We have a consistent set of strategic priorities

Growing and deepening relationships by engaging customers

1

with products and services they

love and by expanding our distribution

Delivering financial performance that is consistently best-in-class

Leveraging data and technology to drive speed to market and deliver customer value

Protecting our customers and the firm through a strong risk and controls environment

Cultivating talent to build high-performing, diverse teams where culture is a competitive advantage

Strategy

Enablers

Outcome

1

5

2

3

4

For footnoted information, refer to slide 45

1

We continue to make progress against our commitments

Strategy

Enablers

Outcome

Added net ~3.6mm customers to the CCB franchise

Continued to scale distribution by opening 166 branches – committed to build over 500 new branches in the next three years

Launched Freedom Rise and DoorDash credit cards, JPM Premium Deposit and Chase Travel brand

Grew client investment assets

1

to ~$950B (+$300B YoY), benefitting from market performance and First Republic (FRC)

Delivered $20B in volume through our Commerce platforms

2

– on track for ~$30B 2025 target, while macro travel headwinds affect margins

Added 350+ Business Relationship Managers and 420+ Advisors

Migrated ~80% of production applications to strategic data centers and the public cloud

3

Migrated ~90% of analytical data to the public cloud

4

Continued to operate in a strong risk and controls environment

Attracted top talent and reduced employee attrition

Extended #1 position in retail deposit share

5

by 40bps to 11.3% (up 10bps ex. FRC)

Extended #1 position in credit card sales share by 50bps to 22.9% and outstandings by 30bps to 16.9% – on path to 20%

6

Generated $52.6B in net interest income ex. FRC and $55.0B incl. FRC, up ~$15B from last year

Incurred $33.4B in adjusted expense ex. FRC ($34.6B incl. FRC)

7

, in line with ~$33B guidance from last year

Delivered 38% ROE on net income of $21.2B – delivered >25% ROE for the past 3 years

STRATEGIC COMMITMENTS

For footnoted information, refer to slide 45

2

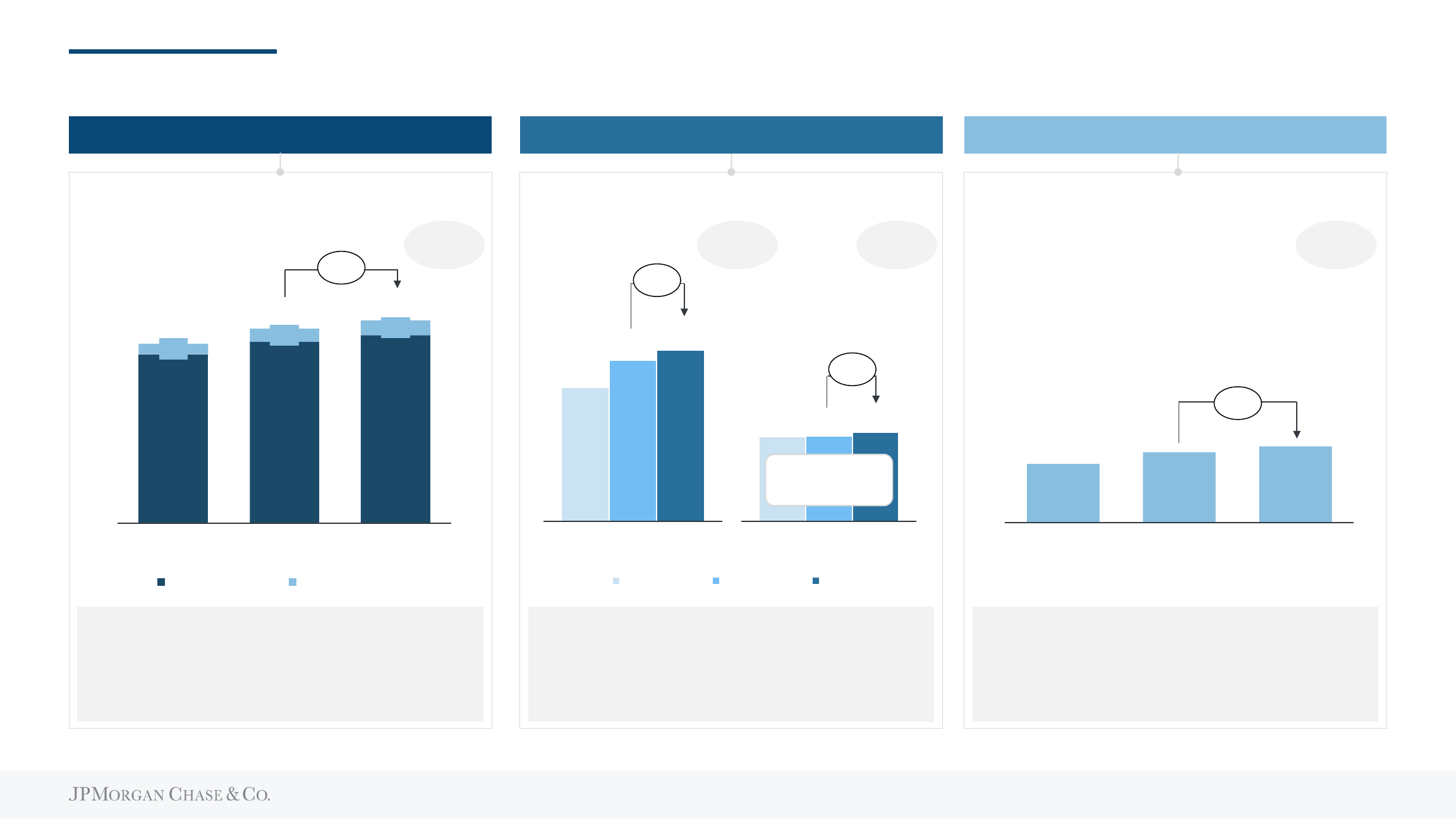

32.6

32.9

34.3

Branch active

2019 2022 2023

We continue to successfully execute on our strategy

Engage

73.8

79.2

82.1

4.6

5.7

6.4

2019 2022 2023

Consumers Small businesses

18.6

22.3

24.2

2019 2022 2023

Overall customers (mm)

1

Multi-LOB customers

4

(mm)Digital

2

and branch

3

active customers (mm)

78.4

88.5

84.9

52.5

63.1

67.0

Digital active

>20% reduction in

everyday branch

transactions vs. ‘19

+9%

+4%

+6%

+4%

For footnoted information, refer to slide 45

Grow Deepen

2x

faster growth since

the pandemic

2 of 3

of new Consumer Bank and

Branded Card customers

are Millennials or Gen-Z

~75%

of CCB customers

are digitally active

~85%

of D&I

5

balances

held by branch

active customers

~50%

multi-LOB among

Branded Card customers

~50%

multi-LOB among

Primary Consumer

Bank customers

6

3%

CAGR

6%

CAGR

1%

CAGR

7%

CAGR

3

22.9%

16.9%

20.4%

10.4%

Sales OS

Chase Leading competitor

We continue to grow faster than the competition

11.3%

10.1%

Chase Leading competitor

+220bps

+20bps

+30bps

growth in net new checking accounts vs. 2019

4

>25%

growth in new accounts vs. 2019

primary bank customer retention

8

98%

>60%

primary bank

6

highly engaged card members

7

>40%

>95%

~80%

account retention

9

+190bps ex. FRC

Grow Engage Deepen

+50bps +10bps

Growth

vs. 2019

Growth

vs. 2019

growth in total checking accounts vs. 2019

4

>20% >30%

growth in active accounts

5

vs. 2019

For footnoted information, refer to slide 46

Card

Deposit share

1,2

Card sales and outstandings market share

3

Consumer & Business Banking

4

(70bps)

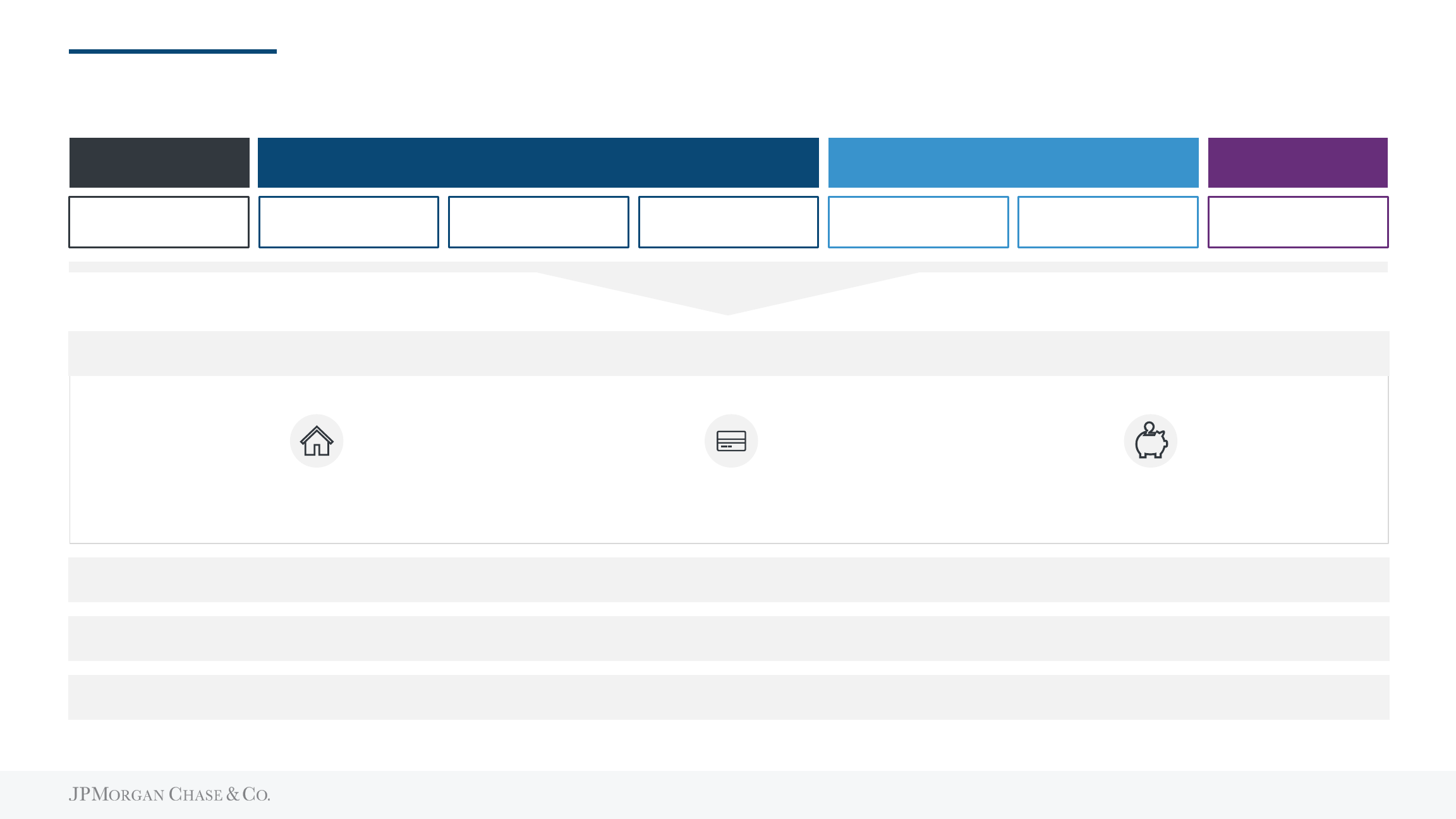

Our customers are engaging with us across channels to manage their financial lives

Our channels complement each

other via omnichannel journeys

(examples):

Planning

Account opening

Relationship & advice

90-day digitally

active users

1

Digital

Branch

% mobile active

users who engaged

2

at

least once a week

Branch active

customers

~34mm

% who met

with a banker

>40%~67mm >50%

Open / upgrade

an account

Account updates

& questions

Information

on investing

Key digital experiences (monthly active users)

3

:

Key reasons for meetings:

OMNI-CHANNEL

Payments

~45mm

View Offers

~36mm

Financial planning

& advice tools

4

~17mm

Total monthly

engaged sessions

2

vs. ‘22

+20%

Customers who met

with a banker

5

vs. ‘22

+20%

Grow Engage Deepen

For footnoted information, refer to slide 46

>20% of in-branch account

openings now digitally-enabled

7

>3mm score plans

created since launch

>1mm personalized plans

created since launch

12% increase in bookings

6

in 1Q24 vs. 1Q23

When we launch a new feature, we have a proven track record of scaling and driving customer engagement

Credit score planning tool Wealth Plan

Digitally-enabled opening in branch

Chase Travel

Launched: 4Q 2023Launched: 4Q 2022Launched: 1Q 2023 Brand launch: 1Q 2024

Recently launched features:

5

We have the scale and scope of data to drive increasing value from AI / ML

Fraud detection

Credit risk

Predictive servicing

Branch optimization

Future stateCurrent state

Sales effectiveness

Personalization

Marketing effectiveness

Underwriting

Grow Engage Deepen

For footnoted information, refer to slide 47

THE SCALE OF OUR DATA CONTINUES TO GROW,

ENABLING US TO SERVE CUSTOMER NEEDS

1

THE VALUE FROM AI / ML INVESTMENTS

IS ACCELERATING AND CHANGING

2

Financial data

34mm customer incomes

36mm credit profiles

Digital engagement

18B digital log-ins

325B digital customer

interactions

Shopping behavior

25B credit and debit card

transactions

>10B Offers

served

3

Lifestyle

9mm+ trips booked

~1T Ultimate Rewards

points redeemed

Efficiency & risk examples

Revenue examples

82mm

consumers

6

Customer experience is an operating discipline

NPS

1

impact of design target alignmentCustomer segment Growth in product-segment fit vs. ‘19Design target product (examples)

Grow DeepenEngage

For footnoted information, refer to slide 47

~65 Net Promoter Score (NPS)

among primary bank deposit customers & highly engaged card members

Record channel satisfaction

across branch, digital and phone channels in ‘23

Build products & services our customers love

and continuously innovate

Help customers discover the right

solutions for them

Understand

customer needs

Emerging

Banking

Card

Affluent

Banking &

Wealth

Card

Small

business

(SMB)

Banking

>10

For Affluent customers in Chase Private

Client (CPC) with JPMWM Advisor

coverage vs. other Affluent customers

~50%

CPC clients with deposits & investments

>10

For Large SMBs

5

with Business

Relationship Manager (BRM) coverage

80%

clients with BRM coverage

6

>5

For Lower Mass in Secure Banking

vs. other accounts

2x

Secure Banking

2

accounts

>10

For Affluent top of wallet customers with a

Sapphire card

4

vs. other Branded cards

~50%

Sapphire card accounts

2.5x

new-to-credit accounts

3

>5

For early month on book accounts in

Freedom Rise vs. other Freedom cards

7

We continue to deepen relationships into natural adjacencies

Grow Engage Deepen

For footnoted information, refer to slide 47

Wealth Management Connected Commerce

# of Wealth

Management

relationships

2

Client investment assets ($B)

Target: ~6,000 advisors

~$500

~$650

~$950

2019 2022 2023

~2x

2025 Target:

$1T

1.6mm

2019

2.5mm

2023

420+ advisors added ending the year with ~5,500 advisors

(+30% total advisors vs. 2019)

120k+ first time investors with a full-service relationship

(record-high and +24% YoY)

2025 Target: ~$30B

$7

$15

$20

2019 2022 2023

Volume through our Connected Commerce platforms

1

($B)

~3x

% of Branded Card

3

Travel spend captured

on Chase Travel

~8% ~10%

2019 2023

9mm+ travel bookings as we improve our Travel experience

(+19% YoY)

$8B+ attribution spend from Chase Offers via scale & UX uplift

(+31% YoY)

8

2019 2022 2023 ex. FRC

Average deposits ($B) $698 $1,163 $1,127 $1,087

Average loans ($B) $478 $439 $526 $464

Average Card outstandings ($B) $156 $163 $191

Revenue ($B) $55.0 $54.8 $70.1 $66.9

Deposit margin

3

2.48% 1.71% 2.84% 2.81%

Expense ($B) $28.1 $31.2 $34.8 $33.6

Overhead ratio 51% 57% 50% 50%

ROE 31% 29% 38% 38%

$21.7

$20.9

$30.0

We continue to deliver strong financial performance

CCB Pretax Income ex. LLR ($B)

1,2

Note: Totals may not sum due to rounding

For footnoted information, refer to slide 48

ex. FRC: $27.9B

9

2022 Macro rate Volume Margin / Other First Republic 2023

In 2023, we benefitted from a positive macro rate environment and absorbed headwinds with core growth

$12.4

($0.2)

$3.3

▲ Card loan growth

▼ Deposit balances

▼ Auto leases

▼ Increase in Card acquisition

▲ Card margin expansion and annual fees

▼ Overdraft fee policy change

▼ Home Lending NIM compression

$54.8

$70.1

NII

($0.2)

NIR

$14.9

$15.1

$39.9

$55.0

CCB REVENUE ($B)

NII

NIR

Note: Totals may not sum due to rounding

2024 outlook

10

Since 2019, organic growth has been the biggest revenue driver – more than offsetting net headwinds

Our investments will continue to deliver core business growth

For footnoted information, refer to slide 48

Note: Totals may not sum due to rounding

$54.9

$66.9

$37.3

$52.6

$17.6

$14.2

2019 2023

NII

NIR

1

+$11.9

CCB REVENUE ($B) EX. FRC

▲ Wealth Management

▲ Connected Commerce

▲ Other growth

▼ Auto lease

▼ Mortgage market

▼ Card acquisitions

▼ Overdraft policy changes

+$3.6B

Growth

($7B)

Headwinds

▲ Deposit margin

2

(+33bps)

▲ Deposit balances (+12% CAGR)

▲ Card NII (+5% CAGR Card OS)

▼ Other

2024 OUTLOOK

Reduced headwinds

Business growth

NIR

Deposit margin &

balances

Card OS

NII

+$3.5B

+$2.8B

+$9.6B

+$15.3

($3.4)

NII

NIR

11

DRIVERS OF ADJUSTED EXPENSE

1

($B) – 2023 vs. 2024 OUTLOOK

We will continue to invest in our business to drive profitable growth and efficiency

2023 Field & Branch network Technology and

product

Marketing Operations & fraud

losses

Other First

Republic

2024 outlook

$34.6

~$38

$0.8

$1.0

$0.5

$0.6

$0.2

$0.7

▲ Wage inflation

▼ Connected Commerce acquisition

▼ Auto lease depreciation

$33.4 ex. FRC

~$36 ex. FRC

Note: Totals may not sum due to rounding

For footnoted information, refer to slide 48

12

Staff Functions,

Real Estate and

Regulatory

3% CAGR

FDIC assessments

wage inflation

We are delivering the benefits of scale

RUN THE BANK EXPENSE

1

PER ACCOUNT

Field & Branch

Network

(ex. Card accounts)

0% CAGR

8%

6%

8%

customers per branch

2

checking / savings sales per branch

2

client investment assets per tenured Advisor

3

Operations &

Fraud Losses

(2%) CAGR

servicing calls per account

6%

fraud loss rate per transaction

1%

statement / payment processing per account

4

2%

Tech

Production

6

6% CAGR

risk platforms and cyber controls

“bubble” costs during data center migration

wage inflation

Card Marketing

& Product

Benefits

(per Card account

5

)

4% CAGR

voluntary attrition on annual fee cards

9%

annual fees per account

5

7%

All percentages reflect 2019-2024 outlook CAGR

WE’VE MANAGED OUR RUN THE BANK EXPENSE

1

AS WE GROW

All percentages reflect 2019-2024 outlook CAGR

5%

DIGITAL

LOG-INS / ACCT

2% 3%

We have driven strong

top-line growth of the

franchise

6%5%

1%

Higher volumes have

added to inflationary

pressures on expenses

TRANSACTION

VOLUMES ($)

per account

TRANSACTION

VOLUMES (#)

per account

DIGITAL

LOG-INS

per account

We’re delivering benefits

of scale – moderating

expense growth

RUN THE BANK EXPENSE

2024 outlook, ex. auto lease depreciation

RUN THE BANK EXPENSE

per account

~$26B

6%

TOTAL CCB ACCOUNTS

CCB REVENUE

ex. impact of auto lease income

For footnoted information, refer to slide 48

13

Our investment strategies are consistent – and consistently delivering

Wealth

Management

Connected

Commerce

Branch

Network

Marketing

Deal integration & amortization (cxLoyalty, FROSCH,

Figg)

Advisor hiring

New builds in expansion and mature markets

Banker hiring

Acquisitions & deepening

Branding

6 year

payback

4 year

break-even

4 year

break-even

2 – 3x ROI

Growth

businesses

$0.3

$0.4

$1.6

$2.6

Note: marketing investments

are part of ~$9B total gross

marketing spend

Technology

& product

1

Channels, products and platform development

Infrastructure, applications and data modernization

Our disciplined investment process is focused on long-term growth and profitability

+$0.8

2024

status

2023 return

profile

6+

years

Distribution

~50% pays

back in <5

years

CCB INVESTMENTS ($B)

$3.6

$4.0

$3.8

$4.3

$0.8

$0.7

$8.2

~$9.0

2023 2024 Outlook

Note: Totals may not sum due to rounding

For footnoted information, refer to slide 49

outlook

14

2024 outlook

We continue to invest in technology to support growth and profitability

$1.4

$1.4

$1.3

$1.7

$0.8

$0.9

2023 2024 outlook

~$4.0

Tech

modernization

Product &

design org

Tech product

development

$3.6

+$0.4

TECH MODERNIZATION: ~$1.4B

Products

Data & AI / ML

Platforms

Channel

Delivery &

Enablement

Other

TECHNOLOGY & PRODUCT

INVESTMENTS BY CATEGORY ($B)

2024 total

Tech spend

outlook

(incl. Run

the Bank):

<$7B

TECHNOLOGY & PRODUCT

INVESTMENTS ($B)

~$4.0

~80%

~55%

Analytical data migrated to the

public cloud

2

Production applications

migrated to strategic data

centers and the public cloud

1

Applications processing

largely in the public or

private cloud

~90%

It takes >100 products and services to deliver the end-to-end ecosystem for our customers

Note: Totals do not sum due to rounding; Product investment costs include all CCB product compensation costs

For footnoted information, refer to slide 49

15

Consumer financial health has largely normalized and remains stable

Historical avg. Pandemic high Mar '24

Total population

Median cash buffer

1

Deposit balances Peak Mar ‘24

All incomes +126% +66%

Lowest incomes

3

+183% +86%

Cash buffer Peak Mar ’24

All incomes +16 days +3 days

Lowest incomes +15 days +3 days

FY23 vs.

FY22

1Q24 vs.

1Q23

Mar ’24 vs.

Mar ’23

Total spend 1.4% 0.6% 2.2%

Total spend:

lowest incomes

5

3.3% 1.8% 3.2%

Discretionary spend

6

:

all incomes

1.6% 0.2% 1.5%

Consumer credit card stable cohort

4

Stable cohort

2

vs. historical avg.

8%

7%

9%

FY23 vs. FY22 1Q24 vs. 1Q23 Mar '24 vs. Mar '23

Total portfolio debit and credit spend growth

Total population

7

8

9

For footnoted information, refer to slide 49

+84%

Median deposit balance

+98%

+46%

+11%

Total population

Median balances remain up from pre-pandemic levels and

operating cash buffers have largely normalized

Spending remains solid as our portfolio is growing, while

spend growth at the stable cohort level remains stable

In aggregate, wages are keeping up with inflation

Inflation (all categories)

Nominal income growth (stable cohort, all incomes)

Nominal income growth (stable cohort, lowest incomes)

Median nominal income growth vs. inflation

Jan ’20 Mar ’24

41%

24%

21%

16

2019 Pandemic high Mar '24

Small businesses also remain financially healthy as normalization continues

Cohort of clients

2

Median cash buffer

1

Deposit balances Peak Mar ’24

Large revenue

4

+128% +60%

Small revenue

5

+67% +14%

Cash buffer Peak Mar ‘24

Large revenue +29 days +8 days

Small revenue +25 days +8 days

Debt levels Low Mar ’24

Large revenue (20%) (25%)

Small revenue (10%) +3%

vs. 2019vs. 2019

For footnoted information, refer to slide 50

Median deposit balance

+69%

+14%

+26%

Cohort of clients

2

42%

39%

Jan ’19

Mar ’24

Non-payroll expenses and payroll expenses

7,8

Cohort of clients indexed to Jan. 2019

2019 Pandemic low Mar '24

(18)%

(17)%

Combined debt levels

6

Cohort of clients

Deposit balances and cash buffers remain elevated as businesses navigate uncertain times

Median deposit balances and cash buffers remain

elevated, particularly for larger businesses

While overall debt levels remain below 2019, debt for

smaller businesses are closer to historical norms

As businesses manage expenses,

they are prioritizing spend on payroll

3 3

17

+83%

We’ve maintained a prudent risk profile while we continue to grow the business

2012 2019 2023

Card

% of portfolio <660 credit

score

1,2

16% 16% 14%

% of outstandings from balance

parker segment

3

20% 9% 5%

Auto

4

% of portfolio <660 credit score

5

22% 18% 16%

% of portfolio <660 credit score

and LTV >120

6

1.6% 2.1% 1.2%

Home

Lending

7,8

Owned-portfolio avg. credit

score

1

692 758 770

Owned-portfolio avg. CLTV 79% 55% 49%

2019 2023 ∆

Card

% of originations

<660 credit score

Industry

9

10% 10% -

Chase 3% 2% (1)ppt

Auto

4

% of originations

with term ≥84

months

Industry

9

12% 18% 6ppts

Chase 5% 7% 2ppts

Home

Lending

% LTV >80 HFI

jumbo origination

mix

Industry

10

11% 18% 7ppts

Chase

11

9% 8% (1)ppt

PORTFOLIO RISK METRICS ORIGINATION RISK METRICS

For footnoted information, refer to slide 51

18

Credit has normalized

Consumer balance sheets and credit have normalized

and continue to remain generally healthy

Loss performance reflects primarily:

Normalization

Change in portfolio mix

We continue to invest in new data and scores to

enhance our risk management and have tightened on

the margin

As excess cash buffers have largely been exhausted,

we are closely monitoring consumers whose incomes

have not kept pace with inflation

Looking forward, we expect loss rates to remain

relatively stable

2019 2020 2021 2022 2023

2024

outlook

Card

Services

3.10% 2.93% 1.94% 1.47% 2.45% ~3.4%

Auto

0.33% 0.20% 0.05% 0.21% 0.49% ~0.65%

Retail only

0.44% 0.25% 0.04% 0.24% 0.56% ~0.75%

Home

Lending

1

(0.05%) (0.09%) (0.17%) (0.14%) (0.02%) ~0.0%

Business

Banking

2

ex. overdraft

0.47% 0.48% 0.41% 0.17% 0.35% ~0.70%

~3.6%

2025 outlook

CREDIT RISK OUTLOOK NET CHARGE-OFF GUIDANCE

For footnoted information, refer to slide 51

19

Proposed regulation and legislation will negatively impact the banking industry and harm consumers

Note: Regulation, legislation and litigation referenced on this page are in various stages of development and finalization

For footnoted information, refer to slide 51

Capital

Basel III

Credit card

Late fee changes

Merchant litigation

settlement

Credit Card

Competition Act

Overdraft rule Reg II

1022, 1033,

1034(c), 1071

Deposit

Data sharing,

collection & reporting

1

Mortgages

>$500 annual increase in

payments for a mortgage

2

Credit cards

>10% fewer customers issued a card per

year and/or pay up to 2% higher APR

Checking accounts

Estimated 2 of 3 consumers would likely

have to pay a monthly service fee

Less consumer access to financial products and services, and higher cost for those who do have access

Margin pressures may disincentivize investment and innovation – leading to a decline in customer experience

Difficulty for smaller banks to absorb costs – leading to increased consolidation

More financial activity moving outside of the regulatory perimeter – increasing risk for consumers

Proforma impact to consumers if costs are fully passed through given current proposals / rules – not intended to reflect our strategy

Likely impacts:

20

We run our business for the long-term and manage through cycles

Regulatory uncertainty Deposit outlook Credit trends

We are operating from a position of strength…

Scale of our customer

relationships and

diversification of our

businesses

Continued core business

growth despite

headwinds

Unmatched capacity to

invest through cycles

Disciplined management

of resources, capital,

liquidity

…and while the current outlook is uncertain…

Our medium-term guidance remains at 25%+ ROE through the cycle

…we are prepared for a range of outcomes

Through-the-cycle

approach to managing

our business

Execute with an

increased focus on

efficiency and flexibility

Industry leading

credit performance

Reshape our business

where necessary in

response to regulations

21

Key questions on Deposits and Branch Network

3. Outlook

What is your outlook for deposits?

2. Deposits

How are deposits performing at this point in the cycle?

4. Market Share

What is your progress on capturing deposit share?

5. Branch Network

What is the impact and outlook for branch expansion?

1. Primary Bank

How have primary bank relationships held up at this point in the cycle?

22

We are growing primary bank relationships, which are satisfied, loyal, and engaged

How have primary bank relationships held up at this point in the cycle?

35.5

38.1

39.4

40.6

42.0

2019 2020 2021 2022 2023

2.9

3.2

3.5

3.8

4.1

2019 2020 2021 2022 2023

8 in 10

primary bank

customers would

recommend Chase

3

~50%

>95%

retention rate among

primary bank

customers

4

of primary bank

customers are

multi-LOB

5

2 in 3

primary bank

businesses would

recommend Chase

3

~80%>90%

retention rate

among primary bank

clients

7

of clients also have a

Consumer Banking

relationship

Primary

bank

2

Primary

bank

+9% CAGR

Business Banking clients (mm)

6

Consumer Banking customers (mm)

1

We continue to grow valuable primary bank relationships through rate cycles

Consistently ~80%

Consistently ~70%

Q1: Primary Bank Q2: Deposits Q3: Outlook Q4: Market Share Q5: Branch Network

For footnoted information, refer to slide 52

+4% CAGR

CONSUMER BANKING BUSINESS BANKING

23

Satisfied

Loyal Engaged Satisfied Loyal

Engaged

Focusing on the distinct needs of customer segments is critical to our success

Emerging Segments

~20% of accounts

1

Core Segments

~75% of accounts

1

Affluent Segments

~5% of accounts

1

Small / Micro SMBs

5

~90% of clients

1

Large SMBs

6

~10% of clients

1

How have primary bank relationships held up at this point in the cycle?

Growth since 2019 Recent accomplishments How we’re extending our position

>50%

Increase in checking accounts tailored

to younger and lower income segments

2

Launched Freedom Rise for new-to-credit customers

Launched Score Planner on Credit Journey

Enhancing risk and marketing strategies for Secure Banking

Scaling Community Strategy to 19 locations by year end

>10%

Increase in mass market

checking accounts

3

Launched Pay in 4

Strengthened Overdraft Assist with next day no-fee and

$50 buffer

Strengthening digital offerings (e.g., self-directed investing

experience)

Continuing branch expansion to serve more communities

~50%

Increase in Chase Private Client relationships

with deposits and investments

4

Scaled Banker and Advisor capacity

Scaled high-yield offerings

Launching Private Client tiered offering

Launching J.P. Morgan Financial Centers

>40%

Increase in Small / Micro

clients

Improved servicing and increased client coverage

Refreshed Ink Cash to better serve Small / Micro SMB needs

Launching invoicing functionality

Expanding Tap to Pay

~75%

Increase in Large client

deposit balances

Scaled Business Relationship Manager capacity

Launched Ink Business Premier

Continuing to hire bankers to cover more Large clients

Launching payroll capabilities

Our segment strategies are critical to drive growth and scale primary bank relationships

Q1: Primary Bank Q2: Deposits Q3: Outlook Q4: Market Share Q5: Branch Network

For footnoted information, refer to slide 52

24

Our strategy enables us to capture money in motion

How are deposits performing at this point in the cycle?

Deposit margin: 2.78%

% in CDs: 5%

Deposit margin: 2.71%

% in CDs: 11%

$1,134

$72

($117)

($150)

$110

$41

$53

$1,093

4/1/2023 Customer Growth Customer Activity Yield-Seeking Outflows Yield-seeking Inflows 3/31/2024

▼ JPMWM investments

▼ Internal migration

3

▼ External brokerages

▼ Online banks

▲ Internal migration

6

▲ Net new money ~$40B

JPMWM investments

$163

Total yield-seeking inflows

52% checking

52% checking

FRC balances

▲ Income growth

▼ Tax payments

▼ Elevated spend

Chase growth

2

retention of yield

seeking flows

7

~80%

of banking customers outflow to an

online bank, while maintaining above

portfolio average primary bank rate

5

<10%

YoY customer

growth

~4%

~10%

decline in deposit

balances driven by

spend and taxes

1Q23 1Q24

Banking & Wealth Management Deposit Balances - EOP ($B)

1

Q1: Primary Bank Q2: Deposits Q3: Outlook Q4: Market Share Q5: Branch Network

Note: totals may not sum due to rounding

For footnoted information, refer to slide 53

Customer growth

Customer activity

Yield-seeking outflows

4

Yield-seeking inflows

We have maintained primary bank relationships and captured money in motion, with a modest increase in rate paid

Core

Drivers

25

We are prepared for a range of scenarios and continue to execute our proven playbook

What is your outlook for deposits?

SOFR 5-year forward curves

Maintain primary

bank relationships

~80% of customers

are primary bank

Profitably capture

money in motion

~80% capture of yield

seeking flows

Accelerate Wealth

strategy

~50% growth of Private

Client relationships

with D&I on us

We expect deposits to be relatively flat for the remainder of 2024 with a modest increase in rate paid

Grow customers by meeting distinct segment needs

Improve core experiences in all channels

Extend advisor capacity

Compete on holistic value, not just price

Enhance and tier Private Client value propositions

Provide customers with high-yield options

5.30%

0.29%

0.79%

1.50%

2.29%

3.02%

3.81%

4.30%

4.80%

5.06%

5.34%

5.31%

5.03%

4.24%

Jan-21 Jan-22 Jan-23 Jan-24 Jan-25 Jan-26 Jan-27 Jan-28 Jan-29

THE OUTLOOK FOR RATES CONTINUES TO EVOLVE… …WHILE OUR STRATEGY REMAINS CONSISTENT

Q1: Primary Bank Q3: OutlookQ2: Deposits Q4: Market Share Q5: Branch Network

26

Our strategies are enabling deposit share gains over time

What is your progress on capturing deposit share?

9.1%

9.9%

9.8%

11.3%

10.1%

9.2%

2019 2023 2019 2023 2019 2023

#3 #1 #1 #2 #2 #3

Rank

+220bps +20bps

(60bps)

We have #1 deposit share in 20 of top 125 markets, including 4 of top 5

We gained share in 95% of the top 125 markets over the past 5 years

4

0.2%

6.1%

10.5%

18.0%

1.3%

7.8%

12.9%

22.5%

2019 2023 2019 2023 2019 2023 2019 2023

+110bps

+170bps

+240bps

+450bps

2023 deposit share

<5% 5-10% 10-15% 15%+

Number of markets

39 16 18 33

(+26 since 2019) (+11 since 2019)

Peer 1 Peer 2

WE OUTPERFORMED PEERS IN DEPOSIT GROWTH SINCE 2019 OUR DEPOSIT SHARE GAINS HAVE BEEN WIDESPREAD

Retail deposit share in top 125 markets

1,3

National retail deposit share

1,2

+190bps

ex FRC

Q1: Primary Bank Q4: Market ShareQ2: Deposits Q3: Outlook Q5: Branch Network

For footnoted information, refer to slide 53

27

Branch expansion is core to our long-term growth

What is the impact and outlook for branch expansion?

2019-2023 Retail deposits ($B)

4

Branch expansion is contributing meaningfully to our outperformance with more upside as branches mature

5,028

4,878

685

921

86

2019-2023 Branch count

1

Peer 1

1

4,338 184 708 - 3,814

Peer 2

1

5,588 52 1,071 - 4,569

Large

Banks

1,2

29,089

657 6,076 - 23,670

2019 2023New builds Consolidations

21%

Next 3 years

3

8%

4%

% of

network <10

years old

500

new builds

1,700

branch refreshes

3,500

branch employees

6%

$676

$1,072

$78

$33

2019 2023

Growth from

branches <10

years old in ‘23

Growth from

branches >10

years old in ‘23

~80bps

of deposit share gain from

branches <10 years old

~4 year

break-even on

new builds

$285

Growth from

First Republic

acquisition

9.1%

11.3%

Retail deposit share

WE CONTINUE TO EXPAND AND OPTIMIZE OUR NETWORK

OUR INVESTMENTS CREATE AN UNPARALLELED GROWTH ENGINE

First Republic

Q1: Primary Bank Q5: Branch NetworkQ2: Deposits Q3: Outlook Q4: Market Share

For footnoted information, refer to slide 54

28

Branch expansion impact

Looking ahead, we will extend our presence to cover >50% of the population in each state

What is the impact and outlook for branch expansion?

Increasing population coverage by

state within an accessible drive time

~65%

National population coverage

1,2

within an accessible drive time

~75%

24

States with >50% population coverage

1,2,3

within an accessible drive time

48

BRANCH NETWORK – LOOKING AHEAD

BRANCH NETWORK – YE 2023

>50%

Q1: Primary Bank Q5: Branch NetworkQ2: Deposits Q3: Outlook Q4: Market Share

For footnoted information, refer to slide 54

Our expansion strategy is key to achieving our target of 15% national retail deposit share, with more upside from there

29

The Bronx, NY

Birmingham, AL

Los Angeles, CA

Miami, FL

New York, NY

33

Key questions for Card & Connected Commerce

1. Market Share What is your progress on gaining sales and OS share and what are your plans to continue doing so?

2. Marketing

Investment

What is your outlook for marketing investment? How do you balance account growth with quality?

3. Connected

Commerce

What is the latest on your progress in Connected Commerce and how are you tracking to your goals?

31

We are gaining share in an increasingly competitive market

Q1: Market Share Q2: Marketing Investment Q3: Connected Commerce

What is your progress on gaining sales and OS share and what are your plans to continue doing so?

10.3%

10.4%

10.4%

16.6%

16.6%

16.9%

7.5%

8.4%

8.7%

2019 2020 2021 2022 2023

#1 Sales Volume Share

2

#1 Outstandings Share

2,3

11.4%

12.0%

11.9%

22.4%

22.4%

22.9%

21.2%

20.4%

20.4%

2019 2020 2021 2022 2023

Peer 1

Peer 2

Peer 2

Peer 1

7.8

8.0

9.6

10.0

2019 2021 2022 2023

New accounts (mm)

43

47

52

56

2019 2021 2022 2023

Active accounts (mm)

1

0.8

0.9

1.1

1.2

2019 2021 2022 2023

Sales volume ($T)

156

140

163

191

2019 2021 2022 2023

Average outstandings ($B)

For footnoted information, refer to slide 55

KEY DRIVERS MARKET SHARE

6% CAGR

7% CAGR

11% CAGR

5% CAGR

32

$163

$191

($7)

$11

FY22 Mature book attrition

(pre-'21 vintages)

Existing portfolio growth

(pre-'21 vintages)

Account acquisition seasoning

('21-'23 vintages)

FY23

2023 Vintage

2022 Vintage

2021 Vintage

We are driving OS growth by executing on our strategy as revolve behavior continues to normalize

Core

Drivers

We are expecting a double-digit OS growth rate in 2024

Q1: Market Share Q2: Marketing Investment Q3: Connected Commerce

What is your progress on gaining sales and OS share and what are your plans to continue doing so?

Average Outstandings ($B)

Of Card customers are

highly spend engaged

3

>60%

Account retention

2

98% 28mm

New accounts in

2021 – 2023

$24

▲ Size of account vintages

▲ Premium mix shift

1

▲ Revolve normalization

– Consistent spend levels

For footnoted information, refer to slide 55

33

We are focused on key segments where we have outsized opportunity for growth

Q1: Market Share Q2: Marketing Investment Q3: Connected Commerce

What is your progress on gaining sales and OS share and what are your plans to continue doing so?

For footnoted information, refer to slide 55

Record year of new accounts in new-to-credit

1

segment

~95% of Freedom Rise customers also have a Consumer Bank relationship

Majority of Freedom Rise accounts from customers 18-24 years old

Starter

Record year of new accounts in business portfolios

>40% of Ink accounts also have a Business Banking relationship

Refreshed Ink Cash to better serve the needs of smaller SMBs

Small Business

Record year of new accounts in consumer T&E portfolios

Sapphire accounts spend ~2.5x more than other consumer portfolios

Opened 6 lounges, including BOS, LGA, and JFK, with 6 in the pipeline

Affluent

Named #1 overall airport lounge

2

Launched Freedom

Rise in June ‘23

Refreshed Ink Cash

in March ‘24

34

Our strategy will fuel growth toward our goal of 20% share of outstandings

We continue to invest in attractive opportunities to fuel future growth

CARD GROSS CASH MARKETING SPEND (B)

Q2: Marketing InvestmentQ1: Market Share Q3: Connected Commerce

2023 KEY DRIVERS AND PERFORMANCE METRICS

What is your outlook for marketing investment? How do you balance account growth with quality?

$4.3

$4.9

$1.6

$1.9

2022 2023

$5.9

$6.8

98%

Account retention

2

~20%

YoY growth in annual fee revenue

9.6mm 10.0mm

New

Accounts

Product Benefits

Acquisition, Distribution & Media

ROI of 2023 vintage

3

~2x

Payback period

3 yr.

14%

15%

CARD GROSS CASH MARKETING SPEND ($B)

1

8%

YoY growth in active accounts

YoY

+4%

KEY PERFORMANCE METRICS

We increased share of new accounts from premium portfolios by >550bps in 2023

5

For footnoted information, refer to slide 56

YoY growth in lifetime value

4

per account

9%

15%

Product benefits

(incl. co-brand)

Acquisition,

Distribution & Media

35

We are leveraging our Connected Commerce acquisitions to scale our two-sided platform

Q3: Connected CommerceQ1: Market Share Q2: Marketing Investment

Identify high value experiences

with high category spend that

resonate with card members

Develop differentiated on-us

journeys and own the economics

with owned platforms

Accelerate engagement in

existing channels and products

with benefits, rewards, and content

Make Chase the best platform to

book travel, explore shopping, and

discover new dining experiences

REMINDER OF OUR CONNECTED COMMERCE PLAYBOOK:

We have the

assets to win…

Enabled by:

Talent

Differentiated

customer experience

Merchant value Business resiliency

…unlocking

Gaining access to new customers to

shift share away from competitors

BrandsConsumers

Gaining access to exclusive offers and

benefits from brands that they love

Larger

profit pools

What is the latest on your progress in Connected Commerce and how are you tracking to your goals?

~67mm

Digital active

customers

1

~$1.7T

Credit & debit

spend volume

~18B

Annual customer

digital logins

~350k

Chase Travel

hotel properties

~30k

Infatuation dining

venues covered

2

>600

National Chase

Offers merchants

For footnoted information, refer to slide 56

36

We have been executing on our Connected Commerce playbook

What is the latest on your progress in Connected Commerce and how are you tracking to your goals?

Q3: Connected CommerceQ1: Market Share Q2: Marketing Investment

2023 ENGAGEMENT METRICSACTIONS WE HAVE TAKEN

Launched Chase Media Solutions, the only bank-

led media platform of its kind

Delivered uplifted offers digital experience and

testing AI/ML enabled personalization engine

Launched Chase Travel brand and improved

discoverability of our platform

Debuted our premium hotel collection The Edit with

~800 properties live

Launched the capability to sell Southwest Airlines

inventory online, directly to consumers

Embedded bookings into The Infatuation and

expanded EEEEEATSCON to new cities

>10B

Offers served to customers

4

(+12% YoY)

>5.5mm

Unique monthly Infatuation visitors

3

(+25% YoY)

3.5mm

Unique customers booking travel

1

(+19% YoY)

63mm

Customers served Chase Offers

(+5% YoY)

We expect our strategy to deliver ~$30B in Commerce platform volume in 2025 and ~$2B in run-rate revenue in 2026

$11

$15

$20

2021 2022 2023

COMMERCE VOLUME ($B)

5

Reached >$10B in Travel sales in ‘23

Shopping

Travel &

Dining

~40%

YoY increase in premium

hotel bookings

2

For footnoted information, refer to slide 56

37

Key questions for First Republic update

1. Integration

How is the integration going – what have you completed and what is left to migrate to JPMC?

2. Business

Performance

How has the business performed across key metrics (e.g., retention, balance growth)?

3. Go-Forward

Strategy

How does the acquisition fit into your go-forward strategy to grow share with Affluent clients?

39

We have been focused on integrating the legacy business while minimizing disruption

For footnoted information, refer to slide 57

How is the integration going – what have you completed and what is left to migrate to JPMC?

How has the business performed across key metrics (e.g., retention, balance growth)?

Q1: Integration Q2: Business Performance Q3: Go-Forward Strategy

OUR INTEGRATION

PLAN IS ON TRACK…

~20%

growth in deposits in the

months following acquisition,

balances have stabilized since

2

~85%

of client

relationships

retained

3

~80%

of employees

offered permanent

roles retained

4

~95%

of accounts will

be migrated by

the end of 2Q

1

…AND WE’RE FOCUSED ON

WINNING BACK DEPOSITS…

...WHILE STABILIZING

THE CLIENT BASE...

...AND PRESERVING

TALENT

40

First Republic complements growth strategies across the firm

Commercial &

Investment Bank

Asset & Wealth

Management

Innovation

Economy

Commercial

Real Estate

Extend #1 U.S. Multifamily lender

position

1

, serving Commercial Term

Lending in 13 major metros

Acquired large Commercial Term Lending

book and gained share on the West Coast

Become leading bank for Innovation

Economy across high-growth companies,

startups, founders, and VC community

Accelerated growth strategy in tech, life

sciences, founders, and VCs; added scale

to existing JPMorgan co-invest platform

Consumer &

Community

Banking

Wealth

Management

Affluent

Strategy

Scale Wealth Advisors and client

investment assets

Added talent, client investment assets, and

depth in service expertise

Deliver value for relationship, expert

advice & guidance, and premium service

Added talent, premium locations, and a

concierge servicing model

Existing JPMC growth strategy First Republic acceleration

Q2: Business Performance Q3: Go-Forward StrategyQ1: Integration

For footnoted information, refer to slide 57

How does the acquisition fit into your go-forward strategy to grow share with Affluent clients?

41

We are building a more complete Affluent value proposition

Partnering across the firm to offer the

full breadth of JPMC products…

…delivered through new distribution

channels across Affluent markets

J.P. Morgan Private ClientChase Private Client J.P. Morgan Private Bank

End-to-end resolution through

single point-of-contact

Priority response and resolution

on requests

Hospitality through opportunities

to ‘surprise and delight’

Investing

LendingBanking

Fund

finance

Management

company lines

Co-invest

programs

Commercial

real estate

Multifamily

real estate

Large

commercial

lines

Single point-

of-contact

Affluent segments High / Ultra-High Net Worth segments

… supported by a dedicated

concierge servicing team…

J.P. Morgan Private Client

Financial Centers

Q2: Business Performance Q3: Go-Forward StrategyQ1: Integration

How does the acquisition fit into your go-forward strategy to grow share with Affluent clients?

42

New York San Francisco

43

Notes on non-GAAP financial measures

1. Adjusted expense excludes CCB legal expense and is a non-GAAP financial measure. For 2022, reported noninterest expense was $31,208 million and

legal losses were $47 million; for 2023, reported noninterest expense was $34,819 million (or $33,600 million excluding FRC), and legal losses were $242

million including FRC. Management believes this information helps investors understand the effect of certain items on reported results and provides an

alternate presentation of the Firm’s performance.

2. Income before income tax expense (pretax income) excluding the change in loan loss reserves (“pretax income ex. LLR”) is a non-GAAP financial

measure. This metric reflects the exclusion of the portion of the provision for credit losses attributable to the change in allowance for credit losses. The table

below provides a reconciliation of reported results to this non-GAAP financial measure.

Pre-tax income ex. LLR First Republic

Pre-tax income ex. LLR

(ex. First Republic)

Year ended December 31,

(in millions) 2019 2022 2023 2023 2023

Reported pretax income 21,950 19,793 28,430 1,637 26,793

Adjustments:

Change in loan loss reserves (299) 1,125 1,560 421 1,139

Pretax income ex. LLR 21,651 20,918 29,990 2,058 27,932

44

Notes on slides 1-3

Slide 1 – We have a consistent set of strategic priorities

1. "Customer” includes both consumers and small businesses and reflects unique individuals and businesses and legal entities, respectively, that have financial ownership or decision-making power with respect to accounts;

these metrics exclude customers under the age of 18. Where a customer uses the same unique identifier as both a consumer and a small business (SMB), the customer is included in both metrics. All following references

to customers in these materials exclude First Republic except when otherwise noted

Slide 2 – We continue to make progress against our commitments

1. Includes assets invested in managed accounts and J.P. Morgan mutual funds where AWM is the investment manager

2. Includes Chase Travel Sales Volume (incl. FROSCH affiliates), and volume attributed to Chase Offers, Chase Media Solutions, Shop Through Chase and Ultimate Rewards Apple Store

3. Includes retired / replaced applications

4. Share of analytical data in scope for migration to public cloud

5. Federal Deposit Insurance Corporation (FDIC) Summary of Deposits survey per S&P Global Market Intelligence applies a $1 billion deposit cap to Chase and industry branches for market share. While many of our

branches have more than $1 billion in retail deposits, applying a cap consistently to ourselves and the industry is critical to the integrity of this measurement. Includes all commercial banks, savings banks and savings

institutions as defined by the FDIC

6. Based on 2022-2023 sales volume and loans outstanding public disclosures by peers (C, BAC, COF, AXP, DFS) and JPMorgan Chase estimates. Sales volume excludes private label and Commercial Card. Loans

outstanding exclude private label, AXP Charge Card, and Citi Retail. Card outstandings market share has been revised to reflect a restatement to the 2022 reported total industry outstandings disclosed by Nilson; Chase

restated from 17.3%

7. See note 1 on slide 44

Slide 3 – We continue to successfully execute on our strategy

1. Prior period consumer amounts have been revised to include certain checking account only consumers previously excluded

2. Digital active customers are users of all web and/or mobile platforms who have logged in within the past 90 days

3. Branch active customers are customers who have visited a branch at least once a year

4. Refers to consumers and small businesses with two or more relationships within the following sub-LOBs: Consumer Banking, Business Banking, Wealth Management, Credit Card, Home Lending, and Auto Lending

5. Deposits and Investments

6. Primary bank customers meet one of the following conditions: ≥15 withdrawals from a checking account or ≥5 withdrawals from a checking account and ≥$500 of inflows in a given month

45

Notes on slides 4-5

Slide 4 – We continue to grow faster than the competition

1. Source: Federal Deposit Insurance Corporation (“FDIC”) 2023 Summary of Deposits survey per S&P Global Market Intelligence; applies a $1B deposit cap to Chase and industry branches; includes all commercial banks,

savings banks, and savings institutions as defined by the FDIC; prior periods have been revised to conform to the current period presentation

2. Deposit share changes are rounded to reflect the change in share listed on the page with 1 decimal point

3. Based on 2019-2023 sales volume and loans outstanding public disclosures by peers (C, BAC, COF, AXP, DFS) and JPMorgan Chase estimates. Sales volume excludes private label and Commercial Card. Loans

outstanding exclude private label, AXP Charge Card, and Citi Retail. Card outstandings market share has been revised to reflect a restatement to the 2022 reported total industry outstandings disclosed by Nilson; Chase

restated from 17.3%

4. Accounts for growth in both consumer and SMB checking accounts

5. Active accounts defined as average sales debit active accounts

6. Reflects primary bank customers for both consumers and SMBs

7. % of monthly active customers who have greater than or equal to 10 transactions or greater than or equal to $833 per month ($10K in annualized) spend

8. Reflects retention for consumers and SMBs with a tenure of >6 months

9. Account retention is based on voluntary attrition of accounts with greater than 12 months-on-book

Slide 5 – Our customers are engaging with us across channels to manage their financial lives

1. Users of all web and/or mobile platforms who have logged in within the past 90 days as of December 2023. Excludes First Republic

2. Engaged sessions defined as mobile app sessions with page views beyond homepage, account transactions and mandatory pages (e.g., log-in, pop-ups)

3. 30-day monthly active users as of December 2023

4. Financial planning and advice tools includes Finance & Drive, Chase MyHome, Credit Journey, Spending Planner and Wealth Plan

5. Customers who met with a banker includes walk-in and scheduled meetings, banker phone calls and ‘Discover Needs’ sessions

6. Gross number of bookings on Chase Travel made by Chase Branded Card (excluding Slate), Amazon co-brand and Instacart co-brand customers

7. Share of Consumer Bank 1Q 2024 in-branch accounts opened on digitally-enabled platform. Digitally-enabled opening in branch is a capability where bankers start the account opening process in-branch and track

customers’ progress as they finish the process digitally

46

Notes on slides 6-8

Slide 6 – We have the scale and scope of data to drive increasing value from AI / ML

1. Data reflects full year 2023, except for credit profiles and consumer counts which are as of YE 2023

2. Growing use of advanced modeling capabilities (AI/ML) has been supported across CCB by controls to mitigate risks associated with fairness, including independent oversight, bias testing and enhanced model

risk governance

3. Number of offers viewed by a customer during a campaign (excludes multiple views of the same offer)

Slide 7 – Customer experience is an operating discipline

1. Net promoter score (NPS) is an indicator of customer satisfaction

2. Secure Banking accounts includes consolidated Liquid accounts in 2019

3. Includes any customer approved for a new account if they are one of the following: (1) have no credit history or report at any of the three national bureaus; (2) have primary tradeline(s) less than 12 months at the national

bureaus; (3) have only authorized user tradelines at the national bureaus

4. Sapphire cards include Sapphire Reserve, Sapphire Preferred, and other legacy Sapphire credit cards

5. Small and medium sized businesses with annual revenue greater than $1mm

6. Compares December 2023 covered client count to that of January 2020

Slide 8 – We continue to deepen relationships into natural adjacencies

1. Connected Commerce business launched in 2021. 2019 volumes represent $3B in Travel GTV prior to cxLoyalty acquisition, and $4B in Offers attribution spend. Volumes include Travel Sales volume (including FROSCH

affiliates), Offers Attribution Spend and Shopping & Apple GMV (incl. non-Chase Offers redemption volume)

2. Unique families with primary and joint account owners for open and funded accounts. Excluding First Republic

3. Includes Chase Branded Card (excluding Slate)

47

Notes on slides 9-13

Slide 9 – We continue to deliver strong financial performance

1. Represents loan loss reserves

2. See note 2 on slide 44

3. Reflects Banking & Wealth Management deposit margin

Slide 11 - Since 2019, organic growth has been the biggest revenue driver – more than offsetting net headwinds

1. In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior period

amounts have been revised to conform with the current presentation

2. Reflects Banking & Wealth Management deposit margin

Slide 12 - We will continue to invest in our business to drive profitable growth and efficiency

1. See note 1 on slide 44

Slide 13 – We are delivering the benefits of scale

1. Run the bank expense excludes legal losses, investments, auto lease depreciation and First Republic

2. Reflects 2019 to 2023 CAGR

3. Tenured Advisors includes both CWM and JPMA advisors

4. Excludes JPMorgan Wealth Management

5. Represents Card accounts that receive a statement

6. Tech Production excludes Product and Data & Analytics

48

Notes on slides 14-16

Slide 14 – Our investment strategies are consistent – and consistently delivering

1. Reflects 80% gearing ratio for Product expenses

Slide 15 – We continue to invest in technology to support growth and profitability

1. Includes retired / replaced applications

2. Share of analytical data in scope for migration to public cloud

Slide 16 – Consumer financial health has largely normalized and remains stable

1. Average Daily Balance divided by the total outflow in the month, multiplied by 30 to express in number of days. Includes all the checking and savings (ex. CDs) Chase accounts that are owned or jointly owned by the

customer. Customers without outflow in the month are excluded

2. Tracks cohort of primary bank customers from March 2020 – January 2024. At time of start in March 2020, cohort includes all primary bank customers, with at least one year of consumer checking tenure, and greater than

$6k of take-home income (payroll, government assistance, unemployment benefits, tax refunds, social security, and retirement) within the last twelve months

3. Lowest incomes represents customers within the cohort who had greater than $6k but less than $30k of net take-home income within the last twelve months of March 2020

4. Tracks a cohort of Credit Card customers who had at least one spend active, 18+ month on book account in the prior year and at least one spend active account in the current year for each month

5. Lowest income defined as gross income (self-reported) of <$50k

6. Includes spending on Retail, Restaurants, Travel, Entertainment, and other smaller discretionary categories

7. Source: Bureau of Labor Statistics (CPIU)

8. Tracks income growth for cohort defined in Note 2 above, requiring greater than $6k of take-home income (payroll, government assistance, unemployment benefits, tax refunds, social security, and retirement) within last

twelve months of Jan 2020. Additionally, take home income must be greater than $0 within the last twelve months throughout the measurement period

9. Represents customers within the cohort who had greater than $6k but less than $30k of net take-home income (payroll, government assistance, unemployment benefits, tax refunds, social security, and retirement) within

the last twelve months of January 2020. Additionally, take home income must be greater than $0 within the last twelve months throughout the measurement period

49

Notes on slides 17

Slide 17 – Small businesses also remain financially healthy as normalization continues

1. Cash buffers (measured in days) indicate the number of days a business can cover regular expenses using existing cash assets from demand deposit accounts without new income

2. Cohort of clients defined as Business Deposits clients active with deposit accounts from January 2019 to March 2024, which have not shifted revenue bands

3. Pandemic High and Pandemic Low include max, min values during March 2020 – December 2022 time period

4. Large ($1mm+) includes Business Banking clients with annual revenue greater than or equal to $1mm. These clients have an active Chase Business Banking Deposit account, and they may have a Chase Business Card

and/or Chase Business Lines/Loans

5. Small (<$1mm) includes Business Banking clients with annual revenue below $1mm. These clients have an active Chase Business Banking Deposit account, and they may have a Chase Business Card and/or Chase

Business Lines/Loans

6. Combined debt includes Business Card and/or Business Line/Loan debt balances with Chase. Revenue band groups include clients with Business Loans/Lines and/or Business Card with Business Deposits

7. Payroll expenses are based on transaction mining, tagging large payroll service providers (e.g., ADP) and exclude transfers made from Business Deposits accounts to the Consumer Deposits accounts of identified

business owners and signers

8. Payroll and non-payroll expenses are calculated on a 12 month rolling average and are indexed to January 2019

50

Notes on slides 18-20

Slide 18 – We’ve maintained a prudent risk profile while we continue to grow the business

1. Represents refreshed FICO scores

2. Includes those with no FICO score

3. Customers who revolve on credit cards but are not spend active

4. Chase Auto excludes Wholesale (Dealer Commercial Services) & Lease

5. Calculated using refreshed VantageScore

TM

sourced from Experian

6. Represents FICO scores and LTV at time of origination

7. Includes AWM and Corporate mortgage loans

8. Includes First Republic beginning in 2023

9. Sourced from Experian

10. Sourced from Lender Share. Data is obtained from market shares relative to lenders participating in Curinos’ retail and correspondent channel origination analytics. Curinos is not liable for reliance on the data

11. Excludes First Republic

Slide 19 – Credit has normalized

1. Includes First Republic beginning in 2023

2. Excludes Paycheck Protection Program loans

Slide 20 – Proposed regulation and legislation will negatively impact the banking industry and harm consumers

1. Data sharing, collection and reporting developments include: 12 CFR §1022 (CFPB Proposal Expected Shortly) - Regulation V (Fair Credit Reporting Act); §1033 of the Dodd-Frank Act (CFPB Proposed Rule) –

Consumer Rights to Access Information; §1034(c) of the Dodd-Frank Act (CFPB Advisory Opinion) – Provision of Information to Consumers; and,§1071 of the Dodd-Frank Act (CFPB Final Rule) – Small Business Data

Collection

2. Reflects an estimated impact for a mortgage characteristic of those held on the balance sheet of JPMC

51

Notes on slides 23-24

Slide 23 – We are growing primary bank relationships, which are satisfied, loyal, and engaged

1. “Consumer Banking customer” reflects unique individuals that have financial ownership or decision-making power with respect to Consumer Banking accounts; excludes First Republic; prior periods have been revised to

conform to the current period presentation

2. A customer is considered primary bank if it meets one of the following conditions: ≥15 withdrawals from a checking account or ≥5 withdrawals from a checking account and ≥$500 of inflows in a given month

3. Source: One Chase Net Promoter Score (NPS) Survey. Reflects promoters, calculated as share of “9” and “10” responses as a % of total responses

4. Reflects retention for checking customers with a tenure of >6 months

5. Refers to primary bank customers with two or more relationships within the following sub-LOBs: Consumer Banking, Wealth Management, Credit Card, Home Lending, and Auto Lending

6. Reflects Business Banking clients only, excluding Small Business Card-only

7. Reflects FY 2023 retention, excluding transfers to the Commercial Bank

Slide 24 – Focusing on the distinct needs of customer segments is critical to our success

1. Account and client distribution is based on YE 2023

2. Includes Chase First Banking, Chase High School Checking, Chase College Checking, and Chase Secure Banking

3. Includes Chase Total Checking, Chase Premier Plus Checking, and Chase Sapphire Banking

4. Based on Chase Private Client households

5. Small clients defined as businesses with annual sales under $1mm

6. Large clients defined as businesses with annual sales $1mm or greater

52

Notes on slides 25-27

Slide 25 – Our strategy enables us to capture money in motion

1. Totals may not sum due to rounding; end of period balances for March 2023 and March 2024; customer activity and flows do not include First Republic accounts

2. Customer growth represents balances of customers that opened their first primary account in Banking and Wealth Management from EOP March 2023 – EOP March 2024 with these customers’ flows removed from

subsequent categories

3. Migration of deposits out of checking and savings accounts

4. Net deposit flows to JPMorgan Wealth Management (JPMWM) Investments, and estimated flows for select external brokerages and online banks

5. Consumer Banking customers with at least one outflow to an online bank from EOP March 2023 – EOP March 2024; a customer is considered primary bank if it meets one of the following conditions: ≥15 withdrawals from

a checking account or ≥5 withdrawals from a checking account and ≥$500 of inflows per month

6. Migration of deposits into higher yielding JPMC products

7. Internal yield seeking inflows (incl. JPMWM flows and internal migration) excluding net new money, divided by total measured yield seeking outflows (incl. JPMWM flows, internal migration, external brokerages, online

banks)

Slide 27 – Our strategies are enabling deposit share gains over time

1. Source: Federal Deposit Insurance Corporation (“FDIC”) 2023 Summary of Deposits survey per S&P Global Market Intelligence; applies a $1B deposit cap to Chase and industry branches; includes all commercial banks,

savings banks, and savings institutions as defined by the FDIC; prior periods have been revised to conform to the current period presentation

2. Deposit share changes are rounded to reflect the change in share listed on the page with 1 decimal point

3. Markets within each deposit share tier are assigned based on 2023 deposit share

4. Includes 106 of the top 125 markets with a Chase presence as of 2023

53

Notes on slides 28-29

Slide 28 – Branch expansion is core to our long-term growth

1. Source: Federal Deposit Insurance Corporation (“FDIC”) 2023 Summary of Deposits survey per S&P Global Market Intelligence; applies a $1B deposit cap to Chase and industry branches; includes all commercial banks,

savings banks, and savings institutions as defined by the FDIC; prior periods have been revised to conform to the current period presentation; numbers do not foot to Form 10-K as FDIC represents branch counts as of

June 30

th

, 2023

2. Large banks consist of institutions with >$100B in retail deposits based on Federal Deposit Insurance Corporation (“FDIC”) 2023 Summary of Deposits survey per S&P Global Market Intelligence, excluding Chase and

including Peer 1 and Peer 2

3. Announced February 6

th

, 2024; reflects commitment through 2027

4. Source: Federal Deposit Insurance Corporation (“FDIC”) 2023 Summary of Deposits survey per S&P Global Market Intelligence; applies a $1B deposit cap to Chase and industry branches; includes all commercial banks,

savings banks, and savings institutions as defined by the FDIC; prior periods have been revised to conform to the current period presentation

Slide 29 – Looking ahead, we will extend our presence to cover >50% of the population in each state

1. Drive times and population are derived from ESRI Business Analyst using 2023 and forward-looking population metrics; drive times are derived from 2022 street network vintage for 2023 and forward-looking time periods;

future traffic information may impact forward-looking statement

2. Accessible drive time of 10-minutes for populations that live in City / Suburb and adjusted drive time for populations that live in Rural / Town based on typical drive times to other services

3. State counts exclude Washington, D.C., where Chase currently has >50% population coverage within an accessible drive time

54

Notes on slides 32-34

Slide 32 – We are gaining share in an increasingly competitive market

1. Defined as average sales debit active accounts

2. Based on 2019-2023 sales volume and loans outstanding public disclosures by peers and JPMorgan Chase estimates. Sales volume excludes private label and Commercial Card. Total industry loans outstanding

excludes private label, AXP Charge Card, and Citi Retail

3. Card outstandings market share has been revised to reflect a restatement to the 2022 reported total industry outstandings disclosed by Nilson; Chase restated from 17.3%

Slide 33 – We are driving OS growth by executing on our strategy as revolve behavior continues to normalize

1. Reflects branded consumer T&E and small business accounts; premium definition based on spend

2. Account retention is based on voluntary attrition of accounts with greater than 12 months-on-book

3. % of monthly active customers who have >= 10 transactions or >= $833 per month ($10K in annualized) spend

Slide 34 – We are focused on key segments where we have outsized opportunity for growth

1. Includes any customer approved for a new account if they are one of the following: (1) have no credit history or report at any of the three national bureaus; (2) have primary tradeline(s) less than 12 months at the national

bureaus; (3) have only authorized user tradelines at the national bureaus

2. 2023 Travel Weekly Magellan Awards

55

Notes on slides 35-37

Slide 35 – We continue to invest in attractive opportunities to fuel future growth

1. Gross cash marketing spend represents total outlays in a calendar year, which includes expenses and contra revenues. Contra-revenue may be amortized and not all recognized in the year the outlay was made. Growth

rates may not tie due to rounding

2. Account retention is based on voluntary attrition of accounts with greater than 12 months-on-book

3. Reflects expected return of 2023 vintage

4. Defined as Net Present Value (NPV) of the vintage; NPV defined as the post-tax lifetime value of all incremental cash flows for the investment, including upfront investment costs and all other variable revenues and costs

resulting, discounted at the cost of equity

5. Reflects branded consumer T&E and small business accounts; premium definition based on spend

Slide 36 – We are leveraging our Connected Commerce acquisitions to scale our two-sided platform

1. Users of all web and/or mobile platforms who have logged in within the past 90 days

2. Reflects the number of individual geographic business locations featured on The Infatuation website and app (as of Dec. 2023)

Slide 37 – We have been executing on our Connected Commerce playbook

1. Represents customers booking through Chase Travel (excludes FROSCH and cxLoyalty partner business)

2. Represents YoY increase in 4.5+ star hotel bookings through Chase Travel, star rating sourced through cxLoyalty inventory application

3. Reflects the 2023 monthly average number of user device identifications to visit The Infatuation website and app

4. Number of offers viewed by a customer during a campaign (excludes multiple views of the same offer)

5. Includes Chase Travel Sales Volume (incl. FROSCH affiliates), and volume attributed to Chase Offers, Chase Media Solutions, Shop Through Chase and Ultimate Rewards Apple Store

56

Notes on slides 40-41

Slide 40 – We have been focused on integrating the legacy business while minimizing disruption

1. Includes deposits accounts and lending accounts, excludes wealth assets. Lending accounts migrating or exiting by 2Q24 include Home Lending, Personal Lines of Credit, Student Loan Refinance, Overdraft Line of

Credit

2. Core deposits (excludes institutional and sweep deposits). Months following acquisition includes period from deal to July 2023

3. Client relationships measured in households (includes individual and business relationships). As of 1Q24

4. Includes permanently placed employees since acquisition. As of April 2024

Slide 41 – First Republic complements growth strategies across the firm

1. S&P Global Market Intelligence as of December 31, 2023

57