Journal of Undergraduate Research at Journal of Undergraduate Research at

Minnesota State University, Mankato Minnesota State University, Mankato

Volume 13 Article 1

2013

The Tax Treatment of Mixed Personal and Rental Use of Real The Tax Treatment of Mixed Personal and Rental Use of Real

Estate Estate

Natsua Asai

Minnesota State University, Mankato

Follow this and additional works at: https://cornerstone.lib.mnsu.edu/jur

Part of the Finance Commons, and the Property Law and Real Estate Commons

Recommended Citation Recommended Citation

Asai, Natsua (2013) "The Tax Treatment of Mixed Personal and Rental Use of Real Estate,"

Journal of

Undergraduate Research at Minnesota State University, Mankato

: Vol. 13, Article 1.

DOI: https://doi.org/10.56816/2378-6949.1000

Available at: https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

This Article is brought to you for free and open access by the Journals at Cornerstone: A Collection of Scholarly

and Creative Works for Minnesota State University, Mankato. It has been accepted for inclusion in Journal of

Undergraduate Research at Minnesota State University, Mankato by an authorized editor of Cornerstone: A

Collection of Scholarly and Creative Works for Minnesota State University, Mankato.

The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Natsua Asai

Mentor: Paul Brennan

Minnesota State University, Mankato

1

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

Contents

1) Introduction 3

2) Categorization of Tax Type for Residential Property 3

(A) Personal Use Real Estate Defined and Illustrated 3

(B) Mixed-Use Real Estate Defined and Illustrated 4

(C) Rental Real Estate Defined and Illustrated 5

3) Types of Deductions for Individuals under the Tax Law 5

(A)Trade or Business Expenses 5

(B) Expenses Incurred for the Production of Income 6

(C) Personal Expenses 6

4) Deduction for Losses 7

(A) Business Losses 8

(B) Investment or Production of Income Losses 8

(C) Personal losses 10

5) Allocation of Deductions on Mixed-Use Real Estate 11

6) Sales and Exchanges of Mixed-Use Real Estate 13

(A) Code Sec. 121 13

(B) Code Sec. 1031 13

(C) Combination of Code Sec. 121 and 1031 14

(D) The Basis of Real Estate Property 17

Conclusion 19

2

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

1) Introduction

In 2010, individual taxes provided almost half (43.35 %) of the U.S. Federal Revenue. Every

U.S. citizen has an obligation to pay tax in order to support their government; however, they also

have the right to keep tax as low as possible by effective tax planning (Smith, Harmelink, &

Hasselback, 2012).

Tax planning is a proper arrangement of transactions or affairs in order to reduce tax liability.

Tax planning can become complex if the transaction involves multiple areas of tax law. I am

going to discuss an aspect of real estate that involves multiple concepts and rules governing tax

compliance: the tax treatment of mixed personal and rental use of real estate.

The paper discusses tax treatment of deductions, losses, sales, and exchanges of mixed-use real

estate. Mixed-use real estate means that homeowners rent, or use for business purposes, part or

all of their primary or secondary homes, either permanently or temporarily. These situations are

pretty common for U.S. citizens yet the tax effects on these transactions are not well understood

and can be complex. The focus on the paper is to describe the tax treatment of various situations

where residential property is rented at least part of the tax year.

2) Categorization of Tax Type for Residential Property

If the owner of a dwelling unit rents all or part of it out to someone, there are three possible types

of tax categorization. The first is personal use, the second is mixed-use, and the last is purely

rental use of the dwelling unit. The categorization depends upon the number of days of personal

use and rental use, and the categorization affects deductibility of an owner’s expenses on a

dwelling unit and rental losses. The tax law limits deductibility of expenses and losses of

personal us

e of a dwelling unit although it provides more generous rules for rental use. Therefore,

proper tax categorization is the first and the essential element to understand further tax rules for

this paper.

(A) Personal Use Real Estate Defined and Illustrated

Categorizing real estate depends on how a dwelling unit is used, either for personal, business,

and/or investment purposes. A dwelling unit is a basic living accommodation equipped with

plumbing, a kitchen, sleeping facilities and a living area. In the tax sense, the personal use of a

dwelling unit can include uses other than the taxpayer living in the dwelling personally. A

taxpayer also uses a dwelling for personal purposes if the taxpayer rents the dwelling to a friend

or family member for a less than market value. It is also personal use if an owner rents out his or

her personal residence for only a small number of days. The lax law states that it is still personal

use when a taxpayer rents out his or her personal residence less than 15 days during a tax year.

When the residence is rented less than 15 days, the taxpayer is not required to report the rental

3

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

income and may not deduct any rental expenses other than mortgage interest (if it is qualified

residence) and property taxes as itemized deductions. Code Sec.280A (g) (2).

The following are all examples illustrating personal use of a dwelling unit:

Example 1: Adrian rents his residence to his sister. He tells her that she only has to pay half of

the fair rental price.

Example 2: Adrian exchanges the right to use his vacation home for the use of Mellissa’s beach

house. Mellissa’s use of Adrian’s vacation home under this arrangement is considered Adrian’s

personal use of his vacation home from a tax planning point of view.

Example 3: Adrian rents out his personal residence for Alex. Alex stayed 14 days at the

basement of Adrian’s resident and paid $100 for the rent.

A dwelling unit can have more than one owner. If two or more people invest in one dwelling unit

it is considered joint ownership of the property. Even if only one of the owners uses the dwelling

unit for personal use, it is considered personal use of the dwelling for the remaining joint owners.

Example 1: Adrian and Jerry bought a duplex as joint owners by dividing the cost of the duplex.

Adrian lives in one of the units part of the year. This is considered personal use of half of the

duplex.

If the owner rents out his property and discovers it needs maintenance, the property is not

considered personal use during the time of repair. Code Sec. 280A (d).

Example 2: If Adrian spent two days fixing leaking pipes of his dwelling unit for a new tenant,

these two days are not included as personal use of the property.

(B) Mixed-Use Real Estate Defined and Illustrated

Mixed-use of real estate involves renting a dwelling unit at market value and also using it for

personal purposes. If an owner of a dwelling unit uses his or her dwelling unit more than the

greater of (1) 14 days or (2) 10% of rental days, then the dwelling unit is categorized as a

personal residence. If the owner also rents out the residence for more than 14 days, the residence

is classified as mixed-use. These examples illustrate mixed-use real estate.

Example 1: Adrian rents part of his residence to his sister for six months. She pays fair market

value.

Example 2: Adrian rents his vacation home to Mellissa. He uses the home two weeks for winter

vacation. Mellissa uses the home for one month for summer vacation and pays fair rental price to

Adrian.

4

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

(C) Rental Real Estate Defined and Illustrated

Residential rental activity occurs when there isn’t significant personal use under the tax rules. If

an owner of the dwelling unit rents out the dwelling unit for more than 15 days for market value

and he or she does not use it for a personal purpose, then it is rental use for tax categorization.

Significant personal use occurs if the rental property is used for personal purposes more than the

greater of 14 days or 10 % of the days rented. Code Sec. 280A(d). These examples illustrate

pure rental use of real estate.

Example 1 : Adrian rents out his second home to the Adams family at fair market value.

Example 2 : Adrian rents out his vacation home to Alex for fair market value for 200 days. He

also used his vacation home for 1 week.

Example 3 : Adrian and Jerry bought a duplex as joint owners and they divided the cost of the

duplex. They rent out one of the units at market value for a whole year to the Adams family. This

type of rental use is considered rental activity of half of the duplex.

It is important to distinguish between personal use and rental use for tax planning since tax

treatment differs between categories. For example, an owner cannot deduct any maintenance

costs from taxable income for a personal use dwelling unit, whereas the owner can deduct the

maintenance costs from taxable income for a rental property.

One common way to reduce tax liabilities is through effective use of tax deductions. Tax

deductions are subtractions from income used to calculate the eventual taxable profit from the

activity. There are four categories of deductions for tax payers. The four categories include: (1)

Trade or business, (2) Production of income, (3) Personal expenses, and (4) Losses (Smith,

Harmelink, & Hasselback, 2012).

3) Types of Deductions for Individuals under the Tax Law

(A)Trade or business expenses (Code Sec. 162)

Trade or business expenses for individual taxpayers include the business-related expenses of sole

proprietors and employees. Trade or business expenses are ordinary, necessary and reasonable

expenses that are deducted from any income of the taxpayer.

Example: Adrian owns a business and he expended $30,000 for his business. His income from

his business for the year was $25,000. He also had interest income of $10,000 and dividend

income of $5,000. The $30,000 of business expenses first reduce business income but if business

expenses are more than business income, the excess can also reduce taxable income from other

5

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

sources. Adrian’s adjusted gross income after taking the expenses would be $10,000.

3-A

Business

Interest

Dividend

Total

Income

$

25,000

$ 10,000

$

5,000

$ 40,000

Expenses

$

30,000

$ 30,000

Adjusted Gross Income

$ 10,000

(B) Expenses Incurred For the Production of Income (Code Sec. 212)

Expenses incurred for the production of income includes investment related expenses and rental

expenses. The deductible expenses for this category must relate to the production or collection of

income, or in other words, the expenses necessary to produce profit. The expenses incurred for

the production of income include management, maintenance, collection of income, and

determination of tax payments or refunds. While rental expenses are directly deductible from

rental income, most production of income expenses are deducted as itemized deductions and are

subject to more restrictions on the ability to use them as deductions against other taxable income.

The tax law limits the deductibility of miscellaneous itemized deductions. Depending upon a

taxpayer’s adjusted gross income, expenses of this category may not be deductible or only

partially deductible. This example shows deductibility of production income expenses.

Example - Production of Income: Allen has some securities as an investor and his investment

expenses are $3,000 for this year. His income from his investment activity for the year was

$2,500, and his wage income was $30,000. His investment expenses can be deducted from his

miscellaneous itemized deduction up to his investment income.

3-B

Investment

Wage

Total

Deducable Itemixed Expenses

Income

$ 2,500

$ 30,000

$ 32,500

Investment Expenses

$ 3,000

Adjusted Gross Income

$ 32,500

2% floor

(32500x2%)

$ (650)

Itemized Deduction

$ 2,350

$ 2,350

Taxable Income

$ 30,150

Note: Rental expenses are reported on Schedule E and deducted directly from the rental income.

(C) Personal Expenses ( Code Sec.262)

Personal expenses are those a taxpayer spends for personal or family needs and almost none are

deductible for tax purposes. Generally an owner of a residential home can only deduct the related

personal expenses of qualified mortgage interest and property taxes on the property.

Home mortgage interest is any interest a taxpayer pays on a loan secured by his or her home,

including mortgage, home equity loans, points, and mortgage insurance premiums. A taxpayer

can deduct his or her home mortgage interest only if the mortgage is a secured debt. A mortgage

is a secured debt if a taxpayer puts his or her home up as collateral to protect the interest of the

lender. Hence, when a taxpayer defaults on his obligation to the lender, his or her home will

6

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

serve as payment to the lender. Those expenses are deductible only for qualified homes. Code

Sec. 163 (h) (3).

A qualified home is a main home and a second home. A taxpayer must use these homes more

than 14 days or more than 10% of the number of days during the year that the home is rented at a

fair rental, whichever is longer. Code Sec. 163 (h) (4).

Acquisitions indebtedness is an outstanding amount owed on a loan as a secured debt taken out

for purpose of acquisition, construction, or substantial improvement of qualified residence, it is

deductible up to $1,000,000. Code Sec. 163 (h) (3)(B).

Home equity loans are a type of loan; a homeowner borrows money by leveraging the equity in

his or her home. A taxpayer can deduct the interest that is the lesser of $100,000 or fair market

value subtracting acquisition indebtedness in the home. Code Sec. 163 (h) (3)(C).

Points are prepaid interest to obtain a home mortgage. They may be deducted in the year paid

unless they are added to the loan balance. The IRS takes the view that points paid on a mortgage

refinancing are deductible ratably over the life of the mortgage.

Mortgage insurance premiums are insurance premiums paid by a taxpayer in order to acquire a

mortgage when the taxpayer’s down payment is insufficient (typically less than 20% of the value

of the residence). The allowable deduction is phased out ratably when the taxpayer’s adjusted

gross income exceeds $100,000 ($50,000 for a married taxpayer filing separately). Code Sec.

163(h)(3)(E).

Property taxes include local, state, and foreign real property taxes. These must be imposed on the

value and be paid or accrued. If the tax is paid for local benefits (also called special

assessments), then the payment is not deductible because of direct benefit to the property.

Examples of this kind of payment are street and sidewalk improvements. Code Sec. 164 (a) and

(c). These types of special assessments are normally added to the basis of the property.

Expenses of a residential property other than mortgage interest and property taxes are normally

not deductible unless the property is a bona fide rental property. Code Sec. 280A (a). Bona fide

means in rented in good faith and without fraud or deceit. If the property is a rental property,

rental expenses are deductible for Adjusted Gross Income on Schedule E.

4) Deduction for Losses

Losses can occur when a property is sold for less than the taxpayer’s investment (basis), when

operating expenses exceed income, or as the result of casualties and theft. A loss can be

categorized one of three types for tax purpose:

A. Business losses

7

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

B. Investment/Production of income losses

C. Personal losses

(A) Business Losses are losses incurred in trade or business activities. In general, those

losses are deductible from any types of income, thus a taxpayer is able to reduce his/her gross

income by the amount of these losses. Code Sec. 172.

(B) Investment or Production of Income Losses consists of rental and investment activities.

Investment income and expenses consist of those relating to interest income, dividends, capital

gains or losses incurred upon the sale of a security or other assets, and any other profit or losses

that is made through an investment. Rental income and expenses are also considered investment

related but rental expenses are deducted from rental expenses in arriving at adjusted gross

income instead of being relegated to the less desirable status of miscellaneous itemized

deductions. Rental operating losses may or may not be deductible depending upon whether the

taxpayer satisfies certain requirements for deducting losses under the passive activity rules.

Rental activities are usually subject to Passive Activity Rules. Code Sec. 469, the Passive

Activity Loss Rules, address two types of activities:

1-Trade or business activities in which a taxpayer does not materially participate during

the tax year;

2-Rental activities, with or without material participation, which includes rental real

estate.

The trade or business activities are not a passive activity when the taxpayer materially

participates in the activity. Reg §1.469-5T. Material participation is defined at IRC Sec.469 (h).

When the taxpayer’s activity satisfies material participation standards, the activity is treated as a

trade or business instead of a passive activity. However, the normal rules for material

participation rule are not applicable to rental activities. Code Sec. 469 (c) (4).

According to the tax law, real estate held by an individual taxpayer that is used by renters is

usually categorized as a passive rental activity. There are a few exceptions where rental real-

estate activities are not categorized passive activities. These are the trade or business uses such as

hotels or motels. Another important exception falls under Code Sec.469 (c)(7) describing

exceptions from the passive activity rules for rental real estate held by a real estate professional,

Fed. Reg. Vol. 77, No. 234, p. 72611. 12/05/2012. Finally, rental real estate that is also used

substantially for personal purposes (as described above) is not treated as bona fide rental

property.

Tax law limits the amount of a taxpayer’s deductible loss of passive activity. Normally, a

taxpayer can deduct passive activity losses only from passive activity income. When the

expenses of passive activity exceed the income of passive activity, then a taxpayer can carry

8

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

forward deductions to future years, but those losses face the same deduction restrictions in future

years. This example shows deductibility of passive activity losses (Smith, Harmelink, &

Hasselback, 2012).

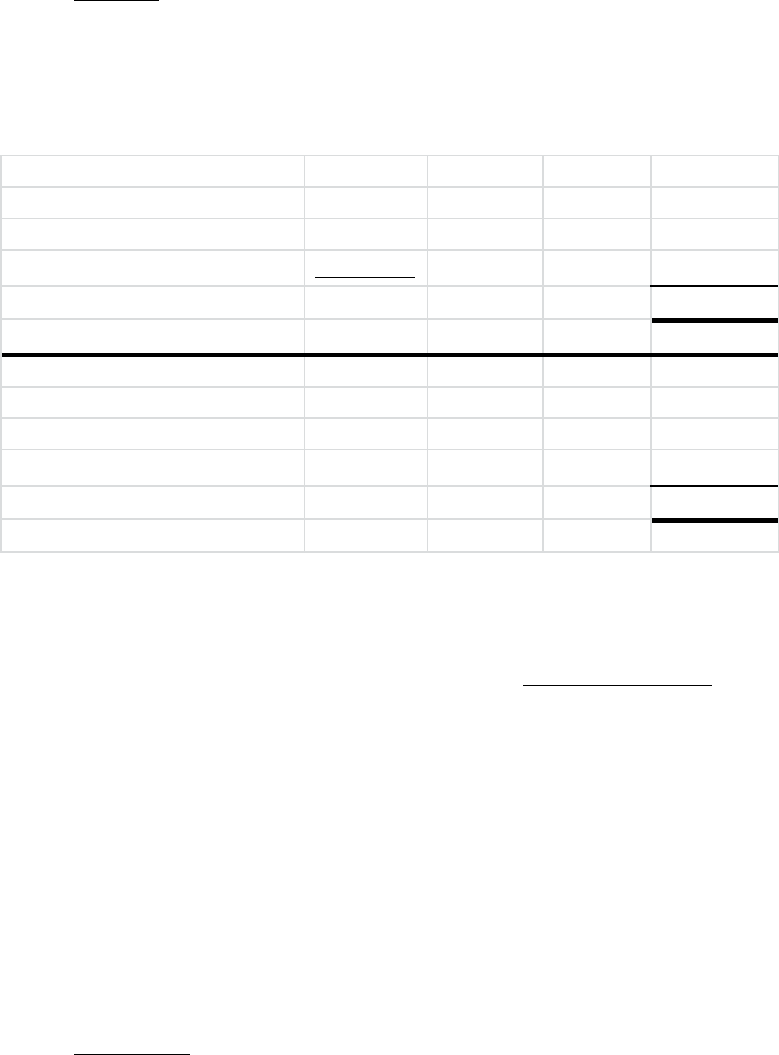

Example: If the previous year Alex had rental losses of $8000, he would carryover the

losses. If he now has $10,000 in rental income, he can deduct the carryover expenses

from the current income. However, if his rental income of the current year is zero and he

has other sources of income, he cannot deduct the carryover losses from other types of

income.

4-B Sec469

Fiscal year 1 (FY1)

Rental

Interest

Dividend

Total

Income

$ 2,000

$ 10,000

$

5,000

$

17,000

Expenses

$ 10,000

$

2,000

Taxable Income

$

15,000

Carryover for future year

$ 8,000

Fiscal year 2

Income

$

10,000

$ 10,000

$

5,000

$

25,000

Expenses

$

3,000

$

3,000

Carryover from FY1

$

8,000

$

7,000

Taxable Income

$

15,000

Carryover for future year

$

1,000

Rental expenses + Carryover are deductible up to rental income, thus the rest of $1,000 will be

carried over to future years.

Code Sec. 469 (i) (6) provides a special allowance for active participation of a rental real estate

activity. When a taxpayer or his or her spouse actively participated in a rental real estate activity,

then a taxpayer can deduct up to $25,000 of loss from non-passive activity income. A taxpayer is

an active participant when a taxpayer owns at least 10% of the rental activity and is the landlord

maintaining general management responsibilities such as approving new tenants, or deciding on

rental terms. However, there is an income limitation for this allowance. When a taxpayer’s

adjusted gross income without considering the rental loss (and certain other income like taxable

social security benefits as well as certain other deductions) exceeds $100,000 the allowance is

reduced by 50% of the AGI exceeding that amount. Therefore, a taxpayer with $150,000 AGI is

not able to use rental losses as a deduction against non-passive income. These two examples

show the differences of special allowance application by income level.

Example 1: Alex is single and has $40,000 wage income, $2,000 passive income, and

$3,500 of passive expense from his rental real estate activity. He actively participates in

his rental activity, thus after he offsets the passive income to passive expenses, he can

9

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

offset the residual passive loss of $1,500 from wage income. As a result, he is able to

reduce his adjusted gross income from $40,000 to $38,500.

4-B Sec469(i)

Example1

Wage

Rental

Total

Income

$ 40,000

$ 2,000

$

42,000

Expenses

$ 3,500

$

(2,000)

Losses

$ (1,500)

A Special Allowance

$

(1,500)

Taxable Income

$

38,500

Example 2: Adrian is single and has $140,000 wage income, $2,000 passive income, and

$8,500 of passive loss from his rental real estate activity. He actively participates in his

rental activity, but his adjusted gross income is $140,000. After he offsets the passive

income to passive loss, he can only offset the residual passive loss of $5000 from wage

income. As a result, he lost 80% or $20,000 of special allowance caused by a high level

of income.

4-B Sec469(i)

Example 2

Wage

Rental

Special Allowance Calculation

Income

$ 140,000

$ 2,000

Wage

$ 140,000

Expenses

$ 8,500

Phase out range

100,000-150,000

Losses

$ (6,500)

Phase out %

40,000/50,000=80%

A Special Allowance

$5,000

Allowance

5,000=25,000 x 20%

Taxable Income

$ 135,000

Carryover

1,500

(C) The last type of loss is a personal loss. Personal losses include selling personal use

property for less than basis (the taxpayer’s original cost or remaining investment in the property),

losses by casualty or theft of personal use property, and operating losses from hobby activities

that provide some income. A loss on the sale of a personal residence (as defined above) would

also produce a personal loss. Generally the tax law does not allow deductions of personal losses

from taxable income. Therefore, rental expenses are only allowed up to the rental income when

the property is used excessively for personal purpose as in the mixed-use status as described

above. Code Sec. 165 (c).

Example: Alex bought his residential home for $220,000 5 years ago and he decided to sell it for

money for his operation. He sold it for $190,000. He cannot deduct the loss of $30,000.

10

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

Example: Alen used his vacation home for two months for his winter vacation. He also rented it

for fair rental value to Adam’s family for two months for their summer vacation. He collected

$1,500 from the family and spent $1,700 for cleaning, maintenance, and advertising. He cannot

deduct the loss of $200 because he used the property excessively for personal purpose.

Exception for non-deduction of personal losses is casualty or theft losses. However, the

deductibility of the losses is severely limited. Code Sec. 165 (h).

The categorization of activities has a huge impact on the tax treatment of expenses and losses.

However, many individual taxpayers use their real estate for both rental and personal uses.

Because of this, its tax treatment becomes more complex.

5) Allocation of Deductions on Mixed-use Real Estate

When a taxpayer uses his real estate more than the greater of (1)14 days or (2) 10% of rental

days, then it is categorized as a personal residence. However, if at the same time he rents out the

residence for more than 14 days for fair market value, then the dwelling is considered as mixed-

use. In other words, the real estate was used a lot for a personal purpose and a rental purpose.

The expenses of mixed-use real estate are allocated between rental and personal. Some tax

deductions can be used only for rental purposes while others (like mortgage interest and property

taxes) may be deducted for both purposes. Compare these examples (Publication 527,P.23)

Background: Alex Brown rents a cabin for part of the year. The mortgage interest on the cabin is

$10,000. If it were rented for 100% then its depreciation expenses would be $7,000. Property

taxes for the cabin are $2,000, plus other expenses in sum of $2,000.

Example 1: Alex lived in the cabin for 31 days and he rented it for only 12 days. He received

$1,000 for rental fees.

Since he rented less than 14 days, this is not mixed-use real estate. Alex does not have to report

the income as well as no deduction for expenses. However, he can deduct the mortgage interest

and property taxes from his Schedule A as itemized deductions allowable for a personal

residence.

Example 2: Alex lived in the cabin for 10 days and rented it for 90 days. He received $7,000 for

rental fees. Under these circumstances, the property would be classified as a rental property

because Alex lived in the cabin for less than 14 days. He must allocate his expenses between

personal and rental use. Only his property taxes are deductible for personal purposes because

this property does not qualify as a second residence for purposes of the mortgage interest

deduction (needs to live in the property for at least 14 days). The rental expenses may exceed

the rental income, but whether any loss is deductible depends upon the application of the passive

activity rules as described above.

11

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

Alex can report the portion of rental expenses on Schedule E as deduction used in arriving at

adjusted gross income. For mixed-use property, rental deductions can only be taken up to rental

income.

5) Example 2

Total

Rental

Personal

Days

100

90

10

Mortgage & Property taxes

are allocated as personal use

for the total days of the year

minus the rental days of the

year.

Since personal use is less

than 14 days, this residence

does not qualify for the

mortgage interest deduction.

Income

$ 7,000

$

7,000

Expenses

Allocation

365

0.25

0.75

Mortgage

$ 10,000

$

2,466

Prop. Taxes

$ 2,000

$

493

$

1,507

Allocation

100%

90%

10%

Depreciation

$ 7,000

$

6,300

Other

$ 2,000

$

1,800

Total Expenses

$ 21,001

$

11,059

$

1,507

Deductable Exp for the year (***)

$

7,000

$

1,507

Carryover

$

4,059

*** Alex’s deductible expenses would range from $7,000 to the full $11,059 depending upon the

application of the passive activity rules. This example shows the calculation when passive

activity is applied.

Example 3: A mixed-use of real estate. Alex lived in the cabin for 25 days and rented it 90 days

during the tax year. He received $7,000 for rental fees.

He needs to allocate his expenses between personal use portions of expenses and rental use

expenses. IRC Sec 280A (e)(1).The rental portion of expenses is deductible in Schedule E .

5) Example 3

Total

Rental

Personal

Days

115

90

25

Income

$ 7,000

$

7,000

Expenses

Allocation

365

0.25

0.75

Mortgage

$ 10,000

$

2,466

$

7,534

Prop. Taxes

$ 2,000

$

493

$

1,507

Allocation

115days

78%

22%

Depreciation

$ 7,000

$

5,460

Other

$ 2,000

$

1,560

Total Expenses

$

9,979

$

9,041

Deductable Exp for the year

$

7,000

$

9,041

Carryover

$

2,979

12

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

The deductible and carryover amounts in Examples 2 and 3 are far different even though rental

income and expenses are the same because of the amount of personal use days.

6) Sales and Exchanges of Mixed-use Real Estate

A sale occurs when an owner of the property exchanges real estate for cash or other property.

Other property may include the buyer’s assumption of liabilities which is treated the same as

receiving cash.

Rental use of real estate is property used for investment purposes. When a rental property is sold,

its gains and losses are recognized for tax purposes.

When a taxpayer’s residential property was used for part personal and part rental, the

gains from the sale of the property should be allocated between personal and rental. The

personal portion of gain may be excluded but the rental portion of gain must be recognized.

The structure of real estate affects the allocation method for gain and loss of sales. Rev.

Proc. 2005-14.

(A)Code Sec. 121 allows a taxpayer to exclude the gain from sale of his or her

principal residence up to $250,000 ($500,000 for joint return). To be qualified, the

taxpayer must own and use the property as his or her principal residence for at least 2 years

during the 5-year period, ending on the date of the sale or exchange. The taxpayer must also have

no transactions that apply to the $250,000 exclusion for at least two years.

Example: Adrian sold the principal residence that he lived in for 7 years. After the deduction of

his sales expenses, his profit from the transaction was $210,000. He can exclude this profit from

his income for tax filing because this transaction is a qualified residence and his profit is under

the $250,000 limit. If he purchases another principal residence for $210,000, that will be the cost

basis of the new residence.

When a taxpayer realizes the losses from sale of his or her principal residence, the losses are not

allowed to be deducted from his taxable income.

Under the Sec.121, a taxpayer who used a portion of a property for residential purpose and a

portion of the property for business or rental purposes is treated as using the property as the

taxpayer’s principal residence if it satisfying the 2 year use requirement. When this kind of sale

occurred, the taxpayer may exclude most gain from realized gain but he or she still has to

recognize the gain to the extent of any depreciation taken. The gain exclusion under Sec.121

doesn’t include gain resulting from previous depreciation deductions. Rev. Proc. 2005.

Depreciation is the term for expensing the cost of a long-term asset over its useful life.

Depreciation expenses reduce profits from the activity using the property. The owner of the

property can deduct depreciation only on the part of his or her property used for rental purpose.

13

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

Sec. 121 is applicable only for personal use of real estate; therefore depreciation is not deductible

under Sec.121.

(B) If a taxpayer acquired the relinquished property during a five year period from on

the date of like-kind exchange (explained below), he or she cannot apply Sec 121 exclusion

when he or she sold the real estate within the period. Rev. Proc. 2005. A taxpayer trades the

rental or business property for other property of similar type that qualifies as “like-kind” under

Code Sec. 1031. Like-kind treatment under Section 1031 allows the taxpayer to delay or not

recognize the gain from the transaction. However, an exchange involving personal use property

does not qualify for this purpose.

Example: Adrian exchanged his rental apartment for Alex’s rental house. The exchange is the

same business class and function, so it is a like-kind exchange.

Example: Adrian exchanges his rental apartment for Alex’s residential house. If Adrian uses the

residential house for rental purpose, he is qualified for non-recognition of gain treatment under

Section 1031. However, if Adrian uses the house for personal residence then the exchange is not

like-kind and the gain from his former rental property must be recognized.

When a taxpayer exchanges his or her rental property for like-kind property and boot, he or she

may recognize gain. Boot is cash or cash equivalent, stock, inventory and other property not of a

similar type as stated under Code Sec. 1031 (a) (2). Gain is recognized to the extent of the lower

amount of

A- The fair market value of the boot received or

B- The realized gain on the transaction

A realized gain is the difference between the amount realized from the sale or other disposition

of property and the adjusted basis at the time of sale or disposition. In other word, the gain

resulting from the sale price of an asset exceeds its purchase price or adjusted basis. The realized

gain is not necessarily taxable. However, when fair market value of like-kind property and boot

received are less than adjusted basis of property given up, the losses cannot be recognized.

(C) Combination of Code Sec. 121 and 1031

When a taxpayer sells real estate which was used for both personal and rental use, there is the

possibility that the single transaction would meet both gain exclusion under Code Sec. 121 and

non-recognition of gain under Code Sec. 1031. This type of treatment would occur when mixed-

use property is exchanged for a similar mixed-use property. For example, a person uses two

floors of a single house for different purposes. The first floor is used as the office space for her

business and the second floor is used for her residence. She exchanges this property for another

property of similar use. She could have this type of exchange for a property of similar but

14

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

somewhat different use. One example is that, she exchanges the property for a motel or bed and

breakfast house where she lives in part of the structure and rents the other rooms.

The Internal Revenue Service specifies the procedure of accounting for this type of transaction,

and the allocation depends on the usage and nature of the real estate. When a taxpayer used real

estate for a period of personal use and another period of rental use, and the transaction meets

both requirements, the taxpayer should apply Code Sec. 121 first. However, when a taxpayer

uses real estate for personal and rental purposed simultaneously, then he or she should allocate

the gain between personal and rental use. Rev. Proc. 2005-14.

One way to allocate the profit is to first deduct the excludable gain under Section 121 (up to

$250,000 for unmarried or up to $500,000 for married joint taxpayers) from the total gain and

apply the deferral opportunity under Section 1031to the remainder of the gain. A taxpayer who

used the property as personal in a certain period of time and then rented it in another period of

time should use this method. A taxpayer used one dwelling unit for mixed-use the same time of

period also fits in this method. Rev. Proc. 2005-14.

Example 1: Adrian exchanged his condo for a townhouse for a rental purpose with a fair market

value of $440,000. He used the condo for his principal residence for 2 years and then rented it for

3 years. He bought the condo for $240,000 in 2000. He claimed depreciation for $30,000 from

2011 to 2013.

Bought and Used

Period of

year

Gain

Allocation

Apply

Sec 121

Bought for residnce

$ 240,000

2

0.4

$ 96,000

Conv. To Rental

Depreciation

$ 30,000

3

0.6

Basis at the end of 2013

$ 210,000

5

1

Exchange it for fair value

$ 480,000

Gain from the exchange

$ 270,000

Attribute to Depreciation

$ 30,000

Gain 121. defenition

$ 240,000

Excludable Gain 121

$ 96,000

Residual Gain

$ 144,000

Attribute to Depreciation

$ 30,000

Delay Recognition 1031

$ 174,000

Since he used the house 2 years during the 5 year period ending with the transaction, he is

eligible for both Code Sec. 121 and 1031 on his gain. First he applies Code Sec.121 for his

realized gain of $270,000 minus depreciation taken, then calculates the portion of the gain which

is applicable to Sec. 121 gain exclusion by total number of days used for his principal residence

15

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

divided by total days that he owns the condo. The remaining gain of $174,000 then applies for

Sec. 1031, as a result Adrian has no recognized gain. RIA ¶104, Code Sec. 121(b)(4).

Example 2: Alex exchanged his townhouse for a duplex with a fair market value of $360,000. He

rented one room of the townhouse for fair market value and used the remainder for his principal

residence for 5 years. He bought the townhouse for $210,000 and it depreciated $30,000. Alex

allocated 1/3 of the basis the townhouse for rent and 2/3 for his principal residence. His

townhouse was a single dwelling unit.

Year

Total

Residence

Rental

100%

2/3

1/3

2000-2004

Bought and Used

Cost

$ 210,000

$ 140,000

$ 70,000

Depreciation

$ 30,000

$ 30,000

Basis

$ 180,000

$ 140,000

$ 40,000

2005

Exchange

Fair Value

$ 360,000

$ 240,000

$ 120,000

Basis

$ 180,000

$ 140,000

$ 40,000

Realized Gain

$ 180,000

$ 100,000

$ 80,000

Sec. 121

$ 150,000

$ 100,000

$ 50,000

Residual gain

$ 30,000

$ -

$ 30,000

Sec. 1031

$ 30,000

$ 30,000

Since Alex used one dwelling unit for rental and personal purpose, the realized gain should be

applied for Sec. 121 first. However, gain exclusion Sec. 121 does not take depreciation.

Another method is to allocate the profit proportionally. When a taxpayer used a dwelling unit for

his or her primary residence and he or she rented a dwelling unit that is separate from the other

dwelling unit, then profit should be allocated between Code Sec 121 and 1031 proportionally.

Rev. Proc.2005-14, RIA¶1214.06. A single structure may contain more than one dwelling unit if

it has multiple apartments each used as separate dwelling units. If the basement of a house

contained basic living accommodations, it would be a separate dwelling unit. Prop. Reg

§1.280A-1(c)(1), Reg. §1.121-1, RIA EXP¶280A4.07.

Example 3: The facts are the same as in Example 2 except Alex’s townhouse consists of two

dwelling units.

16

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

Year

Total

Residence

Rental

100%

2/3

1/3

2000-2004

Bought and Used

Cost

$ 210,000

$ 140,000

$ 70,000

Depriciation

$ 30,000

$ 30,000

Basis

$ 180,000

$ 140,000

$ 40,000

2005

Exchanged

Fair Value

$ 360,000

$ 240,000

$ 120,000

Basis

$ 180,000

$ 140,000

$ 40,000

Realized Gain

$ 180,000

$ 100,000

$ 80,000

Sec. 121

$ 100,000

Resedual gain

$ 80,000

Sec. 1031

$ 80,000

Since the townhouse consists of two dwelling units, he allocates the gain between residential and

rental proportions under Sec. 121 and Sec. 1031, applied respectively. Sec. 121 applies only the

proportion of residential use or 2/3 of gain, and Sec. 1031 applies only for the 1/3 of the rental

portion.

(D)The Basis of Real Estate Property

The basis of residential property is usually “cost basis”, that is the purchase price plus some

capitalized costs at the time of purchase. For the rental property, basis is calculated by costs plus

increases for improvement minus depreciation deductions and any losses taken on the property

(for example, partial casualty losses or losses from partial condemnations by governmental

agencies). The mathematical result is called “adjusted basis.”

The basis of like-kind exchanged property is “carryover basis”.

Carryover basis = like-kind property exchanged + boot given + gain recognized – loss

recognized – fair market value of boot received.

When a mixed-use of property with Code Sec. 121 and 1031 apply, the determination of the

basis of the property received in the exchange is used in the replacement rental or business

property. Although the gain excluded under Code Sec. 121 does not have to be recognized, any

excluded gain is added to the basis of replacement property. If a taxpayer does not include it in

the replacement basis, then he or she will have a lower basis of new property and will have to

deal with the gain when he or she sells or exchanges the new property in the future. The residual

gain i

ncreases the replacement business property by adding the basis of exchanged property. Rev.

Proc. 2005-14, 2005-1 CB 528.

Example 1: Adrian exchanged his condo for $10,000 of cash and a townhouse with a fair market

value of $470,000. He intends to use the townhouse for a rental activity. Adrian used his condo

17

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

for his principal residence for 2 years and then rented it for 3 years. He bought the condo for

$240,000. He claimed depreciation of $30,000.

Gain

Carryover

basis

Like-kind exchange

$ 470,000

Cash (Boot)

$ 10,000

$ (10,000)

Amount realized

$ 480,000

Cost of Aprtment

$ 240,000

Depreciation

$ 30,000

Adjusted basis

$ 210,000

$ 210,000

Realized Gain

$ 270,000

Less: Sec.121

$ 240,000

$ 240,000

Gain to be defrred Sec 1031

$ 30,000

Gain to be recognized

$ -

Basis in the replacement property

$ 440,000

Adrian allocated the gain to Sec 121 at first, because he converted residential use to rental use for

a dwelling unit. He received cash as boot but it is included in Sec 121, so he recognized no gain

the year of exchange. However, the gain excluded under Sec. 121 should be included in the

carryover basis for his received property.

Example 2: Alex bought a house for $360,000; the house consists of two separate dwelling units.

He used one dwelling unit of the house as his principal residence for 5 years. He rented the other

dwelling unit of the house for fair market value. The allocation of the costs and expenses is 2/3

for him and 1/3 for the rental unit. He claimed $50,000 for depreciation during the 5 years. Then

he exchanged the house for a $660,000 duplex. He uses one side of the duplex for his principal

residence and rents the other side.

18

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

Total

Residential

Rental

1

2/3

1/3

Like-kind exchange

$

660,000

$

440,000

$

220,000

Cash

$

-

Amount realized

$

660,000

$

440,000

$

220,000

Cost of Aprtment

$

360,000

$

240,000

$

120,000

Depreciation

$

50,000

$

50,000

Adjusted basis

$

240,000

$

70,000

Realized Gain

$

200,000

$

150,000

Less: Sec.121

$ (200,000)

0

Gain to be defrred

0

$

150,000

Gain to be recognized

0

Basis in the replacement property

$

440,000

$

70,000

Since the rental portion of the gain is excluded under Sec.121 and Alex receives no boot and has

recognized no gain or loss in the exchange, his basis of rental property is the adjusted basis of the

relinquished rental property.

Conclusion

This paper was intended to serve as a guide to the tax treatment of deductions, gains, losses, and

exchanges involving mixed-use real estate. The tax law has specific definitions for each word

and phrase and those definitions need to be understood in order to apply the tax laws. The

categorization of transactions helps us understand which rules to follow, but some transactions

involve more than one set of categorical rules and that complexity makes proper compliance

more difficult and time consuming.

Tax law is changing constantly in response to economic and political change. This paper refers to

2013 tax law, and the rules and numbers above may be modified in the future. A tax practitioner

is responsible for researching and applying appropriate and up-to-date tax law. I hope this paper

provides some insight into a commonplace yet complex area of the tax law and helps readers

appreciate the importance of tax planning.

19

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013

References

Trade or Business Expenses. Internal Revenue Code §162

Interest. Internal Revenue Code §163

Taxes. Internal Revenue Code §164

Losses. Internal Revenue Code §165.

Net operation loss deduction. Internal Revenue Code §172.

Exclusion of gain from sale of principal residence. Internal Revenue Code § 121

Expenses for production of income. Internal Revenue Code §212

Personal, living, and family expenses. Internal Revenue Code §262

Disallowance of certain expenses in connection with business use of home, rental of vacation

homes, etc. Internal Revenue Code §280A

Passive activity losses and credits limited. Internal Revenue Code §469

Exchange of property held for productive use or investment. Internal Revenue Code § 1031

Exclusion of gain from sale of principal residence – single exchange of like-kind property,

Revenue Procedure 2005-14, 2005-1 CB 528, 01/27/2005, IRC Sec(s). 121

Department of the Treasury, Internal Revenue Service (2011), Residential Rental Property

Publication 527, Cat.No.15052W

Department of the Treasury, Internal Revenue Service (2011), Passive Activity and At-Risk

Rules, Publication 925, Cat.No.64265X

Department of the Treasury, Internal Revenue Service (2011) Home Mortgage Interest

Deduction, Publication 936, Cat.No.10426G

CCH. (2012). CCH Federal Taxation : Basic principles (2013 ed.). Chicago, IL: Smith, E.,

Harmelink, P., & Hasselback, J.

Gain allocated to periods of nonqualified use will not be excluded from income for sales or

exchanges of a principal residence after Dec. 31, 2008 ¶104. Retrieved from RIA

Checkpoint

Business use or rental of a principal residence – effect on the exclusion that applies to gain from

the sale or exchange of a principal residence. EXP ¶1214.06. Retrieved from RIA

Checkpoint

20

Journal of Undergraduate Research at Minnesota State University, Mankato, Vol. 13 [2013], Art. 1

https://cornerstone.lib.mnsu.edu/jur/vol13/iss1/1

DOI: 10.56816/2378-6949.1000

Dwelling unit defined for purpose of the disallowance rules that apply to certain expenses in

connection with business use of a home or rental of vacation homes. EXP ¶280A4.07.

Retrieved from RIA Checkpoint

Limitations on deductions with respect to a dwelling unit which is used by the taxpayer during

the taxable year as a residence. Proposed Regulation §1.280A-1. Retrieved from RIA

Checkpoint

Exclusion of gain from sale or exchange of a principal residence. Regulation §1.121-1. Retrieved

from RIA Checkpoint

Author

Natsua Asai, a native Japanese person, moved to Minnesota to learn business foundation and

became a student of Accounting at Minnesota State University, Mankato. She is a member of the

Honors Program at Minnesota State University, Mankato. Her future aspiration is to obtain a job

at an accounting firm to support local business.

Faculty Mentor

Paul Brennan is originally from Pennsylvania. He obtained his Ph. D from Southern Illinois

University in 1999. He is an enthusiastic teacher and an associate professor of accounting and

taxation in the College of Business at Minnesota State University, Mankato.

21

Asai: The Tax Treatment of Mixed Personal and Rental Use of Real Estate

Published by Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University, Mankato, 2013