Statement of

Michael Fratantoni, Ph.D.

Chief Economist and Senior Vice President,

Research and Industry Technology

On Behalf of the Mortgage Bankers Association

U.S. House of Representatives

Financial Services Committee

Subcommittee on Housing and Insurance

“The Characteristics and Challenges of Today’s

Homebuyers”

Wednesday, March 20, 2024

2:00 P.M.

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Chairman Davidson, Ranking Member Cleaver, and members of the subcommittee, thank you

for the opportunity to testify on behalf of the Mortgage Bankers Association (MBA)

1

. My name is

Mike Fratantoni, and I am the Chief Economist and Senior Vice President of Research and

Industry Technology at the MBA.

In my remarks today, I will review current market data on various aspects of the mortgage

market, focusing on the buyers, the products, the sources of financing, and the obstacles that

homebuyers and lenders face. I will also examine some of the current trends in the rental

housing market, including that for single-family rentals (SFR).

Overview of the mortgage market

Let me start by highlighting just how large the single-family residential market is: $45 trillion in

real estate owned by households. $13 trillion in mortgage debt outstanding. $32 trillion in home

equity. In terms of new origination of mortgages, there was a record volume of originations of

almost $4.5 trillion in 2021. In contrast to that figure, we are forecasting about $2.0 trillion in

originations for 2024 – up from $1.6 trillion in 2023.

Source: MBA estimates and forecast, February 2024

1

The Mortgage Bankers Association (MBA) is the national association representing the real

estate finance industry, an industry that employs more than 300,000 people in virtually every

community in the country. Headquartered in Washington, D.C., the association works to ensure

the continued strength of the nation's residential and commercial real estate markets, to expand

homeownership, and to extend access to affordable housing to all Americans. MBA promotes

fair and ethical lending practices and fosters professional excellence among real estate finance

employees through a wide range of educational programs and a variety of publications. Its

membership includes all elements of real estate finance: independent mortgage banks,

mortgage brokers, commercial banks, thrifts, REITs, Wall Street conduits, life insurance

companies, credit unions, and others in the mortgage lending field.

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

These mortgages exist to fund the purchase of homes or to refinance existing loans. The broad

availability of mortgage credit supports a U.S. homeownership rate that in recent years has

hovered around 65%. Given the link between homeownership and wealth building for middle-

American households, it is important to note that there is still a wide gap between the

homeownership rates across different racial and ethnic groups.

Source: MBA analysis of American Community Survey data

Of the $13 trillion of mortgage debt outstanding, roughly $9 trillion of all mortgage debt is

securitized through the Department of Housing and Urban Development’s (HUD) Government

National Mortgage Association (Ginnie Mae), and the housing Government Sponsored

Enterprises, Fannie Mae and Freddie Mac (the GSEs). Most of the remaining $4 trillion of

mortgage debt is held on bank portfolios as whole loans, with some held as whole loans by

other types of investors.

While right before the Great Financial Crisis (GFC) as much as half of securitized volume was

private label, with banks and broker dealers the issuers, the Private Label Securities (PLS)

sector is much smaller in today’s market, comprising $80 billion or so of the $1.6 trillion

originations in 2023. About $30 billion of this volume in 2023 was for non-QM lending, i.e.,

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

loans with somewhat more flexible underwriting primarily intended for self-employed borrowers

or others with more complex financial or employment patterns.

In the U.S., the predominance of the freely prepayable 30-year fixed-rate mortgage (FRM) as

the product of choice for most homebuyers and refinance borrowers has led to the current

infrastructure where the majority of new loans are securitized rather than held on portfolios.

Typically, more than 80% of mortgages used to purchase a home are 30-year FRMs, while

many refinance borrowers opt for shorter-term, 10-, 15-, or 20-year FRMs. Most of the

remaining loans are hybrid adjustable-rate mortgages (ARM), with initial fixed-rate periods of 5,

7, or 10 years, and then more frequent rate adjustments.

2

According to MBA’s Weekly

Application Survey data, the ARM share ranged from 7 to a little over 8 percent of applications

in the last two years. This contrasts to an ARM share of only about 3 percent of applications

during the refinance wave in 2020-2021.

Given the inherent interest rate risk in holding FRMs, long-term, freely prepayable mortgages

are not a good asset-to-liability match for banks, most of whom fund themselves primarily with

deposits. ARMs do tend to be a better match. Many banks will sell their FRMs but hold their

ARMs.

Investors of various types, including insurance companies, pension funds, and other fixed

income investors, have an appetite for longer-term assets. Ginnie Mae and the housing GSEs

perform vital functions as intermediaries and/or guarantors of these FRMs, issuing or

guaranteeing mortgage-backed securities (MBS) created from pools of largely fixed-rate loans.

This $9 trillion agency MBS market is one the largest, most liquid fixed income markets in the

world.

Limitations on the loan size and characteristics of loans that can be pooled into agency MBS

pools mean that there is a need for many remaining non-agency eligible mortgages to be held

on balance sheets or to be issued as PLS. Ginnie Mae MBS, backed by Federal Housing

Administration (FHA), Veterans Affairs (VA), and Rural Housing Service (RHS) loans, have an

explicit full faith and credit guarantee. This enables investors to have complete confidence in

the credit worthiness of these securities, while receiving a yield well above that on U.S. Treasury

bonds of a similar duration. Uniform mortgage-backed securities (UMBS), or MBS backed by

Fannie Mae or Freddie Mac, are viewed by global investors as only somewhat less safe given

their strong support from the U.S. government.

The broad and diversified investor base for Ginnie Mae MBS leads to a very liquid market.

Practically, that means that the secondary market for FHA, VA, and RHS loans is always open.

Mortgage rates may move up and down, but low-to-moderate (LMI) first-time home buyers

(FTHB), Veterans, and rural homebuyers will be able to access credit and buy homes.

Deep, liquid capital markets, like those for agency MBS, provide for the availability of mortgage

credit at almost all times. Importantly, I would note that during the GFC and the global

pandemic the Federal Reserve did step in with extraordinary measures to ensure that these

markets remained liquid.

2

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Contrast this with the ebb and flow of bank portfolio demand for mortgages, driven by the

quantity of deposits in the banking system and the relative returns of mortgage to other potential

portfolio investments.

The abundant liquidity of agency MBS is directly valued and priced accordingly by investors.

Those investors can get in and out of positions in the sizes they need and are willing to give up

some yield in return for that liquidity. That is directly reflected in better mortgage rates offered to

borrowers, and hence increased affordability for homebuyers and homeowners who are

refinancing, as they will be getting loans that will be securitized into these markets.

Profile of homebuyers today

Homebuyers can purchase properties with cash or by using mortgage financing. For existing

homes, roughly 28% of borrowers purchased with cash in 2023. I would note that given the

extremely competitive sellers’ market in recent years, at least some buyers were “cash” buyers

in order to win the property, who later used a cash-out refinance or a home equity loan to

restore their liquidity. For new homes, more than 8% were cash buyers.

3

Home Mortgage Disclosure Act (HMDA) data from 2022 show that for those homebuyers who

used mortgage financing, 70% took out conventional conforming loans (typically securitized

through the housing GSEs), 14% used FHA loans, 9% VA, 1% RHS, and 6% used conventional

jumbo loans.

MBA Weekly Application Survey data typically show about 90% of applications are for buyers

who intended to occupy their properties as primary residences, while the remaining 10% are for

second home or investor properties.

Over time, roughly half of financed home purchases, i.e., purchase mortgages, are for first-time

home buyers. As these first timers tend to be buying less expensive properties, they account for

a smaller share of the dollar value of these mortgages compared to the unit count.

3

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Source: MBA analysis of National Mortgage Database data, FHFA

Many first-time homebuyers rely on the government housing finance programs for their loans.

In particular, FHA supported affordable mortgage financing for more than 478,000 first-time

homebuyers in Fiscal Year 2023, representing more than 82 percent of its forward mortgage

purchase endorsements.

First-time buyers purchasing entry level properties often have relatively low average loan sizes.

A challenge for lenders is that there are substantial fixed costs in loan origination and servicing,

and hence it can be more costly to focus on the entry level market. MBA recently conducted a

comprehensive analysis examining the relationship between a lender’s average loan size and

their revenues and costs.

4

The findings concluded that loan originators with the highest loan

balances experienced the highest of highs for net production profits in 2021 (a strong market)

and the lowest of lows in 2022 (a weak market). On the other hand, while companies with the

lowest loan balances performed the worst in 2021, in 2022 they mitigated net production losses

to a greater extent than lenders with higher average loan balances.

Cost barriers and regulatory barriers are thought to be the primary reasons for the dearth in

small-dollar lending—an essential way for the mortgage industry to facilitate access to

affordable, lower-valued homes. The cost barrier argument suggests that the revenues garnered

through originating and servicing lower balance loans do not justify the costs. MBA’s analysis

suggests that the relationship between loan balance and profitability is more nuanced and may

change over the course of market cycles. For example, and as alluded to previously, in a weak

origination market, as in 2022, lenders with lower average loan sizes were able to mitigate

production losses to a greater extent than lenders with larger average loan size. Additionally, in

4

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

a period of high loan prepayment, as in 2020, servicers with higher loan balances posted lower

net servicing financial income than servicers with lower loan balance loans.

5

Different lenders with varying business models tend to focus on distinct types of lending. In

recent years, a growing share of mortgage originations and mortgage servicing have been

conducted by independent mortgage banks (IMBs), while market shares for banks and credit

unions have been decreasing. More specifically, IMBs have grown to account for the vast

majority of originations of government loans, while banks as a group have retained the majority

of conventional jumbo loans.

Source: MBA analysis of 2022 HMDA data

5

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Data from MBA’s Peer Group Roundtable program show that while IMBs tend to focus primarily

on government and conventional loans to first-time homebuyers, banks have concentrated more

on ARMs and jumbo loans for their retail banking clients that they intend to hold on their

portfolios.

Source: PGR: MBA and STRATMOR Peer Group Roundtable Program; 2022 data

Source: MBA’s Weekly Application Survey

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

As evident by the changing relative pricing between conforming and jumbo 30-year loans, bank

appetite for holding mortgages on their portfolios has varied widely over time. Changes in the

pace of deposit growth and the level of GSE guarantee fees have been among the primary

drivers of these changes.

6

Mortgage rates reached record lows below 3% for 30-year fixed-rate mortgages in late 2020

through early 2021 during the pandemic. In 2022, to combat inflation, the Federal Reserve

briskly raised short-term rates and 30-year mortgage rates more than doubled in response.

Over the same time period, given a lack of housing supply and brisk demand, home prices

increased 39% over the 2020-2022 timeframe. The net impact was a dramatic reduction in

affordability, as shown in MBA’s Purchase Application Payments Index, the ratio of median

principal and interest (P+I) payments from our Weekly Applications Survey to typical weekly

earnings measured by the Census Bureau. Median P+I payments increased more than $900

over this time period.

One manifestation of this declining affordability has been increasing debt to income (DTI) ratios

on new originations. Homebuyers, particularly first-time buyers who do not have the ability to

make larger downpayments, have been more willing to accept a higher payment burden. For

FHA borrowers in particular, this is posing a noticeable increase in risk, and we are seeing FHA

delinquencies increase in recent quarters. In Q4 2023, the delinquency rate on FHA mortgages

increased to 10.8%, the highest rate since 2021 (when borrowers were recovering from the

pandemic driven spike in delinquencies).

6

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Source: MBA analysis of FHA data

With these challenges to affordability, along with increasing consumer debt levels, another sign

of stress in the market is a modest decrease in average credit scores in FHA and GSE new

originations. While we expect a slowdown in the economy this year and an increase in

unemployment, we do not anticipate more than a gradual increase in delinquency rates because

of these stresses. However, a sharper slowdown in the economy could be problematic in this

regard.

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Source: FHA

Source: Fannie Mae

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

The rental market

Roughly two-thirds of households own their home in this country, and another one-third are

renters. Data compiled by Harvard’s Joint Center for Housing Studies shows clearly how

housing burdens vary across renters and homeowners at different income levels. The Joint

Center characterizes households that pay less than 30% of their income towards housing as

“not burdened”, those that pay 30-50% of their income as “moderately burdened”, and those

that pay more than 50% of their income as “severely burdened.” Renters tend to have lower

incomes, and at each income level tend to have a higher proportion of households that are

moderately or severely burdened.

For some households renting occurs during a phase of their lives where they are establishing

their careers, increasing their earnings capacity, and perhaps before they start their families.

However, for many households, who might live in higher cost markets, or who may not see their

incomes grow substantially over time, renting may be a more permanent status. We know from

multiple data sources that renter households tend to have lower incomes and substantially lower

net worth than owner households.

7

By various measures, rents in the aggregate grew substantially since the beginning of the

pandemic. However, asking rents on vacant units have leveled out recently as we are seeing a

large influx of new multifamily housing supply ready to hit the market. In fact, with close to 1

million apartment units currently under construction, the highest level since the early 1970s, we

7

15 10 5 0 5 10 15 20 25 30 35 40 45 50

2022

2019

2016

2013

2010

2007

2004

2001

2022

2019

2016

2013

2010

2007

2004

2001

2022

2019

2016

2013

2010

2007

2004

2001

2022

2019

2016

2013

2010

2007

2004

2001

2022

2019

2016

2013

2010

2007

2004

2001

Severely Burdened

Moderately Burdened

Not Burdened

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

expect a slowdown in multifamily construction over the next few years as this incremental

supply is absorbed by the market. Construction activity has not been uniform, with relatively

more taking place in some areas (Sunbelt markets) and relatively less in others (Midwest).

For renters, this leveling off in rents is likely to be a welcome respite. However, for property

owners, it is a somewhat tougher time given the decline in rent growth at the same time as

interest and other property management expenses have increased.

Source: MBA analysis of BLS, Census, and RealPage data

What Type of Structure Do Renters Live In?

Structure Type

Households

Percent

Residents

Percent

Single-Family

14,205,402

31%

40,426,498

39%

2 to 4 Units

7,891,588

17%

17,592,199

17%

5 or More Units

21,278,969

47%

40,017,878

39%

Mobile Homes

1,777,914

4%

4,675,897

5%

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Other

67,971

0%

121,307

0%

Total

45,221,844

100%

102,833,779

100%

Source: NMHC analysis of 2022 ACS data

While many think of high-rise apartment buildings (in particular) when considering the rental

housing market, in fact, the majority of renters in the country live in 1–4-unit properties. The

single-family rental (SFR) market has always been an important part of the rental housing

picture. It has garnered increased attention in recent years as some institutional investors have

entered this market which has traditionally been dominated by small (“mom and pop”) investors.

Following the GFC, with foreclosure inventories at record levels, home prices dropping in much

of the country, and housing demand quite low, some institutional investors saw an opportunity to

buy homes in bulk, with a goal to potentially sell as home prices rebounded. Since that time,

some of these investors have continued to purchase or hold onto these homes with a view to

earn from them as income investments, similar to how other investors would invest equity in the

multifamily market.

Taken together at the national level institutional investors hold a relatively small share of all

single-family homes in the country. However, understandably given the economies for the

business of concentrating their holdings in certain pockets within certain metro areas, these

investors do hold a higher share of investment properties in some areas including Dallas,

Houston, Atlanta, and Phoenix.

8

Another aspect of this market is that some institutional investors are now purchasing newly

constructed homes directly from builders, a “Single-family built-for-rent” (SFBFR) market.

NAHB estimates that SFBFR purchases in 2023 accounted for roughly 8% of single-family

housing starts.

9

8

9

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Supply challenges

The biggest challenge in today’s housing market is the lack of housing inventory. While the

demographic fundamentals of the market continue to support strong housing demand for the

next several years, the market is millions of units short of that needed to support this demand.

Source: MBA analysis of Census Bureau data

The U.S population currently has about 50 million individuals between the ages of 30 and 40.

This large Millennial cohort is in the ages where household formation is at its peak, and we are

seeing roughly 1.5 million households formed each year. It is important to note that this is also

the age range at which the homeownership rate jumps higher, from 38% for those under 35, to

63% for those 35-44. We expect that this demographic demand will continue to support the

housing market.

It is important to note that Baby Boomers are reaching the age at which we would expect their

housing demand to begin to decline. We expect that Boomer households will net supply about

250 thousand housing units per year over the next decade, a welcome addition to housing

inventory.

10

10

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Source: MBA analysis of Census Bureau data

This strong demand has run into a structural undersupply in the housing market. While this

country built 16-18 million housing units of all types per decade from 1970-2009, following the

GFC, in the next decade, only 11 million units were built. With the interruption from the

pandemic, we are also running short of the needed supply thus far this decade. While

estimates of the needed supply vary widely, it is clear that we are millions of units behind at this

point. And even though we expect to see a large delivery of multifamily units over the next few

years, this will not resolve the broader lack of inventory that we see across the country.

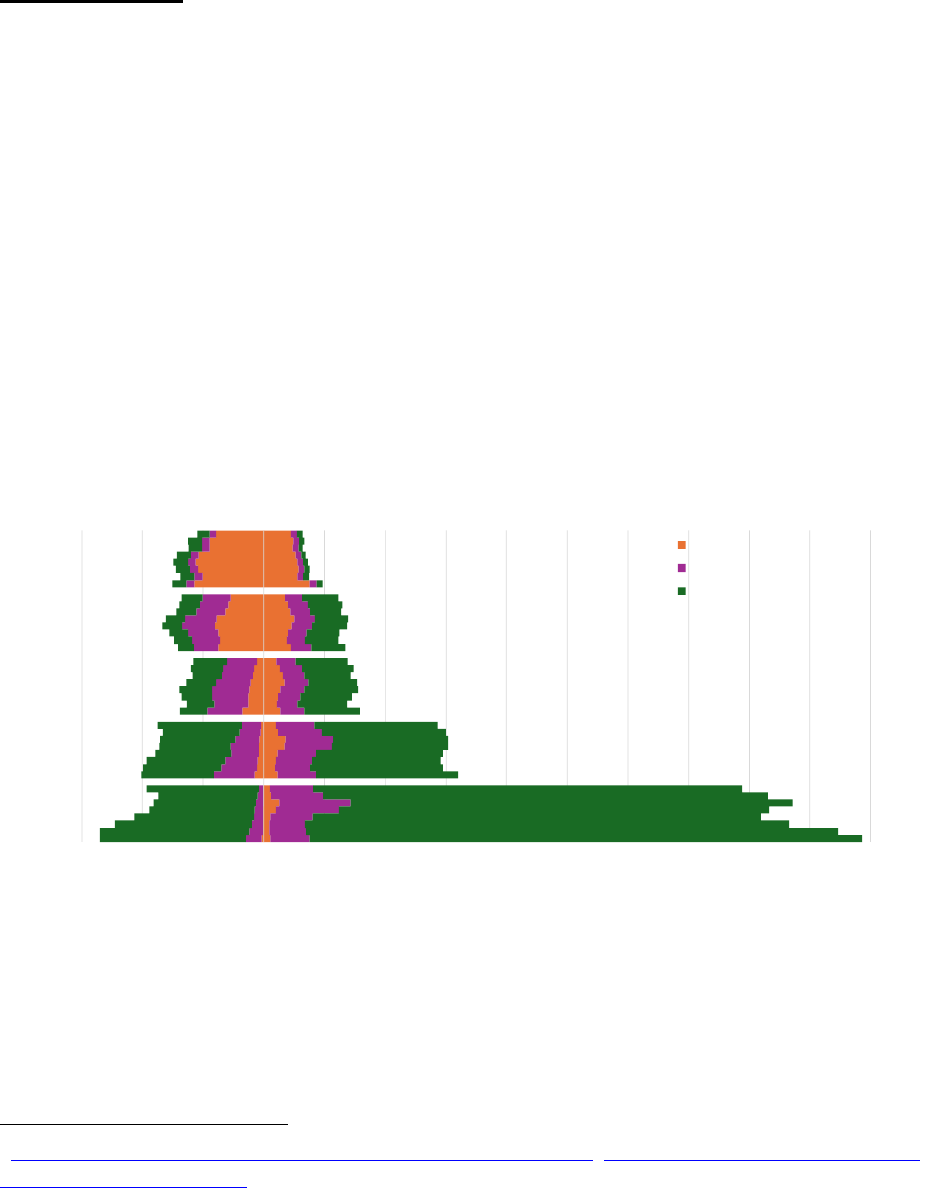

The recent trend in mortgage rates has exacerbated this supply shortfall. With the record low

mortgage rates during the pandemic, many homeowners refinanced and locked in much lower

housing payments. While this certainly has helped them strengthen their balance sheets, this

“lock in” effect has also made them less interested in selling their current homes, as it would

necessitate them taking on a new mortgage at a much higher rate.

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

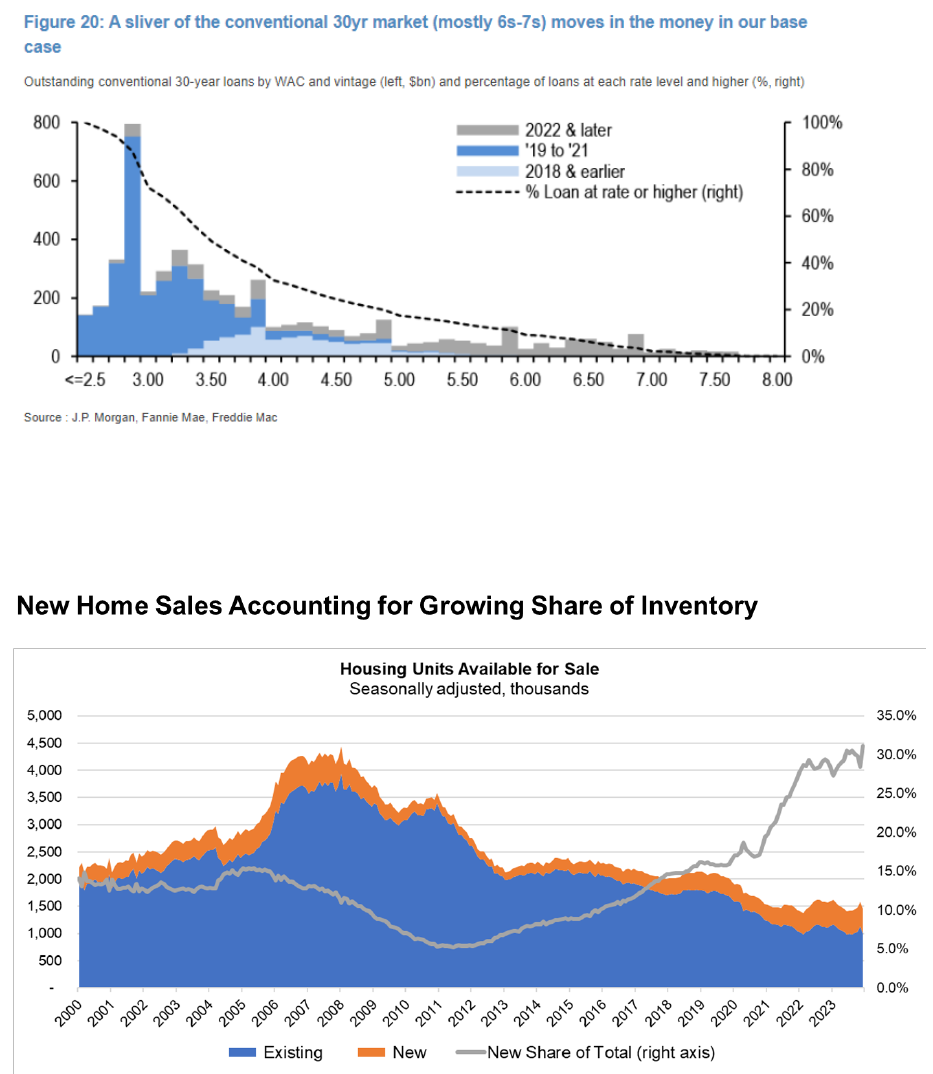

While existing home inventory is quite constrained, with about 1 million homes for sale

nationwide, about 3.5 months’ supply at the current sales pace, builders have certainly picked

up their pace of construction, and new homes now account for roughly one-third of homes on

the market. This compares to a more typical 10% share of total home inventory historically.

Source: MBA analysis of Census Bureau and NAR data

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Regulatory and other challenges

Post GFC, the mortgage market has changed significantly with respect to the types of

companies originating and servicing loans, with a pronounced shift away from depositories,

particularly large banks, towards non-depositories/IMBs. While many of the consumer-facing

mortgage regulations that were part of the Dodd-Frank Act apply equally across lender types,

additional regulation, notably including capital requirements, have played a significant role in

this shift, as the mortgage business has become much less attractive for many banks.

11

Source: MBA analysis of HMDA data

11

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Source: MBA’s National Delinquency Survey

MBA is concerned that the recent Basel III “Endgame” proposal would only accelerate this trend.

In particular, MBA’s comment letter highlighted the overly conservative risk weights on mortgage

loans (particularly for low downpayment loans favored by first-time homebuyers, and the lack of

benefit for loans with mortgage insurance), the punitive treatment of mortgage servicing rights

(MSRs), and the burdensome treatment of warehouse lending as being particularly negative for

the mortgage market.

12

Warehouse lending involves the use of short-term revolving credit

facilities extended by financial institutions to mortgage loan originators for the funding of

mortgage loans.

The Basel Endgame proposal would increase capital requirements on all three types of

mortgage activity by banks – low downpayment loans held on balance sheet (e.g., Community

Reinvestment Act loans), mortgage servicing, and warehouse lending – and poses a significant

risk to the stability of the housing finance market if it is not modified across all of these

dimensions.

Increasing Cost of Property Insurance

With the rising incidence of severe storms and wildfires

13

, coupled with rising replacement costs

for structures and increasing legal costs in some jurisdictions, property insurance premiums

have jumped for many prospective and current homeowners. For prospective homebuyers, this

increase in the cost of insurance can impede their ability to qualify for a mortgage. For current

12

13

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

homeowners, who had thought they had locked in a relatively fixed mortgage payment over

time, the jump in insurance premiums can lead to real stress.

Moreover, certain insurance carriers have also limited their participation in some states given

the increases in risk and costs. Although these increases in premia and reductions in availability

of insurance have been concentrated in certain markets at this point, the concerns regarding

property insurance continue to build for our lender members in the residential, multifamily, and

commercial sectors – and for all their customers. MBA certainly appreciates focus on this issue

by a range of policymakers, including (but not limited to) this subcommittee, HUD, the Treasury

Department, and FHFA.

Testimony of Michael Fratantoni, Ph.D., for the MBA

House Financial Services Committee

Subcommittee on Housing & Insurance

March 20, 2024

Source: National Mortgage News, Guaranteed Rate

Concluding thoughts

The U.S. housing and mortgage markets are large, complex, and multi-faceted. Keeping these

markets healthy and dynamic remains an important consideration for the strength of the broader

economy. Whether families currently rent, are hoping to purchase their first home, or are current

owners working to maintain their investment, there are numerous challenges to affordability and

sustainability within today’s individual housing markets across our country.

Thank you again for the opportunity to walk through these latest market trends with you. I look

forward to your questions.