E-Invoicing / E-Billing 2016

○

C

B. Koch, Billentis Page 1

Business Case

E-Invoicing / E-Billing

2017

Bruno Koch

Billentis

February 10, 2017

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 2

Whilst every care has been taken to ensure the accuracy of this report, the facts, estimates and

opinions stated are based on information and sources which, whilst we believe them to be relia-

ble, are not guaranteed. In particular, they should not be relied upon as being the sole source of

reference in relation to the subject matter. No liability can be accepted by Billentis, its employ-

ees, or by the author of the report for any loss occasioned to any person or entity acting or failing

to act because of anything contained in or omitted from this report, or because of our conclusions

as stated.

All rights reserved.

Readers may reproduce selected parts of the document content for non-commercial use if the

source and date is acknowledged.

This document contains links or references to other websites outside of our control. Such links

are provided for your convenience only. We are not responsible for these websites or any con-

tents thereof. The inclusion of any such links in this report shall not constitute an endorsement

of, or representation or warranty by us regarding the content of such websites, the products or

services of such websites, or the operators of such websites.

We will not enter into any correspondence about the content of this document.

www.billentis.com

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 3

Contents

1. E-invoicing opportunities in a challenging market environment .................................................... 5

1.1 Overview ..................................................................................................................................... 5

1.2 Reduce costs ................................................................................................................................ 5

1.2.1 Increase electronic proportion ...................................................................................... 6

1.2.2 Enhance the degree of process optimization ................................................................ 8

1.3 Increase elasticity of costs ........................................................................................................... 8

1.3.1 Inhouse developments vs. third party solutions ........................................................... 8

1.3.2 Shift fixed costs towards variable costs ....................................................................... 8

1.4 Improve Working Capital ............................................................................................................ 9

1.4.1 Challenges and today’s options for organizations ....................................................... 9

1.4.2 Improving company internal processes ........................................................................ 9

1.4.3 Trade Finance / Supply Chain Finance (SCF) ........................................................... 10

1.4.4 Dynamic discounting ................................................................................................. 10

2. Related processes and optimisation areas ....................................................................................... 12

3. Business Case for Issuer/Recipient .................................................................................................. 15

3.1 Saving potential ......................................................................................................................... 15

3.2 Know your volume .................................................................................................................... 16

3.3 Know your current and future costs .......................................................................................... 17

3.3.1 Current costs for outbound invoices .......................................................................... 17

3.3.2 Current cost for inbound invoices .............................................................................. 18

3.3.3 Cost differences among continents and countries ...................................................... 18

3.3.4 Future costs with automated processes ...................................................................... 18

3.4 Business Case ............................................................................................................................ 19

3.4.1 Small businesses ........................................................................................................ 19

3.4.2 Mid-sized and large businesses .................................................................................. 19

3.4.3 Financial benefits for the public sector ...................................................................... 20

4. Digitisation & Automation ................................................................................................................ 23

4.1 From gradual evolution to innovative business process automation ......................................... 23

4.2 Sustaining improvement with manual paper processing ........................................................... 23

4.3 Digitisation ................................................................................................................................ 24

4.4 Automated e-invoicing .............................................................................................................. 24

4.5 Business process automation with disruptive innovation .......................................................... 25

5. Appendix: Sources ............................................................................................................................. 27

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 4

Table of Figures

Figure 1: Optimise corporate finances with e-invoicing ................................................................. 5

Figure 2: Migration path to exploit the full optimization potential ................................................. 6

Figure 3: Success rate dependant on practiced on-boarding methods ............................................ 6

Figure 4: Processes and optimisation areas for invoice/bill issuers .............................................. 12

Figure 5: Processes and optimisation areas for invoice recipients ................................................ 13

Figure 6: Saving potential for invoice/bill issuers (actual customer case) .................................... 15

Figure 7: Saving potential for invoice recipients (actual customer case) ..................................... 16

Figure 8: Key-metrics for number of invoices .............................................................................. 16

Figure 9: Items to be considered in a business case ...................................................................... 19

Figure 10: Breakdown of saving potential in the public sector ..................................................... 20

Figure 11: Indication for the saving potential in the public sector of some European countries .. 21

Figure 12: Saving potential for cities ............................................................................................ 22

Figure 13: From gradual evolution to innovative business process automation ........................... 23

Figure 14: Exploit the full optimisation potential ......................................................................... 26

Figure 15: Key sources used in this report .................................................................................... 27

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 5

1. E-invoicing opportunities in a challenging market environment

1.1 Overview

There are of course several reasons to start an e-invoicing project, but one is the strongest driver:

Even during a period of robust economic growth, organizations state that the major drivers for

process automation were the improvement of financials. This is especially valid during today’s

challenging economy.

Electronic and automated invoice processes can result in savings of 60-80% compared to tradi-

tional paper-based processing. Projects typically result in a payback period of 0.5-1.5 years. This

document will give the reader useful information for achieving these results.

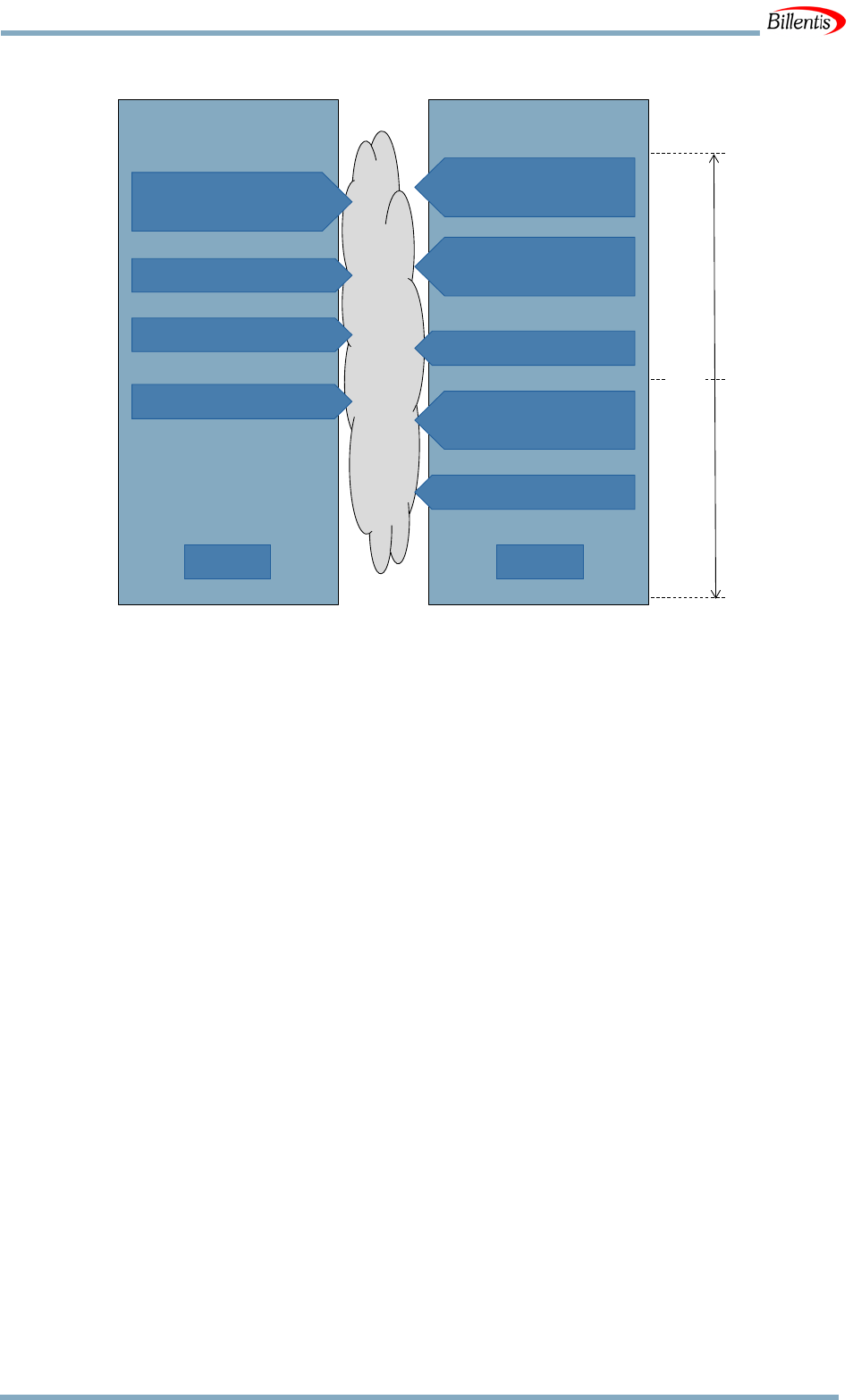

The author sees a set of parameters where e-invoicing has a major impact on the optimization of

corporate finance.

Figure 1: Optimise corporate finances with e-invoicing

1.2 Reduce costs

Chapter 3 describes in detail how the Business Case might look like – and that is already very

promising. The author intended to apply today’s reality to those calculations: Organizations re-

place a portion of its paper invoices with electronic ones and only partially optimize their pro-

cesses.

The next chart describes the classical evolution in most organizations. Today, just low hanging

fruits are picked. Very few enterprises also challenge their processes in general and streamline,

re-design and optimize them. It is likely that it will take some more years until the market is ma-

ture for this next step. Thus, this chapter focuses on the migration path options.

Reduce costs

Optimization of corporate finance

with E-Invoicing

Improve

Working Capital

Increase

elasticity of costs

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 6

Figure 2: Migration path to exploit the full optimization potential

1.2.1 Increase electronic proportion

By monitoring the international markets for 20 years, the author analysed the differing develop-

ments in organizations. The success rates and electronic proportions differ greatly.

Figure 3: Success rate dependant on practiced on-boarding methods

Phase

Description

Classic ap-

proach

Mainly large companies are innovators for e-invoicing. They push their larger

trading partners to send and receive the invoices electronically. The Opt-In on-

boarding method is practiced (convince one by one to enter into the electronic

community). For the vast majority of organisations, the achievable share of e-in-

voices with large trading partners is just 25-30% after several years.

Low High

Degree of process automation

Electronic portion of bills/invoices

Low High

Status 2012

Objective

0

10

20

30

40

50

60

70

80

90

100

0

1

2

3

4

5

6

7

8

9

10

% E-Invoices

Year after starting the rollout process

Loop E-Order +

E-Invoice

Powerplay

Pressing

Classic approach

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 7

Phase

Description

In a next step, the large innovators also try to push their mid-sized and small

trading partners to support electronic invoices. Even by increasing the marketing

activities, a large organization does not have the power to make the market

alone. They are dependent on the maturity of the mass market. The annual

growth rates are limited.

This market evolution was common in the past and is still in progress today in

most countries. It did not cause a broad break-through in the markets up to to-

day.

Pressing

For most large companies, it is possible to achieve an electronic invoice share of

at least 60% after 3 years. This will not happen automatically with a smart and

friendly approach towards trading partners. Instead, powerplay and marketing is

necessary for increasing the share of e-invoices. In addition, the general contract

terms should be enhanced to provide the contractual instrument to force trading

partners towards e-invoicing.

Although the rollout is strongly based on powerplay, this is still a fair method if

the promoter or its service provider offers appropriate solutions for any kind and

size of trading partner and for fair conditions. Registration and usage barriers

shall be as low as possible. This can happen, for example, by taking the first step

using only the internet. An account shall be pre-defined for each trading party

and can be activated with just a click of the mouse, followed by completing the

user’s master data.

An increasing number of large companies are practicing this method.

Powerplay

For most large companies, it is also possible to achieve an electronic invoice

share of at least 80% after 3 years. The “Pressing” method is enriched with pen-

alties for counterparts which insist on paper invoices. Electronic invoice ex-

change is declared as the default channel, but penalties are applied for paper in-

voices:

• Suppliers charge typically EUR 1 – 3.50 to consumers and EUR 5 – 25 to

companies per paper invoice

• Buyers reduce the paid invoice amount typically by EUR 15 – 25 per paper

invoice if the suppliers are not willing or not able to send the invoices elec-

tronically

Closed

electronic

loop for or-

ders and in-

voices

In many large companies, at least 40% of the invoices are based on Purchase Or-

ders. This rate is steadily increasing. Enterprises have the chance to receive all

PO-based invoices electronically within just a few months.

Suppliers are keen to get purchase orders. If they only get the chance to receive

them electronically in the future, they will accept the new channel rapidly. In ad-

dition, they also have the chance to return invoices electronically. This model re-

sults in a quick win-win situation for suppliers and buyers.

Considering these known facts, it is surprising that more organizations do not switch to more

promising on-boarding methods.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 8

1.2.2 Enhance the degree of process optimization

Today a major bulk of electronic invoices is just digital images of paper. This is not really a sur-

prise, as people are familiar with PDFs and the barriers to start with are quite low. However, the

benefits are mainly on the supplier side and buyers are keen to move towards the next steps.

Improvements, which can be noticed on the market

• PDF Images Intelligent PDFs including images + structured invoice data (+ interactive

components, digital signatures, logfiles, workflow functionality); PDF invoice becomes in-

terpretable by both humans and computer systems

• PDF Images structured XML invoices

• Scanning of images only Scanning + OCR + Workflow

Any development as mentioned above helps to increase the degree of automation on the recipi-

ent’s side as well. The weak economy might accelerate the next evolutionary step towards fully

automated processes and to tap the full potential in the mid-term.

1.3 Increase elasticity of costs

1.3.1 Inhouse developments vs. third party solutions

Businesses in smaller countries intend to use solutions proven on the market. Such solutions are

indeed available in high numbers (hundreds) and of good quality. From this perspective, it is sur-

prising that mainly businesses in larger countries still intend to re-invent things and develop in-

house solutions. This is not only the case with large organizations, but even in companies with

less than 20,000 employees. In such scenarios, it is the IT staff who often drive projects. Clarify-

ing legal requirements for all trading parties (located in dozens of countries) is extremely chal-

lenging or almost unsolvable for them. Such projects typically never succeed. Companies even-

tually switch to state-of-the-art third party solutions.

1.3.2 Shift fixed costs towards variable costs

Customer demand today is becoming more and more erratic and the turnover is subject to con-

siderable variations.

Thus, most companies try to reduce fixed costs and to shift them towards variable costs. Provid-

ers of e-billing/e-invoicing solutions reacted at a very early stage and offer suitable products for

any kind of demand.

Due to investment freezes in many companies and attractive on-demand pricing, numerous busi-

nesses are expected to change from inhouse operated solutions to SaaS (Software as a Service),

white label or network services offered by third parties.

It is therefore scalable regardless of organization size and, most importantly, businesses only pay

for the services they use.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 9

1.4 Improve Working Capital

1.4.1 Challenges and today’s options for organizations

The crisis in the global financial markets, a corporate credit squeeze, combined with weak eco-

nomic growth, all change financial managers’ minds on working capital optimisation. Invoice

automation is a key component to achieve this objective!

There is a growing demand for financially efficient supply chains, with customers and their sup-

pliers under conflicting pressures to improve payment terms, reduce prices and improve cash

flow efficiencies.

A number of related buzzwords currently dominate the mass media

• Optimize cash flow and working capital

• Decrease DSO

• Accelerate processing and workflow cycle to benefit (dynamic) discounts

• Payment guarantees; Reduced risks

• Trade Finance; Supply Chain Finance

• Access to liquidity; Reduce capital outlay

• On-demand SCF (not full turnover, just some invoices)

• Enable suppliers to keep pace with buyers’ growth.

These topics reflect the market demand, but also what providers of such finance tools and instru-

ments increasingly offer.

The major challenge for solution providers is to offer a balanced product portfolio appropriate

for suppliers and buyers, regardless of company size and the location of the trading party.

There is also a major part, which is directly under the control of suppliers and buyers and their

internal processes and whose improvement may not be outsourced.

1.4.2 Improving company internal processes

1.4.2.1 Increase transparency for inbound invoices

Typically, 30-35% of larger companies still manage the invoices decentralised. Almost all of

them use several ERP and accounting systems. This environment does not allow the financial

manager the required transparency about the number, the total amount and the status of invoices.

e-invoicing often results in a central outbound and inbound gateway, aggregating all invoices.

This significantly increases transparency for finance managers and is a pre-requisite to optimise

the working capital.

1.4.2.2 Accelerate internal invoicing cycles for inbound invoices

Suppliers of goods and services suffer from the credit crunch. This is especially valid for SMEs.

For that reason, they increasingly offer discounts to their clients. Despite these discounts, the ef-

fect is very limited and the payment period (e.g. 15 days to benefit from discounts) cannot be im-

proved significantly.

The reason is primarily that many larger invoice recipients are just unable to process paper in-

voices faster than within 23-25 days.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 10

A consulting customer of the author confirmed to have missed discounts with a value of EUR

1.50 per paper invoice. The discount benefits alone more than compensate the project costs and

investments for the e-invoicing in this project!

An efficient workflow and archive solution is in most cases another result of an e-invoice pro-

ject. This enables real-time monitoring of the invoice processing and permits an optimisation of

the working capital.

1.4.3 Trade Finance / Supply Chain Finance (SCF)

Supply Chain Finance refers to the set of solutions available for financing specific goods and/or

products as they move from origin to destination along the supply chain. It shall improve the

Working Capital for suppliers and buyers. This is of special relevance during the challenging

economy and the fact that an increasing number of trading parties is located abroad.

The market opportunity for a SCF solution is significant. The total worldwide market for receiv-

ables management is US$1.3 trillion. Payables discounting and asset-based lending add an addi-

tional US$100 billion and $340 billion, respectively. Only a small percentage of companies are

currently using SCF techniques, but more than half have plans or are investigating options to im-

prove SCF techniques [Wikipedia]. Some 43% of German companies and 61% of British enter-

prises are planning to monetise their receivables & payables to provide liquidity within their sup-

ply chain [1]. In an US survey of 2014 [2], the percentage of respondents reporting that they use

supply chain financing increased to 13.7 percent from 8 percent a year ago.

Some of the solutions that could be sold under the banner of SCF with relevance to e-invoicing

include, but are not limited to:

• Asset-based lending, e.g. mortgage, factoring and reverse-factoring

• Receivables management services – Provides third-party outsourcing of receivables manage-

ment and collections process. It also provides financing of those receivables and guarantees

on the payment of those receivables.

• Dynamic payables discounting –Provides third-party outsourcing of the payables process and

leverages a buyer’s credit quality to obtain favourable financing rates for suppliers.

Suppliers are mainly interested in financing, guaranteed and early payments, whereas the focus

on the buyer side is more on working capital / benefit of discounts etc. Providers should address

both sides with suitable solutions and they should be appropriate for small businesses. It should

also be possible to use it selectively on a case-by-case basis.

One component of SCF is currently gaining much traction and forms an ideal combination with

e-invoicing. It is therefore described in the following chapter.

1.4.4 Dynamic discounting

Dynamic discounting is a process which allows buyers and sellers of commercial goods and ser-

vices to dynamically change the payment terms – such as net 30 – to accelerated payment based

on a sliding discount scale. Dynamic payables discounting is “dynamic” in one or more ways.

Dynamic discounting is also known as dynamic discount management, early payment discount-

ing, or payables discounting.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 11

It encourages suppliers to opt in for early payments. Dynamic discounting allows buyers and

sellers to dynamically change the payment terms to accelerated payment based on a sliding dis-

count scale. The buyer allocates a “pool” of liquidity, determines liquidity limits, and establishes

the interest rate for early payments. Once invoices are approved, the suppliers are automatically

informed about new early-payment options. Through the portal, suppliers are able to view their

approved invoices and trigger payments prior to the nominal due date, accepting the correspond-

ing discounts.

The dynamic discounting functionality may be directly implemented as a Plug-In in the ERP or

accounting application of suppliers and buyers. Another smart way is a “Pay me early button” on

the buyer’s e-invoice portal (in case of direct exchange) or on the portal of the e-invoicing net-

work operator.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 12

2. Related processes and optimisation areas

Figure 4: Processes and optimisation areas for invoice/bill issuers

Issuer Process

Manual work and problems

with paper based processes

Optimisation with e-invoice &

automated processes

• High costs

• Paper with negative impact

on pollution

• Long delivery time

• No control over whether cus-

tomers have received the in-

voices

• Customer may reject the in-

voice weeks later if key data

is missing from it

• Send electronic invoices se-

curely via the net

• Contributes an improvement

of up to 0.8% to the Kyoto

protocol requirements

• Real-time delivery with re-

ceipt/download confirmation

• Validation of key data as

soon as sent

• 10-15% of invoice volume re-

quires a payment reminder as

recipients have time-consum-

ing workflows and payment

release systems for paper in-

voices

• Is reduced, as many of the

clients process the electronic

invoices automatically (below

a certain amount and match-

ing with order)

• Time-consuming and costly

manual processes

• Data quality problems

• Automatic payment remit-

tance

• Due to faster electronic feed-

back regarding payment sta-

tus, the Cash Manager has

full control of all invoices, af-

fording him optimised Cash

Management

• Hundreds or thousands of

folders with paper invoices

with high demand for storage

capacity

• High costs for manual search

• Automated archiving

• Easy finding of the original

invoice via various keywords

• Quick access to the electronic

archive in a decentralized en-

vironment

• Instant on-screen auditability

of invoices with unprece-

dented levels of integrity and

authenticity guarantees

• Millions of invoices only re-

quire the space of a hard disk

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 13

Figure 5: Processes and optimisation areas for invoice recipients

Recipient Process

Manual work and problems

with paper based processes

Optimisation with e-invoice &

automated processes

• Opening mail

• Check and remove undesired

attachments

• Entrance stamp

• Forward to AP department

• Fully automated

• Entering to AP system

• 10% of entered data statisti-

cally viewed with errors

• Delayed entering during peak

season or permanently

• Alternative Scanning solves

just a small part of the prob-

lem

• Automated import to AP sys-

tem

• Real-time import, independ-

ent of volume

• 100% correct data

• Discrepancy in VAT compli-

ance is detected at a (too) late

stage

• Line items in an invoice quite

often contain a discrepancy

with the order or contract

terms. Manual matching is

time-consuming and expen-

sive

• VAT compliance and valida-

tion of other key data can be

done automatically when E-

Invoice is uploaded by issuer

• Line-item matching with or-

der data and contract term is

fully automated

• Faster and better spend analy-

sis, leading to 1.3% to 5.5%

spend reduction

• The dispute resolution with

the supplier is often done to-

day by phone, unstructured

email or fax

• Dispute resolution can be

very time consuming

• Improved dispute handling

and avoidance

• Many solutions or services

enable automated, structured

and real-time exchange of

dispute information between

buyers and suppliers

• Time consuming and costly

circulation within the com-

pany for payment release;

discounts are typically missed

• Manual work for payment or-

der and risk of errors

• Cash Manager without full

transparency for all pending

invoices

• Payment relevant invoice

data processed directly and

automatically into payment

orders

• Every inbound invoice ap-

pears on the screen of the

Cash Manager immediately

after receipt and affords him

optimised Cash Management

(by offering rebates for pay-

ment on time, working capital

optimisation)

• Circulation within company

for payment release is auto-

mated or at least supported by

electronic workflow

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 14

Recipient Process

Manual work and problems

with paper based processes

Optimisation with e-invoice &

automated processes

• In larger organisations, it is

not unusual to benefit of ad-

ditional 1.50 Euro discount

per e-invoice in average

• Hundreds or thousands of

folders with paper invoices

with high demand for storage

capacity

• High costs for manual search

• Traditionally 6 copies on in-

dustry average, not all clearly

stated as “copy”

• Automated archiving

• Easy finding of the original

invoice via keywords

• Quick access to the electronic

archive in a decentralised en-

vironment

• Instant on-screen auditability

of invoices with unprece-

dented levels of integrity and

authenticity guarantees

• Millions of invoices only re-

quire the space of a disk

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 15

3. Business Case for Issuer/Recipient

3.1 Saving potential

The Finnish State Treasury and some Finnish companies have estimated that an incoming paper

invoice incurs costs amounting to 30-50 Euro for the receiving company. By moving to elec-

tronic invoicing these costs can be reduced to 10 Euro by semi-automating the invoice process

and to one Euro by fully automating the process [3]. Regarding in-depth analysis of Politecnico

di Milano, the net benefits are 4 – 12 Euro per invoice in case of VAT compliant

e-invoicing and up to 65 Euro per cycle in case of full integration of the trade process [4].

Thanks to electronic and automated invoice processing, savings between 1 and 2% of turnover

are realistic objectives.

As a consultant the author analysed the full costs based on traditional paper based processes and

compared it with the new electronic automated solution. The example below reflects the situa-

tion in an industry company with 5,000 employees, based on calculated staff costs of 60€/hour

(full costs including overhead, working place, etc.).

Figure 6: Saving potential for invoice/bill issuers (actual customer case)

The invoices/bills in this example were relatively simple and had an average size of 1.5 pages. In

most organisations, the invoices are more complex and the savings are higher.

Not considered in this calculation are indirect savings. This can include, for example, online up-

dating of master data directly by the customers.

Print, Envelope

Send

3.90€

Payment

Reminders

0.50€

Archiving

2.20€

Remittance &

Cash Management

4.50€

Full-

Costs

11.10€

4.50€*

Paper

Electronic,

automated

0 0.40€

0.80€

3.00€

Saving per Invoice 6.60€ = 59%

*) considered is 0.30€ processing cost

by third party service provider

Source: Billentis

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 16

Figure 7: Saving potential for invoice recipients (actual customer case)

Not considered in this calculation are indirect savings. This can include, for example, the elimi-

nation of redundancies of the supplier master data and inconsistencies.

3.2 Know your volume

Sometimes, larger organisations do not know their precise invoice/bill volume. The reason for

this is quite often the decentralised organisation or a heterogeneous layout of their AR and AP

systems.

Over the last 20 years, the author has built key-metrics for being able to make a quick estimation

of the invoice volume before the project start. Although not perfect in all cases, the key-metrics

are based on the number of employees in an organisation and dependent on the industry.

Figure 8: Key-metrics for number of invoices

Indication for Number of invoices

per employee in various Indus-

tries

Outbound invoices per

employee and year

Inbound invoices per

employee and year

Credit & Customer Cards

40,000

n/a

Mail order houses

8,000

n/a

Media

2,000

20

MRO Goods

1,400

450

Utility with direct distribution

1,200

20

Insurance

700

30

Electronic & IT

400

26

Chemicals & Pharmaceuticals

200

30

Industry independent average

200

80

Automotive Supplier

200

50

Food Supplier

200

20

Receive

1.10€

Entering

Codification

3.00€

Validation &

Matching

4.00€

Dispute

Management

2.50€

Archiving

2.20€

Payment & Cash

Management

4.80€

Full-

Costs

17.60€

6.40€*

Paper

Electronic,

automated

0 0 1.20€ 2.00€

0.80€

2.00€

Saving per Invoice 11.20€ = 64%

*) considered is 0.40 € processing cost

by third party service provider

Source: Billentis

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 17

Indication for Number of invoices

per employee in various Indus-

tries

Outbound invoices per

employee and year

Inbound invoices per

employee and year

Logistics

100

77

Airlines

35

11

Services & Consulting

20

15

Banks

n/a

11

Telco

n/a

39

Industrial manufacturer

n/a

60

Catering

n/a

100

Retail

n/a

250

Buyer Clubs, Trade, Wholesalers

n/a

300

Health insurance

n/a

3,100

1

In groups with service centres and/or subsidiaries, up to 10% can be added to the inbound vol-

ume for Intercompany Billing.

Calculation example: Utility Group with service centre structure and 5,000 employees

Outbound Volume 5,000 x 1,200 = 6,000,000

Inbound Volume 5,000 x 20 = 100,000

Intercompany Billing 10% of Inbound = 10,000

3.3 Know your current and future costs

At first glance only direct costs appear in the organisation budget. However, this is just a fraction

of all processing costs.

For a cost comparison, we have to consider

• Direct costs

• Indirect costs

• Hidden costs

3.3.1 Current costs for outbound invoices

On the outbound side, one part of the direct costs includes invoice printing and stamp costs. In a

well-known telecom company, this represents just 9% of all directly related costs. Another major

part is quite often well hidden and not recognised at first glance. Indirect and hidden cost items,

which may be reduced by e-invoicing are

• Sales Back office (Further inquiries in case of dispute)

• Accounting/Reconciliation manpower

• Debtor interest

• IT development and operation

• Payment fees (reduced or no fees in case of electronically and fully automated processes)

• Customer requests for copies of lost invoices

1

In countries with healthcare systems like The Netherlands, Switzerland etc.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 18

• Archiving

• Query handling

• Settlement time and improved Cash Management

• Easier and faster audit

Typically, just 7,500 – 30,000 paper invoices can be processed per employee per year in the AR

department. Therefore, the direct staff costs in the AR department already vary between EUR

2.50 – 10 per invoice.

3.3.2 Current cost for inbound invoices

Even worse is the cost recognition on the inbound side. Per employee in the AP department, typ-

ically just 5,000 – 15,000 paper invoices can be processed per year. Therefore, the direct staff

costs in the AP department already vary between EUR 5 – 15 per invoice. Further costs are gen-

erated in the paper-based workflow and archiving. Analysis in some organisations showed, that

on average 6 invoice copies are generated and archived decentralised in the files of secretaries

and heads of departments.

3.3.3 Cost differences among continents and countries

The figures in the previous chapters are generally appropriate for Europe and probably for most

parts of Latin America and Asia. Of course, we do have major differences in the labour costs,

which are lower in Mediterranean countries than in the Nordic states. Nevertheless, exactly the

countries with lower labour costs have in most cases the highest legal requirements for invoicing

and are therefore not necessarily able to process the invoices for lower costs.

Surveys imply that invoice processing in the US could be around 25 percent less expensive than

in Europe. This is understandable for several reasons. The US does not apply the VAT system

like many other countries. The invoice is just one of several business documents for the audit

trail. The legal requirements are lower. The US is in addition more harmonized than the various

legislations in Europe. Furthermore, US enterprises have in most cases to support just one or two

languages for the invoice processing. In some but not all cases, economies of scale also help US

titans to achieve lower invoice processing costs than the majority of comparatively small Euro-

pean companies.

This does not however reduce the relative saving potential compared to today’s paper processing

costs.

3.3.4 Future costs with automated processes

Small companies using e-invoicing via website, have no implementation costs and very moderate

or no running costs.

Besides the integration costs, large accounts have to consider the project costs.

In addition, third party service providers often charge a time and volume based fee for issuers

and/or recipients. The level of these costs varies considerably depending on customers’ require-

ments. It is best to summarise customers’ requirements in a document (Request for Proposal) and

ask for binding proposals. As an indication, third party costs of EUR 0.20 – 0.80 per invoice

should be entered into the business case.

Future internal costs will probably be 40-50% of past costs depending on the individual situation

(see also example in chapter “3.1 Saving Potential”).

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 19

World class enterprises are able to process 125,000+ electronic invoices per year and AP em-

ployee, roughly 10 times more than paper based invoices.

3.4 Business Case

3.4.1 Small businesses

Their large suppliers and clients quite often push them to accept respectively send electronic in-

voices “as part of the general contract terms or business rules”. Therefore, it is not necessarily

the business case pushing them forward for electronic invoicing but good business relationships

with their trading partner.

However, in most cases they find an easy and efficient way to practise it. This can be the use of

an invoicing portal, where invoices can be uploaded or downloaded and stored for several years

in a VAT compliant manner. Either no implementation is necessary or the effort required is very

moderate. Key-in invoices on the portals of each large customer is however unpopular among

suppliers and many insist on paper as long as they can. It is slightly better if the suppliers can

key-in the invoices on the web portals of independent service providers and address several cus-

tomers via the same platform. The absolute favourite for small businesses is to push PDF in-

voices to their customers (if they accept PDFs). This method is supported by numerous tools, and

is quick and inexpensive.

3.4.2 Mid-sized and large businesses

Many solution providers offer an online business case calculation tool. Tools and ROI calcu-

laters are also offered by some universities and industry portals.

As many readers of this report perhaps cannot understand the language in some ROI calculators,

here is a translation of the major points to be considered.

Figure 9: Items to be considered in a business case

Item to be considered in a business case

Issuer

Recipient

Quantities and basic data

- Number of electronic counterparts

- Electronic proportion of total invoice volume

- Interest rate

- Hourly rate of employees

x

x

Customer churn rate with and without e-invoicing

x

Costs and Savings in the AR & archiving department

x

Costs and Savings in the AP & archiving department

x

Cash Management, payment due period, payment dis-

count

x

x

Initial costs (Project, implementation, hardware, soft-

ware)

x

x

Operation costs internal and third party

x

x

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 20

3.4.3 Financial benefits for the public sector

With at least 10% of the market invoice volume, the public sector belongs to the “Top 3 indus-

tries”. Measured by the number of trading parties, it is the clear leader: 45-65% of all companies

in a country are suppliers to the public sector and send invoices to it. 100% of enterprises and

households receive invoices from the public sector. That is why e-invoicing initiatives by the

public sector are key for the development of the whole country. Unfortunately, this sector often

belongs to the laggards, despite the huge saving potential.

If a major proportion of paper invoices were replaced by electronic ones, the annual saving po-

tential in Europe’s public sector could be at least 40 billion Euro (for inbound and outbound in-

voices). Today, less than 10% of it is exploited.

This tremendous saving potential is recognized in many countries, but to exploit it within rea-

sonable time is another story. The federal administration is privileged to go into a leading role

and to facilitate a country-wide public sector project. As the public sector itself is very frag-

mented, many stakeholders have to be involved and convinced.

The breakdown of volume in the Danish and Swiss public sector is known. The mix of these two

countries is shown in the next chart.

Figure 10: Breakdown of saving potential in the public sector

In the broadest sense, this breakdown might also be applicable for many other countries. Assum-

ing so, the saving potential breakdown for various countries could look as shown in the follow-

ing table.

Fed. Admin.; 8%

States, Regions;

40%

Cities &

Municipalities; 52%

Sources: Federal

Administrations of Denmark & Switzerland

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 21

Figure 11: Indication for the saving potential in the public sector of some European countries

Country

Minimum public sec-

tor saving potential

(million Euro a year)

States, Regions

Cities & Municipalities

Austria

600 [5]

200

300

Belgium

900

400

470

France

4,200

1,700

2,200

Germany

6,500

2,600

3,400

Italy

3,000

1,200

1,600

Poland

1,700

700

900

Romania

1,400

600

700

Spain

1,800

700

900

Sweden

1,600

600

800

Switzerland

700

300

400

The Netherlands

1,200

500

600

United Kingdom

4,400

1,800

2,300

The difference to the total “public sector saving potential” above is the saving potential for the

federal administration.

The above estimate is based on the assumption that 40% of the e-invoices are exchanged in un-

structured format (PDF) and 60% with structured XML invoices (fully automated processes).

Many administrations insist on just structured invoice data. Their potential is higher than the fig-

ures above.

As attractive as e-invoicing in the public sector appears, it is just as challenging to implement.

The public sector is not one homogenuous segment. The state administration forms one part. In

addition, we find regions, cities and municipalities. Many countries have a federalist structure

with high autonomy for each entity. However, Brazil and Mexico have proved that it is possible

to establish e-invoicing country-wide, even with a federal structure.

The state government has the most power regarding legislation and is preferred to initiate and

steer such projects. However, the saving potential in their segment is just a small proportion

within the public sector.

Cities are in an excellent position to push e-invoicing/e-billing and to save much money. The au-

thor collected various data and built key-metrics over the year. Of course, the key-metrics can

vary a great deal from country to country and city to city. On average, a city receives one invoice

per year and inhabitant. Cities, including all its service units (taxes, energy distribution, garbage

removal, communication, etc.), issue typically 2-6 bills/invoices per year and inhabitant.

The estimated saving potential for cities is based on the assumption that 40% of the e-invoices

are exchanged in unstructured format (PDF) and 60% with structured XML invoices (fully auto-

mated processes).

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 22

Figure 12: Saving potential for cities

Population

(Millions)

Example of city (or metropolis) in this category

Based on population as published in Wikipedia

Minimum an-

nual saving po-

tential

(million Euro)

0.5

Atlanta, Bradford, Boston, Bratislava, Bremen, Copenha-

gen, Denver, Dortmund, Dublin, Duesseldorf, Duisburg,

Edinburgh, Essen, Frankfurt, Genoa, Gothenburg, Hano-

ver, Helsinki, Kaunas, Leeds, Leipzig, Lisbon, Liverpool,

Málaga, Manchester, Miami, Palermo, Rotterdam, Seattle,

Seville, Sheffield, Stuttgart, Tallinn, Thessaloniki, Tou-

louse, Vilnius, Washington, Zaragoza, Zurich

15

1

Adelaide, Amsterdam, Asturias, Athens, Auckland, Bir-

mingham, Biscay, Brussels, Calgary, Cologne, Dallas, Ed-

monton, Jacksonville, Indianapolis, Kraków, Lyon, Lille,

Marseille, Milan, Munich, Naples, Nice, Ottawa–Gatineau,

Phoenix, Prague, San Antonio, San Diego, San Francisco,

San Jose, Sofia, Stockholm, Turin, Valencia, Wellington

30

2

Barcelona, Brisbane, Bucharest, Budapest, Hamburg, Hou-

ston, Paris, Philadelphia, Vancouver, Vienna, Warsaw

55

3

Berlin, Chicago, Madrid, Rome

80

4

Los Angeles, Montreal

110

5

Sydney, Toronto

130

7

London, New York, Tokyo

200

10

Moscow

270

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 23

4. Digitisation & Automation

4.1 From gradual evolution to innovative business process automation

Remark: In order to simplify the description, the author focuses on the invoice recipient side in

this chapter. The steps for improvement are accordingly also valid for the invoice issuer side.

Organisations typically follow an evolutionary path and gradually improve their processes in 10-

20% steps. Substantial savings are possible with this approach. Besides the introduction of these

classic steps in this chapter, the author will also encourage the readers to assess a more revolu-

tionary model for business process automation based on disruptive innovation with the aim to

improve to 90%.

Figure 13: From gradual evolution to innovative business process automation

4.2 Sustaining improvement with manual paper processing

In most organisations, conventional paper processing is not optimised. Invoices are often re-

ceived decentrally by many departments. Cash managers do not have an overview of all invoices

in the workflow and therefore only have limited opportunities to improve the working capital.

A first step of improvement is to centralise inbound invoices. From the very beginning, they can

be processed more efficiently in a shared service centre. Offshoring such shared service centres

can again reduce the processing costs substantially.

Nevertheless, the classic shortcomings caused by the paper format remain, such as:

• The accuracy of the invoice content remains a problem; typically 20-30% of all invoices

have to be treated as exceptions in one form or another, resulting in very high processing

costs.

• The data are validated and matched with related documents manually; this is time-consuming

and costly. Delayed payments are often caused as invoice errors are detected very late during

the processing cycle. Potential discounts are missed and the DSO stays too long.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 24

• The master data have to be updated manually, resulting in high trading partner administration

costs.

• For archiving paper invoices, a great deal of space is required. It is also costly to retrieve pa-

per invoices in the event of audits or queries.

• The demand of trading partners for an electronic channel is not satisfied.

• Last but not least, paper invoices are harmful to the environment.

4.3 Digitisation

Digitisation is a huge step forward. Currently, two methods are in the foreground:

• Paper scan and capture

• Image-based PDF invoices

Digitisation requires organisations to establish invoice workflow and archiving solutions. As a

consequence of this improvement, many disadvantages of conventional paper processing disap-

pear, but several still remain:

• The accuracy of the invoice content remains a problem; typically 20-30% of all invoices

have to be treated as exceptions in one form or another, resulting in very high processing

costs.

• The master data can be updated on a semi-automatic basis, but the risk of redundancies of

master data with minor differences could increase.

• The demand of trading partners for an electronic channel is not, or not fully, satisfied.

• Last but not least, paper invoices are harmful to the environment.

Image-based PDF invoices are for many organisations a first step towards paperless invoices. In-

voice issuers favour these as they have an immediate positive impact on costs. Larger invoice re-

ceivers are more sceptical towards exclusively image-based digital invoices. Nevertheless, it is

even an improvement for them compared to paper invoices. Transport is much faster. They have

access to a quick, digital channel for feedback and rejects. For internal processing, recipients can

feed the PDF invoices into the scan and capture process. The resulting data quality of this is

slightly better than with paper invoices.

4.4 Automated e-invoicing

The legislation in many countries (in Europe, North America, Pacific etc.) considers paperless

invoices in any electronic format to be e-invoices. This includes structured electronic invoices as

well as image-based PDFs. Depending on the country, up to 50% of all businesses use office

programs to generate invoices. They often neither have AR nor AP modules for their accounting.

Many of them have outsourced invoice-related processes to third parties. For them, it is challeng-

ing to practically automate e-invoicing processes. For most others, however, a key objective is to

fully automate these processes. Terms like ‘touchless e-invoicing’, ‘zero touch e-invoicing’,

‘true e-invoicing’ or ‘automated e-invoicing’ are used in this connection.

Suppliers and buyers use structured invoice data and typically establish direct two-way commu-

nication or increasingly use a service provider for the bilateral exchange. This results in many

benefits.

E-invoicing is typically practiced in a centralised manner for all outbound and inbound invoices.

This results in increased transparency and builds an excellent basis for the optimisation of cash

management.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 25

A major shortcoming of any paper and digital image-based approach is that the accuracy of in-

voice data is not guaranteed. With the appropriate approach, this problem can immediately be

eliminated or at least improved. The unique identification of trading partners based on compliant

master data is a prerequisite and becomes the norm for automated e-invoicing.

True e-invoicing paves the way for real-time or near real-time data validation. The earlier an in-

correct invoice is rejected, the sooner a new one can be sent. As a result of the improved invoice

accuracy, the approval and processing time can be reduced significantly. The DSO can in most

cases be shortened by several days

2

.

Dispute handling can be conducted in a more structured way by using the same electronic com-

munication channel. As a result of the increased electronic interaction, the trading partner admin-

istration costs can be reduced substantially.

Compared to conventional paper invoice processing, the automated e-invoicing will result in cost

savings of 60-80% in most cases.

Structured e-invoices build a good starting basis for value-added services and the easier imple-

mentation of trade financing services.

4.5 Business process automation with disruptive innovation

More advanced organisations might have a broader objective than merely to optimise invoice

processes. This is indeed a worthwhile undertaking: the automation and optimisation of the in-

voice process typically represents only one third of the total potential. In light of this, the full

purchase-to-pay and order-to-cash process may be brought to the foreground over the coming

years.

2

A survey in Germany confirmed 5.4 days for example.

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 26

Figure 14: Exploit the full optimisation potential

Many businesses seeking to optimise the full purchase-to-pay and order-to-cash cycle intend to

replace paper processes with electronic processes. They can thereby achieve substantial savings.

However, it can be worthwhile to critically scrutinise the current processes and systems. Both of

which likely evolved over one or two decades. Gradual improvements achieved by substituting

paper-based processes are positive, however it is possible to take a disruptive approach and

thereby improve the entire financial supply chain by many factors.

Experience shows that often one third of the sub-processes can be removed without losing any-

thing essential. Monolithic systems can be replaced by cloud services on a modular basis. Costs

can be significantly reduced and the organisations following this approach can become more

agile.

Buyer

Supplier

Exchange network

Offer

Catalogue

Order confirmation

Invoice

Archive

Delivery note

Payment

Archive

Request for Proposal

Tender

Order

Contract

Goods delivery note

Invoice

processing

1/3 Saving potential 2/3

Business Case E-Invoicing / E-Billing

○

C

B. Koch, Billentis Page 27

5. Appendix: Sources

Figure 15: Key sources used in this report

Ref

Document and/or hyperlink

Date or version

[1]

Demica, A Rising Role, “A study in the growth of Supply Chain

Finance, as evidenced by SCF-dedicated job titles at top European

banks”

April 2014

[2]

IOFO, 2014 AP Automation Study

2014

[3]

Helsinki School of Economics, “Electronic Invoicing Initiatives in

Finland and in the European Union”

2008, B-95

[4]

Politecnico di Milano, Alessandro Perego, Presentation “Process

Optimization and Saving Potential with e-Invoicing” at the EXPP

Summit in Munich/Germany

October 2010

[5]

Billentis, Nutzenpotenziale der E-Rechnung

http://wko.at/e-rechnung

October 2011