Post-implementation Review

IFRS 10 Consolidated Financial Statements

IFRS 11 Joint Arrangements

IFRS 12 Disclosure of Interests in Other Entities

June 2022

Project Report and Feedback Statement

IFRS Accounting Standards

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 2

Post-implementation Review

The International Accounting Standards Board (IASB) conducts post-implementation reviews of new

IFRSAccounting Standards or major amendments to IFRS Accounting Standards to assess the effects of the

requirements on users of nancial statements, preparers and auditors.

This Project Report and Feedback Statement (Report) summarises the work completed and conclusions

reached in the Post-implementation Review of IFRS 10 Consolidated Financial Statements, IFRS 11 Joint

Arrangements and IFRS 12 Disclosure of Interests in Other Entities (Post-implementation Review).

Contents

from page

At a glance 3

Introduction 4

First phase—Identifying matters to be examined 6

Second phase—Summary of ndings and the IASB’s response 7

Appendix A—Questions in the Request for Information 10

Appendix B—How evidence was gathered 14

Appendix C—Feedback summary and the IASB’s responses 17

Appendix D—Time line of the Post-implementation Review 27

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 3

At a glance

The IASB conducted a Post-implementation Review of IFRS 10 Consolidated Financial Statements,

IFRS11 Joint Arrangements and IFRS 12 Disclosure of Interests in Other Entities between 2019

and2022.

The objective of the Post-implementation Review was to assess the effects of the requirements in the

Standards on users of nancial statements, preparers and auditors.

The IASB’s conclusions on the Post-implementation Review

Based on its analysis of the evidence gathered in the Post-implementation Review, the IASB concluded that

the requirements of IFRS 10, IFRS 11 and IFRS 12 are working as intended. In particular, the IASB concluded

the Standards are meeting their objectives and that:

• IFRS 10—using the control model as the single basis for consolidation, including guidance for applying that

model to situations in which it can be difficult for an entity to assess control, enables entities to determine

whether they control another entity.

• IFRS 11—the classication of a joint arrangement based on a party’s rights and obligations provides

a faithful representation of an entity’s interest in a joint arrangement. IFRS 11 overcomes previous

impediments to nancial reporting that classied joint arrangements based on legal structure and permitted

an entity a choice in accounting for jointly controlled entities.

• IFRS 12—the information required by IFRS 12 enables users of nancial statements to evaluate the

nature of, and risks associated with, the entity’s interests in other entities, including subsidiaries, joint

arrangements, associates and structured entities; and the effects of those interests on the entity’s nancial

position, nancial performance and cash ows.

• no unexpected costs arose when applying or enforcing the requirements of IFRS 10, IFRS 11 and IFRS 12,

nor when using or auditing information the Standard requires an entity to provide.

Outcomes of the Post-implementation Review

Applying the approach on pages 7–8 of this Report, the IASB assessed none of the matters arising from the

Post-implementation Review to be of high or medium priority. The IASB assessed ve matters to be of low

priority and these could be explored if identied as priorities in the next agenda consultation:

1

• subsidiaries that are investment entities;

• transactions that change the relationship between an investor and an investee;

• transactions that involve ‘corporate wrappers’;

• collaborative arrangements outside the scope of IFRS 11; and

• additional disclosures about interests in other entities.

The IASB decided no further action was required on other matters identied in the Post-implementation Review.

1 The next agenda consultation will be the IASB’s fourth agenda consultation.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 4

Introduction

Post-implementation reviews

A post-implementation review is a mandatory step in the IFRS Foundation's due process. The International

Accounting Standards Board (IASB) is required to conduct a post-implementation review of each new IFRS

Accounting Standard or major amendment to an IFRS Accounting Standard. These reviews help the IASB to

assess the effects of requirements on users of nancial statements, preparers and auditors.

The IFRS Foundation’s Due Process Handbook states that a post-implementation review has two phases:

• the rst phase, which involves identifying and assessing matters to be examined, which then become the

subject of a public consultation in a request for information.

• the second phase, in which the IASB considers the responses to the request for information along with

the information it has gathered through other consultative and research activities. These activities include

meetings with stakeholders and a review of relevant research, including academic literature, on the effect of

applying the IFRS Accounting Standard to nancial reporting.

A post-implementation review ends when the IASB presents its ndings and sets out the steps it plans to take,

if any, as a result of the review.

Purpose of a post-implementation review

In a post-implementation review, the IASB aims to assess whether:

• an entity applying the requirements in an IFRS Accounting Standard produces nancial statements that

faithfully portray the entity’s nancial position and performance, and whether this information helps users of

nancial statements to make informed economic decisions;

• areas of the IFRS Accounting Standard pose challenges;

• areas of the IFRS Accounting Standard could result in inconsistent application; and

• unexpected costs arise when applying or enforcing the requirements in the IFRS Accounting Standard, or

when using or auditing information the IFRS Accounting Standard requires an entity to provide.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 5

Introduction continued...

The IASB’s objectives when issuing IFRS 10, IFRS 11 and IFRS 12

The IASB’s objectives when issuing IFRS 10, IFRS 11 and IFRS 12 were to:

• develop a control model as the single basis for consolidation and robust guidance for applying that control

model to situations in which it proved difficult for an entity to assess control;

• establish an accounting principle to reect the rights and obligations that parties have as a result of their

interests in joint arrangements; and

• enable users of nancial statements to evaluate the nature of and risks associated with an entity’s interests in

other entities, including subsidiaries, joint arrangements, associates and structured entities; and to evaluate

the effects of those interests on the entity’s nancial position, nancial performance and cash ows.

Time line of the Post-implementation Review

The time line of the Post-implementation Review is presented in Appendix D of this Report.

More information about the project

More information about the project, including recordings of public meetings, is available on the

IFRSFoundation’s website.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 6

First phase—Identifying matters to

beexamined

Identifying matters to be examined

In the rst phase of the Post-implementation Review the IASB identied matters to be examined in a Request

for Information. To identify matters the IASB:

• reviewed materials published alongside IFRS 10, IFRS 11 and IFRS 12 and after issuing IFRS 10, IFRS 11

and IFRS 12, including Agenda Decisions issued by the IFRS Interpretations Committee (Committee);

• held more than 20 meetings to consult with stakeholders and other consultative bodies; and

• reviewed academic research and other literature.

2

2 For further details, see Agenda Paper 7A Findings from the rst phase and determining the next step and Agenda Paper 7C Work undertaken in the

rst phase from the April 2020 meeting of the International Accounting Standards Board (IASB).

Feedback from the rst phase

Feedback from the rst phase of the Post-implementation Review demonstrated that stakeholders:

• agreed with using the control model as the single basis for consolidation. Some stakeholders said that,

sometimes, applying the requirements of IFRS 10 involves signicant judgement and reaching a conclusion

can prove challenging. For example, challenges can arise when the information available to the entity could

lead to several conclusions, or when an entity or other party is uncertain whether a right or obligation exists.

• supported the principle in IFRS 11, though some stakeholders raised concerns about the classication of

joint arrangements in specic situations, and the accounting requirements for joint operations.

There was little feedback on the disclosure requirements of IFRS 12 in the rst phase of the

Post-implementation Review.

Based on feedback from the rst phase, the IASB identied questions to be included in the Request for

Information. The IASB asked questions about matters it wanted more information on. For example, the IASB

asked how frequently a party to a joint arrangement needs to consider other facts and circumstances to

determine the classication of a joint arrangement.

Appendix A of this Report sets out the questions asked in the Request for Information.

Auditors Standard-

setters

Users

Preparers

Academics Regulators

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 7

Second phase—Summary of ndings and

the IASB’s response

Gathering evidence

In the second phase of the Post-implementation Review, the IASB gathered evidence on the matters in the

Request for Information. The IASB relied on three main sources of evidence:

• public consultation via the Request for Information;

• meeting with stakeholders; and

• reviewing academic research.

3

The IASB also examined disclosures provided by entities applying IFRS 12 in a limited desk-based review of

nancial statements.

Appendix B of this Report summarises how the IASB gathered evidence in the second phase of the Post-

implementation Review.

Approach to assessing evidence

For this Post-implementation Review the IASB applied the following approach to identifying and prioritising

matters arising in the second phase of the Post-implementation Review. The IASB assessed:

• whether matters warrant further action; and

• how such matters should be prioritised.

Assessing whether matters warrant further action

The IASB decided it would act on matters arising from a post-implementation review when the ndings provide

evidence that:

• the objective of the new IFRS Accounting Standard is not being met;

• there is a signicant deciency in how information arising from applying the new IFRS Accounting Standard

meets the needs of users of nancial statements (for example, signicant diversity in application); and/or

• the costs or challenges of applying the new IFRS Accounting Standard or auditing, enforcing or using

information arising from applying the new IFRS Accounting Standard are signicantly greater than

expected (for example, there is a signicant difference between the actual effects of applying the new

IFRSAccounting Standard and the expected effects as described in the effects analysis published with the

new IFRS Accounting Standard).

3 For further details, see Agenda Paper 7D Academic literature review update from the July 2021 IASB meeting.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 8

Second phase—Summary of ndings and

the IASB’s response continued...

Assessing the priority of the matters that warrant further action

The IASB decided it would prioritise matters arising from this Post-implementation Review based on the

characteristics of the matter—that is, the extent to which:

• the matter has substantial consequences.

• the matter is pervasive.

• the IASB or the Committee can respond to the matter.

• the benets of any action would be expected to outweigh the costs. To determine this, the IASB would

consider the extent of disruption and operational costs resulting from change and the importance of the

matter to users of nancial statements.

The IASB classied matters arising in the second phase based on the characteristics for prioritisation, as set

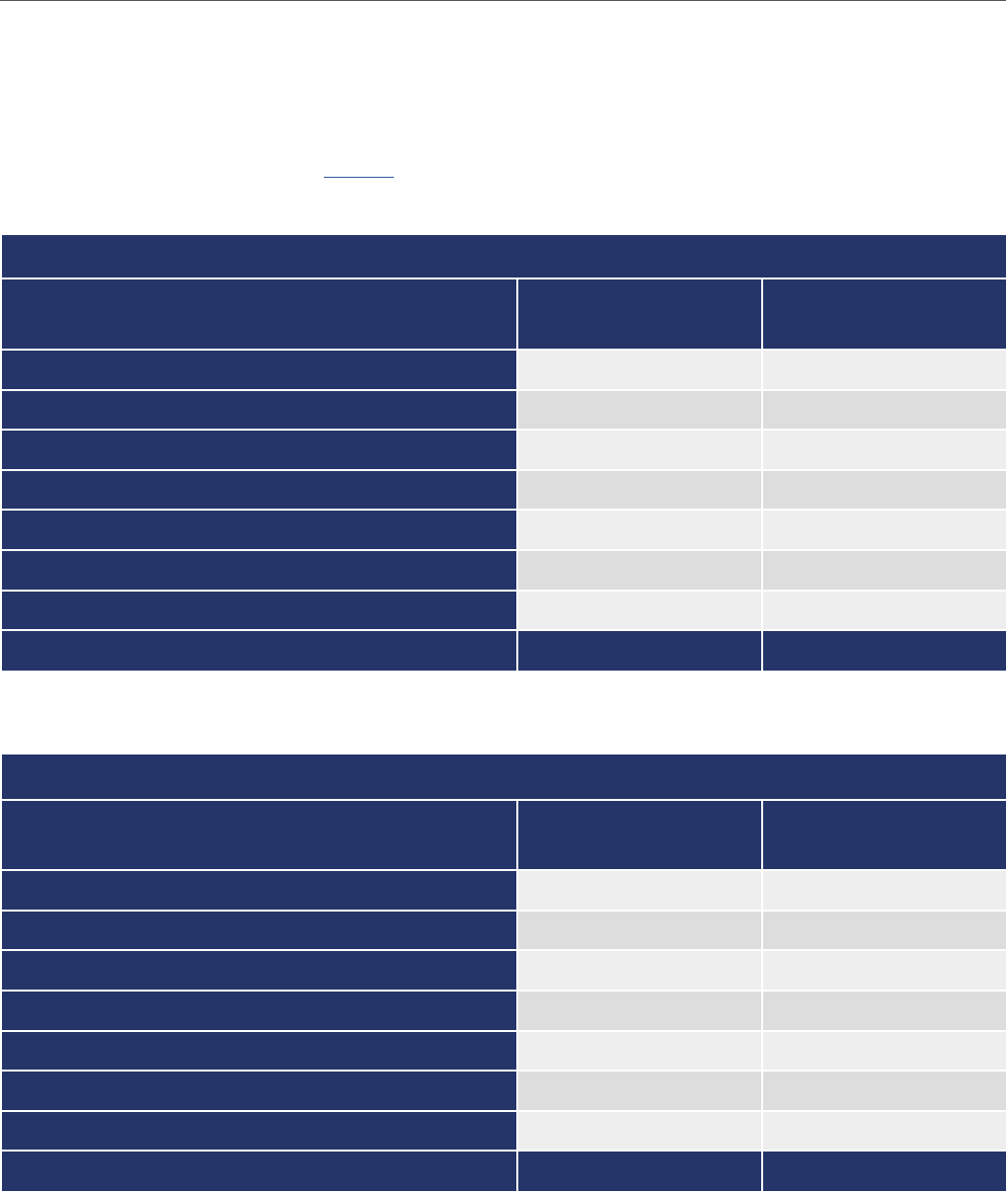

out in Table 1:

Table 1—Prioritisation of matters raised

Priority When to act To what extent the characteristics are present

High As soon as

possible

Matters that:

• relate to the objective or core principle of the new IFRS Accounting

Standard and result in the IASB being unable to conclude that the

new IFRS Accounting Standard is working as intended; or

• require an urgent solution.

Medium Add to the

research

pipeline

Matters that exhibit most of the characteristics required to qualify as

priorities and for which the benets of responding to the matter are

expected to exceed the costs.

Low Explore if

identied as a

priority in the

next agenda

consultation

Matters that:

• exhibit some of the characteristics required to qualify as priorities;

and

• omit other characteristics required to qualify as priorities or

lack enough information for the IASB to conclude whether such

characteristics are present.

No action Not applicable Matters that exhibit few or none of the characteristics required to qualify

as priorities.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 9

Second phase—Summary of ndings and

the IASB’s response continued...

Overall conclusion

The IASB concluded that IFRS 10, IFRS 11 and IFRS 12 are working as intended after considering the

evidence gathered in the second phase of the Post-implementation Review.

Outcomes

Applying the approach on pages 7–8 of this Report, the IASB assessed none of the matters arising from the

Post-implementation Review to be of high or medium priority. The IASB assessed ve matters to be of low

priority and these could be explored if identied as priorities in the next agenda consultation. These are:

• subsidiaries that are investment entities;

• transactions that change the relationship between an investor and an investee;

• transactions that involve ‘corporate wrappers’;

• collaborative arrangements outside the scope of IFRS 11; and

• additional disclosures about interests in other entities.

The IASB’s response to the low-priority matters is set out in Appendix C of this Report.

The IASB decided no further action was required on other matters identied in the Post-implementation

Review. The IASB observed that:

• if stakeholders need further guidance they are encouraged to submit application questions meeting the

submission criteria to the Committee; and

• other matters exhibited few or none of the characteristics required to qualify as priorities, for example,

the IASB noted that only a few respondents raised a concern about IFRS 11 eliminating proportionate

consolidation for joint ventures.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 10

Appendix A—Questions in the Request

forInformation

Table A1—Questions in the Request for Information

Number Questions in the Request for Information

1 To understand whether groups of stakeholders share similar views, the IASB would like to know:

(a) your principal role in relation to nancial reporting. Are you a user or a preparer of

nancial statements, an auditor, a regulator, a standard-setter or an academic? Do you

represent a professional accounting body? If you are a user of nancial statements, what

kind of user are you, for example, are you a buy-side analyst, sell-side analyst, credit

rating analyst, creditor or lender, or asset or portfolio manager?

(b) your principal jurisdiction and industry. For example, if you are a user of nancial

statements, which regions do you follow or invest in? Please state whether your

responses to questions 2–10 are unrelated to your principal jurisdiction or industry.

2(a) In your experience:

(i) to what extent does applying paragraphs 10–14 and B11–B13 of IFRS 10 enable an

investor to identify the relevant activities of an investee?

(ii) are there situations in which identifying the relevant activities of an investee poses a

challenge, and how frequently do these situations arise? In these situations, what other

factors are relevant to identifying the relevant activities?

2(b) In your experience:

(i) to what extent does applying paragraphs B26–B33 of IFRS 10 enable an investor to

determine if rights are protective rights?

(ii) to what extent does applying paragraphs B22–B24 of IFRS 10 enable an investor

to determine if rights (including potential voting rights) are, or have ceased to be,

substantive?

2(c) In your experience:

(i) to what extent does applying paragraphs B41–B46 of IFRS 10 to situations in which the

other shareholdings are widely dispersed enable an investor that does not hold a majority

of the voting rights to make an appropriate assessment of whether it has acquired (or

lost) the practical ability to direct an investee’s relevant activities?

(ii) how frequently does the situation in which an investor needs to make the assessment

described in question 2(c)(i) arise?

(iii) is the cost of obtaining the information required to make the assessment signicant?

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 11

Appendix A—Questions in the Request

forInformation continued...

Table A1—Questions in the Request for Information

Number Questions in the Request for Information

3(a) In your experience:

(i) to what extent does applying the factors listed in paragraph B60 of IFRS 10 (and the

application guidance in paragraphs B62–B72 of IFRS 10) enable an investor to determine

whether a decision maker is a principal or an agent?

(ii) are there situations in which it is challenging to identify an agency relationship? If yes,

please describe the challenges that arise in these situations.

(iii) how frequently do these situations arise?

3(b) In your experience:

(i) to what extent does applying paragraphs B73–B75 of IFRS 10 enable an investor to

assess whether control exists because another party is acting as a de facto agent (ie in

the absence of a contractual arrangement between the parties)?

(ii) how frequently does the situation in which an investor needs to make the assessment

described in question 3(b)(i) arise?

(iii) please describe the situations that give rise to such a need.

4(a) In your experience:

(i) to what extent does applying the denition (paragraph 27 of IFRS 10) and the description

of the typical characteristics of an investment entity (paragraph 28 of IFRS 10) lead

to consistent outcomes? If you have found that inconsistent outcomes arise, please

describe these outcomes and explain the situations in which they arise.

(ii) to what extent does the denition and the description of typical characteristics result in

classication outcomes that, in your view, fail to represent the nature of the entity in a

relevant or faithful manner? For example, do the denition and the description of typical

characteristics include entities in (or exclude entities from) the category of investment

entities that in your view should be excluded (or included)? Please provide the reasons

for your answer.

4(b) In your experience:

(i) are there situations in which requiring an investment entity to measure at fair value

its investment in a subsidiary that is an investment entity itself results in a loss of

information? If so, please provide details of the useful information that is missing and

explain why you think that information is useful.

(ii) are there criteria, other than those in paragraph 32 of IFRS 10, that may be relevant to the

scope of application of the consolidation exception for investment entities?

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 12

Appendix A—Questions in the Request

forInformation continued...

Table A1—Questions in the Request for Information

Number Questions in the Request for Information

5(a) In your experience:

(i) how frequently do transactions, events or circumstances arise that:

(a) alter the relationship between an investor and an investee (for example, a change

from being a parent to being a joint operator); and

(b) are not addressed in IFRS Accounting Standards?

(ii) how do entities account for these transactions, events or circumstances that alter the

relationship between an investor and an investee?

(iii) in transactions, events or circumstances that result in a loss of control, does remeasuring

the retained interest at fair value provide relevant information? If not, please explain why

not, and describe the relevant transactions, events or circumstances.

5(b) In your experience:

(i) how do entities account for transactions in which an investor acquires control of

a subsidiary that does not constitute a business, as dened in IFRS 3 Business

Combinations? Does the investor recognise a non-controlling interest for equity not

attributable to the parent?

(ii) how frequently do these transactions occur?

6 In your experience:

(a) how widespread are collaborative arrangements that do not meet the IFRS 11 denition

of ‘joint arrangement’ because the parties to the arrangement do not have joint control?

Please provide a description of the features of these collaborative arrangements,

including whether they are structured through a separate legal vehicle.

(b) how do entities that apply IFRS Accounting Standards account for such collaborative

arrangements? Is the accounting a faithful representation of the arrangement and why?

7 In your experience:

(a) how frequently does a party to a joint arrangement need to consider other facts and

circumstances to determine the classication of the joint arrangement after having

considered the legal form and the contractual arrangement?

(b) to what extent does applying paragraphs B29–B32 of IFRS 11 enable an investor

to determine the classication of a joint arrangement based on ‘other facts and

circumstances’? Are there other factors that may be relevant to the classication that are

not included in paragraphs B29–B32 of IFRS 11?

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 13

Table A1—Questions in the Request for Information

Number Questions in the Request for Information

8 In your experience:

(a) to what extent does applying the requirements in IFRS 11 enable a joint operator to report

its assets, liabilities, revenue and expenses in a relevant and faithful manner?

(b) are there situations in which a joint operator cannot so report? If so, please describe

these situations and explain why the report fails to constitute a relevant and faithful

representation of the joint operator’s assets, liabilities, revenue and expenses.

9 In your experience:

(a) to what extent do the IFRS 12 disclosure requirements assist an entity to meet the

objective of IFRS 12, especially the new requirements introduced by IFRS 12 (for

example the requirements for summarised information for each material joint venture or

associate)?

(b) do the IFRS 12 disclosure requirements help an entity determine the level of detail

necessary to satisfy the objective of IFRS 12 so that useful information is not obscured

by either the inclusion of a large amount of detail or the aggregation of items that have

different characteristics?

(c) what additional information that is not required by IFRS 12, if any, would be useful to

meet the objective of IFRS 12? If there is such information, why and how would it be

used? Please provide suggestions on how such information could be disclosed.

(d) does IFRS 12 require information to be provided that is not useful to meet the objective

of IFRS 12? If yes, please specify the information that you consider unnecessary, why

it is unnecessary and what requirements in IFRS 12 give rise to the provision of this

information.

10 Are there matters not addressed in this Request for Information, including those arising

from the interaction of IFRS 10 and IFRS 11 and other IFRS Accounting Standards, that you

consider to be relevant to this Post-implementation Review? If so, please explain the matter

and why you think it should be addressed in the Post-implementation Review.

Appendix A—Questions in the Request

forInformation continued...

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 14

Public consultation through a Request for Information

In December 2020, the IASB published a Request for Information for public comment. The Request for

Information was open for comment until 10 May 2021. The IASB received 84 comment letters, which are

available on the IFRS Foundation’s website.

Respondents to the Request for Information represented various stakeholder groups:

Table B1—Respondents by stakeholder type

Type of respondent Number of

respondents

Percentage of

respondents (%)

Academics 2 3

Accounting rms 7 8

Preparers and industry organisations 28 33

Professional accountancy bodies 16 19

Regulators and government agencies 5 6

Standard-setters 22 26

Users of nancial statements 4 5

Total 84 100

Respondents to the Request for Information represented different geographical regions:

Table B2—Respondents by geographical region

Geographical region Number of

respondents

Percentage of

respondents (%)

Global 9 11

Africa 6 7

Asia 18 21

Europe 36 43

Latin America and the Caribbean 7 8

North America 3 4

Oceania 5 6

Total 84 100

Appendix B—How evidence was gathered

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 15

Stakeholder engagement

In the second phase of the Post-implementation Review, IASB members and technical staff participated in

more than 35 stakeholder-engagement events, including discussion forums, conferences and meetings with

individuals. Some of the events were facilitated by standard-setters or professional accountancy bodies.

The IASB also consulted with users of nancial statements, with a focus on understanding users’ views on the

information disclosed in accordance with IFRS 12.

The events included various stakeholder groups:

Table B3—Participants by stakeholder type

Type of participant Number of

events

Percentage of

events (%)

Academics 2 5

Accounting rms 5 14

Preparers and industry organisations 3 8

Professional accountancy bodies 2 5

Regulators and government agencies 5 14

Standard-setters 11 30

Users of nancial statements 9 24

Total 37 100

The events included participants from various geographical regions:

Table B4—Participants by geographical region

Geographical region Number of

events

Percentage of

events (%)

Global 9 24

Africa 4 11

Asia 6 17

Europe 10 27

Latin America and the Caribbean 2 5

North America 4 11

Oceania 2 5

Total 37 100

Appendix B—How evidence was gathered

continued...

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 16

Review of academic research

The IASB reviewed academic research using the databases Google Scholar, the Social Science Research

Network, LexisNexis and EBSCO Business Complete. The IASB searched these databases using a set of

keywords based on areas within the scope of the Post-implementation Review. The IASB examined both

published and unpublished manuscripts identied from the search.

The review of academic research was conducted in two phases and discussed at the IASB meetings in:

• April 2020, in the rst phase of the Post-implementation Review; and

• July 2021, in the second phase of the Post-implementation Review, when an updated review was presented.

The review of academic research identied 11 studies within the scope of the Post-implementation Review—of

which 10 were published in academic journals and one was unpublished.

The ndings from the academic research included:

• mixed evidence on whether implementing IFRS 10 resulted in an entity changing its assessment of whether

it controlled an investee;

• mixed evidence on whether IFRS 11 improved relevance and comparability in the accounting for joint

arrangements; and

• limited evidence on IFRS 12.

Additional research

The IASB supplemented the academic research by conducting a limited desk-based review of nancial

statements focusing on disclosures provided in accordance with IFRS 12. The objective of the review was

to provide evidence on whether the disclosure objective of IFRS 12 has resulted in improved information for

users of nancial statements.

The ndings from the research helped with developing materials for discussion during meetings with

stakeholders, especially in meetings with users.

Appendix B—How evidence was gathered

continued...

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 17

Appendix C—Feedback summary and the

IASB’s responses

Matters the IASB assessed as low priority

Subsidiaries that are investment entities

Table C1—Question 4(b) of the Request for Information

Feedback Response

Question 4(b) of the Request for Information

asked whether useful information is lost when

an investment entity measures at fair value

its investment in a subsidiary that is itself an

investment entity.

Respondents generally supported the IASB’s view

that fair value information is the most relevant

information for investment entities. However,

some respondents said information is lost

when an investment entity parent measures an

investment entity subsidiary at fair value, including

informationon:

• investments held by the subsidiary, for example,

information on fair value and changes in the fair

value of these investments;

• other assets and liabilities held by the subsidiary,

such as cash balances and borrowings; and

• investment-related services provided by the

subsidiary, for example, revenue and the cost of

the services.

The IASB observed that some investment entity

parents voluntarily disclose this information.

The IASB observed that:

• information is lost only for investment entities

with multi-layered structures; and

• information loss can be compensated for by

voluntary disclosure.

If identied as a priority in the next agenda

consultation, the IASB could either:

• research and consider developing disclosure

requirements for subsidiaries that are investment

entities themselves; or

• reconsider which subsidiaries an investment

entity parent consolidates, and which

subsidiaries are measured at fair value.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 18

Appendix C—Feedback summary and the

IASB’s responses continued...

Matters the IASB assessed as low priority

Transactions that change the relationship between an investor and an investee

Table C2—Question 5(a) of the Request for Information

Feedback Response

Question 5(a) of the Request for Information asked

for feedback on the frequency of transactions

that alter the relationship between an investor

and an investee and are not addressed in

IFRSAccounting Standards, and how entities

account for the transactions. Respondents

discussed transactionsinvolving:

• a subsidiary becoming a joint operation;

• a joint venture becoming a joint operation;

• changes in a parent’s ownership interest in a

subsidiary that do not result in the parent losing

control of the subsidiary (the parent might

reclassify goodwill between equity interest

attributable to the parent and non-controlling

interest, which affects the subsequent

impairment assessment of the goodwill); and

• an entity becoming a party to a joint operation

without joint control.

The IASB considered:

• IFRS Accounting Standards do not provide

requirements for all transactions that alter

the relationship between an investor and an

investee; and

• respondents to the Request for Information

had mixed views on the frequency of those

transactions IFRS Accounting Standards do not

provide requirements for.

If identied as a priority in the next agenda

consultation, the IASB could either:

• provide requirements for transactions if they are

found to arise frequently; or

• explore the feasibility of identifying principles for

transactions that alter the relationship between

an investor and an investee.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 19

Appendix C—Feedback summary and the

IASB’s responses continued...

Matters the IASB assessed as low priority

Transactions that involve ‘corporate wrappers’

Table C3—Question 5(b) and question 10 of the Request for Information

Feedback Response

Question 5(b) of the Request for Information asked

how entities account for transactions in which an

investor acquires control of a subsidiary that does

not constitute a business.

Question 10 asked if there were other matters,

not specied in the Request for Information, that

respondents considered to be relevant to the

Post-implementation Review.

Respondents to these two questions asked if

the accounting outcome for transactions that are

structured through ‘corporate wrappers’ to achieve

particular purposes—for example, tax, legal

or regulatory purposes—should differ from the

accounting outcome for similar transactions that

are structured without ‘corporate wrappers’.

The IASB was concerned it might not be able to

successfully resolve this matter within the scope

of IFRS 10, particularly as the matter extends

beyond the scope of this Post-implementation

Review. For example, the matter might also affect

IFRS15 Revenue from Contracts with Customers

or IFRS16 Leases.

The structure of ‘corporate wrappers’ also depends

on jurisdictional laws and/or regulations. Therefore,

identifying matters to be addressed by the IASB

could require substantial resources for both the

IASB and its stakeholders.

If identied as a priority in the next agenda

consultation, the IASB could either:

• research whether it is appropriate and, if so,

whether it is possible to develop a principle for

transactions that involve ‘corporate wrappers’; or

• focus only on particular transactions that involve

‘corporate wrappers’.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 20

Appendix C—Feedback summary and the

IASB’s responses continued...

Matters the IASB assessed as low priority

Collaborative arrangements outside the scope of IFRS 11

Table C4—Question 6 of the Request for Information

Feedback Response

Question 6 of the Request for Information asked

whether collaborative arrangements outside the

scope of IFRS 11 were widespread and how

entities apply IFRS Accounting Standards to such

collaborative arrangements.

Respondents said such collaborative arrangements

are commonplace in:

• the extractive industry;

• the real estate industry;

• the pharmaceutical industry;

• the entertainment industry; and

• the telecommunications industry.

Most respondents said entities determine

accounting policies by analogy to the requirements

for joint operations in IFRS 11. Some respondents

said some entities apply the equity method in

accordance with IAS 28 Investments in Associates

and Joint Ventures.

The IASB noted that collaborative arrangements

are only commonplace in some industries.

If identied as a priority in the next agenda

consultation, the IASB could research whether

there is a group of collaborative arrangements,

outside the scope of IFRS 11, with common

features (a homogeneous group).

If there is a homogeneous group of collaborative

arrangements, the IASB could assess whether

IFRS Accounting Standards provide guidance

for those arrangements and if standard-setting

isneeded.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 21

Appendix C—Feedback summary and the

IASB’s responses continued...

Matters the IASB assessed as low priority

Additional disclosures about interests in other entities

Table C5—Question 9 of the Request for Information

Feedback Response

Question 9 of the Request for Information asked to

what extent the disclosure requirements in IFRS12

help an entity to meet the Standard’s disclosure

objective.

Respondents generally agreed that the IFRS 12

disclosure requirements enable an entity to meet

the Standard’s disclosure objective. However,

many users (particularly in meetings) requested

additional information on:

• management’s signicant judgements and

assumptions;

• subsidiaries with material non-controlling

interests;

• unconsolidated structured entities;

• information on joint ventures and associates by

operating segment, including line items, such as

the revenue of joint ventures; and

• joint operations.

The IASB acknowledged users’ requests for

additional disclosure on interests in other entities.

However, it also noted that, in developing additional

disclosure requirements, it would need to assess

the costs of implementing the new requirements

and the benets of the additional information.

Because the IASB concluded that entities can

meet the disclosure objective of IFRS 12, it

assessed the matter to be of low priority.

If identied as a priority in the next agenda

consultation, the IASB could assess whether there

is a need to improve the disclosure requirements

for interests in other entities.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 22

Appendix C—Feedback summary and the

IASB’s responses continued...

Matters the IASB decided to take no further action on

Assessing control

Table C6—Questions 2 and 3 of the Request for Information

Feedback Response

Questions 2 and 3 of the Request for Information

asked for information on the requirements

for assessing whether an investor controls

anotherentity.

Most respondents agreed that applying the

requirements in IFRS 10 enables an investor

to assess whether it controls an investee—

inparticular, an investor can:

• identify the investee’s relevant activities;

• decide whether rights held by the investor or

other investors are substantive;

• decide whether rights held by the investor or

other investors are protective;

• decide whether the investor without a majority of

the voting rights controls the investee;

• decide whether a decision maker acts as a

principal or agent; and

• decide whether a non-contractual agency

relationship exists.

Some respondents provided fact patterns

illustrating challenges in assessing elements of the

denition of control. Some respondents asked for

further guidance to help assess control. However,

many respondents acknowledged that assessing

control requires judgement.

Because many respondents said an investor can

assess whether it controls an investee by applying

the requirements in IFRS 10, the IASB decided

against acting on matters relating to the denition

of control.

In developing IFRS 10, the IASB acknowledged

that assessing control requires judgement.

Theextent of the judgement required depends

on the complexity of the transaction and can,

sometimes, be signicant.

The IASB acknowledged the requests for further

guidance. However, the IASB also acknowledged

the need to balance the costs and benets of

developing and implementing new requirements.

On balance, the IASB decided that, if stakeholders

need further guidance, they are encouraged

to submit application questions meeting the

submission criteria to the IFRS Interpretations

Committee (Committee).

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 23

Appendix C—Feedback summary and the

IASB’s responses continued...

Matters the IASB decided to take no further action on

Denition of an investment entity

Table C7—Question 4(a) of the Request for Information

Feedback Response

Question 4(a) of the Request for Information asked

whether applying the denition of an investment

entity leads to consistent outcomes.

Most respondents said applying the denition in

paragraph 27 of IFRS 10 and the description of

the typical characteristics of an investment entity

in paragraph 28 of IFRS 10 leads to consistent

outcomes.

A few respondents (including those participating

in meetings with stakeholders) said there are

challenges in applying elements of the denition of

an investment entity. Consequently, inconsistent

application can arise.

The specic elements of the denition mentioned

by these respondents include:

• how to identify an entity’s exit strategy

(paragraph B85F of IFRS10); and

• how the business purpose of an entity

is compatible with the denition of an

investmententity.

The IASB decided to take no further action on this

matter.

The IASB acknowledged that judgement is

required when assessing whether an entity is

an investment entity. However, as supported by

most respondents, the IASB concluded that the

requirements in IFRS 10 adequately enable entities

to decide if an entity is an investment entity.

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 24

Matters the IASB decided to take no further action on

Classifying joint arrangements

Table C8—Question 7 of the Request for Information

Feedback Response

Question 7 of the Request for Information asked

whether a party to a joint arrangement can

determine the classication of a joint arrangement

based on other facts and circumstances.

Most respondents said applying paragraphs B29–

B32 of IFRS 11 enables an investor to determine

the classication of a joint arrangement based on

other facts and circumstances.

However, some respondents reported challenging

situations they encountered when classifying

joint arrangements based on other facts

and circumstances. For example, having to

determine whether a joint arrangement can be

classied as a joint operation when the life of the

arrangement is longer than the life of the assets of

thearrangement.

The IASB decided to take no further action on

thismatter.

The IASB agreed with most respondents that the

requirements of IFRS 11 enable an investor to

determine the classication of a joint arrangement

based on other facts and circumstances.

Appendix C—Feedback summary and the

IASB’s responses continued...

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 25

Matters the IASB decided to take no further action on

Accounting for joint operations

Table C9—Question 8 of the Request for Information

Feedback Response

Question 8 of the Request for Information asked

whether applying the requirements in IFRS 11

enables a joint operator to report its assets,

liabilities, revenue and expenses in a relevant and

faithful manner.

Many respondents said it is unclear how IFRS 11

requirements should be applied in a situation in

which a joint operator’s share of output purchased

differs from its ownership interest in the joint

operation. Respondents asked:

• for the basis on which a joint operator

determines its share of jointly held assets and

jointly incurred liabilities; and

• how an entity accounts for a difference

between the amount of assets and liabilities

initially recognised and the equity that was

initiallycontributed.

The IASB decided to take no further action, noting

that the Committee issued an Agenda Decision

on this matter in March 2015—IFRS 11 Joint

Arrangements—Accounting by the joint operator:

the accounting treatment when the joint operator’s

share of output purchased differs from its share of

ownership interest in the joint operation.

The Agenda Decision states that it is important to

understand why the share of the output purchased

differs from the ownership interests in the joint

operation and that judgement would, therefore, be

needed to determine the appropriate accounting.

Appendix C—Feedback summary and the

IASB’s responses continued...

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 26

Matters the IASB decided to take no further action on

Other matters

Table C10—Question 10 of the Request for Information

Feedback Response

Question 10 of the Request for Information asked

whether there are other matters respondents

consider to be relevant to the Post-implementation

Review.

Respondents raised other matters that, in their

view, could be relevant to the Post-implementation

Review, for example:

• elimination of proportionate consolidation;

• application questions on the equity method;

• put options on non-controlling interests;

• non-investment entity parents and their

investment entity subsidiaries;

• separate nancial statements of a joint

operation; and

• assessing control of a not-for-prot investee.

The IASB decided to take no further action on

these matters because:

• the matters lack many of the characteristics

required to qualify as priorities, in particular:

– the matters are not pervasive;

– the matters have no substantial

consequences; or

– the cost of developing and implementing new

requirements would outweigh the benet.

• some matters might be addressed by other

projects.

Appendix C—Feedback summary and the

IASB’s responses continued...

Post-implementation Review of IFRS 10, IFRS 11 and IFRS 12 | June 2022 | 27

Appendix D—Time line of the

Post-implementation Review

September 2019

–March 2020

May 2021

December 2020

October 2021–

February 2022

April 2020

July 2021

January–

April 2021

June 2022

FIRST PHASE

SECOND PHASE

Initial consultation with

stakeholders and a review of

academic research.

Request for Information

comment deadline—84 comment

letters received.

The IASB assessed evidence

gathered in the second phase and

decided outcomes.

Request for Information

published.

The IASB decided which matters

would be examined further in the

Request for Information.

Summary of feedback and other

evidence presented to the IASB.

The IASB published the Project

Report and Feedback Statement.

Extensive and focused consultation

with stakeholders, an update

on academic research and a

limited desk-based review of

nancialstatements.

Copyright © 2022 IFRS Foundation

All rights reserved. Reproduction and use rights are strictly limited. No part of this publication may be translated, reprinted, reproduced

or used in any form either in whole or in part or by any electronic, mechanical or other means, now known or hereafter invented, including

photocopying and recording, or in any information storage and retrieval system, without prior permission in writing from the IFRS Foundation.

The Foundation has trade marks registered around the world including ‘IAS

®

’, ‘IASB

®

’, the IASB

®

logo, ‘IFRIC

®

’, ‘IFRS

®

’, the IFRS

®

logo,

‘IFRS for SMEs

®

’, the IFRS for SMEs

®

logo, the ‘Hexagon Device’, ‘InternationalAccounting Standards

®

’, ‘International Financial Reporting

Standards

®

’, ‘NIIF

®

’ and ‘SIC

®

’. Further details of the Foundation’s trade marks are available from the Foundation on request.

The IFRS Foundation is a not-for-prot corporation under the General Corporation Law of the State of Delaware, USA and operates in

England and Wales as an overseas company

(Company number: FC023235) with its principal office in London.

Columbus Building

7 Westferry Circus

Canary Wharf

London E14 4HD, UK

Tel +44 (0) 20 7246 6410

Email customerservices@ifrs.org

ifrs.org

International Financial Reporting Standards

®

,

IFRS Foundation

®

, IFRS

®

, IAS

®

, IFRIC

®

, SIC

®

, IASB

®

, ISSB

TM

Copyright © 2022 IFRS Foundation