MERCED COUNTY ASSOCIATION OF GOVERNMENTS

Prepared by LSC Transportation Consultants, Inc

YARTS STRATEGIC PLAN

Final Report

YARTS Strategic Plan

Final Report

Prepared for

Merced County of Governments

369 W. 18 St.

Merced, California, 95340

209-723-3153

Prepared by

LSC Transportation Consultants, Inc.

2690 Lake Forest Road, Ste. C

Tahoe City, CA 96145

530-583-4053

June 14, 2021

LSC#207480

YARTS Strategic Plan Draft Report LSC Transportation Consultants, Inc.

Merced County Council of Governments Page i

TABLE OF CONTENTS

CHAPTERS

Chapter 1: Introduction

Introduction ............................................................................................................................................... 1

Chapter 2: Institutional Overview

Institutional Structure of YARTSS= ............................................................................................................ 3

YARTS Agreements .................................................................................................................................... 5

Chapter 3: Review of Yosemite Visitation and YARTS Service

Historic Annual & Seasonal Visitation to Yosemite National Park .......................................................... 13

YARTS Services Overview ........................................................................................................................ 17

Current and Historical YARTS Ridership .................................................................................................. 24

YARTS Performance Analysis ................................................................................................................... 34

YARTS Connections .................................................................................................................................. 38

Chapter 4: YARTS Capital Overview

Introduction ............................................................................................................................................. 41

YARTS Fleet .............................................................................................................................................. 41

Moving Towards Zero Emissions ............................................................................................................. 43

YARTS Facilities ........................................................................................................................................ 47

Chapter 5: Funding History and Opportunities

YARTS Funding Sources ........................................................................................................................... 49

Federal Sources of Revenue .................................................................................................................... 54

State Sources of Revenue ........................................................................................................................ 57

Local Sources of Revenue ........................................................................................................................ 59

Summary – The Future Funding of YARTS .............................................................................................. 60

Chapter 6: Recommended Strategies for YARTS

Introduction ............................................................................................................................................. 61

Service Recommendations ...................................................................................................................... 61

Capital Recommendations ...................................................................................................................... 73

Institutional Plan ...................................................................................................................................... 79

Appendix A: YARTS Fare Structure

Appendix B: YARTS Ridership Trends

Appendix C: YARTS Boarding and Alighting Data

YARTS Strategic Plan Draft Report LSC Transportation Consultants, Inc.

Merced County Council of Governments Page ii

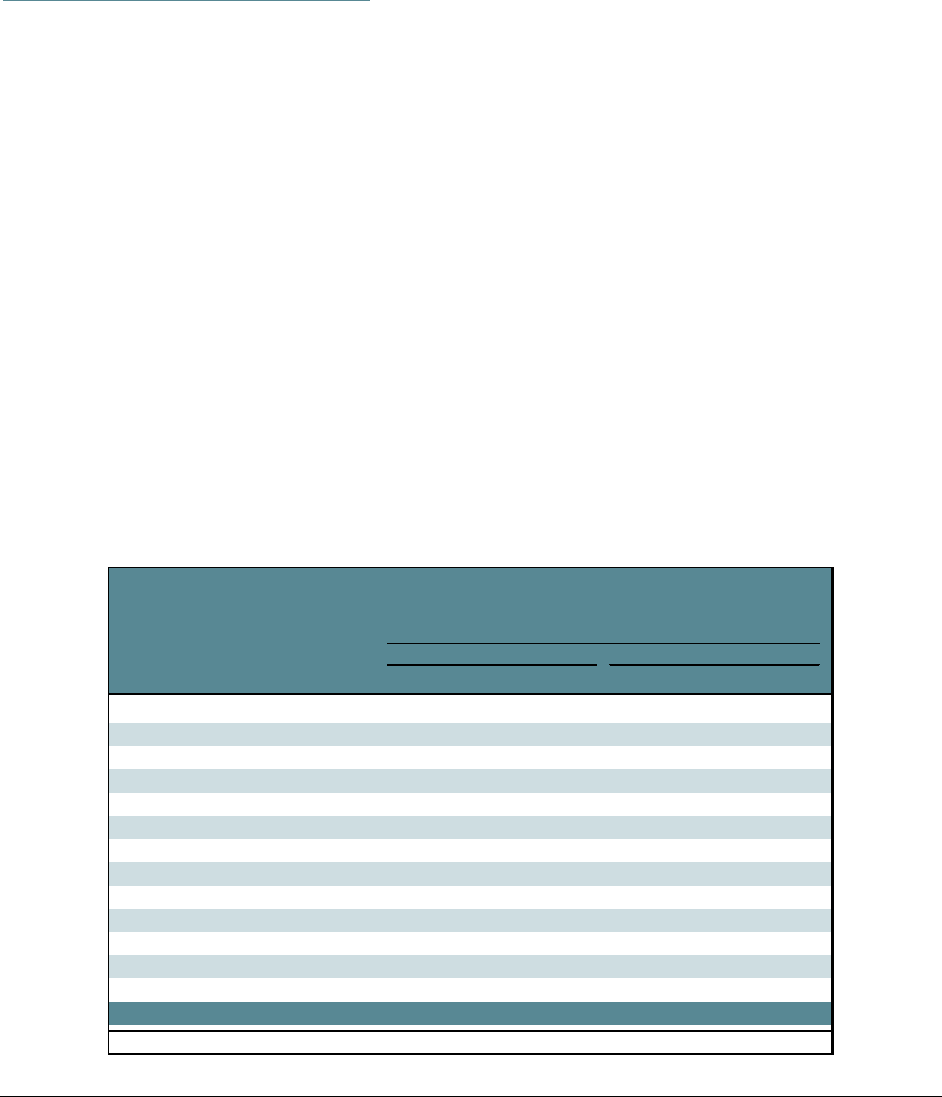

LIST OF TABLES

Table 1: NPS Financial Assistance for YARTS Service .............................................................................. 10

Table 2: Monthly Visitor Count (2000 – 2019)........................................................................................ 14

Table 3: Annual Vehicle Count by Park Entrance (1998 – 2019) ............................................................ 16

Table 4: Annual Visitation by Major Entrance Station (2015– 2019) ..................................................... 17

Table 5: 2019 Monthly Visitation by Major Entrance Station ................................................................ 18

Table 6: Summary of Existing YART Service ............................................................................................ 20

Table 7: Recent YARTS Service Changes ................................................................................................. 21

Table 8: YARTS 2019 and 2020 Service Quantities by Route and Month ............................................... 23

Table 9: YARTS Ridership History by Route ............................................................................................. 25

Table 10: YARTS Ridership History by Route and Season ....................................................................... 27

Table 11: Route 140 Ridership History by Type ...................................................................................... 28

Table 12: Passenger Boardings by Route by Month 2019 & 2020 ......................................................... 30

Table 13: Route Ridership by Average Weekday and Weekend by Month ........................................... 32

Table 14: YARTS 2019 Performance Analysis by Route and Month ....................................................... 36

Table 15: YARTS Vehicle Fleet – Replacement Needs ............................................................................ 42

Table 16: YARTS versus VIA Bus Use – Calendar Year 2019 ................................................................... 43

Table 17: YARTS Expenses by Year – Merced Contract .......................................................................... 50

Table 18: YARTS Revenues – Merced Contract ....................................................................................... 51

Table 19: YARTS Expenses and Revenue by Year – Fresno Contract ...................................................... 52

Table 20: YARTS Total Operating Expenses and Revenue by Year ......................................................... 52

Table 21: Countywide Retail Sales Trends in YARTS Service Area .......................................................... 54

Table 22: Recommended Service Reduction Plan to Generate Local Capital Match Funding ............... 62

Table 23: YARTS Alternative Service Reductions Analysis ...................................................................... 63

Table 24: Existing Buses Required in Service by Time-of-Day ................................................................ 65

Table 25: Route 120 Average Daily Ridership in July .............................................................................. 68

Table 26: 120 Route Reduced Schedule (June 22 to September 11) ..................................................... 69

Table 27: Route 41 Average Daily Ridership in August ........................................................................... 71

Table 28: Example Oakhurst – YNP Schedule ......................................................................................... 71

Table 29: YARTS Bus Size Requirements ................................................................................................. 75

LIST OF FIGURES

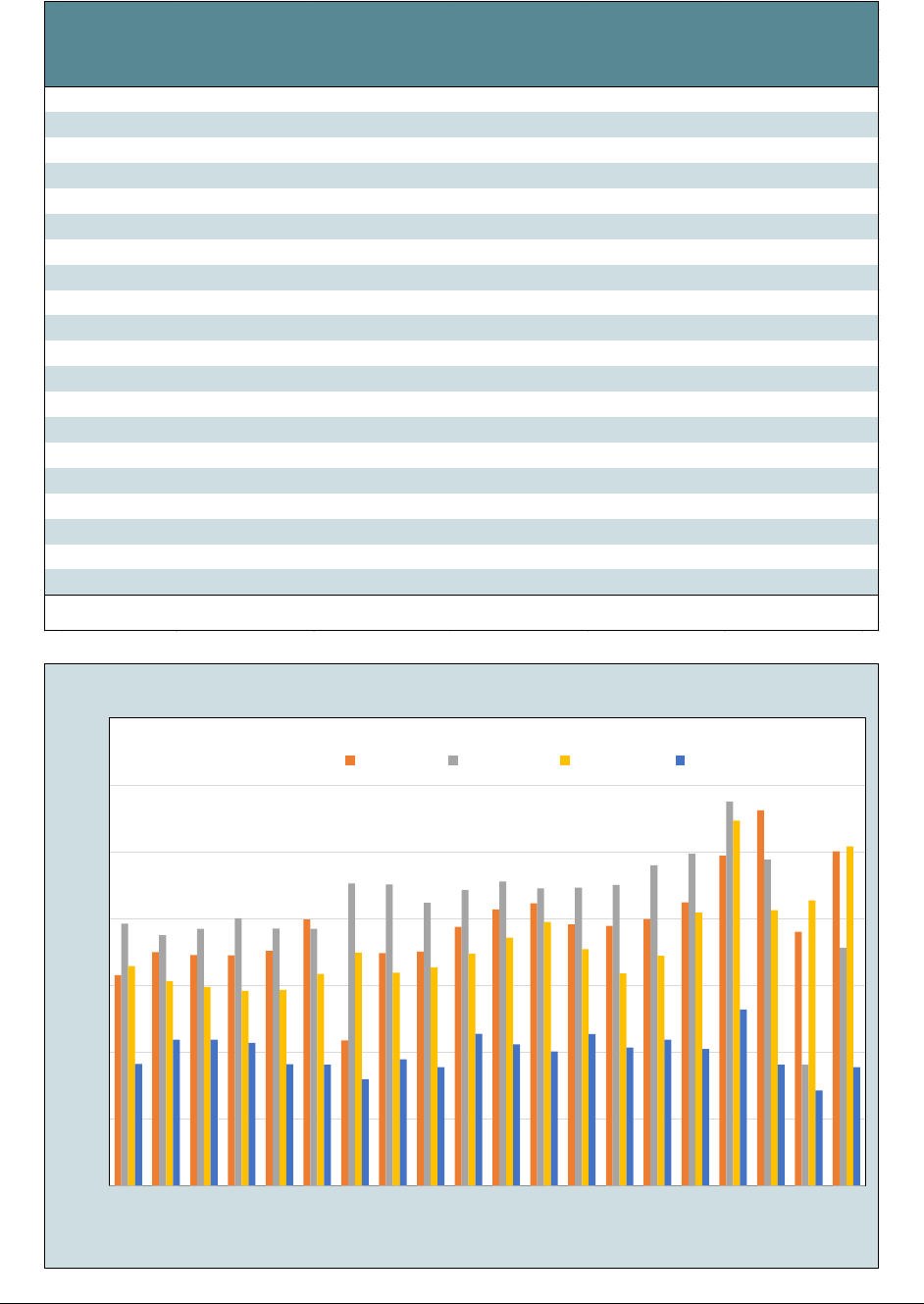

Figure 1: YARTS 2021 – 21 Board of Directors .......................................................................................... 4

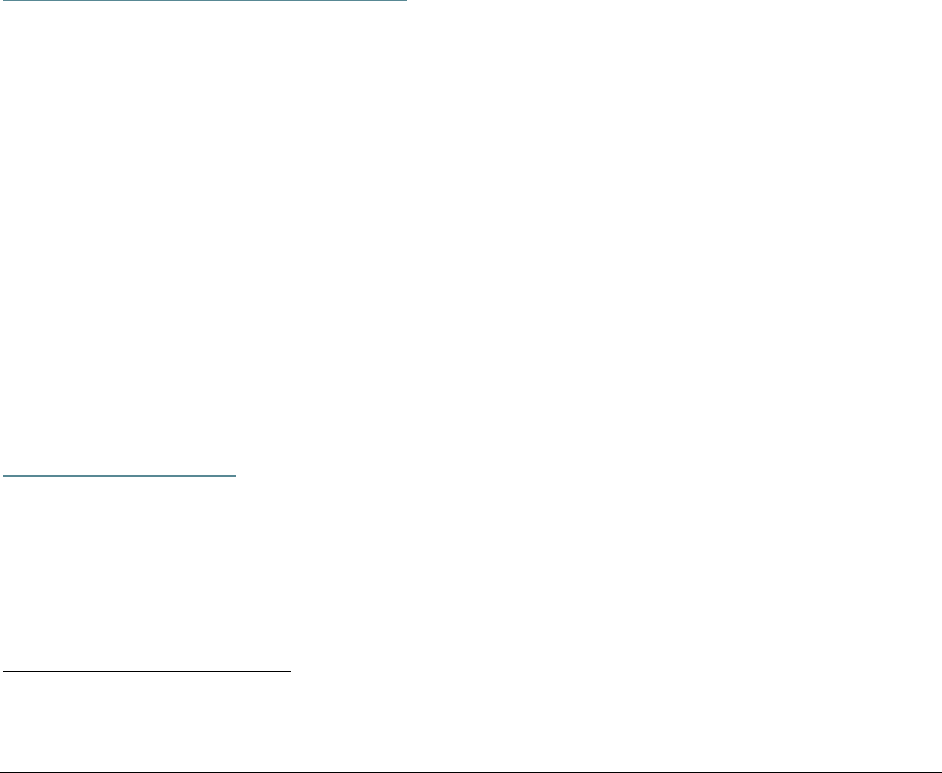

Figure 2: Total Annual Visitors (2000 – 2019) ......................................................................................... 15

Figure 3: Annual Visitors by Season (2000 – 2019) ................................................................................ 15

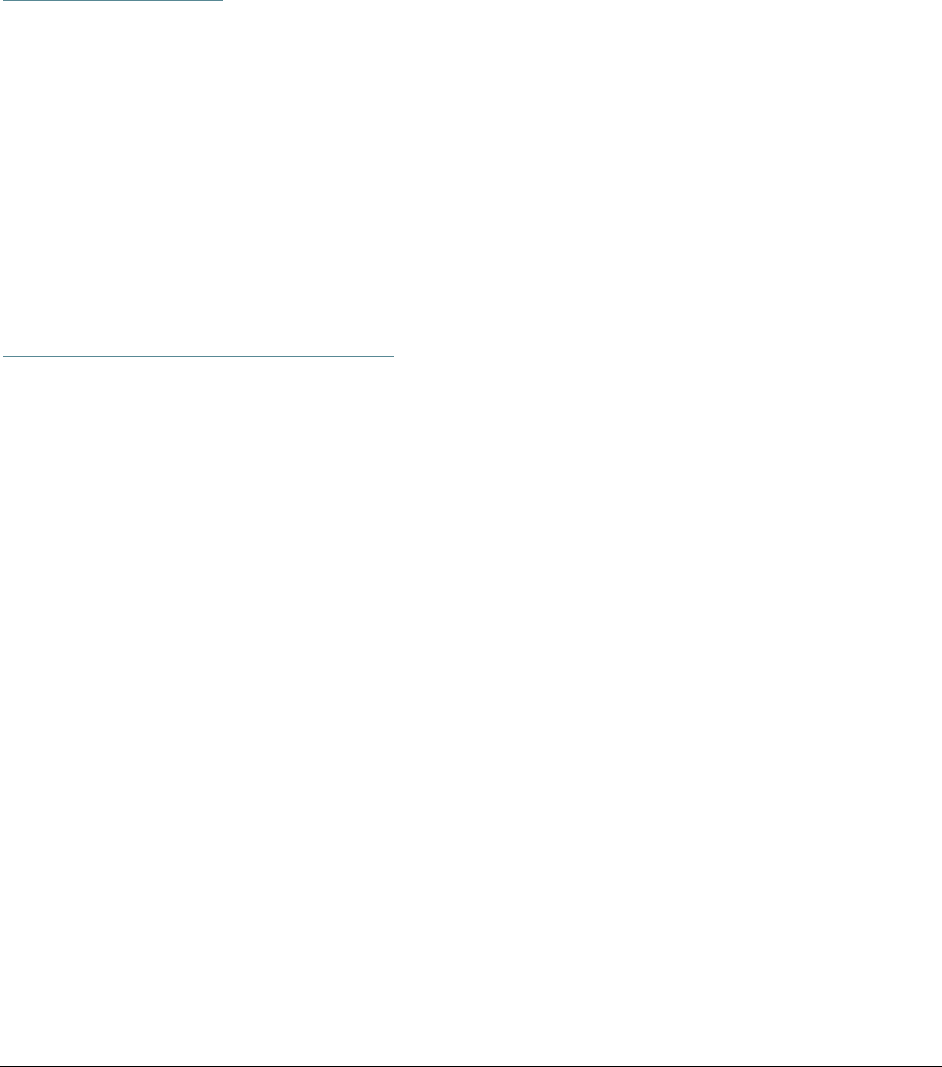

Figure 4: Annual Vehicle Count by Park Entrance .................................................................................. 16

Figure 5: Yosemite Area Regional Transportation System ..................................................................... 19

Figure 6: YARTS Historic Annual Ridership by Route .............................................................................. 25

Figure 7: 2019 Monthly Ridership by Route ................................

........................................................... 31

Figure 8: 2020 Monthly Ridership by Route ........................................................................................... 31

Figure 9: 2019 Average Weekday and Weekend/Holiday Ridership ...................................................... 33

YARTSStrategicPlanLSCTransportationConsultants,Inc.

MercedCountyAssociationofGovernments Page1

Chapter 1

INTRODUCTION

INTRODUCTION

Sinceitsfoundingin2000,theYosemiteAreaRegionalTransitSystem(YARTS)hasgrowntobeacrucial

elementinYosemiteNationalPark’stransportationstrategyandakeymobilityandeconomicresource

fortheoverallYosemiteRegion.However,severalfactorsarecurrentlythreateningthelong‐termviability

oftheYARTS

programasitcurrentlystands.Mostobviously,theCOVID‐19pandemichasreduced

ridershipandimpactedoperationswhilealsoreducingpotentialfundinglevels.Theagingandinsufficient

fleetofYARTS‐ownedvehiclesalsoimposesnewfinancialrequirementsonthesystem.Finally,theshort‐

termnatureofYARTSagreementsandcontractingarrangements

limitsthestabilityoftheprogramand

theavailabilitytomakelong‐terminvestments.

Concernedwiththeseissues,theYARTSBoardofDirectorshasinitiatedthisStrategicPlantodefinenew

approachestoservicelevels,capitalimprovements,financialplans,andinstitutionalstrategiestodefinea

sustainablelong‐termframeworkfor

theprogram.ItbuildsontheShort‐RangeTransitPlan(SRTP)

completedin2018,consideringsubsequentchangesinridership,financialsupport,andcontracting

arrangementaswellasincludingareviewofpreviousplansconsideringthese changingconditions.

ThisWorkingPaperisaninterimstudyproduct,reviewingexistingconditionsandframingthe

current

issues.ItisintendedtoserveasaresourcetotheBoard,theAuthorityAdvisoryCommittee,andother

decisionmakersinfuturediscussions.Thisdocumentthegroundworkfortheanalysisbyprovidingan

overviewofthecurrentinstitutionalframework, reviewingthevis itationtoYosemiteNationalPark,

analyzingrecentservice

andridershipstatisticsforYARTS,reviewingcapitalneeds(includingbus

replacementandzeroemissionrequirements),assessingfundinglevels,andframingthechallengesfacing

theprogram.Thesefuturediscussionsandtechnicalanalysiswillformthebasisforfinalstrategiesfor

implementation.

Itshouldbenotedattheoutsetthatthisplanis

lookingatconditionsbeyondtheendoftheCOVID‐19

pandemic,which,asofthiswriting,appearstobeontracktooccurinmid‐2021.Thoughitisuncertain

whethertherewillbelong‐termpermanentimpactstotravelpatterns,thisanalysisfocusesonconditions

priortotheoutset

ofthepandemicimpactsinMarch2020.Atpresentitappearsthatrecreationaltravel

demandwillbestrongafterthepandemic,andthatthereislittleoverallhesitancytoreturntotravelby

bus.Additionally,thisdocumentrepresentsacompilationofpreviousworkingpapers,whichinclude

referencestoagreementsandcost

factorswhichhavesincebeenupdated.Inthefinalrecommendations,

thelatestavailabl ecostestimatesareapplied.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 2

This page intentionally left blank

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 3

Chapter 2

INSTITUTIONAL OVERVIEW

INSTITUTIONAL STRUCTURE OF YARTS

The Yosemite Area Regional Transportation System (YARTS) is a Joint Powers Authority (JPA) whose

members currently consist of Merced County, Mariposa County, and Mono County. Tuolumne County has

recently joined the JPA. YARTS is overseen by a Board of Commissioners (the Board) which includes eight

voting members and two non-voting members. Voting members consist of two elected Supervisors from

each of the four member-counties, while non-voting members consist of one elected official from

Madera County, and two elected officials from Fresno County. The makeup of the YARTS Board is

depicted in Figure 1.

An 18-member Authority Advisory Committee (AAC) assists the YARTS Board by studying issues and

making recommendations to YARTS on policy matters and projects. Three members of the AAC are

nominated by each member county of the JPA Board, two by the National Park Service, two by the YARTS

Executive Director, one each from Madera and Tuolumne Counties, and three from Fresno County. In

addition to the JPA, YARTS has several agreements with additional entities as described below.

YARTS Joint Powers Authority

YARTS is a party to many agreements that define YARTS service and funding arrangements. In some cases,

YARTS is the contracting agency and in others it is the contractor. The following is a summary of

contractual agreements.

YARTS Joint Powers Authority Agreement

The original YARTS JPA was entered into on September 21, 1999, between the Counties of Merced,

Mariposa, and Mono (JPA parties), and was most recently amended on May 9, 2017. The purpose of the

JPA is to plan, operate, manage, and evaluate transportation improvements within and among the

respective JPA parties’ jurisdictions around Yosemite National Park. The JPA was borne out of a common

desire, not only among the JPA parties but also the National Park Service and Yosemite Regional Strategic

Board, to address the transportation impacts of continued growth in Yosemite visitation and the need for

transportation alternatives that helped protect the visitor experience and natural resources of the area.

The JPA established YARTS as a separate public entity with the stated purpose to start an initial two-year

passenger bus demonstration project to serve the geographic jurisdictions of the JPA parties and

Yosemite. Recognizing that a close relationship with the National Park Service (NPS) was critical, the JPA

required that YARTS work with the NPS, as well as Caltrans and the Forest Service.

Per the JPA, the Board consists of two voting members from each JPA party along with one alternate

Director from among the elected official of any political office in the member geographic area. The JPA

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 4

defines that the Board has the power to contract with an Administering Agency, enter contracts, acquire,

and hold property, incur debt, accept funding, invest, have an unpaid Board, and other necessary acts in

the provision of passenger bus service.

The JPA established the YARTS fiscal year (FY) as October 1st through September 30th. Moreover, the JPA

defines a process for creating and adopting a budget, making contributions of funds or in-kind support,

appointing a treasurer and controller, and distributing assets if dissolved.

Mayor Michelle Roman, City of Kingsburg

Fresno County

Merced County

2 elected Supervisors

Mariposa County

2 elected Supervisors

Mayor Ray Leon, City of Huron

Supervisor Ryan Campbell

Tuolumne County

2 elected Supervisors

Mono County

2 elected Supervisors

Madera County

Supervisor Tom Wheeler

Figure 1: YARTS 2020-21 Board of Directors

VOTING MEMBERS

Supervisor Rosemarie Smallcombe

Supervisor Miles Menetrey

Supervisor Daron McDaniel

Supervisor Scott Silveira, Chair 2020-2021

Supervisor Stacy Corless

Supervisor Bob Gardner, Vice Chair 2020-2021

NON-VOTING MEMBERS

Supervisor Kathleen Haff

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 5

Joint Powers Authority Bylaws

The YARTS bylaws were adopted by the YARTS Board of Commissioners on June 10, 2013 and, in many

ways, reinforced and further defined pieces contained in the JPA. The bylaws establish the objectives of

the Authority as:

• Preservation of the natural environment of the Yosemite Region

• Coordination and communication with Yosemite National Park

• Accommodation of increasing visitation to Yosemite and surrounding region and of

transportation options

• Coordinate of local policy and planning of regional transit service and financial resources

The bylaws establish the positions of Chairperson and Vice-Chairperson. The Chairperson is required to

have at least one year’s experience as a Commissioner.

The powers and functions of the authority are defined in these bylaws as the ability of the Board to:

• Plan, establish, manage, and evaluate passenger bus service

• Employ an Executive Director

• Employ agents and employees and contract for services

• Make and enter into contracts and agreements

• Acquire, hold, and convey property

• Incur debt, obligations, and liabilities

• Accept funding

• Have members of the Board serve without compensation

• Establish committees

• Exercise any and all other powers provided by California Code section 6547

The bylaws state that authority meetings must be held at least quarterly with proper noticing and agenda

posting. Furthermore, the bylaws state that the Board will appoint an Executive Director to manage and

administer the transit service plan and budget, in addition to serving as the secretary of the board. A

quorum is defined as a majority of voting members. A majority vote of all voting members is required to

approve all expenditures.

Importantly, the JPA does not define specific funding requirements on the part of any participant.

YARTS AGREEMENTS

YARTS is a party to many agreements that define YARTS service and funding arrangements. In some cases,

YARTS is the contracting agency and in others it is the contractor. The following summary of contractual

agreements is all related to financial transactions with YARTS.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 6

YARTS and Merced County Association of Governments Agreement for Management and

Marketing

The Merced County Association of Governments (MCAG), under an agreement with the YARTS JPA,

provides management, marketing, financial and grant administration, and transportation planning

services on behalf of YARTS. In return, YARTS agrees to pay MCAG an annual fee for this service, equal to

$465,506 for Fiscal Year 2020/21. This agreement is renewable annually, with the current term expiring

June 30, 2021. More specifically, the duties consist of the following:

• Administration and Management—Conduct JPA Board and AAC meetings, accounting services,

grants management, contracts and agreements (with Amtrak, Fresno COG, Tuolumne County,

etc.), state and federal reporting, maintain YARTS-owned property

• Planning—Conduct passenger surveys, evaluate service modifications, participate in SSTAC

meetings, oversee SRTP process, coordinate with other public and private transportation services

• Marketing—Prepare and distribute schedules and brochures, oversee the reservation process,

maintain website and social media, administer ticket sales, and distribute public information and

advertising.

This arrangement has been in place since the formation of YARTS in 2000 and appears to work well and in

the best interest of YARTS. It allows YARTS to benefit from the cost savings associated with sharing staff

resources (and office space) between YARTS and the other transit services (The Bus) managed by MCAG.

Managing and marketing a public transit system is a complicated endeavor, particularly with regards to

state and federal requirements, the high level of coordination needed for a regional service, the needs

specific to serving a national park, and the need to address the many challenges of service operations in

the Sierra. Providing the necessary level of expertise as a separate staff would almost certainly incur a

greater overall cost than the current arrangement. Considering the relative staff size of the various JPA

member organizations, shifting this work to another of these organizations would require significant

expansion of the existing staff, with associated increase in costs. In sum, the current YARTS/MCAG

agreement is the appropriate means of providing these services in the most cost-effective manner.

The year-to-year agreement, however, places an additional administrative burden on MCAG that could be

avoided through a longer-term agreement (such as a five-year agreement). The short-term nature of the

contract also has the potential to reduce employees’ level of commitment to their jobs. It would also be

beneficial to align the contract term with the federal fiscal year (October to September) as the separate

agreement with the National Park Service is a major funding source and as this would avoid the potential

of changing YARTS administration in the middle of the busy summer season.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 7

YARTS—VIA Agreement for Daily Operations

YARTS contracts with VIA Adventures, Inc. for daily operations of the YARTS fixed route services, including

service operations, bus maintenance and bus fuel. Since the current contract was signed, there have been

two amendments, as discussed below.

Original Agreement

The current agreement was enacted on November 1, 2018.

1

It identified a two-year term, along with the

option to extend for up to two additional one-year terms. Key points of this agreement are as follows:

• Broadly speaking, VIA Adventures is responsible for the day-to-day operations of YARTS services,

including providing staff (drivers, schedules/dispatchers and supervisors, trainers) and up to 12

over-the-road coaches (to supplement the 10 owned by YARTS), maintaining and fueling all

vehicles, and operating all scheduled services.

• Costs are determined on a fixed-price per service-vehicle-hour of service basis, with fuel costs

passed directly through to YARTS. This cost varies by location and ownership of the vehicles in

use. Under the original agreement, these “unit costs” were as follows:

o YARTS-owned buses: 2020/21 = $110.60 per vehicle-service hour, 2021/22 = $113.92 per

vehicle-service-hour

o VIA-provided buses based in Merced: 2020/21 = $158.11 per vehicle-service hour, 2021/22 =

$162.85 per vehicle-service-hour

o VIA-provided buses based in Fresno: 2020/21 = $165.11 per vehicle-service hour, 2021/22 =

$169.85 per vehicle-service-hour

This differential in hourly costs is crucial to future planning regarding YARTS services. Using a VIA-

provided vehicle based in Merced increases costs over using a YARTS-owned bus by 43 percent,

while using a VIA-provided vehicle based in Fresno increases costs by 49 percent. Put another

way, for any specific dollar amount, using a VIA bus reduces the number of vehicle-hours of

service that can be provided by 30 percent for buses based in Merced and by 33 percent for

buses based in Fresno.

• The original contract was developed assuming a total of 21,878 annual vehicle-service-hours,

consisting of 15,070 operated by YARTS buses, 2,195 operated by VIA Merced buses and 4,613

operated by VIA Fresno buses.

1

As a result of the term of the contract, the service year is from November 1

st

to October 31

st

.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 8

• Through the 2019 – 20 service year, a minimum hourly transit operator pay scale is identified.

• A series of performance standards and associated liquidated damage penalties are defined, for

on-time performance, missed runs, late runs, and bus cleanliness.

• YARTS has the authority to (upon 60 days written notice) modify the scope of services. VIA

Adventures would then determine the impacts on operations and costs and negotiate for a

change in scope.

Amendment #1

Amendment #1 (August 4, 2020) identifies a term extending to October 31, 2021, with extension at the

sole discretion of YARTS for one additional year (to October 31, 2022). It also added categories (including

pandemic) to the original Force Majeure clause. In addition, VIA Adventures is required to develop

policies and procedures for cash fares handling and accountability.

Amendment #2

The second amendment to the current contract, enacted on November 1, 2020, reflects a substantial

change in the contracting arragement. Rather than a straight per-service-hour basis, costs are now

identified on a “fixed plus vehicle-service-hour” basis. Fixed costs are identified as $973,389 per year for

the Merced-based service and $310,833 per year for the Fresno-based service, while the hourly costs are

at a rate of $57.89 per vehicle-service-hour. Note that this rate does not vary by whether a YARTS-owned

bus or a VIA-provided bus is operated, or what base the run initiates from. The costs are based on a total

of 16,548 annual vehicle-hours for Merced-based service and 2,902 for Fresno-based service, and total

payment shall not exceed $2,471,805. This level of service is 11 percent lower than the number of

vehicle-service-hours identified in the original contract.

Discussion

The shift from a straight per-service-hour costing to a fixed-plus-per-service-hour costing is more in line

with transit industry standards. The change is beneficial in that it better reflects how costs are actually

incurred by the contractor and reduces the risk to the contractor that possible future reductions in

service will be an undue financial burden. Using a single variable rate, regardless of whether a YARTS bus

or contractor bus is used, tends to mask the additional costs associated with use of a contractor bus.

Though under this amended contract YARTS does not immediately see a cost differential, the contractor’s

costs to provide some of the necessary fleet are built into the rates. Over the long-term, it is still in

YARTS’s interest to eliminate the need for contractor-provided buses.

Under the current agreement, the contractor provides storage and maintenance facility space for YARTS

buses at the facility at 300 Grogan Avenue in Merced. Costs incurred by VIA for the facility are considered

in the monthly and hourly cost rates. Providing a separate publicly owned operations/maintenance facility

would lower annual ongoing costs for MCAG. In addition, it is not feasible for public funding to be used to

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 9

install electric charging or hydrogen fueling facilities on the contractor’s lot. As California’s public transit

programs move towards zero-emission vehicles, the need for a publicly owned facility (perhaps jointly

with other public transit programs) will increase.

YARTS—U.S. Department of the Interior National Park Service Cooperative Agreement

The YARTS and National Park Service (NPS) agreement defines the contribution to YARTS for operating

ongoing service on YARTS State Route 140 Route and seasonal service on the YARTS State Route 41

Route, as well as enhanced and seasonal service on Routes 120 East, 120 West, and 140. The most recent

cooperative agreement was signed on May 27, 2020. For the Federal 2929 fiscal year (October 1, 2020 to

Sept 30, 2021), Federal funding totaling $1,403,788 is identified, as shown in Table 1. The service levels

identified in this table exceed the minimum defined in the Agreement text, in that the six daily roundtrips

on SR 140 exceed the five identified in the text. The Agreement also indicates that service levels may

grow to eight daily year-round trips on Highway 140, five summer and three winter roundtrips on both

Highway 41 and Highway 120 West, and three summer roundtrips on Highway 120 East/US 395.

Funding in subsequent years will reflect services as modified, based on the specific service parameters.

The agreement specifies that YARTS operate four peak-season routes providing connections to the San

Joaquin Valley and Mono Basin. Beyond providing funding, the NPS is required to encourage use of the

YARTS system through marketing and coordination and provide park access.

The NPS Agreement outlines goals for the project, which can be summarized as the NPS and YARTS

working cooperatively to provide public transportation services in a safe and convenient manner along

the State Routes (or Highways) 41, 120, and 140 corridors to Yosemite Valley, for employment,

recreation, shopping, education, and social service trips, so long as service can be provided in a cost-

effective manner. The agreement also defines project objectives, such as minimum numbers of trips, on-

time performance, etc.

The most recent agreement includes a statement about COVID-19 provisions, essentially conditioning the

award of financial support based on COVID-19 conditions, and potentially waiving minimum service

requirements because of those conditions.

The statements of work beyond the first year are loosely defined in the agreement, with detailed

statements of work to be defined annually via modification of the agreement.

YARTS—Mariposa County Agreement

The YARTS and Mariposa County contract defines the Mariposa County annual funding contribution for

operation of public transportation services that connect Mariposa with Yosemite on the Highway 140

Route. The original term of the agreement was from July 1, 2017 for one year, and is annually renewable,

with the current agreement running from July 1, 2020 to June 30, 2021. Under this agreement, YARTS is

required to provide Route 140 services, though a specific level of service is not defined, as well as provide

planning, marketing, and management services. Mariposa County is required to pay YARTS an annual

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 10

service contribution, with the amount for the 2020 – 21 fiscal year not to exceed $191,000, due in four

quarterly payments.

YARTS—Fresno Council of Governments Agreement

The YARTS agreement with Fresno Council of Governments (FCOG) agreement was initially enacted in

2014 to provide funding for Route 41 service. Under this agreement, FCOG payments are equal to the

operating/administrative costs of the service minus the credit revenues (passenger fares, NPS funding

and Amtrak funding).

The most recent (the third) amendment defines a maximum contribution of $746,776 for services from

May 2020 through September 2020, less any revenues collected from other sources, resulting in a

maximum total of $478,526 from FCOG. Due to the COVID-related drop in ridership, the rate in 2020 was

cut by one-third, to $678.32 per day. A new agreement is expected for summer 2021 service, to be

negotiated in the spring.

YARTS—National Railroad Passenger Corp (Amtrak) Agreement

The services contract between Amtrak and YARTS, originally enacted in 2007, was most recently amended

on July 1, 2020 to extend until June 30, 2021. It defines the Amtrak contribution to YARTS for Thruway

bus service provided by YARTS on the Highway 140 Route and the Highway 41 Route. The three-year

amendment for service between July 1, 2017, to June 30, 2020, wherein YARTS is the contractor, included

a daily rate for service between Merced and Yosemite of $987.84, with an option to increase the daily

Table 1: NPS Financial Assistance for YARTS Service

2020 Federal Fiscal Year

Routes

Origin by

County

Round

Trips

Provided

Scheduled Dates of Service

Hours of

Operation

1

Days in

Service

Recipient

Operating

Costs

2

NPS Award

Highway 41, Wawona

Road

Fresno

Madera

3

5/11/20 to 9/11/20 (summer

only)

9

124 $569,160 $200,000

Highway 120 East (Tioga

Road) and U.S. 395

Mono 1 6/15 to 10/16/20 (summer) 7 139 $165,410 $79,360

1

5/13/20 to 9/30/20 142

$152,082

2

5/25/20 to 8/31/20

102 $218,484

Highway 140, El Portal

Road

Merced

Mariposa

6

7/1/20 to 6/30/21 (year-

round)

7.9

361

$2,908,938

Highway 120 East (Tioga

Road) and U.S. 395

Mono 1 6/1 to 10/16/20 (summer) 7 153 $182,070

Highway 140, El Portal

Road

Merced

Mariposa

2

5/18/20 to 9/30/20 (summer) 7.9

136 $365,296 $240,000

Note 1: Per bus, per day $4,561,440

$1,403,788

Source: NPS Cooperative Agreement

Highway 120 West

Tuolumne

6.3

$348,768

$535,660

Recipient's Operating Cost

Note 2: Hourly rate = $170 x Hours of

Operation per bus per day x Days in

Service

Total Financial Assistance

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 11

amount by 3 percent each of the final two years of a contract extension. The contract was extended by

amendment to continue through June 30, 2021, at a daily rate of $1,017.47. However, due to the COVID-

19 related capacity restrictions and drop in ridership, the rate has been cut by one third for this year, to

$678.31.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 12

This page intentionally left blank

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 13

Chapter 3

REVIEW OF YOSEMITE VISITATION AND YARTS SERVICE

HISTORIC ANNUAL & SEASONAL VISITATION TO YOSEMITE NATIONAL PARK

Over the past two decades, the number of visitors to Yosemite National Park has averaged 3.7 million per

year, as shown in Table 2 and Figure 2. Since 2015, annual visitation has exceeded 4.0 million people,

reaching a peak of 5,028,868 visitors in 2016. In recent years, rock falls and wildfires have closed portions

of the park at various times, yet 4,422,861 visitors still came to the park in 2019. This reflects a 12 percent

decline from the peak in 2016.

Table 2 and Figure 2 also show the number of visitors by month for the past two decades. This data

provides some insight into the annual increases in visitation. Summer continues to be the most popular

time of year with 1,917,240 people visiting the park in 2019. As shown in Figure 3, the fall season

(September through November) has shown growth over the past five years with 1,264,201 visitors in

2019, or a 16.6 percent increase in visitors from 2015. Over these five years, summer (June to August)

visitation has grown by 5.7 percent, spring (April and May) visitation has been essentially unchanged,

while winter (December through March) visitation declined by 8.6 percent. Since the completion of the

YARTS SRTP, visitation over the past three year has increased by 5.6 percent in summer, 4.1 percent in

fall, and 3.3 percent in winter, while declining 10.9 percent in spring.

Visitation by Gateway to Yosemite National Park

There are four key corridors serving Yosemite Valley: Arch Rock, South Entrance, Big Oak Flat, and Tioga

Pass. As shown in Table 3 and Figure 4, the South Entrance (via State Route (SR) 41) has historically

received the highest number of vehicles (31 percent on average), although in over the past few years

Arch Rock and Big Oak Flat have also received more visitors due to wildfires affecting the South Entrance.

Tioga Pass, which is closed during winter months, receives an average of 15 percent.

The number and types of visitors over the past five years has been tracked by each entrance kiosk, as

shown in Table 4. Over the past five years, 97 percent of visitors entering through Arch Rock, Big Oak Flat,

and Tioga Pass were recreational visitors and just 3 percent were non-recreational (employees, etc.). The

South Entrance has the most non-recreational visitors (5 percent). In terms of non-recreational visitors,

39 percent entered through the South Gate and just 11 percent enter through Tioga Pass in 2019.

The observation of visitors by entrance station, by month, is shown in Table 5 for 2019. This data reflects

the strong seasonality of visitors in the park. As shown, recreational visitors make up roughly 96 percent

of the total visitors to the park, with only 4 percent being those entering the park for other reasons

(employment, goods distribution, etc.). Of the various entrances, Big Oak Flat had the highest rate of

recreational visitors during the summer months of June, July, and August at 33.7 percent of total visitors.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 14

Table 2: Monthly Visitor Count (2000-2019)

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Total

2019 116,746 111,665 173,610 297,207 393,004 496,625 717,462 703,153 584,664 448,939 230,598 149,188 4,422,861

2018 129,432 143,321 170,681 278,349 385,670 543,690 504,230 441,867 524,387 360,776 215,854 311,179 4,009,436

2017

120,025 119,421 166,793 302,553 471,844 565,702 633,351 615,892 566,279 429,827 217,927 127,276 4,336,890

2016

139,780 201,601 286,990 305,092 457,309 703,614 780,728 692,450 598,428 483,232 218,998 160,646 5,028,868

2015

128,318 135,316 194,667 281,328 408,121 545,231 626,009 636,936 527,402 357,223 169,425 140,241 4,150,217

2014

112,133 113,403 146,750 242,722 333,308 496,363 623,663 654,157 467,205 354,769 203,678 134,491 3,882,642

2013

103,910 114,440 165,409 231,178 370,422 508,941 611,538 552,137 460,855 279,526 161,356 131,479 3,691,191

2012

120,496 113,341 136,687 243,102 356,500 528,186 623,101 660,118 482,004 322,687 141,868 125,314 3,853,404

2011

100,718 93,588 100,433 231,372 356,588 503,741 704,553 699,749 533,502 360,449 139,079 127,621 3,951,393

2010

96,089 100,379 149,651 224,461 382,414 521,059 643,566 659,857 520,210 356,370 148,459 98,893 3,901,408

2009

101,984 78,795 132,711 230,828 399,683 483,382 586,591 643,300 471,530 346,826 151,297 110,545 3,737,472

2008

95,124 107,729 153,735 199,592 361,193 473,186 539,874 543,799 416,918 295,547 146,838 97,979 3,431,514

2007

99,892 100,941 135,925 219,854 374,184 466,054 543,235 550,172 417,882 298,122 178,846 118,321 3,503,428

2006

104,591 101,194 125,556 189,472 309,387 382,972 510,932 528,254 421,502 298,771 165,499 104,514 3,242,644

2005

91,238 103,756 143,335 195,385 304,552 413,124 554,567 485,643 430,134 318,508 152,671 111,231 3,304,144

2004

100,020 106,258 146,876 228,212 326,017 449,566 531,864 508,094 393,437 272,200 121,622 96,745 3,280,911

2003

116,984 111,506 137,550 174,337 280,335 445,887 536,683 604,093 405,605 316,366 136,390 112,928 3,378,664

2002

108,906 113,695 141,766 186,682 295,511 436,862 513,789 570,914 426,684 300,919 149,828 116,311 3,361,867

2001

102,455 101,897 142,141 192,936 315,897 434,014 528,849 591,196 448,519 264,465 137,876 108,486 3,368,731

2000

93,633 103,444 136,523 216,087 317,009 454,638 548,440 546,981 388,707 324,484 144,958 125,999 3,400,903

Average 109,124 113,785 154,389 233,537 359,947 492,642 593,151 594,438 474,293 339,500 166,653 130,469 3,761,929

Source: https://irma.nps.gov/Stats/SSRSReports

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 15

3,400,903

3,737,472

4,150,217

5,028,868

4,009,436

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Figure 2: Total Annual Visitors (2000

-2019)

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Seasonal Visitation

Figure 3: Annual Visitors by Season (2000-2019)

Winter

Spring

Summer

Fall

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 16

Table 3: Annual Vehicle Count by Park Entrance (1998-2019)

Year Arch Rock South Gate Big Oak Flat Tioga Pass Total

2019 500,591 356,632 508,295 177,794 1,543,312

2018 380,520 181,375 427,409 142,766 1,132,070

2017 562,150 488,373 412,740 181,377 1,644,640

2016 494,331 575,399 546,804 264,245 1,880,779

2015 424,316 497,056 408,943 204,882 1,535,197

2014 399,544 479,824 344,345 218,950 1,442,663

2013 389,005 450,725 318,088 207,250 1,365,068

2012 391,468 446,456 354,446 227,150 1,419,520

2011 422,988 445,426 395,178 201,150 1,464,742

2010 413,561 455,531 371,634 211,993 1,452,719

2009 387,502 442,679 347,999 227,490 1,405,670

2008 350,771 423,689 327,177 177,695 1,279,332

2007 348,570 451,045 319,034 189,450 1,308,099

2006 217,742 452,546 349,106 159,933 1,179,327

2005 398,723 384,783 317,504 181,463 1,282,473

2004 351,588 385,167 293,620 181,925 1,212,300

2003 345,097 400,800 291,748 214,023 1,251,668

2002 345,476 384,858 297,869 218,950 1,247,153

2001 350,007 375,261 306,554 218,950 1,250,772

2000 315,250 392,603 328,910 182,732 1,219,495

Source: https://irma.nps.gov/Stats/SSRSReports/Park%20Specific%20Reports/Park%20YTD%20Version%201

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Figure 4: Annual Vehicle Count by Park Entrance

Arch Rock South Gate Big Oak Flat Tioga Pass

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 17

This was followed by South Entrance (25.9 percent), Arch Rock (22.6 percent), and Tioga Pass (17.9

percent). During the winter months (December through February), 39.7 percent of visitors enter through

the South Entrance, followed by 37.9 percent at Arch Rock.

YARTS SERVICES OVERVIEW

Currently YARTS has one year-round route (SR 140 Route between Merced and Yosemite) and three

seasonal routes running between May and September (Routes SR 41 from Fresno, SR 120 from Sonora,

and SR 120/395 from Mammoth Lakes). A map of the routes is shown in Figure 5, and a list of operating

seasons for a typical year, including runs and vehicles required, is shown in Table 6. In 2020, YARTS has

continued to operate their services as usual through the duration of the Covid-19 pandemic.

SR 140 Route

Operated 365 days per year, this route provides service between Merced and Yosemite Valley. In peak

season, eight eastbound trips are operated (seven from Merced and one from Mariposa) and nine

westbound trips are operated (eight from Yosemite to Merced and one from Yosemite and one from

Table 4: Annual Visitation by Major Entrance Station (2015-2019)

2019

% of All Visitors

2015 2016 2017 2018 2019 # % By Type

Arch Rock

Total Recreation Visitors 1,050,610 1,169,124 1,317,788 866,839 1,158,421 107,811 10% 26%

Total Non-Rec Visitors 33,945 39,150 44,234 30,441 40,047 6,102 18% 25%

Total Visitors 1,084,555 1,208,274 1,362,022 897,279 1,198,468 113,913 11% 26%

South Gate

Total Recreation Visitors 1,321,296 1,538,459 1,259,512 1,247,169 1,197,789 -123,507 -9% 27%

Total Non-Rec Visitors 69,588 81,750 66,998 65,980 63,102 -6,486 -9% 39%

Total Visitors 1,390,884 1,620,209 1,326,510 1,313,149 1,260,891 -129,993 -9% 28%

Big Oak Flat

Total Recreation Visitors 1,141,535 1,491,873 1,141,652 1,189,641 1,414,323 272,788 24% 32%

Total Non-Rec Visitors 32,715 43,031 32,736 34,193 40,663 7,947 24% 25%

Total Visitors 1,174,250 1,534,903 1,174,388 1,223,834 1,454,985 280,735 24% 32%

Tioga Pass

Total Recreation Visitors 592,171 754,819 518,879 661,741 603,683 11,511 2% 14%

Total Non-Rec Visitors 16,391 21,140 14,510 18,624 17,124 734 4% 11%

Total Visitors 608,562 775,959 533,389 680,365 620,807 12,245 2% 14%

TOTAL

Total Recreation Visitors 4,105,613 4,954,275 4,237,831 3,965,390 4,374,215 268,603 7% 100%

Total Non-Rec Visitors 152,639 185,070 158,478 149,238 160,936 8,297 5% 100%

Total Visitors 4,258,252 5,139,346 4,396,309 4,114,627 4,535,151 276,899 7% 100%

Arch Rock 97% 97% 97% 97% 97%

South Gate 95% 95% 95% 95% 95%

Big Oak Flat 97% 97% 97% 97% 97%

Tioga Pass 97% 97% 97% 97% 97%

Source: NPS Monthly Year-to-Date tables. Hetch Hetchy entrance data not included.

Change 2015-19

Percent Recreational Visitors

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 18

Table 5: 2019 Monthly Visitation by Major Entrance Station

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Summer Winter

Arch Rock

Total Recreation Visitors 45,731 45,309 63,691 98,704 125,891 140,435 147,573 138,640 132,775 96,401 71,771 51,500 22.6% 37.9%

Total Non-Rec Visitors 1,624 1,490 2,137 3,339 4,241 4,852 5,203 4,922 4,578 3,362 2,504 1,794

Total Visitors 47,355 46,799 65,828 102,043 130,131 145,288 152,776 143,563 137,353 99,763 74,275 53,294

South Entrance

Total Recreation Visitors 44,784 48,058 57,440 89,296 122,333 148,673 171,065 169,433 126,168 104,245 59,724 56,569 25.9% 39.7%

Total Non-Rec Visitors 2,496 2,646 3,038 4,725 6,293 7,770 9,114 9,114 6,510 5,208 3,150 3,038

Total Visitors 47,280 50,704 60,478 94,021 128,626 156,443 180,179 178,547 132,678 109,453 62,874 59,607

Big Oak Flat

Total Recreation Visitors 25,973 18,104 50,110 109,207 136,179 196,074 225,813 214,644 178,098 147,085 72,547 40,490 33.7% 22.5%

Total Non-Rec Visitors 768 527 1,440 3,123 3,911 5,663 6,516 6,188 5,118 4,193 2,079 1,137

Total Visitors 26,741 18,631 51,550 112,330 140,090 201,737 232,328 220,832 183,216 151,278 74,626 41,627

Tioga Pass

Total Recreation Visitors 0 0 0 0 0 0 164,871 174,119 141,280 96,856 26,557 0 17.9% 0.0%

Total Non-Rec Visitors 0 0 0 0 0 0 4,738 4,905 3,970 2,749 763 0

Total Visitors 0 0 0 0 0 0 169,609 179,024 145,250 99,604 27,319 0

TOTAL

Total Recreation Visitors 116,488 111,471 171,241 297,207 384,402 485,183 709,322 696,836 578,322 444,587 230,598 148,559 41.7% 8.3%

Total Non-Rec Visitors 4,888 4,663 6,615 11,187 14,445 18,285 25,571 25,129 20,176 15,512 8,496 5,969 1.5% 0.3%

Total Visitors 121,376 116,134 177,856 308,394 398,847 503,468 734,892 721,966 598,498 460,098 239,094 154,528 - -

Percent of Total

Recreation Visitors 96% 96% 96% 96% 96% 96% 97% 97% 97% 97% 96% 96%

Non-Recreation Visitors 4% 4% 4% 4% 4% 4% 3% 3% 3% 3% 4% 4%

Source: NPS Monthly Year-to-Date tables. Hetch Hetchy entrance data not included.

Percent of Rec. Visitors

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 19

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 20

Midpines to Merced). Service is reduced by one trip each direction on weekends and holidays. The 140

Route operates reduced service (Runs 140-1 and 140-27, which are scheduled to serve commuters, are

not operated) on weekends and on the following holidays: President’s Day, Memorial Day, Independence

Day, Veteran’s Day, Thanksgiving Day, Christmas Day, and New Year’s Day.

This route requires up to 3 hours 11 minutes to operate in the eastbound direction, and 2 hours 45

minutes in the westbound direction. A full one-way trip is 87 miles (174-mile round trip). This route

requires seven buses to operate a full summer schedule, while in winter five buses are needed on

weekdays and four on weekends/holidays. Note that these figures are only those in operations, excluding

spares.

Table 7 provides a review of recent changes in SR 140 Route services since 2018, both those identified in

the 2018 Short-Range Transit Plan (SRTP) as well as other changes. Key changes are the addition of

eastbound service in the morning, the reduction in short runs ending in Mariposa, and shifting run times

to provide greater choices in departure times and matching changes in train times. The required daily

number of buses to operate the service remains unchanged at seven.

SR 120 Route

In summer, three eastbound trips are operated each day between the Black Oak Casino 10 miles east of

Sonora and Yosemite Valley in the morning, with three westbound trips in the afternoon. Between June

22 and August 31, three trips are operated daily in each direction, dropping to one trip in September. This

route requires 3 hours 10 minutes to operate into the Valley and 3 hours 15 minutes on the outbound

runs. The route is 84 miles in one direction or 168 miles round-trip.

Over the last few years, the number of daily runs has remained unchanged, though the season has been

shortened to eliminate service from mid-May to June 21st.

Table 6: Summary of Existing YART Service

41

Service Parameters

Summer Winter

Peak

Summer

Shoulder

Season

Peak

Summer

Shoulder

Season

Summer

Peak

Summer

Shoulder

Season

Winter

Start Date

11-Jun 1-Oct 1-Jul 22-Jun 22-Jun 1-Sep 22-Jun

End Date 30-Sep 10-Jun 31-Aug 30-Jun 31-Aug 30-Sep 11-Sep

Start Date -- -- -- 1-Sep -- -- --

End Date -- -- -- 15-Oct -- -- --

Days per Year 111 254 61 52 70 29 81

1-Way Runs per Day

Weekdays 17 12 4 2 6 2 6 33 21 12

Weekends/Holidays 15 9 4 2 6 2 6 31 19 9

Required # of Buses in Operation

Weekdays 7 5 2 1 3 1 3 15 9 5

Weekends/Holidays 7 4 2 1 3 1 3 15 9 4

Source: LSC

Route

140

120/395

120

Total

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 21

SR 120 East/US 395 Route

Dependent on when Tioga Pass is cleared of snow (at the discretion of the National Park Service), service

is provided between Yosemite Valley and Mammoth Lakes (via Lee Vining and June Lake) seven days a

week from June 22nd to October 15th, with one bus operating prior to July 1 and after Labor Day. The

route stretches a total of 110 miles (or 220 miles per round-trip). Over the last few years, this route has

Table 7: Recent YARTS Sevice Changes

YARTS 2018 SRTP Service Plan Elements Status

Add 140 Route Summer Run (12:50 PM Eastbound,

9:05 PM Westbound)

Not implemented, but the last westbound departure shifted 29

minutes later

Serve Mariposa Fairgrounds Yes - 7 runs per day serve Fairgrounds on request

Extend 395 Route Season (Weekdays June and Sept,

Weekends in October)

Implemented (7 days a week June through October 15)

Streamline the 120/395 Route by Dropping June Lane

Loop Stops, Lee Vining Stops

Implemented (Lee Vining Stops made On Request Only)

Reduce Route 120 Runs to Sonora from 3 to 2, Add 2

Groveland-Valley Round Trips

Not Implemented

Start 120 Route Season on May 1, not May 15

Not Implemented. Service now does not start until June 22.

Eliminate 41 Route Oakdale-Fresno Run Implemented

Combine 41 Route Runs Implemented

Drop The Pines Resort on 41 Route Implemented

Shift Route 41 Runs to Better Serve Amtrak

Not Implemented. Shifting Run 41-5 1 hour 10 minutes later would

provide a good connection from Train 719, but would require

shifting Run 41-6 to depart YNP at 7:10 PM.

Operate 1 Run of 41 Route Staring Mid-April Not Implemented

Drop 41 Route Service After Labor Day

Not Implemented

Other Changes Implemented Since SRTP

140 Summer Westbound earliest AM run now starts at 8:15 AM, not 9:32 AM

New 140 Summer Eastbound run at 6:00 AM

Last 140 Summer Eastbound run shifted later (from 4:30 to 5:45 PM)

New 140 Summer Westbound run at 2:30 PM

140 Summer Westbound afternoon runs ending in Mariposa dropped from 2 (at 3:15 and 4:35) to 1 at 5:15

140 Summer Westbound early AM short run now starts at Midpines, not Mariposa

Early AM runs that previously started in Catheys Valley now start in Merced

New 140 Winter Eastbound Run at 8:45 AM

140 Winter Eastbound Run at 1:20 PM dropped

Last 140 Winter Eastbound Run shifted later from 4:30 PM to 5:25 PM

First 140 Winter Westbound Run shifter earlier from 9:32 AM to 8:20 AM

120 -- No change, except start date shifted later from 1 bus May 14 and 3 buses June 1 to 3 buses all June 22.

140 Winter Westbound Run at 1:20 PM shifted to 2:15 PM

Last 140 Winter Westbound Run shifted earlier from 5:45 PM to 5:05 PM

41 Fresno-Oakhurst and Oakhurst-Fresno runs dropped

41 Service consolidated into 3 full trips per day in each direction, down from 5 in 2017 and 4 in 2018. Now 2 arrivals in late

morning/Noon plus 1 in evening, and 1 departure late morning and 2 late afternoon.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 22

been streamlined to drop service to stops along the June Lake Loop and to make stops in Lee Vining on

request only.

SR 41 Route

This service consists of three roundtrips per day seven days a week, from mid-May through mid-

September, with two runs into Yosemite in the morning and one mid-day, paired with one mid-day

southbound run and two in the late afternoon. All Fresno runs originate at the Fresno Yosemite

International Airport and terminate at the airport if passengers request such. This is the longest route in

the YARTS system, at 111 miles in length and 222 miles per round-trip. The schedule requires up to 3

hours 55 minutes into Yosemite Valley and 3 hours 30 minutes leaving the Valley.

Over the last few years, this service has been reduced in the number of full runs and by dropping runs

between Oakhurst and Fresno. Service off of SR 41 to The Pines Resort has also been dropped, as has

service between mid-May and mid-June.

Summary of Route Service

YARTS routes total 392 miles in length along some of the most challenging rural highways in the nation.

Up to 33 one-way runs are operated per day in summer and 12 in winter. The overall service requires 15

buses to operate the summer schedule (excluding spare buses), nine buses in the shoulder season and 5

in the winter. In comparison with the 10 buses currently owned by YARTS, this indicates that a minimum

of five contractor-provided buses are required to operate the summer schedule, while YARTS buses can

operate the schedule in other seasons.

Summary of YARTS Vehicle-Hours and Vehicle-Miles

Table 8 presents a summary of the vehicle-miles and vehicle-hours by route and by month from January

2019 to September 2020. For the most recent available 12 months, Route 140 comprises roughly 71

percent of YARTS systemwide services. SR 41 Route comes in second with 14 percent of the revenue

hours, followed by SR 120 West Route (9 percent), and SR 120/395 Route (8 percent).

Over the last few years, YARTS overall service levels have been dropping. In total, comparing the 2018

vehicle-hours with the most recent 12 months’ vehicle-hours, service has been reduced by 3,816 vehicle-

hours, or by 33 percent. By route, this change in service levels is as follows:

Route 140: 11-percent reduction

Route 120: 26-percent reduction

Route 395/120: 70-percent increase

Route 41: 66-percent decrease

These shifts are largely due to reduction in runs on Route 140 and Route 41, a reduction in the days of

service on Route 120 and Route 41, and an increase in the days of service on Route 395/120.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 23

Table 8: YARTS 2019 and 2020 Service Quantities by Route and Month

Month

SR 140 SR 120 W. SR 41

SR 120

E/395

TOTAL

% of

Total

SR 140

SR 120

W.

SR 41

SR 120

E/395

TOTAL

% of

Total

2019

January 27,756 0 0 0 27,756 5% 964 0 0 0 964 5%

February 22,243 0 0 0 22,243 4% 773 0 0 0 773 4%

March 27,897 0 0 0 27,897 5% 969 0 0 0 969 5%

April 27,987 0 0 0 27,987 5% 970 0 0 0 970 5%

May 37,099 4,872 12,138 0 54,109 10% 1,249 189 423.3 0 1,860 9%

June 40,950 15,120 21,420 0 77,490 14% 1,361 585 756 0 2,702 14%

July 42,325 15,624 20,560 13,420 91,929 16% 1,407 605 770 445 3,227 16%

August 42,325 15,456 20,774 13,530 92,085 16% 1,406 598 778 449 3,231 16%

September 40,167 5,712 9,856 5,940 61,675 11% 1,337 221 370 197 2,124 11%

October 24,814 0 0 6,820 31,634 6% 831 0 0 226.3 1,057 5%

November 26,058 0 0 0 26,058 5% 875 0 0 0 875 4%

December 27,491 0 0 0 27,491 5% 919 0 0 0 919 5%

Total 387,112 56,784 84,748 39,710 568,354 100% 13,060 2,197 3,097 1,318 19,671 100%

% of Total 68% 10% 15% 7% 100% 66% 11% 16% 7% 100%

2020

January 27,987 0 0 0 27,987 7% 935 0 0 0 935 5%

February 26,634 0 0 0 26,634 7% 891 0 0 0 891 5%

March 23,442 0 0 0 23,442 6% 811 0 0 0 811 4%

April 14,783 0 0 0 14,783 4% 564 0 0 0 564 3%

May 11,966 0 0 0 11,966 3% 493 0 0 0 493 3%

June 31,165 4,536 5,994 1980 43,675 12% 1,081 176 211 65.7 1,532 8%

July 42,637 15,540 20,646 13,640 92,463 24% 1,437 601 725 453 3,217 16%

August 42,361 12,718 20,646 13,640 89,365 24% 1,429 493 725 453 3,101 16%

September 35,203 4,788 3,996 5,060 49,047 13% 1,186 182 185 168 1,721 9%

Total (to date) 256,178 37,582 51,282 34,320 379,362 100% 8,827 1,452 1,847 1,139 13,264 100%

% of Total 68% 10% 14% 9% 100% 67% 11% 14% 9% 100%

Most Recent 12 Months

Total 334,541 37,582 51,282 41,140 464,545 11,452 1,452 1,847 1,365 16,115

% of Total 72% 8% 11% 9% 100% 71% 9% 11% 8% 100%

Revenue Miles by Route

Revenue Hours by Route

Source: MCAG Summary Reports, October 2020

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 24

YARTS Fare Structure

Reflecting the length of the various routes, YARTS has established individual fares for each route and for

each trip origin/destination. These fares are presented in Appendix A: YARTS Fare Structure Tables A-1

through A-5 for each of the individual routes. Full fares are roughly equal to 16 cents per mile on the full

length of the 41 Route and 22 to 24 cents per mile on the other three routes. Round trip fares are offered

at generally twice the one-way fare (no discount). Discounted fares are offered for persons ages 62 and

above, children ages 12 and under, and persons with disabilities. This discount is 44 percent on the SR

140 and SR 120 W. Routes, 58 percent on the SR 41 Route, and only 53 percent on the SR 395/120 Route.

In addition, commuter passes are offered on the SR 140 Route and the SR 41 Route. Monthly passes, 20-

ride passes, and 10-ride passes are all offered. The monthly pass and 20-ride passes are priced identically,

while the 10-ride pass is half the price. These passes provide a 56 percent reduction in the full fare for the

140 Route and a 58 percent reduction for the 41 Route.

Since 2018, full-length base round-trip fares have changed as follows:

• Routes 140 and Route 120: 50-percent increase in regular fare, no change in discounted fare

• Route 395/120: 44-percent increase in regular fare, no change in discounted fare

• Route 41: 13-percent increase in regular fare, no change in discounted fare

CURRENT AND HISTORICAL YARTS RIDERSHIP

Table 9 summarizes annual ridership by route over the past six years. As shown, a total of 102,143

passengers boarded the YARTS system in 2019, reflecting an increase of 13 percent over the previous

year and a slight (1 percent) drop since 2015. By route,

2

the SR 140 Route in 2019 generated 59 percent

of the annual ridership, followed by 15.8 percent on the SR 120 West Route, 8.5 percent on the SR 41

Route, and 6.1 percent on the SR 120 E./US 395 Route. Ridership by route and by year is also shown in

Figure 6 dating back to the year 2000. As shown, ridership has fluctuated most along the SR 140 Route

and the SR 41 Route over the past three years with overall rideship peaking at 127,055 passengers in

2017. It should be noted that while 2020 is included, winter ridership (after September) has not been

included. As of September of 2020, overall ridership has declined by 58.3 percent from the same period

in 2019.

Considering the 2015 to 2019 period (pre-COVID), on a percentage basis the data indicates a dramatic

195 percent increase in ridership on the 120 Route serving Sonora/Tuolumne County. The US 395/120

Route also had a substantial (33 percent) growth in ridership, while the 140 route had a modest (5

percent) growth. On the other hand, the 41 Route ridership dropped by 29 percent, the Amtrak ridership

by 38 percent and the Aramark/NPS Ridership fell by 70 percent.

2

Note that YARTS ridership tracking includes two types of ridership (Amtrak and Aramark/NPS) that are not

summarized by the specific route. These categories represent a relatively small proportion of current ridership (6

percent in total).

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 25

Table 9: YARTS Ridership History by Route

# # # # # % # %

Merced SR 140 Route 57,442 67,184

73,371 51,979 60,305

59.0%

23,734

56% 16% 5%

Mono US 395/ SR 120 E.

Route

4,721 6,740 6,503 5,505 6,279 6.1% 3,909 9% 14% 33%

Sonora SR 120 W. Route 5,472

9,762 16,187 10,654

16,135 15.8%

6,785

16%

51%

195%

Fresno SR 41 Route 12,159 21,496 14,910 8,251 8,636 8.5% 5,895 14% 5% -29%

Amtrak Ridership 11,840

10,528 9,674

8,770 7,336 7.2%

1,082

3%

-16%

-38%

Aramark/NPS Ridership 11,575 9,270 6,410 5,602 3,452 3.4% 1,112 3% -38% -70%

Total 103,209 124,980 127,055 90,761 102,143 42,517

13% -1%

Source: YARTS Ridership Report, 2020

% Change

2020

2015

2016

2017

2018

2019

2018-

19

2015-

19

0

20,000

40,000

60,000

80,000

100,000

120,000

Boardings per Year

Figure 6: YARTS Historic Annual Ridership by Route

Merced 140 Route

Mono 395/ 120 Route

Sonora 120 Route

Fresno 41 Route

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 26

YARTS monthly data can also be used to assess the impact of COVID-19 on ridership. Comparing ridership

for the months of March through September in 2019 with the same months of 2020 indicates that the

overall ridership dropped by 57 percent (45,694 passenger-trips). By route, this drop was as follows:

• 140 Route: 60-percent drop

• 120 Route: 58-percent drop

• 395/120 Route: 30-percent drop

• 41 Route: 32-percent drop

• Amtrak ridership (all routes): 96-percent drop

• NPS/Aramark ridership (all routes): 79-percent drop

The drop in ridership generated through Amtrak ticketing was particularly dramatic; over the seven

months included in the data, only 206 passengers boarded using Amtrak-generated tickets.

Ridership by Season

To allow further analysis of route ridership trends, YARTS ridership data was grouped into three operating

“seasons”: Summer (June, July, August), Shoulder (May, September) and Winter (remainder of the year).

Table 10 presents this data while also summarizing change year-over-year. As indicated, ridership along

all routes have been greatest during the summer months over the past five years, in large part because

this is when the most service has been offered. However, reviewing the ridership by season by route

shows several trends:

• In 2019, more than half of the annual systemwide ridership was carried during the summer season

(52.7 percent), followed by 28.9 percent in winter, and 18.3 percent in the shoulder season.

• The US 395 Route has experienced some decline in total and summer ridership over the past few

years. However, the route ran services through October in 2019, allowing for a 14-percent increase

in ridership over the previous year.

• SR 120 ridership has been steadily increasing over the past five years with the exception of 2018,

which was impacted by the Ferguson Fire.

• SR 41 had been increasing in ridership between 2015 and 2017, however after eliminating winter

service and reducing other services in 2017, ridership has decreased.

Additional data for seasonal ridership is included in graphic form Appendix B: YARTS Ridership Trends,

Figures B-1 to B5.

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 27

Ridership by Passenger Type

Detailed ridership data for Route 140 is tracked for employee (NPS and concessionaire) versus

visitor/other ridership. In addition, starting with the 2007 YARTS-Amtrak agreement, ridership generated

by through Amtrak ticketing has also been tracked. This data is provided in Table 11. A review of this data

indicates the following:

Table 10: YARTS Ridership History by Route and Season

Routes

2015

2016 2017 2018 2019

2020

1

2016 2017

2018

2

2019

2020

1

2015-19

Merced SR 140 Route

Summer 19,286 23,861 27,022 12,189 23,490 12,817 24% 13% -55% 93% -45% 22%

Shoulder 10,276

13,155 14,982 11,195 11,014 2,198 28% 14% -25% -2% -80% 7%

Winter 27,880 30,168 31,367 28,595 25,801 8,719 8% 4% -9% -10% -66% -7%

Total 57,442

67,184 73,371 51,979 60,305 23,734 17% 9% -29% 16% -61% 5%

Mono US 395/ SR 120 E

2016 2017 2018 2019

Summer 4,380 6,046 5,901 4,914 4,378 3,532 38% -2% -17% -11% -19% 0%

Shoulder 341 694 602 591 1,244 377 104% -13% -2% 110% -70% 265%

Winter 0

0 0 0 657 0 - - - - - -

Total 4,721

6,740 6,503 5,505 6,279 3,909 43% -4% -15% 14% -38% 33%

2015 2016 2017 2018 2019

Sonora SR 120 W. Route

Summer 4,487 8,185 13,442 8,190 13,521 6,430 82% 64% -39% 65% -52% 201%

Shoulder 985 1,577 2,745 2,464 2,614 355 60% 74% -10% 6% -86% --

Total 5,472 9,762 16,187 10,654 16,135 6,785 78% 66% -34% 51% -58% --

2015

2016

2017 2018 2019

Fresno SR 41 Route

Summer 5,512 9,809 12,711 6,207 6,781 5,494 78% 30% -51% 9% -19% 23%

Shoulder 1,727 4,571 2,199 2,044 1,855 401 165% -52% -7% -9% -78% 7%

Winter 4,920 7,116 0 0 0 0 45% -100% -- -- -- -100%

Total 12,159 21,496 14,910 8,251 8,636 5,895 77% -31% -45% 5% -32% -29%

YARTS Route Ridership Total

Summer 33,665 47,901 59,076 31,500 48,170 28,273 42% 23% -47% 53% -41% 43%

Shoulder 13,329 19,997 20,528 16,294 16,727 3,331 50% 3% -21% 3% -80% 25%

Winter 32,800 37,284 31,367 28,595 26,458 8,719 14% -16% -9% -7% -67% -19%

Total 79,794 105,182 110,971 76,389 91,355 40,323 32% 6% -31% 20% -56% 14%

Amtrak Ridership

Summer 3,341 2,952 2,791 2,365 2,306 7 -12% -5% -15% -2% -100% -31%

Shoulder 2,253 2,151 2,184 2,086 1,582 0 -5% 2% -4% -24% -- -30%

Winter 6,246 5,425 4,699 4,319 3,448 1,075 -13% -13% -- -- -- -45%

Total 11,840 10,528 9,674 8,770 7,336 1,082 -11% -8% -9% -16% -- -38%

Aramark/NPS Ridership

Summer 3,034 2,855 1,724 1,482 1,230 200 -6% -40% -14% -17% -84% -59%

Shoulder 1,897 1,574 910 954 560 62 -17% -42% 5% -41% -- -70%

Winter 6,644 4,841 3,776 3,166 1,662 850 -27% -22% -- -- -- -75%

Total 11,575 9,270 6,410 5,602 3,452 1,112 -20% -31% -13% -38% -- -70%

All Route Ridership

Summer 40,040 53,708 63,591 35,347 51,706 28,480 34% 18% -44% 46% -45% 29%

Shoulder 17,479 23,722 23,622 19,334 18,869 3,393 36% 0% -18% -2% -82% 8%

Winter 45,690 47,550 39,842 36,080 31,568 10,644 4% -16% -9% -13% -66% -31%

Total 103,209 124,980 127,055 90,761 102,143 42,517 21% 2% -29% 13% -- -1%

Data is summarized by calendar year. Summer is June, July and August; shoulder is May and September; winter is the remainder of months.

Note 1: Through September.

Source: YARTS Ridership Report, 2020

Note 2: External factors affecting ridership include the Ferguson fire (summer 2018), Creek fire (summer 2020) and Covid-19 (beginning March 2020)

Calendar Year

Five Year

Change

Change From Previous Year

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 28

Table 11: Route 140 Ridership History by Type

Summer Shoulder Winter Total Summer Shoulder Winter Total Summer Shoulder Winter Total Summer Shoulder Winter Total

2000 11,856 4,334 4,645 20,835 -- -- -- -- 10,562 3,756 7,204 21,522 22,418 8,090 11,849 42,357

2001 10,741 5,365 12,239 28,345 -- -- -- -- 9,939 4,938 14,347 29,224 20,680 10,303 26,586 57,569

2002 13,484 7,178 15,230 35,892 -- -- -- -- 5,562 3,512 11,726 20,800 19,046 10,690 26,956 56,692

2003 12,755 6,567 15,474 34,796 -- -- -- -- 5,257 3,589 11,120 19,966 18,012 10,156 26,594 54,762

2004 13,386 7,634 14,836 35,856 -- -- -- -- 6,309 3,636 12,079 22,024 19,695 11,270 26,915 57,880

2005 14,927 7,849 15,590 38,366 -- -- -- -- 7,606 3,984 12,790 24,380 22,533 11,833 28,380 62,746

2006 9,035 5,836 16,064 30,935 -- -- -- -- 1,956 1,980 12,743 16,679 10,991 7,816 28,807 47,614

2007 13,390 6,929 15,615 35,934 2,601 821 2,307 5,729 5,330 3,276 11,283 19,889 21,321 11,026 29,205 61,552

2008 17,008 8,532 17,889 43,429 3,735 2,606 6,961 13,302 7,654 3,962 12,024 23,640 28,397 15,100 36,874 80,371

2009 14,876 8,120 17,081 40,077 3,152 2,343 5,567 11,062 7,045 3,829 12,857 23,731 25,073 14,292 35,505 74,870

2010 16,795 9,094 20,740 46,629 3,376 2,541 6,391 12,308 7,566 4,197 12,904 24,667 27,737 15,832 40,035 83,604

2011 19,958 9,932 19,728 49,618 3,685 2,284 5,090 11,059 6,495 4,049 12,740 23,284 30,138 16,265 37,558 83,961

2012 20,562 10,202 23,546 54,310 6,788 2,372 5,306 14,466 6,051 3,876 12,958 22,885 33,401 16,450 41,810 91,661

2013 19,176 11,255 23,376 53,807 3,586 1,880 4,703 10,169 6,101 3,554 9,937 19,592 28,863 16,689 38,016 83,568

2014 20,512 10,661 24,857 56,030 3,851 2,272 5,686 11,809 3,646 2,429 7,807 13,882 28,009 15,362 38,350 81,721

2015 19,286 10,276 27,880 57,442 3,341 2,253 6,246 11,840 3,348 1,897 6,644 11,889 25,975 14,426 40,770 81,171

2016 23,861 13,155 30,168 67,184 2,952 2,151 5,425 10,528 2,855 1,574 4,841 9,270 29,668 16,880 40,434 86,982

2017 27,022 14,982 31,367 73,371 2,791 2,184 4,699 9,674 1,724 910 3,776 6,410 31,537 18,076 39,842 89,455

2018 12,189 11,195 28,595 51,979 2,365 2,086 4,319 8,770 1,482 954 3,166 5,602 16,036 14,235 36,080 66,351

2019 23,490 11,014 25,801 60,305 2,306 1,582 3,448 7,336 1,230 560 1,662 3,452 27,026 13,156 30,911 71,093

2020 12,817 2,198 8,719 23,734 7 0 1,075 1,082 200 62 850 1,112 13,024 2,260 10,644 25,928

Percent of Total

2007 63% 63% 53% 58% 12% 7% 8% 9% 25% 30% 39% 32%

2008 60% 57% 49% 54% 13% 17% 19% 17% 27% 26% 33%

29%

2009 59% 57% 48% 54% 13% 16% 16% 15% 28% 27% 36% 32%

2010 61% 57% 52% 56% 12% 16% 16% 15% 27% 27% 32% 30%

2011 66% 61% 53% 59% 12% 14% 14% 13% 22% 25% 34% 28%

2012 62% 62% 56% 59% 20% 14% 13% 16% 18% 24% 31% 25%

2013 66% 67% 61% 64% 12% 11% 12% 12% 21% 21% 26% 23%

2014 73% 69% 65% 69% 14% 15% 15% 14% 13% 16% 20% 17%

2015 74% 71% 68% 71% 13% 16% 15% 15% 13% 13% 16% 15%

2016 80% 78% 75% 77% 10% 13% 13% 12% 10% 9% 12% 11%

2017 86% 83% 79% 82% 9% 12% 12% 11% 5% 5% 9% 7%

2018 76% 79% 79% 78% 15% 15% 12% 13% 9% 7% 9% 8%

2019 87% 84% 83% 85% 9% 12% 11% 10% 5% 4% 5% 5%

2020 98% 97% 82% 92% 0% 0% 10% 4% 2% 3% 8% 4%

Percent Change over Last 10 and 5 Years

2010-19 40% 21% 24% 29% -100% -100% -53% -81% -96% -98% -92% -94% -39% -80% -64% -58%

2015-19 22% 7% -7% 5% -100% -100% -80% -93% -97% -98% -93% -95% -61% -86% -75% -72%

Source: 2019-2020 VIA Monthly Reports through September 2020

Note 1: Summer includes June, July and

August. Shoulder includes May and

September. Winter includes January to

April and October to December.

Visitor/Other - Non-Amtrak

Visitor - Amtrak

Employees

Total Route 140

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 29

• At the outset of the YARTS program (2000), employees comprised roughly half of the overall

ridership.

• As visitor ridership grew, the proportion of ridership generated by employees declined but in

absolute numbers remained relatively constant until 2012.

• Since 2012, employee ridership has declined dramatically—a 72 percent decline from 22,885 to

6,410 in 2017—a decline that has occurred over all seasons (indicating that this is not a result

solely of seasonal employee commute patterns). Over the last two years, ridership has continued

to decline another 46 percent between 2017 and 2019, from 6,410 to 3,452 employee trips.

This data also provides trends in Amtrak ridership. Overall, Amtrak riders peaked in 2012 at 14,446 and

have since declined by 49 percent to a 2019 figure of 7,336. This decline has largely occurred in the

summer (a 66 percent decline), while off-season and winter Amtrak ridership has dropped by 33.3

percent and 35 percent, respectively.

Ridership by Month

The ridership data from 2019 and 2020 were further analyzed by month, as shown in Table 12, and

depicted in Figures 7 and 8. In 2019, the peak month was July with 18,194, barely edging out August with

17,767. The lowest ridership was 2,774 in February.

During 2020, ridership initially started off with greater ridership in January than the previous year.

Ridership immediately dropped in March due to Covid-19 and has stayed low through June. However,

ridership did rise to 13,100 trips in July (a 28 percent decrease from the previous year).

Ridership by Route by Month and Day

Average ridership for 2019 was also analyzed by month, weekday, and weekend/holiday by service (Table

13 and Figure 9). This data indicates that weekend ridership is typically higher than weekday ridership on

all routes, with ridership relatively close to equal on the 395 Route and relatively more concentrated on

weekends/holidays on the 140 and 120 Routes. Weekend/holiday ridership is highest in July (reflecting

the Fourth of July).

Boarding by Fare Type

The detailed records of passenger boardings by fare type provide a good indication of the type of

passenger and trip purpose on the various routes. This data is included in Appendix B, Tables B-1 to B-4,

and indicates the following:

YARTS Strategic Plan LSC Transportation Consultants, Inc.

Merced County Association of Governments Page 30