A Plan to Grow Our Economy

and Make Life More Affordable

©Her Majesty the Queen in Right of Canada (2022)

All rights reserved

All requests for permission to reproduce this document

or any part thereof shall be addressed to the Department of Finance Canada.

This document is available at www.Canada.ca/Budget

Cette publication est aussi disponible en français.

F1-23/3E-PDF

Cat No.: 1719-7740

In case of discrepancy between the printed version and the electronic version,

the electronic version will prevail.

Foreword v

Foreword

Taken individually, the events of the last two years have not been without

precedent. Canada has endured previous recessions and even pandemics.

We have been bueted by European wars and fought in them, too. We have

experienced crises big and small, and we have always prevailed.

But in this country’s nearly 155 years, Canadians have never been through a

time like the one we have been living through these past 25 months.

On that Thursday in March of 2020––when travel plans were hastily cancelled

and lines suddenly formed at our grocery stores––we knew that this virus would

disrupt our lives. But few imagined quite how much and for quite how long.

Yet here we are. We bent but we did not break.

Canadians have done everything that has been asked of them, and more.

And so, to all of them—to all of you—I want to say thank you!

I now have the honour of tabling my second federal Budget.

I tabled my rst in April of 2021.

In the year preceding it, the Canadian economy had teetered on the brink.

Our economy contracted by 17 per cent—the deepest recession since the

1930s. Three million Canadians lost their jobs.

It was a shattering economic blow. The Great Depression scarred this country

for a generation or more. It was entirely reasonable to fear that the COVID

recession would likewise hamstring us for years; that millions of Canadians

would still today be without jobs; and that the task of rebuilding our country

would be the work of decades.

We knew we could not let that happen. And so we provided unprecedented

emergency support to Canadian families and Canadian businesses. Our

relentless focus was on jobs—on keeping Canadians employed, and on keeping

their employers aoat.

It was an audacious plan. And it worked.

Our economy has recovered 112 per cent of the jobs that were lost during

those awful rst months, compared to just 90 per cent in the United States.

Our unemployment rate is down to just 5.5 per cent—close to the 5.4 per cent

low in 2019 that was Canada’s best in ve decades.

Our real GDP is a full 1.2 per cent above where it was before the pandemic.

Just think about that: After a devastating recession—after wave after wave and

lockdown after lockdown—our economy has not just recovered. It is booming.

Today, Canada has come roaring back.

vi

But Canadians know that ghting COVID and the COVID recession came at a

high price.

Snarled supply chains are driving prices higher at the checkout counter. Buying

a house is out of reach for far too many Canadians.

Ination—a global phenomenon—is making things more expensive in Canada, too.

The money that rescued Canadians and the Canadian economy—deployed

chiey and rightly by the federal government to the tune of eight of every

ten dollars invested—has depleted our treasury.

Our COVID response came at a signicant cost, and our ability to spend is not

innite. We will review and reduce government spending, because that is the

responsible thing to do.

And on this next point, let me be very clear: We are absolutely determined that

our debt-to-GDP ratio must continue to decline. Our pandemic decits are and

must continue to be reduced. The extraordinary debts we incurred to keep

Canadians safe and solvent must be paid down.

This is our scal anchor—a line we shall not cross, and that will ensure that our

nances remain sustainable so long as it remains unbreached.

Canada has a proud tradition of scal responsibility. It is my duty to maintain

it—and I will.

So now is the time for us to focus—with smart investments and a clarity of

purpose—on growing our economy.

That is what our government proposes to do. And this is how we propose to

do it.

Pillar one of our plan is investing in the backbone of a strong and growing

country: our people.

Let me start with housing.

Housing is a basic human need, but it is also an economic imperative.

Our economy is built by people, and people need homes in which to live.

But Canada does not have enough homes. We need more of them, fast.

This Budget represents perhaps the most ambitious plan that Canada has ever

had to solve that fundamental problem.

Over the next ten years, we will double the number of new homes we build.

This must become a great national eort, and it will demand a new spirit of

collaboration—provinces and territories; cities and towns; the private sector and

non-prots all working together with us to build the homes that Canadians need.

We will invest in building more homes and in bringing down the barriers that

Foreword vii

keep them from being built. We will invest in the rental housing that so many

count on. We will make it easier for our young people to get those rst keys of

their own.

And we will do everything we can to make the market fairer for Canadians.

We will prevent foreign buyers from parking their money in Canada by buying

up homes. We will make sure that houses are being used as homes, rather than

as commodities to be traded.

But on housing, I would like to oer one caution: There is no silver bullet which

will immediately, once and forever, make every Canadian a homeowner in the

neighbourhood where they want to live.

As Canada grows—and as a growing Canada becomes more and more

prosperous—we will need to continue to invest, year after year after year,

in building more homes for a growing country.

A growing country and a growing economy also demand a growing workforce.

A lack of workers—and of workers with the right skills—is constraining the

industrialized economies around the world.

But there is good news.

In 2020, Canada had the fastest population growth in the G7. At a time when

the world is starved for workers and talent, our country’s unique enthusiasm for

welcoming new Canadians is a powerful—and particularly Canadian—driver of

economic prosperity.

This Budget will make it easier for the skilled immigrants that our economy

needs to make Canada their home.

It will also invest in the determined and talented workers who are already here.

We will make it more aordable for our workers to move to where the jobs are.

Programs like the Canada Worker’s Benet will make it more worthwhile for

people to work.

We will invest in the skills that Canadian workers will need to ll the good-

paying jobs of today and tomorrow, and we will break down barriers and ensure

that everyone is able to roll up their sleeves and get to work if they want to.

And yes: One of those barriers is aordable childcare.

When we promised—less than a year ago—to make high quality, aordable

childcare a reality for all Canadians, our plan was certainly welcomed. But the

cheers were muted by justiable skepticism. After all, similar promises had been

made and broken for decades—ve of them in fact!

That’s why, as I stand here today, I am so proud to say we have delivered. We

have signed agreements on early learning and child care with every single

province and territory.

viii

This is women’s liberation. It will mean more women no longer need to choose

between motherhood and a career. And it will make life more aordable for

middle class Canadian families.

Fees are already being slashed across the country. By the end of this year, they

will be reduced by an average of 50 per cent.

And by 2025-26, child care will average just $10-a-day, from coast-to-

coast-to-coast.

This is feminist economic policy in action.

Housing and immigration and skills and child care. These are social policies, to

be sure. But just as importantly, they are economic policies, too.

This strategy, which our government has been pursuing for the past seven

years, is what the US Secretary of the Treasury, Janet Yellen, has recently dubbed

“Modern Supply Side Economics.”

And because these policies will create supply-led growth that helps satisfy the

demand driving ination, they are precisely what Canada needs right now.

Our second pillar for growing our economy is the green transition.

In Canada—and around the world—climate action is no longer a matter of

political debate or personal conviction; it is an existential challenge. That means

it is also an economic necessity.

In the largest economic transformation since the Industrial Revolution, the

world economy is going green.

Canada can be in the vanguard, or we can be left behind.

That is, of course, no choice at all—which is why our government is investing

urgently in this shift.

Our plan is driven by our national price on pollution—the smartest, most

eective incentive for climate action—and a new Canada Growth Fund which

will help attract the billions of dollars in private capital we need to transform

our economy at speed and at scale.

For our children, that means cleaner air and cleaner water tomorrow. And it will

mean good jobs for Canadians today.

Our third pillar for growth is a plan to tackle the Achilles heel of the Canadian

economy: productivity and innovation.

We are among the most educated countries in the world. Our scientists win

Nobel prizes, and our cities are outshining Silicon Valley in creating high-paying

technology jobs.

Foreword ix

But we are falling behind when it comes to economic productivity. Productivity

matters because it is what guarantees the dream of every parent—that our

children will be more prosperous than we are.

This is a well-known Canadian problem—and an insidious one. It is time for

Canada to tackle it.

We propose to do so, in part, with a new innovation and investment agency—

drawing on international best practices from around the world—that will give

companies across the country and across our economy the tools and incentives

they need to create and invent, and to produce more with less.

We will encourage small Canadian companies to get bigger.

We will help Canadians and Canadian companies develop new IP—and turn

their new ideas into new businesses and new jobs.

These three pillars—investing in people, investing in the green transition, and

investing in innovation and productivity—will create jobs and prosperity today,

and build a stronger economic future for our children.

They will make life more aordable, and they will ensure Canada continues to

be the best place in the world to live, work, and raise a family.

From the rst day we started working on this Budget, this growth agenda was

always going to be our focus.

And then, Vladimir Putin invaded Ukraine.

The world we woke up to on February 24 was dierent from the one that had

existed when we turned o the lights the night before.

When Putin opened re on the people of Ukraine, he also turned his guns on

the unprecedented period of prosperity that the world’s democracies have

worked so diligently to build over more than 76 years.

Our rules-based international order—born from the ashes of the Second World

War—today confronts the greatest threat since its inception.

And so our response was swift and strong. Canada and our allies imposed the

toughest sanctions ever inicted on a major economy. Russia has become an

economic pariah.

But Putin’s assault has been so vicious that we all now understand that the

world’s democracies—including our own—can be safe only if the Russian tyrant

and his criminal armies are entirely vanquished.

And that is what we are counting on the brave people of Ukraine to do.

Because they are ghting our ght—a ght for democracy—it is in our urgent

national interest to ensure they have the missiles and the money they need to

win.

x

And that is what this Budget provides.

Putin’s invasion of Ukraine has also reminded us that our own peaceful

democracy—like all the democracies of the world—depends ultimately on the

defence of hard power. The world’s dictators should never mistake our civility

for pacism. We know that freedom does not come for free, and that peace is

guaranteed only by our readiness to ght for it.

That is why this Budget makes an immediate, additional investment in our

armed forces, and proposes a swift defence policy review to equip Canada for a

world that has become more dangerous.

The images of Russian tanks rolling across Ukraine did not change the

fundamental goal of this Budget.

But Putin’s attack on Ukraine, and that country’s remarkable and valiant

resistance, has reinforced our government’s deepest conviction—a line that runs

through everything in this Budget, and in each of the Budgets that have preceded

it: That the strength of a country does not come solely from the vastness of the

reserves of its central bank, or from the size of the force in its garrisons.

Those do matter, to be sure. But they matter less than democracy itself.

They can be defeated—they are being defeated—by a people who are united

and free.

And that is every country’s true source of strength.

For a country to be strong, everyone must be included and empowered and united.

So let me explain what that stronger country looks like here at home:

It means we need housing that is aordable for everyone, and a system where

an entire generation is not priced out of owning a home.

It means we need to do our part to ght climate change so that we can leave

our children with clean air, clean water, and a livable planet.

It means we need to continue to face up to the sins of our past, and ensure that

Indigenous peoples in this country are able to live dignied and prosperous lives.

It means we need a health care system that allows people to see a doctor or a

dentist, and to receive mental health care, too.

It means we need to continue to build a society that is truly equal for everyone,

because the colour of your skin, or who you love, or where you were born should

not dictate whether you get to share in the opportunities that Canada provides.

And it means we need an economy that allows businesses to grow and create

good middle class jobs, and where everyone can earn a decent living for an

honest day’s work.

The brave people of Ukraine have shaken the world’s older democracies out of

Foreword xi

our 21

st

century malaise. They have reminded us that the strength and unity of a

country comes from the strength and unity of its people.

And they have reminded us that there should be no greater priority than to

build a country that we would be willing to ght for.

That is what we have tried to do these last seven years. And that is what we will

continue to do today.

And so, I am proud to introduce Budget 2022: A Plan to Grow Our Economy and

Make Life More Aordable.

A plan that invests in people. And a plan that will help build a Canada where

nobody gets left behind.

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

xiii

Table of Contents

Foreword ...........................................................................................................v

Overview: Economic Context ..........................................................................3

1. A Strong Recovery Path .....................................................................................................4

Canada’s Performance Has Exceeded Expectations .............................................4

Canada’s Jobs Recovery Has Been Exceptionally Strong ...................................5

2. From Pandemic to Conict .............................................................................................7

Russia’s Invasion Is Dragging Down Global Growth ...........................................7

High Global Ination and the Outlook for Canada ........................................... 10

3. Budget 2022 Economic Environment ........................................................................ 14

Survey of Private Sector Economists ...................................................................... 14

Budget 2022 Economic Scenario Analysis ............................................................ 15

4. Budget 2022 Fiscal Framework ..................................................................................... 17

A Responsible Fiscal Plan ............................................................................................. 17

Preserving Canada’s Low Debt Advantage: The Fiscal Anchor ..................... 21

5. Investing to Grow the Economy ................................................................................... 25

Investing in a Green Transition That Will Support Jobs and Growth .......... 27

Investing in Our Economic Capacity and Security ............................................. 28

Investing in an Inclusive Workforce ......................................................................... 29

Chapter 1: Making Housing More Aordable ........................................... 33

1.1 Building Aordable Homes ........................................................................................ 36

Launching a New Housing Accelerator Fund ..................................................... 37

Using Infrastructure Funding to Encourage More Home Construction ... 37

Leveraging Transit Funding to Build More Homes ........................................... 38

Rapidly Building New Aordable Housing .......................................................... 38

Speeding Up Housing Construction and Repairs for Vulnerable

Canadians ......................................................................................................................... 38

Building More Aordable and Energy Ecient Rental Units ....................... 39

Direct Support for those in Housing Need ......................................................... 40

A New Generation of Co-Operative Housing Development ........................ 40

Aordable Housing in the North ............................................................................ 41

Multigenerational Home Renovation Tax Credit ............................................... 41

Greener Buildings and Homes ................................................................................. 42

Establishing a Greener Neighbourhood Pilot Program .................................. 42

xiv

Greener Construction in Housing and Buildings .............................................. 43

Greener Aordable Housing ..................................................................................... 43

Long-Term Supports to End Homelessness ........................................................ 43

Improving Community Responses to Homelessness ...................................... 44

A New Veteran Homelessness Program ............................................................... 44

1.2 Helping Canadians Buy Their First Home ............................................................... 44

A Tax-Free First Home Savings Account ............................................................... 45

Doubling the First-Time Home Buyers’ Tax Credit ........................................... 45

An Extended and More Flexible First-Time Home Buyer Incentive ........... 46

Supporting Rent-to-Own Projects .......................................................................... 46

1.3 Protecting Buyers and Renters ................................................................................... 47

Moving Forward on a Home Buyers’ Bill of Rights .......................................... 47

Housing for Canadians, Not for Big Corporations ........................................... 47

1.4 Curbing Foreign Investment and Speculation ...................................................... 48

A Ban on Foreign Investment in Canadian Housing ........................................ 48

Making Property Flippers Pay Their Fair Share .................................................. 49

Taxing Assignment Sales ............................................................................................ 49

Protecting Canadians From Money Laundering in the

Mortgage Lending Sector .......................................................................................... 50

Chapter 2: A Strong, Growing, and Resilient Economy ............................... 57

2.1 Leading Economic Growth and Innovation ........................................................... 60

Launching a World-Leading Canada Growth Fund .......................................... 60

Creating a Canadian Innovation and Investment Agency ............................. 61

Review of Tax Support to R&D and Intellectual Property .............................. 63

Cutting Taxes for Canada’s Growing Small Businesses ................................... 64

2.2 Supporting Economic Growth and Stable Supply Chains ................................ 65

Canada’s Critical Minerals and Clean Industrial Strategies ............................ 65

Better Supply Chain Infrastructure ........................................................................... 69

Moving on Canada’s Infrastructure Investments .............................................. 70

Strengthening Canada’s Semiconductor Industry ............................................ 72

Growing Canada’s Health-Focused Small and Medium-Sized Businesses . 72

Making Canada’s Economy More Competitive ................................................. 72

Leadership on Internal Trade and Labour Mobility ........................................... 73

Supporting Canada’s Innovation Clusters ............................................................. 73

Renewing the Canadian Agricultural Partnership .............................................. 74

xv

2.3 Investing in Intellectual Property and Research .................................................. 74

Building a World-Class Intellectual Property Regime ....................................... 74

Securing Canada’s Research from Foreign Threats .......................................... 76

Hiring More Leading Researchers ............................................................................ 77

Expanding Canada’s Presence in Space ................................................................. 77

Leveraging the National Research Council ........................................................... 78

Funding for Black Researchers .................................................................................. 78

Funding the Canadian High Arctic Research Station ....................................... 78

2.4 Driving Investment and Growth for Our Small Businesses .............................. 79

Reducing Credit Card Transaction Fees ................................................................. 79

Strengthening Canada’s Trade Remedy and Revenue Systems ................. 79

Employee Ownership Trusts ...................................................................................... 80

Engaging the Cannabis Sector .................................................................................. 80

2.5 Supporting Recovery and Growth in Aected Sectors ..................................... 81

The Next Steps Towards High Frequency Rail ..................................................... 81

Investing in VIA Rail Stations and Maintenance Centres ................................ 81

Supporting the Prince Edward Island Potato Industry ..................................... 82

Full and Fair Compensation for Supply Managed Sectors ............................. 82

Support for Canada’s Tourism Sector ..................................................................... 83

Chapter 3: Clean Air and a Strong Economy .............................................. 89

3.1 Reducing Pollution to Fight Climate Change ........................................................ 91

Reducing Emissions on the Road ............................................................................. 91

Sustainable Agriculture to Fight Climate Change ............................................ 93

Expanding the Nature Smart Climate Solutions Fund .................................... 93

A New Tax Credit for Investments in Clean Technology ................................. 94

Returning Fuel Charge Proceeds to Small and Medium- Sized Enterprises . 94

Expanding the Low Carbon Economy Fund and Supporting Clean

Energy in Yukon ............................................................................................................. 95

Support for Business Investment in Air-Source Heat Pumps ....................... 95

Building Capacity to Support Green Procurement ........................................... 96

Industrial Energy Management ................................................................................ 96

3.2 Building a Clean, Resilient Energy Sector .............................................................. 96

Investment Tax Credit for Carbon Capture, Utilization, and Storage ........ 97

Clean Electricity .............................................................................................................. 98

Small Modular Reactors .............................................................................................. 99

xvi

Phasing Out Flow-Through Shares for Oil, Gas, and Coal Activities ......... 99

3.3 Protecting Our Lands, Lakes, and Oceans ............................................................ 100

Renewing and Expanding the Oceans Protection Plan ................................100

Protecting Our Freshwater ....................................................................................... 101

Taking More Action to Eliminate Plastic Waste ...............................................102

Fighting and Managing Wildres .........................................................................102

Growing Canada’s Trail Network ...........................................................................103

British Columbia Old Growth Nature Fund .......................................................104

3.4 Building Canada’s Net-Zero Economy .................................................................104

Increasing the Impact of the Canada Infrastructure Bank ........................... 105

Net-Zero Capital Allocation Strategy ..................................................................106

Climate Disclosures for Federally Regulated Institutions ............................106

Supporting the International Sustainability Standards Board’s

Montreal Oce ............................................................................................................106

Chapter 4: Creating Good Middle Class Jobs ......................................... 113

4.1 Delivering on Child Care .............................................................................................114

Supporting Early Learning and Child Care ..........................................................114

4.2 Immigration for Our Economy ................................................................................117

Canada’s Ambitious Immigration Plan ................................................................. 117

Eciently Welcoming Visitors, Students, and Workers to Canada ...........118

Securing the Integrity of Canada’s Asylum System .......................................118

Supporting Legal Aid for Asylum Seekers ..........................................................119

Improving Support Services for Immigrants and Visitors to Canada .....119

Improving the Citizenship Program ......................................................................119

4.3 A Workforce for the 21

st

Century Economy ........................................................120

Modernizing Labour Market Transfer Agreements ........................................ 120

Bringing Workers to the Decision-Making Table ............................................121

Doubling the Union Training and Innovation Program ................................121

Sustainable Jobs ............................................................................................................ 122

4.4 Connecting Workers to Good Jobs .......................................................................122

Labour Mobility Deduction for Tradespeople ..................................................123

Supporting Foreign Credential Recognition in the Health Sector ...........123

An Employment Strategy for Persons With Disabilities ................................124

Improving the Temporary Foreign Worker Program .....................................124

Completing the Employment Equity Act Review ............................................125

xvii

4.5 Towards A Better Employment Insurance System .............................................126

Extending Temporary Support for Seasonal Workers ...................................126

Chapter 5: Canada’s Leadership in the World .......................................... 131

5.1 Reinforcing Our National Defence .......................................................................... 132

Reviewing Canada’s Defence Policy .....................................................................133

Reinforcing our Defence Priorities ........................................................................ 134

Supporting Culture Change in the Canadian

Armed Forces ............................................................................................................... 135

Enhancing Canada’s Cyber Security .....................................................................136

5.2 Supporting Ukraine .....................................................................................................137

Bolstering Ukraine’s Fight for Freedom ...............................................................137

Holding Russia Accountable ....................................................................................137

Supporting Ukrainians Through the Crisis .......................................................... 139

A Safe Haven for Ukrainians ....................................................................................139

5.3 Standing Up for Democracy, Transparency, and the Rule of Law ..............140

Strengthening Canada’s Anti-Money Laundering and Anti-Terrorist

Financing (AML/ATF) Regime ..................................................................................140

Implementing a Publicly Accessible Benecial Ownership Registry ........141

Combatting Misinformation and Disinformation ...........................................142

5.4 Providing International Assistance ..........................................................................143

Leading in the Global Fight Against COVID-19 ........................................................ 144

Strengthening Global Health Security ................................................................. 144

Chapter 6: Strong Public Health Care ...................................................... 149

6.1 A Stronger Health Care System ................................................................................ 151

Dental Care for Canadians .......................................................................................152

Reducing the Backlogs of Surgeries and Procedures ....................................152

Increasing Loan Forgiveness for Doctors and Nurses in Rural and

Remote Communities ................................................................................................152

Researching the Long-Term Impacts of COVID-19 ........................................153

Improving Canada’s Dementia and Brain Health Research ........................153

Supporting the Centre for Aging and Brain Health Innovation ................153

The Canada Health Transfer .....................................................................................154

6.2 Supporting Mental Health and Well-Being .........................................................155

Supporting Mental Well-Being With the Wellness Together Canada

Portal ................................................................................................................................156

xviii

Addressing the Opioid Crisis ..................................................................................157

Better Mental Health Support for Black Federal Public Servants .............157

6.3 Investing in Public Health ..........................................................................................157

Strengthening Canada’s Ability to Detect and Respond to Public

Health Events and Emergencies .............................................................................. 158

Maintaining the National Emergency Strategic Stockpile ............................158

Piloting a Menstrual Equity Fund for Those in Need ....................................158

Help for Canadians Who Want to Become Parents .......................................159

Taxation of Vaping Products ...................................................................................159

Chapter 7: Moving Forward on Reconciliation ........................................ 165

7.1 Addressing Past Harms and Discrimination Related to Indigenous

Children and Families .................................................................................................167

Supporting First Nations Children Through Jordan’s Principle .................168

Implementing Indigenous Child Welfare Legislation ....................................169

Addressing the Shameful Legacy of Residential Schools ............................170

7.2 Supporting Strong and Healthy Communities ................................................... 171

Improving Health Outcomes in Indigenous Communities .........................171

Distinctions-based Mental Health and Wellness ............................................172

First Nations Elementary and Secondary Education ...................................... 172

Clean Drinking Water and Better Infrastructure for First Nations

Communities .................................................................................................................172

Investing in Housing for Indigenous Communities .......................................174

7.3 Advancing Self-Determination and Prosperity ..................................................174

Implementing the United Nations Declaration on the Rights of

Indigenous Peoples Act ..............................................................................................175

Legislative Changes to Support Self-Determination .....................................175

Indigenous Climate Leadership .............................................................................176

Partnering with Indigenous Peoples in Natural Resource Projects .......... 176

Indigenous Economic Participation in Trans Mountain ................................ 177

Supporting Indigenous Businesses and Community Economic

Development ................................................................................................................. 177

Advancing Tax Jurisdiction for Indigenous Governments ...........................178

xix

Chapter 8: Safe and Inclusive Communities ............................................. 183

8.1 A Diverse and Inclusive Canada .............................................................................. 184

A Federal LGBTQ2 Action Plan ...............................................................................184

Fighting Systemic Racism, Discrimination, and Hate .....................................184

Supporting Black Canadian Communities .........................................................185

Federal Funding for the Jean Augustine Chair in Education,

Community and Diaspora .........................................................................................186

Supporting the Muslims in Canada Archive .....................................................186

Building the Jewish Community Centre of Greater Vancouver .................186

Ensuring Fair Compensation for News Media in the Digital News

Ecosystem ....................................................................................................................... 187

Supporting Local and Diverse Journalism .........................................................187

Creating a Safer Sport System ................................................................................188

Supporting Special Olympics Canada .................................................................188

Supporting Our Seniors ........................................................................................... 188

Doubling the Home Accessibility Tax Credit ..................................................... 190

National School Food Policy ...................................................................................190

Support for Workers Experiencing Miscarriage

or Stillbirth ......................................................................................................................191

8.2 Keeping Canadians Safe ............................................................................................191

Developing a Buy-Back Program for Assault Weapons ...............................191

Working with Provinces and Territories to Advance the National

Action Plan to End Gender-Based Violence ...................................................... 192

Preparing for Emergencies ......................................................................................192

Supporting Recovery and Completing the Rail Bypass in Lac-Mégantic .192

Increasing the Capacity of Superior Courts ......................................................193

Enhancing Legal Aid for Those Who Need It Most ........................................193

8.3 Supporting Artists and Charities in Our Communities ..................................194

Supporting Canada’s Performing Arts and Heritage Sectors ..................... 194

Supporting a More Inclusive Arts Training Sector .......................................... 195

Stronger Partnerships in the Charitable Sector ...............................................195

Boosting Charitable Spending in Our Communities .....................................196

xx

Chapter 9: Tax Fairness and Eective Government ................................. 203

9.1 A Fair Tax System ..........................................................................................................204

Requiring Financial Institutions to Help Pay for the Recovery ...................205

Preventing the Use of Foreign Corporations to Avoid Canadian Tax .....206

Next Steps Towards a Minimum Tax for High Earners ...................................206

Limiting Aggressive Tax Avoidance by Financial Institutions .....................207

Closing the Double-Deduction Loophole .......................................................... 208

Expanding Anti-Avoidance Tax Rules ..................................................................208

Strengthening the General Anti-Avoidance Rule ............................................ 208

International Tax Reform ............................................................................................ 209

International Accounting Standards for Insurance Contracts .................... 210

Reinforcing the Canada Revenue Agency ..........................................................211

Eliminating Excise Duty on Low-Alcohol Beer ..................................................212

Bill C-208 Follow-up ...................................................................................................212

9.2 Eective Government .................................................................................................212

Reducing Planned Spending in the Context of a Stronger Recovery .....213

Strategic Policy Review .............................................................................................. 213

Council of Economic Advisors .................................................................................214

Addressing the Digitalization of Money .............................................................214

A Fairer Banking Complaints Handling System for Canadians ..................215

Embracing Digital Government ............................................................................215

Public Sector Pension Plan Governance .............................................................215

Review of the Public Servants Disclosure Protection Act ..............................215

Annex 1: Details of Economic and Fiscal Projections .............................. 219

Annex 2: Debt Management Strategy ...................................................... 261

Annex 3: Legislative Measures................................................................... 273

Overview

Economic Context

1. A Strong Recovery Path .....................................................................................................4

Canada’s Performance Has Exceeded Expectations .............................................4

Canada’s Jobs Recovery Has Been Exceptionally Strong ...................................5

2. From Pandemic to Conict .............................................................................................7

Russia’s Invasion Is Dragging Down Global Growth ...........................................7

High Global Ination and the Outlook for Canada ........................................... 10

3. Budget 2022 Economic Environment ........................................................................ 14

Survey of Private Sector Economists ...................................................................... 14

Budget 2022 Economic Scenario Analysis ............................................................ 15

4. Budget 2022 Fiscal Framework ..................................................................................... 17

A Responsible Fiscal Plan ............................................................................................. 17

Preserving Canada’s Low Debt Advantage: The Fiscal Anchor ..................... 21

5. Investing to Grow the Economy ................................................................................... 25

Investing in a Green Transition That Will Support Jobs and Growth .......... 27

Investing in Our Economic Capacity and Security ............................................. 28

Investing in an Inclusive Workforce ......................................................................... 29

2 Overview

Economic Context 3

Overview

Economic Context

The Canadian economy has staged a strong recovery from the pandemic.

Our workers and businesses have displayed remarkable resilience as the world

endured multiple waves of COVID-19. Real GDP returned to pre-pandemic

levels earlier than expected. Canada’s jobs recovery has outperformed its G7

peers and surpassed even the most optimistic expectations. Economic scarring

from the pandemic has largely been avoided.

The impacts of the pandemic are still being felt by workers and businesses,

whether from the ongoing rebalancing of consumer demand and related

supply chain issues, or new realities such as increased remote work and the

accelerating digitalization of our economy. Federal emergency supports

managed to stabilize household nances, support millions of jobs, and keep

small businesses aoat. And now, unemployment is lower than it was when the

pandemic started.

However, the global economy remains fragile and any potential setbacks could

have a major impact on Canada. The illegal and barbaric Russian invasion of

Ukraine has led to the loss of thousands of lives and the exodus of millions of

Ukrainians. For those watching from afar, the invasion is a major new source of

uncertainty. The ramications are being felt worldwide.

The invasion of Ukraine and the resulting sanctions against Russia have weighed

on markets and condence; led to a surge in commodity prices; and resulted in

a deterioration of the global economic outlook. Higher commodity prices and

additional supply disruptions will exacerbate the inationary pressures already

seen across the world.

As an open economy and a trading nation, Canada has to confront, head-on,

longstanding challenges and new global economic dynamics. The world is

changing, and Canada cannot be left behind.

We need to invest in an economy that is innovative and growth-friendly.

We need to navigate a global green transition that is accelerating every day.

We need to ensure that all Canadian workers, Canadian businesses, and all

regions of the country benet from it. We need to build more aordable

housing to meet the growing needs of a growing workforce. We need to invest

in skills and immigration to ensure that the workforce is prepared for the

economy of today, and tomorrow.

The government is focused on positioning Canada to thrive in an uncertain

world. Budget 2022 takes needed steps to create an environment that spurs

the investments we need to grow our economy, create new, good-paying jobs

for Canadians, and grow the middle class.

4 Overview

1. A Strong Recovery Path

Canada’s Performance Has Exceeded Expectations

The Canadian economy returned to its pre-pandemic level of activity in the

fourth quarter of 2021, marking the fastest recovery of the last three recessions

(Chart 1). Real GDP also grew 6.7 per cent at an annual rate in the last quarter

of 2021—the second-strongest pace of growth in the G7.

The scale of the government’s emergency economic support has fostered a

strong recovery, and has helped Canadians and Canadian businesses weather

the pandemic.

However, the eects of economic uncertainty are evident in measures of

consumer and business condence. The Conference Board of Canada’s Index of

Business Condence was 10 per cent below its long-term average in the fourth

quarter of 2021. Consumer condence was also below its historical average as

of March 2022, weighed down by concerns about ination.

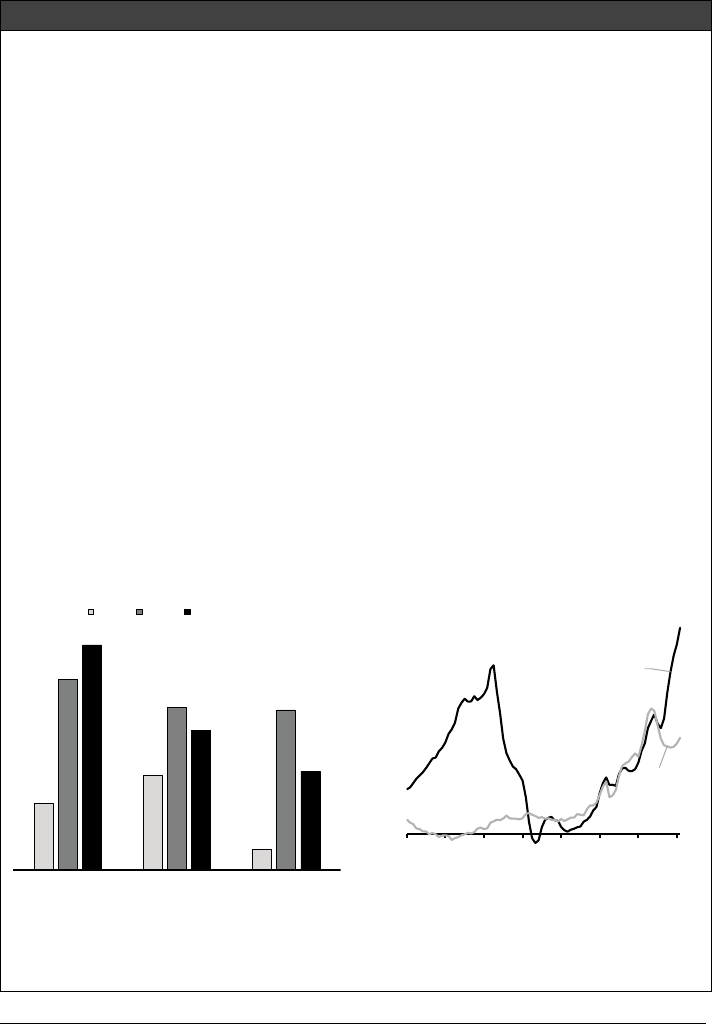

Chart 1

Real GDP Change During COVID-19 and Previous Recessions

COVID-19

recession

2008-2009

recession

1990-1991

recession

1981-1982

recession

85

90

95

100

0 1 2 3 4 5 6 7 8

quarters after pre-recession peaks

index, pre-recession peak = 100

Pre-pandemic level

Note: Three recessions are 1981-1982, 1990-1991 and 2008-2009. Last data point is 2021Q4.

Sources: Statistics Canada; Department of Finance Canada calculations.

Economic Context 5

Canada’s Jobs Recovery Has Been Exceptionally

Strong

Canada’s labour market is emerging strongly from the fth wave of the

pandemic, with the economy adding nearly 340,000 new jobs in February—

more than making up for January’s loss (Chart 2). Canada has seen the fastest

jobs recovery in the G7 (Chart 3)—recouping 112 per cent of the jobs lost at the

outset of the pandemic, compared with 90 per cent in the U.S.

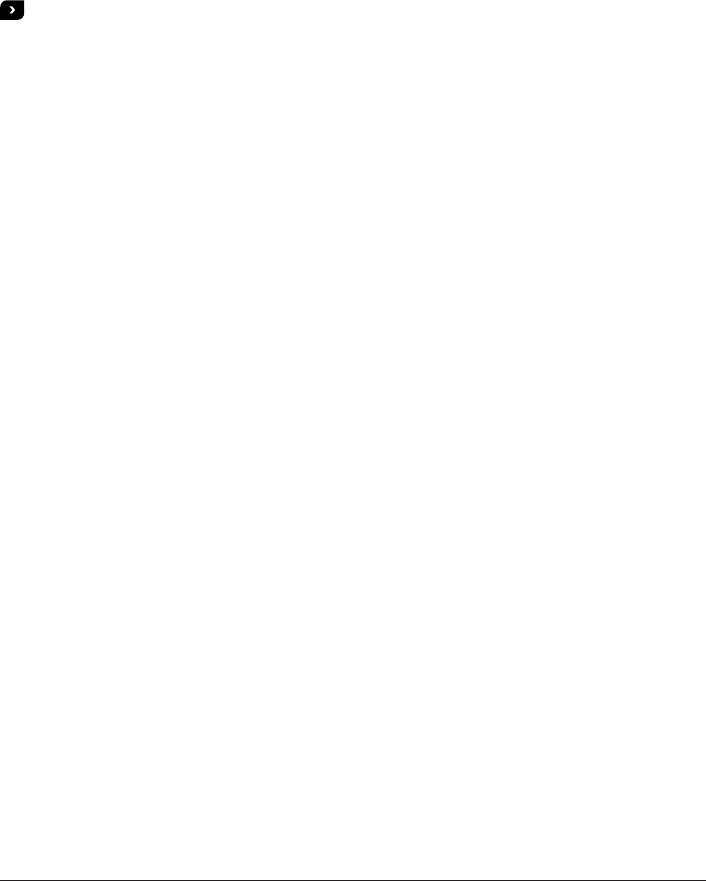

Chart 2

Employment in Canada

Chart 3

Change in Employment Across G7

Countries Relative to February 2020

80

85

90

95

100

Feb

2020

Jun

2020

Oct

2020

Feb

2021

Jun

2021

Oct

2021

Feb

2022

index, February 2020 = 100

-2 -1 0 1 2

United Kingdom

United States

Japan

Italy

Germany

France

Canada

per cent change relative to February 2020

Note: Last data point is February 2022.

Source: Statistics Canada.

Note: Last data point is February 2022 for Canada,

Germany, Italy, Japan, and the United States; December

2021 for the United Kingdom; and 2021Q4 for France

(which is compared to 2019Q4 for France).

Source: Haver Analytics.

6 Overview

The February jobs report also means that all of Canada’s scal guardrails—from

the unemployment rate, to employment rate, to actual hours worked—have

eectively recovered to their pre-pandemic levels (Chart 4). Signicant progress

along many other labour market dimensions has also been made (Chart 5).

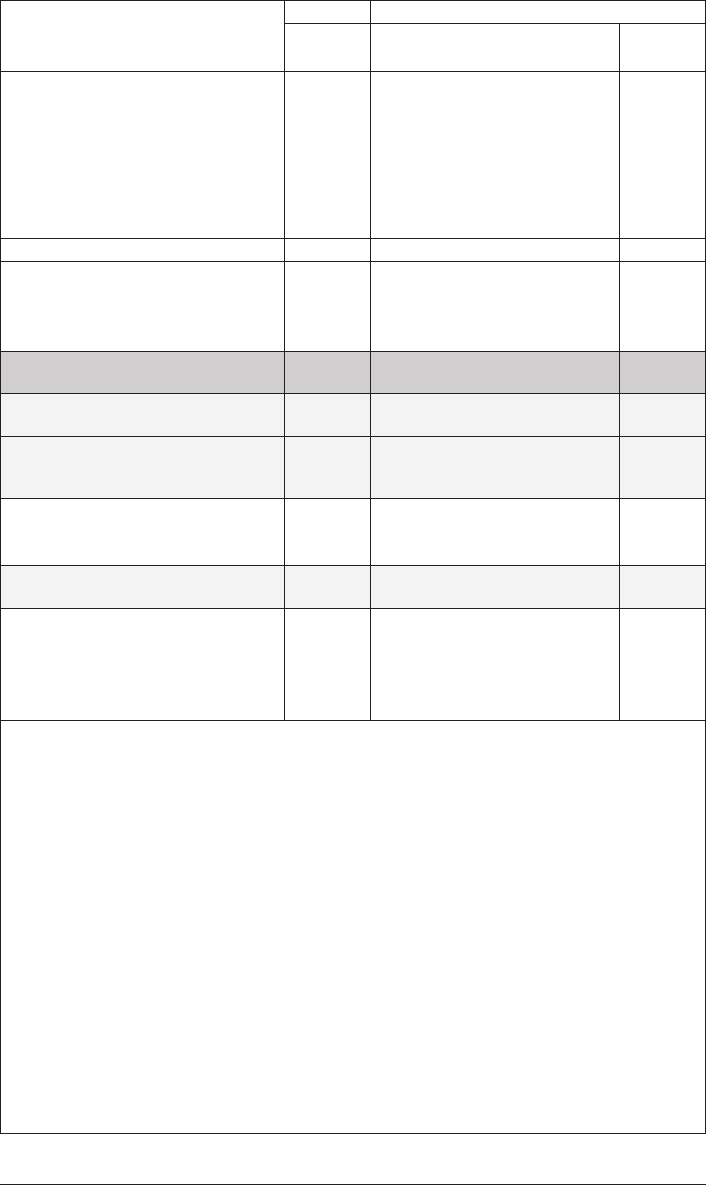

Chart 4

Change in Fiscal Guardrails Relative

to February 2020

Chart 5

Progress in Other Key Labour

Market Metrics Through

February 2022

Employment rate (left

axis)

Total hours

worked (right

axis)

Unemployment rate

(left axis)

-30

0

30

60

90

120

150-30

-25

-20

-15

-10

-5

0

5

Feb

2020

June

2020

Oct

2020

Feb

2021

June

2021

Oct

2021

Feb

2022

per cent

per cent

90%

97%

100%

101%

101%

114%

0% 20% 40% 60% 80% 100% 120%

Long-term unemployment rate

Unemployment rate, 55+

Average hours worked

Unemployment rate, women

Unemployment rate, 15-24

Participation rate, 15-64

Crisis

Trough

2019

Average

Note: Last data point is February 2022.

Source: Statistics Canada.

Note: Illustrates the extent to which labour market

conditions have recovered. The recovery is shown

through progress bars, where the current value (i.e.,

February 2022) of each measure is compared with both

its trough during the pandemic and a pre-pandemic

benchmark value (i.e., 2019 average). Long-term

unemployed are those who have been unemployed for

27 weeks or more.

Source: Statistics Canada.

With February’s job gains, Canada’s unemployment rate dropped to

5.5 per cent, falling below its pre-pandemic level for the rst time, and near

the 50-year low of 5.4 per cent reached in May 2019 (Chart 6). While many

advanced economies have seen signicant declines in their unemployment rate,

few have also experienced an increase in labour force participation to the extent

Canada has (Chart 7).

Economic Context 7

Chart 6

Unemployment Rate

Chart 7

Change in the Labour Force

Participation Rate Across G7

Countries Relative to 2019Q4

5

6

7

8

9

10

11

12

13

14

Jan

1976

Jan

1982

Jan

1988

Jan

1994

Jan

2000

Jan

2006

Jan

2012

Jan

2018

per cent

Historical low

-1.0

-0.5

0.0

0.5

1.0

1.5

percentage points

Note: Last data point is February 2022.

Source: Statistics Canada.

Note: For Ages 15-64. Shows the change from 2019Q4

to the latest quarter, which is 2021Q4 for all countries.

Sources: Statistics Canada; OECD.

While tight labour markets are leading to improved opportunities for workers,

it also creates signicant and pressing challenges for businesses looking to hire

more workers. Employers were actively recruiting for more than 900,000 jobs

in the fourth quarter of 2021, pointing to continued strong labour demand and

the potential for wage growth to increase further.

2. From Pandemic to Conict

Russia’s Invasion Is Dragging Down Global Growth

The unprovoked and unjustied Russian invasion of Ukraine is a signicant

headwind for the global economic outlook. The economic damage risks

becoming increasingly severe and long-lasting, and the economic shockwaves

from the war will be felt by consumers around the world through higher energy

and food prices. These eects—along with disruptions to trade, tighter nancial

conditions, and fragile condence—will contribute to a meaningful weakening

of global economic growth if the conict persists.

While Russia and Ukraine account for less than 2 per cent of global GDP,

they are major suppliers of key commodities such as wheat, energy, potash,

palladium, and nickel. As a result, the invasion of Ukraine—and the signicant

sanctions imposed on Russia’s economy—have jolted commodity markets with

a surge in prices (Chart 8). With sanctions likely to remain for some time and

a longer-term strategic shift away from Russian resources in some parts of the

world, certain commodity prices are poised to remain elevated and volatile.

8 Overview

Though higher commodity prices are leading to a surge in Canada’s terms of

trade (the ratio of export prices to import prices), sharply higher prices risk

causing hardship for many households and disrupting the production of goods

and services worldwide (Chart 9). Europe in particular is highly dependent on

Russian natural gas and crude oil.

Chart 8

Change in Select Commodity Prices

Since January 3, 2022

Chart 9

Commodity Prices and Canada’s

Terms of Trade

57

48

33

32

24

23

17

9

0 10 20 30 40 50 60

European natural gas

North American natural gas

Wheat

WTI crude oil

Palladium

Industrial metals

Fertilizer

Precious metals

per cent

Commodity

price index

(left)

Terms of

trade (right)

85

90

95

100

105

110

50

100

150

200

250

300

350

2007

Q1

2010

Q1

2013

Q1

2016

Q1

2019

Q1

2022

Q1

index, 2002 = 100 index, 2002 = 100

Note: Unless otherwise noted, prices are based on North

American prices and benchmarks; all priced in U.S. dollars.

Last data point is March 31, 2022.

Source: Bloomberg.

Note: The commodity price index is a production-

weighted composite of U.S.-dollar benchmark

commodity prices. Last data point for the commodity

price index and terms of trade are 2022Q1 and

2021Q4, respectively.

Sources: Statistics Canada; Department of Finance

Canada calculations.

The heightened level of uncertainty, along with deterioration of the global

economic outlook, is also aecting investor and business condence globally.

This has translated into signicant weakness in equity markets worldwide, with

most major global stock market indices—especially those in Europe—still down

from their peaks. The longer the Russia-Ukraine conict lasts, the greater the

downside will be.

If recent moves in commodity prices and nancial markets were to persist for

a year, the Organisation for Economic Co-operation and Development (OECD)

estimates that it could reduce global growth by more than 1 percentage point

in the rst year (Chart 10), while global ination could be at least 2.5 percentage

points higher. The economic impact will vary heavily by region. In Russia, the

conict along with the direct blow from signicant economic and nancial

sanctions, could lead the economy to suer a severe recession. Given close

trade ties and nancial links to Russia and Ukraine, the euro area is likely to be

one of the most aected regions, with its real GDP expected to be reduced by

1.4 per cent over the rst full year after the start of the conict.

Economic Context 9

As a commodity producer with limited economic ties to Russia, Canada is more

insulated from the crisis than other countries. While weaker global growth and

much higher commodity prices will reduce consumers’ purchasing power and

push up costs for businesses, Canada also stands to benet from the positive

impact on Canada’s terms of trade and from being able to export commodities

now in short supply. The impact of the conict on economic activity in Canada

cannot be denitively predicted, but deep uncertainty emanating from the

conict points to risks tilted to the downside.

Chart 10

Impact on Real GDP in a First Full Year of the Russian Invasion of Ukraine

-1.4

-1.0

-0.9

-1.1

-0.8

Decline

of more

than 10%

-12

-10

-8

-6

-4

-2

0

-5

-4

-3

-2

-1

0

Euro Area OECD United

States

World World

excluding

Russia

Russia

(right scale)

per cent

Note: Simulated impact on real GDP over a one-year period beginning 24 February 2022.

Source: OECD.

10 Overview

High Global Ination and the Outlook for Canada

While ination is a global challenge, the impacts on Canadians are real.

The majority of Canadians remain concerned about the cost of living. As a

rst line of defence, many of the direct income supports that nancially

vulnerable Canadians rely on are automatically adjusted to ination. Further, the

government is taking crucial steps to help make life more aordable for more

Canadians, while investing to grow the economy and create jobs – the best

sustainable route to rising living standards in the long-run.

Making Life More Aordable

Making life more aordable is one of the government’s primary goals in

Budget 2022. In the long run, this will require addressing long-standing,

structural challenges to deliver meaningful improvements in living standards

for more Canadians.

In the near term, Canadians can be condent that they have access to support

when they need it most. Since 2015, the government has delivered real

improvements to make Canadians’ lives more aordable, including:

• Making an historic investment of $30 billion over ve years to build a

Canada-wide early learning and child care system in collaboration with

provinces, territories, and Indigenous partners. By the end of 2022, child

care fees will have been reduced by an average of 50 per cent, and by

2025-26, the average child care fee for all regulated child care spaces

across Canada will be $10 a day;

• Introducing the Canada Child Benet, which will provide up to $6,833 per

child to Canadian families this year, and has helped 435,000 children out

of poverty since 2015;

• Expanding the Canada Workers Benet to support an estimated one

million additional Canadians, which could mean $1,000 more per year for

a full-time, minimum-wage worker;

• Increasing the federal minimum wage to $15.55 per hour;

• Implementing a ten per cent increase to the maximum GIS benet for

single seniors, and reversing the announced increase to the eligibility for

OAS and GIS back to age 65 from 67;

• Providing ten days of paid sick leave for all federally regulated private

sector employees;

• Increasing Climate Action Incentive payments, which puts more money in

the pockets of eight out of every ten people in the provinces where the

federal system applies, and means a family of four will receive, for

2022-2023, $745 in Ontario, $832 in Manitoba, $1,101 in Saskatchewan

and $1,079 in Alberta; and

Economic Context 11

Making Life More Aordable

• Making post-secondary education more aordable by waiving interest

on Canada Student Loans until March 2023 and enhancing repayment

assistance to ensure that no person making $40,000 or less will need to

make payments on their federal student loans going forward.

Budget 2022 also includes a range of measures that will help to bring down

the cost of living, including:

• $5.3 billion to provide dental care for Canadians with family incomes of

less than $90,000 annually, starting with under 12 years-olds in 2022,

expanding to under 18 years-olds, seniors and persons living with a

disability in 2023, with full implementation by 2025;

• Doubling support provided through the First Time Home Buyers’ Tax

Credit from $750 to $1,500;

• Introducing a Multigenerational Home Renovation Tax Credit, which

provides up to $7,500 in support for constructing a secondary suite; and

• $475 million in 2022-23 to provide a one-time, $500 payment to those

facing housing aordability challenges.

Budget 2022 also includes a comprehensive plan to make housing more

aordable, focused on doubling the rate of new builds over the next decade,

while introducing measures to help Canadians buy their rst home, protect

buyers and renters, and curb foreign investment and speculation.

Key government benets are also adjusted for ination over time, including,

among others, Old Age Security (OAS), the Guaranteed Income Supplement

(GIS), the Canada Child Benet, and the GST Credit.

Looking ahead, Budget 2022 redoubles the government’s focus on expanding

Canada’s economic capacity with investments to create jobs and boost

growth through innovation and skills development; facilitate the transition

to a low-carbon economy by encouraging private sector investments and

targeting major sources of emissions; drive innovation and business growth;

and make our cities more competitive by expanding the supply of housing.

These investments will provide the foundation for boosting Canada’s long-

term growth and creating good-paying jobs— the best way to make life

aordable for years to come.

Even before the invasion of Ukraine, elevated ination was undermining

consumer and business condence around the world. Economists have had to

repeatedly revise their forecasts as global ination has proven to be stronger

and more persistent than anticipated. In advanced economies, ination has

now reached levels not seen in decades. This is creating uncertainty about how

quickly—and at what cost—central banks can rein in ination.

12 Overview

The current global concern over ination comes after decades during which

ination was very low. Several factors have driven ination up, including higher

food and energy prices, supply constraints associated with the pandemic, and

unprecedented demand for goods. In many advanced economies, ination

pressures have started to broaden as wage pressures build in a context marked

by tight labour markets.

While ination in Canada is more moderate than in some other countries, total

consumer price ination reached 5.7 per cent year over year in February—the

highest level since August 1991 (Chart 11). In addition to global pressures

on the prices of goods, strong demand for housing—combined with limited

supply—has also led to surging house prices (Chart 12). Canadians are facing

higher-than-expected costs of living which is putting the squeeze on household

nances across the country—and could lead to lower economic activity and

condence over time.

Chart 11

Consumer Price Ination in

Select Economies

Chart 12

Deviation of Consumer Price

Ination From Its Long-Term

Average, Canada

Canada

Euro area

G20

United

States

-1

0

1

2

3

4

5

6

7

8

Jan

2019

Jan

2020

Jan

2021

Jan

2022

per cent, year over year

-3

-2

-1

0

1

2

3

4

5

Jan

2020

Jul

2020

Jan

2021

Jul

2021

Jan

2022

Goods

Shelter services

Other services

Total

percentage points, year over year

Note: Last data point is February 2022 for all regions

but the G20, for which it is January 2022.

Sources: Haver Analytics; OECD.

Note: The long-term average is calculated over the period

1997-2019. Last data point is February 2022.

Source: Statistics Canada.

A rebalancing of global demand towards services—after pandemic-related

public health measures saw people redirect their spending heavily towards

goods—along with the easing of supply bottlenecks should help to reduce

global inationary pressures over the course of the year. However, the Russian

invasion of Ukraine is causing higher prices for food, energy, and other key

commodities. In addition, a resurgence of COVID-19 in China has led to

lockdowns that are disrupting global manufacturing supply chains once again.

As a result, uncertainty remains about the outlook for ination.

Economic Context 13

In response to these pressures, central banks—including the Bank of Canada

and the U.S. Federal Reserve—have begun to withdraw monetary stimulus.

The Bank of Canada has been clear that it will use its monetary policy tools to

return ination to the 2 per cent target and keep ination expectations well-

anchored. Ination is expected to be broadly in line with the Bank of Canada’s

2 per cent ination target in 2023.

Housing Supply Challenges and Aordability

Housing demand has been very strong during the pandemic, which was the

result of low borrowing costs combined with people’s desire for more space as

they worked from home. Though builders have responded with new residential

construction rising well above pre-pandemic levels, housing supply has been

unable to keep up with demand (Chart 13).

With inventories at record lows, house prices have rapidly increased across the

country (Chart 14), making aordability a real concern. British Columbia and

Ontario have endured longstanding supply constraints and prospective home

buyers in those markets are facing the most acute aordability challenges;

Toronto in particular has recently seen the largest increases in house prices

since 2015. Rental markets are facing similar challenges with constrained supply

putting pressure on rents.

Looking ahead, housing demand is expected to ease as interest rates rise and the

pandemic-related boost in demand fades. In combination with the increase in

new construction, this will help to slow house price growth. However, it will take

years of strong supply growth to address the very real aordability challenges

Canadians in many regions are facing. The federal government is working with

all orders of government to increase supply and address the issues of housing

aordability. As outlined in Chapter 1, Budget 2022 makes a series of signicant

investments to help jump start the construction of more aordable homes.

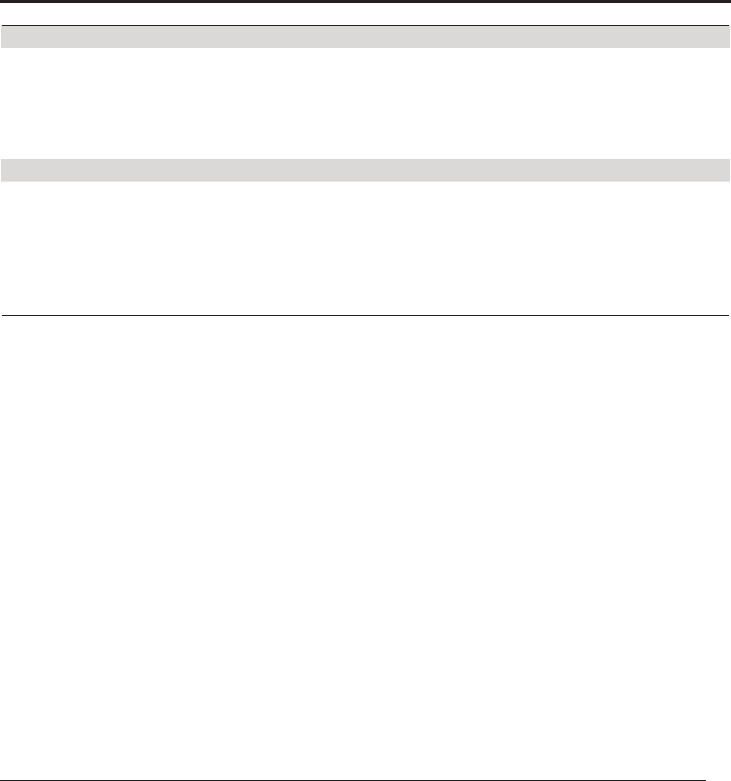

Chart 13

Changes in Key Measures of Housing

Activity

Chart 14

House Price Growth

12

18

4

36

30

30

42

26

18

MLS resales Sales-to-new

listings ratio

Housing starts

2020 2021 February 2022

per cent change from 2019

Toronto

and

Vancouver

Other

major

Canadian

cities

-5

0

5

10

15

20

25

30

35

Jan

2015

Jan

2016

Jan

2017

Jan

2018

Jan

2019

Jan

2020

Jan

2021

Jan

2022

per cent, year-over-year

Note: February 2022 is a seasonally adjusted annualized

gure.

Source: Canadian Real Estate Association.

Note: Latest data point is February 2022. Other major

Canadian cities include Calgary, Edmonton, Regina,

Saskatoon, Winnipeg, Ottawa, Montreal and Moncton.

Source: Canadian Real Estate Association.

14 Overview

3. Budget 2022 Economic Environment

Survey of Private Sector Economists

The Department of Finance Canada surveyed the group of private sector

economists in early February 2022. The average of private sector forecasts

has been used as the basis for economic and scal planning since 1994,

helping to ensure objectivity and transparency, and introducing an element of

independence into the government’s economic and scal forecast.

Following a strong rebound of 4.6 per cent in 2021, real GDP was expected to

grow by a still solid 3.9 per cent in 2022 (down from 4.2 per cent in the 2021

Economic and Fiscal Update) and by 3.1 per cent in 2023 (up from 2.8 per cent in

the 2021 Economic and Fiscal Update) (Charts 15 and 16).

Chart 15

Real GDP Growth Projections

Actual

Actual

0

2

4

6

8

2021

Q4

2022

Q1

2022

Q2

2022

Q3

2022

Q4

2021 2022 2023

Economic and Fiscal Update 2021 (November 2021 survey) February 2022 survey

per cent, quarter to quarter at annual rates

Sources: Statistics Canada; Department of Finance Canada November 2021 and February 2022 surveys of private

sector economists; Department of Finance Canada calculations.

Signicantly stronger-than-expected GDP ination—driven by consumer price

ination and commodity prices—provided a material boost to the expected

level of nominal GDP (the broadest measure of the tax base), which was up

by an average of roughly $41 billion per year over the forecast horizon in

the February 2022 survey compared to the 2021 Economic and Fiscal Update

(Chart 17). Importantly, Canada’s nominal GDP continues to outperform

expectations, as it has over the course of the recovery from the pandemic.

Economic Context 15

Chart 16

Real GDP Projections

Chart 17

Nominal GDP Projections

Economic

and Fiscal

Update

2021

February

2022

survey

98

100

102

104

106

108

110

2021

Q3

2022

Q1

2022

Q3

2023

Q1

2023

Q3

2024

Q1

2024

Q3

index, pre-recession peak = 100

Economic

and Fiscal

Update

2021

February

2022

survey

100

105

110

115

120

125

130

2021

Q3

2022

Q1

2022

Q3

2023

Q1

2023

Q3

2024

Q1

2024

Q3

index, pre-recession peak = 100

Sources: Statistics Canada; Department of Finance

Canada December 2019, November 2021 and

February 2022 surveys of private sector economists;

Department of Finance Canada calculations.

Sources: Statistics Canada; Department of Finance

Canada December 2019, November 2021 and

February 2022 surveys of private sector economists;

Department of Finance Canada calculations.

Budget 2022 Economic Scenario Analysis

The macroeconomic inputs of the February 2022 survey continue to provide

a reasonable basis for scal planning (see Annex 1 for details of the economic

and scal planning framework). However, the outlook is clouded by a number

of key uncertainties, including the impact of Russia’s illegal invasion of Ukraine;

the impact on supply chains due to the COVID-19 resurgence in China;

the eects of supply and labour shortages on ination; and the impact of rising

interest rates on the Canadian economy.

16 Overview

The Department of Finance actively engages with external economists to assess

risks and uncertainties to the outlook. Throughout March, the Department closely

tracked evolving external views and forecasts. This information was used to

inform two alternative economic scenarios that illustrate the eects of unusually

high uncertainty around the illegal Russian invasion of Ukraine and its spillovers:

• Heightened Impact Scenario – considers the economic repercussions of a

drawn-out crisis in Ukraine with elevated commodity prices, prolonged

supply-chain disruptions, and more rapid monetary policy tightening.

A reduction in Russian energy exports leads to a spike in commodity prices,

while pandemic-related lockdowns in parts of the world exacerbate supply-

chain issues, leading to temporarily stronger ination. In response to higher

ination, global interest rates rise higher and more quickly than expected,

with Canada’s three-month treasury bill rate up by almost 50 basis points

on average per year compared to the February 2022 survey. Higher energy

bills and weaker condence substantially reduce consumption while supply

shortages and trade disruptions hold back activity, leading to a sharp

slowdown in global economic growth and a subsequent moderation in

global crude oil prices.

Overall, real GDP growth in Canada is 0.6 percentage point lower on average

per year (Chart 18), and the unemployment rate is 0.5 percentage point higher

on average as a result of adverse eects on condence and sharply lower

global demand.

Higher ination pushes up nominal GDP in the near term before falling below

the February survey in 2024 amid easing commodity prices and much weaker

growth. Initially, nominal GDP is $126 billion higher than the February survey

in 2022, but this improvement shrinks to $18 billion in 2023 and falls below the

February survey level by $23 billion on average over the last three years of the

forecast horizon as ination falls (Chart 19).

• Moderate Impact Scenario – considers a de-escalation of tensions in Ukraine

and a world in which supply disruptions from the war and pandemic are

smaller than expected while global demand remains resilient along with an

easing of geopolitical tensions. The global economy successfully adapts to

COVID-19 risks and pivots to more secure commodity suppliers, reducing

global inationary pressures. At the same time, Canadian commodity

producers make full use of current spare capacity and increase investment,

albeit not commensurate to the rise in energy prices. This provides a

boost to economic growth. Higher interest rates (up by 20 basis points on

average per year compared to the February 2022 survey), combined with

easing of supply-chain pressures, bring ination closer to the 2 per cent

target without derailing the economic expansion.

Altogether, the recovery is stronger than the February survey, supported by

Canada’s strong fundamentals. While commodity prices and ination are below

the downside scenario, they remain well above the February survey, especially

in the near term. With higher commodity prices and better economic prospects,

nominal GDP is $77 billion higher than the February survey on average per year

over the forecast horizon.

Economic Context 17

Chart 18

Real GDP Growth

Chart 19

Nominal GDP Level Dierence With

February 2022 Survey Outlook

3.9

3.1

2.0

1.9

1.8

2.8

0.4

2.0

2.4

2.2

4.3

4.0

2.1

1.8

1.7

0

1

2

3

4

5

2022 2023 2024 2025 2026

February 2022 Survey

Heightened impact scenario

Moderate impact scenario

per cent

126

18

-21

-25

-22

57

86

82

79

79

-40

-20

0

20

40

60

80

100

120

140

2022 2023 2024 2025 2026

Heightened impact scenario

Moderate impact scenario

$ billions