODUCTS & SERVICES TO BE OFFERED: .............................. 15

10. FUNCTIONAL REQUIREMENTS: .................................................................................................... 15

11. ENROLLMENT OF CUSTOMERS: .................................................................................................. 16

12. ACCOUNT OPENING/PRODUCT REGISTRATION AND ACTIVATION: ...................................... 16

13. ELIGIBLE ENTITIES AND GENERAL GUIDELINES: ..................................................................... 18

14. REMITTANCE SERVICES: .............................................................................................................. 18

15. OTHER PRODUCTS AND SERVICES: ........................................................................................... 18

16. STANDARD OPERATING PROCEDURE (SOP) FOR BC:............................................................. 18

17. MANAGEMENT INFORMATION SYSTEM: ..................................................................................... 18

18. REVIEW AND MONITORING MECHANISM: .................................................................................. 18

19. BID PROCESS: ................................................................................................................................ 19

20. AMENDMENT TO BIDDING DOCUMENT: ...................................................................................... 19

21. BID SYSTEM OFFER: ...................................................................................................................... 19

22. PREPARATION OF BIDS: ................................................................................................................ 20

23. PART A- TECHNICAL PROPOSAL: ................................................................................................ 20

24. PART B-COMMERCIAL BID (INDICATIVE): ................................................................................... 21

25. APPLICATION MONEY: ................................................................................................................... 22

26. EARNEST MONEY DEPOSIT (EMD): ............................................................................................. 22

27. DOCUMENTATION: ......................................................................................................................... 22

28. COSTS & CURRENCY: .................................................................................................................... 22

29. ERASURES OR ALTERATIONS: ..................................................................................................... 23

30. ASSUMPTIONS/PRESUMPTIONS/MODIFICATIONS: ................................................................... 23

31. SUBMISSION OF BIDS: ................................................................................................................... 23

32. BID OPENING: .................................................................................................................................. 23

33. SELECTION OF BIDDER ................................................................................................................. 24

34. VALIDITY OF BIDS: .......................................................................................................................... 26

35. BANK’ S RIGHT TO ACCEPT ANY BID AND TO REJECT ANY OR ALL BIDS: ........................... 26

36. PERFORMANCE GUARANTEE: .................................................................................................... 27

37. AWARDING OF CONTRACT: .......................................................................................................... 27

38. REPRESENTATIONS AND WARRANTIES:.................................................................................... 28

P a g e 5 | 42

39. COMPLIANCE WITH LAWS: ............................................................................................................ 29

40. CANCELLATION OF THE ORDER AND TERMINATION OF CONTRACT: .................................. 30

41. INDEMNITY: ...................................................................................................................................... 30

42. INSPECTION OF RECORDS: .......................................................................................................... 31

43. ASSIGNMENT: .................................................................................................................................. 31

44. PUBLICITY: ....................................................................................................................................... 32

45. INSURANCE: .................................................................................................................................... 32

46. CONFIDENTIALITY AND NON-DISCLOSURE ............................................................................... 32

47. CORRUPT AND FRAUDULENT PRACTICES ................................................................................ 32

48. MODIFICATION/CANCELLATION OF RFP: ................................................................................. 33

49. HUMAN RESOURCE REQUIREMENT: .......................................................................................... 33

50. LEGAL DISPUTES AND JURISDICTION OF THE COURT: ........................................................... 34

51. SERVICE AGREEMENT AND PENALTIES: ............................................................................... 35

52. TIME SCHEDULE: ............................................................................................................................ 36

53. PERIOD OF CONTRACT: ................................................................................................................ 37

54. REVIEW OF SERVICES: .................................................................................................................. 37

55. PAYMENT TERMS: .......................................................................................................................... 38

56. FORCE MAJEURE: .......................................................................................................................... 38

57. COMPLIANCE WITH STATUTORY AND REGULATORY PROVISIONS: ..................................... 39

58. SOCIAL MEDIA POLICY: ................................................................................................................. 39

59. TAXES AND DUTIES: ....................................................................................................................... 39

60. TERMS AND CONDITIONS FOR THE PROPOSAL: ...................................................................... 40

61. CERTIFICATE BY THE BIDDER: ..................................................................................................... 41

62. LIABILITIES OF THE BANK: ............................................................................................................ 42

63. PROPOSAL FORMAT: ..................................................................................................................... 42

64. OWNERSHIP: ................................................................................................................................... 42

P a g e 6 | 42

APPENDIX

I

Number of locations Region wise to be covered by the

business correspondent in Tamil Nadu

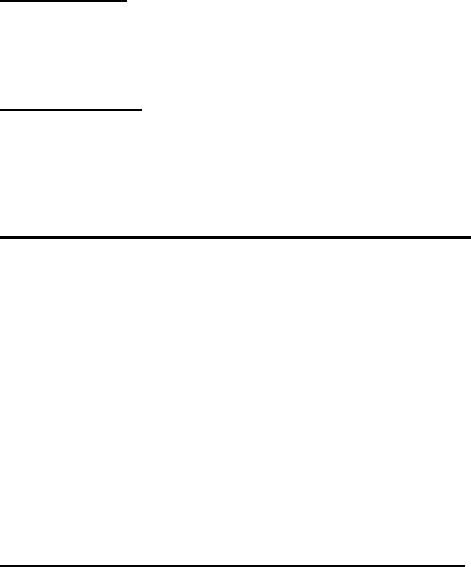

II Role of Service Provider / Bank

III Scope of basic banking products and services to be offered

IV

Entities eligible to be appointed as BC/BCA and general guidelines

to be followed by BC while appointing BCA

V

Standard operating procedure for BC

ANNEXURES

I

Bidders profile

II Profile of BC proposed for the Project

III Agencies to whom FI solutions have been offered

IV Financial position of the bidder

V

Confirmation of soft copy

VI Bidder’s undertaking letter

VII Compliance statement

VIII Technical Evaluation Criteria

IX

Commercial bid – Undertaking letter

X

Commercial Bid – Indicative Price Bid

XI

Authorization letter format

XII Proforma of bank guarantee for contract performance

XIII

Format for sending pre-bid queries

XIV Non-disclosure agreement

P a g e 7 | 42

ABBREVIATIO NS USED IN THE DOCUMENTS

BIDDER* BIDDER- SERVICE PROVIDER(SP) – VENDOR- CORPORATE BC- BC

BC BUSINESS CORRESPONDENT

BCA BUSINESS CORRESPONDENT AGENT

BCO BUSINESS CORRESPONDENT OUTLET – HYBRID (BOTH KIOSK AND MOBILE)

CBS CORE BANKING SYSTEM

CSP CUSTOMER SERVICE PROVIDER

DBT DIRECT BENEFIT TRANSFER

DFS DEPARTMENT OF FINANCIAL SERVICES

EBT ELECTRONIC BENEFIT TRANSFER

EMD EARNEST MONEY DEPOSIT

FI FINANCIAL INCLUSION

GOI GOVERNMENT OF INDIA

IBA INDIAN BANKS’ ASSOCIATION

ICT INFORMATION AND COMMUNICATION TECHNOLOGY

IDRBT

INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING

TECHNOLOGY

ITIL

INFORMATION TECHNOLOGY INFRASTRUCTURE LIBRARY

KYC KNOW YOUR CUSTOMER

MIS MANAGEMENT INFORMATION SYSTEM

NABARD NATIONAL BANK FOR AGRICULATURE AND RURAL DEVELOPMENT

NBFC

NON-BANKING FINANCIAL COMPANY

NGO NON-GOVERNMENT ORGANISATION

NPA NON PERFORMING ASSETS

NPCI NATIONAL PAYMENT CORPORATION OF INDIA

NREGP NATIONAL RURAL EMPLOYMENT GENERATION PROGRAMME

RBI RESERVE BANK OF INDIA

RFP REQEUST FOR PROPOSAL

SHG SELF HELP GROUP

TAB TABLET TO BE USED IN KIOSK/MOBILE BC

UID UNIQUE IDENTITY

UIDAI UNIQUE IDENTIFICATION AUTHORITY OF INDIA

*BIDDER/ SERVICE PROVIDER/VENDOR/CORPORATE BC/BC MENTIONED

IN THE DOCUMENTS ARE ALL ONE AND THE SAME.

P a g e 8 | 42

1. ABOUT TAMIL NADU GRAMA BANK:

Tamil Nadu Grama Bank is a Regional Rural Bank (hereinafter referred to as

Bank), having its Head office at 6, Yercaud Main Road, Hasthampatti, Salem 636

007.

The Bank is operating in all Districts of Tamil Nadu except Chennai. The Bank is

having a network of 640 branches as on 31st March 2021.

2. ABOUT THE RFP:

In the context of Financial Inclusion, Tamil Nadu Grama Bank envisages

extension of Banking & Financial Services to under banked & unbanked areas

through ICT based “branchless banking” model, where integrated Micro ATM

/Tab/Tablet devices would be used by Business Correspondents to deliver

financial and banking services. Bank has already implemented ICT based solution

in allotted Sub Service Areas (SSAs) and in other areas as decided by the Bank.

The technology architecture supporting this strategy involves a combination of

various technologies like Field BCs/ Fixed Point BC , contact / contact- less cards,

biometric identification and authentication, etc. These technologies will

support online transactions and operations.

The proposed RFP has been floated with the objective of increasing the reach of

banking and financial services to the underprivileged, particularly in unbanked

and under- banked areas.

The eligibility criteria, the evaluation process and other terms and conditions are

set out in this RFP. Bank will enter into contract with the selected Service Provider

(SP) on such terms and conditions as contained in this RFP. The selected SP will

act on behalf of the Bank in respect of the specified services and will not be

eligible to claim any benefits except for the fee or commission as may be agreed.

The SP shall not use the trade mark, logo or any proprietary right of the Bank

without it’s written consent.

3. DEFINITIONS:

Words/phrases used in this Request for Proposal shall have the meanings

assigned to them as hereunder unless used in a context totally contrary:

a) “Bank” means TAMIL NADU GRAMA BANK.

b) “Bidder” means any company/entity who bids for offering services

as a Business Correspondent (BC) for the Bank pursuant to the

terms of this RFP.

c) “Bid” means the offer made by the Bidder in response to this

RFP.

d) “Corporate Business Correspondent” (CBC) or “Service

Provider (SP)” means any person/entity who is eligible to act as

BC for the banks under the terms hereof for providing services

described in the RFP.

e) “BCA” is Business correspondent Agent /person engaged

by CBC for operating in the field.

P a g e 9 | 42

f) “Business Correspondent Agreement” means the agreement to be

executed between the Bank and the Service Provider containing

the terms and conditions on which the Services will be provided.

g) “Eligibility Criteria” means the criteria required to be satisfied

by the Bidder in order to bid so as to be engaged as a Service

Provider, which is as per the guidelines of RBI, more particularly

described in this RFP.

h) “Area of operation” means geographic area allocated like

villages, wards in the towns or cities, etc. It is expected that each BCA

will cater about 1500 households. Provided however, that in case,

more than one BCA is allotted for any gram Panchayat on account of

Sub Service Area approach, their respective areas would be

specifically defined. Provided further that in case another BC already

exists in a village and the BC who will be allotted the work under this

RFP may also be allowed to work in the same village concurrently.

i) “RFP” means this Request for Proposal issued by the Bank.

j) “Services” means the services to be provided by the BC/SP pursuant

to the terms of the RFP/Service Agreement.

k) “Back end System” means Banks Core Banking Solution

l) “Front end System” means Tab/Tablet system installed/working at

BC points

m) “Financial inclusion Plan” means providing banking services to the

financially excluded segment as well as to provide banking and

financial services using innovative channels.

n) “Solution” means the various hardware & peripherals (

including Android based Tab/Tablet) used by the BC for

implementation of the Business Correspondent Services

4. PRE-QUALIFICATION/ELIGIBILITY CRITERIA FOR BIDDERS:

4.1 . A vendor submitting the proposal in response to this RFP shall hereinafter be

referred to as ‘Bidder’ and the solution for implementation of Business

Correspondent Services – through Micro ATM/ HHD/ Tab in Tamil Nadu

Grama Bank shall hereinafter be referred as “Solution”.

4.2 . Interested Bidders, who will provide Corporate Business Correspondent

services in the Bank and meeting the Eligibility Criteria as below may

respond :

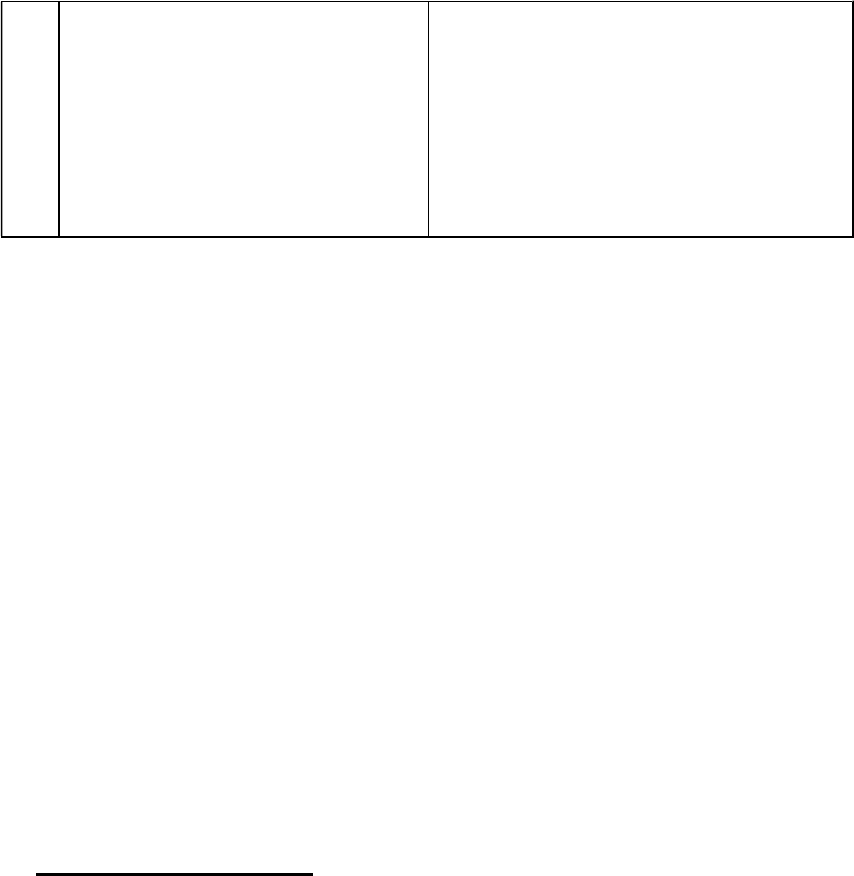

No. Criteria Documents to be submitted

1.

Bidder should be a registered

company in India under

Companies Act 1956 or 2013 and

should have been in operation for

at least Three years as on the

date of RFP.

Copy of Certificate of Incorporation &

Certificate of Commencement of

Business in case of Public Limited

Company or Certificate of Incorporation

in case of Private Limited Company,

issued by the Registrar of Companies.

P a g e 10 | 42

2.

The bidder should have been a

BC/SP for providing FI solution

(such as EBT, DBT, Aadhaar

based Payment etc.) for

Scheduled Commercial Bank /

Regional Rural Banks Sponsored

by Public Sector Bank in India for

a minimum period of 3 years

The Kiosk /BC solution should

have been implemented in at least

in 500 locations in India.

Supported by documentary evidence

such as purchase order/ copies of the

Service Contracts wherever entered.

Letter from the concerned organization

confirming successful implementation of

FI project with them is to be submitted

with following details:

Name of the client

Number of Locations

Type of Model

Scope of Project

Name of the person who can be referred

to from Clients’ side, with Name,

Designation, Postal Address, Phone

and Fax numbers, E-Mail IDs, etc.,

The bank reserves the right to inspect

such installations while evaluating the

Technical Bid.

4. Bidder or its wholly owned

Parent Company should have

maintained Positive Net Worth

during the last Four financial

years, i.e. 2017-18, 2018-19 and

2019-20, (All audited) and PBS for

2020-21

Audited Financial statements to

be submitted for Three years. Self-

certified copy of financial statement for

2020-21, if not audited.

5.

Annual turnover should not be

less than Rs. 5 (Five) crores in the

last financial year as per audited

financial statement.

Audited Financial statements to be

submitted for FY 2019-20 and Self

certified copy of financial statement for

2020-21, if not audited.

6.

The bidder should have

strong organizational strength to

undertake and execute large

projects including hardware,

networking, disaster recovery,

system integration,

implementation, etc. System

integration should be based on

industry’s best practices.

Documentary proof - Satisfactory

certificate from the present Banker where

the vendor is extending the BC services.

7. Bidder should also have internal

control and audit measures in

place.

Copy of latest Audit Report.

8. Bidder should not have been

blacklisted by any PSU Bank /

IBA/ RBI /NPCI /UIDAI/ IDRBT /

NABARD

Notarized Affidavit.

P a g e 11 | 42

9.

Neither the bidder nor its

promoters and Directors should be

defaulters to any financial

institution. The bidder should not

have been reported against by

any Public Sector Bank to Indian

Banks’ Association for any

malpractice, fraud, poor service,

etc.

Auditor’s Certificate & Notarized

Affidavit

Note: - In the event of bidder being a company formed as a result of demerger,

amalgamation, reconstruction etc., the services rendered by its predecessor in

accordance with aforesaid criteria shall be reckoned and taken into consideration for

determining the eligibility of bidder and it shall be deemed that services rendered by

predecessor of such bidder were rendered by bidder itself and the bidder shall be

deemed to be in existence from the date of incorporation of its predecessor.

In addition, the prospective bidders who comply with the following criteria are only

eligible to bid:

a) The bidder will be single point of contact to provide the solution to the

Bank.

b) The bidder must be fully aware of the RBI, IDRBT, Government of

India, UIDAI etc. guidelines with regard to Financial Inclusion.

c) The bidder should have proven capability to provide services

mentioned in this RFP. Successful implementation of a related project

( such as delivery of financial services / products / Biometric

solutions, Card Based solutions etc.) with a Bank and a copy

of such agreement should be enclosed.

d) The Bidder should ensure that the FIELD BC works exclusively for the

Bank.

5. REQUIREMENT DETAILS:

5.1 Bank has provided Financial Inclusion services through Business

Correspondents in 700+ locations for the state of Tamil Nadu. This number may

be increased to around 1000 locations in future.

5.2 The scope of the current project, being one of the ICT - BC based banking

channels, may extend to all or some of the envisaged villages depending on

the performance. Bank may extend services to other areas as well under this

project. The aforesaid figures are only indicative and the actual numbers may

vary.

5.3 The geographic locations that fall within the scope of this project can span over

rural, semi- urban, urban and metropolitan areas. The Regions wise number of

existing BCA locations is provided in Appendix I.

5.4 Micro ATM/ HHD/TAB based solution and device will be provided by the Bank.

There will be no separate solution for service at field, it will be a common

application and the TAB to be used.

P a g e 12 | 42

5.5 Wherever KIOSK is referred it may be read as Fixed Point wherein BC has to

work for 4 -5 hours per day & for the remaining period BCA has to work as

mobile.

5.6 Wherever HHM/Hand held machine/POS is referred, it may be read as

TAB/Micro ATM, as it will be the common device to work as Kiosk and Mobile.

6. RESPONSIBILITIES OF THE BIDDER:

6.1 Bidder shall be responsible for entire Management of Business

Correspondents such as Engagement, Monitoring, Cash Management and

covering the entire scope of this RFP.

6.2 At present Bank is having around 700 BCs. Bidder should give preference to

existing BCs for engagement.

6.3 The roles and responsibilities of the Bidder will also include those stated in

greater detail in other parts of RFP.

6.4 Bidder shall use the solution & interface provided by the bank and to provide

supporting organizational structures and skilled human resources to educate,

facilitate and deliver financial services to the targeted customers.

6.5 Bidder shall be responsible for compliance with mandatory compliance

requirements indicated in the section “Compliance Requirements” and at

various specific requirements indicated in other parts of the RFP;

6.6 Indemnifying the bank of risks indicated in the section “Indemnity” and

specific requirements indicated in other parts of the RFP.

6.7 Bidder shall act as the single point of contact for the Bank. Under no

circumstance the bidder should sub-contract the work entrusted to them.

6.8 Bidder shall be responsible to resolve all issues that may arise from the BC

Management and monitoring.

6.9 Bidder shall also man and manage all the incidental activities related to the

scope of the RFP.

6.10 The details of the BCs along with the photograph will be placed in Bank’s WEB

portal.

6.11 Bank will enter into a detailed agreement with the Bidder clearly defining the

roles and responsibilities and the terms of engagement for the

infrastructural support and services extended to the bank as per the

format prescribed by the Bank.

6.12 Render banking and financial services as entrusted by the Bank under

BC model at designated locations to all the customers of Tamil Nadu Grama

Bank, duly complying with Bank, RBI, IDRBT,IBA, NPCI,UIDAI,NABARD,

GOI, State Govt. guidelines.

P a g e 13 | 42

6.13 Bidder will have to qualify and render financial / banking services under BC

model duly meeting regulatory requirements stipulated by RBI for

rendering specified banking & financial services and those entrusted by the

bank from time-to-time.

6.14 Bidder shall provide well trained personnel and extend necessary

mentoring and operational support to the intermediary network of agents,

etc.

6.15 Bidder shall confirm that every person deployed by them on the project has

been vetted through third- party background check prior to their engagement.

Reference from two respectable persons of that area known to the bank should

be submitted to the bank prior to their engagement.

6.16 Bidder shall confirm that every person deployed by them on the project to

submit Police Verification Certificate prior to their engagement.

6.17 Bidder shall manage the activities of its personnel or others engaged in the

project etc. and will be accountable for all the personnel deployed/engaged in

the project.

6.18 . In case the performance of the Business Correspondents, their agents

or personnel engaged in the project is not satisfactory or is detrimental to the

interests of the Bank, the Bidder shall have to replace the said person within

15 days or any such time limits stipulated by the Bank. Failing which, Bank

shall impose Rs.10,000/- per case per month

6.19 No right to employment in the Bank shall accrue or arise, by virtue of

engagement of employees, agents etc. of the bidder for any assignment under

this project.

6.20 Bidder will exercise due diligence and only engage persons

having established identity, integrity, requisite qualifications &

skills and deployment experience for all critical activities.

6.21 Bidder will involve designated officials of the Bank in selection process of BC

agents.

6.22 Cash Management is the sole Responsibility of CBC/BC.

6.23 Bidder to extend all of the outsourced banking & financial services

by deploying such personnel that have high integrity and meet

the qualifications and other criteria stipulated by the Reserve Bank of India,

Government or the Bank from time to time.

7. COMPLIANCE REQUIREMENTS:

7.1 The entire activity under this solution would be guided by and conform to

policies & guidelines of the Bank, GOI, RBI, NABARD, NPCI, UIDAI,

IDRBT, IBA, State Govt.

P a g e 14 | 42

7.2 Service management process based- on ITIL standards.( Information

Technology Infrastructure Library)

7.3 Bidder who deploys for rendering outsourced banking/financial

services shall conform to bank/RBI’s guidelines.

7.4 The business practices, processes adopted for rendering

services, maintenance of records, accounting norms & procedures etc

for Banking and Financial services shall conform to regulatory, legal

and bank’s policies and guidelines.

7.5 Customers enrolled under the project shall meet “Know Your Customer”

norms as stipulated by the Bank.

7.6 Accounts, transactions, services, controls, etc related to banking

and financial services should integrate with Bank’s Core- Banking system.

7.7 The solution should conform to and integrate with UIDAI/NPCI’s directions on

Financial Inclusion / Direct Benefit Transfer.

7.8 Bidder should ensure that in addition to security features- as stipulated by the

Bank from time to time- deployed in the technology, controls and

operational procedures should ensure protection of the bank from loss,

disclosure or frauds.

7.9 Bidder shall indemnify the Bank from transaction risk (from system

error, human error, negligence and mismanagement) and fraud risk

(loss to earnings or capital due to intentional deception by employees,

customers, agents, external entities, etc.).

7.10 Bidder shall indemnify the Bank and hold the bank harmless against loss or

liability, claims actions or proceedings if any, that may arise through the

action of its employees, agents etc.

7.11 Bidder shall assist the Bank in identifying potential risks in the solution,

remedy any of the identified risks, develop strategies to measure, monitor

and mitigate those risks and implement new controls.

7.12 Bidder shall maintain adequate documentation, records, audit trails, etc and

cooperate with the RBI/Bank’ s internal audit teams, regulatory authorities

and third- party external auditors for conducting periodical audit and arrange

for necessary access to relevant information / assets under the control of the

bidder.

7.13 Financial Exposures & Performance risks from third- party service

providers under the project would be regulated and mitigated through

Financial Guarantees, Collateral Securities, etc based on risk perception of

the Bank.

P a g e 15 | 42

8. TECHNICAL DELIVERABLES:

8.1 The Bidder shall ensure that the BC location /Fixed Point is located within the

Geographical area allotted to the concerned BCA and is in a prominent

place, acceptable to the Bank and with requisite furniture & fixtures for BCA

and customers in case of Fixed Point BC location. The bidder shall also

provide training and operational support for software upgradation training with

the help of Technical Service Provider

8.2 Network connectivity, consumables, Bank approved overcoat, Identity Card,

Cab, Stationery etc. applicable to BCs would be to the cost of the Bidder.

8.3 Bank may at its discretion close or shift any location based on the needs.

8.4 Spare devices will be kept at Bank’s Regional Offices. Bidder shall make own

logistics arrangements for replacement of faulty devices

8.5 Bidder shall ensure that the service is rendered in a manner that

the agents would encourage & promote the customers to use Bank’s services.

8.6 Bidder shall ensure that faulty equipment should be replaced within

a maximum period of 48 hours of reporting.

8.7 The Bidder also ensure that non-login/ Inactive for more than 7 days will be

reported to Bank through Coordinator/ Supervisor/ Area Manager to

respective Regional Office of the Bank and immediate replacement to be

done.

8.8 Role of Service Provider / Bank is given in Appendix II

9. SCOPE OF BASIC BANKING PRODUCTS & SERVICES TO BE OFFERED:

The Service Provider would be required to provide the services, facilities,

infrastructure, training, etc. The detailed scope of basic banking products

and services to be offered are mentioned under Appendix III.

10. FUNCTIONAL REQUIREMENTS:

10.1 The authentication of transactions would be through matching the

biometrics/fresh sample of fingerprint with UIDAI server

10.2 The customers should be able to perform selected banking transactions

through authorized representatives of the Bidder. Enabled with

interconnectivity, these representatives of the Bidder will extend banking

& financial services on behalf of the Bank to its customers at

their (customers’) respective locations/ villages/habitats during the time

window and at the frequency stipulated by the Bank.

10.3 The entities deployed by the Bidder as BCAs for extending banking and

financial services on behalf of the bank shall conform to

Bank/RBI/UIDAI/IDRBT/NABARD/GOI/state Govt. guidelines.

10.4 The bidder shall ensure that the project has the sufficient human

resources which shall be able to support deposit taking, lending, account

management, financial literacy & advice, remittances, electronic benefit

payments/transfer, etc.

P a g e 16 | 42

11. ENROLLMENT OF CUSTOMERS:

11.1 Bidder shall enroll customers to various products using the same solution.

Customers may enroll themselves for several products simultaneously

or to different products at different points-in- time. The Bidder should

undertake enrollment to each of the products (as may be required by the

Bank) as per the customers’ choice and Bank’ s policy.

11.2 Every customer in the target group will have at least a savings bank account.

Other schemes & banking products would also be offered to customers of

target-group based on the policy of the bank.

11.3 Bank will entrust the process of enrollment to the Bidder. Bidder may engage

his representatives to carry out the operations duly complying with Bank’s

norm and other associated norms of GOI/RBI/UIDAI/IDRBT/IBA/legal

guidelines.

11.4 Due care and security should be accorded to all the related physical

documents.

11.5 Bidder shall also ensure that the Business Correspondent Agents are

frequently trained and kept updated with bank’ s new schemes, policies, etc

as may be required to discharge their roles and serve the target- customers.

11.6 Bidder would also ensure that required supplies of stationery and other

consumables are made available with Business Correspondent Agents for

uninterrupted operations.

11.7 Bidder may be required to enroll the customer on production of documentary

evidence/support that RBI or the Bank may prescribe duly complying with

customer due- diligence (including Know-Your-Customer requirements).

11.8 The physical documents and application form will be delivered at the

designated location of the Bank Branch within three working days.

12. ACCOUNT OPENING/PRODUCT REGISTRATION AND ACTIVATION:

12.1 General:

a) Every customer Account shall be opened in the banking system after all

the mandatory information about the applicant/customer has been

captured.

b) However the account/scheme/product/service will be activated only after

fulfilling the stipulations given by the Bank.

c) The scheme/product or service may require authorization by Bank’ s

official before it becomes operational.

d) The personnel handling the above processes should be capable of

enforcing all the controls required by the Bank.

12.2 Customer Operations:

a) The customers will carry out all the banking transactions through the BCA

b) Mode of transactions is online.

c) A customer may have multiple accounts/services linked to the same.

d) The services availed by the customers may vary.

e) Bank may extend additional Products/services in future to be rolled out in

P a g e 17 | 42

BC channel.

f) Bidder would obtain application/enrollment forms for other permitted

schemes like insurance etc, or any other product/services introduced by the

Bank from time to time, as & when they are offered by the Bank/subscribed

by the customers.

12.3 Customer Account Operations:

a) Customers who wish to receive Banking & Financial services shall

approach the authorized representative of the Bidder, the BCA. Customer

will carry out AEPS, RuPay card based financial & Non- Financial

transactions both on us and off us.

b) The identity of the customers has to be ensured by the BCA.

c) BCA may verify additional details of the customer if stipulated by the Bank.

d) Customer is permitted to transact in online mode only through the Micro

ATM/ Tab/Tablet at BC locations.

e) The requested transaction is put through only if the conditions stipulated by

the bank are met.

f) The successful cash transaction is concluded by payment of cash or receipt

of cash by the Bidder depending on whether the transaction is a withdrawal

or a receipt.

g) Further, each customer will be permitted only certain number of transactions

and within a maximum limit prescribed by the Bank for each category for a

given period.

h) The above details will be furnished to the Successful Bidder by the Bank.

i) Receipts will be printed for each transaction. One will be handed over to the

customer and the other will be held with the Bidder for records

j) Each transaction will have a unique reference number for the Bank and the

same would also be printed on every receipt.

k) The account holder may request for statement of account and the BCA at

the village will provide a printout of last 10 transactions together with the

outstanding balance in the desired account(s) using the front- end

equipment.

l) The receipts and statements shall be in English/vernacular language

m) BCA may assist the customer by pursuing with the Bank.

n) In case the RuPay card is lost by the account- holder, the matter shall be

reported to the BCAs, who will direct the customers to approach Bank for

issuance of duplicate card. Bank will charge applicable charges to the

customer for issuing duplicate card.

12.4 Operations at BC Outlet ( BCO):

a) Bidder will be responsible for physical custody and upkeep of the

systems/devices provided for front-end operations.

b) Bidder would also be responsible for cash and accounting of transactions;

maintenance receipts of transactions, details of exceptional transactions, etc.

c) Following registers to be maintained:

Records of customers enrolled;

Account opening forms sent to link branch;

Account opening forms pending to be sent;

Customer contact register;

Applications movement register;

P a g e 18 | 42

Visitors/Bank officials visit register.

List of Do’ s and Don’ts for customers to be displayed.

Complaints register.

13. ELIGIBLE ENTITIES AND GENERAL GUIDELINES:

Entities eligible to be appointed as BCAs and general guidelines to be

followed by BC while appointing BCAs is mentioned in Appendix IV.

14. REMITTANCE SERVICES:

Customer should be able to remit funds and receive funds using the front-

end system with the agent.

15. OTHER PRODUCTS AND SERVICES:

15.1 Bank would share the product brochures or other products and services that

would be extended through this channel to the successful bidder. The

responsibility of training & dissemination of product information to BCA lies

with the bidder. In future, if any new products/services are introduced the

Bank would share the operational guidelines separately.

16. STANDARD OPERATING PROCEDURE (SOP) FOR BC:

16.1 The Standard operating procedure for the Business correspondents/BC

agents are mentioned under Appendix V

17. MANAGEMENT INFORMATION SYSTEM:

17.1 The Bank will provide Daily MIS received from our TSP for effective

monitoring of BC activity.

17.2 The bidder shall put in place a mechanism to the BCAs to whom the work is

intended to.

17.3 Bidder shall assist the bank in defining exceptional transactions and monitor

all such exceptional transactions

17.4 It should also be possible to centrally monitor and obtain reports on cash

movement, cash balances, cash payments, etc at each of the front- end

functionaries in consultation with the Bank and TSP.

18. REVIEW AND MONITORING MECHANISM:

18.1 Bank will evaluate the Bidder on an ongoing basis and may take a suitable

decision for continuation/ termination / expansion of contracted services

based on the Annexure VII.

18.2 The project shall conform to Bank’ s policies and would be subject to Internal

and External audits. The Bidder is required to extend all necessary co-

operations to facilitate audit process.

18.3 Bidder shall have adequate audit controls and track normal and exceptional

transactions.

18.4 Bank will utilize the services of internal or external auditors for ensuring proper

operations by Bidders.

P a g e 19 | 42

18.5 Bank may also arrange for a random verification of enrollment/ payments,

card-personalization, etc for better control.

19. BID PROCESS:

Clarification to RFP and Pre-Bid Queries:

19.1 The bidder should carefully examine and understand the specifications,

terms & conditions of the RFP and may seek clarifications, if required.

The bidders in all such cases should seek clarification in writing in

the same serial order as that of the RFP by mentioning the relevant page

number and clause number of the RFP as per format provided under

Annexure XIII

19.2 All communications regarding points requiring clarifications and any

doubts shall be given in writing to The Chief Manager, Tamil Nadu Grama

Bank, Head office Annex, Thiru Nagar, Hasthampatti, Salem- 636007 or an

14.06.2021

19.3 No queries will be entertained from the bidders after the above date and time.

19.4 The Bank will consolidate all the written queries and the replies for the queries

shall be made available in the Bank’s website and no individual

correspondence shall be made. The clarification of the Bank in response to

the queries raised by the bidder/s, and any other clarification/amendments

/corrigendum furnished thereof will become part and parcel of the RFP and it

will be binding on the bidders.

19.5 No oral or individual consultation will be entertained.

20. AMENDMENT TO BIDDING DOCUMENT:

20.1 At any time prior to deadline for submission of Bids, the Bank, for any reason,

whether, at its own initiative or in response to a clarification requested by

prospective bidder, may modify the bidding document, by amendment.

20.2 Notification of amendments will be made available on the Bank’s website only

and will be binding on all bidders and no separate communication will be

issued in this regard.

20.3 In order to allow prospective bidders to take the amendment into account in

preparing their bids, the Bank at its discretion, may extend the deadline for a

reasonable period as decided by the Bank for submission of Bids.

21. BID SYSTEM OFFER:

This is two bid system which has following 2 (Two) parts:

21.1 Part A-Technical Proposal: Indicating the response to the Technical

specification for Engagement of Corporate Business Correspondent for

providing Financial Inclusion Banking Services using Micro ATM /TAB in

Tamil Nadu Grama Bank.(Annexure I to VIII).

21.2 Part B- Commercial Bid (Indicative): Furnishing all relevant information as

required as per Indicative Price Bid as per Annexure- X.

P a g e 20 | 42

22. PREPARATION OF BIDS:

22.1 The Bid shall be typed in English language in Arial font style with font size of

12 in indelible ink and shall be signed by the Bidder or a person or persons

duly authorized to bind the Bidder to the Contract. The person or persons

signing the Bids shall affix signature in all pages of the Bids, except for un-

amended printed literature.

22.2 The two parts as stated above, should be placed in two separate

envelopes superscribed with ‘Technical Proposal’ and ‘Commercial Bid’

respectively and properly closed & sealed. Thereafter, both the envelopes

shall be placed inside another envelope and properly closed & sealed. The

final envelope should be superscribed as Request for Proposal for

Engagement of Corporate Business Correspondent for providing

Financial Inclusion Banking Services using Micro ATM / TAB in Tamil

Nadu Grama Bank in response to RFP No. TNGB / HO / FI / 01 / 2021-22”

(includes separately sealed ‘Conformity to ‘Technical Proposal’ and

‘Commercial Bid’) on the top of the envelope. All the envelopes shall bear

the name and complete postal address of the bidder as well as the

addressee, namely the The General Manager (Credit), Tamil Nadu Grama

Bank, Head Office, No.6, Yercaud Main Road, Hasthampatti, Salem 636 007.

a) All the pages of Bid including Brochures should be made in an

organized, structured, and neat manner. Brochures / leaflets etc.

should not be submitted in loose form. All the pages of the

submitted bids should be paginated with Name, Seal and

Signature of the Authorized Signatory. Bids with erasing /

overwriting / cutting without authentication may be liable for

rejection.

b) Authorization letter for signing the Bid documents duly signed by

Company’s Authorized signatory should be submitted.

c) All the envelopes shall bear the name and complete postal

address of the Bidder and authority to whom the Bid is submitted.

23. PART A- TECHNICAL PROPOSAL:

23.1 Technical Proposal should be submitted as per the format as per Annexure I

to VIII. Relevant technical details and documentation should be provided

along with Technical Proposal.

23.2 The offer may not be evaluated and may be rejected by the Bank without any

further reference in case of non-adherence to the format or partial submission

of technical information as per the format given in the offer.

23.3 In case of any contravention of technical specification detected at any stage

which is not explained to the satisfaction of the Bank, the technical

specifications elaborated in RFP shall prevail and the bidder shall be

considered as disqualified ab initio and it shall be presumed that the

commercial bid of CONTRACTOR was never opened by the bank.

23.4 The Bank shall not allow / permit changes in the technical specifications once

it is submitted.

P a g e 21 | 42

23.5 The Technical Proposal should be complete in all respects and contain all

information sought for, as per Annexure I to VIII.

23.6 After ensuring the above, it shall be placed inside a separate Envelope

and sealed and super scribed on the top of the cover as “PART A-

Technical Proposal for RFP No. TNGB / HO / FI / 01 / 2021-22 f o r

Engagement of Corporate Business Correspondent for providing

Financial Inclusion Banking Services”

24. PART B-COMMERCIAL BID (INDICATIVE):

24.1 Commercial Bid (Indicative Price Bid) shall be submitted as per format given

in Annexure X and other terms and conditions of RFP on prices. Any

deviations / non submission of prices as per the format given in Annexure X

shall make the bid liable for rejection.

24.2 Under no circumstances the Commercial Bid should be kept in Part A

(i. e.Technical Proposal) Cover. The placement of commercial bid in PartA

(i. e. Technical Proposal) cover will make bid liable for rejection.

24.3 Bidder must take care in filling price information in the Commercial Offer, to

ensure that there are no typographical or arithmetic errors. All fields must be

filled up correctly.

24.4 Any change in the Commercial Bid format may render the bid liable for

rejection. The Commercial Bids (Indicative) that are incomplete or conditional

are liable to be rejected.

24.5 After ensuring the above, it shall be placed inside a separate Envelope

and sealed and superscribed on the top of the cover as “PART B-

Commercial Bid for RFP No. TNGB / HO / FI / 01 / 2021-22 for

Engagement of Corporate Business Correspondent for providing

Financial Inclusion Banking Services”.

24.6 General conditions

a) The Bidder to quote in Indian Rupees only and bids in currencies

other than INR would not be considered.

b) The prices and other terms offered by Bidders must be in force for a

period of 365 days from the date of opening of the commercial bid.

c) All costs should be inclusive of all taxes, duties, charges and levies

of State or Central Governments as applicable, at the date of signing

the Agreement and subject to deduction of all statutory deductions

applicable, if any. The benefits realized by Bidder due to lower rates

duties, charges and levies shall be passed on by Bidder to Bank.

d) The Bidder has to include all costs like Travel, Lodging & Boarding,

Local Travel expenses, etc incurred during the implementation as a

part of the Commercial Bid and Bank will not bear any additional

costs on these.

e) The prices quoted by the Bidders shall include all costs such as

Taxes, Custom Duties, Levies, Cess, Insurance, etc. that need to

be incurred.

f) Terms of payment indicated in the RFP shall be final and binding on

the Bidder and no alternate terms & conditions proposed in the RFP

shall be considered.

P a g e 22 | 42

25. APPLICATION MONEY:

25.1 This document can be downloaded from Bank’s website. In that event,

the bidders should pay the Application Fee of Rs.11,800/- (non-

refundable) (Rs 10,000/- Plus GST) for tender document by means of

DD drawn on any Scheduled Commercial Bank in favour of Tamil Nadu

Grama Bank, payable at Salem and submit the same along with Part A –

Technical Proposal

25.2 Submission of the Application Money in other than “Part- A- Technical

Proposal” is liable to be rejected on grounds of non- payment of the

Application Money.

25.3 The Bidder shall bear all costs associated with the preparation and

submission of the Bid and Bank will not be responsible for the costs,

regardless of the conduct or outcome of the bidding process. The Bank

is not liable for any cost incurred by the Bidder in replying to this RFP. It

is also clarified that no binding relationship will exist between any of the

respondents and the Bank until the execution of the contract.

26. EARNEST MONEY DEPOSIT (EMD):

26.1 The bidder shall furnish Non interest earning Earnest Money Deposit

(EMD) of Rs.10,00, 000/- (Rupees Ten lakhs Only) by way of Demand

Draft drawn on any Scheduled Commercial Bank In India in favour of

Tamil Nadu Grama Bank, payable at Salem

26.2 Submission of EMD in other than Part A-Technical Proposal Envelope is liable

to be rejected on grounds of non-submission of EMD.

26.3 The EMD of the Bidders not qualified under Technical Proposal will be

returned within 30 days after opening the Commercial Bid of the Technically

Qualified Bidders. The EMD of Technically Qualified bidders will be returned

upon the selected bidder accepting the order and furnishing the Performance

Bank Guarantee as per Annexure XII.

26.4 The EMD may be forfeited:

a) If the bidder withdraws or amends the bid during the period of

bid validity specified in this document.

b) If the selected bidder fails to accept the purchase order within 7

days or fails to sign the contract or fails to furnish performance

guarantee in accordance with the terms of the RFP and as per

Annexure XII.

27. DOCUMENTATION:

Technical information in the form of Brochures / Manuals / CD etc. of the most

current and updated version available in English must be submitted in support of

the Technical Offer made without any additional charges to the bank. The Bank is

at liberty to reproduce all the documents and printed materials furnished by the

Bidder in relation to the RFP for its own use.

28. COSTS & CURRENCY:

The Offer must be made in Indian Rupees only as per Commercial Bid (Indicative Price

Bid) format (Annexure-X).

P a g e 23 | 42

29. ERASURES OR ALTERATIONS:

The Offers containing erasures or alterations or overwriting may not be

considered. There should be no hand-written material, corrections or alterations

in the offer. Technical details must be completely filled in. Correct technical

information of the product being offered must be filled in. Filling up of the

information using terms such as “OK”, “accepted”, “noted”, “as given in

brochure/manual” is not acceptable. The Bank may treat such Offers as not

adhering to the tender guidelines and as unacceptable.

30. ASSUMPTIONS/PRESUMPTIONS/MODIFICATIONS:

The Bank would like to expressly state that any assumption, presumptions,

modifications, terms, conditions, deviation etc., which the bidder includes in any

part of the Bidder’s response to this RFP, will not be taken into account either for

the purpose of evaluation or at a later stage, unless such assumptions,

presumptions, modifications, terms, conditions deviations etc., have been

accepted by the Bank and communicated to the bidder in writing. The bidder at

a later date cannot make any plea of having specified any assumption, terms,

conditions, deviation etc in the bidder’s response to this RFP document. No offer

can be modified or withdrawn by a bidder after submission of Bid/s.

31. SUBMISSION OF BIDS:

31.1 The Name and address of the Bidder, RFP No. and Due Date of the RFP

are to be specifically mentioned on the Top of the envelope containing

Bid.

31.2 The bid/s properly superscribed in the manner prescribed in earlier

clauses of this RFP should be sent to the address mentioned below:

The General Manager(Credit),

Tamil Nadu Grama Bank, Head Office,

No.6, Yercaud main road, Hasthampatti,

Salem – 636 007

31.3 If the last day of submission of bids is declared as a holiday under NI

Act by the Government subsequent to issuance of RFP, the next working

day will be deemed to be the last day for submission of the RFP. The

Bid/s which is/are received after the said date and time shall not be

considered.

31.4 If the envelopes, including the outer envelope is not sealed and marked

in the prescribed manner, the Bank will assume no responsibility for

the bid’s misplacement or premature opening.

32. BID OPENING:

32.1 The Part A- Technical Proposal shall be opened in the presence of the

Bidder’s representative/s.

32.2 Bidder’s representative may be present in the place and venue well in time

P a g e 24 | 42

along with an authorization letter in hand for each bid opening under this RFP,

as per the format (Annexure– XI) enclosed.

Note: Authorisation letter should be carried in person and shall not be

placed inside in any of the bid covers.

32.3 Attendance of all the representatives of the bidders who are present

at bid opening will be taken in a register against Name, Name of the

Company and with full signature.

32.4 The Bidders may note that no further notice will be given in this regard.

Further, in case the bank does not function on the aforesaid date due to

unforeseen circumstances or declared as holiday then the bid will be

accepted up to 11.00 AM on the next working day and bids will be

opened at 11.30 AM at the same venue on the same day.

32.5 The following details will be announced at the time of bid opening.

a) Name of the Bidders.

b) Presence or absence of cost of the Bidding document and Bid

security.

c) Such other details as the Bank at its discretion may consider

appropriate.

32.6 If any of the bidders or all bidders who has submitted the tender are not

present during the specified date, time, and venue of opening it will be

deemed that such bidder is not interested to participate in the opening of

the Bid/s and the bank at its discretion will proceed further with opening

of the Part A – Technical Bid in their absence.

32.7 The Part A- Technical Proposal submitted by the bidder will be evaluated

based on the Eligibility Criteria and functional requirements as per

Annexure I to VIII as stipulated in RFP document.

32.8 The Commercial Bid ( Indicative) of only those bidders who are qualified in

Part-A Technical Proposal will be opened for arriving L1 bidder

33. SELECTION OF BIDDER

33.1 Preliminary Scrutiny:

The Bank will scrutinize the Bid/s received to determine whether they are

complete in all respects as per the requirement of RFP, whether the

documents have been properly signed, items are offered as per RFP

requirements and technical documentation as required to evaluate the

offer has been submitted.

Prior to detailed evaluation, the Bank will determine the substantial

responsiveness of each Bid to the bidding document. Substantial

responsiveness means that the bid conforms to all terms & conditions,

scope of work, technical specifications and bidding document is submitted

without any deviations.

33.2 Clarification of Offers:

a) During the process of scrutiny, evaluation and comparison of offers,

the Bank may, at its discretion, seek clarifications from all the

P a g e 25 | 42

bidders/any of the bidders on the offer made by them. The bidder has

to respond to the bank and submit the relevant proof /supporting

documents required against clarifications, if applicable. The request for

such clarifications and the Bidders response will necessarily be in writing

and it should be submitted within the time frame stipulated by the Bank.

b) The Bank may, at its discretion, waive any minor non- conformity or

any minor irregularity in the offer. Bank’s decision with regard to ‘minor

non- conformity’ is final. The waiver shall be binding on all the bidders

and the Bank reserves the right for such waivers.

33.3 Evaluation of Bid:

a) The Bank will evaluate the bid submitted by the bidders under this RFP.

The Part A- Technical Proposal submitted by the bidder will be evaluated

based on Annexure I - VIII of RFP. The Commercial Bid of only those

bidders who qualified in Part A-Technical Proposal will be reckoned for

evaluation purpose.

b) The Bid will be evaluated by a Committee of officers of the Bank. If

warranted, the Bank may engage the services of external consultants for

evaluation of the bid. It is Bank's discretion to decide at the relevant point

of time.

33.4 Bidders Presentation /Site Visits

a) Bidders may be required to prepare for making necessary presentations

as a part of the final evaluation in accordance with the responses given for

the identified requirements any time after the last date for submission

of bids.

b) All expenses incurred in connection with the above shall be borne by the

bidder.

c) Setting of evaluation criteria shall be entirely at the discretion of Bank. The

decision of Bank in this regard shall be final and in this regard, no

correspondence shall be entertained.

d) Bidders should arrange for visits to the reference sites wherein the

product is successfully implemented by them. The bidder shall take

necessary permission from the concerned and demonstrate the features &

performance to Bank at their own cost. Bank prefers the Bidder to provide

details of the organization as Reference with the details of contacts as

mentioned in Annexure III of the RFP Document. Bank would preferably

want to have an onsite reference visit or a Telephonic conversation with

the concerned.

33.5 Intimation to Qualified/Successful Bidders:

The Bank will prepare a list of qualified bidders at each stage on the basis of

evaluation of Part A- Technical Proposal and Part B-Commercial Bid. The

names of qualified bidders at Technical Bid would be informed to all eligible

bidders through email. Commercial Bids of only technical qualified bidders

shall be opened. Final list of the bidders (L1, L2, L3….etc) will be announced

as indicated above.

P a g e 26 | 42

33.6 Correction of Errors in Commercial Bid:

Bank reserves the right to correct any arithmetical errors furnished in the

Commercial Bid. If any such errors are noticed it will be rectified on the

following basis:

a) Bank may waive off any minor infirmity or non- conformity or

irregularity in a bid, which does not constitute a material deviation.

b) If there is discrepancy in the total arrived at Commercial Bid (addition,

subtraction, multiplication, division and carryover of amount from one

page to another), correct total will be arrived by the Bank and the

same will prevail over the total furnished in the Commercial Bid

c) If there is a discrepancy between words and figures, the rate/ amount

in words shall prevail, unless the amount expressed in words is

related to an arithmetical error in which case, the amount in figures

will prevail, subject to the above two provisions.

d) If the bidder does not accept the correction of errors, the bid will be

rejected.

33.7 Determination of L1 Bidder:

a) L1 Price will be determined after giving effect to arithmetical

correction, if any.

b) The L-1 bidder will be determined on the basis of the lowest price

quoted in the Commercial bid.

34. VALIDITY OF BIDS:

34.1 Bids shall remain valid for 365 days from the date of opening of the Bid. A Bid

valid for a shorter period may be rejected by the Bank as non- responsive.

34.2 In exceptional circumstances, the Bank may seek the Bidders’ consent for

extension of the period of validity. The request and the responses thereto shall

be made in writing. Retention of Earnest Money deposit shall also be suitably

extended.

34.3 The rates quoted by the Service Provider will be valid for the duration of the

tenor of the agreement.

35. BANK’ S RIGHT TO ACCEPT ANY BID AND TO REJECT ANY OR ALL BIDS:

35.1 The Bank reserves the right to accept or reject any Bid /offer received in part

or in full, and to cancel the Bidding process and reject all Bids at any time prior

to contract of award, without thereby incurring any liability to the affected or

Bidder or Bidders or any obligation to inform the affected Bidder or Bidders of

the grounds for the Bank’s action. The Bank reserves the right to reject any Bid

on security and/or other considerations without assigning any reason.

35.2 The Bank reserves the right to cancel the entire Bidding/procurement process

at any stage without assigning any reason whatsoever.

P a g e 27 | 42

36. PERFORMANCE GUARANTEE:

36.1 The successful bidder shall provide irrevocable and unconditional performance

Bank guarantee in the form and manner prescribed by the Bank equivalent

to Rs.25,00,000 (Rupees Twenty five lakhs only) The successful bidder should

submit a Security Deposit/ Performance Guarantee within 30 days from the

date of work order as below:

a) The performance Guarantee should be for 4 years (Three years plus

a claim period of 1 years).

b) The successful bidder should submit Security Deposit by way of DD

favouring Tamil Nadu Grama Bank / Performance Bank Guarantee

issued by a Scheduled Commercial Bank (other than Tamil Nadu

Grama Bank) in India as per Annexure XII.

36.2 Security deposit if submitted in the form of Performance Bank Guarantee, the

guarantee period should be valid for 48 months from the date of placing the

order.

36.3 The security deposit / bank guarantee will be discharged by the bank and

returned to the bidder one year after the successful completion of

implementation of Corporate Business Correspondent Services using Micro

ATM /Tablet.

36.4 The selected bidder shall be responsible for extending the validity date

of the bank guarantees as and when it is due to coincide, on account of delay

in completion of the project

36.5 The Bank shall invoke the Bank guarantee before the expiry of validity, if work

is not completed and the guarantee is not extended or fails to execute the

contract Agreement or if the selected bidder fails to complete his obligations

under the contract. The proceeds of the guarantee shall be payable to the

bank as compensation for any loss from the selected Bidder’s failure to

complete his obligations under the contract.

37. AWARDING OF CONTRACT:

37.1 The Bidder whose commercial bid is accepted and quotes the lowest bid will

be referred to as selected Bidder and Bank will notify the name of the selected

Bidder by displaying in the official Website of Bank.

37.2 The contract shall be awarded and the order shall be placed on selected

Bidder. Bank releases the order either in Full or in part or place more than

one order towards the contract based on banks requirements.

37.3 The selected bidder shall submit the acceptance of the order within seven

days from the date of receipt of the order. No conditional or qualified

acceptance shall be permitted. The effective date for start of provisional

contract with the Selected Bidder shall be the date of acceptance of the order

by the bidder.

37.4 Bank reserves its right to consider at its sole discretion the late acceptance of

the order by selected bidder.

37.5 On failure of the selected bidder to accept the order with in stipulated time,

Bank shall be at liberty to proceed with other technically qualified Bidders

within the purview of the same RFP by calling for fresh commercial quotes

either considering existing commercial quote or fresh commercial quote. The

initially selected bidder stands disqualified for further participation in the

subject bid.

P a g e 28 | 42

37.6 Within 15 days from the date of acceptance of the order by the selected

bidder, the bidder shall sign a stamped “Contract agreement” referred to as

Contract in this RFP, with Bank, at the time, place and in the format prescribed

by Bank. All stamp duty charges applicable on the agreement shall be borne

by the selected bidder.

38. REPRESENTATIONS AND WARRANTIES:

38.1 The Bidder warrants that they have obtained all necessary corporate

approvals to enter into an Agreement and that no consent, approval, or

withholding of objection is required from any governmental authority with

respect to the entering into or the performance of this project. The

bidder further warrants that they are under no obligation or restriction,

nor shall they assume any such obligation or restriction, that would in any

way interfere or conflict with, or that would present a conflict of interest

concerning, any obligations under this project.

38.2 Bidder warrants that it shall perform the Services in a professional &

workmanlike manner and materially in accordance with the applicable

specifications in the RFP.

38.3 The Bidder represents that it is duly incorporated, validly existing and in

good standing under as per the laws of the state in which such Party is

incorporated.

38.4 The Bidder represents that it has the corporate power & authority to

enter into Agreements and perform its obligations there under. The

execution, delivery and performance of terms and conditions under

agreements by such Party and the performance of its obligations there

under are duly authorized and approved by all necessary action and no

other action on the part of such Party is necessary to authorize the

execution, delivery and performance under an Agreement.

38.5 The Bidder represents that the submission of responses to the RFP

execution, delivery and performance under an Agreement entered in

case the Bidder is selected:

a) Will not violate or contravene any provision of its documents of

incorporation;

b) Will not violate or contravene any law, statute, rule, regulation,

licensing requirement, order, writ, injunction or decree of any

court, governmental instrumentality or other regulatory,

governmental or public body, agency or authority by which it is

bound or by which any of its properties or assets are bound;

c) Except to the extent that the same have been duly and properly

completed or obtained, will not require any filing with, or

permit, consent or approval of or license from, or the giving of

any notice to, any court, governmental instrumentality or other

regulatory, governmental or public body, agency or authority,

joint venture party, or any other entity or person whatsoever;

d) To the best of its knowledge, after reasonable investigation, no

P a g e 29 | 42

representation or warranty by such Party in this Agreement and

no document furnished or to be furnished to the other Party to

this Agreement, or in connection herewith or with the

transactions contemplated hereby, contains or will contain any

untrue or misleading statement or omits or will omit any fact

necessary to make the statements contained herein or therein, in

light of the circumstances under which made, not misleading.

There have been no events or transactions or facts or information

which has come to, or upon reasonable diligence, should have

come to the attention of such Party and which have not been

disclosed herein or in a schedule hereto, having a direct impact

on the transactions contemplated hereunder.

39. COMPLIANCE WITH LAWS:

39.1 The Bidder shall undertake to observe , adhere to, abide by, comply with

and notify Bank about all laws in force or as are made applicable in

future, pertaining to or applicable to them, their business , their

employees or their obligations towards them and all purposes of this

tender and shall indemnify, keep indemnified, hold harmless, defend and

protect Bank and its employees/ officers/ staff/ personnel/

representatives/ agents from any failure or omission on its part to do so

and against all claims or demands of liability and all consequences that

may occur or arise for any default or failure on its part to conform or comply

with the above and all other statutory obligations arising there from.

39.2 The Bidder shall promptly and timely obtain all such consents,

permissions, approvals, licenses, etc, as may be necessary or required

for any of the purposes of this project or for the conduct of their own

business under any applicable Law, Government Regulation/Guidelines

and shall keep the same valid and in force during th e term of the project,

and in the event of any failure or omission to do so, shall indemnify, keep

indemnified, hold harmless, defend, protect and fully compensate Bank

and its employees/ officers/ staff/ personnel/ representatives/agents

from and against all claims or demands of liability and all consequences

that may occur or arise for any default or failure on its part to conform or

comply with the above & all other statutory obligations arising there from

and Bank shall give notice of any such claim or demand of liability within

reasonable time to the Bidder.

39.3 The Bidder agrees that the Bidder shall not be entitled to assign / sub

lease any or all of its rights and/or obligations under this tender and

subsequent Agreement to any entity including Bidder’ s affiliate without

the prior written consent of Bank.

39.4 In case Bank undergoes a merger, amalgamation, takeover, consolidation,

reconstruction, change of ownership, etc., this RFP shall be considered

to be assigned to the new entity and such an act shall not affect the

rights of the Bidder under this RFP.

P a g e 30 | 42

40. CANCELLATION OF THE ORDER AND TERMINATION OF CONTRACT:

40.1 Bank reserves its right to cancel the order and terminate the contract in

the event of one or more of the following situations, that are not

occasioned due to reasons solely and directly attributable to Bank alone:

a) Delay in implementation beyond the specified period that is agreed

in the contract that shall be signed with the successful Bidder; and

b) Serious discrepancy in the quality of service expected during the

implementation, rollout and subsequent maintenance process.

40.2 In case of order cancellation, any payments made by Bank to the Bidder

would necessarily have to be returned to Bank with interest @15% per

annum.

40.3 Notwithstanding anything contained in this RFP, Bank shall terminate

this RFP if it is found that the project envisaged under this RFP could not

be taken place on account of change in policy /guidelines of the

Bank/Government/RBI or any other regulatory/authority.

40.4 Failure to observe the time schedule as mentioned in point No.52 of the

RFP for implementation, appointment and rollout.

40.5 If there is contravention as provided under Clause 54.

40.6 If violation of social media policy is detected at any stage.

40.7 Bank shall also have the right to cancel the order and terminate the

contract by issuing a 30 days notice to the successful bidders without

assigning any reasons.

40.8 Effect of Termination

a) The Bidder agrees that it shall not be relieved of its obligations

under the reverse transition mechanism notwithstanding the

termination of the contract.

b) Reverse Transition mechanism would typically include service and

tasks that are required to be performed / rendered by the Bidder

to the Bank or its designee to ensure smooth handover and