2

Blanco County Appraisal District

November 2021

Thank you for taking time to view our 2021 Annual Report. This report is

designed to provide to the taxpayers that we serve, a year-to-year comparison of the

data that the Appraisal District is responsible for. It will also make available to the

public, the results of the performance evaluations and property value studies that have

been conducted by the Texas Comptroller Property Tax Assistance Division.

The Blanco County Appraisal District strives to discover, list and appraise your

property in the most fair and uniform method that is possible and as accurately as

possible. We sincerely hope that this report will help our taxpayers to gain insight into

the daily operations of our office. Our staff has many responsibilities, and we take each

and every one of them very seriously. We are here to serve the taxpayers of Blanco

County to the best of our ability. We will strive to be courteous, efficient, and

professional in our day-to-day operations.

We look forward to being able to continue serving and assisting the taxpayers of

Blanco County in the future.

Sincerely,

Candice Fry

Chief Appraiser

3

The Blanco County Appraisal District Mission

The Texas Property Tax Code outlined in §23.01 and other statutory requirements

complying with generally accepted appraisal standards, procedures, and methodology

in §5.102 govern the practices of the Blanco County Appraisal District. These

requirements ensure equal and uniform taxation while adhering to the highest standards

in appraisal practices and law. At BCAD we strive provide quality service to the public

and the taxing entities that we serve. We work to develop quality employees and keep

up with the newest technology trends to increase work-flow, while adhering to ethical

standards and professionalism. We will work together with taxpayers to provide greater

access to services while reducing costs to the taxing units that we serve.

The Blanco County Appraisal District has a responsibility to safeguard taxpayer dollars

by eliminating waste and providing efficient and honest government.

General Information

Blanco County Appraisal District was created effective January 1, 1980, as a political

subdivision of the state of Texas. The appraisal district board of directors hires the chief

appraiser, sets the budget and appoints appraisal review board members. These

directors do not have authority to set the values on property located within the district.

The chief appraiser is hired to perform this function as well as hiring of staff, legal

duties, administrative duties, and operation of the appraisal district. The board of

directors of the Blanco County Appraisal District is made up od five members. These

directors are appointed by the eligible taxing units as specified in §6.03 of the Texas

Property Tax Code.

BCAD Board Members

Lynn Boyd (Chairman)

David Behrends

Janice Fox

Shelton Coleman

Lanny Counts

4

Entities Served

Fredericksburg ISD

Blanco Pedernales Groundwater District

North Blanco ESD #1

South Blanco ESD #2

City of Blanco

Blanco ISD

City of Johnson City

Johnson City ISD

Blanco County

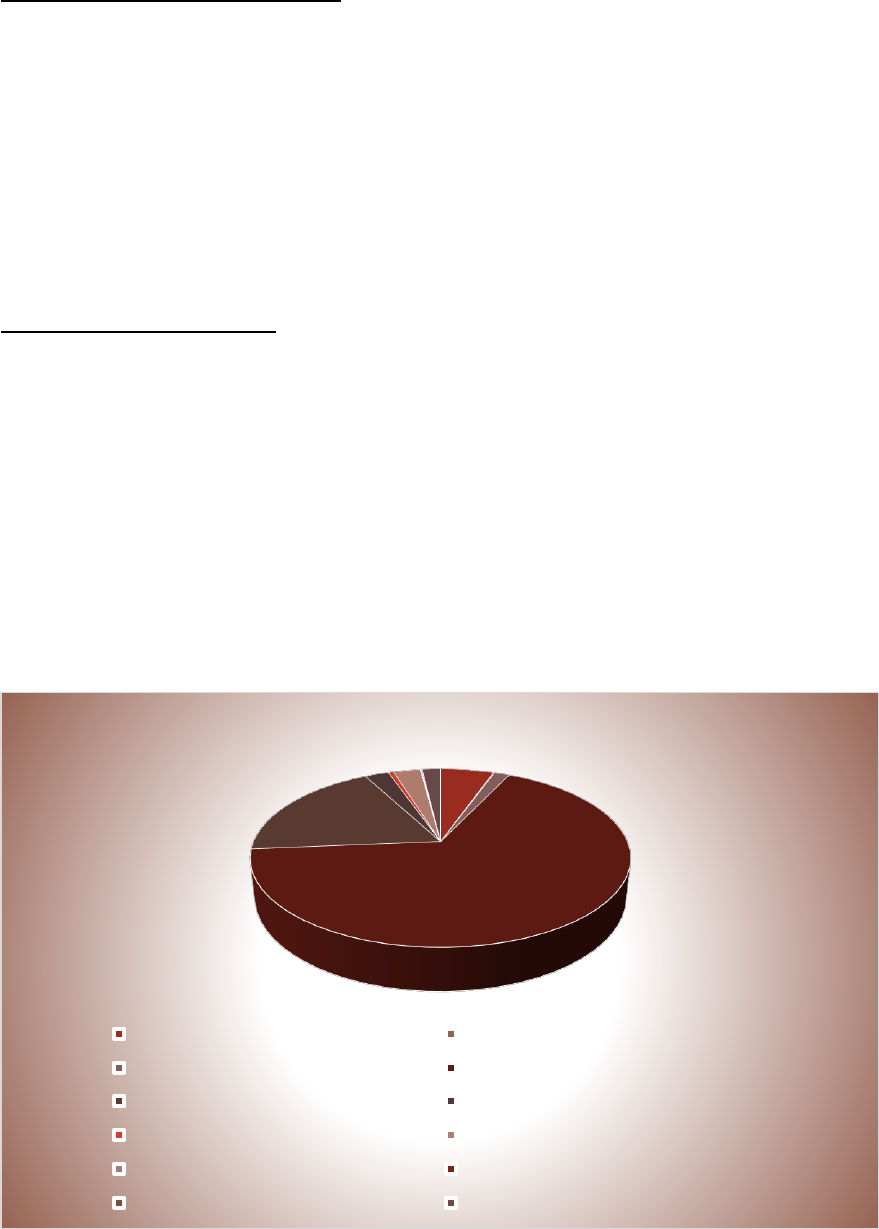

Appraisal District Funding Breakdown

The Blanco County Appraisal District appraises property for parcels located within the

boundaries of Blanco County. The District serves 8 taxing jurisdictions. Exhibit A

shows the prorated allocation of funding for the Blanco County Appraisal District based

on the 2020 budget amount of $695,932 broken down by entity. The largest three

contributors to the 2020 budget are Blanco ISD, Johnson City ISD and Blanco County

respectively.

Exhibit A:

156,087.11

235,990.40

16,698,62

255,969,32

14,448,16

17,415,28

20,032,09

9467.26

2198.76

5

Market Value by State Category

Appraisals carried out by Blanco County Appraisal District are an estimate of market

value as of January 1

st

of each taxing year as defined by §1.04 of the Texas Property

Tax Code on all property located within the boundary of BCAD. These estimates of

value are used to provide each taxing entity with a certified appraisal roll for ad valorem

taxation and establish a base for the tax levies that these entities will assess. For the

2021 appraisal year, the Blanco County Appraisal District provided mass appraisals for

just over 17,000 parcels. The 2021 market value for these properties totaled

$6,978,784,850, an 11.3% increase over the 2020 value overall. Exhibit B will show the

value breakdown per state category for these properties for 2021.

Definition of Market Value

The pricing at which property would transfer for cash or its equivalent under prevailing

market conditions if:

a. Exposed for sale in the open market with a reasonable time for the seller to find a

purchaser;

b. Both the seller and the purchaser know of all of the uses and purposes to which

the property is adapted and for which it is capable of being used and of the

enforceable restrictions on its use; and

c. Both the seller and the purchaser seek to maximize their gains and neither is in a

position to take advantage of the exigencies of the other.

Exhibit B:

2021 Value Per Category

A-Single Family Residence B-Multi Family Residence

C-Vacant Lot D1/D2-Qualified Ag Land & Improvements

E-Non Qualified Land & Improvements F-Commercial/Industrial Real

J-Water,Gas,Electric,Telephone L-Commercial/Industrial Personal Property

M-Mobile Homes O-Residential Lot Inventory

S-Special Inventory X-Exempt Property

6

State Category

Market Value

Taxable Value

Number of Accounts

A-Single Family Residence

390,241,802

368,334,170

1656

B-Multi Family Residence

7,912,913

6,904,265

27

C-Vacant Lot

96,407,497

2274

2352

D1/D2-Qualified Ag Land & Improvements

4,611,092,618

70,082,967

8063

E-Non Qualified Land & Improvements

1,287,580,799

1,113,510,994

5916

F-Commercial/Industrial Real

198,382,916

149,821,323

549

J-Water,Gas,Electric,Telephone

35,938,990

33,811,070

91

L-Commercial/Industrial Personal

Property

184,240,300

168,823,640

716

M-Mobile Homes

5,380,000

164

169

O-Residential Lot Inventory

5,927,920

6,146,110

297

S-Special Inventory

140,690

23,230

4

X-Exempt Property

136,404,900

0

277

Totals

6,841,383,230

2,244,080,877

Overall, the major property use in the Blanco County Appraisal District continues to be

qualified ag land. The County is seeing increases in subdivision development which will

lead to a shift in the trend in the future to more non-qualified ag land, vacant lots and

residential properties.

A-Single Family Residence

B-Multi Family Residence

C-Vacant Lot

D1/D2-Qualified Ag Land & Improvements

E-Non Qualified Land & Improvements

F-Commercial/Industrial Real

J-Water,Gas,Electric,Telephone

L-Commercial/Industrial Personal Property

M-Mobile Homes

O-Residential Lot Inventory

S-Special Inventory

X-Exempt Property

2021 Market Value Vs. Taxable

7

8

Category A & E Average Homestead Value

New Construction/New Improvement Data

The new improvement values come from various category types. These include

residential, multifamily, manufactured homes, real commercial, real industrial and

industrial business personal property. New market value includes mostly new

structures to the land. From a workflow standpoint, if there was a structure not on the

appraisal roll the previous year, when the new structure is added, it is coded as new to

assist with the new value calculations. The table below indicates the increases in the

latest six- year period. As can be seen, the new improvement values are rising

significantly year to year and are anticipated to continue this trend with new subdivisions

and wineries being built each year.

$183,872.00

$198,563.00

$216,559.00

$230,206.00

$254,444.00

$267,667.00

$-

$50,000.00

$100,000.00

$150,000.00

$200,000.00

$250,000.00

$300,000.00

2016 2017 2018 2019 2020 2021

Average Homestead Value Over time

$46,576,919.00

$46,020,081.00

$63,347,731.00

$71,616,929.00

$72,919,341.00

$81,257,718.00

$-

$10,000,000.00

$20,000,000.00

$30,000,000.00

$40,000,000.00

$50,000,000.00

$60,000,000.00

$70,000,000.00

$80,000,000.00

$90,000,000.00

2016 2017 2018 2019 2020 2021

Year to Year New Construction

9

Exemption Data

The population of Blanco County has increased to 11,478 as of the 2020 census This is

an increase of 13.8% compared with a national average of 8.0%. Due to these statistics

and the increased availability of exemption types, Blanco County can anticipate an

increasing number and value of exemptions in the future. Many of these can be

attributed to new legislation and inclusion of certain groups in the exemption criteria.

Some of these are Surviving Spouses of Disabled Veterans and First Responders and a

notable increase in 100% Disabled Veterans. These exemptions and special valuations

can be seen in the chart below. They are displayed as value lost to the taxing entities.

The district has various exemptions that taxpayers may qualify for. Two of these are the

homestead and over 65 residential exemptions. You may only apply for residence

homestead exemption on one property in a tax year. A homestead may include up to 20

acres of land you actually use in the residential use (occupancy) of your home. To

qualify for a homestead exemption, you must own and reside in your home on January

1 of the tax year. The age 65 or older or disability exemption for school taxes includes a

school tax limitation or ceiling. Some taxing units such as county and cities have

exemptions and tax ceilings limits. The filing of this application is between January 1

and April 30. You may file a late homestead exemption if you file it no later than two

years after the date taxes become delinquent. There is also a Transfer of Tax Limitation

or Ceiling Certificate for school taxes if you move out of the county; this can transfer to

the new school district that you reside in. There is the possibility of the homestead

exemption being increased from $25,000 to $40,000 for 2022. This will go before the

voters in the May general election.

$-

$725,170.00

$1,870,430.00

$985,840.00

$2,271,450.00

$535,900.00

$-

$3,782,665.00

$4,488,203.00

$4,143,360.00

$8,080,126.00

$7,988,260.00

$-

$1,241,252.00

$586,465.00

$1,327,131.00

$684,335.00

$777,125.00

$-

$2,000,000.00

$4,000,000.00

$6,000,000.00

$8,000,000.00

$10,000,000.00

$12,000,000.00

2017 2018 2019 2020 2021

Exemption Breakdown by Year

Absolute Exemptions Partial exemption Loss New Ag Loss

10

EXEMPTION DATA

ENTITY

HOMESTEAD

OVER 65 OR DISABLED

BLANCO COUNTY

5,000

5,000

BLANCO ISD

25,000

10,000

JOHNSON CITY ISD

25,000

10,000

CITY OF BLANCO

0

23,000

CITY OF JOHNSON CITY

0

Ceiling

DISABLED VETERANS

AMOUNT

PERCENTAGE

DV1

5,000

10-29%

DV2

7,500

30-49%

DV3

10,000

50-69%

DV4

12,000

70-100%

DVHS

Totally Exempt

100%

2021 Tax Rate Information

2021 TAX RATES FOR BLANCO COUNTY

Blanco County

.3900

Blanco ISD

.9970

City of Blanco

.3503

South Blanco Co Emergency Service District #2

0.1000

Johnson City ISD

1.0659

City of Johnson City

.3990

North Blanco Co Emergency Service District # 1

.1000

Blanco/Pedernales Groundwater Conservation

District

.0221

COMBINATION RATES

Blanco in the City

1.8594

Blanco out of the City

1.5091

Johnson City in the City

1.9770

Johnson City out of the City

1.5780

11

External Reviews-M.A.P.S & P.V.S.-State Comptroller of Public Accounts

Blanco County Appraisal District is audited every other year by the State Comptroller’s

Property Tax Assistance Division (PTAD). These reviews are based on Section 5.10

and 5.102 of the Property Tax Code. These audits are done in an alternating review

cycle. In even numbered years Blanco CAD undergoes the Methods & Assistance

Program (MAP) review and in odd numbered years there is a Property Value Study

(PVS) performed. At this time we are still awaiting the results of the 2021 Property

Value Study.

The MAP review analyzes different areas of the appraisal district. Governance,

taxpayer assistance, and the appraisal standards, operating procedures and the

methodology used by the appraisal district are looked at. The PVS determined the

degree of uniformity and median level of appraised value ratios for certain state

categories for each appraisal district. This study also impacts each school district in

regards to state school funding. The most recent results of each type of study are listed

below.

MAP Results

2018 2020

Governance Meets All Meets All

Taxpayer Assistance Meets All Meets All

Operating Procedures Meets All Meets All

Appraisal Standards, Procedures and Methodology Meets All Meets All

PVS Results

2017 2019

Median Level of Appraisal .99 1.01

Coefficient of Dispersion 9.22 12.96

Appeals Data

For the January 1, 2021 appraisal date, the Blanco County Appraisal District mailed

15,097 notices of appraised value which account for approximately 89% of the appraisal

roll. These notices were mailed April 15, 2021 and property owners and authorized

agents had until May 15, 2021 to file a valid appeal. The Appraisal Review Board began

hearings on May 25, 2021 and finished on July 15, 2021 with the ARB approving the

records and the Chief Appraiser certifying the roll on July 20, 2021. There were a total

of 770 protest filed with 248 of those cases going before the Appraisal Review Board

and 87 cases where property owners did not show up for the hearing. The rest of the

cases were either settled or withdrawn prior to their hearing date and time.

12

Legislative Changes

The 86

th

legislative session was one of the most far reaching and extensive sessions

that the property tax industry has seen in a very long time. With the implementation of

SB2 and HB3, appraisal districts throughout the state had to make the necessary

adjustments to ensure compliance with all of the new statutes and laws. SB2 required

appraisal districts to host and maintain a website for information produced by taxing

units as related to their truth in taxation process. This required that appraisal districts

mail estimated tax information to each property owner by August 7

th

. This was a

learning process as our postcards were not mailed from the vendor timely. The website

implementation was successful and helpful to taxpayers. This year found us with the

87

th

legislative session. There were not a lot of bills that affected appraisal districts in

the first session, but several special sessions were called and there were some new

laws passed. These bills that were passed during the most recent session can be found

at http://www.capitol.state.tx.us and in the appendix to this report.

Moving Forward to 2022

The year of 2021 was trying in many ways for appraisal districts and for many

businesses and government entities. Appraisal districts were still coping with how to

handle COVID-19 and minimize exposure for employees and taxpayers alike. Districts

had to figure out how to operate with employees out due to exposure and illness, but

they did find new and innovative ways to operate. Blanco CAD continued to be fully

staffed for the most part and all of our ARB hearings were held live once again. We had

to endure the big freeze of 2021 when the office was closed for an entire week due to

3412

4202

10,948

10,366

5318

7834

12,435

12,787

11,536

15,097

0

2000

4000

6000

8000

10000

12000

14000

16000

1

History of Appraisal Notices

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

13

freezing temperatures and ice accumulations. The governor declared Texas a disaster

area and appraisal districts were required to inform taxpayers about the new disaster

exemptions that they were eligible for. It is our hopes that 2022 will be virtually COVID

free and you just never know about Texas weather. As mentioned before, appraisal

districts have found new ways to make operations more stream-lined and we hope to

continue to better our service and operations for the taxpayers of Blanco County.

14

APPENDIX

Bills Related to Property Taxation Passed by the 87th Texas Legislature in Regular Session

Provided by LOW SWINNEY EVANS & JAMES, PLLC

Comprehensive, Multi-Subject

HB 988 Rep. Hugh Shine Relating to ad valorem taxation

Sen. Kelly Hancock (see LSEJ section-by-section analysis)

Signed by the Governor on June 15, 2021, Effective

immediately

SB 63 Sen. Jane Nelson Relating to the property tax appraisal system, including an entitlement

to a tax

Rep. Morgan Meyer exemption based on the appraised value of certain renewable energy

devices.

(see LSEJ section-by-section analysis)

Signed by the Governor on June 14, 2021, Effective on

September 1, 2021

Appraisal Office Administration

HB 1118 Rep. Giovanni Capriglione Relating to state agency and local government compliance with

cybersecurity training requirements

Chapters 772 and Sections 2054 and 2056, Government Code, are amended. At least once annually, a local

government (includes appraisal districts) is required to identify employees and elected/appointed officials who have

access to the entity’s computer system or data base and use a computer to perform at least 25% of the person’s

required duties. These employees and officials must complete a certified cybersecurity training program. Failure to

comply will prevent the employee or official from having access to the computer system or data base. Training

compliance must be reported on a specific form. Certain exceptions exist for military leave, FMLA, or other specified

extended leave. The effective date is immediate (signed by the Governor on May 18, 2021).

HB 1476 Rep. Keith Bell Relating to a vendor’s remedies for nonpayment of a contract with this

state of a political subdivision of this state

Section 2251.042, Government Code, is amended. A governmental entity (includes appraisal districts) shall notify a

vendor of an error or disputed amount in an invoice submitted for payment by the vendor not later than the 21st day

after the entity receives the invoice. The notice shall specify the amount of the invoice that is disputed. The

governmental entity may withhold from payment no more than 110% of the disputed amount. The effective date is

September 1, 2021 (signed by the Governor on June 7, 2021).

HB 1560 Rep. Craig Goldman Relating to the continuation and functions of the Texas Department of

Licensing and Regulation (see amendments to Section 1151,

Occupations Code only)

This is the legislation that continues the Texas Department of Licensing and Regulation (TDLR) after review by the

Texas Sunset Commission. Of importance to appraisal districts are the changes to Section 1151.1581, Occupations

Code, dealing with continuing education. The Comptroller of Public Accounts is given full authority for approving these

programs. The effective date is immediate (signed by the Governor on June 15, 2021).

HB 2581 Rep. Kyle Kacal Relating to civil works projects and other projects of governmental

entities

Section 2269, Government Code, is amended. Governmental entities (includes appraisal districts) must follow

evaluation requirements for bids on certain projects (constructing, altering, or repairing a public building).

Documentation about the selection process must be made available to an offeror on request. Not later than the 30th

day after the request is made, the entity shall deliver the documents relating to the evaluation of the submission

15

including, if applicable, its ranking of the submission. Not later than the 7th business day after the contract is awarded,

the entity shall make the evaluations, including any scores, public and provide them to all offerors. The effective date

is September 1, 2021 (signed by the Governor on June 15, 2021).

SB 58 Sen. Judith Zaffirini Relating to purchasing of cloud computing services by a political

subdivision

Section 271.003(8), Local Government Code, is amended to add cloud computing services to the definition of personal

property for purposes of contracting by local governmental entities (includes appraisal districts). The new law is effective

immediately (signed by the Governor on June 3, 2021).

SB 916 Sen. Kel Seliger Relating to certain information regarding appraisal district

noncompliance and property values in the Texas Department of

Licensing and Regulation records of a professional property tax

appraiser serving as chief appraiser

Chapter 1151, Occupations Code, is amended to add a section that requires the Texas Department of Licensing and

Regulation (TDLR) to include electronic links to the findings of the Comptroller of Public Accounts concerning the

biennial reviews of the appraisal districts where the chief appraisers served, as well as the results of the property value

studies, for registrants who are chief appraisers. An appraisal district may request information concerning a registered

professional appraiser whom the board of directors is considering for appointment as chief appraiser. Rules must be

adopted by TDLR to implement this provision. The effective date is September 1, 2021 (signed by the Governor on

June 14, 2021).

Appraisal Issues

HB 1090 Rep. Ernest Bailes Relating to the appraisal for ad valorem tax purposes of real property

that was erroneously omitted from an appraisal roll in a

previous year

Section 25.21(a), Tax Code, is amended to reduce the number of years from five to three that omitted real property

may be added to the appraisal rolls. Omitted personal property may be added as of January 1 of each of the two

preceding tax years. The effective date is September 1, 2021 (signed by the Governor on June 9, 2021).

HB 1475 Rep. John Cyrier Relating to municipal board of adjustment zoning variances

based on unnecessary hardship

Section 211.009, Local Government Code, is amended to provide specific direction to municipal boards of adjustment

regarding zoning and building code compliance. They are permitted to consider the financial costs of compliance,

encroachment on adjacent property, and other factors. The effective date is September 1, 2021 (signed by the

Governor on June 7, 2021).

HB 1939 Rep. Reggie Smith Relating to the limitation periods for certain suits against real estate

appraisers and appraisal firms

Chapter 16, Civil Practices and Remedies Code, is amended to add Section 16.013 to authorize a lawsuit for damages

or other relief arising from an appraisal or appraisal review conducted by a real estate appraiser or appraisal firm, as

defined by Chapter 1103, Occupations Code. The suit must be brought not later than the earlier of two years after the

day the person knew or should have known the facts upon which the action is based or five years after the day the

appraisal or appraisal review was completed. The effective date is September 1, 2021 (signed by the Governor on June

7, 2021). NOTE: This provision deals with fee appraisers, not registered professional appraisers who are employed by

appraisal districts.

HB 2535 Rep. Scott Sanford Relating to the appraisal for ad valorem tax purposes of real property

that includes certain improvements used for the noncommercial

production of food for personal consumption

Section 23.014, Tax Code, is amended to exclude from the value of real property chicken coops or rabbit pens used

for the non-commercial production of food for personal consumption. The effective date is January 1, 2022 (signed by

the Governor on June 15, 2021).

16

HB 3514 Rep. Terry Canales Relating to the functions of the Texas Department of Motor Vehicles;

authorizing a penalty

Amendments to various codes (mainly the Transportation Code) are included in the bill. Chapter 2301, Occupations

Code, is amended to add Section 2301.612 to provide that information filed with the Texas Department of Motor

Vehicles (TDMV) is not a public record and not subject to disclosure under the Public Information Act until a complaint

is resolved in a final order of the Department. Section 23.121, Tax Code, is amended to address motor vehicle inventory

filings with appraisal districts. Chief appraisers are authorized (not required) to report dealers who fail to file declarations

to initiate cancellation of the dealer’s general distinguishing number. The chief appraiser must include written verification

that the chief appraiser informed the dealer of the requirement to file a declaration under this provision of the Tax Code.

If a dealer reports the sale of fewer than five motor vehicles in the prior year, the chief appraiser shall report the dealer

to the TDMV to initiate cancellation of the general distinguishing number and include a copy of the declaration indicating

that the number of sales was fewer than five. This report from the chief appraiser is prima facie ground for cancellation

or for refusal by the TDMV to renew the dealer’s general distinguishing number. The effective date is September 1,

2021 (signed by the Governor on June 4, 2021).

HB 3833 Rep. Phil King Relating to the appraisal of certain real property for ad valorem tax

purposes

Section 23.215, Tax Code, is amended. This section deals with the appraisal of non-exempt property used for low-

income or moderate-income housing. It clarifies that property is eligible if it is owned by an organization for the purpose

of renting to low-income or moderate-income individuals or families and the land is subject to a use restriction

agreement. For property under construction or property that has not reached stabilized occupancy on January 1 of the

tax year, the chief appraiser shall value the property using projected income and expenses for the first full year of

operations as outlined in the underwriting report prepared by the Texas Department of Housing and Community Affairs

and adjusted according to actual occupancy on January 1. After construction is complete and occupancy has stabilized,

the property shall be appraised according to Section 11.1825(q). The effective date is January 1, 2022. Section 23.55

(open-space land), Section 23.58 (loan secured open-space land), Section 23.76 (timber land), Section 23.86

(recreational, park, or scenic land), Section 23.96 (public access airport), and Section 23.9807 (restricted use timber

land), Tax Code, are amended to delete interest on the penalty assessed as a rollback for a change of use of the land.

Interest remains if the tax becomes delinquent. The provisions apply only to a change of use that occurs on or after the

effective date (immediate). The bill was signed by the Governor on June 15, 2021.

HB 3971 Rep. Morgan Meyer Relating to the appraisal for ad valorem tax purposes of residential real

property located in a designated historic district

Section 23.013, Tax Code, amended to add subsection (e) to require that the chief appraiser consider the effect on

value created by restrictions on the owner’s ability to alter, improve, or repair his/her residential real property located in

a designated historic district (defined as an area that is zoned or otherwise designated as a historic district under

municipal, state, or federal law). The effective date is January 1, 2022 (signed by the Governor on June 18, 2021).

HJR 125 Rep. Jake Elizey Proposing a constitutional amendment to allow the surviving spouse of

a person who is disabled to receive a limitation on the school

district ad valorem taxes on the spouse’s residence homestead if the

spouse is 55 years of age or older at the time of the person’s

death

Article VIII, Section 1-b(d), Texas Constitution, is amended to allow the surviving spouse (if at least 55 years of age) of

a disabled person to receive the limitation on school taxes. If the constitutional change is approved, tax assessor-

collectors for schools are required to calculate the taxes for the 2020 and 2021 tax years according to the limitation and

refund taxes to eligible surviving spouses. The proposal was filed with the Secretary of State on May 18, 2021.

SB 113 Sen. Royce West Relating to community land trusts

Section 373B.003, Local Government Code, is amended to expand the types of entities that can hold land in a

community land trust. They are: (1) nonprofit corporations exempt from federal income tax; (2) limited partnerships for

which a nonprofit corporation controls 100% of the general partner interest; or (3) limited liability companies for which

a nonprofit corporation serves as the only member.

Section 23.21, Tax Code, is amended to require the use of the income method of appraisal for land leased to a

community land trust and for housing units leased by community land trusts to families meeting income-eligibility

17

standards. The chief appraiser shall use the method regardless of whether he/she considers that method to be the

most appropriate method. The chief appraiser shall consider the uses and limitations on the property and apply the

same capitalization rate used to appraise other rent-restricted properties. For properties acquired from community

land trusts, the appraised value may not exceed the price for which the housing unit may be sold under land use

restrictions (agreements, deed restrictions, or restrictive covenants that are recorded, have terms of at least 40 years,

restricts sales prices, and restricts sales to families meeting income-eligibility standards established by Section

373B.006, Local Government Code). Section 26.10, Tax Code, is amended to allow an exemption to continue for the

rest of the tax year after eligibility of the community land trust ends under certain circumstances. The effective date of

these amendments is September 1, 2021. The new law applies only to taxes imposed for a tax year that begins

thereafter. The bill was filed with no signature on June 18, 2021.

SB 725 Sen. Charles Schwertner Relating to the qualification of land for appraisal for ad valorem tax

purposes as agricultural land and the liability for the additional tax

imposed on such land if the use of the land changes as a result of a

condemnation

Section 23.46, Tax Code, dealing with the appraisal of agricultural land, is amended to add language that states that

land is not diverted to nonagricultural use for purposes of determining a change of use because a portion is subject to

a right-of-way that is less than 200 feet wide and was taken by condemnation if the remainder of the land qualifies for

special appraisal. If additional taxes are due because land has been diverted due to condemnation, the taxes and

interest are the personal obligation of the condemning entity and not the property owner. These provisions apply to

changes of use and tax years after September 1, 2021 (signed by the Governor on May 18, 2021).

SB 1088 Sen. Brandon Creighton Relating to the duty of the chief appraiser of an appraisal district to

provide certain information

Section 11.50 is added to the Tax Code. It allows a chief appraiser to request from another appraisal district a list of

the names of all individuals who currently receive residence homestead exemptions. No confidentiality provisions apply

to the disclosure to a chief appraiser. The effective date is September 1, 2021. Section 41.413, Tax Code, is amended

to require owners of real property to send to a lessee of the real property (who is required to pay taxes for the property)

a copy of the notice of appraised value. The new law does not apply to personal property owners and lessees. The

new law applies to a notice of appraised value received by an owner after the effective date of September 1, 2021. The

bill was signed by the Governor on June 14, 2021.

SB 1245 Sen. Charles Perry Relating to the farm and ranch survey conducted by the comptroller for

purposes of estimating the productivity value of qualified open-

space land as part of the study of school district taxable values

Section 403.3022 is added to the Government Code to require the Comptroller of Public Accounts to conduct an annual

farm and ranch survey to estimate the productivity value of qualified open-space land as part of the biennial value study

for school districts. Instructional guides are required. Annually, the Comptroller must conduct an online or in-person

session open to the public about how to complete the survey and solicit comments from the public and the property tax

administration advisory board concerning the survey. Not later than January 1, 2022, the Comptroller shall prepare and

issue the instructional guide. The new law is effective on September 1, 2021 (signed by the Governor on June 7, 2021).

SB 1315 Sen. Eddie Lucio Relating to the determination that certain property is used as an aid or

facility incidental to or useful in the operation or development of a port

or waterway or in aid of navigation-related commerce for purposes of

the application of certain ad valorem tax laws

Section 25.07, Tax Code, is amended to add subsection (d) to provide an exclusion from listing certain leased property

in the appraisal records. Property that is used as an aid or facility incidental or useful in the operation of a port or

waterway is excluded. The property (1) must be leased to a person engaged in the business of navigation-related

commerce or specific purposes found in sections of the Water Code; (2) be located adjacent to a federal navigation

project or in a foreign trade zone; or (3) include part of a rail facility that serves the users of the port or waterway.

“Navigation-related commerce” is defined. The new law applies only to the taxation of property for a tax year beginning

on or after September 1, 2021 (signed by the Governor on June 16, 2021).

SB 1421 Sen. Paul Bettencourt Relating to the correction of an ad valorem tax appraisal roll and to

related appraisal records

Section 25.25, Tax Code, is amended to allow for motions by a property owner or chief appraiser to correct appraisal

rolls for two preceding tax years due to an error or omission in a rendition statement or property report filed under

18

Chapter 22. No change may be made if the property owner failed to render timely and was assessed a penalty; the

property was protested under Chapter 41 and a determination was made; the property was the subject of a previous

motion on which action was taken; or the appraised value of the property was established by written agreement. The

effective date is September 1, 2021. Section 41.413, Tax Code, is amended to require owners of real property to send

to a lessee of the real property (who is required to pay taxes for the property) a copy of the notice of appraised value.

The new law does not apply to personal property owners and lessees. The new law applies to a notice of appraised

value received by an owner after the effective date of September 1, 2021. The bill was signed by the Governor on June

14, 2021.

SB 1585 Sen. Bryan Hughes Relating to requirements for the designation of a property as a historic

landmark and the inclusion of a property in a historic district by a municipality

Section 211.0165, Local Government Code, is amended to prohibit cities from including property within the boundaries

of a historic district unless: (1) the owner of the property consents; or (2) if the owner does not consent, the inclusion

of the property in the district is approved by a ¾ vote of the city council and the zoning/planning/historical commission

of the city, if any. If a city has more than one commission, the city shall designate one as the entity with exclusive

authority to approve the designations of property as local historic landmarks and the inclusion of property in a local

historic district. Property owned by a religious organization may also be included in a historic district. This provision

applies to a proposal to include property in a historic district or to designate a property as a local historic landmark

made on or after September 1, 2021 (signed by the Governor on June 7, 2021).

SB 1679 Sen. Carol Alvarado Relating to the creation of an urban land bank by certain municipalities

Chapter 379H is added to the Local Government Code. A land bank is created for a municipality with a population of

2,000,000 or more. The land bank is a governmental unit, as well as a public nonprofit corporation (and therefore

exempt from property taxation). The land bank is specifically not a housing finance corporation or a program created

under Chapters 373 and 374. The land bank is required to comply with the Open Meetings Act and the Public

Information Act. The purpose of the land bank is to acquire, manage, and dispose of vacant, abandoned, deteriorated,

non-revenue generating, and non-tax producing properties and convert them to productive uses. Those uses include

housing, food desert solutions, parks, recreational facilities, and infrastructure development. Provisions are included

concerning the collection of taxes conveyed to the land bank and operational funding. The Houston Land Bank is

authorized to continue its operations. The effective date is September 1, 2021 (filed with no signature on June 16,

2021).

Appraisal Review Boards and Binding Arbitration

HB 2941 Rep. DeWayne Burns Relating to the appointment of appraisal review board members

Section 6.41, Tax Code, is amended to require that appraisal review boards in all counties be appointed by the local

administrative district judge in the county in which the appraisal district is established. Taxpayer liaison officers are

responsible for providing clerical assistance to the judges concerning the selection process (amendment to Section

6.052(f), Tax Code). Restrictions for appraisal review board membership are continued for counties with populations

of 120,000 or more (Section 6.412(d), Tax Code). All appraisal districts are authorized to provide criminal history

information to the administrative district judge under Section 411.1296(c), Government Code. These changes apply to

appraisal review board member terms beginning on January 1, 2022. The new law does not affect the term of a member

serving on December 31, 2021, if the member was appointed before that date to a term beginning before December

31, 2021, and expiring December 31, 2022. The bill was signed by the Governor on June 7, 2021.

HB 3788 Rep. Justin Holland Relating to the training and education of appraisal review board

members

Section 5.041, Tax Code, is amended to authorize distance training and education of appraisal review board members

by the Comptroller of Public Accounts. The Comptroller is authorized to adopt rules to implement this section, including

rules establishing criteria for course availability and for demonstrating course completion. The effective date is January

1, 2022 (signed by the Governor on June 4, 2021).

SB 1854 Sen. Beverly Powell Relating to an appeal through binding arbitration of an appraisal review

board order determining a protest concerning a residence

homestead for which the property owner has elected to defer the

collection of ad valorem taxes

19

Section 41A.10, Tax Code, is amended to clarify that an eligible property owner is not delinquent in paying property

taxes on his/her residence homestead if the taxes are deferred under Section 33.06 or 33.065, Tax Code. This

amendment deals with the eligibility of a property owner to request binding arbitration administered by the Comptroller

of Public Accounts. The new law applies to requests for binding arbitration filed on or after September 1, 2021 (signed

by the Governor on June 18, 2021).

SB 1919 Sen. Eddie Lucio Relating to the authority of a property owner to participate by

videoconference at a protest hearing by certain appraisal review

boards

Section 41.45, Tax Code, is amended to authorize the use of videoconferences of appraisal review board hearings, in

the same manner as telephone conferences are conducted, if requested by a property owner. An appraisal review

board must provide an Internet location or URL address to the property owner. An appraisal review board is not required

to conduct a hearing by videoconference if the board is established for a county with a population of less than 100,000

and lacks the technological capability to conduct a video conference. These provisions only apply to a protest under

Chapter 41, Tax Code, for a notice of protest filed on or after September 1, 2021 (signed by the Governor on June 18,

2021).

Exemptions

HB 115 Rep. Eddie Rodriguez Relating to the exemption from ad valorem taxation of certain property

owned by a charitable organization and used in providing housing

and related services to certain homeless individuals

Section 11.18(p), Tax Code, is amended to change eligibility requirements for exemptions of property used to house

certain homeless persons. The property must be owned by a charitable organization that has been in existence for at

least (1) 20 years in a county with a population for between one million and less than 1.5 million, or (2) two years if

located in a city with a population of more than 100,000 and less than 150,000, at least part of which is located in a

county with a population of less than 5,000. The property must be at least 15 acres in size and was owned by the

organization on July 1, 2021, or acquired by donation and owned by the organization on January 1, 2023. The property

must be used to provide permanent housing for homeless persons. The effective date is January 1, 2022 (signed by

the Governor on June 15, 2021).

HB 368 Rep. Carl Sherman Relating to the issuance of a driver’s license to a state legislator or

prosecutor that includes an alternative to the license holder’s

residence address

Section 521.1211, Transportation Code, is amended to include prosecutors (county attorneys, district attorneys,

criminal district attorneys, assistant county attorneys, assistant district attorneys, and assistant criminal district

attorneys) with peace officers for purposes of permitting alternative addresses on driver’s licenses. The Texas

Department of Public Safety shall accept as an alternative address for a peace officer an address that is in the

municipality or county of the peace officer’s residence or the county of the peace officer’s place of employment. The

Department shall accept as an alternative address for a prosecutor, the address of the office of the prosecutor. Section

63.0101, Election Code, is amended to provide that proof of identification is presented only for the purpose of identifying

a voter and not for verification of residence. The effective date is September 1, 2021 (signed by the Governor on June

18, 2021).

HB 1197 Rep. Will Metcalf Relating to the period for which certain land owned by a religious

organization for the purpose of expanding a place of religious worship

or constructing a new place of religious worship may be exempted

from ad valorem taxation

Section 11.20(j), Tax Code, is amended to extend the time for which land that is contiguous to a religious organization’s

place of regular worship may be exempt from six to ten years. The effective date is January 1, 2022 (signed by the

Governor on June 3, 2021).

HB 3610 Rep. Gervin-Hawkins Relating to the applicability of certain laws to certain public schools and

certain requirements of a charter school that receives certain tax

exemptions

Section 12.1058(a), Education Code, is amended to add to the definition of open-enrollment charter school that it is a

political subdivision for purposes of (1) the property tax exemption under Section 11.11, Tax Code, and (2)

20

purchasing, leasing, constructing, renovating, or improving any property with state funds (Section 12.128, Education

Code) as provided by Section 16.061, Civil Practices and Remedies Code. Section 12.128(a) and (a-1), Education

Code, are amended to state that property purchased or leased with funds received by a charter holder is exempt from

property taxation as public property under Section 11.11, Tax Code. Subsection (a-2) is added to state that the owner

of property that receives a tax exemption shall transfer the amount of tax savings from the exemption to the tenant or

reduce the common area maintenance fee in a proportionate amount based upon the square footage of the exempt

portion.

Section 11.211 is added to the Tax Code. It provides that the portion of real property that is leased to an independent

school district, community college district, or open-enrollment charter school is qualified and exempt from taxation

pursuant to Sections 11.11 and 11.21, Tax Code, if the portion of the real property that is leased to the public school

is (1) used exclusively by the public school for the operation or administration of the school or the performance of

other educational functions of the school; and (2) reasonably necessary for a purpose described in (1) as found by

the school’s governing body. The change in law applies to taxes imposed in a tax year that begins on or after the

effective date (September 1, 2021). The bill was filed without signature on June 18, 2021.

SB 611 Sen. Donna Campbell Relating to an exemption from ad valorem taxation of the residence

homestead of the

(See SJR 35) surviving spouse of a member of the armed services of the United

States who is killed or fatally injured in the line of duty and to late applications

for exemptions from such taxation for disabled members

Section 11.133(b), Tax Code, is amended to add language that surviving spouses of members of the armed services

who are killed or fatally injured in the line of duty are entitled to an exemption from taxation of the total appraised value

of his/her residence homestead if the surviving spouse has not remarried since the death of the member of the armed

services. The effective date is January 1, 2022, if the constitutional amendment is approved. Section 11.431(a), and

Section 11.439(a), Tax Code, are amended to require the chief appraiser to accept residence homestead exemption

applications from persons eligible under Section 11.131 or 11.132 (disabled veterans, but not their surviving spouses)

after the deadline, if they are filed not later than five years after delinquency. The effective date is January 1, 2022

(signed by the Governor on June 14, 2021).

SB 794 Sen. Donna Campbell Relating to eligibility for the exemption from ad valorem taxation of the

residence homestead of a totally disabled veteran

Section 11.131(b), Tax Code, is amended to allow a disabled veteran who has been awarded (rather than received)

100% disability compensation to be eligible for a total residence homestead exemption. The effective date is January

1, 2022 (signed by the Governor on June 16, 2021).

SB 1427 Sen. Paul Bettencourt Relating to the applicability of the temporary exemption from ad valorem

taxation of a portion of the appraised value of certain property

damaged by a disaster

Section 11.35, Tax Code, is amended to clarify that property qualifying for a partial exemption due to a disaster declared

by the governor is only property that has physical damage. The bill provides that the amendment is a clarification of

existing law and does not imply that existing law may be construed as inconsistent with this amendment. The effective

date is immediate (signed by the Governor on June 16, 2021).

SB 1449 Sen. Paul Bettencourt Relating to the exemption from ad valorem taxation of income-producing

tangible personal property having a value of less than a certain amount

Section 11.145, Tax Code, is amended to increase the exemption for tangible personal property held for the production

of income if the property has a taxable value of less than $2,500 (rather than $500). The effective date is January 1,

2022 (signed by the Governor on June 7, 2021).

SJR 35 Sen. Donna Campbell Proposing a constitutional amendment authorizing the legislature to

provide for an

(See SB 611) exemption from ad valorem taxation of all or part of the market value of

the residence homestead of the surviving spouse of a member of

the armed services of the United States who is killed or fatally injured in

the line of duty

21

Article VIII, Section 1-b(m), Texas Constitution, is amended to expand the residence homestead exemption for the

surviving spouse of a member of the armed services who is killed or fatally injured in the line of duty (rather than “in

action”). The proposal was filed with the Secretary of State on May 25, 2021.

Public Information and Records

HB 1082 Rep. Phil King Relating to the availability of personal information of an elected public

officer

Section 552.117(a), Government Code, is amended to expand the protection of home addresses, telephone numbers,

emergency contact information, and social security numbers from disclosure under the Public Information Act to all

elected public officers (rather than just state officers, legislators, and persons elected statewide). Section 25.025(a),

Tax Code, is amended to include all elected public officers in the list of persons for which information may not be

disclosed in appraisal records (rather than just state officers, legislators, and persons elected statewide). The effective

date is immediate (signed by the Governor on May 19, 2021).

HB 1154 Rep. Jacey Jetton Relating to the requirements for meetings held and Internet websites

developed by certain special purpose districts

Section 403.0241, Government Code, is amended to address reporting by special purposes districts to the Comptroller

of Public Accounts if the district does not maintain an Internet website. Section 551.1283, Government Code, is also

amended to address posting of website links to ensure compliance. Section 2051.201 and Section 2051.202,

Government Code, are amended to address information that is required on websites of local governments with authority

to impose ad valorem taxes (referred to as “special purpose districts”). These entities must post certain financial and

operating information, including bonds outstanding, gross receipts from various sources exceeding $250,000, or cash

and temporary investments exceeding $250,000. Contact information is required for certain individuals related to the

districts. Notices of hearings and meetings are required to be posted, as well as minutes of public meetings and the

most recent financial audit for the district. Sections 49.062 and 49.0631, Water Code, are amended to address “rural

area districts” and how they conduct meetings and provide notice of board meetings. The effective date is September

1, 2021 (signed by the Governor on June 15, 2021).

HB 1493 Rep. Abel Herrero Relating to the use of an entity name that falsely implies governmental

affiliation

Chapter 150C is added to the Civil Practices and Remedies Code. The chapter applies to “governmental units,” which

includes all political subdivisions (includes appraisal districts). A governmental unit is entitled to enjoin another person’s

use of an entity name that falsely implies governmental affiliation with the governmental unit. Injunctive relief is

permitted. Awards of attorney’s fees and court costs are authorized. Sections 5.064 and 5.065 are added to the

Business Organizations Code. Businesses are prohibited from filing names that falsely imply governmental affiliation.

The Secretary of State is required to adopt rules to implement these provisions and is authorized to determine whether

a business name falsely implies affiliation on the written request of a governmental entity specifying the basis of the

claim. The Attorney General is authorized to bring an action in the name of the State for injunctive relief to require

compliance with the law. The effective date is September 1, 2021 (signed by the Governor on June 15, 2021).

HB 2723 Rep. Morgan Meyer Relating to public notices of the availability on the Internet of property-

tax-related information

Section 44.004(c), Education Code, is amended to require that notices of meetings to discuss budget and proposed

tax rate adoption by a school district include: “Visit Texas.gov/Property Taxes to find a link to your local property tax

database on which you can easily access information regarding your property taxes, including information, about

proposed tax rates and scheduled public hearings of each entity that taxes your property.”

Section 25.19, Tax Code, is amended to require the following language on notices of appraised value: “Beginning

August 7th, visit Texas.gov/Property Taxes to find a link to your local property tax database on which you can easily

access information regarding your property taxes, including information regarding the amount of taxes that each

entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database

will be updated regularly during August and September as local elected officials propose and adopt the property tax

rates that will determine how much you pay in property taxes.”

Section 26.04(e-2), Tax Code, is amended to change the notice of estimated taxes that must be delivered to all

property owners to include the following statement: “Visit Texas.gov/Property Taxes to find a link to your local

property tax database on which you can easily access information regarding your property taxes, including

22

information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its

proposed tax rate. Your local property tax database will be updated regularly during August and September as local

elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.”

Section 26.052 and Section 26.06, Tax Code, are amended to require public notice as follows: “Visit

Texas.gov/Property Taxes to find a link to your local property tax database on which you can easily access

information regarding your property taxes, including information about proposed tax rates and scheduled public

hearings of each entity that taxes your property.”

Section 26.175 is added to the Tax Code. It establishes a property tax database website (Texas.gov/Property Taxes)

developed and maintained by the Texas Department of Information Resources (DIR). It will provide a separate link to

the Internet location of each property tax database that must be created and maintained by each chief appraiser (see

Section 26.17, Tax Code).

Section 49.236, Water Code, is amended to require the following language on notices of public hearings for tax rates:

“Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access

information regarding your property tax(See SB 611)es, including information about proposed tax rates and

scheduled public hearings of each entity that taxes your property.”

Not later than January 1, 2022, DIR shall develop the Internet website required by this new law. The change in law

apply to notices required to be delivered on or after January 1, 2022. The Act was effective immediately (signed by

the Governor on June 3, 2021).

HB 3786 Rep. Justin Holland Relating to the authority of the comptroller to send, or to require the

submission to the comptroller of, certain ad valorem tax-related

items electronically

Section 5.03, Tax Code, is amended by adding subsection (d) to authorize the Comptroller of Public Accounts to require

documents, payments, notices, reports, or other items to be submitted or sent electronically. The Comptroller is

authorized to adopt rules to administer this subsection. The effective date is September 1, 2021 (signed by the Governor

on June 4, 2021).

SB 56 Sen. Judith Zaffirini Relating to the availability of personal information of a current or former

federal prosecutor or public defender

Chapter 552, Government Code, is amended to exclude home addresses, telephone numbers, emergency contact

information, or social security numbers from disclosure under the Public Information Act for current or former United

States attorneys, assistant United States attorneys, federal public defenders, deputy federal public defenders, or

assistant federal public defenders and their spouses and children. The effective date is immediate (signed by the

Governor on June 14, 2021).

SB 334 Sen. Nathan Johnson Relating to disclosure under the public information law of certain

records of an appraisal district

Section 552.149(b), Government Code, is amended to permit the disclosure of information that the chief appraiser used

to appraise property, including comparable sales data, to a property owner or agent (on request) in a binding arbitration

proceeding (as well as an appraisal review board hearing). Section 552.149(e), Tax Code, that prevented disclosure

of sales data in counties with populations below 50,000, is repealed. The effective date is immediate (signed by the

Governor on June 14, 2021).

SB 841 Sen. Bryan Hughes Relating to the availability of personal information of individuals who are

honorably retired from certain law enforcement positions

Section 552.003, Government Code, and Section 25.025, Tax Code, are amended by adding a definition for “honorably

retired” to mean a person who previously served but is not currently serving in the position; did not retire in lieu of a

disciplinary action; was eligible to retire or ineligible only due an injury received in the course of employment; and is

eligible to receive a pension or annuity for service. The term applies to peace officers and security officers as defined

by the Code of Criminal Procedure or Education Code, as applicable. The home addresses, telephone numbers,

emergency contact information, and social security numbers for these individuals are exempt from disclosure under the

Public Information Act. Section 552.1175, Government Code, is amended is add “current or honorably retired” peace

officers, county jailers, police officers, and inspectors of the United States Federal Protective Services to the list for

which the section is applicable. Section 25.025(a), Tax Code, is amended to add “current or honorably retired” county

23

jailers, police officers, and inspectors of the United States Federal Protective Services to the list of persons for which

information may not be disclosed in appraisal records. The effective date is immediate (signed by the Governor on

June 14, 2021).

SB 1134 Sen. Bryan Hughes Relating to address confidentiality on certain documents for certain

federal officials and family members of certain federal officials or

federal or state court judges

Section 13.0021, Election Code, is amended to add federal bankruptcy judges, United States marshals, and United

States attorneys to the list of judges and the county registrar whose residence addresses are omitted from the voter

registration list. They (as well as their family members defined as spouses, minor children, and adult children who

reside in the person’s home) are also included in the list of persons whose addresses are confidential (Section

13.004, Election Code). Section 15.0215 and Section 254.0313, Election Code, are amended to omit addresses for

the same individuals and their family members. Section 411.179, Government Code, is amended to require that

handgun licenses for the same individuals omit residence addresses. Section 552.117, Government Code, excepts

from disclosure under the Public Information Act the home addresses, telephone numbers, emergency contact

information, and social security numbers for the same individuals. Similar exclusions exist under Section 145.007 and

Section 159.071, Local Government Code, dealing with municipal court judges and county attorneys, and Section

521.054 and Section 521.121, Transportation Code, dealing with drivers’ licenses. Section 11.008, Property Code, is

amended to add the same individuals to online databases maintained in property records in counties. Section

25.025(a), Tax Code, is amended to add the same individuals to the list of persons for which information may not be

disclosed in appraisal records. The effective date of all sections is September 1, 2021 (signed by the Governor on

June 7, 2021).

SB 1225 Sen. Joan Huffman Relating to the authority of a governmental body impacted by a

catastrophe to temporarily suspend the requirements of the public

information law

Section 552.233, Government Code, is amended to include in the definition of “catastrophe” the following: “

‘Catastrophe’ does not mean a period when staff is required to work remotely and can access information responsive

to an application for information electronically, but the physical office of the governmental body is closed.” A

governmental body may suspend the requirements of the Public Information Act only once for each catastrophe. The

exception applies if the governmental body is significantly impacted such that the catastrophe directly causes the

inability of a governmental body to comply with the Act. The total suspension period for a governmental body may not

exceed a total of 14 consecutive calendar days with respect to any single catastrophe. If a governmental body closes

its physical offices, but requires staff to work, including remotely, then the governmental body shall make a good faith

effort to continue responding to applications for public information, to the extent staff members have access to

responsive information. Failure to respond to requests may constitute refusal to request an attorney general’s decision

or a refusal to supply information that the attorney general has determined is public. The effective date is September

1, 2021 (signed by the Governor on May 28, 2021).

SB 1257 Sen. Brian Birdwell Relating to the information required to be provided by the chief appraiser

to the comptroller in connection with the comptroller’s central registry

of reinvestment zones designated and ad valorem tax

abatement agreements executed under the Property Redevelopment

and Tax Abatement Act

Section 312.005, Tax Code, is amended to require that the Comptroller of Public Accounts include in the central registry

of reinvestment zones the information described by Section 312.205(a)(1) in connection with each tax abatement

agreement (the kind, number, and location of all proposed improvements to the property). The effective date is

September 1, 2021 (signed by the Governor on June 7, 2021).

Tax Collection and Rates

HB 295 Rep. Andrew Murr Relating to the provision of funding for indigent defense services

Section 79.037(a), Government Code, is amended to provide for services for indigent defense in counties. Section

26.0442(a), Tax Code, is amended to change the definition of “indigent defense compensation expenditures” for

purposes of truth-in-taxation calculations. It means the difference between (1) the amount paid by a county in the

period beginning on July 1 of the tax year preceding the tax year for which the tax is adopted and ending on June 30

of the tax year for which the tax is adopted (to include operations of the public defender’s office) and (2) the amount

24

of any state grants received by the county during that period for those purposes. The effective date of the bill is

September 1, 2021 (signed by the Governor on June 14, 2021).

HB 533 Rep. Hugh Shine Relating to ad valorem tax sales of personalproperty seize under a tax

warrant

Section 33.25, Tax Code, is amended to permit public on-line auctions of personal property seized for delinquent

property taxes in all counties. The effective date is September 1, 2021 (signed by the Governor on May 19, 2021).

HB 1410 Rep. Jim Murphy Relating to the issuance of bonds by certain conservation and

reclamation districts

Section 49.4645, Water Code, adds subsection (a-1) to provide for bonding authority for specific conservation and

reclamation district to finance parks and recreational facilities (excluding indoor or outdoor swimming pools or golf

courses). The outstanding principal amount of bonds, notes, and other obligations may not exceed an amount equal to

1% but not exceed 3% of the value of the taxable property in the district or, if supported by contract taxes, the value of

the taxable property in the districts making payments under the contract (with certain restrictions related to debt ratio

and credit rating). Section 54.016(e), Water Code, is amended to change the restrictions for bond issuance that may

be imposed by a city on a water district. This change does not affect the terms of a city’s resolution or ordinance adopted

before the effective date of the new law. The effective date is September 1, 2021 (filed with no signature on June 14,

2021).

HB 1428 Rep. Dan Huberty Relating to procurement by a political subdivision of a contingent fee

contract for legal services

Section 2254.102, Government Code, is amended to exclude from review by the Attorney General contracts for legal

services entered by political subdivisions for the collection of an obligation that is delinquent or for certain services. For

purposes of this provision, an obligation does not include a fine or penalty that results from an action by a political

subdivision under Chapter 7, Water Code. The effective date is September 1, 2021 (signed by the Governor on May

15, 2021).

HB 1564 Rep. Mary Gonzalez Relating to the appointment of a receivership for and disposition of

certain platted lots that are abandoned, unoccupied, and

undeveloped in certain counties

Chapter 232 is added to the Local Government Code to deal with abandoned, unoccupied, and undeveloped platted

lots in counties with populations of more than 800,000 which are adjacent to an international border and contains more

than 30,000 acres of lots that have remained substantially undeveloped for more than 25 years after the date the lots

were platted. The county commissioners court may implement an expedited process to administratively determine that

a platted lot is abandoned, unoccupied, and underdeveloped under certain conditions. The county does not have

ownership interest in any lot (except for other legal interests under other provisions of law). Notices and public hearings

are required. Judicial appeal is authorized. Once a lot is determined to be abandoned, unoccupied, and undeveloped,

the county shall bring a civil action to have the lot placed in receivership. The appointed receiver is an officer of the

court and has specific responsibilities and powers. The lots may be sold according to procedures outlined in the new

law. If the procedures are followed and the property sells, the sale price is conclusive as to the fair market value of the

property at the time of sale. The effective date is September 1, 2021 (filed without signature on June 18, 2021).

HB 1869 Rep. Dustin Burrows Relating to the definition of debt for the purposes of calculating certain

ad valorem tax rates of a taxing unit

Section 26.012, Tax Code, is amended to change the definition of “debt” for purposes of tax rate calculations. It means

a bond, warrant, certificate of obligation, or other evidence of indebtedness owed by a taxing unit that is payable from

property taxes for a period of over one year and meets one of the following requirements: (1) has been approved at an

election; (2) includes self-supporting debt; (3) evidences a loan under a state or federal financial assistance program;

(4) is issued for designated infrastructure; (5) is a refunding bond; (6) is issued in response to an emergency; (7) is

issued for renovating, improving or equipping existing buildings or facilities; (8) is issued for vehicles or equipment; or

(9) is issued for a project under certain provisions related to reinvestment zones. “Debt” also means a payment made

under a contract to secure indebtedness issued by another political subdivision on behalf of the taxing unit. “Designated

infrastructure” is defined as a facility, equipment, rights-of-way, or land for one of seven purposes. “Refunding bond”

and “self-supporting debt” are defined. The changes in law apply only to a bond, warrant, certificate of obligation, or

other evidence of indebtedness for which the ordinance, order, or resolution authorizing the issuance is adopted by the

25

governing body of the taxing unit on or after the effective date of September 1, 2021 (signed by the Governor on June

15, 2021).

HB 1900 Rep. Craig Goldman Relating to municipalities and counties that adopt budgets that defund

law enforcement agencies

Chapter 109 is added to the Local Government Code to provide for “defunding determinations” for municipalities that

reduce budgets for police departments. Chapter 43 is also amended to allow portions of a municipality to deannex if

determinations of defunding exist. Sections 26.0444 and 26.0501 are added to the Tax Code to provide for adjustments

in tax rate calculations for defunding municipalities. These adjustments would limit tax rate increases. Part of the

provisions apply to the 2021 tax year rate calculations. Other changes are included in the bill. The effective date is

September 1, 2021 (signed by the Governor on June 1, 2021).

HB 2429 Rep. Morgan Meyer Relating to the alternate provisions for ad valorem tax rate notices when

the de minimis rate of a taxing unit exceeds the voter-approval tax

rate

Section 26.063, Tax Code, is amended to add subsection (d) to change the notice used by a taxing unit that is not

required to hold an election under Section 26.07 and for which no petition for an election can be made under Section

26.075. The notice shall add to the end of the list of rates included in the notice: “de minimis rate--$ ______ per $100.”

The definition of “voter-approval tax rate” is changed and additional and substitute language is required. The effective

date is September 1, 2021 (signed by the Governor on May 15, 2021).

HB 3115 Rep. Hugh Shine Relating to the release of a judgment lien on homestead property

Section 52.0012 of the Property Code is amended to require a certificate of mailing by a judgment debtor indicating

notice to a judgment creditor concerning a release of lien on a homestead property. The exact language of the certificate

of mailing is prescribed in the statute. The effective date is immediate (signed by the Governor on June 16, 2021).

HB 3629 Rep. Greg Bonnen Relating to the date a deferral or abatement of the collection of ad

valorem taxes on the residence homestead of an elderly or disabled

person or disabled veteran expires

Section 33.06, Tax Code, is amended to require that a foreclosure sale for delinquent property taxes may not be held

for property that was subject to a deferral until the 181st day after the date the collector for the taxing unit delivers a

notice of delinquency of the taxes following the date the individual no longer owns and occupies the residence

homestead. The same requirement is added when property is subject to an abatement of a pending delinquent tax suit.

If an individual who qualifies for a deferral or abatement dies, the deferral or abatement continues in effect until the

181st day after the date the collector for the taxing unit delivers a notice of delinquency of the taxes following the date

the surviving spouse of the individual no longer owns and occupies the property as a residence homestead under

certain conditions. The effective date is September 1, 2021 (signed by the Governor on June 8, 2021).

HJR 99 Rep. Terry Canales Proposing a constitutional amendment authorizing a county to finance

the development or redevelopment of unproductive,

underdeveloped, or blighted areas in the county; authorizing the

issuance of bonds and notes

Article VIII, Section 1-g(b), Texas Constitution, is amended to allow counties (along with municipalities) to issue bonds

or notes for developing blighted areas and for transportation improvements under general law, except that the

transportation bonds may not be pledged for repayment at an amount of more than 65% of the increase in property tax

revenues annually or be used to finance construction, operation, maintenance, or acquisition of rights-of-way for toll

roads. The proposal was filed with the Secretary of State on June 1, 2021.

SB 23 Sen. Joan Huffman Relating to an election to approve a reduction or reallocation of funding

or resources for certain county law enforcement agencies

Chapter 120 is added to the Local Government Code to require an election to approve a budget reduction or reallocation

of funding for county law enforcement. Certain exceptions are included in the bill, including one for disasters. The

Comptroller of Public Accounts is responsible for making determinations of budget reductions or reallocations. If a

determination is made, a county may not adopt a tax rate that exceeds the county’s no-new-revenue tax rate under a

specific timeline.

26

The effective date is January 1, 2022 (signed by the Governor on June 1, 2021).

SB 604 Sen. Paul Bettencourt Relating to bonds issued by and the dissolution of municipal

management districts

Chapter 375 of the Local Government Code is amended to allow municipal management districts to exist after a petition

for dissolution is filed for the purpose of winding up district operations and discharging bonded indebtedness. This

provision does not apply if the indebtedness is secured by a source other than assessments on the date the petition is

filed with the district board. The effective date is September 1, 2021 (signed by the Governor on June 14, 2021).

SB 742 Sen. Brian Birdwell Relating to installment payments of ad valorem taxes on property in a

disaster area or emergency area

Section 31.032, Tax Code, is amended and Section 31.033, Tax Code, is added to permit installment payments of

property taxes in emergency areas. They are defined as areas designated by the governor to be affected by an

emergency as defined by Section 433.001, Government Code (a riot or unlawful assembly of three or more persons

acting together to use force or violence; if a clear and present danger of the use of violence exists; or a natural or man-

made disaster). The new law applies only to real property that is owned or leased by a business entity with gross