How to Read and Review Certificates of Insurance Page 1 of 8

© Elizabeth Carmichael 2017

HOW TO READ AND REVIEW CERTIFICATES OF INSURANCE

PURPOSE

This document is designed to provide college administrators the necessary tools to review and evaluate

Certificates of Insurance that are provided by third parties.

DIRECTIONS FOR USE

Review the attached Sample Certificate of Insurance. Note the numbers in red on the Sample Certificate at

the end of this document. The number will correspond with a numbered paragraph in the following

document. Each paragraph includes a description of the information provided in the section, as well as

additional information as to the meaning or importance of the section.

READING AND REVIEWING CERTIFICATES OF INSURANCE:

A Certificate of Insurance is a very important document in a contract. It is intended to confirm that the

Contractor can meet its financial obligations to pay for any losses that the contracting party might be

responsible for, under the terms of the contract. The term “Contractor” is used to describe any type of

contracting party, including vendors, facility users, construction contractors or subcontractors, consultants

If possible, have the Agreement (or the Insurance Clause of the Agreement) that the College has with the

Contractor who is providing the certificate, and use it to confirm various points corresponding to the

numbers in red on the Sample Certificate of Insurance as described below.

1) Title: Certificate of Liability Insurance

ACORD issues other types of Certificates, so verify that the certificate is the one requested.

ACORD 20 - Certificate of Aviation Liability Insurance

ACORD 21 - Certificate of Aircraft Insurance

ACORD 22 - Intermodal Interchange Certificate of Insurance

ACORD 23 - Automobile Certificate of Insurance

ACORD 24 - Certificate of Property Insurance

ACORD 25 - Certificate of Liability Insurance

ACORD 27 - Evidence of Property Insurance

ACORD 28 - Evidence of Commercial Property Insurance

These forms are updated periodically, but agents and brokers may use older forms than the

current year. Older forms may be accepted.

2) Date

Check the date the certificate was issued. It should be current. Missing or old dates may be a sign

of a forged certificate.

How to Read and Review Certificates of Insurance Page 2 of 8

© Elizabeth Carmichael 2017

3) Notice (reformatted to sentence case for ease of reading)

This certificate is issued as a matter of information only and confers no rights upon the

certificate holder. This certificate does not affirmatively or negatively amend, extend

or alter the coverage afforded by the policies below. This certificate of insurance does

not constitute a contract between the issuing insurer(s), authorized representative or

producer, and the certificate holder.

This Notice clarifies that the Certificate of Insurance merely shows the Certificate Holder that the

insured has purchased the insurance coverages stated on the Certificate. It stipulates that

the Certificate Holder has no legal right to be covered by the insurance indicated;

the only coverage terms and conditions that are applicable are those stated on the actual

insurance policies; and

the Certificate does not legally change or alter the actual insurance policy.

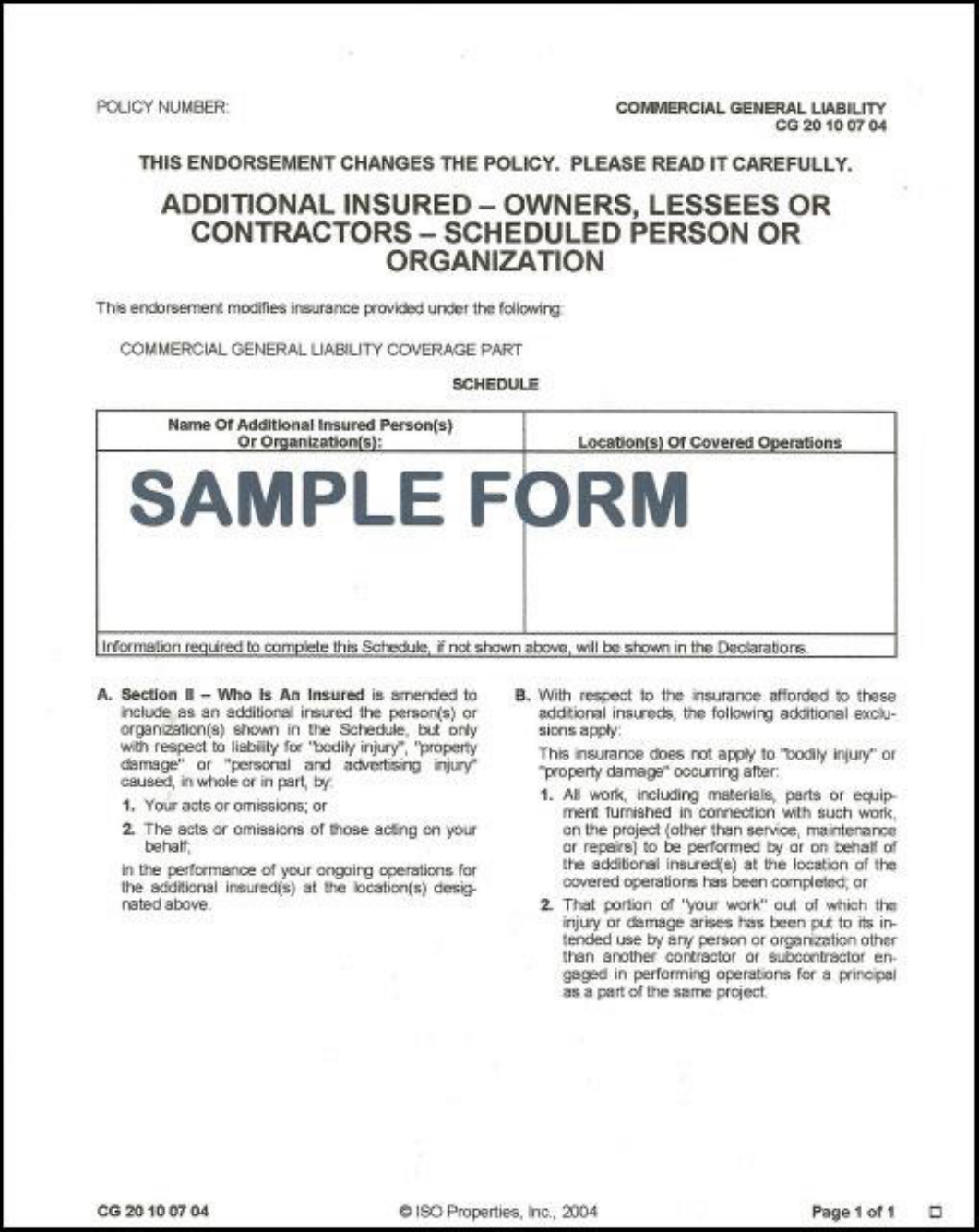

This means that the Certificate does not convey Additional Insured status. This may be conveyed

only by endorsement which adds the University as an additional insured on the actual policy;

without the endorsement, the University may have no legal rights or access to the stated

coverages. Check the Agreement for any requirement that the Contractor has to provide Additional

Insured status on its insurance policies.

4) Notice

IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must

be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the

policy, certain policies may require an endorsement. A statement on this certificate

does not confer rights to the certificate holder in lieu of such endorsement(s).

This notice warns the Certificate Holder to check the Contract and to make sure that if Additional

Insured Status is required by the Contract, to be sure to get a copy of the Endorsement. An

Endorsement is an addendum to the insurance policy that changes the coverage, in this case, by

adding the University as an Additional Insured or that Subrogation is waived.

“Additional Insured” means that the insurance company will defend and indemnify the University

for claims made against the University because of the negligence of the Insured.

“Subrogation is Waived” means that the insurance company will not prosecute the University if

their Insured suffers a claim or loss because of the acts or negligence of the University.

Check the Agreement for any requirement that the Contractor has to provide Additional Insured or

Subrogation is Waived status on its insurance policies.

5) Producer

The Producer is the insurance agent or broker that arranged the insurance coverage for the Named

Insured (the party providing the Certificate of Insurance. With few exceptions you will want to

make sure that the Producer has issued and sent the Certificate. This greatly reduces the likelihood

of getting a forged certificate. The Producer issues the Certificate on behalf of the Insurance

Company.

How to Read and Review Certificates of Insurance Page 3 of 8

© Elizabeth Carmichael 2017

Check who sent the Certificate by noting the email or fax number of the sender; it should

correspond to the Producer information. The Contact name may not always be provided; it is not a

critical part of the Certificate but is very helpful if you have any questions on anything on the

certificate, as the Producer is the party to contact.

6) Insured

The Insured is the organization that has purchased the insurance coverages shown on the

Certificate of Insurance and is a Named Insured. Other parties, such as subsidiaries or affiliates,

may also be Named Insureds under the policies listed.

Check to make sure that the party shown in this box is the contractor or other party that has been

requested to provide coverage. Make sure that it includes the full name and address of the

contractor. If the named party is not the same as in the contract, “red flag” it to the project or

contract manager for clarification.

7) Companies/Insurers Affording Coverage

The insurance companies issuing the polices listed in Coverages (6) are each given an alphabetical

identification so that the reader can see which insurance company is issuing what policies. See

INSR LTR (6a) in left column on certificate.

Check the A.M. Best Rating for each insurer if a requirement is stipulated in the Contract. It is

recommended that each insurer have a Best Rating of A-, VII or higher to be deemed acceptable.

These may be checked on the insurer’s web site, or your own insurance agent may check Best’s

Ratings for you.

8) NAIC #

The NAIC number is a number that the National Association of Insurance Commissioner's (NAIC)

assigns to each individual underwriting company.

If provided, the NAIC# may be used to research complaints made to the NAIC about the Insurance

Company. It can be helpful when companies have similar names or subsidiaries. It is not essential.

9) Coverages Notice (reformatted to sentence case for ease of reading)

This is to certify that the policies of insurance listed below have been issued to the

insured named above for the policy period indicated. Notwithstanding any

requirement, term or condition of any contract or other document with respect to

which this certificate may be issued or may pertain, the insurance afforded by the

policies described herein is subject to all the terms, exclusions and conditions of such

policies. Limits shown may have been reduced by paid claims.

This statement confirms that the insurance policies listed were issued to the insured for the period

indicated. The rest of it serves as disclaimer, to warn the Certificate Holder that

the Certificate does not guarantee any coverage specifics even if those specifics are

outlined in the Contract for Services; and

the insurance limits may not actually be available to the Certificate Holder because they

may have been used to pay other claims.

How to Read and Review Certificates of Insurance Page 4 of 8

© Elizabeth Carmichael 2017

The University can manage these risks by including in the Contract the right to request a certified

copy of the policy and by requiring per-project or per-event limits. This is rather rare on ordinary

contracts, but is common on high-risk construction projects or other high-risk contracts.

10) Certificate Number / Revision Number: This is a unique number assigned by the Producer. Not

essential, but helpful for reference.

11) Coverages Header

a) INSR – A letter will appear in the boxes below that correspond to the Insurers listed in (7)

Insurers Affording Coverage Check to make sure that a letter appears for each coverage that is

required.

b) Type of Insurance – each type of insurance is described in the boxes in this column

c) ADDL INSD – “Additional Insured” – an “X” will appear in this column if Additional Insured

status is provided – See (3) above; check for the endorsement if required. If not provided,

follow up with the Producer for a copy. If the endorsement is not provided in a reasonable

time period, notify the Contract Manager or Project Manager; failure to provide the

endorsement is a breach of contract.

d) SUBR WVD – “Subrogation Waived” – an “X” will appear in this column if Additional Insured

status is provided – See (4) above; check for the endorsement if required. If not provided,

follow up with the Producer for a copy. If the endorsement is not provided in a reasonable

time period, notify the Contract Manager or Project Manager; failure to provide the

endorsement is a breach of contract.

e) Policy Number – this is the number assigned to the Insurance Policy shown and is its identifier.

This is sometimes left blank – check for and insist that all policy numbers be listed.

f) Policy Effective Date – this is the date the policy became effective, i.e. the date coverage

started. Check to make sure that the effective date is appropriate to the contractual

requirements.

g) Policy Expiration Date – this is the date that the insurance policy coverage will end. Check to

make sure that the expiration date is appropriate to the contractual requirements. If the policy

will expire before the contractual obligation will end, diary the certificate to 30 days before the

expiry date and request a renewal certificate from the Producer or Insured.

h) Limits – this is how much money the insurance policy will pay if there is a claim or a loss. Each

limit will be addressed for the coverage provided, see below.

Apart from obtaining a certified copy of the insurance policy, there is little that the certificate

holder can do to verify the accuracy of the information provided. However, insurance agents have

professional standards and obligations, which is another reason to always require that the

certificate be provided by the Producer and not the Insured.

12) General Liability

General Liability Insurance (GL) covers the Insured’s liability arising out of the insured’s premises or

operations, products and completed operations.

a) Coverage Particulars – Check the Contract for these details

i. Commercial General Liability or CGL is the current proper name for General Liability

coverage exposures arising out of a business operation. This box should be marked with an

“X” if the coverage is provided

How to Read and Review Certificates of Insurance Page 5 of 8

© Elizabeth Carmichael 2017

ii. “Claims-made” and “Occurrence” (OCCUR) are two types of general liability insurance

forms. Check to see if the Contract specifies “Occurrence Form”; if not, either will do.

iii. Other (blank line) – most common is an Owners and Contractors Protective Liability policy.

This would be required by Contract to provide separate coverage limits that are contract or

job specific. These policies can also be issued to the property owner as the named insured.

Coverage is very limited. A specific coverage in the GL policy might also be indicated, for

example, a box might be checked “X” and “Molestation Coverage included” be indicated on

the line opposite.

iv. “GEN’L AGGREGATE LIMIT APPLIES PER:” – This section provides information about the

aggregate limit of the policy. The aggregate limit is the highest amount of money that the

insurance policy will pay no matter how many claims are filed. Check the contract to see if it

stipulates whether the aggregate limit must be provided per project or location (terms

favorable to the University); otherwise, aggregate limit per policy is most common.

v. OTHER – as stipulated, usually by contract.

b) Limits – Check the Contract for the amount require for each of these categories

i. “Each Occurrence” means how much money the insurance policy will pay for a single loss.

Common limits are $1,000,000 or $2,000,000.

ii. “Damage to Rented Premises” means how much money the insurance policy will pay for

damage that the insured causes to premises it rents. Common limits are $50,000 or

Occurrence limits.

iii. “Med Exp[ense] (Any One Person)” means the amount of money that will be paid for

documented medical expenses if someone is hurt or injured on the Insured’s premises or by

their Operations, without regard for negligence of the Insured. If more money is needed,

the claimant usually has to prove negligence. Common limits range from $1,000 to $10,000.

iv. “Personal & Adv[ertising] Injury” is a kind general liability coverage that covers personal

injury (i.e., slander, libel, wrongful eviction, false arrest, malicious prosecution, invasion of

privacy) or similar offenses in connection with the insured's operations advertising of its

goods or services: libel, slander, invasion of privacy, copyright infringement, and

misappropriation of advertising ideas. Common limits are Occurrence Limits. Typically, the

University requires insurance to cover third party claims of bodily injury or property

damage; this insurance is not usually of concern.

v. General Aggregate is the highest amount of money that the insurance policy will pay no

matter how many claims are filed. Common limits are the Occurrence Limit or multiples, up

to $5,000,000. Usually for limits in excess of $5,000,000, an Excess policy is needed.

vi. “Products – Comp/Op Agg” means “Products Liability or Completed Operations Aggregate”,

and is the most that the policy will pay for all claims arising out of the Insured’s defective

products or work. It is very common for construction projects to require extended

Completed Operations Insurance for a period from one to three years following the

completion of the work. Check the contract and if applicable, diary the certificate for annual

renewals throughout the extension period.

13) Automobile Liability

Coverage is provided for protection from liability arising out of negligent operation, maintenance

or use of a covered auto, which results in bodily injury or property damage to a third party.

The University does not need to be named as additional insured on the contractor's auto liability

policy. One reason for this is that the definition of an insured, on an ISO CA 0001 Business Auto

How to Read and Review Certificates of Insurance Page 6 of 8

© Elizabeth Carmichael 2017

Policy, states that "Anyone liable for the conduct of insured" is also considered an insured. Also,

Auto Insurers will not add any other party as additional insured.

a) Coverage Particulars

i. Any Auto (symbol 1 on auto policy) means that any auto driven by the Insured or its

employees is covered regardless who owns it.

ii. All Owned Autos (symbol 2 on auto policy) means that only the autos the Insured owns and

any trailers they don't own that are attached to the owned autos are covered.

iii. Scheduled Autos (symbol 7 on auto policy) means that only autos actually listed in the

Policy Declaration's section are covered in addition to any non-owned trailers while

attached to covered (scheduled) autos.

iv. Hired Autos (symbol 8 on auto policy) means that only those autos the insured has leased,

hired, rented or borrowed are covered. This coverage is not afforded for autos of

employees, partners or their families.

v. Non-Owned Autos (symbol 9 on auto policy) means state that only autos the insured does

not own, lease, hire, rent or borrow are covered when used for insurer’s business use. This

also includes coverage for autos of the insurer’s employees, partners and their families for

business or personal use. This coverage is commonly purchased by business that do not

own any autos.

Check the contract to determine what coverage was required if anything other than “Any Auto” is

checked.

b) Limits

i. Combined Single Limit is the most the policy will pay for third party bodily injury and

property damage combined for each accident.

ii. Bodily Injury (per person) would be the most the policy would pay for bodily injury to one

person from each accident.

iii. Bodily Injury (per accident) would be the most the policy would pay for bodily injury from

each accident, regardless of the number of persons injured.

iv. Property Damage would be the most the policy would pay for third party property damage

resulting from one accident.

Check the contract to determine what coverage was required if anything other than “Combined

Single Limit” is checked.

14) Excess Liability/Umbrella Liability

Coverage is provided for Liability in addition to or on top of one or more of the liability policies

listed on the Certificate.

a) Coverage Particulars

i. Excess Liability insurance usually provides additional coverage only for the Contractor’s

General Liability insurance, though other lines of insurance, such as Auto, may also be

scheduled on the policy.

ii. Umbrella Liability insurance provides excess over multiple lines of insurance, including

General Liability, Auto, and Employers Liability (found in the Worker’s Compensation

coverage). Coverage may be broader than the underlying policies, or may insure liabilities

not otherwise insured, which is why there may be a deductible or retention shown.

iii. Either type of policy may be issued on an “Occurrence” or “Claims-made” form. (See (12)

General Liability for more information.

How to Read and Review Certificates of Insurance Page 7 of 8

© Elizabeth Carmichael 2017

iv. DED means “Deductible”; “Retention” is similar to a deductible – this is the amount that

the Insured will have to pay for a loss before the Insurer pays. It is not essential that this be

completed.

Check the contract to determine what coverage was required if anything other than “Umbrella” is

checked. Check the contract to determine what coverage was required if anything other than

“OCCUR” is checked.

b) Limits

i. “Each Occurrence” means how much money the insurance policy will pay for a single loss.

Common limits are $5,000,000 or higher.

ii. General Aggregate is the highest amount of money that the insurance policy will pay no

matter how many claims are filed. Common limits are the Occurrence Limit or multiples.

Check the Agreement to verify the Occurrence and Aggregate limits required.

15) Workers Compensation and Employers Liability

Workers Compensation is statutory coverage that pays for the Insured’s employees’ medical

expenses and lost wages because of injuries or diseases sustained in the course and scope of their

employment. Employers Liability is used to cover liability actions brought by a Contractor’s

employee against the University (a third party) that the Insured is contractually liable for.

a) Any Proprietor/Partners/Executive Officers/Member Excluded – this typically arises with small

contractors whose principals are not insured under the Workers Compensation policy. This

statement verifies whether or not the insured/contractor's owners and officers are covered

under their Workers Compensation policy. MA does not require that owners or officers be

covered for Workers Compensation. If any owner or officer of a contractor will be working on

your contract or project, then they should be covered for Workers Compensation coverage to

avoid any possibility of the exposure being transferred to the University if he/she is seriously

injured.

b) Statutory Limits indicates that the benefits meet the Workers Compensation coverage

requirements for the state in which the injury occurs. Check to make sure that the PER

STATUTE box is checked. If OTHER is checked, refer to the Contract for terms.

c) Each Accident/Disease-Policy Limit/Disease-Each Employee indicates the employers’ liability

coverage limits or Coverage B of the Workers Compensation policy. Check the limits shown

against the Contract. Typical limits are $500,000 / $1,000,000 / $500,000 or $1,000,000 across

all sections.

16) Other

This space may be used to list other types of coverage not shown above. Common coverages are

Professional Liability, Pollution Liability, or other specialty coverages that may be needed due to

the nature of the work being performed or operations. Check the Agreement to determine if any

specialty insurance is needed.

17) Description Of Operations/Locations/Vehicles (ACORD 101, Additional Remarks Schedule…)

This section can be used to describe special operations, identify a specific job site/location or

contract number as well as indicate additional insured to the liability coverage. Note, indicating

Additional Insured Status here does not replace the need for an Endorsement.

How to Read and Review Certificates of Insurance Page 8 of 8

© Elizabeth Carmichael 2017

18) Certificate Holder

This is the entity to which the Certificate of Coverage is issued, i.e., the University. Check to make

sure that it is issued to the contracting entity (e.g., Trustees of XX University) not a department or

individual.

19) Cancellation

Older forms may have a specified period, such as 30 days’ notice. Because the Certificate does not

amend policy terms, the new wording is used. Without a copy of the policy, the Certificate Holder

cannot know what the terms are, but they are likely that “the insurance companies will "endeavor"

to provide to the Certificate Holder on cancellation of the policies”, as they do not want to create

liability because of a promise to give notice. This may be amended in the endorsement providing

Additional Insured status. Check the Agreement terms for specifics. Also note that most insurance

companies can cancel a policy with only 10 days written notice for non-payment of premiums by

the insured.

20. Authorized Representative

This is the insurance company representative or producer/broker who has been authorized to sign

the Certificate.

Special Note: It is important that all Certificates of Insurance are received, reviewed and approved prior to

the start of any work.

DATE (MM/DD/YYYY)

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS

CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES

BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED

REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER.

IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed.

If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on

this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).

PRODUCER

CONTACT

NAME:

PHONE

(A/C, No, Ext):

FAX

(A/C, No):

E-MAIL

ADDRESS:

INSURER(S) AFFORDING COVERAGE

NAIC #

INSURER A :

INSURED

INSURER B :

INSURER C :

INSURER D :

INSURER E :

INSURER F :

1 CERTIFICATE OF LIABILITY INSURANCE 2

COVERAGES

9

CERTIFICATE NUMBER

:

-

10 - REVISION NUMBER:

THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD

INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS

CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS,

EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS.

INSR

LTR

TYPE OF INSURANCE

ADDL

INSD

SUBR

WVD

POLICY NUMBER

POLICY EFF

(MM/DD/YYYY)

POLICY EXP

(MM/DD/YYYY)

LIMITS

COMMERCIAL GENERAL LIABILITY

EACH OCCURRENCE

$

CLAIMS-MADE OCCUR

DAMAGE TO RENTED

PREMISES (Ea occurrence)

$

MED EXP (Any one person)

$

PERSONAL & ADV INJURY

$

GEN'L AGGREGATE LIMIT APPLIES PER:

GENERAL AGGREGATE

$

POLICY

PRO-

LOC

JECT

OTHER:

PRODUCTS - COMP/OP AGG

$

$

AUTOMOBILE LIABILITY

COMBINED SINGLE LIMIT

(Ea accident)

$

ANY AUTO

BODILY INJURY (Per person)

$

OWNED

AUTOS

ONLY HIRED

AUTOS

ONLY

SCHEDULED

AUTOS

NON-OWNED

AUTOS ONLY

BODILY INJURY (Per accident)

$

PROPERTY DAMAGE

(Per accident)

$

$

UMBRELLA LIAB

EXCESS LIAB

OCCUR

CLAIMS-

MADE

EACH OCCURRENCE

$

AGGREGATE

$

DED

RETENTION $

$

WORKERS COMPENSATION

AND EMPLOYERS' LIABILITY

Y / N

ANYPROPRIETOR/PARTNER/EXECUTIVE

OFFICER/MEMBER EXCLUDED?

(Mandatory in NH)

If yes, describe under

DESCRIPTION OF OPERATIONS below

N / A

PER

STATUTE

OTH-

ER

E.L. EACH ACCIDENT

$

E.L. DISEASE - EA EMPLOYEE

$

E.L. DISEASE - POLICY LIMIT

$

DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required)

CERTIFICATE HOLDER

CANCELLATION

SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE

THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN

ACCORDANCE WITH THE POLICY PROVISIONS.

AUTHORIZED REPRESENTATIVE

ACORD 25 (2016/03)

1988-2015 ACORD CORPORATION. All rights reserved.

The ACORD name and logo are registered marks of ACORD

3

4

5

6

7

8

20

19

18

17

16

11

12

13

14

15

(a)

(b)

(c)

(a)

(b)

(a)

(b)

(a)

(b)