1

Guidelines for Garnishment

of Accounts Containing

Federal Benefit Payments

In accordance with Title 31 of the Code of

Federal Regulations, Part 212

Note: Appendix 1 shows the list of federal benefit payments protected under the regulation and the

respective ACH Batch Header Record descriptions and garnishment exemption identifiers

March 2020

2

Table of Contents

Sections

A.

Purpose and Authority ..................................................................................................................................... 3

B.

Effective Date .................................................................................................................................................. 3

C.

Scope ............................................................................................................................................................... 3

D.

Key Definitions from 31 CFR part 212 ........................................................................................................... 4

E.

Identifying Federal Benefit Payments ............................................................................................................. 5

F.

Initial Action Upon Receipt of Garnishment Order ........................................................................................ 6

G.

Account Review .............................................................................................................................................. 7

H.

Protected Amount ............................................................................................................................................ 8

I.

Notice to Account Holder ............................................................................................................................... 9

J.

Other Requirements ...................................................................................................................................... 11

Appendix 1: Federal Benefit Payments That Are Protected Under the Regulation .............................................. 12

Appendix 2: Sample Form of Notice of Right to Garnish Benefits ...................................................................... 14

Appendix 3: Model Notice of Garnishment to Account Holder ........................................................................... 15

Appendix 4: Examples of Lookback Period and Protected Amount ..................................................................... 18

3

A.

Purpose and Authority

These guidelines are for use by financial institutions when a garnishment order is

received for an account into which federal benefit payments have been directly

deposited. Financial institutions that receive a garnishment order are required to

determine the sum of protected federal benefits deposited to the account during a two-

month period, and to ensure that the account holder has access to an amount equal to that

sum or to the current balance of the account, whichever is lower. This document will be

updated, as necessary, and eventually be published as a new chapter in the Department

of the Treasury (Treasury)/Bureau of the Fiscal Service’s (Fiscal Service) Green Book, A

Guide to Federal Government Automated Clearing House (ACH) Payments.

The authority for these guidelines is Title 31 of the Code of Federal Regulations, part 212

(31 CFR part 212), and the several statutory authorities listed therein. Please refer to that

part of the CFR itself for more detailed regulatory and compliance language and

stipulations.

B.

Effective Date

On May 29, 2013, Treasury published a final rule amending 31 CFR part 212 (found at

78 Fed. Reg. 32099). This Final Rule, effective on June 28, 2013, amended 31 CFR part

212 which had originally been promulgated as an Interim Final Rule with Request for

Comment that was effective on May 1, 2011. As of that date, financial institutions

became subject to the requirements of 31 CFR part 212 and were required to take certain

actions upon receipt of garnishment orders. Treasury’s encoding of ACH payments

enabled financial institutions to identify federal benefit payments subject to the

requirements of 31 CFR part 212. Benefit payments are sent to financial institutions

under the following ACH Standard Entry Class Codes: 1) Prearranged Payment and

Deposit (PPD) entries; and 2) Corporate Credit or Debit (CCD) entries.

C.

Scope

These guidelines apply to the following federal programs:

• Social Security and Supplemental Security Income benefits administered by the

Social Security Administration,

• Veterans benefits administered by the Department of Veterans Affairs,

• Federal Railroad retirement unemployment and sickness benefits administered by

the Railroad Retirement Board, and

• Civil Service Retirement System and Federal Employee Retirement System

benefits administered by the Office of Personnel Management.

In addition, these guidelines apply only to federal benefits paid electronically via the

4

ACH. Financial institutions are not responsible for examining accounts to identify

federal benefits paid by Treasury check.

D.

Key Definitions from 31 CFR part 212

The following definitions apply:

Account means an account, including a master account or sub account, at a financial

institution and to which an electronic payment may be directly routed.

Account holder means a natural person against whom a garnishment order is issued and

whose name appears in a financial institution’s records as the direct or beneficial owner

of an account.

Account review means the process of examining deposits in an account to determine if a

benefit agency has deposited a benefit payment into the account during the lookback

period.

Benefit agency means the Social Security Administration (SSA), the Department of

Veterans Affairs (VA), the Office of Personnel Management (OPM), or the Railroad

Retirement Board (RRB).

Benefit payment means a federal benefit payment paid by direct deposit to an account

with the character “XX” encoded in positions 54 and 55 of the Company Entry

Description field and the number “2” encoded in the Originator Status field, both in the

Batch Header Record of the direct deposit entry.

Financial institution means a bank, savings association, credit union, or other entity

chartered under federal or state law to engage in the business of banking.

Freeze or account freeze means an action by a financial institution to seize, withhold, or

preserve funds, or to otherwise prevent an account holder from drawing on or transacting

against funds in an account, in response to a garnishment order.

Garnish or garnishment means execution, levy, attachment, garnishment, or other

legal process.

Garnishment fee means any service or legal processing fee, charged by a financial

institution to an account holder, for processing a garnishment order or any associated

withholding or release of funds.

Garnishment order or order means a writ, order, notice, summons, judgment, levy or

similar written instruction issued by a court, a state or state agency, a municipality or

municipal corporation or a state child support enforcement agency, including a lien

arising by operation of law for overdue child support or an order to freeze the assets in an

account, to effect a garnishment against a debtor.

5

Lookback period means the two-month period that (i) begins on the date preceding the

date of account review and (ii) ends on the corresponding date of the month two months

earlier, or on the last date of the month two months earlier if the corresponding date does

not exist (e.g. June 31

st

). Examples illustrating the application of this definition are

included in Appendix 4.

Protected amount means the lesser of (i) the sum of all benefit payments posted to an

account between the close of business on the beginning date of the lookback period and

the open of business on the ending date of the lookback period, or (ii) the balance in an

account when the account review is performed. Examples illustrating the application of

this definition are included in Appendix 4.

State means a state of the United States, the District of Columbia, the Commonwealth

of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa,

Guam, or the United States Virgin Islands.

State child support enforcement agency means the single and separate organizational

unit in a state that has the responsibility for administering or supervising the state's plan

for child and spousal support pursuant to Title IV, Part D, of the Social Security Act, 42

U.S.C. 654.

United States means 1) A federal corporation, (2) An agency, department, commission,

board, or other entity of the United States, or (3) An instrumentality of the United

States, as set forth in 28 U.S.C. 3002(15).

E.

Identifying Federal Benefit Payments

Treasury/Fiscal Service will encode an “XX” in Positions 54-55 of the “Company Entry

Description” Field and a “2” in the “Originator Status Code” Field of the Batch Header

Record for ACH/PPD and ACH/CCD payments that are designated as federal benefit

payments that are exempt from garnishment. This encoding will allow financial

institutions to determine whether a federal direct deposit payment is an exempt federal

benefit payment. Financial institutions may rely on the presence of an “XX” encoded in

Positions 54-55 of the “Company Entry Description” Field and a “2” in the “Originator

Status Code” Field of the Batch Header Record of a direct deposit entry to identify a

federal benefit payment exempt from garnishment.

EXAMPLES:

Benefit Payment Type

Company Entry

Description (Positions

54-63) – Prior to the

Garnishment Rule

Company Entry

Description (Positions

54-63) – With the

Garnishment Rule

Social Security

SOC SEC

XXSOC SEC

Supplemental Security

Income

SUPP SEC

XXSUPP SEC

Railroad Retirement

RR RET

XXRR RET

6

Because it is possible that a commercial payment could also have an “XX” encoded in

Positions 54-55, financial institutions must verify that the payment is a federal payment.

This can be confirmed either by searching for a “2” in the “Originator Status Code” Field

in the Batch Header Record (Position 79) OR by reviewing the description of the

payment in the ACH Batch Header Record Company Entry Description to ensure that the

payment is one of the exempt federal Benefit Types shown in Appendix 1.

F.

Initial Action Upon Receipt of Garnishment Order

1.

Examination: Prior to taking any action related to a garnishment order

against an account, but no later than two business days following receipt of the

order, a financial institution shall examine the order to determine if the United

States or a State child support agency has attached or included a Notice of Right

to Garnish Federal Benefits.

2.

Notice of Right to Garnish is Attached or Included: If a Notice of Right to

Garnish Federal Benefits is attached or included with the garnishment order, then

the financial institution shall follow its otherwise customary procedures for

handling a garnishment order and shall STOP. Do NOT continue with the

following procedures.

3.

No Notice of Right to Garnish: If a Notice of Right to Garnish Federal

Benefits is NOT attached or included with the garnishment order, then the

financial institution shall GO forward and continue as follows.

See Appendix 2 for an example of the Notice of Right to Garnish Federal

Benefits.

7

G.

Account Review

The financial institution shall proceed to performing an account review as

follows:

1. Timing: No later than two business days following receipt of: a) the order,

and b) sufficient information from the creditor that initiated the order to

determine whether the debtor is an account holder, if such information is not

already in the order.

-OR-

In cases where the financial institution is served a batch of a large number of

orders, by a later date that may be permitted by the creditor that initiated the

orders, consistent with the terms of the orders. The financial institution shall

maintain records on such batches and creditor permissions.

2.

Lookback Period: This is a two-month period that (i) begins on the date

preceding the date of account review and (ii) ends on the corresponding date of

the month two months earlier, or on the last date of the month two months earlier

if the corresponding date does not exist. See Appendix 4 for examples of how to

determine the lookback period.

3.

Applying uniform account review: The financial institution shall perform an

account review without consideration for any other attributes of the account or

garnishment order, including but not limited to:

a. the presence of other funds, from whatever source, that may be

commingled in the account with funds from a benefit payment,

b. the existence of a co-owner on the account,

c. the existence of benefit payments to multiple beneficiaries, and/or under

multiple programs, deposited in the account,

d. the balance in the account, provided the balance is above zero dollars on

the date of the account review,

e. instructions to the contrary in the order, or

f. the nature of the debt or obligation underlying the order.

4.

Priority of Account Review: The financial institution shall perform the

account review prior to taking any other actions related to the garnishment order

that may affect funds in the account.

8

5.

Separate account reviews: The financial institution shall perform the account

review separately for each account in the name of an account holder against

whom a garnishment order has been issued. In performing the account reviews

for multiple accounts in the name of one account holder, a financial institution

shall not trace the movement of funds between accounts by attempting to

associate funds from a benefit payment deposited into one account with amounts

subsequently transferred to another account.

For example, a $500 SSA benefit payment is deposited into the account holder’s

deposit account (Account A). On the same day, the account holder transfers

$300 of the $500 to another account in his/her name (Account B) at the same

financial institution. The next day, a garnishment order against the account

holder is received. The financial institution will be required to conduct separate

account reviews for Account A and Account B. The $500 will be included in the

protected amount that is established for Account A. However, the $300 that was

transferred to Account B will not be included in calculating the protected

amount for Account B.

H.

Protected Amount

1.

No benefit payment deposited during the lookback period: If the account

review shows that no benefit payment was directly deposited during the

lookback period, then the financial institution shall STOP and follow its

customary procedures for handling the garnishment order.

2.

Benefit payment deposited during the lookback period. If the account

review shows that a benefit payment was deposited, then the financial institution

will GO forward and immediately calculate and establish the protected amount

for the account.

The protected amount is the lesser of (i) the sum of all benefit payments posted

to an account between the close of business on the beginning date of the

lookback period and the open of business on the ending date of the lookback

period, or (ii) the balance in an account when the account review is performed.

See Appendix 4 for examples of how to calculate the protected amount.

The financial institution shall ensure that the account holder has access to the

protected amount, which the financial institution shall NOT freeze in response to

the garnishment order.

An account holder shall have no obligation to claim any garnishment exemption

prior to accessing the protected amount.

9

3.

Separate protected amounts: The financial institution shall calculate and

establish the protected amount separately for each account in the name of the

account holder, consistent with the requirement to conduct distinct account

reviews.

4.

No challenge of protection: A protected amount calculated and

established by a financial institution pursuant to the rule shall be considered

to be exempt from garnishment under law.

5.

Funds in excess of the protected amount. For any funds in an account in

excess of the protected amount, the financial institution shall proceed with

its customary procedures for handling a garnishment order, including the

freezing of funds.

I.

Notice to Account Holder

A financial institution shall issue a notice to the account holder according to the

following requirements:

1.

Notice requirement: The financial institution shall send the notice in cases

where: a) a benefit agency deposited a benefit payment into an account during

the lookback period; b) the balance in the account on the date of the account

review was above zero dollars and the financial institution established a

protected amount; and c) there are funds in the account in excess of the

protected amount.

2.

Notice content. The financial institution shall notify the account holder

named in the garnishment order of the following:

• Notice that a garnishment order has been received,

• The date it was received,

• A succinct explanation of the garnishment,

• The financial institution’s requirements to ensure that account

balances up to the protected amount are protected and made

available to the account holder if a benefit agency deposited a

benefit payment into the account in the last two months,

• The account subject to the order and the protected amount

established by the financial institution,

10

• The financial institution’s requirement pursuant to state law

to freeze other funds in the account to satisfy the order,

• The amount of any garnishment fee charged to the account,

• A list of the federal benefit payments exempt from

garnishment under the rule,

• The account holder’s right to assert against the creditor that

initiated the order a further exemption for amounts above the

protected amount, by completing exemption claims forms,

contacting the court of jurisdiction, or contacting the creditor,

• The account holder’s right to consult an attorney or legal aid

service to assert a garnishment exemption for amounts above

the protected amount, and

• Contact information for the judgment creditor if included in

the order

3.

Optional notice content: The financial institution may, but is not required to,

provide the account holder with the following:

• Contact information for a local free attorney or legal aid

service, and

• Contact information for the financial institution.

4.

Amending notice content: The financial institution may amend the notice to

integrate information about a state’s garnishment rules and protections, to avoid

potential confusion regarding the interplay of the rule with state requirements, or

to provide more complete information about an account.

5.

Notice delivery: The financial institution shall issue the notice directly to the

account holder, or to a fiduciary who administers the account and receives

communications on behalf of the account holder. Only information and

documents pertaining to the garnishment order, including notices or forms

required under state or local government law, may be included in the

communication.

6.

Notice timing. The financial institution shall send the notice to the account

holder within three business days from the date of the account review.

7.

Not legal advice: By issuing a notice, a financial institution creates no

obligation to provide, and is not offering, legal advice.

11

8.

One notice for multiple accounts: The financial institution may issue one

notice with information related to multiple accounts of an account holder.

9.

Model notice: For the convenience of the financial institution, a letter

appears in Appendix 3 as a model to follow. A financial institution is not

required to use the model notice; however, a financial institution that uses the

model notice will be deemed to be in compliance with the notice content

requirements of the rule.

J.

Other Requirements

1.

One-time account review: The financial institution shall perform an

account review only one time upon the first service of a given garnishment

order. The financial institution shall not repeat the account review or take any

other action related to the order if the same order is subsequently served again

upon the financial institution. If the financial institution is subsequently

served a new or different garnishment order against the same account holder,

the financial institution shall perform a separate and new account review.

2.

No continuing or periodic garnishment responsibilities: The financial

institution shall not continually garnish amounts deposited or credited to the

account following the date of the account review, and shall take no action to

freeze any funds subsequently deposited or credited, unless the institution is

served with a new or different garnishment order, consistent with these

guidelines.

3.

Impermissible garnishment fee: The financial institution may not charge

or collect a garnishment fee against a protected amount.

The financial institution may charge or collect a garnishment fee up to five (5)

business days after the account review if funds other than a federal benefit

payment are deposited to the account within this period provided the fee may

not exceed the amount of the non-benefit deposited funds.

For example, an account contains a protected amount of $500 on the date of

the account review, which constitutes the entire balance of the account. Two

(2) business days later $50 in non-benefit funds are deposited in the account.

The financial institution can impose a garnishment fee not exceeding $50.

12

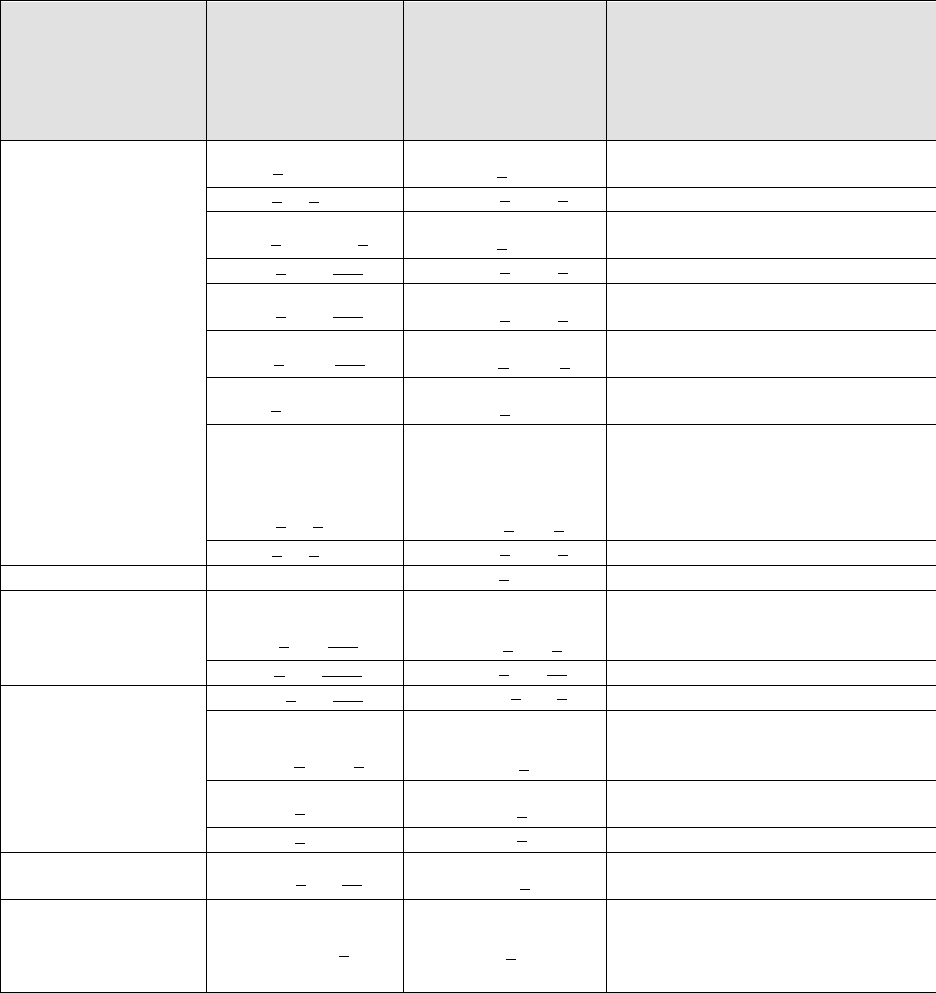

Appendix 1: Federal Benefit Payments That Are Protected Under the Regulation

Below is a table, which was prepared in consultation with benefit-paying agencies, that identifies which Fiscal

Service disbursed payments are exempt, the Company Entry Description in the ACH Batch Header Record, and a

description of the payment type.

Federal Benefit

Payment Types

Statutorily Exempt

from Garnishment

Company Entry

Description

(Positions 54-63) -

PRIOR TO NEW

GARNISHMENT

RULE

Company Entry

Description

(Positions 54-63) -

WITH NEW

GARNISHMENT

RULE

Payment Type Description

VA Benefit

VAbBENEFIT

XXVAbBENEF

VA Benefit

(Comp and Pension, DIC, Burial)

VAbEDbCH30

XXVAbCH30b

VA Education

VAbMGIBSRb

XXVAbMGIBS

VA Montgomery GI

Bill, Select Reserve

VAbCH18bbb

XXVAbCH18b

VA Spina Bifida, Birth Defects

VAbCH31bbb

XXVAbCH31b

VA Vocational

Rehabilitation (Retroactive)

VAbREAPbbb

XXVAbREAPb

VA Reservist Education Assistance

Program

VAb31RECUR

XXVAb31REC

VA Vocational

Rehabilitation (Recurring)

VAbEDb1607

XXVAb1607b

VA Reservist Education Assistance

Program,

VA Dependents'

Educational Assistance

(Ch. 35), VA Education (Ch. 32)

VAbEDbCH33

XXVAbCH33b

VA Education Ch 33

VA Insurance

FEDVAINSUR

XXVAbINSUR

VA Insurance

Railroad Retirement

Benefit

RRbUISIbbb

XXRRbUISIb

Railroad Retirement

Board Unemployment

Insurance

RRbRETbbbb

XXRRbRETbb

Railroad Retirement Benefit

Social Security Benefit

SOCbSECbbb

XXSOCbSECb

Social Security Benefit

MISCbPAY2b

XXMISCbPAY

Social Security Child Support

and Alimony

(SSA Garnishment)

INTLbPYMT

XXINTLbPMT

International Direct Deposit

– Recurring

INTLbPYMT

XXINTLbPMT

International Direct Deposit - Daily

Supplemental Security

Income

SUPPbSECbb

XXSUPPbSEC

Supplemental Security

Income Benefit

Office of Personnel

Management

(Civil Service

Retirement)

CIVILbSERV

XXCIVbSERV

Civil Service Retirement Benefit

13

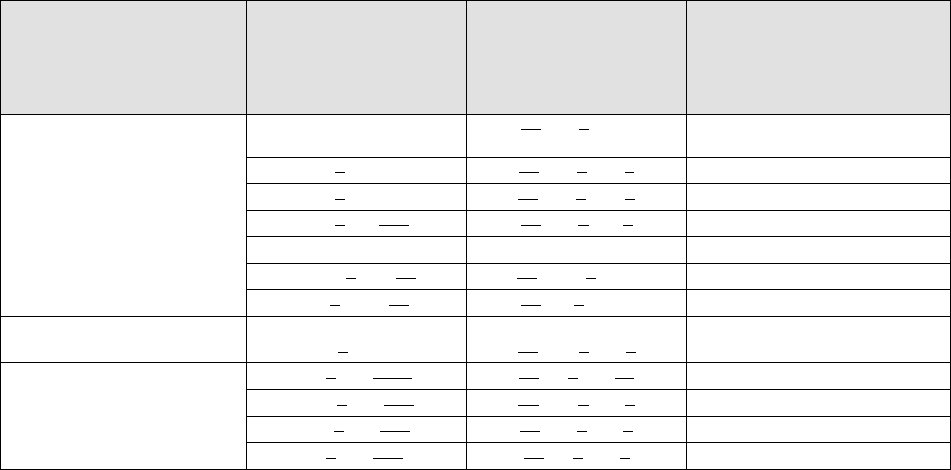

NOTE: The payment descriptions shown below are changing to contain blanks in

Positions 54 and 55 of the Company Entry Description Field. This enables Fiscal

Service to be positioned for future use of the “XX” identifier for other payments, should

additional authority be acquired.

OTHER PAYMENTS

Agency

Current Company

Entry Description,

(Without Blanks in

Positions 54-63)

Future Company

Entry Description

(With Blanks in

Positions 54-63)

Payment Type

Description

Any agency - Including

SSA, RRB, VA, OPM,

etc.

FEDANNUITY

bbFEDbANN

U

Annuity

FEDbSALARY

bbFEDbSALb

Salary

FEDbTRAVEL

bbFEDbTVLb

Travel

FEDbTSPbbb

bbFEDbTSPb

Thrift Savings

FEDPREAUTH

NA

Preauthorized Debits

MISCbPAYbb

bbMISCbPAY

Vendor Misc

EDIbMISCbb

bbEDIbMISC

CTX

IRS

TAXbREFUND

bbTAXbREFb

TAX - IMF / BMF (Local,

Consolidated, or CADE)

Any ERP payment -

Including SSA, RRB, VA,

OPM, etc.

VAbERPbbbb

bbVAbERPbb

ERP Payment

RRBbERPbbb

bbRRBbERPb

ERP Payment

SSAbERPbbb

bbSSAbERPb

ERP Payment

SSIbERPbbb

bbSSIbERPb

ERP Payment

14

Appendix 2: Sample Form of Notice of Right to Garnish Benefits

The United States, or a state child support enforcement agency, certifying its right to

garnish federal benefits shall attach or include with a garnishment order the following

Notice, on official organizational letterhead.

Information in brackets should be completed by the United States or a state child support

enforcement agency, as applicable. Where the bracketed information indicates a choice

of words, as indicated by a slash, the appropriate words should be selected from the

options.

Notice of Right to Garnish Federal Benefits

Date:

[Garnishment Order Number] / [State Case ID]:

The attached garnishment order was [obtained by the United States, pursuant to the

Federal Debt Collection Procedures Act, 28 U.S.C. § 3205, or the Mandatory Victims

Restitution Act, 18 U.S.C. § 3613, or other federal statute] / [issued by (name of the state

child support enforcement agency), pursuant to authority to attach or seize assets of

noncustodial parents in financial institutions in the state of (name of state), 42 U.S.C. §

666].

Accordingly, the garnishee is hereby notified that the procedures established under 31

CFR part 212 for identifying and protecting federal benefits deposited to accounts at

financial institutions do not apply to this garnishment order.

The garnishee should comply with the terms of this order, including instructions for

withholding and retaining any funds deposited to any account(s) covered by this order,

pending further order of [name of the court] / [the name of the state child support

enforcement agency].

15

Appendix 3: Model Notice of Garnishment to Account Holder

A financial institution may use the following model notice to meet the requirements of

31 CFR § Although use of the model notice is not required, a financial institution using

it properly is deemed to be in compliance with § 212.7.

Information in brackets should be completed by the financial institution. Where the

bracketed information indicates a choice of words, as indicated by a slash, the financial

institution should either select the appropriate words or provide substitute words suitable

to the garnishment process in a given jurisdiction.

Parenthetical wording in italics represents instructions to the financial institution and

should not be printed with the notice. In most cases, this wording indicates that the

model language either is optional for the financial institution, or should only be included

if some condition is met.

MODEL NOTICE:

[Financial institution name, city, and state, shown as letterhead or otherwise printed at

the beginning of the notice]

IMPORTANT INFORMATION ABOUT YOUR ACCOUNT

Date:

Notice to:

Account Number:

Why am I receiving this notice?

On [date on which garnishment order was served], [Name of financial institution]

received a garnishment order from a court to [freeze/remove] funds in your account. The

amount of the garnishment order was for $[amount of garnishment order]. We are

sending you this notice to let you know what we have done in response to the

garnishment order.

What is garnishment?

16

(If the account holder has multiple accounts, add a row for each account)

Please note that these amount(s) may be affected by deposits or withdrawals after the

protected amount was calculated on [date of account review].

Do I need to do anything to access my protected funds?

You may use the “protected amount” of money in your account as you normally would.

It will not be frozen or removed from your account.

There is nothing else that you need to

do to make sure that the “protected amount” is remains available to you.

Who garnished my account?

The creditor who obtained a garnishment order against you is [name of creditor].

What types of Federal benefit payments are protected from garnishment?

In most cases, you have protections from garnishment if the funds in your account

include one or more of the following Federal benefit payments:

Account

number

Amount in

account

Amount

protected

Amount subject to

garnishment (now

[frozen/removed])

Garnishment

fee charged

Garnishment is a legal process that allows a creditor to remove funds from your

[bank]/[credit union] account to satisfy a debt that you have not paid. In other words, if

you owe money to a person or company, they can obtain a court order directing your

[bank]/[credit union] to take money out of your account to pay off your debt. If this

happens, you cannot use that money in your account.

What has happened to my account?

On [date of account review], we researched your account and identified one or more

Federal benefit payments deposited in the last 2 months. In most cases, Federal benefit

payments deposited during this period are protected from garnishment. As required by

Federal regulations, therefore, we have established a “protected amount” of funds that

will remain available to you and that will not be [frozen/removed] from your account in

response to the garnishment order.

(Conditional paragraph if funds have been frozen) Your account contained additional

money that may not be protected from garnishment. As required by law, we have [placed

a hold on/removed] these funds in the amount of $[amount frozen] and may have to turn

these funds over to your creditor as directed by the garnishment order.

The chart below summarizes this information about your account(s):

Account Summary as of [date of account review]

17

• Supplemental Security Income benefits,

• Veterans benefits,

• Railroad retirement benefits,

• Railroad Unemployment Insurance benefits,

• Civil Service Retirement System benefits, and

• Federal Employees Retirement System benefits.

(Conditional section if funds have been frozen) What should I do if I think that

additional funds in my account are from federal benefit payments?

If you believe that additional funds in your account(s) are from protected federal benefit

payments and should not have been [frozen/removed], there are several things you can

do.

(Conditional sentence if applicable for the jurisdiction) You can fill out a garnishment

exemption form and submit it to the court.

You may contact the creditor that garnished your account and explain that additional

funds are from federal benefit payments and should be released back to you.

(Conditional sentence if contact information is in the garnishment order) The creditor

may be contacted at [contact information included in the garnishment order].

You may also consult an attorney (lawyer) to help you prove to the creditor who

garnished your account that additional funds are from federal benefit payments and

cannot be taken. If you cannot afford an attorney, you can seek assistance from a free

attorney or a legal aid society.

(Optional sentences) [Name of State, local, or independent legal aid service] is an

organization that provides free legal aid and can be reached at [contact information].

You can find information about other free legal aid programs at [insert

“www.lawhelp.org” or other legal aid programs website].

(Optional section) How to contact [name of financial institution].

This notice contains all the information that we have about the garnishment order.

However, if you have a question about your account, you may contact us at [contact

number].

18

Appendix 4: Examples of Lookback Period and Protected Amount

The following examples illustrate this definition of lookback period:

Example 1: Account review performed same day garnishment order is served

a)

A financial institution receives garnishment order on Wednesday, March 17.

b)

The financial institution performs account review the same day on Wednesday,

March 17.

c)

The lookback period begins on Tuesday, March 16, the date preceding the date

of account review.

d)

The lookback period ends on Saturday, January 16, the corresponding date two

months earlier.

Example 2: Account review performed the day after garnishment order is served

a)

A financial institution receives garnishment order on Wednesday, November 17.

b)

The financial institution performs account review next business day on Thursday,

November 18.

c)

The lookback period begins on Wednesday, November 17, the date preceding the

date of account review.

d)

The lookback period ends on Friday, September 17, the corresponding date two

months earlier.

Example 3: No corresponding date two months earlier

a)

The financial institution receives garnishment order on Tuesday, August 30.

b)

The financial institution performs the account review two business days later on

Thursday, September 1.

c)

The lookback period begins on Wednesday, August 31, the date preceding the

date of account review.

d)

The lookback period ends on Wednesday, June 30, the last date of the month

two months earlier, since June 31 does not exist to correspond with August 31.

19

Example 4: Weekend between receipt of garnishment order and account review

a)

A financial institution receives garnishment order on Friday, December 10.

b)

The financial institution performs the account review two business days later on

Tuesday, December 14.

c)

The lookback period begins on Monday, December 13, the date preceding the

date of the account review.

d)

The lookback period ends on Wednesday, October 13, the corresponding date

two months earlier.

The following examples illustrate the definition of protected amount:

Example 1: Account balance less than sum of benefit payments

a)

A financial institution receives a garnishment order against an account holder for

$2,000 on May 20.

b)

The date of account review is the same day, May 20, and the balance in the

account when the review is performed is $1,000.

c)

The lookback period begins on May 19, the date preceding the date of account

review, and ends on March 19, the corresponding date two months earlier.

d)

The account review shows that two federal benefit payments were deposited to the

account during the lookback period totaling $2,500, one for $1,250 on Friday,

April 30 and one for $1,250 on Tuesday, April 1.

e)

Since the $1,000 balance in the account when the account

review is performed is less than the $2,500 sum of benefit payments posted to the

account during the lookback period, the financial institution establishes the

protected amount at $1,000.

f)

The financial institution is not required to send a notice to the account holder.

Example 2: Three benefit payments during lookback period

a)

A financial institution receives a garnishment order against an account holder for

$8,000 on December 2.

b)

The date of account review is the same day, December 2, and the balance in the

account when the account review is performed is $5,000.

c)

The lookback period begins on December 1, the date preceding the date of account

review, and ends on October 1, the corresponding date two months earlier.

d)

The account review shows that three federal benefit payments were deposited to

the account during the lookback period totaling $4,500, one for $1,500 on

December 1, another for $1,500 on November 1, and a third for $1,500 on

October 1.

e)

Since the $4,500 sum of the three benefit payments posted to the account during

the lookback period is less than the $5,000 balance in the account when the

account review is performed, the financial institution establishes the

protected amount at $4,500 and seizes the remaining $500 in the account consistent

20

with state law.

f)

The financial institution is required to send a notice to the account holder.

Example 3: Intraday transactions

a)

A financial institution receives a garnishment order against an account holder for

$4,000 on Friday, September 10.

b)

The date of account review is Monday, September 13, when the opening balance in

the account is $6,000.

c)

A cash withdrawal for $1,000 is processed after the open of business on

September 13, but before the financial institution has performed the account

review, and the balance in the account is $5,000 when the financial institution

initiates an automated program to conduct the account review.

d)

The lookback period begins on Sunday, September 12, the date preceding the

date of account review, and ends on Monday, July 12, the corresponding date

two months earlier.

e)

The account review shows that two federal benefit payments were deposited to the

account during the lookback period totaling $3,000, one for $1,500 on Wednesday,

July 21, and the other for $1,500 on Wednesday, August 18.

f)

Since the $3,000 sum of the two benefit payments posted to the account during the

lookback period is less than the $5,000 balance in the account when the account

review is performed, the financial institution establishes the

protected amount at $3,000 and, consistent with state law, freezes the $2,000

remaining in the account after the cash withdrawal.

g)

The financial institution is required to send a notice to the account holder.

Example 4: Benefit payment on date of account review

a)

A financial institution receives a garnishment order against an account holder for

$5,000 on Thursday, July 1.

b)

The date of account review is the same day, July 1, when the opening balance in the

account is $3,000, and reflects a federal benefit payment of $1,000 posted that day.

c)

The lookback period begins on Wednesday, June 30, the date preceding the date of

account review, and ends on Friday, April 30, the corresponding date two months

earlier.

d)

The account review shows that two federal benefit payments were deposited to the

account during the lookback period totaling $2,000, one for $1,000 on Friday,

April 30 and one for $1,000 on Tuesday, June 1.

e)

Since the $2,000 sum of the two benefit payments posted to the account during the

lookback period is less than the $3,000 balance in the account when the account

review is performed the financial institution establishes the protected amount at

$2,000 and places a hold on the remaining $1,000 in the account in accordance with

state law.

f)

The financial institution is required to send a notice to the account holder.

21

Example 5: Account co-owners with benefit payments

a)

A financial institution receives a garnishment order against an account holder for

$3,800 on March 22.

b)

The date of account review is the same day, March 22, and the opening balance in

the account is $7,000.

c)

The lookback period begins on March 21, the date preceding the date of account

review, and ends on January 21, the corresponding date two months earlier.

d)

The account review shows that four federal benefit payments were deposited to the

account during the lookback period totaling $7,000.

e)

Two of these benefit payments, totaling $3,000, were made to the account holder

against whom the garnishment order was issued.

f)

The other two payments, totaling $4,000, were made to a co-owner of the account.

g)

Since the financial institution must perform the account review based only on the

presence of benefit payments, without regard to the existence of co-owners on the

account or payments to multiple beneficiaries or under multiple programs, the

financial institution establishes the protected amount at $7,000, equal to the

sum of the four benefit payments posted to the account during the lookback period.

h)

Since $7,000 is also the balance in the account at the time of the account review,

there are no additional funds in the account which can be frozen.

i)

The financial institution is not required to send a notice to the account holder.